MFS Bundle

Can Max Financial Services (MFS) maintain its growth trajectory in India's dynamic financial landscape?

The Indian life insurance sector is constantly evolving, with strategic partnerships reshaping the competitive environment. Max Financial Services Limited (MFSL), the holding company of Max Life Insurance, has navigated these shifts, demonstrating significant adaptability since its inception in 1988. This analysis delves into the MFS SWOT Analysis to explore its growth strategies and future prospects.

This exploration will examine MFS's strategic initiatives, innovation in the Fintech industry, and financial planning to solidify its market leadership. We will analyze the MFS market analysis 2024, considering the impact of digital payments and financial inclusion on its future. Understanding the challenges facing mobile financial services and the growth opportunities for MFS providers is crucial for informed investment decisions and strategic planning in this evolving sector, including mobile money transfer services.

How Is MFS Expanding Its Reach?

The expansion initiatives of Max Financial Services Limited, through its subsidiary Max Life Insurance, are designed to boost market penetration and diversify its offerings. A core focus is on strengthening its distribution network, particularly through its bancassurance channel. This strategy is exemplified by its partnership with Axis Bank.

This collaboration significantly enhances Max Life's reach, enabling it to tap into new customer segments and drive premium growth. The company is also exploring expansion into new geographical markets within India, focusing on underserved regions to increase insurance penetration. Furthermore, Max Life is continuously enhancing its product portfolio, introducing innovative solutions in long-term savings, protection, and retirement.

These initiatives aim to acquire new customers, diversify revenue streams, and stay ahead of the evolving regulatory landscape and competitive pressures within the Indian insurance sector. The company's strategic moves are crucial for sustaining growth in the dynamic financial market. For a deeper understanding of the company's background, you can explore the Brief History of MFS.

The company is focused on strengthening its distribution network, especially through its bancassurance channel. The strategic partnership with Axis Bank, where Axis Bank increased its stake to 19.02% as of March 2024, is a key element of this strategy. This collaboration significantly boosts Max Life's access to a wider customer base.

Max Life is looking to expand into new geographical markets within India. The focus is on underserved regions to increase insurance penetration. This expansion is part of a broader strategy to reach more customers and increase its market share across the country.

Max Life is continuously enhancing its product portfolio. The company is introducing innovative solutions in long-term savings, protection, and retirement. This includes leveraging digital platforms to reach a wider audience and streamline the customer experience.

The company is actively using digital platforms to reach a wider audience. This approach streamlines the customer experience, making it easier for customers to access and manage their insurance policies. Digital integration is a key part of the MFS growth strategy.

Max Life's expansion strategy includes strengthening its distribution channels, expanding geographically, and innovating its product offerings. These initiatives are designed to enhance market penetration and diversify revenue streams, crucial for the future of MFS in emerging markets.

- Strengthening Bancassurance: Leveraging partnerships like the one with Axis Bank to boost distribution.

- Geographical Expansion: Targeting underserved regions within India to increase insurance penetration.

- Product Innovation: Introducing new products and solutions to meet evolving customer needs.

- Digital Transformation: Utilizing digital platforms to improve customer experience and reach.

