Mammoth Energy Service Bundle

What's Next for Mammoth Energy Services After a Strategic Shift?

Mammoth Energy Services (NASDAQ: TUSK) is reshaping its future in the dynamic energy sector. Following a significant strategic move in April 2025, the company has positioned itself for a new chapter of growth. This analysis delves into Mammoth Energy Services' Mammoth Energy Service SWOT Analysis, exploring its evolving business model and the potential impact on its financial performance.

With the sale of its infrastructure subsidiaries, Mammoth Energy Services has a strengthened balance sheet and is ready to explore new avenues. This strategic divestiture and enhanced liquidity position the company to explore how it plans to achieve future growth through expansion, innovation, and strategic planning. This shift allows a deeper dive into the company's growth strategy and future prospects within the competitive oil and gas services landscape, considering factors like market share and the impact of oil prices.

How Is Mammoth Energy Service Expanding Its Reach?

The company, focusing on its Growth Strategy, is actively pursuing several expansion initiatives to drive future growth. These initiatives are particularly centered around the strategic deployment of its enhanced cash reserves. The sale of its infrastructure subsidiaries for $108.7 million in April 2025 is a key recent action, providing the company with significant liquidity.

As of May 2, 2025, the company's cash position reached approximately $155 million. This substantial capital is earmarked for strategic, accretive investments to fuel future growth. The focus is on operational execution, efficiency improvements, and unlocking value within its existing business segments. This approach is vital for the company's Future Prospects.

While specific details on new market entries or major product launches beyond current offerings are not provided, the company is strategically expanding its equipment rentals segment. Additionally, it is converting its pressure pumping fleet to Tier 4 standards. These actions are part of the broader Growth Strategy.

The acquisition of eight small passenger aircraft for approximately $11.5 million in April 2025 is a key move. This acquisition diversifies the company's rental services fleet. It is expected to be immediately accretive to financial results due to existing long-term leases with a commuter airline. This expansion aligns with the company's Future Prospects.

Converting the pressure pumping fleet to Tier 4 standards is another strategic initiative. This upgrade enhances operational efficiency and aligns with environmental standards. These upgrades are a part of the company's long-term Growth Strategy.

Looking ahead, the company anticipates maintaining steady completions activity throughout 2025. It foresees potential upside in 2026, driven by incremental natural gas demand. The company aims to operate 1.5 active fleets to generate free cash flow. It continues to evaluate strategic opportunities to deploy capital for attractive returns and value appreciation.

- Focus on operational execution and efficiency improvements.

- Strategic deployment of enhanced cash reserves from recent asset sales.

- Expansion of the equipment rentals segment with the acquisition of aircraft.

- Conversion of the pressure pumping fleet to Tier 4 standards.

Mammoth Energy Service SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Mammoth Energy Service Invest in Innovation?

The innovation and technology strategy of Mammoth Energy Services focuses on boosting operational efficiency and cost-effectiveness across its core segments. The company's approach prioritizes practical advancements that enhance service delivery and improve operational capabilities, rather than solely focusing on cutting-edge technologies like AI or IoT.

A key element of their technology strategy involves upgrading the pressure pumping fleet to Tier 4 standards, particularly within the well completion services segment. This move is aimed at improving efficiency and meeting evolving industry standards. The company is strategically managing this conversion, with a focus on cost-effectiveness and operational efficiency.

Furthermore, the company's in-house equipment manufacturing capabilities support its operations in pressure pumping, water transfer, and infrastructure services. This internal manufacturing capacity also provides a foundation for possible expansion into third-party sales. The company is also investing in its engineering team and service offerings to support its growth objectives.

The conversion of the pressure pumping fleet to Tier 4 standards is a crucial part of the company's technology strategy. This upgrade improves efficiency and aligns with industry regulations. The company currently operates a fleet that includes 57 dual-fuel pumps, with 13 already meeting Tier 4 standards.

The company's ability to manufacture equipment internally supports its operations and provides a strategic advantage. This capability is used across pressure pumping, water transfer, and infrastructure services. It also opens up potential opportunities for future expansion into third-party sales.

The company emphasizes its engineering team and the traction seen with its service offerings. Investments in these areas are planned to support growth objectives. This approach focuses on optimizing existing assets and capabilities to drive operational improvements.

