Mammoth Energy Service Bundle

Who Does Mammoth Energy Services Serve?

Navigating the complexities of the energy sector requires a deep understanding of its players. Mammoth Energy Service SWOT Analysis is essential for grasping the company's position. This analysis is particularly critical given Mammoth Energy Services' strategic shifts, including recent asset sales and fleet diversification. Understanding the customer demographics and target market is key to Mammoth's success.

This exploration delves into Mammoth Energy Services' customer profile, examining its evolution from serving independent oil and gas producers to catering to a broader spectrum including utilities. We'll conduct a thorough market analysis to identify the company's ideal customers and the strategies employed to meet their needs. This includes an examination of customer acquisition and retention tactics within the fluctuating energy services landscape.

Who Are Mammoth Energy Service’s Main Customers?

The primary customer segments for Mammoth Energy Services are primarily businesses (B2B) within the energy sector. This includes companies involved in the exploration and development of North American onshore unconventional oil and natural gas reserves, as well as various types of utilities. Understanding the Marketing Strategy of Mammoth Energy Service is crucial for grasping its customer focus.

Mammoth Energy Services' customer base is segmented according to its operational divisions: infrastructure services, well completion services, natural sand proppant, and drilling services. Each segment targets specific types of clients, reflecting the diverse nature of the energy industry. Detailed customer demographics are not publicly available, but the company's focus is clearly on the business-to-business market.

The company's strategic direction and target market have evolved based on market conditions, such as the decline in activity within the well completion and natural sand proppant segments. This shift has led Mammoth Energy to emphasize its infrastructure services and explore new opportunities.

The infrastructure services segment targets government-funded utilities, private utilities, public investor-owned utilities, and cooperative utilities. This segment focuses on the construction, upgrade, maintenance, and repair of electrical infrastructure, including transmission and distribution networks and substation facilities. Revenue from infrastructure services remained relatively stable, contributing $110.4 million in 2024, compared to $110.5 million in 2023.

The primary customers for well completion services, natural sand proppant, and drilling services are independent oil and natural gas producers and land-based drilling contractors. These customers operate in major unconventional resource plays across the United States and Alberta, Canada, such as the Utica Shale, Permian Basin, and Marcellus Shale. The well completion services division saw a significant decrease in revenue to $34.0 million in 2024 from $127.4 million in 2023.

The company's customer base is influenced by market conditions and strategic decisions. The decline in the well completion and natural sand proppant segments in 2024 prompted a shift towards infrastructure services and new opportunities. The sale of infrastructure subsidiaries and acquisition of aircraft for long-term leases indicate a strategic pivot to diversify revenue streams and enhance financial flexibility.

- Infrastructure Services: Focus on utilities, with stable revenue.

- Well Completion Services: Significant revenue decrease in 2024.

- Natural Sand Proppant: Decline in tons sold and average sales price.

- Strategic Shift: Diversification and enhanced financial flexibility.

Mammoth Energy Service SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Mammoth Energy Service’s Customers Want?

Understanding the customer needs and preferences is crucial for any company, and for the company in question, this involves a deep dive into the demands of its business-to-business (B2B) clientele within the energy and utility sectors. These customers, including oil and natural gas producers and infrastructure services, have specific requirements that drive their purchasing decisions. A thorough market analysis reveals the importance of tailoring services to meet these needs effectively.

The company's success hinges on its ability to provide efficient, reliable, and cost-effective solutions. For instance, oil and natural gas producers require services that optimize production and reduce operational costs, while utilities prioritize reliable infrastructure services. The company's strategic focus on 'single source solutions' and operational efficiency reflects an understanding of these customer needs. This approach helps the company maintain a competitive edge and adapt to fluctuating market conditions.

The company's approach to customer needs is reflected in its strategic investments and operational strategies. The company's commitment to enhancing its services is evident in its capital expenditures. For instance, capital expenditures in 2025 include $5 million for well completions and $1 million for infrastructure, indicating a continuous effort to meet evolving customer demands. This proactive approach to customer satisfaction and market adaptation is key to its sustained success.

Oil and natural gas producers prioritize efficiency, reliability, and cost-effectiveness in well completion, natural sand proppant, and drilling services. They seek solutions that optimize production and minimize downtime.

