Mammoth Energy Service Bundle

How is Mammoth Energy Services navigating the evolving energy landscape?

Mammoth Energy Services, a key player in North America's energy sector, has recently undergone significant strategic shifts. From resolving major financial hurdles to reshaping its operational focus, the company's trajectory offers a compelling case study in adaptability. Understanding its Mammoth Energy Service SWOT Analysis is crucial to grasp its strategic positioning.

This analysis dives deep into Mammoth Energy Services' sales strategy and marketing strategy, revealing how it aims to capture market share. We'll examine its business development initiatives, including how Mammoth Energy Services acquires customers and the effectiveness of its marketing campaign examples. The article also explores the company's brand positioning within the competitive landscape and its plans for future growth, providing actionable insights for investors and industry observers alike, focusing on its sales and marketing goals.

How Does Mammoth Energy Service Reach Its Customers?

The sales and marketing strategy of Mammoth Energy Services centers on direct sales channels to reach its diverse customer base. This approach is crucial given the nature of its energy services, which include infrastructure construction, well completion, and drilling services. The company's direct engagement model allows for tailored solutions and direct relationship building with key decision-makers.

Mammoth Energy Services focuses on serving a broad range of clients, including private and public utilities, independent oil and natural gas producers, and drilling contractors across the United States and Canada. This strategic focus is supported by the company's ability to adapt its operational focus based on market conditions, as demonstrated by shifts in revenue streams between well completion and infrastructure services.

The company's sales strategy is closely tied to its ability to secure projects through competitive bidding. This underscores the importance of a robust sales team capable of navigating complex contract negotiations and building strong relationships within the energy and utility sectors. A detailed look at the Growth Strategy of Mammoth Energy Service provides additional insights into the company's strategic direction.

Mammoth Energy Services primarily utilizes direct sales teams to engage with its target customers. This strategy is particularly effective for complex projects and services, such as infrastructure construction and well completion. The direct approach facilitates tailored solutions and strong customer relationships.

The company's customer base includes private and public utilities, independent oil and gas producers, and drilling contractors. This diverse customer base requires a sales strategy that can address the specific needs of each segment. The company operates across the United States and Canada.

Mammoth Energy Services adjusts its operational focus based on market conditions. In 2024, well completion services revenue decreased to $34.0 million, while infrastructure services contributed $110.4 million. This shift reflects strategic decisions to capitalize on different market opportunities.

In April 2025, the company sold three infrastructure subsidiaries for $108.7 million, indicating a strategic portfolio re-evaluation. Also in April 2025, Mammoth Energy purchased eight passenger aircraft for $11.5 million, immediately generating revenue through long-term leases.

The sales strategy is heavily reliant on direct engagement and relationship building with clients. The company's ability to adapt to market changes and make strategic investments is critical. The competitive bidding process is a core element of securing projects.

- Direct Sales Teams: Focus on building relationships and providing tailored solutions.

- Market Adaptation: Adjusting service offerings based on market demand, such as the shift towards infrastructure services.

- Strategic Investments: Recent acquisitions and divestitures to optimize asset utilization and revenue streams.

- Competitive Bidding: Securing projects through a competitive bidding process.

