MFS Bundle

How Does Max Financial Services Navigate the MFS Competitive Landscape?

The Indian life insurance sector is a dynamic arena, and Max Financial Services Limited (MFSL) has emerged as a key player. With a strong foundation built on customer-centricity and innovative products, MFSL, through Max Life Insurance, has consistently expanded its footprint. Understanding the MFS SWOT Analysis is crucial to grasp its position in this evolving market.

This article will dissect the MFS competitive landscape, providing a detailed MFS market analysis. We will explore the strategies employed by MFSL to compete with its fintech rivals and other mobile money providers. Furthermore, we'll examine the challenges in the MFS market and the competitive advantages that enable MFSL to thrive, offering insights into the future of MFS competition.

Where Does MFS’ Stand in the Current Market?

Max Financial Services Limited, through its subsidiary Max Life Insurance, holds a significant market position within the Indian life insurance sector. The company's strategic initiatives and consistent performance have solidified its standing as India's largest non-bank private life insurance company. This strong foundation is built on a comprehensive suite of long-term savings, protection, and retirement solutions designed to meet the diverse needs of its customers.

The company's operations are supported by a multi-channel distribution network, including agency, bancassurance partnerships, and online platforms. This diversified approach allows the company to effectively reach a broad customer base across India, adapting to local market nuances. The company's focus on enhancing its digital capabilities and expanding its bancassurance footprint, especially through its partnership with Axis Bank, has significantly boosted its distribution reach and market penetration.

The competitive landscape of MFS is dynamic, with various players vying for market share. Max Life Insurance navigates this environment by focusing on innovation, customer-centric solutions, and strategic partnerships. A deeper understanding of the Brief History of MFS can provide additional context to the company's evolution and competitive strategies.

Max Life Insurance reported a Gross Written Premium of ₹29,568 crore for FY24, demonstrating its substantial scale and operational capacity. This figure reflects a healthy growth rate, showcasing its ability to expand within a competitive market. The company's consistent financial performance underscores its strong market position.

For the nine months ended December 31, 2024, Max Life Insurance reported a Profit After Tax (PAT) of ₹1,048 crore. This indicates healthy profitability and financial stability, positioning the company favorably compared to industry averages. The company's financial health supports its strategic initiatives and future growth plans.

The company is focused on enhancing its market share in specific segments and regions, particularly in the protection and annuity businesses. This strategic focus allows Max Life to capitalize on emerging opportunities within the MFS industry. The company's ability to adapt and innovate is crucial in the face of Fintech rivals.

Max Life Insurance leverages a multi-channel distribution network, including a strong bancassurance partnership with Axis Bank, to reach a broad customer base. This diversified approach, combined with a focus on digital capabilities, provides a competitive edge in the MFS market. The company's robust market position is a result of its strategic initiatives.

The MFS competitive landscape is influenced by factors such as technological advancements, regulatory changes, and evolving customer preferences. Max Life Insurance addresses these challenges by investing in digital solutions and strengthening its distribution channels. The company continuously assesses market trends and opportunities to maintain its competitive advantage.

- Focus on Protection and Annuity: Targeting high-growth segments.

- Digital Transformation: Enhancing online platforms and customer experience.

- Strategic Partnerships: Leveraging bancassurance and other collaborations.

- Geographic Expansion: Broadening reach across urban and semi-urban areas.

