Mammoth Energy Service Bundle

What's the Story Behind Mammoth Energy Services?

Ever wondered how Mammoth Energy Service SWOT Analysis shaped the energy landscape? Mammoth Energy Services, Inc. (NASDAQ: TUSK) has carved a unique niche in the competitive energy services sector. From its roots in 2014, this company has navigated the complexities of the oil and gas industry, and infrastructure projects.

This exploration into the brief history of Mammoth Energy Services will uncover its strategic moves, from its formation through consolidation to its current dual focus on oilfield services and infrastructure. We'll examine the key milestones that have defined Mammoth Energy Company, including its public listing and its involvement in significant projects. Understanding the company's trajectory provides valuable insights into the broader energy services market and the challenges it faces.

What is the Mammoth Energy Service Founding Story?

The story of Mammoth Energy Services began in 2014. It was formally established, assembling several energy and infrastructure service companies under the umbrella of Wexford Capital LP, a private equity firm. The company quickly became a notable player in the oil and gas industry.

The consolidation included entities such as Redback Energy Services Inc., Bison Drilling and Field Services LLC, and Stingray Energy Services, Inc. The strategic location for the company headquarters was set in Oklahoma City, Oklahoma, a key area within the energy sector. Arty Straehla was appointed as the Chief Executive Officer during its early stages, guiding the company through its initial public offering (IPO).

The core opportunity identified was the need for a diversified service provider in the North American onshore unconventional oil and natural gas exploration and development, alongside electric grid infrastructure. Wexford Capital LP provided the initial funding. The company later entered public markets with its IPO in October 2016.

Mammoth Energy Services rapidly expanded its operations.

- The IPO in October 2016 raised approximately $116 million before underwriting discounts and commissions.

- Net proceeds to Mammoth Energy were around $103.2 million.

- The capital was used to repay outstanding borrowings and for general corporate purposes, including potential acquisitions.

- The initial business model focused on well completion, infrastructure, natural sand proppant, and drilling services.

The IPO was a pivotal moment for Mammoth Energy Services. The funds raised allowed the company to solidify its financial position and pursue growth opportunities within the energy services sector. The company's focus on providing a comprehensive suite of services positioned it to capitalize on the evolving demands of the oil and gas industry.

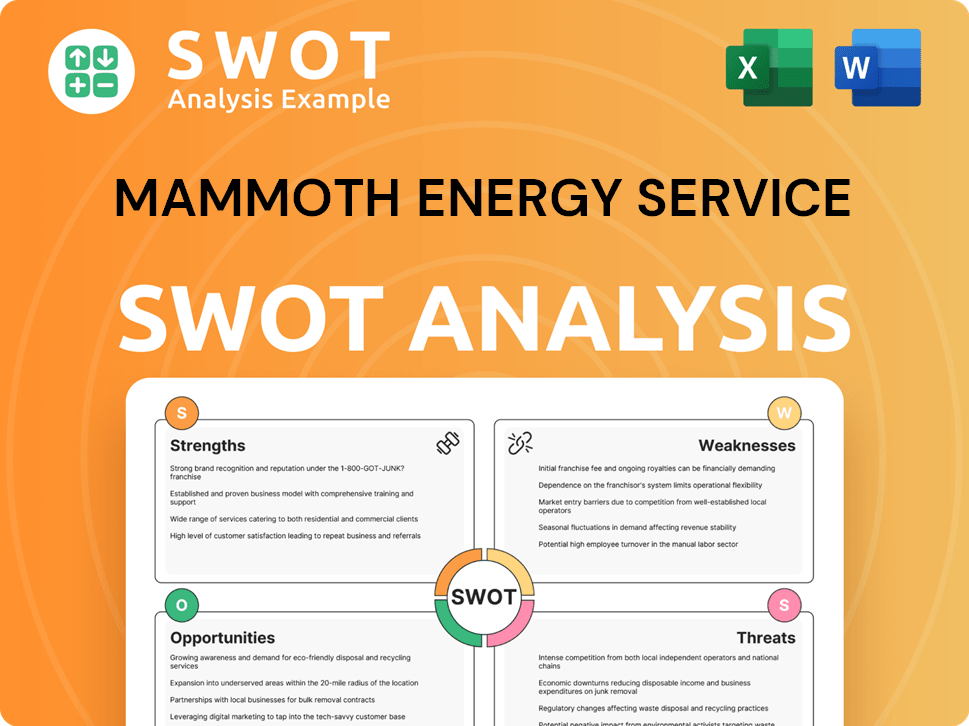

Mammoth Energy Service SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Mammoth Energy Service?

