Mammoth Energy Service Bundle

How Does Mammoth Energy Services Stack Up in Today's Energy Market?

Founded in 2014, Mammoth Energy Services quickly carved a niche in the energy sector, going public in 2016. The company has evolved into an integrated Mammoth Energy Service SWOT Analysis, focusing on both electric grid construction and energy exploration services. With a reported 17% sequential revenue increase in Q1 2025, Mammoth Energy Services demonstrates its resilience and strategic adaptation in a fluctuating market.

This analysis delves into the Mammoth Energy Services competitive landscape, providing a comprehensive market analysis to understand its position. We will explore key competitors, evaluate its financial performance, and examine the industry trends shaping its business strategy. Understanding the challenges and opportunities facing Mammoth Energy Services is crucial for investors, analysts, and anyone interested in the future prospects of this Energy Services Company.

Where Does Mammoth Energy Service’ Stand in the Current Market?

Mammoth Energy Services, an Energy Services Company, operates across several key segments. These include infrastructure services, well completion services, natural sand proppant, and drilling services. Its business model focuses on providing essential services to the oil and gas industry, aiming to support various stages of energy production and infrastructure development.

The company's value proposition centers on delivering reliable and efficient services. It focuses on meeting the evolving needs of its clients within the energy sector. The company's ability to adapt to market dynamics and maintain a strong financial position is crucial for its long-term success.

In the first quarter of 2025, Mammoth Energy Services reported a sequential increase in revenue. Total revenue reached $62.5 million, demonstrating a 17% increase compared to the fourth quarter of 2024. This growth was driven by increased demand and utilization across its service segments.

The infrastructure services segment contributed $30.7 million in revenue. The well completion services segment saw a notable increase, reaching $20.9 million, supported by increased pressure pumping utilization. The natural sand proppant services segment generated $6.7 million in revenue.

Mammoth Energy Services maintains a strong liquidity position. As of May 2, 2025, the company had unrestricted cash on hand of $135.4 million. Total liquidity stood at $202.9 million. The company was debt-free as of October 30, 2024.

Following a settlement agreement, the company's debt-free status and substantial cash reserves provide significant capacity. This financial strength supports future investments and strategic growth initiatives. The company's strong financial standing enhances its ability to navigate market fluctuations.

Mammoth Energy Services has shown positive financial performance in Q1 2025, with increased revenue and strong liquidity. This positions the company well within the competitive landscape.

- Revenue increased to $62.5 million in Q1 2025.

- Unrestricted cash on hand was $135.4 million as of May 2, 2025.

- The company is debt-free, enhancing financial flexibility.

- Strong performance in infrastructure and well completion services.

Mammoth Energy Service SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Mammoth Energy Service?

The competitive landscape for Mammoth Energy Services is shaped by its diverse service offerings within the energy sector. The company faces competition in well completion services, including hydraulic fracturing, and in infrastructure services, particularly in electric grid construction and repair. Market dynamics and industry trends significantly influence the competitive positioning of Mammoth Energy Services.

In the well completion services segment, the company competes directly with other oilfield service providers. The infrastructure services segment competes with other engineering and utility service providers. The financial performance of Mammoth Energy Services reflects the pressures of this competitive environment, as seen in its revenue fluctuations.

The company's financial results highlight the impact of market conditions. For the full year 2024, total revenue was $187.9 million, a decrease from $309.5 million in 2023. This decrease was primarily due to reduced utilization in well completion services. In the first quarter of 2025, the infrastructure services segment contributed $30.7 million in revenue. The company operated six high-pressure hydraulic fracturing fleets with a total pump capacity of 310,000 horsepower as of December 31, 2024.

Mammoth Energy Services competes with other oilfield service providers in hydraulic fracturing and related services. The market experienced softness in natural gas basins during 2024, impacting utilization rates. The company anticipates increased competition in gas basins in 2025.

In infrastructure services, Mammoth competes with engineering and utility service providers. This segment includes electric grid construction and repair. The Infrastructure Investment and Jobs Act is expected to provide growth opportunities, potentially intensifying competition.

The competitive landscape is influenced by commodity prices, demand, and industry trends. The company's financial performance, including revenue fluctuations, reflects these market dynamics. The decrease in 2024 revenue indicates the sensitivity of the business to market conditions.

Total revenue for 2024 was $187.9 million, down from $309.5 million in 2023. Infrastructure services contributed $30.7 million in the first quarter of 2025. These figures highlight the impact of competition and market conditions on Mammoth's financial results.

