JetBlue Bundle

Can JetBlue Soar to New Heights?

In the turbulent skies of the airline industry, JetBlue Airways has charted a course fueled by customer-centricity and innovation. From its inception, JetBlue aimed to disrupt the market, offering a unique blend of affordability and enhanced passenger experience. This analysis dives deep into the JetBlue SWOT Analysis, exploring its growth strategy and future prospects within the evolving airline industry.

JetBlue's journey, marked by both triumphs and challenges, offers valuable insights into adapting to shifting market dynamics and competitive pressures. Examining its strategic framework, including 'JetForward,' is crucial for understanding how the company plans to navigate the complexities of the airline industry. This exploration of JetBlue's business model and market share, alongside its expansion plans and competitive advantages, provides a comprehensive view of its potential for long-term growth and financial performance, considering current airline industry trends.

How Is JetBlue Expanding Its Reach?

The expansion initiatives of the airline are largely guided by its 'JetForward' strategy. This strategy focuses on building a strong East Coast leisure network. It also aims to strengthen its presence in key geographies like New York, New England, Florida, and Puerto Rico. This approach is a core element of the overall JetBlue growth strategy.

As part of its network optimization, the airline has been strategically exiting routes and cities that do not align with its financial goals. In 2024, this optimization led to the closure of 15 cities, representing approximately 20% of its network. Simultaneously, the airline launched services to new locations, showcasing its adaptability within the dynamic airline industry trends.

Looking ahead, the airline is set to launch seasonal routes from Boston to Madrid, Spain, and Edinburgh, Scotland, starting in May 2025. This expansion complements its existing European services to Dublin, Amsterdam, London, and Paris. The airline's commitment to enhancing connectivity across Latin America and the Caribbean is evident through new flights to Honduras and the reintroduction of service between Santo Domingo and Newark. These moves are crucial for assessing the JetBlue future prospects.

The airline is expanding its route network to include new destinations and enhance existing services. This includes launching seasonal routes to Europe and increasing connectivity in Latin America and the Caribbean. These expansions are key elements of the JetBlue expansion plans 2024 and beyond.

The airline is enhancing its product offerings to improve the customer experience and diversify revenue streams. This includes introducing a domestic first-class experience and opening new customer lounges. These improvements are vital for the JetBlue business model.

The airline is focusing on building a strong presence in core geographies such as New York, New England, Florida, and Puerto Rico. This strategic focus is designed to capitalize on high-demand markets and strengthen its competitive position. This is a part of the JetBlue market share strategy.

The airline is actively optimizing its network by exiting routes and cities that do not meet financial targets. This approach allows the company to allocate resources more efficiently and focus on profitable operations. This is crucial for the JetBlue financial performance review.

Further expansion includes enhanced product offerings. In 2024, the airline announced plans to introduce a domestic first-class experience across its non-Mint fleet, starting in 2026. The airline is also preparing to debut its first customer lounges at JFK's Terminal 5 in 2025, followed by Boston Logan International Airport's Terminal C. These lounges will offer perks for TrueBlue Mosaic members and premium cardholders. The EvenMore program is also being enhanced to include additional amenities. These initiatives are designed to attract new customers, diversify revenue streams, and stay ahead of industry changes by offering valuable products and perks. Understanding the company's mission, vision, and core values is vital for a complete JetBlue company analysis, as discussed in Mission, Vision & Core Values of JetBlue.

The airline's expansion initiatives are designed to enhance its route network, improve customer experience, and optimize its financial performance. These initiatives are essential for achieving long-term growth and maintaining a competitive edge in the airline industry.

- Route Network Expansion: Launching new seasonal routes and increasing connectivity in key regions.

- Product Enhancements: Introducing a domestic first-class experience and new customer lounges.

- Network Optimization: Strategically exiting underperforming routes and cities.

- Customer Experience: Enhancing the EvenMore program with additional amenities.