The early growth of Mammoth Energy Services, a key player in the energy services sector, was marked by strategic acquisitions and expansion. This period saw the company establishing its presence and laying the groundwork for future developments. The company's initial public offering (IPO) in 2016 provided significant capital, fueling its growth initiatives.

In 2014, Mammoth Energy Services began its journey through strategic consolidation, integrating various energy service companies. This move was crucial in building scale and diversifying its service offerings within the oil and gas industry. The IPO on October 14, 2016, was a major milestone. The company began trading on The Nasdaq Global Select Market under the ticker symbol 'TUSK'.

The IPO provided Mammoth Energy Services with approximately $103.2 million in net proceeds. These funds were primarily allocated to debt repayment and general corporate purposes. The capital also supported potential acquisitions and equipment purchases, enhancing the company's ability to offer diverse services. This financial injection was vital for the company's early expansion.

The infrastructure services division of Mammoth Energy Services, focusing on electric grid construction and repair, has been a consistent revenue generator. The fourth quarter of 2024 saw revenues of $27.9 million, which increased to $30.7 million in the first quarter of 2025. The average crew count in this division grew to 100 crews in Q1 2025, up from 86 crews in Q4 2024, reflecting operational expansion.

While the well completion services division saw a decline in 2024, it showed sequential improvement. Revenue in Q4 2024 was $15.8 million, growing to $20.9 million in Q1 2025, with active fleets increasing to an average of 1.3. The natural sand proppant services division also experienced growth, with revenue increasing from $5.1 million in Q4 2024 to $6.7 million in Q1 2025. This increase was supported by sales volumes of 189,000 tons in Q1 2025. For more details on the competitive landscape, consider exploring the Competitors Landscape of Mammoth Energy Service.

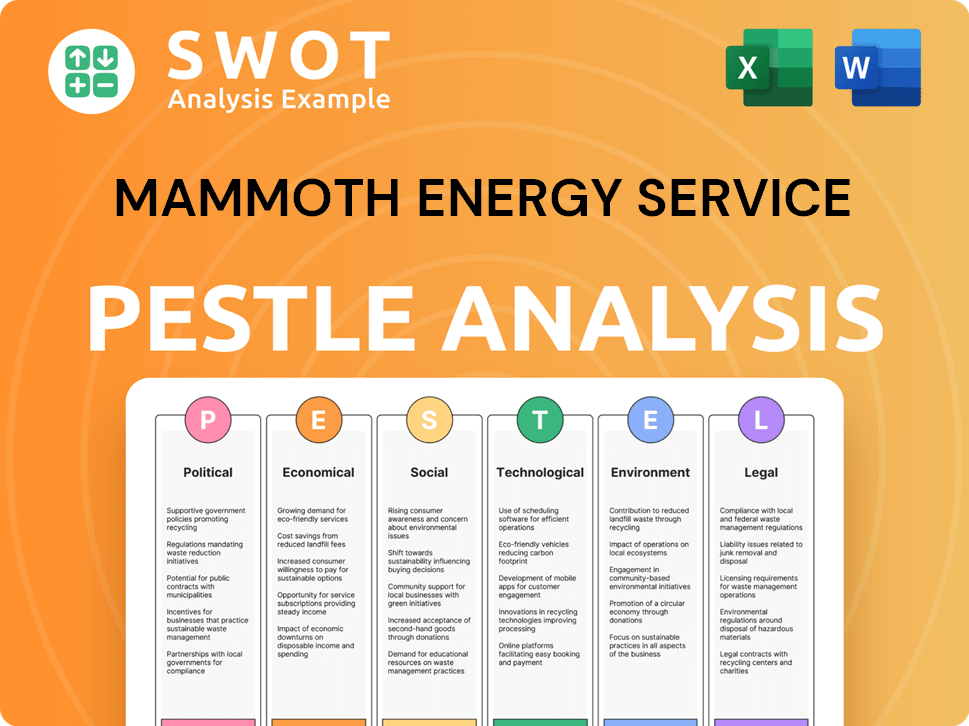

Mammoth Energy Service PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Mammoth Energy Service history?

