MFS Bundle

How Does Max Financial Services Dominate the Indian Insurance Market?

In the dynamic Indian insurance sector, understanding the MFS SWOT Analysis is crucial to grasping how Max Financial Services (MFS) has achieved remarkable success. This analysis dives deep into the sales strategy and marketing strategy employed by MFS, particularly through its subsidiary, Max Life Insurance, to capture a significant market share. Discover how this MFS company has strategically positioned itself for sustained growth.

This exploration goes beyond mere numbers, offering insights into the innovative approaches that have propelled Max Life to the forefront. We'll dissect the key campaigns, digital strategies, and customer-centric initiatives that define its market leadership. Furthermore, we'll examine the challenges and opportunities within the MFS business landscape, providing a comprehensive view of its future trajectory, including financial inclusion initiatives and the role of technology in MFS sales and marketing.

How Does MFS Reach Its Customers?

The sales strategy of Max Life Insurance, a key part of Max Financial Services (MFS), involves a multifaceted approach to reach its target market. This strategy incorporates both traditional and modern sales channels to maximize reach and customer engagement. The company's focus is on providing accessible financial products and services to a diverse customer base across India.

The marketing strategy of an MFS company like Max Life is designed to enhance customer accessibility and convenience. This includes a strong emphasis on digital integration and strategic partnerships. These efforts are crucial for driving growth and maintaining a competitive edge in the financial services sector.

Max Life Insurance leverages a variety of sales channels to distribute its products effectively. The agency channel, bancassurance partnerships, and digital platforms each play a crucial role in the overall sales strategy.

The agency channel remains a cornerstone of Max Life's sales strategy. This channel relies on a vast network of trained insurance agents spread across India. These agents offer personalized advice and support to customers in various geographical locations.

Bancassurance partnerships are a key component of Max Life's distribution strategy. Collaborations with leading banks allow Max Life to distribute its products through extensive branch networks. These partnerships have significantly expanded Max Life's reach and market share.

Max Life is actively investing in digital adoption to cater to the growing demand for online services. The company has a direct-to-consumer (DTC) model through its website. This digital push helps reach a younger, tech-savvy demographic and improves customer convenience.

Max Life integrates digital channels into an omnichannel strategy to provide a seamless customer experience. This approach ensures that customers can interact with the company across various online and offline touchpoints. The goal is to provide a consistent and convenient experience.

Max Life's sales strategy is designed to maximize market reach and customer engagement. The company focuses on a balanced approach, using both traditional and modern channels. This strategy is crucial for the Growth Strategy of MFS.

- The agency channel is a key part of the sales strategy, offering personalized service.

- Bancassurance partnerships are expanding, with new business premium growing by 21% in fiscal year 2024.

- Digital channels are being integrated to enhance customer experience and reach a wider audience.

- The omnichannel approach ensures a seamless experience across all touchpoints.