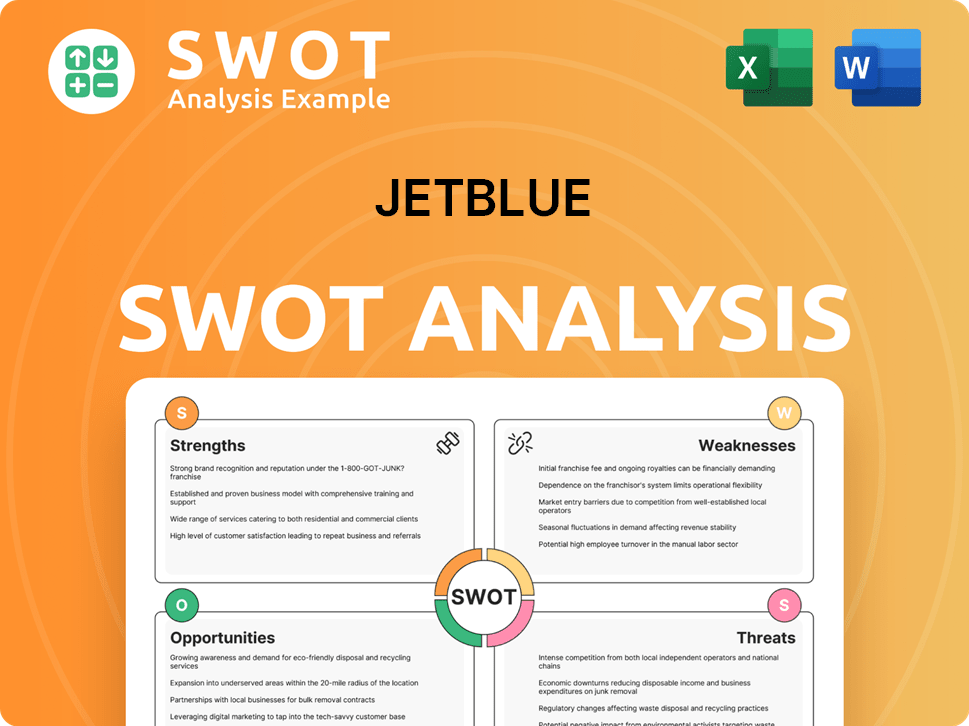

JetBlue SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does JetBlue Invest in Innovation?

The company's growth strategy heavily relies on innovation and technology to enhance customer experience, boost operational efficiency, and promote sustainability. This approach is crucial for navigating the dynamic airline industry trends and maintaining a competitive edge. By focusing on these areas, the company aims to secure its future prospects and maintain a strong position in the market.

A key element of the company's strategy is its investment in early-stage startups through its subsidiary, JetBlue Technology Ventures. This venture capital arm actively seeks out and partners with companies that can bring about improvements in the travel sector. This proactive approach allows the company to stay at the forefront of technological advancements and integrate new solutions quickly. The company's business model is also enhanced by these strategic investments.

The airline's commitment to sustainability is another significant aspect of its innovation strategy. This includes ambitious goals to reduce greenhouse gas emissions and transition to sustainable aviation fuel (SAF). These initiatives are not only environmentally responsible but also align with the increasing demand for sustainable practices within the airline industry, which is crucial for its long-term growth strategy.

In 2024, JetBlue Ventures expanded its portfolio, introducing 19 new startups to the company. They also conducted 17 strategic deep dives.

The company aims to reduce greenhouse gas emissions by 50% per revenue tonne kilometer by 2035. They plan to convert 10% of jet fuel usage to blended Sustainable Aviation Fuel (SAF) by 2030.

The airline aims to convert 40% of its Ground Service Equipment to electric power by 2025 and 50% by 2030.

The company's 'Fly-Fi®' product provides free unlimited high-speed Wi-Fi across its fleet, setting an industry standard.

The airline's cybersecurity strategy follows the National Institute of Standards and Technology Cybersecurity Framework (NIST CSF) for threat detection and response.

In 2024, the company announced its first regular supply of blended SAF for commercial travel in New York, with initial delivery expected in 2024.

The company's digital transformation efforts are evident in its 'Fly-Fi®' service, offering free, high-speed Wi-Fi. Cybersecurity is also a priority, with a strategy aligned with the NIST CSF. While technology enhances the onboard experience, the company acknowledges the risks associated with system faults and hacking. For more insights into the company's journey, you can explore a Brief History of JetBlue.

The company's innovation strategy encompasses several key areas, including investments in startups, sustainability initiatives, and digital enhancements.