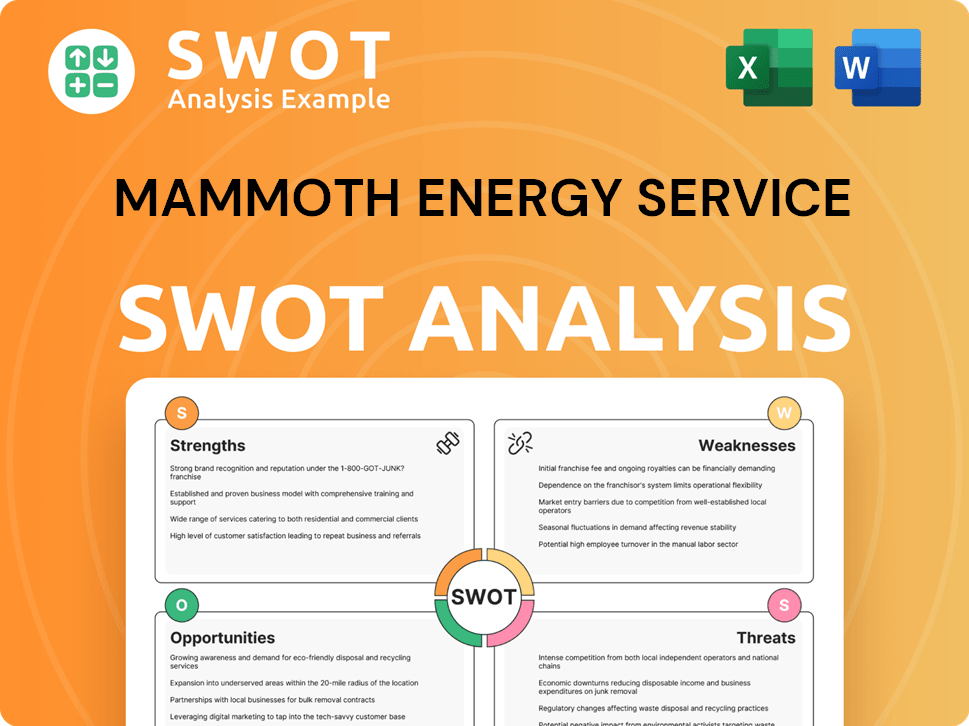

Mammoth Energy Service SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Mammoth Energy Service Use?

The Marketing Strategy of Mammoth Energy Services is primarily geared towards business-to-business (B2B) interactions, emphasizing direct engagement and demonstrating operational excellence. The company's approach focuses on building awareness and generating leads by showcasing its efficiency, reliability, and high-quality service delivery across all its operational segments. This is particularly noticeable in its infrastructure services, where its work on electric grid construction and repair for various utilities is a key driver for its sales strategy.

Digital tactics likely include a strong online presence through its corporate website, www.mammothenergy.com, which acts as a central hub for investor relations, press releases, and financial information. This platform is crucial for communicating financial performance and strategic updates to investors and potential clients. For instance, earnings call transcripts and investor presentations for Q4 2024 and Q1 2025 are readily available, providing detailed insights into the company's operations and future outlook, which is important for business development.

Traditional media and events, such as industry conferences and trade shows, also play a role in direct networking and showcasing their specialized equipment and services. The company's focus on data-driven marketing, customer segmentation, and personalization revolves around understanding the specific needs of utility companies and oil and gas operators, tailoring their service offerings and proposals accordingly. The marketing mix has likely evolved to emphasize the stability and growth potential of its infrastructure segment, especially given the challenging market for well completion services in 2024.

The company leverages its website, www.mammothenergy.com, for investor relations and financial disclosures, which is important for its digital marketing efforts. This is crucial for communicating financial performance and strategic updates to investors and potential clients.

Thought leadership, case studies, and industry-specific content are vital for lead generation and demonstrating expertise to a specialized audience. This approach helps in attracting and retaining customers within the energy services sector.

Industry conferences and trade shows are essential for direct networking and showcasing specialized equipment and services. This helps in building relationships and generating leads within the oil and gas sector.

Customer segmentation and personalization are key to understanding the specific needs of utility companies and oil and gas operators. This approach allows for tailored service offerings and proposals.

The marketing mix emphasizes the stability and growth potential of its infrastructure segment, especially given the challenging market for well completion services in 2024. This strategic shift reflects a focus on more stable revenue streams.

Earnings call transcripts and investor presentations for Q4 2024 and Q1 2025 are readily available, providing detailed insights into the company's operations and future outlook. This transparency is crucial for maintaining investor confidence.

The sales and marketing goals of Mammoth Energy Services are focused on direct engagement and demonstrating operational excellence. The company's approach involves a strong online presence, content marketing, and participation in industry events.

- Direct Engagement: Emphasis on building relationships with utility companies and oil and gas operators.

- Online Presence: Utilizing the corporate website for investor relations and financial disclosures.

- Content Marketing: Employing thought leadership and case studies to demonstrate expertise.

- Industry Events: Participating in conferences and trade shows for networking and showcasing services.

- Data-Driven Approach: Tailoring service offerings based on customer needs and market analysis.