Utilities, including government-funded, private, public investor-owned, and cooperative entities, prioritize reliable and efficient construction, upgrades, maintenance, and repair of the electric grid. Regulatory compliance and safety are key factors.

Customers value a 'single source solution' approach for cost efficiencies and operational continuity. This helps in risk mitigation and access to specialized equipment and skilled personnel.

The demand for well completion services is directly tied to drilling activity and commodity prices. Reduced natural gas prices in 2024 led to a significant decrease in revenue for this segment, highlighting the need for adaptable services.

The company's capital expenditures, such as the $5 million for well completions and $1 million for infrastructure in 2025, indicate ongoing investment to meet evolving customer demands and maintain a competitive edge.

The company's emphasis on operational execution and efficiency, as stated in recent earnings calls, reflects an understanding of its customers' need for optimized service delivery.

The company's target market, which includes oil and gas producers and utility companies, has specific needs that drive their decisions. The company's ability to meet these needs is critical for its success. To understand the company's customer base, it's essential to perform a detailed market analysis.

- Efficiency and Cost-Effectiveness: Oil and gas producers require solutions that optimize production and reduce operational costs.

- Reliability and Downtime Reduction: Both oil and gas producers and utilities prioritize services that minimize downtime and ensure operational continuity.

- Regulatory Compliance and Safety: Utilities place a high value on services that adhere to regulations and maintain high safety standards.

- Single-Source Solutions: Customers prefer a 'single source solution' for cost efficiencies and streamlined operations.

- Adaptability to Market Conditions: The company's services must be able to adapt to fluctuating market conditions, such as changes in commodity prices. For example, the well completion segment experienced a significant revenue decrease in 2024.

Mammoth Energy Service PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Mammoth Energy Service operate?

The geographical market presence of the company is primarily concentrated in North America. The company strategically focuses on the United States and Alberta, Canada. This focus allows the company to cater to key areas for oil and natural gas exploration and production. This includes the Utica Shale, Permian Basin, and Marcellus Shale, which are central to the company's well completion, natural sand proppant, and drilling services.

Within the U.S., the company's infrastructure services division provides electric utility infrastructure services across northeastern, southwestern, midwestern, and western regions. This broad reach allows the company to serve a diverse range of utilities, including private, public investor-owned, and cooperative utilities. The sustained revenue from infrastructure services, which was $110.4 million in 2024, indicates a strong presence in these areas.

The company's operations are influenced by regional energy demands and regulatory environments. For example, the weakness in natural gas basins affected the well completion services, which led to a revenue decrease. For more insights, you can explore the Revenue Streams & Business Model of Mammoth Energy Service.

The company strategically locates its facilities and service centers to serve major unconventional resource plays in the U.S. These regions are key for oil and natural gas exploration and production.

The infrastructure services division offers electric utility infrastructure services across multiple regions. This includes the northeastern, southwestern, midwestern, and western regions of the United States.

The company's geographical market presence also includes Alberta, Canada. This expansion allows the company to broaden its reach in the energy sector.

In April 2025, the company sold three infrastructure subsidiaries for $108.7 million. The company plans to use its approximately $86 million in cash (as of March 5, 2025) for future growth.

Mammoth Energy Service Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Mammoth Energy Service Win & Keep Customers?

The company's approach to customer acquisition and retention is heavily influenced by its business-to-business (B2B) model. Unlike consumer-facing businesses, the company focuses on direct sales, building strong client relationships, and showcasing reliability and efficiency. This strategy is crucial for maintaining a competitive edge in the energy services sector. Understanding the Growth Strategy of Mammoth Energy Service is key to grasping its customer-centric approach.

For acquiring new customers, the company leverages its reputation and expertise in specialized services such as hydraulic fracturing and electrical infrastructure construction. Participation in industry events and direct engagement with key players like independent oil and natural gas producers are essential. The strategic locations of its facilities and service centers across major North American resource plays support direct engagement and service delivery, facilitating customer acquisition.

Customer retention hinges on consistent operational performance and responsive after-sales service. This includes maintaining high standards in electric transmission and distribution and delivering effective solutions for well completion and drilling services. Adaptability and strategic capital management are also vital, as seen in its response to market changes and disciplined approach to capital spending.

The company primarily focuses on direct sales efforts and building strategic partnerships within the energy sector. This involves actively participating in industry events and engaging directly with independent oil and natural gas producers. The strategy aims to secure contracts by demonstrating expertise and reliability in specialized services, such as hydraulic fracturing and electrical infrastructure.

