JetBlue Bundle

How Does JetBlue Navigate the Turbulent Skies of Airline Competition?

The airline industry is a battlefield, constantly reshaped by innovation, economic shifts, and fierce rivalry. JetBlue Airways, a pioneer in the low-cost carrier segment, has consistently challenged industry norms with its customer-focused approach. But how does JetBlue fare against its competitors in this dynamic environment? This analysis dives deep into the JetBlue SWOT Analysis, exploring its position within the intensely competitive landscape.

This exploration of the JetBlue competitive landscape will dissect its market position, evaluating its key rivals and uncovering its unique competitive advantages within the airline industry competition. We will examine JetBlue's business strategy, assessing its responses to industry changes and challenges, and analyzing its potential for sustained growth. Understanding JetBlue's position requires a thorough market analysis, considering factors like market share, pricing strategies, and customer service compared to its competitors, including an understanding of the impact of Southwest Airlines on JetBlue.

Where Does JetBlue’ Stand in the Current Market?

JetBlue Airways secures its position within the North American airline industry as a low-cost carrier, distinguished by its emphasis on customer experience. The JetBlue competitive landscape is shaped by its focus on routes within the United States, Latin America, and the Caribbean. Key hubs include New York (JFK and LGA), Boston (BOS), and Fort Lauderdale (FLL), which are crucial for its operations.

The airline's core offerings include air transportation services in economy and Mint (premium) classes. JetBlue targets both leisure travelers seeking affordable fares and business travelers who value service and network connectivity. Its strategic shift towards the Mint service has allowed it to compete more effectively with legacy carriers. For a deeper dive into the ownership structure, you can explore Owners & Shareholders of JetBlue.

JetBlue's financial performance reflects its market position and strategic initiatives. In Q1 2024, the airline reported a net loss of $153 million, an improvement from the $192 million loss in Q1 2023. Revenue for Q1 2024 reached $2.2 billion, demonstrating its substantial scale. The airline is adjusting its network, particularly after the termination of the Northeast Alliance (NEA) with American Airlines, reallocating capacity to strong leisure markets.

While precise 2024-2025 market share data fluctuates, JetBlue consistently ranks among the top airlines in terms of passenger traffic and revenue within its key operating regions. This performance reflects its ability to compete effectively within the airline industry competition. The airline’s focus on customer experience and strategic route planning contributes to its market standing.

JetBlue differentiates itself through its product offerings, including the Mint premium service, which allows it to target a broader customer base. This strategy enables JetBlue to compete with legacy carriers on select routes. The airline's focus on customer service and amenities also helps it stand out in the JetBlue competitive landscape.

JetBlue's financial results and strategic decisions directly impact its market position. The Q1 2024 revenue of $2.2 billion and the net loss improvement from the previous year indicate its ongoing efforts to optimize operations. Network adjustments, particularly capacity reallocation, are vital for strengthening its position in key regions.

The strategic importance of hubs like New York, Boston, and Fort Lauderdale is crucial for JetBlue's network. These hubs are critical for its operations and route planning. JetBlue's route strategy is designed to maximize its presence in high-demand markets and provide convenient connectivity for its customers.

JetBlue's competitive advantages include its strong brand reputation for customer service and its Mint premium service, which attracts a higher-yield customer segment. However, disadvantages include its exposure to fluctuating fuel prices and intense competition from both legacy carriers and other low-cost carriers. Understanding these factors is essential for a thorough JetBlue market analysis.

- Strong Brand Reputation: Known for excellent customer service and amenities.

- Premium Service: Mint class allows it to compete for higher-yield customers.

- Network Focus: Strategic hubs and routes in key markets.

- Fuel Price Volatility: Subject to the impact of fluctuating fuel costs.

- Intense Competition: Faces competition from legacy and low-cost carriers.

- Economic Factors: Susceptible to economic downturns affecting travel demand.

