MFS Bundle

What is the story behind MFS Company's rise to financial prominence?

Delve into the fascinating MFS SWOT Analysis and uncover the remarkable journey of Max Financial Services Limited (MFSL), a key player in India's financial landscape. From its inception in 1988, the company, founded by Analjit Singh, has evolved significantly. Discover how strategic shifts and a commitment to customer well-being have shaped its trajectory.

This exploration of MFS history will examine the key milestones and strategic decisions that have defined its evolution. From its roots in diverse sectors to its current specialization in life insurance through Max Life Insurance Company Limited, understand the factors that have driven its growth. Learn about the company's transition to its current name and its position as a leading non-bank private life insurance provider in India, impacting the financial services history.

What is the MFS Founding Story?

The story of the MFS Company, now known as Max Financial Services Limited, began in 1988 when it was incorporated as Max India Limited. This marked the start of a journey that would evolve significantly over the years. The initial focus was on creating businesses centered on customer well-being, emphasizing core values like integrity and innovation.

The origins of the Max Group date back to 1985, when Analjit Singh took over a company after the passing of his father, Bhai Mohan Singh, the founder of Ranbaxy Laboratories. The original company, Max India, started by manufacturing an active drug compound for penicillin.

A pivotal shift occurred around 2000, as the group transitioned from a business-to-business (B2B) model to a business-to-consumer (B2C) model. This strategic move led to ventures in healthcare and life insurance, marking a significant turning point in the company's history.

The transformation of Max India into Max Financial Services reflects a strategic evolution. The company's early focus on pharmaceuticals gave way to a broader vision that included financial services, particularly life insurance.

- 1988: Max India Limited was incorporated.

- 2000: The group shifted its focus to B2C models, entering healthcare and life insurance.

- 2000: Max Life Insurance was founded.

- 2001: Max Life Insurance began operations.

Max Life Insurance was founded in 2000, and operations commenced in 2001 following the liberalization of the insurance sector in India. The company started as a joint venture, initially between Max Financial Services and New York Life, and later with Mitsui Sumitomo Insurance (MSI). Max Financial Services holds an 80.98% majority stake in Max Life Insurance, which is India's largest non-bank owned private life insurance company.

For more insights into the company's mission and values, you can explore the Mission, Vision & Core Values of MFS.

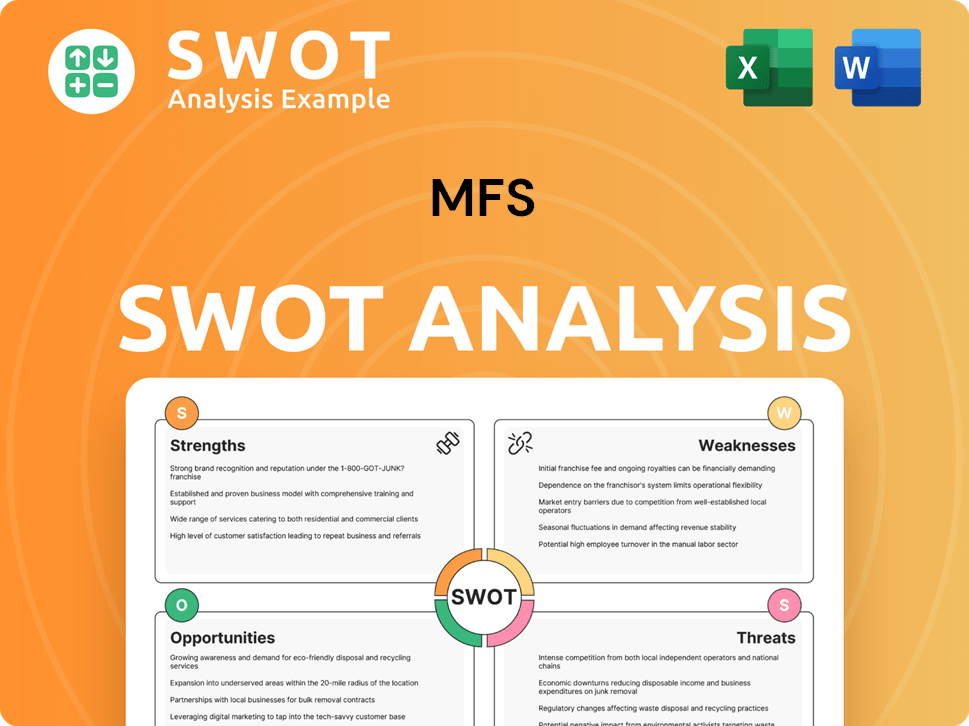

MFS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of MFS?