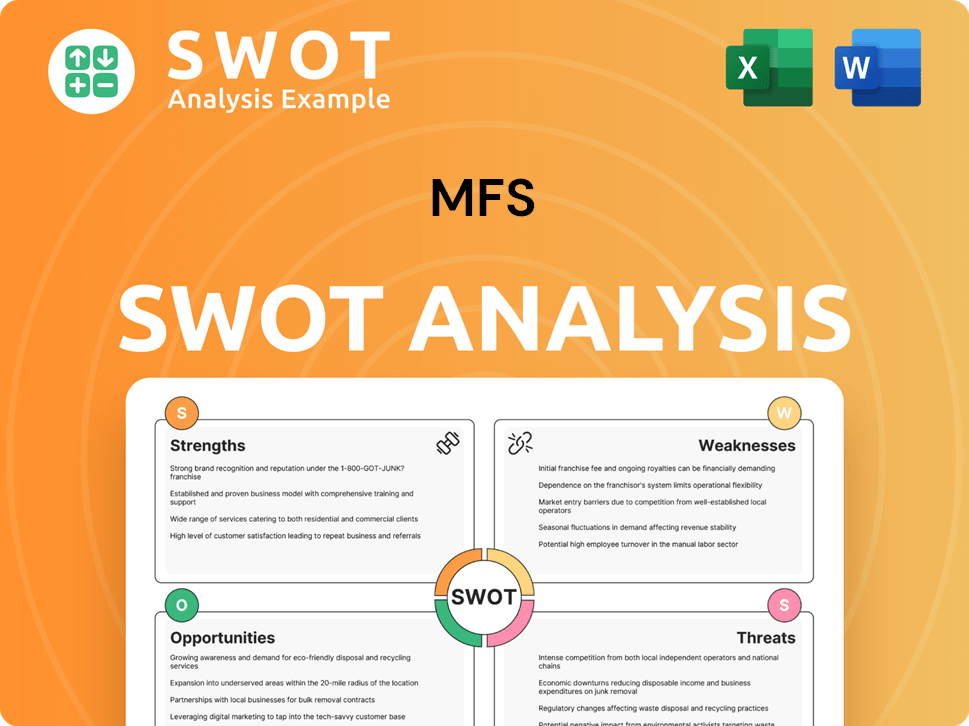

MFS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging MFS?

The competitive landscape for Max Financial Services Limited (MFS), particularly through its subsidiary Max Life Insurance, is intensely contested within the Indian life insurance sector. This environment is shaped by a mix of established public sector entities and dynamic private players, each vying for market share and customer acquisition. Understanding the MFS competitive landscape is crucial for strategic planning and sustained growth.

The dynamics within the MFS industry are influenced by factors such as product innovation, distribution networks, and digital adoption. The market is also affected by regulatory changes and evolving consumer preferences, which require constant adaptation and strategic agility from all participants. This analysis provides insights into the key competitors and their strategies within this competitive ecosystem.

Max Life Insurance faces significant competition from both public and private sector entities. The primary competitors include Life Insurance Corporation of India (LIC), HDFC Life Insurance Company, ICICI Prudential Life Insurance Company, and SBI Life Insurance Company. Each competitor employs different strategies to capture market share, including leveraging extensive distribution networks, offering innovative products, and investing in digital transformation. The competitive intensity necessitates continuous evaluation and strategic adjustments to maintain a strong market position.

LIC, a public sector undertaking, remains a dominant force in the Indian life insurance market. Its extensive legacy, vast agent network, and widespread reach give it a significant competitive advantage. LIC's market share, though subject to fluctuations, continues to be substantial.

HDFC Life is a major private sector competitor, known for its strong financial performance and strategic partnerships. HDFC Life reported a profit after tax of ₹1,756 crore for the nine months ended December 31, 2023, demonstrating its robust market presence. They often leverage strong bancassurance channels.

ICICI Prudential is another key private player, competing aggressively across various product segments. They focus on leveraging their extensive branch networks and distribution capabilities to reach a broad customer base. ICICI Prudential competes directly with Max Life across various product segments.

SBI Life benefits from its association with State Bank of India, giving it a significant distribution advantage, especially in semi-urban and rural areas. This association provides SBI Life with an unparalleled reach. They compete in price, product innovation, and digital adoption.

Emerging players and those with niche digital-first models pose indirect threats. These companies often disrupt traditional distribution channels. Mergers and alliances are strategic moves to consolidate market position.

Competition is intense across price, product innovation, and digital adoption. Digital transformation is crucial for customer onboarding and claims processing. Partnerships, like the one between Max Life and Axis Bank, are key to expanding reach.

Several factors drive competition in the MFS market analysis. These include the ability to offer competitive pricing, innovative products, and efficient digital services. Distribution networks, customer service quality, and brand reputation also play crucial roles in attracting and retaining customers. Understanding these factors is essential for any fintech rivals seeking to succeed.

- Product Innovation: Developing new and relevant insurance products that meet evolving customer needs.

- Distribution Network: Leveraging diverse channels, including agents, bancassurance, and digital platforms, to reach a wider audience.

- Digital Adoption: Investing in technology to streamline processes, improve customer experience, and enhance operational efficiency.

- Pricing Strategy: Offering competitive premiums and value-added services to attract customers.

- Customer Service: Providing excellent customer support to build trust and loyalty.