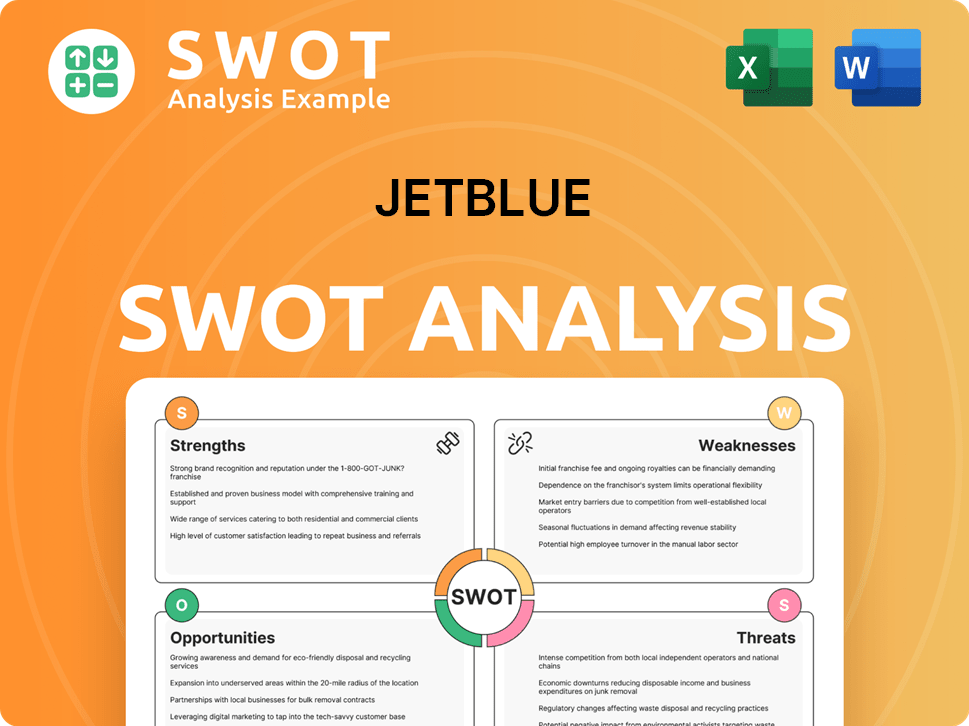

JetBlue SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging JetBlue?

The JetBlue competitive landscape is shaped by a dynamic interplay of various airline competitors. This analysis is crucial for understanding JetBlue's position and strategies within the airline industry. JetBlue's ability to navigate this competitive environment directly impacts its market share and financial performance.

Understanding the competitive landscape is essential for evaluating JetBlue's business strategy. The airline's success hinges on its ability to differentiate itself and respond effectively to the actions of its rivals. A thorough market analysis reveals the challenges and opportunities JetBlue faces.

JetBlue's main rivals in the US include a mix of low-cost carriers and legacy airlines, each with distinct strategies and strengths. The competitive dynamics are constantly evolving, influenced by factors such as pricing, route expansion, and customer service. The airline's financial performance is also significantly impacted by its competitive position.

Southwest Airlines, Spirit Airlines, and Frontier Airlines are key direct competitors. These airlines compete with JetBlue based on price and route offerings. They challenge JetBlue's market share, particularly in the low-cost sector.

Southwest, a well-established low-cost carrier, presents a strong challenge. Its extensive point-to-point network and brand loyalty are significant competitive advantages. Southwest's consistent profitability and large market share make it a formidable competitor.

Spirit and Frontier employ ultra-low-cost models, focusing on bare-bones fares. They primarily compete on price, attracting highly price-sensitive travelers. This strategy puts pressure on JetBlue's base fares and overall pricing strategy.

American Airlines, Delta Air Lines, and United Airlines are legacy carriers that compete with JetBlue. These airlines challenge JetBlue on routes where it offers its Mint premium service. They have vast global networks and extensive loyalty programs.

The termination of the Northeast Alliance (NEA) with American Airlines has intensified competition. This has forced JetBlue to re-evaluate its network strategy and capacity deployment in key markets. The competitive landscape is constantly changing.

Emerging players and regional airlines also pose indirect competition. They compete in specific smaller markets or for connecting traffic. The competitive landscape is shaped by mergers and alliances.

The airline industry competition involves various factors. These include pricing strategies, service enhancements, and network expansion. Airlines compete for passenger loyalty and market dominance. The proposed acquisition of Spirit Airlines by JetBlue, though blocked, highlighted the drive for consolidation.