The early years of Max Financial Services (MFS), then known as Max India, were marked by significant diversification and strategic partnerships. This period saw the company venture into various sectors, laying the groundwork for its future focus on financial services. These early moves were crucial in shaping the company's trajectory and establishing its presence in the market.

In 1992, Max India partnered with Hutchison Telecom to create Hutchison Max Telecom Pvt. Ltd., offering value-added telecom services. A merger with Maxxon India occurred in 1993. The company also formed a memorandum of understanding with Comsat Corporation USA for a joint venture in VSAT communication services.

A pivotal shift happened in 2001 with the entry into the insurance business through Max New York Life, a joint venture with New York Life. Early interest in the health insurance sector was shown in 2002, and the pharmaceutical division was divested to Jubilant Organosys for Rs. 62.7 crore. Further expansion into healthcare staffing was made with a 50% investment in Max HealthStaff International Ltd.

A major corporate restructuring in January 2016 demerged Max India into three entities: Max Financial Services, Max India, and Max Ventures & Industries. Max Financial Services, focused solely on life insurance, began trading on January 27, 2016. In FY 2015-16, the company renewed its corporate agency relationship with Axis Bank, expanding its distribution network. As of Q1 FY25 (June 2024), Max Life Insurance has onboarded seven new partners, including CSB Bank.

In 1994, Maxfoil, a product for the leather industry, was introduced, and cellular, paging, and VSAT satellite communication networks were commissioned. The launch of 'Maxis 2020' in FY 2015-16 marked a nationwide transformation of life insurance selling processes using data analytics. This strategic focus and restructuring were vital steps in the evolution of the MFS Company.

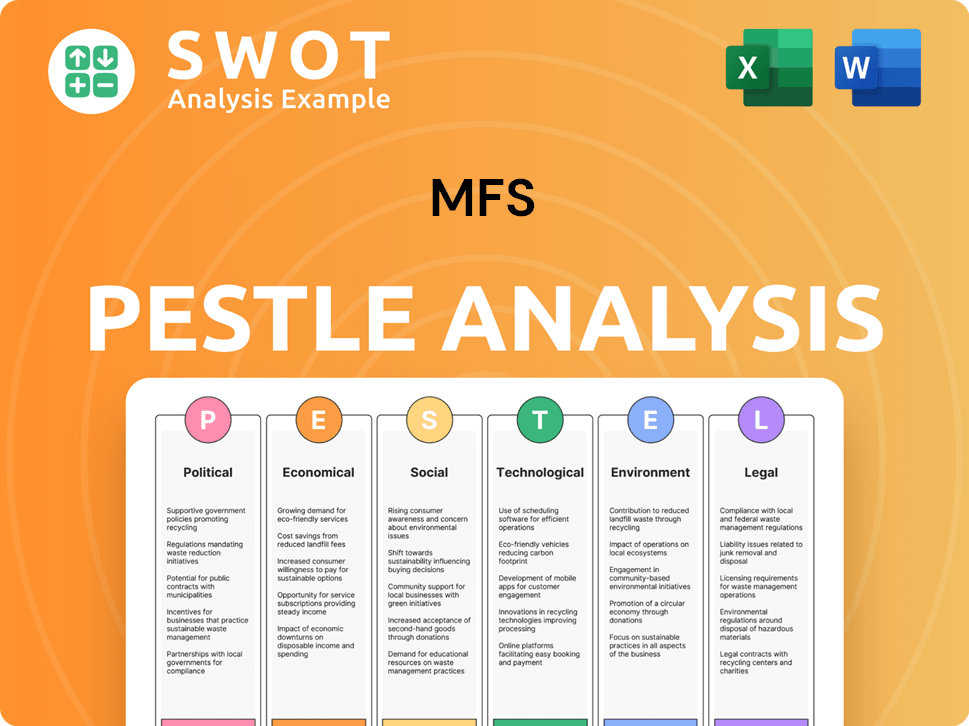

MFS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in MFS history?