Throughout its history, Mammoth Energy Services has achieved several significant milestones. A key moment was securing the PREPA contract in 2017, which diversified its revenue streams. However, this contract also introduced substantial counterparty risk, significantly impacting the company's financial results, as highlighted in the 2024 financial reports.

| Year | Milestone |

|---|---|

| 2017 | Secured the PREPA contract for grid reconstruction, diversifying revenue streams. |

| 2024 | Incurred a non-cash, pre-tax charge of approximately $170.7 million related to the PREPA settlement agreement, contributing to a net loss. |

| April 2025 | Announced the sale of three infrastructure subsidiaries to Peak Utility Services Group for $108.7 million. |

| January 1, 2025 | Phil Lancaster assumed the role of Chief Executive Officer. |

| May 2, 2025 | Maintained a debt-free balance sheet and a significant cash position of approximately $155 million. |

Mammoth Energy Services has maintained the capability to manufacture equipment in-house, supporting its pressure pumping, water transfer, and infrastructure services. This in-house manufacturing capability allows for potential expansion into third-party sales, showcasing an innovative approach within the energy services sector.

Mammoth Energy Services manufactures equipment in-house, supporting its pressure pumping, water transfer, and infrastructure services.

The in-house manufacturing capability allows for potential expansion into third-party sales.

The company has faced challenges in its well completion business due to lower U.S. onshore activity and weakness in natural gas basins, leading to decreased utilization. Sustained weakness in natural gas basins and lower U.S. onshore activity have impacted the company's well completion business.

The PREPA contract introduced substantial counterparty risk, leading to significant financial impact, including a $170.7 million pre-tax charge in 2024.

Lower U.S. onshore activity and weakness in natural gas basins have negatively affected the well completion business.

Total revenue declined to $187.9 million in 2024 from $309.5 million in 2023.

Decreased utilization led to the idling of some operations, including cementing, acidizing, and flowback services.

The sale of three infrastructure subsidiaries for $108.7 million indicates a strategic business transformation.

The retirement of CEO Arty Straehla and the appointment of Phil Lancaster as CEO marked a leadership transition.

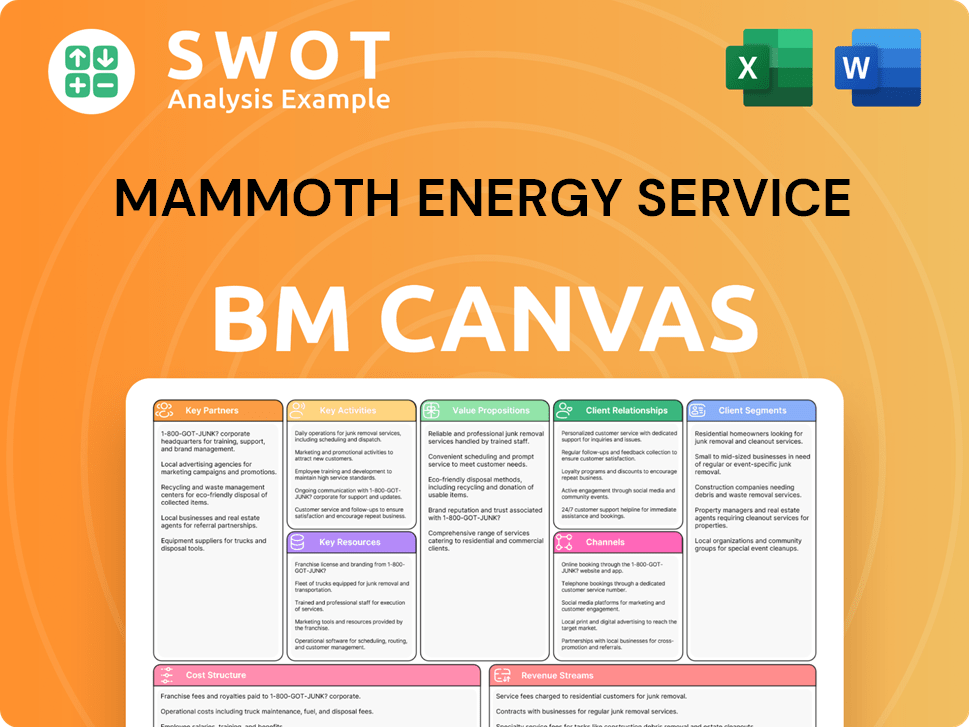

Mammoth Energy Service Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Mammoth Energy Service?