The company faces competitive pressures in both well completion and infrastructure services. Increased competition in gas basins and the growth of infrastructure projects are key factors. The company's ability to adapt to these pressures will be crucial.

The anticipation of increased competition in natural gas basins in 2025 suggests a dynamic market. Growth opportunities in infrastructure services, driven by legislative initiatives, will likely shape the future competitive landscape. The company's strategic responses will be critical.

The competitive landscape for Mammoth Energy Services is multifaceted, influenced by market dynamics and industry trends. The company's performance is sensitive to commodity prices and demand fluctuations. The Infrastructure Investment and Jobs Act presents growth opportunities, potentially intensifying competition.

- Mammoth competes in well completion and infrastructure services.

- Revenue for 2024 was $187.9 million, down from $309.5 million in 2023.

- The infrastructure segment contributed $30.7 million in Q1 2025.

- Increased competition is anticipated in natural gas basins.

Mammoth Energy Service PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Mammoth Energy Service a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Mammoth Energy Services requires a close look at its strategic advantages. The company's integrated service offerings, including well completion, infrastructure, and natural sand proppant, give it a solid foundation. This diversification helps navigate the ups and downs of the energy sector, making it a key player in the Energy Services Company market.

A significant aspect of Mammoth Energy Services' strategy is its focus on in-house manufacturing. This capability supports its pressure pumping, water transfer, and infrastructure services. This not only streamlines operations but also opens doors for potential third-party sales, enhancing its business strategy. Furthermore, the company's commitment to financial discipline provides a crucial edge in a competitive environment.

Mammoth Energy Services' financial health is a major strength. Its debt-free balance sheet as of October 2024 and substantial cash reserves provide flexibility. As of May 2, 2025, the company had unrestricted cash of $135.4 million and total liquidity of $202.9 million. This strong liquidity enables strategic investments and resilience against market volatility, making it a compelling choice for investors seeking stability and growth.

Mammoth Energy Services offers a range of services, including well completion, infrastructure, and natural sand proppant. This diversification allows the company to serve various customer needs. It also helps in mitigating risks associated with fluctuations in any single segment, which is crucial for long-term sustainability.

The ability to manufacture equipment in-house is a key operational advantage. This supports pressure pumping, water transfer, and infrastructure services. This capability not only reduces costs but also provides potential for future expansion into third-party sales, enhancing revenue streams.

Mammoth Energy Services boasts a strong financial position, including a debt-free balance sheet as of October 2024. The company has significant cash on hand, providing substantial liquidity for strategic investments. This financial health is essential for navigating market challenges and capitalizing on growth opportunities.

The company's ability to quickly adapt its capital spending to align with customer demand is a significant operational advantage. This flexibility allows Mammoth Energy Services to respond effectively to market changes. It ensures efficient resource allocation and supports sustained profitability.

Mammoth Energy Services' competitive edge lies in its diversified service offerings, in-house manufacturing capabilities, and strong financial position. These advantages position the company well within the Energy Services Company market. The company's focus on cost management and capital discipline further strengthens its position.

- Integrated Service Offerings: Provides a broad range of services to meet diverse customer needs.

- In-House Manufacturing: Supports operational efficiency and potential for third-party sales.

- Strong Financial Position: Offers financial flexibility for strategic investments and market resilience.

- Operational Flexibility: Enables quick adaptation to customer demand and market changes.

- Strategic Focus: Emphasis on cost management and capital discipline.

For a deeper dive into the company's strategic direction, consider exploring the Growth Strategy of Mammoth Energy Service. This competitive analysis highlights how these advantages contribute to Mammoth Energy Services' overall success and its ability to navigate the dynamic industry trends.

Mammoth Energy Service Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Mammoth Energy Service’s Competitive Landscape?

The Competitive Landscape for an Energy Services Company like Mammoth Energy Services is significantly influenced by current Industry Trends. The energy sector is undergoing a transformation, driven by technological advancements and the shift toward cleaner energy sources. While oil and gas are projected to maintain strong demand, the rise of natural gas, particularly with the increasing demand for liquefied natural gas (LNG), presents both opportunities and challenges.

Mammoth Energy Services faces regulatory challenges, especially concerning environmental, health, and safety regulations, and hydraulic fracturing rules. The Infrastructure Investment and Jobs Act offers growth prospects in the infrastructure sector, particularly in fiber maintenance and installation. Macroeconomic factors, tariffs, and geopolitical events, such as OPEC+'s decisions, can impact commodity prices and activity levels, creating market uncertainties.