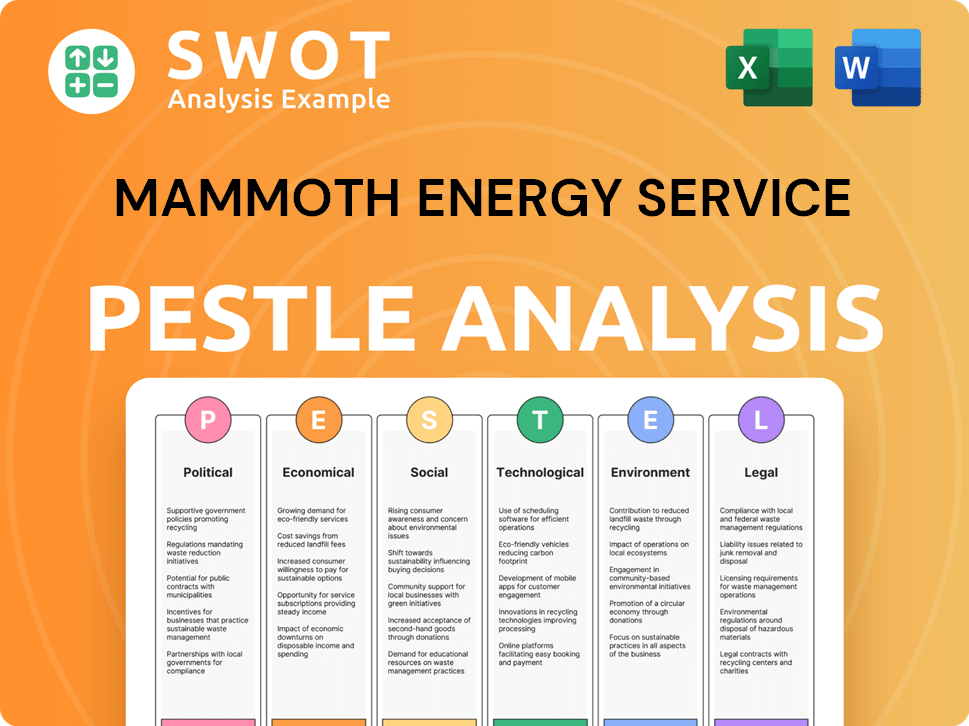

Mammoth Energy Service PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Mammoth Energy Service Positioned in the Market?

Mammoth Energy Services positions itself strategically within the energy sector, focusing on operational excellence and reliability. Their brand message emphasizes providing essential products and services for both North American onshore oil and natural gas development and the construction and repair of the electric grid. This dual specialization is a key differentiator in the competitive landscape, setting them apart from companies that may focus solely on one area.

The company's brand identity likely conveys strength and stability, aligning with the industrial nature of its services. Communications, particularly in investor relations, are direct and forward-looking, highlighting strategic financial management and future growth. The customer experience is centered on delivering tailored solutions and meeting client needs efficiently and safely. This approach supports their overall sales strategy.

The company's unique selling proposition centers on diversified services and a commitment to safety and efficiency. The infrastructure services segment, which generated $110.4 million in revenue for the full year 2024, provides stability. The company's financial health, including a debt-free status and a cash position of approximately $155 million as of May 2, 2025, strengthens its image as a capable partner. Further insights into the company's performance can be found in the analysis of Owners & Shareholders of Mammoth Energy Service.

Mammoth Energy Services' marketing strategy targets the oil and gas sector and the electric grid infrastructure market. Their focus is on providing essential services to support the exploration and development of energy resources and maintain critical infrastructure.

The company's value proposition centers on reliability, efficiency, and tailored solutions. They aim to meet client requirements safely and effectively, offering diversified services that provide stability in a volatile market. This supports their business development efforts.

A key competitive advantage is the dual specialization in both oil and gas services and electric grid infrastructure. This diversification allows the company to serve a broader market and mitigate risks associated with fluctuations in either sector. This is a key part of their sales strategy.

The company's financial strategy emphasizes financial discipline and growth. The sale of infrastructure subsidiaries in April 2025, generating $108.7 million, demonstrates a proactive approach to optimizing the portfolio for value appreciation. This supports their revenue generation goals.

The brand positioning of Mammoth Energy Services is built on several key elements, which influence their marketing campaign examples and lead generation strategies:

- Operational Excellence: Focus on efficiency and reliability in service delivery.

- Diversified Services: Providing services to both the oil and gas sector and electric grid infrastructure.

- Financial Strength: Maintaining a strong financial position, as evidenced by the debt-free status and cash reserves.

- Customer-Centric Approach: Delivering tailored solutions to meet client requirements safely and efficiently.