- Pricing Battles: Airlines frequently engage in price wars to attract customers.

- Service Enhancements: Offering better in-flight experiences and customer service.

- Network Expansion: Adding new routes and increasing flight frequencies.

- Mergers and Alliances: These can significantly alter market dynamics.

- Customer Loyalty Programs: These programs help retain customers.

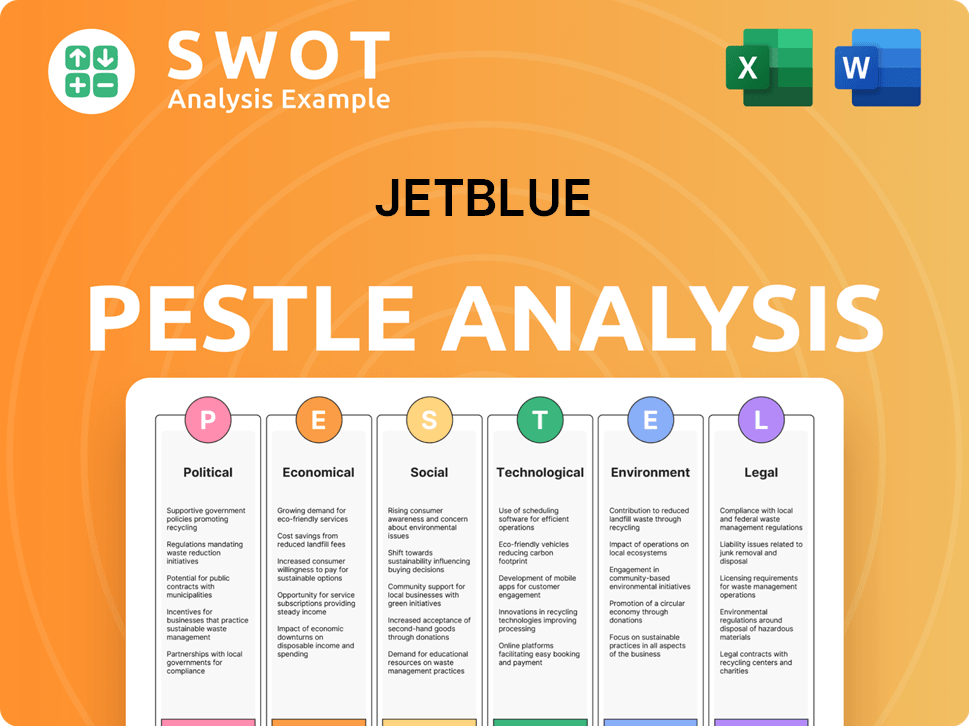

JetBlue PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives JetBlue a Competitive Edge Over Its Rivals?

The Growth Strategy of JetBlue showcases a unique approach to the airline industry. It combines low-cost efficiency with a strong focus on customer experience. This hybrid model has allowed it to carve out a distinct position within the competitive landscape, differentiating itself from both legacy carriers and ultra-low-cost airlines.

JetBlue's competitive advantages are rooted in its brand equity and customer loyalty. The airline has cultivated a reputation for friendly service, complimentary in-flight entertainment, and extra legroom, creating a loyal customer base. The introduction of the Mint premium service has further enabled JetBlue to compete in the lucrative business and premium leisure segments.

Geographic concentration in key cities like Boston, Fort Lauderdale, and San Juan enhances operational efficiency. The airline's modern fleet and strategic route planning are crucial for managing costs. However, JetBlue faces challenges from imitation and industry dynamics, requiring continuous innovation to maintain its competitive edge.

JetBlue's strong brand recognition and customer loyalty are significant competitive advantages. The airline's focus on customer experience, including friendly service and in-flight amenities, has fostered a loyal customer base. This loyalty allows JetBlue to command a slight premium over ultra-low-cost carriers, enhancing its revenue potential.

The Mint premium service is a key differentiator, enabling JetBlue to compete effectively in the business and premium leisure segments. Mint offers lie-flat seats, enhanced dining, and personalized service, providing a strong alternative to legacy carriers' first and business class offerings. This product innovation allows JetBlue to attract higher-yield passengers and diversify revenue streams.