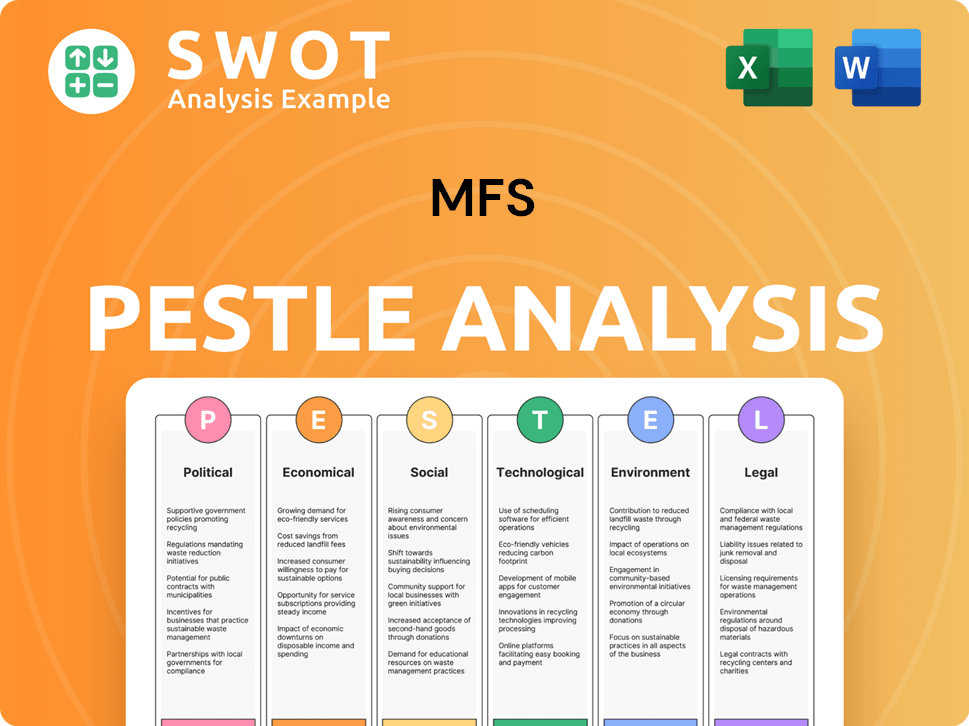

MFS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives MFS a Competitive Edge Over Its Rivals?

The competitive landscape for Max Financial Services Limited (MFS), particularly through its subsidiary Max Life Insurance, is shaped by several key advantages. These strengths enable it to compete effectively in the dynamic Indian life insurance market. A crucial aspect of MFS's strategy involves leveraging its brand reputation and commitment to customer satisfaction, which are vital in building trust and loyalty within the industry.

MFS's success is also driven by its robust distribution network and product innovation. The company's multi-channel approach, encompassing bancassurance partnerships, agency channels, and online platforms, ensures broad market reach. Furthermore, the ability to adapt product offerings to meet evolving customer needs and regulatory changes provides a significant competitive edge. These factors are essential for maintaining and expanding its market position.

Financial health and risk management practices contribute to MFS's ability to offer competitive products and ensure long-term sustainability. Strategic investments in technology and talent have enhanced operational efficiencies and customer experience. MFS continues to leverage these advantages in its marketing efforts, product development, and strategic partnerships to sustain its leadership position. However, the company faces ongoing challenges from competitors and the need for continuous innovation to remain competitive.

MFS benefits from a strong brand reputation, particularly through Max Life, which is known for its customer service and claims settlement. The high claims paid ratio, such as the 99.65% for individual policies in FY24, builds trust and loyalty. This commitment is a key differentiator in the life insurance sector, where trust is paramount for customer retention and acquisition.

A diversified distribution network is a significant advantage for MFS. The company utilizes a multi-channel approach, including a strong bancassurance partnership with Axis Bank, agency channels, and a growing online presence. This strategy provides broad market penetration and reduces reliance on a single distribution stream, enhancing its ability to reach a wider customer base.

MFS focuses on product innovation to offer comprehensive savings, protection, and retirement solutions. The ability to adapt product offerings to changing market dynamics and regulatory landscapes is crucial. This allows MFS to capture new market segments and maintain relevance, ensuring its products meet evolving customer needs and preferences.

Strong financial health and prudent risk management are critical for MFS. These practices support the company's ability to provide competitive products and ensure long-term sustainability. Strategic investments in technology and talent further enhance operational efficiency and improve customer experience, contributing to its competitive edge.

The MFS competitive landscape is significantly shaped by its strategic advantages. These include a strong brand reputation, a robust distribution network, and a focus on product innovation. These elements enable MFS to maintain a competitive edge in the market. For more insights, explore the Growth Strategy of MFS.

- High Claims Paid Ratio: Maintains customer trust and loyalty, a critical factor in the insurance sector.

- Diversified Distribution: Ensures broad market reach and reduces reliance on single channels.

- Product Innovation: Adapts to changing market dynamics and regulatory landscapes.

- Financial Health: Supports competitive product offerings and long-term sustainability.

MFS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping MFS’s Competitive Landscape?

The Indian life insurance industry is currently experiencing significant shifts, creating both challenges and opportunities for companies like Max Financial Services Limited. These changes are driven by technological advancements, evolving consumer preferences, and regulatory adjustments. Understanding these trends is crucial for assessing the MFS competitive landscape and formulating effective strategies.