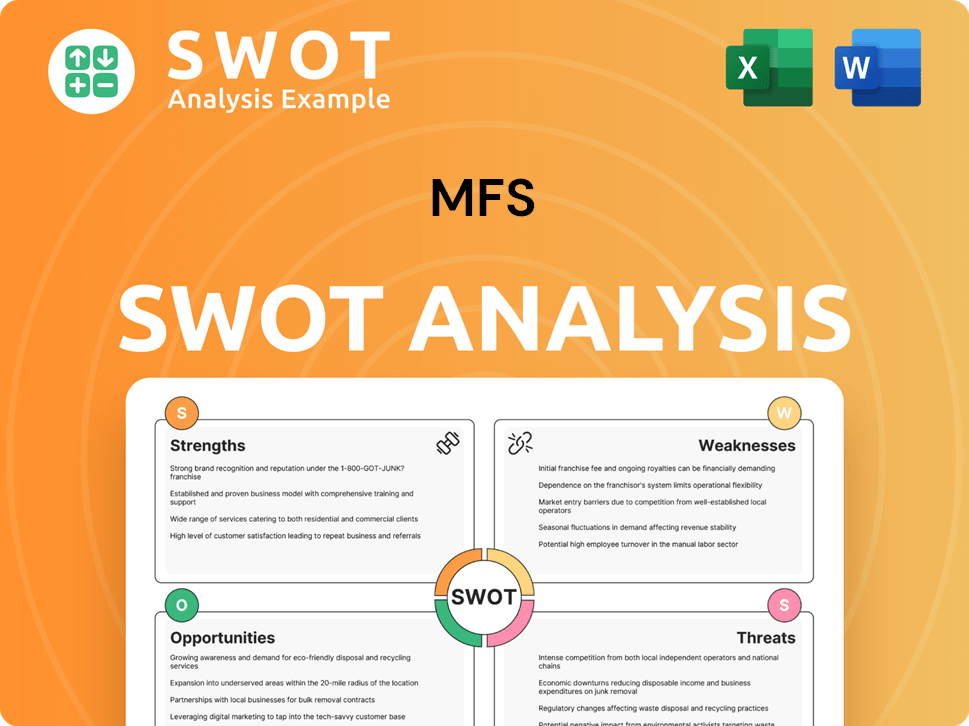

MFS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does MFS Invest in Innovation?

Max Financial Services (MFS), through its subsidiary Max Life Insurance, is strategically leveraging innovation and technology to fuel its growth and improve operational efficiency. This approach involves a comprehensive digital transformation across all facets of its operations, from acquiring and onboarding customers to providing policy servicing and managing claims. The company's commitment to technological advancement is evident in its significant investments in research and development, particularly in areas like artificial intelligence (AI) and machine learning (ML).

These investments are designed to enhance underwriting processes, personalize customer interactions, and detect fraud more effectively. Furthermore, Max Life utilizes data analytics to gain deeper insights into customer behavior and market trends. This enables the company to tailor its products and services, thereby improving customer satisfaction and market competitiveness. The integration of technology also extends to automating internal processes, which helps reduce operational costs and improve service delivery timelines.

Collaborations with external innovators and fintech companies are also a key part of MFS's strategy. These partnerships allow Max Life to integrate cutting-edge solutions more rapidly. For example, the implementation of advanced analytics and AI-driven chatbots for customer support demonstrates the company's dedication to improving customer experience and operational efficiency. These technological advancements directly support growth objectives by improving customer engagement, increasing sales efficiency, and reducing turnaround times for various services.

Max Life Insurance is undergoing a comprehensive digital transformation. This includes digitizing customer acquisition, onboarding, policy servicing, and claims management. The goal is to create a seamless and efficient experience for customers.

Significant investments are being made in AI and ML to improve underwriting processes, personalize customer interactions, and detect fraudulent activities. These technologies help automate decision-making and improve accuracy.

Max Life uses data analytics to understand customer behavior and market trends. This enables the development of more tailored products and services, enhancing customer satisfaction and market competitiveness.

Automation of internal processes is a key component of the digital transformation. This reduces operational costs and improves service delivery times, making operations more efficient.

Partnerships with fintech companies are part of the strategy to bring cutting-edge solutions to market faster. This approach allows Max Life to stay ahead of the curve in terms of technology.

The adoption of advanced analytics and AI-driven chatbots for customer support is aimed at enhancing the overall customer experience. This makes it easier for customers to interact with the company.

Max Life's focus on digital innovation aims to solidify its position as a technologically advanced insurer in the Indian market. These advancements directly contribute to growth objectives by improving customer engagement, increasing sales efficiency, and reducing turnaround times for various services. The company's strategic investments in technology are critical for its Owners & Shareholders of MFS and future success.

- AI-Powered Underwriting: AI algorithms are used to assess risk more accurately and efficiently, reducing the time taken for policy approvals.

- Personalized Customer Service: AI-driven chatbots and personalized digital experiences enhance customer engagement and satisfaction.

- Fraud Detection: Advanced analytics and machine learning models are deployed to detect and prevent fraudulent activities, protecting the company and its customers.

- Data-Driven Decision Making: Insights from data analytics inform product development, marketing strategies, and operational improvements.

- Operational Efficiency: Automation of internal processes reduces operational costs and improves service delivery times.