JetBlue strategically focuses on key cities like Boston, Fort Lauderdale, and San Juan. This geographic concentration allows for optimized flight schedules and better resource utilization. Building a strong presence in these cities enhances operational efficiencies and market share, providing a competitive edge in these specific markets.

JetBlue leverages operational efficiencies and a modern fleet to manage costs effectively. While not always at the scale of legacy carriers, its focus on efficiency helps maintain profitability. This approach is crucial in the competitive airline industry, allowing JetBlue to offer competitive pricing while maintaining a high level of customer service.

JetBlue's competitive advantages face threats from imitation, as other airlines may seek to enhance customer experience or introduce similar premium offerings. The sustainability of these advantages relies on JetBlue's continued innovation and commitment to its distinct service model in a dynamic industry. The airline must adapt to changing market conditions and maintain its focus on customer satisfaction.

- Imitation of premium services by competitors.

- Need for continuous innovation to maintain differentiation.

- Impact of industry changes on pricing and route strategies.

- Maintaining customer satisfaction in a competitive market.

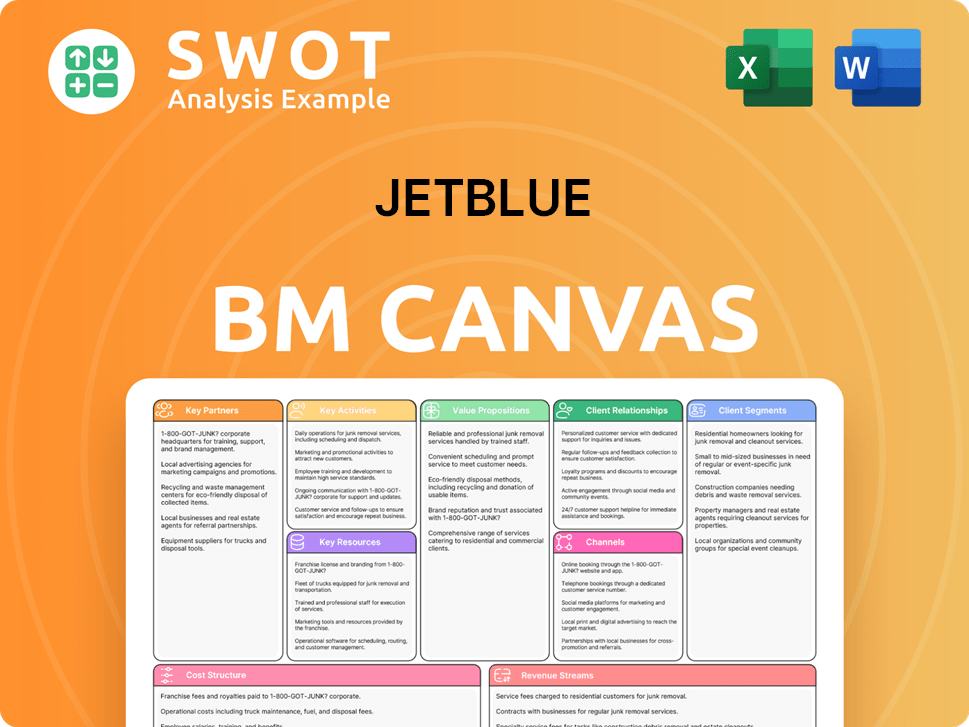

JetBlue Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping JetBlue’s Competitive Landscape?

The Growth Strategy of JetBlue is heavily influenced by the dynamics of the airline industry. The airline industry competition is fierce, with various players vying for market share. Understanding the JetBlue competitive landscape is crucial for assessing its future prospects.

Several factors shape the airline industry, including technological advancements, regulatory changes, and evolving consumer preferences. These trends present both challenges and opportunities for JetBlue. The company's ability to adapt to these shifts will significantly impact its competitive standing.

Technological advancements continue to drive changes, with increased adoption of digital tools for booking, check-in, and in-flight services. Regulatory changes, particularly concerning environmental sustainability and consumer protection, also influence airline operations. Evolving consumer preferences, such as a growing demand for personalized travel experiences and sustainable options, are pushing airlines to adapt their offerings.