The company's innovation strategy is geared towards enhancing operational efficiencies and cost structures within its core segments. This includes strategic fleet upgrades and in-house manufacturing capabilities. The company is focused on practical advancements to improve service delivery and operational capabilities.

- Fleet Modernization: Upgrading the pressure pumping fleet to Tier 4 standards to meet industry regulations and improve efficiency.

- In-House Manufacturing: Utilizing internal manufacturing capabilities for equipment used in pressure pumping, water transfer, and infrastructure services.

- Engineering Focus: Investing in the engineering team and service offerings to support growth and optimize existing assets.

- Cost-Effective Approach: Implementing technology upgrades and innovations in a cost-effective and efficient manner.

For more insights into the company's broader strategic approach, consider exploring the Marketing Strategy of Mammoth Energy Service.

Mammoth Energy Service PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Mammoth Energy Service’s Growth Forecast?

The financial outlook for Mammoth Energy Service reflects a strategic shift and a focus on financial stability within the competitive Oil and Gas Services sector. Despite a challenging 2024, the company has demonstrated resilience and a clear path toward improved financial performance. This includes a focus on capital management and strategic investments to drive future growth.

For the full year 2024, the company reported total revenue of $187.9 million, a decrease from $309.5 million in 2023. This decline was primarily due to reduced utilization in well completion services and a decrease in natural sand proppant sales. However, the first quarter of 2025 showed a significant rebound, with total revenue increasing sequentially.

The company's strategic decisions and operational improvements are crucial for its Growth Strategy and future prospects in the Energy Sector. The financial data highlights the importance of adapting to market conditions and efficiently managing resources to achieve sustainable growth and enhance shareholder value.

Total revenue for 2024 was $187.9 million, a decrease from $309.5 million in 2023. The net loss for 2024 was $207.3 million, significantly impacted by a non-cash charge. Adjusted EBITDA for 2024 was negative $167.5 million, compared to a positive $71.0 million in 2023.

Total revenue for Q1 2025 was $62.5 million, a 17% sequential increase from Q4 2024. The net loss for Q1 2025 narrowed to $0.5 million. Adjusted EBITDA for Q1 2025 was positive at $2.7 million.

As of May 2, 2025, the company had approximately $135.4 million in unrestricted cash and total liquidity of $202.9 million. The sale of three infrastructure subsidiaries for $108.7 million in April 2025 boosted cash reserves. Capital expenditures for Q1 2025 were $7.2 million.

The company plans to strategically utilize its capital for accretive investments. The total 2025 CapEx budget (excluding acquisitions) is $12 million, focusing on equipment rentals and maintenance for pressure pumping. Revenue forecasts for FY 2025 and FY 2026 remain at $187.93 million.

The financial data reveals the company's strategic focus on improving its Financial Performance and securing its Future Prospects. The following points summarize the key financial highlights:

- Significant improvement in Q1 2025 compared to Q4 2024 and Q1 2024.

- Strong liquidity position with approximately $135.4 million in unrestricted cash as of May 2, 2025.

- Strategic use of capital for accretive investments and shareholder value.

- Focus on equipment rentals and maintenance within the pressure pumping segment.

- Stable revenue forecasts for FY 2025 and FY 2026 at $187.93 million.

Mammoth Energy Service Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Mammoth Energy Service’s Growth?

The path forward for Mammoth Energy Services, and its overall Growth Strategy, is fraught with potential risks and obstacles. Understanding these challenges is crucial for investors and stakeholders evaluating the Future Prospects of the company within the dynamic Energy Sector. Several factors could significantly impact the company's performance and strategic goals.

Market volatility, particularly in oil and natural gas prices, represents a significant risk. The actions of OPEC and other exporting nations directly influence commodity prices and production levels, potentially softening activity expectations. Furthermore, the competitive landscape within the Oil and Gas Services industry, especially in natural gas basins, poses a challenge, potentially impacting the company's well completion services.

Operational and regulatory hurdles also loom large. Environmental, health, and safety regulations, particularly those concerning hydraulic fracturing, could increase compliance costs and lead to delays. The transition to a lower carbon footprint and legislation, such as the Inflation Reduction Act of 2022, present additional risks that could negatively affect the business if not properly addressed. These factors necessitate careful consideration and proactive management strategies.

Fluctuations in oil and natural gas prices, influenced by global events and OPEC decisions, can directly impact commodity prices and production levels, leading to uncertainty in activity expectations. This volatility requires a flexible approach to operations and financial planning.