The Mammoth Energy Services company profile reveals a dynamic history marked by strategic moves and significant financial events. Formed in 2014 through consolidation, the company entered the public market in 2016, raising approximately $103.2 million through its IPO. Key events include securing major contracts in Puerto Rico in 2017 and recent leadership and financial results announcements. In April 2025, the company announced the sale of infrastructure subsidiaries for $108.7 million and the purchase of eight small passenger aircraft for $11.5 million. Mammoth Energy Services' journey reflects its evolution and adaptation within the energy services sector, focusing on strategic capital deployment and maximizing shareholder value.

| Year | Key Event |

|---|---|

| 2014 | Mammoth Energy Services, Inc. is formed through consolidation under Wexford Capital LP. |

| 2016 | Mammoth Energy Services common stock begins trading on The Nasdaq Global Select Market and completes its Initial Public Offering (IPO). |

| 2017 | The company secures significant contracts for grid reconstruction in Puerto Rico. |

| 2024 | Arty Straehla announces his decision to retire as CEO, and the company reports a net loss of $207.3 million for the full year. |

| 2025 | Phil Lancaster assumes the role of Chief Executive Officer; the company announces fourth quarter and full year 2024 operational and financial results, and first quarter 2025 results. |

Mammoth Energy Services aims to maintain steady completions activity throughout 2025. The company is focused on strategic capital deployment. Management expects to continue building upon recent positive momentum in 2025, emphasizing operational execution and efficiency.

The company reported a strong liquidity of $202.9 million as of May 2, 2025, and remains debt-free. The company is targeting 1.5 active fleets to generate free cash flow. Stable sand pricing and demand are also anticipated.

Increased natural gas demand in 2026 could provide upside. The Infrastructure Investment and Jobs Act is expected to provide growth opportunities, particularly in fiber maintenance and installation projects.

Mammoth Energy Services is positioning itself to make strategic investments for future growth, leveraging its debt-free balance sheet and substantial cash reserves. The company's forward-looking strategy remains tied to its founding vision of being an integrated energy services provider.

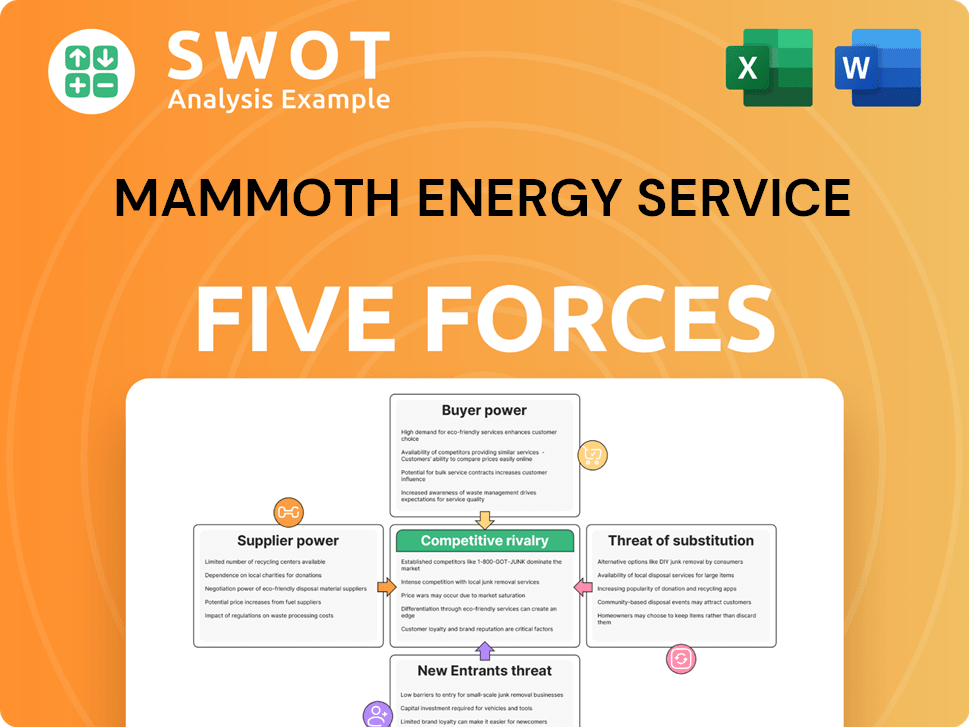

Mammoth Energy Service Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Mammoth Energy Service Company?

- What is Growth Strategy and Future Prospects of Mammoth Energy Service Company?

- How Does Mammoth Energy Service Company Work?

- What is Sales and Marketing Strategy of Mammoth Energy Service Company?

- What is Brief History of Mammoth Energy Service Company?

- Who Owns Mammoth Energy Service Company?

- What is Customer Demographics and Target Market of Mammoth Energy Service Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.