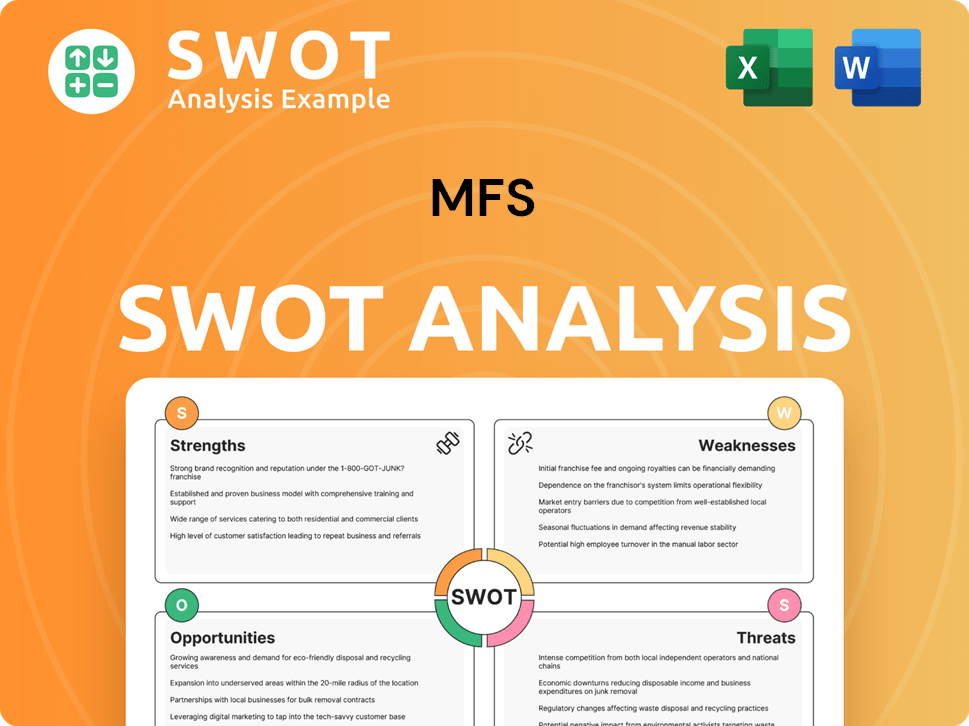

MFS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does MFS Use?

The company's marketing strategy is a blend of digital and traditional methods designed to boost brand awareness, generate leads, and drive sales. This approach is crucial for a competitive edge in the financial services market, especially in a landscape as dynamic as the mobile financial services (MFS) sector. Understanding the nuances of both online and offline channels is key for reaching diverse customer segments effectively.

The strategy focuses on creating a strong brand presence and engaging potential customers through various channels. This integrated approach aims to maximize reach and impact, ensuring that the company remains top-of-mind for consumers seeking financial solutions. The goal is to build trust and credibility, which are essential in the financial industry.

The company utilizes a variety of marketing tactics to build brand awareness and drive sales. These tactics are designed to be comprehensive, reaching a wide audience through both digital and traditional media channels. This multi-faceted approach helps in creating a strong market presence and engaging with potential customers effectively.

Content marketing is a core component, with informative articles, financial planning guides, and educational videos. SEO efforts enhance organic visibility, and paid advertising targets specific customer segments. Email marketing is used for lead nurturing and promoting new products.

Collaborations with financial experts and lifestyle influencers are used to reach broader audiences. This strategy helps build trust and credibility, which is important in the financial sector. Influencers can provide valuable insights and recommendations.

Platforms like LinkedIn, Facebook, and YouTube are actively used for brand building, customer service, and community engagement. Social media helps in creating a direct line of communication with customers. Regular updates and interactions keep the brand relevant.

TV commercials, radio spots, and print advertisements are used to reach a wider demographic, especially in semi-urban and rural areas. This approach ensures comprehensive market penetration. Traditional media remains relevant in certain regions.

Participation in and hosting of financial literacy workshops and customer engagement programs foster direct interaction. These events help in building relationships with customers. They also provide opportunities to educate and inform.

Customer segmentation strategies allow for personalized product recommendations and marketing communications. Analytics tools track campaign performance and customer behavior. This data-driven approach optimizes marketing spend for better results.

The company's comprehensive marketing strategy is designed to enhance its Owners & Shareholders of MFS, focusing on both digital and traditional channels to maximize reach and effectiveness. This approach is critical for success in the competitive MFS business landscape. The integration of various tactics ensures a strong market presence.

The company's marketing strategy is built on several key elements that work together to achieve its goals. These elements include digital marketing, traditional media, and data-driven approaches. Each element plays a crucial role in the overall success of the marketing efforts.

- Content Marketing: Creating valuable content to attract and engage potential customers.

- SEO and Paid Advertising: Improving online visibility and targeting specific customer segments.

- Email Marketing: Nurturing leads and promoting products through targeted campaigns.

- Influencer Partnerships: Collaborating with experts to build trust and reach new audiences.

- Social Media Engagement: Building brand awareness and interacting with customers on social platforms.

- Traditional Media: Utilizing TV, radio, and print to reach a wider demographic.

- Events and Workshops: Hosting events to foster direct interaction and educate customers.

- Data-Driven Marketing: Using analytics to personalize communications and optimize spending.