Customer retention is heavily reliant on consistent operational performance and responsive after-sales service. This involves maintaining high standards in electric transmission and distribution, ensuring project completion on time and within budget. This is crucial for maintaining customer loyalty and lifetime value in a volatile industry.

The company has shown adaptability in response to market conditions, such as the decline in natural gas basin activity. This included a shift towards emphasizing its infrastructure segment. The recent sale of certain infrastructure subsidiaries for $108.7 million in April 2025 is a strategic move to enhance liquidity and provide financial flexibility.

The company's disciplined approach to capital spending, with an estimated $12 million in capital expenditures for 2025, focuses on upgrading its pressure pumping fleet and expanding its infrastructure services. This strategic allocation of capital directly impacts its ability to serve customers effectively and maintain a competitive position.

The company's strategies are centered around operational excellence, direct engagement, and adapting to market changes. Key metrics include project completion rates, customer satisfaction, and financial performance. The company's focus on operational execution, efficiency, and unlocking value reflects a commitment to meeting customer expectations and fostering long-term relationships.

- Direct Sales and Relationship Building: Emphasis on direct engagement with clients and industry events to secure contracts.

- Operational Performance: High standards in electric transmission and distribution, as well as well completion and drilling services.

- Strategic Capital Allocation: Disciplined spending, with $12 million in capital expenditures planned for 2025, to upgrade equipment and expand services.

- Market Adaptability: Adjusting strategies based on market conditions, such as shifting focus towards infrastructure and exploring new investment opportunities.

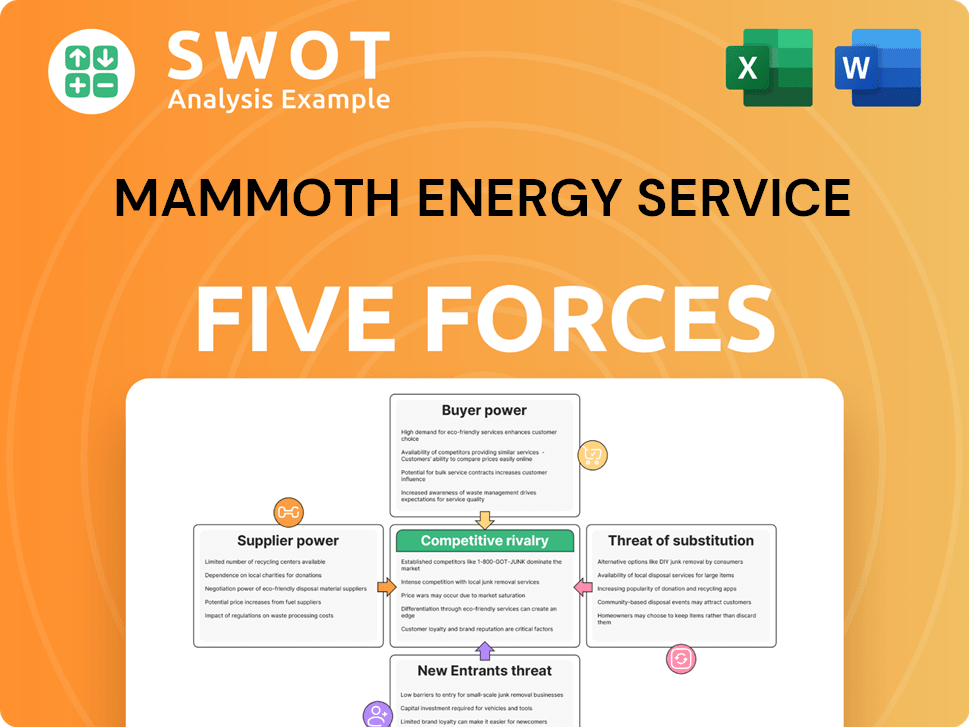

Mammoth Energy Service Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mammoth Energy Service Company?

- What is Competitive Landscape of Mammoth Energy Service Company?

- What is Growth Strategy and Future Prospects of Mammoth Energy Service Company?

- How Does Mammoth Energy Service Company Work?

- What is Sales and Marketing Strategy of Mammoth Energy Service Company?

- What is Brief History of Mammoth Energy Service Company?

- Who Owns Mammoth Energy Service Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.