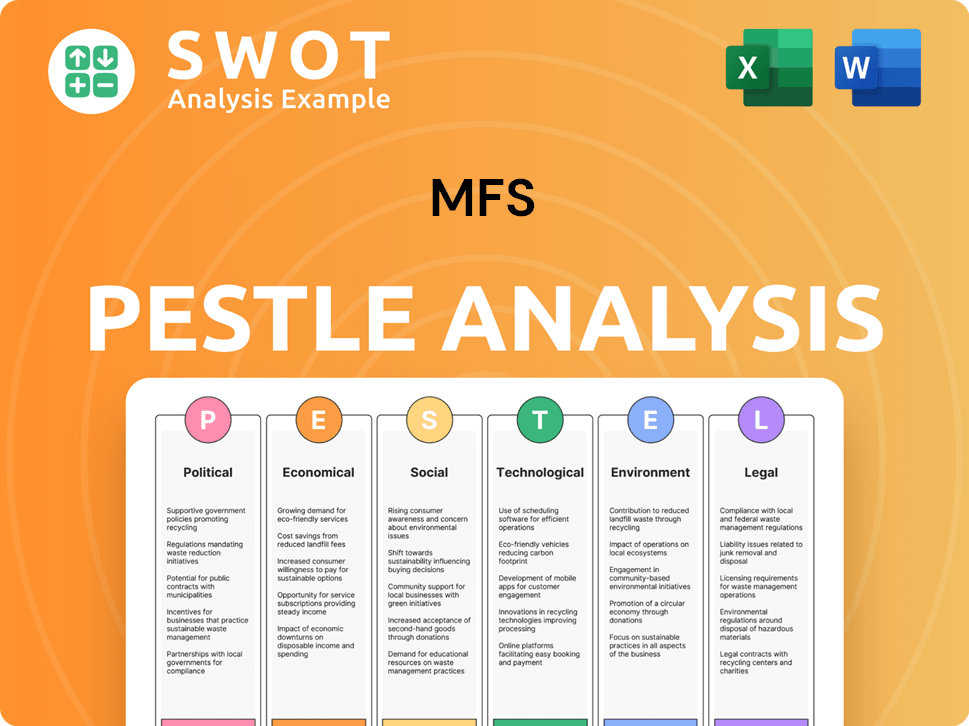

MFS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is MFS’s Growth Forecast?

Max Financial Services Limited (MFS) showcases a strong financial performance, crucial for its ambitious growth strategies. For the fiscal year ending March 31, 2024, Max Life Insurance, the primary operational entity, reported substantial growth in its Gross Written Premium. This performance underscores the company's solid financial foundation and its ability to support expansion initiatives.

The company consistently aims for double-digit growth in its value of new business (VNB). This is a key metric for life insurance companies, indicating the profitability of new policies. This focus on VNB growth highlights the company's commitment to sustainable financial performance and shareholder value creation. Analyst forecasts project continued revenue and profitability growth.

The company's embedded value (EV), a vital valuation metric for life insurers, has shown a healthy upward trend, indicating long-term value creation for shareholders. Max Financial Services maintains a robust solvency ratio, exceeding regulatory requirements. This provides a solid capital base to support expansion and absorb potential risks.

Max Life Insurance demonstrated robust growth in Gross Written Premium for the fiscal year ending March 31, 2024. This growth is a key indicator of the company's market performance and ability to attract new customers. The increase reflects the effectiveness of its sales and distribution strategies.

The company consistently targets double-digit growth in VNB. This metric is crucial for assessing the profitability of new policies. A strong VNB growth rate signals the company's ability to generate profitable business and create long-term shareholder value. The focus on VNB is a core element of the MFS growth strategy.

The Embedded Value (EV) has shown a positive trend, indicating long-term value creation. EV is a key valuation metric that reflects the present value of future profits. The upward trend in EV demonstrates the company's ability to enhance shareholder value. This is critical for assessing the long-term financial health of the business.

Max Financial Services maintains a strong solvency ratio, exceeding regulatory requirements. This provides a solid capital base to support expansion and absorb potential shocks. A robust solvency ratio ensures financial stability and the ability to meet obligations. This financial strength supports the company's growth objectives.

The company's strategic focus on bancassurance, digital transformation, and product innovation is expected to drive sustainable financial growth. These initiatives are designed to enhance market penetration and improve operational efficiency. The recent capital infusion and strategic investments further reinforce the company's financial capacity to pursue its growth objectives. For more insights, consider reading about MFS market analysis.

- Bancassurance: Expanding partnerships with banks to increase distribution channels.

- Digital Transformation: Enhancing online platforms and customer service capabilities.

- Product Innovation: Developing new insurance products to meet evolving customer needs.

- Strategic Investments: Utilizing capital infusions to support growth initiatives.

MFS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow MFS’s Growth?

The growth strategy of Max Financial Services (MFS) faces several potential risks and obstacles. The life insurance sector in India is highly competitive, with numerous players vying for market share, which can lead to pricing pressures and higher customer acquisition costs. Regulatory changes, such as those from the Indian insurance regulator (IRDAI), also pose a continuous challenge, impacting product design, pricing, and distribution strategies.

Supply chain vulnerabilities, though less direct for a financial services company, could disrupt digital infrastructure or third-party service providers. The rise of fintech startups and established tech giants entering the insurance space presents another threat to traditional business models. Furthermore, internal resource constraints, such as attracting and retaining top talent, could hinder innovation and operational efficiency.