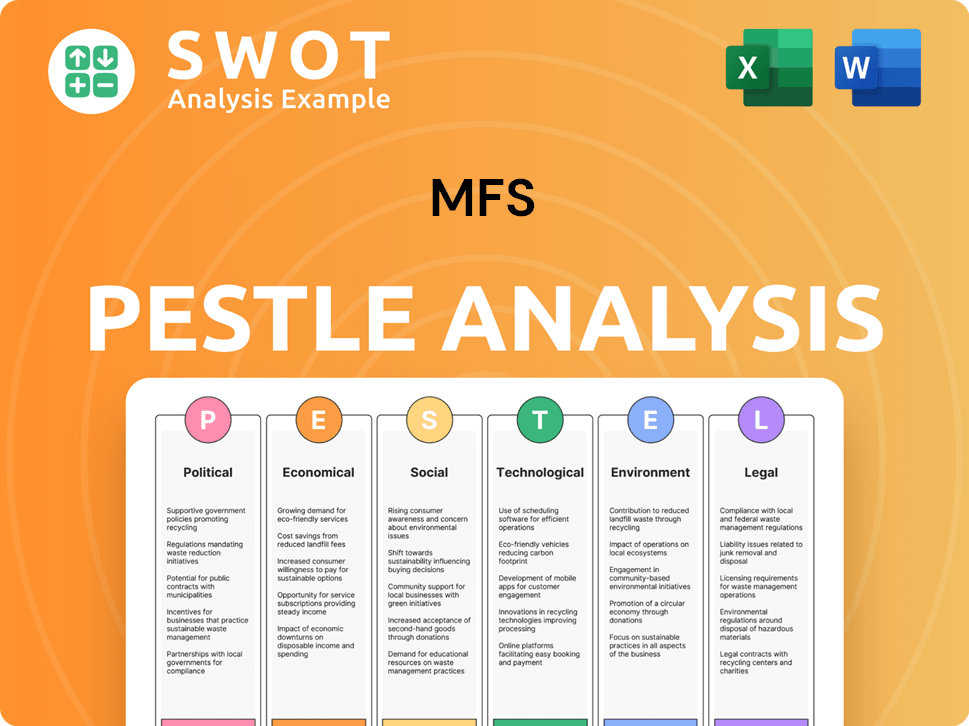

MFS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is MFS Positioned in the Market?

The brand positioning of the company focuses on establishing itself as a dependable and trustworthy partner for long-term financial security, specifically emphasizing its dedication to protecting policyholders and delivering exceptional customer service. This approach is central to its Brief History of MFS, aiming to secure futures and offer peace of mind. This message is designed to resonate with the emotional needs associated with life insurance, building a strong foundation of trust and reliability within the market.

The visual identity of the company often incorporates elements of stability, growth, and care, while its tone of voice is empathetic, informative, and reassuring. This consistency in messaging and branding helps to create a unified brand experience across all customer touchpoints. The company's commitment to a seamless and transparent customer experience, from initial inquiry to claims settlement, further reinforces its brand promise.

The company primarily targets individuals and families seeking comprehensive life insurance solutions. The focus is often on the middle to affluent income segments who prioritize financial planning and protection. This targeted approach allows the company to tailor its products and services to meet the specific needs of this demographic, ensuring relevance and value.

The company differentiates itself through its strong focus on claims settlement ratio, which stood at an impressive 99.65% for the fiscal year 2023-24. This high ratio is a key metric for building trust and confidence among consumers, especially in a market where claim repudiation is a common concern.

The company emphasizes its strong solvency ratio, which was 195% as of December 31, 2023, well above the regulatory requirement of 150%. This financial strength further reinforces the company's stability and ability to meet its obligations to policyholders, providing added assurance.

The company consistently maintains brand consistency across its diverse sales channels and marketing communications. This ensures a unified brand experience, reinforcing its core values and messaging across all customer interactions. This unified approach helps build brand recognition and trust.

In response to shifts in consumer sentiment, the company has adapted its brand messaging to highlight its digital capabilities and convenience. This includes a focus on mobile financial services (MFS) and digital interactions. This adaptation helps to meet the evolving needs of its customer base.

The company focuses on delivering a seamless and transparent customer experience across all touchpoints. This commitment to customer service, from initial inquiry to claims settlement, is a key differentiator. This approach builds loyalty and trust.

MFS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are MFS’s Most Notable Campaigns?

The company has launched several impactful sales and marketing campaigns, significantly boosting its brand visibility and driving business growth. These initiatives have played a crucial role in establishing a strong market presence. These campaigns have reinforced the company's brand image as customer-centric and financially sound, contributing to its consistent growth and market leadership.

One of the notable campaigns, 'The Super Customer Service', highlighted the company's commitment to exceptional customer experience and its high claims settlement ratio. This campaign utilized a mix of digital channels, including social media and online video platforms, alongside traditional TV advertisements. The objective was to build trust and differentiate the company in a competitive market, successfully reinforcing the brand's reputation for reliability. This approach is part of a broader Target Market of MFS strategy, focusing on customer needs.