- JetBlue Ventures actively invests in early-stage startups to improve the travel industry.

- Sustainability efforts include reducing emissions and using sustainable aviation fuel.

- Digital transformation focuses on providing high-speed Wi-Fi and robust cybersecurity measures.

- These initiatives support the company's long-term growth and competitive advantage.

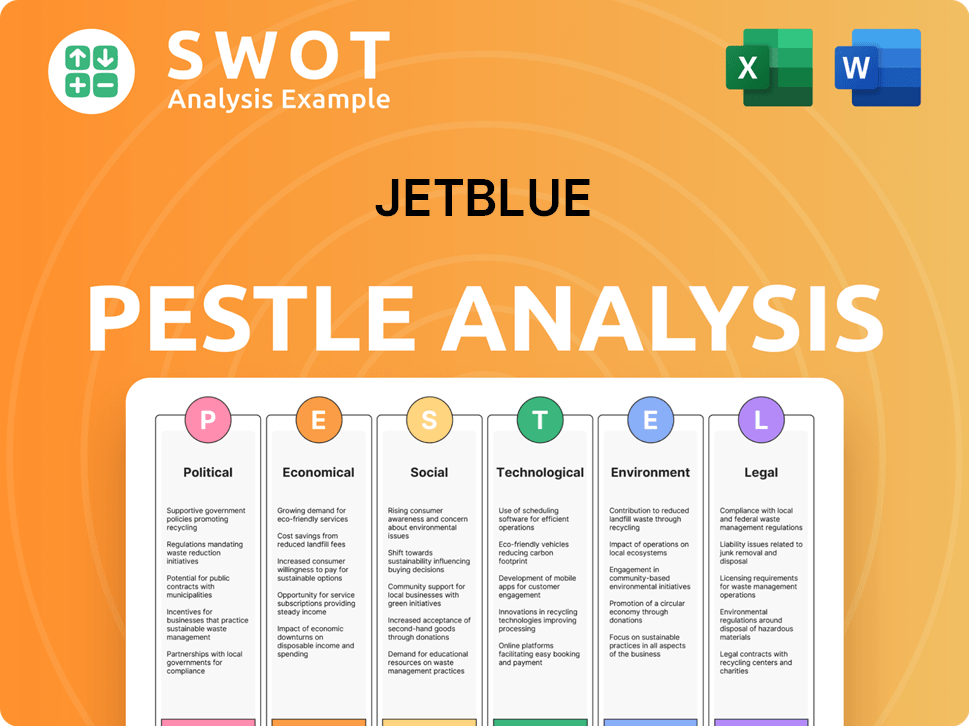

JetBlue PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is JetBlue’s Growth Forecast?

The financial outlook for JetBlue in 2025 centers on achieving positive operating margins and advancing its 'JetForward' strategy. This strategy aims to restore sustained profitability within the evolving landscape of the airline industry. This approach is crucial for navigating the airline industry trends and securing the company's future prospects.

JetBlue's financial strategy involves careful management of revenue and costs. The company is focused on increasing revenue per available seat mile (RASM) while managing cost increases. This balanced approach is essential for maintaining a competitive position and driving long-term growth. The company's focus on these areas is critical to its JetBlue growth strategy.

In the fourth quarter of 2024, JetBlue achieved an operating margin of 0.7% and an adjusted operating margin of 0.8%. These results reflect the impact of revenue initiatives, which delivered $395 million, surpassing the $300 million target. These initiatives contributed $90 million of EBIT to the JetForward program in 2024. The company's performance in 2024 sets a baseline for future financial results and is a key element of the JetBlue company analysis.

For the full year 2025, JetBlue projects an adjusted operating margin of 0.0% to 1.0%. The airline anticipates RASM growth of 3.0% to 6.0% year-over-year. It also expects CASM ex-Fuel to increase by 5.0% to 7.0%. These projections are vital for understanding the JetBlue future prospects.

In the first quarter of 2025, JetBlue reported a GAAP net loss of $208 million or $0.59 per share. Operating revenue was $2.1 billion, a 3.1% decrease year-over-year. Capacity for Q1 2025 decreased by 4.3% year-over-year. This data provides insight into the current financial status of the company.