The MFS Company, through Max Life Insurance, has achieved several significant milestones in the Indian insurance sector, marking its journey in the financial services history.

| Year | Milestone |

|---|---|

| Q1 FY25 | Launched a Flexi Cap Fund designed for e-commerce and bancassurance customers to capitalize on the increasing interest in index funds. |

| FY25 | Consolidated net profit declined by 3.78% to ₹327.21 crore. |

| December 2024 | Consolidated net profit declined by 62.28% to ₹56.04 crore compared to the previous year. |

| March 2025 | Reported a consolidated net profit of ₹31.31 crore, a significant improvement from a net loss of ₹44.05 crore in the year-ago period. |

The MFS Company has consistently driven product innovation, introducing industry-first initiatives. These innovations include the Max Life Smart Wealth Annuity Guaranteed Pension Plan - Limited Pay variant, catering to personalized retirement planning, and the industry-first Whole Life plan to address endowment category clutter.

Launched a Flexi Cap Fund in Q1 FY25 to capitalize on the growing interest in index funds among e-commerce and bancassurance customers.

Introduced an industry-first Whole Life plan to address the clutter in the endowment category, showcasing the MFS Company's commitment to innovative product design.

Offered cash and premium offset bonus options to enhance liquidity for policyholders, providing greater financial flexibility.

Launched the first PAR Top Up option, allowing policyholders to increase their coverage and investment potential.

Introduced a 'Freelook Period,' which became a regulatory standard, giving customers time to review their policies.

Created a Universal Life product to provide transparent customer participation in the debt market.

Despite these innovations, the MFS Company has faced challenges, including competitive pressures and market downturns. In Q1 FY25, while Annual Premium Equivalent (APE) growth was healthy, Value of New Business (VNB) saw a significant miss, with VNB margins at 17.5% against estimates of 23.2% due to an adverse product mix.

The company faces competition from both public and private insurance businesses, impacting profitability and market share.

Market fluctuations and adverse product mixes have affected profitability, as seen in the VNB margins in Q1 FY25.

The shift towards higher ULIP sales and lower non-par business in Q1 FY25 led to lower VNB margins, highlighting the need for strategic adjustments.

Higher operating expenses have also contributed to the challenges faced by the company, impacting overall financial performance.

The company's consolidated net profit declined by 62.28% to ₹56.04 crore in the quarter ended December 2024 compared to the previous year.

The company expects VNB margins to be around 23-24% for FY25, factoring in new surrender value norms, indicating a focus on improving profitability.

MFS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for MFS?

The MFS Company, formerly known as Max India Limited, has a rich

| Year | Key Event |

|---|---|

| February 24, 1988 | Incorporated as Max India Limited. |

| 1992 | Formed a joint venture with Hutchison Telecom, Hutchison Max Telecom Pvt. Ltd. |

| 1993 | Maxxon India merged with the company. |

| 2000 | Max Life Insurance was founded. |

| 2001 | Max New York Life, a joint venture, entered the insurance business. |

| 2012 | Max Life changed its name from Max New York Life after forming a joint venture with Mitsui Sumitomo. |

| January 15, 2016 | Max India was renamed Max Financial Services Limited following a corporate restructuring. |

| January 27, 2016 | Ex-demerger stock of Max Financial Services started trading. |

| February 2016 | Axis Bank acquired a 6% share in Max Life. |

| August 2016 | Board approved the amalgamation of Max Life with HDFC Life, aiming to create India's largest private-sector life insurance company, though this merger did not fructify. |

| 2020-2021 | Reported a consolidated net profit of ₹1,124 crore and revenue of ₹10,582 crore in 2020; partnered with Axis Bank in 2021 to enhance distribution. |

| March 31, 2023 | Max Life's Assets Under Management (AUM) reached ₹1,22,857 crore. Max Financial Services reported a consolidated revenue of ₹13,719 crore. |