Another key initiative has been the ongoing focus on financial literacy and awareness campaigns, often conducted in collaboration with financial advisors and industry bodies. These campaigns aim to educate potential customers about the importance of life insurance and long-term financial planning, rather than just selling products. These educational efforts often involve webinars, workshops, and content marketing initiatives.

This campaign focused on highlighting the company's commitment to exceptional customer experience. It showcased the ease and efficiency of the claim process. The campaign used a mix of digital and traditional media to build trust and differentiate the brand.

These campaigns aimed to educate potential customers about the importance of life insurance and financial planning. They involved webinars, workshops, and content marketing. These initiatives contribute significantly to lead generation and brand building.

Engagements with sports personalities and public figures boosted brand visibility. These collaborations leveraged their credibility to reach a wider audience. Such campaigns have reinforced the company's brand image.

Utilizing digital channels like social media and online video platforms for promotions. These strategies are essential for reaching a broader audience. Digital marketing is a key component of the overall marketing strategy.

The primary objectives are to build trust, differentiate the brand, and enhance customer experience. These campaigns aim to educate and engage potential customers. They focus on long-term financial planning.

The campaigns target a broad audience, including potential customers interested in financial security. They also focus on educating the general public. The marketing strategies are tailored to reach diverse demographics.

The campaigns utilize a mix of digital channels, including social media and online video platforms. Traditional TV advertisements are also used. Collaboration with financial advisors is another key channel.

These campaigns have significantly contributed to brand visibility and business growth. They have reinforced the brand's reputation for reliability. The initiatives support consistent growth and market leadership.

These efforts involve webinars, workshops, and content marketing. They contribute to lead generation and brand building. The focus is on educating customers about financial planning.

The campaigns are designed to build a strong brand image. The focus is on customer-centricity and financial soundness. This strategy contributes to market leadership.

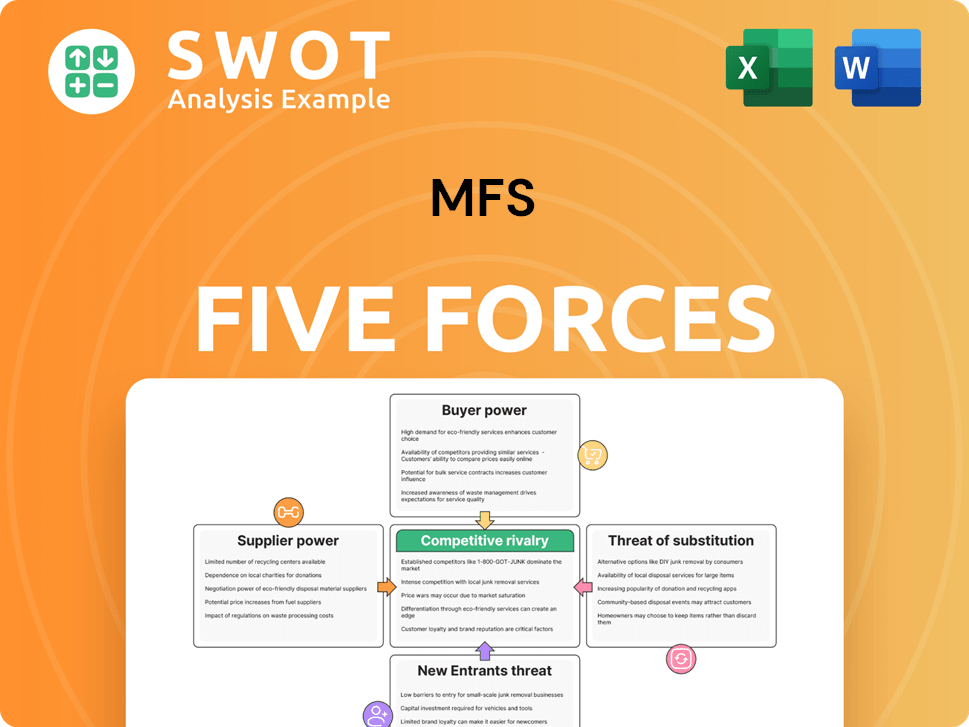

MFS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of MFS Company?

- What is Competitive Landscape of MFS Company?

- What is Growth Strategy and Future Prospects of MFS Company?

- How Does MFS Company Work?

- What is Brief History of MFS Company?

- Who Owns MFS Company?

- What is Customer Demographics and Target Market of MFS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.