To mitigate these risks, MFS employs diversification of distribution channels, robust risk management frameworks, and continuous scenario planning. The company also invests in compliance and legal expertise to navigate regulatory complexities. For a deeper dive into the financial aspects, consider exploring the Revenue Streams & Business Model of MFS. Emerging risks like increasing cyber threats and evolving customer expectations for digital services will continue to shape its future trajectory.

The Indian life insurance market is intensely competitive, with both domestic and international players. This competition can lead to reduced profit margins and increased expenses for customer acquisition, impacting the MFS growth strategy. The need to differentiate products and services becomes critical.

Changes in regulations by IRDAI can significantly affect product design, pricing, and distribution. For instance, alterations in commission structures or solvency norms could directly influence profitability. Adapting quickly to new regulations is vital for sustained growth in the fintech industry.

Fintech startups and established tech companies entering the insurance sector pose a threat to traditional business models. These entities often leverage technology to offer innovative products and services, potentially disrupting the market. Understanding mobile financial services is key to staying competitive.

Attracting and retaining top talent in a competitive environment can be a significant challenge. Moreover, maintaining robust digital infrastructure and managing third-party service providers are crucial for operational efficiency. These factors directly impact the MFS future prospects.

Increasing cyber threats pose a significant risk to financial institutions. Protecting customer data and ensuring the security of digital transactions are paramount. Robust cybersecurity measures are essential for maintaining customer trust and ensuring the long-term viability of MFS.

Customers increasingly demand digital services and personalized experiences. Meeting these evolving expectations requires continuous investment in technology and innovation. Failure to adapt can lead to a loss of market share and hinder the overall growth strategy.

MFS employs several strategies to mitigate risks, including diversifying distribution channels to reduce reliance on any single channel. This helps in reaching a broader customer base. The company also uses robust risk management frameworks for identifying and managing potential threats. Continuous scenario planning is also crucial.

Investing in compliance and legal expertise is essential to navigate the complex regulatory landscape. Staying updated with the latest guidelines and regulations is critical. This ensures that the company remains compliant and can adapt to changes efficiently. This is vital for mobile money transfer services.

Embracing digital transformation is crucial for staying competitive in the fintech industry. This involves investing in technology and enhancing digital service offerings. This includes improving user experience and offering personalized services. This is also a key factor in financial inclusion.

Attracting and retaining top talent is essential for innovation and operational efficiency. This involves creating a positive work environment and offering competitive compensation packages. Continuous training and development programs are also important for MFS providers.

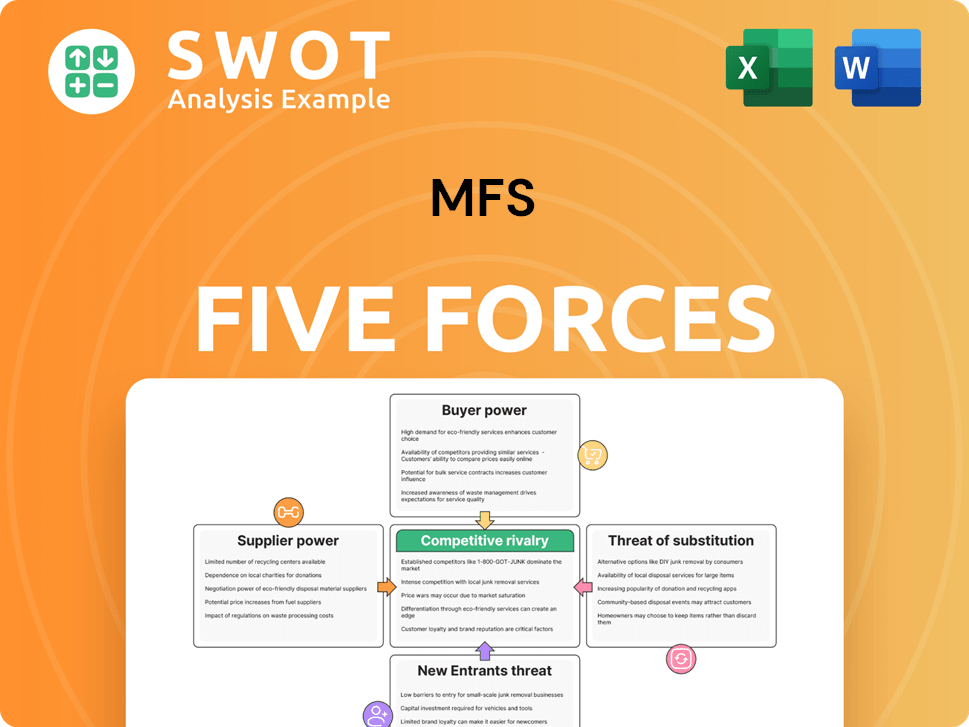

MFS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.