Intense competition within the oil and natural gas industry, especially in key basins, poses a challenge to maintaining market share and profitability. This necessitates continuous innovation and operational efficiency to stay ahead of rivals.

Evolving environmental, health, and safety regulations, particularly those affecting hydraulic fracturing, can increase compliance costs and potentially lead to operational delays. Adapting to these changes is crucial for long-term sustainability and avoiding legal issues.

Potential shortages or delays in the supply of essential equipment and components for pressure pumping operations can disrupt service delivery. Advancements in oilfield service technologies by competitors could create a competitive disadvantage, requiring continuous investment in technology.

Broader macroeconomic uncertainty, including tariffs and geopolitical events, can impact the demand for oil and gas services. These factors require careful monitoring and strategic agility to mitigate potential negative effects on Financial Performance.

Persistent supply chain disruptions and inflationary pressures can increase operational costs and affect project timelines. Proactive supply chain management and cost control measures are essential to maintain profitability.

Mammoth Energy Services is addressing these risks through operational execution, efficiency improvements, and maintaining a strong, debt-free balance sheet. The recent sale of infrastructure subsidiaries provided a significant cash infusion, enhancing financial flexibility. In 2024, the company focused on operational efficiency and strategic capital allocation.

The company’s strategy involves being prepared to quickly react to changes in activity and align spending with customer activity levels. This financial discipline allows for strategic opportunities, such as acquisitions or investments, to be pursued when conditions are favorable. The company's focus on a debt-free balance sheet and substantial cash reserves supports this approach.

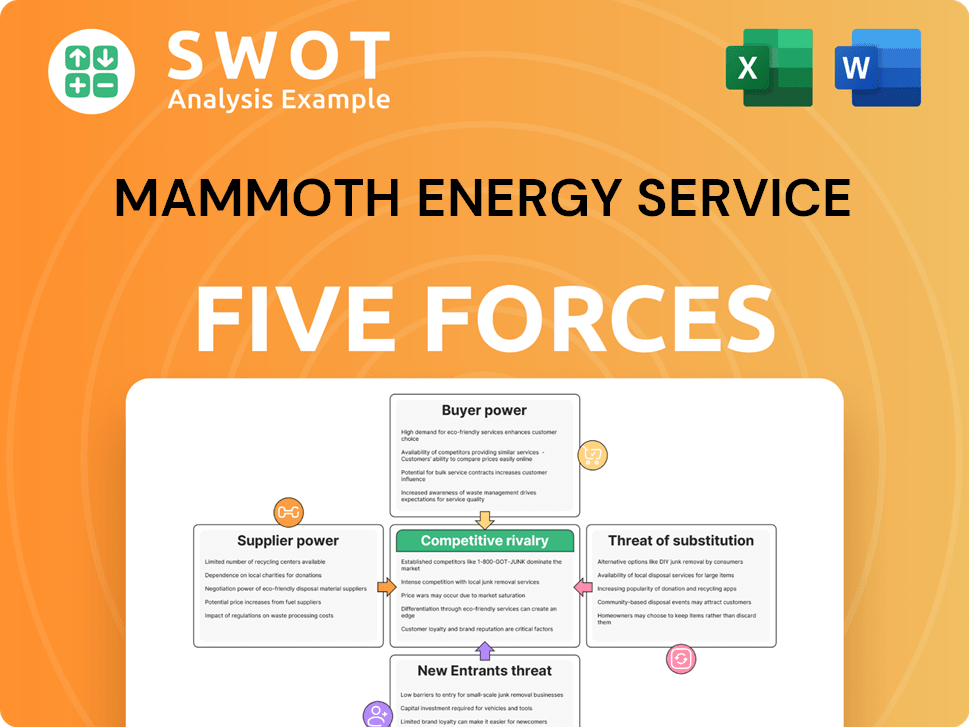

Mammoth Energy Service Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mammoth Energy Service Company?

- What is Competitive Landscape of Mammoth Energy Service Company?

- How Does Mammoth Energy Service Company Work?

- What is Sales and Marketing Strategy of Mammoth Energy Service Company?

- What is Brief History of Mammoth Energy Service Company?

- Who Owns Mammoth Energy Service Company?

- What is Customer Demographics and Target Market of Mammoth Energy Service Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.