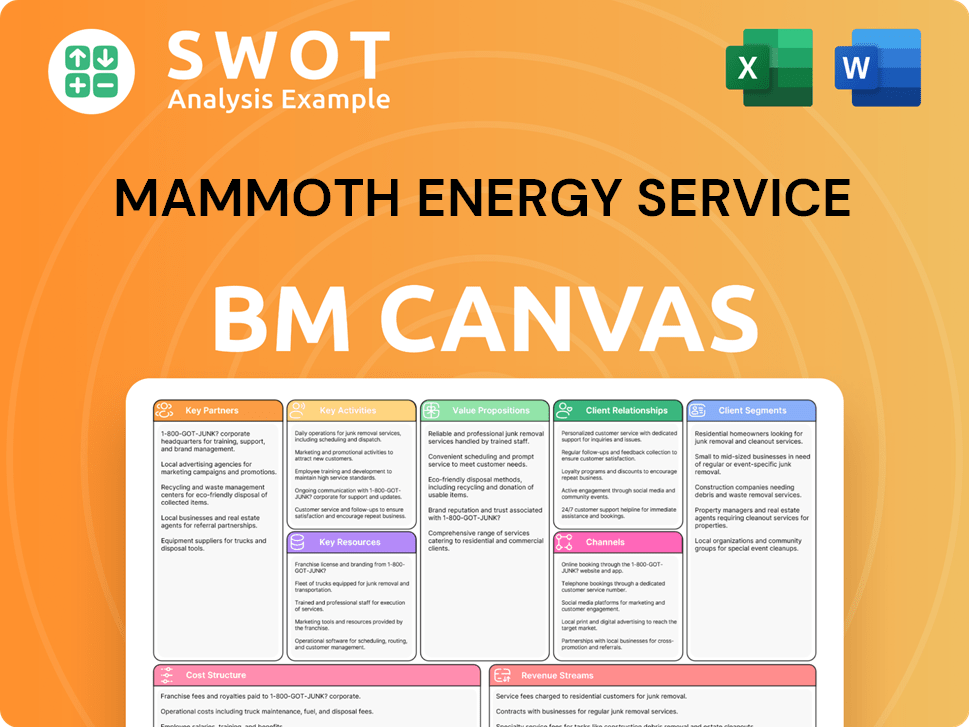

Mammoth Energy Service Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mammoth Energy Service’s Most Notable Campaigns?

The sales strategy and marketing strategy of Mammoth Energy Services are primarily executed through strategic business initiatives. These initiatives, or 'campaigns,' are less about broad consumer marketing and more about focused, B2B-oriented efforts. The company's approach centers on financial and operational strategies designed to enhance shareholder value and strengthen its market position within the energy services sector.

A key focus has been on improving the financial health of the company. This includes initiatives to recover outstanding receivables and optimize the asset portfolio. These strategic moves are crucial for driving revenue generation and ensuring long-term growth. The company's approach to business development is heavily reliant on its ability to execute these strategic campaigns effectively.

The company's success in these campaigns is reflected in its improved financial position and strategic flexibility. The company's actions can be seen as examples of effective marketing strategies for oilfield services, demonstrating a clear understanding of the competitive landscape and a commitment to achieving specific sales and marketing goals.

In July 2024, a settlement with the Puerto Rico Electric Power Authority (PREPA) was reached. This resulted in the receipt of $168.4 million out of $188.4 million owed by October 2024. This was a critical step in improving liquidity.

The improved financial position allowed the company to become debt-free. The company terminated its term credit facility in October 2024, reducing its debt burden and interest expense.

In April 2025, the company announced the sale of three infrastructure subsidiaries for $108.7 million. The objective was to monetize assets at an attractive valuation.

As of May 2, 2025, the company's unrestricted cash reached $135.4 million, with total liquidity at $202.9 million. This provides capital for future growth and investments.

The primary channels for these campaigns were direct communication and legal proceedings. The focus on strategic financial management and asset optimization significantly improved the company's financial health and positioned it for future growth. The company's approach demonstrates a clear understanding of the energy services sector.

- Improved Liquidity: The PREPA settlement and asset sales significantly boosted the company's cash reserves.

- Debt Reduction: Becoming debt-free reduced financial risk and interest expenses.

- Strategic Investments: The enhanced cash position allows for future growth and strategic investments.

- Shareholder Value: These actions collectively unlocked significant shareholder value.

Mammoth Energy Service Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mammoth Energy Service Company?

- What is Competitive Landscape of Mammoth Energy Service Company?

- What is Growth Strategy and Future Prospects of Mammoth Energy Service Company?

- How Does Mammoth Energy Service Company Work?

- What is Brief History of Mammoth Energy Service Company?

- Who Owns Mammoth Energy Service Company?

- What is Customer Demographics and Target Market of Mammoth Energy Service Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.