| December 13, 2024 | Max Life Insurance rebranded itself to Axis Max Life Insurance. |

| Q4 FY25 (March 2025) | Reported a consolidated net profit of ₹31.31 crore. For the full FY25, consolidated net profit declined 3.78% to ₹327.21 crore. |

| Q1 FY25 (June 2024) | Consolidated revenue reached ₹7,709 crore, a 21% growth. Max Life's AUM crossed ₹1.5 lakh crore to ₹1,50,836 crore. Individual Adjusted First Year Premium grew by 27% to ₹1,260 crore, leading to a private market share gain by 22 basis points to 8.8%. |

The company plans a balanced product mix, with non-participating products targeted at 30-35% of Annual Premium Equivalent (APE) and protection products at 35-40%. They are focused on accelerating product innovation, including new offerings like the Smart Wealth Advantage Guarantee and a Guaranteed Lifetime Income Plan.

The company is expanding into new customer segments and leveraging digital channels, with proprietary channels growing by 60% in Q1 FY25. They are also actively onboarding new partners, with seven new collaborations in Q1 FY25, demonstrating a commitment to broader market reach.

Management expects VNB margins to improve by 100-150 basis points beyond FY24 due to new product introductions and an increased share of non-par products. The reverse merger of Max Financial with Max Life Insurance, along with the listing of Max Life, remains a key catalyst.

The long-term vision is to be the most admired company for protecting and enhancing the financial future of its customers. This aligns future growth with its founding principles, focusing on customer value and sustainable financial solutions.

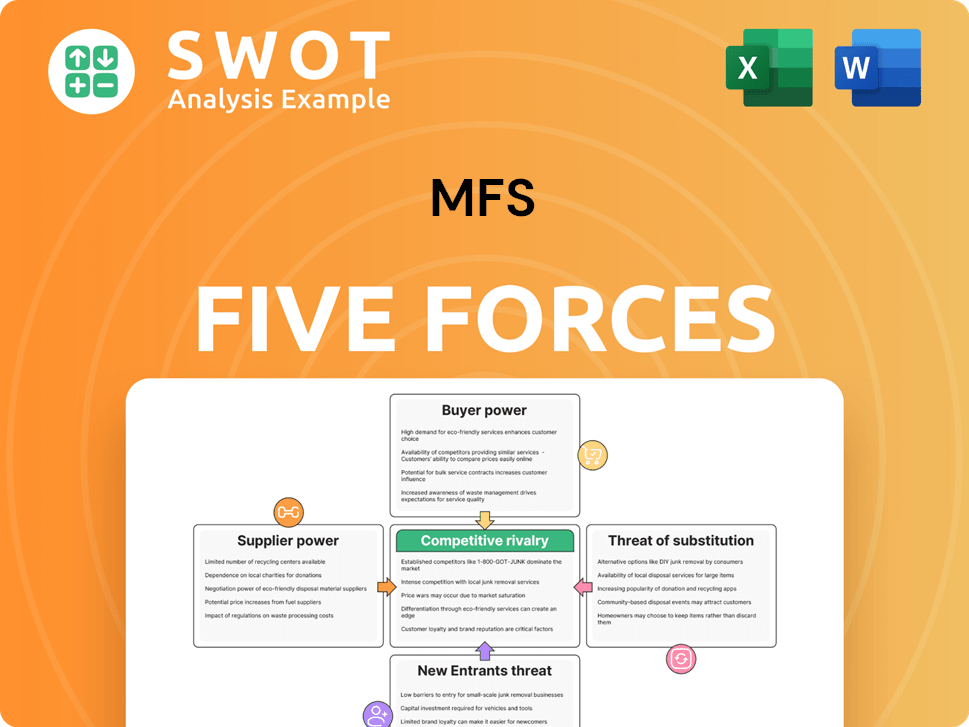

MFS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of MFS Company?

- What is Growth Strategy and Future Prospects of MFS Company?

- How Does MFS Company Work?

- What is Sales and Marketing Strategy of MFS Company?

- What is Brief History of MFS Company?

- Who Owns MFS Company?

- What is Customer Demographics and Target Market of MFS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.