The industry faces potential threats from intensified competition and economic instability, yet it also benefits from India's underserved population and increasing awareness of financial planning. Strategic partnerships and product innovations are key to tapping into these growth areas. Analyzing the MFS market analysis requires a deep understanding of these multifaceted dynamics.

Digitalization is transforming customer acquisition, policy servicing, and claims processing. Insurtech innovations, such as AI-powered underwriting and data analytics for personalized offerings, are reshaping the competitive landscape. The Insurance Regulatory and Development Authority of India (IRDAI) introduces new guidelines impacting product design and distribution.

Intensified competition from new digital-first insurers and aggressive expansion strategies of existing players pose a threat. Economic slowdown or domestic financial instability could impact demand. Adapting to regulatory changes and maintaining customer trust are ongoing challenges. Navigating the MFS competition requires constant innovation.

India's underserved population, particularly in semi-urban and rural areas, presents a significant growth opportunity. Increasing awareness of financial planning and protection, especially post-pandemic, fuels demand. Product innovations in health and wellness-linked insurance offer avenues for expansion. Strategic partnerships, as highlighted in the Marketing Strategy of MFS, are crucial for market penetration.

The competitive landscape is evolving towards a more digitally integrated and customer-centric model. Companies must focus on expanding bancassurance and agency networks while adapting to regulatory shifts. The ability to leverage technology and data for personalized solutions will be a key differentiator. The MFS industry is dynamic.

The Indian insurance market is projected to grow significantly. Digital insurance sales are increasing, with a focus on mobile-first solutions. Regulatory changes are driving transparency and customer-centricity. Understanding the MFS market trends and opportunities is crucial for success.

- The Indian insurance market is expected to reach $278 billion by 2026.

- Digital insurance sales are growing at a rate of approximately 30% annually.

- Bancassurance continues to be a major distribution channel, accounting for about 60% of new business.

- Insurtech investments in India reached $700 million in 2024.

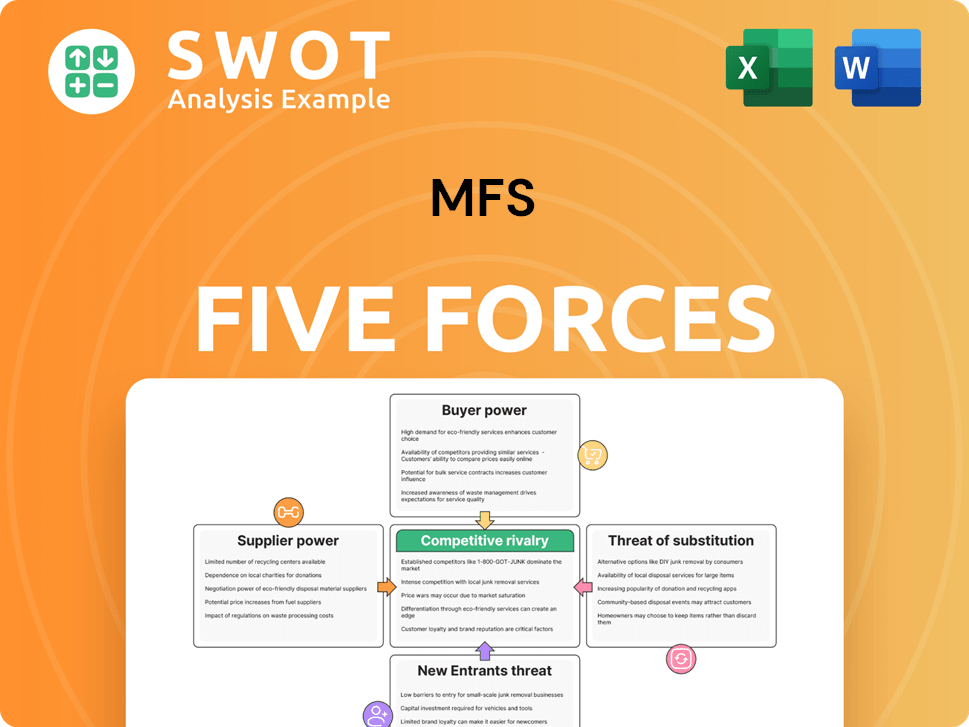

MFS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of MFS Company?

- What is Growth Strategy and Future Prospects of MFS Company?

- How Does MFS Company Work?

- What is Sales and Marketing Strategy of MFS Company?

- What is Brief History of MFS Company?

- Who Owns MFS Company?

- What is Customer Demographics and Target Market of MFS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.