JetBlue raised $3.2 billion in strategic financing in 2024. The company deferred approximately $3 billion in aircraft capital expenditures to 2030 and beyond. These financial strategies are designed to strengthen the company's financial position and support its long-term growth.

As of December 31, 2024, JetBlue had approximately $3.9 billion in unrestricted cash and investments. The company also has an additional $600 million undrawn revolving credit facility available. This financial flexibility is important for managing operations and investments.

JetBlue has over $5 billion in unencumbered assets, mainly consisting of aircraft, engines, slots, gates, and routes. For the full year 2025, capital expenditures are anticipated to be approximately $1.4 billion, and interest expense around $600 million. These figures are important for understanding the JetBlue business model.

The company is actively managing the impact of fuel prices, which is a significant factor in the airline industry. Strategic partnerships also play a role in enhancing operational efficiency and market reach. For more detailed insights, you can refer to this article about JetBlue's focus on profitability.

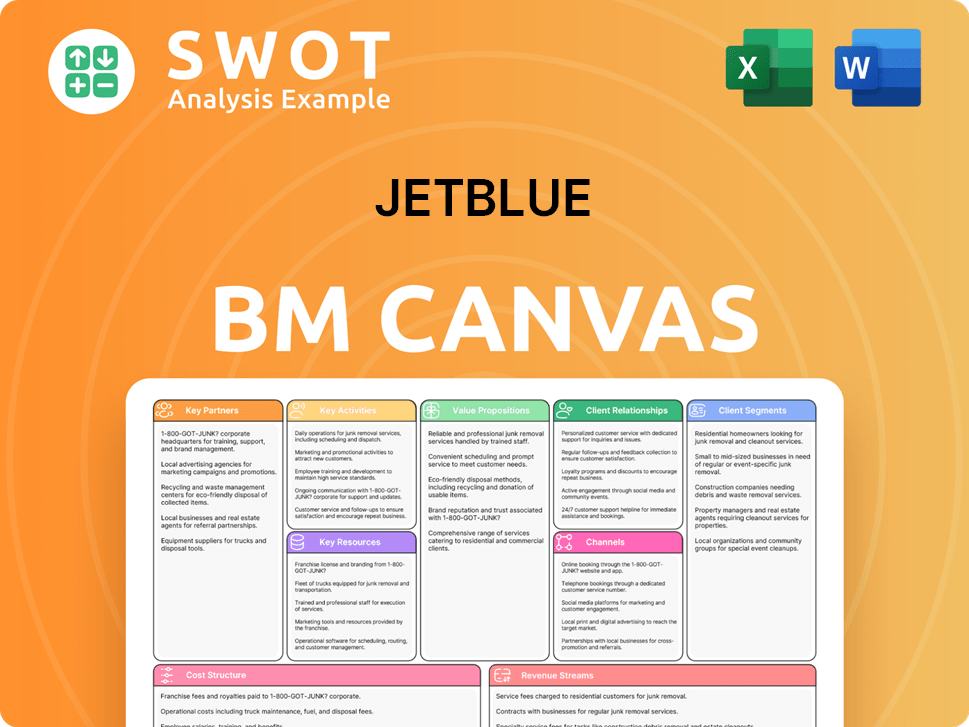

JetBlue Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow JetBlue’s Growth?

The airline faces substantial risks that could impede its growth, as detailed in its 2024 10-K report. The competitive landscape, marked by low profit margins and high fixed costs, poses a significant challenge. Furthermore, the airline's operational success hinges on assumptions about customer demand, fuel prices, and supply chain stability.

Operational risks are considerable, with the execution of the JetForward strategic plan depending on assumptions about customer demand, fuel costs, and supply chain constraints. The airline's high aircraft utilization rate, while cost-effective, makes it vulnerable to delays and cancellations, particularly in the congested New York metropolitan market. Technological disruptions and information security threats also present challenges.

The company's reliance on technology means that system faults or cyberattacks could cause significant operational interruptions, leading to potential legal claims and reputational harm from data breaches. Attracting and retaining qualified personnel in a competitive labor market is an ongoing human capital risk. International operations expose the company to compliance with U.S. and foreign regulations, political instability, and economic fluctuations.