Navigating the post-Northeast Alliance (NEA) landscape is a significant challenge. Ongoing cost pressures, including fuel price volatility and labor costs, can impact its low-cost model. The broader economic environment and potential shifts in travel demand pose a continuous challenge. The airline industry competition remains intense, requiring constant adaptation.

JetBlue can capitalize on the growing demand for leisure travel, particularly to its strong Caribbean and Latin American destinations. Further expansion of its Mint service could capture more high-yield travelers. Strategic partnerships, even after the NEA's termination, could still offer network synergies and expanded reach.

JetBlue's future competitive position will likely evolve with its ability to optimize its network, control costs, innovate its product offerings, and adapt to the changing regulatory and consumer landscape. The airline must focus on maintaining a strong position in a competitive market.

JetBlue's main rivals in the US include major airlines such as Southwest Airlines, Delta Air Lines, and United Airlines. The airline faces competition from both low-cost carriers and legacy airlines, making JetBlue market analysis essential. JetBlue's position in the airline market is constantly evolving due to these competitive pressures.

- Market Share: JetBlue's market share fluctuates, but it consistently competes for a significant portion of the domestic air travel market.

- Pricing Strategies: JetBlue's pricing strategies are designed to attract price-sensitive travelers while offering premium services.

- Customer Service: JetBlue's customer service is often a key differentiator, aiming to provide a superior experience compared to rivals.

- Financial Performance: JetBlue's financial performance is influenced by fuel costs, labor expenses, and overall economic conditions.

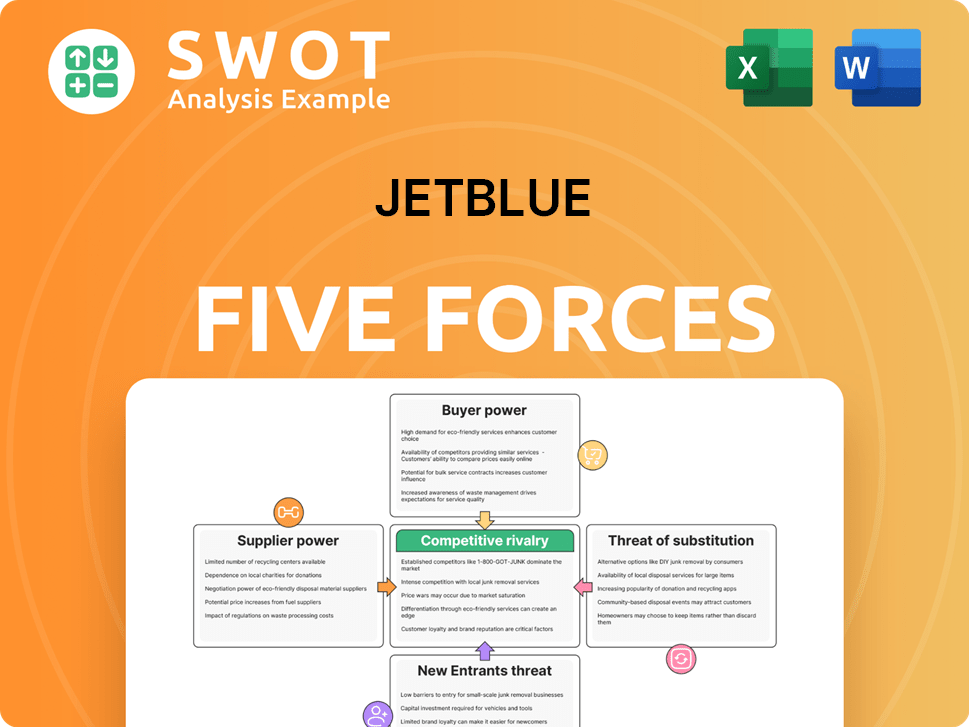

JetBlue Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of JetBlue Company?

- What is Growth Strategy and Future Prospects of JetBlue Company?

- How Does JetBlue Company Work?

- What is Sales and Marketing Strategy of JetBlue Company?

- What is Brief History of JetBlue Company?

- Who Owns JetBlue Company?

- What is Customer Demographics and Target Market of JetBlue Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.