The energy sector is experiencing a shift towards cleaner energy solutions, driven by technological advancements and the energy transition. Natural gas is positioned as a key energy source due to increasing global demand for LNG. Increased natural gas activity is anticipated in 2025 and 2026, which could benefit Mammoth Energy Services.

Market uncertainties stemming from macroeconomic factors, tariffs, and geopolitical events can weigh on commodity prices and activity levels. Declining demand, increased regulation, and aggressive new competitors pose potential threats to Mammoth Energy Services. The company anticipates a somewhat flat activity environment for the remainder of 2025 due to current commodity price expectations.

Growth opportunities exist in emerging markets, product innovations, and strategic partnerships. The Infrastructure Investment and Jobs Act offers significant growth opportunities in the infrastructure sector. Mammoth Energy Services is actively evaluating strategic opportunities to deploy capital and expand its equipment rental business.

Mammoth Energy Services is focusing on upgrading its pressure pumping fleet and expanding its equipment rental business. Recent acquisitions, such as the purchase of eight aircraft, demonstrate a commitment to adapting and growing. The company's strong liquidity and debt-free balance sheet position it to capitalize on opportunities.

Mammoth Energy Services is well-positioned to navigate the evolving energy landscape. The company's focus on strategic initiatives, including fleet upgrades and equipment expansion, underscores its commitment to growth. The company's debt-free balance sheet and strong liquidity provide a solid foundation for capitalizing on opportunities and remaining resilient.

- Financial Performance: The company's financial health is a key factor in its ability to pursue strategic opportunities.

- Market Expansion: Mammoth Energy Services can explore growth in emerging markets.

- Strategic Partnerships: Forming strategic alliances can help to expand their market reach.

- Adaptation to Change: The company's ability to adapt to changing market dynamics is crucial for long-term success. For more details, you can read about the Revenue Streams & Business Model of Mammoth Energy Service.

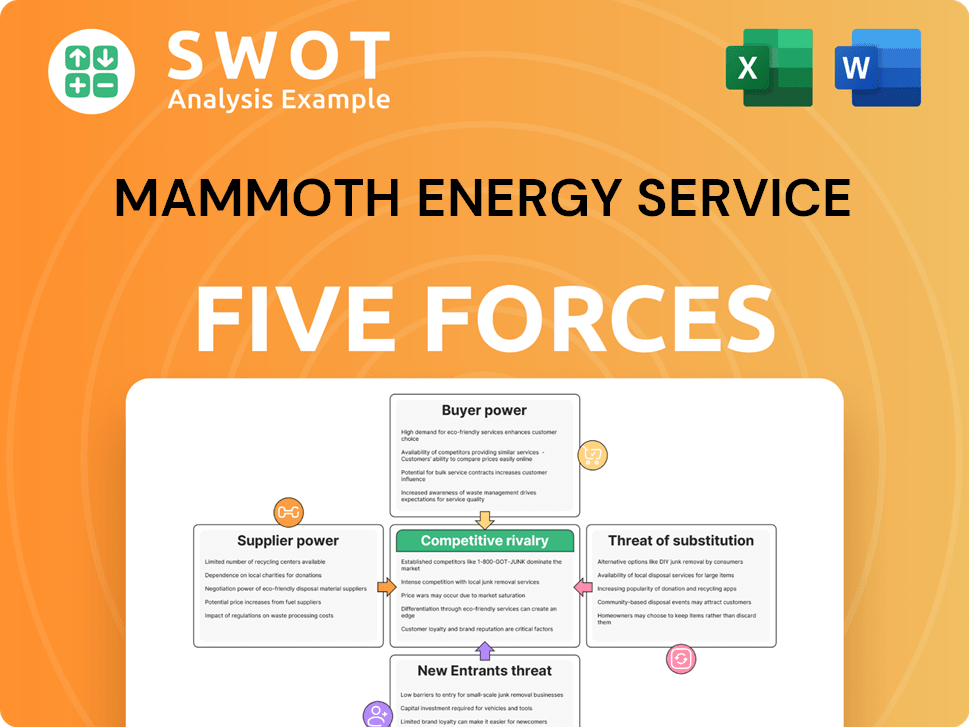

Mammoth Energy Service Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mammoth Energy Service Company?

- What is Growth Strategy and Future Prospects of Mammoth Energy Service Company?

- How Does Mammoth Energy Service Company Work?

- What is Sales and Marketing Strategy of Mammoth Energy Service Company?

- What is Brief History of Mammoth Energy Service Company?

- Who Owns Mammoth Energy Service Company?

- What is Customer Demographics and Target Market of Mammoth Energy Service Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.