The airline operates in a highly competitive industry. It competes with larger airlines that have greater financial resources. The airline also faces competition from surface transportation and virtual meetings.

The success of its strategic plan depends on factors like customer demand and fuel costs. The airline's high aircraft utilization rate can lead to delays. A mechanical malfunction in March 2025 caused a flight to return to Boston, triggering an FAA investigation.

Fuel prices are subject to volatility and geopolitical factors. The airline's financial performance is directly impacted by fluctuations in fuel costs. Fuel hedging strategies are used to mitigate these risks.

System failures or cyberattacks could disrupt operations. Data breaches can lead to legal claims and reputational damage. A formal cybersecurity program, guided by NIST CSF, is in place to address these risks.

Labor costs may increase due to unionization efforts and labor disputes. Maintenance costs are expected to rise as the fleet ages. As of December 31, 2024, 11 of the company's aircraft were grounded due to engine issues.

A significant portion of the airline's operations are concentrated in the New York metropolitan market. Disruptions at its main hub, JFK, can have a significant impact. The U.S. Department of Transportation (DOT) fined the airline $2 million for chronic delays in late 2024.

To address these challenges, the airline employs various strategies. These include fuel hedging to manage price volatility, exploring new market opportunities for expansion, maintaining operational efficiency to reduce costs, and focusing on customer satisfaction to build loyalty. Management also actively prepares for cyber risks.

Industry consolidation and the development of low-cost structures by traditional airlines could further impact the company's market position. The airline must remain competitive to maintain its position in the market. Understanding the Revenue Streams & Business Model of JetBlue is essential for assessing its long-term viability.

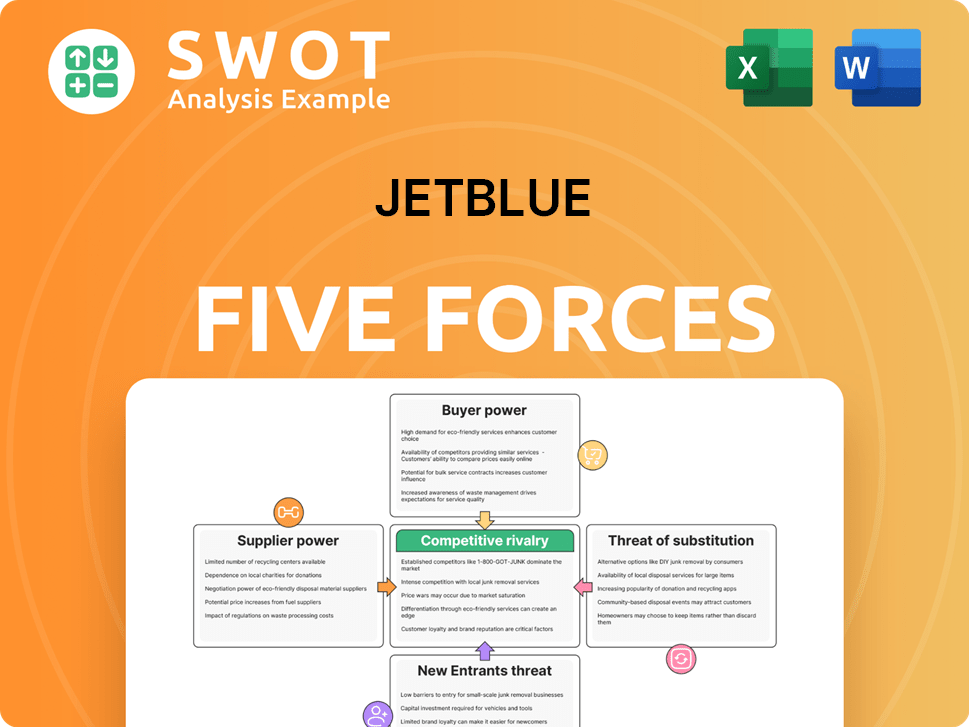

JetBlue Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JetBlue Company?

- What is Competitive Landscape of JetBlue Company?

- How Does JetBlue Company Work?

- What is Sales and Marketing Strategy of JetBlue Company?

- What is Brief History of JetBlue Company?

- Who Owns JetBlue Company?

- What is Customer Demographics and Target Market of JetBlue Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.