MFS Bundle

How Does MFS Company Thrive in India's Insurance Sector?

Max Financial Services Limited (MFSL), the holding company behind Max Life Insurance, is a powerhouse in India's financial landscape. With impressive growth, including a 13% surge in individual adjusted new business premium, MFSL is a key player in the life insurance sector. Its focus on long-term financial solutions makes understanding its operations crucial for anyone interested in the Indian market.

This analysis will explore the MFS SWOT Analysis, delving into the core of MFS operations and its MFS business model. We'll uncover how this MFS company generates revenue, addresses market challenges, and maintains its position as a leader, offering valuable insights for investors and industry observers alike. This exploration will also touch upon the company's strategies for growth and its approach to mobile financial services and financial technology.

What Are the Key Operations Driving MFS’s Success?

The core operations and value proposition of Max Financial Services Limited (MFS company) revolve around its subsidiary, Max Life Insurance Company Limited. Max Life primarily offers life insurance products, including savings plans, protection solutions, and retirement schemes. These products cater to both individual and group clients, aiming to provide financial security and wealth accumulation opportunities.

The MFS business model is supported by robust technology, a wide distribution network, and a strong focus on customer service. This operational framework is crucial for delivering its financial products effectively. Max Life's operations are designed to meet the diverse financial needs of its customers across various life stages, ensuring they have access to reliable financial solutions.

Max Life's operational backbone includes technology development, which is crucial for product innovation and enhancing customer experience through digital channels. Advanced analytics are used for risk assessment, product pricing, and personalization. The distribution network includes agency channels, bancassurance partnerships, and direct digital sales. The bancassurance partnership with Axis Bank, which increased its stake to 19.02% as of April 2024, significantly boosts its capabilities.

Max Life invests heavily in technology to streamline operations and enhance customer experience. This includes digital platforms for policy administration and customer service. The use of advanced analytics helps in risk assessment and product customization, making the company more responsive to market needs.

The distribution network is a key component of Max Life's operations. It includes agency channels, bancassurance partnerships, and direct digital sales. Partnerships, such as the one with Axis Bank, significantly enhance the reach and accessibility of its products.

Max Life places a strong emphasis on customer satisfaction. This includes tailoring products to meet specific customer needs and ensuring efficient policy issuance and claims settlement. This approach helps build trust and loyalty among its customer base.

The company's operational effectiveness is reflected in its financial performance. Consistent growth in key metrics, such as Gross Written Premium and Embedded Value, highlights its market differentiation and customer satisfaction. This demonstrates the impact of its core capabilities.

Max Life's success stems from a combination of product innovation, strong distribution partnerships, and a customer-centric approach. The ability to tailor products to specific customer needs, coupled with efficient processes, translates into tangible benefits for customers.

- Product Innovation: Continuously developing new insurance products to meet evolving customer needs.

- Distribution Partnerships: Leveraging partnerships, particularly bancassurance, to expand market reach.

- Customer-Centric Approach: Focusing on customer satisfaction through efficient processes and personalized services.

- Technology Integration: Utilizing technology to improve operational efficiency and customer experience.

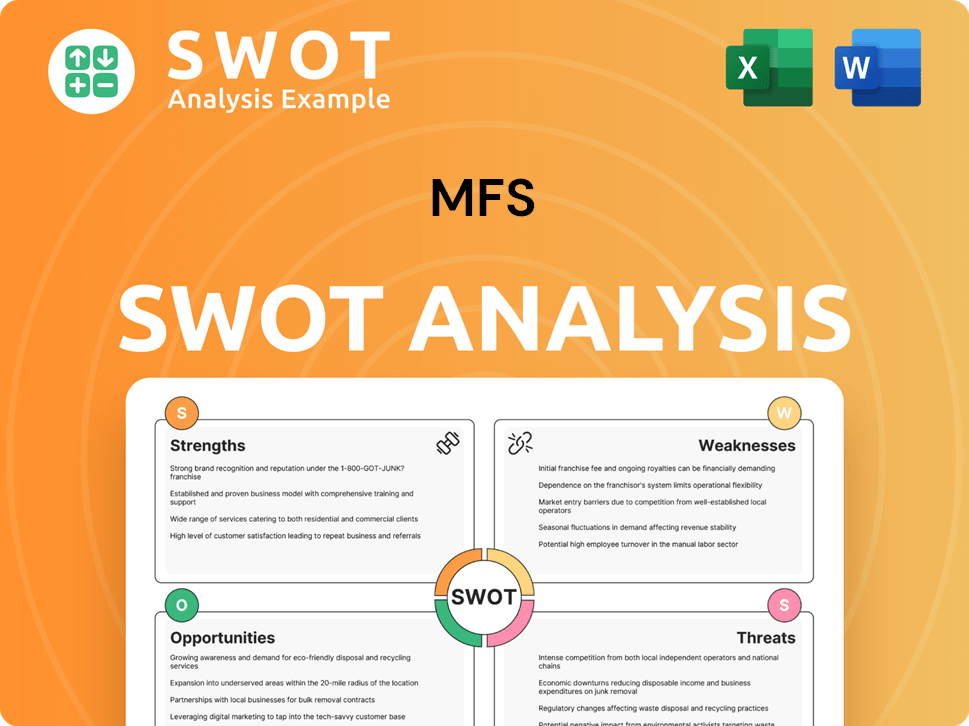

MFS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does MFS Make Money?

The primary revenue streams and monetization strategies of the MFS company are centered around its life insurance operations, particularly through its subsidiary, Max Life Insurance. The company generates income mainly from premiums collected on various insurance policies, including individual and group life insurance, and pension plans. These premiums are categorized into new business and renewal premiums, which are essential for sustaining its financial performance.

For the fiscal year 2024, Max Life Insurance reported a Gross Written Premium of ₹29,566 crore, demonstrating the substantial scale of its premium income. Beyond premium collection, the company employs several monetization strategies to enhance its profitability and market position. These strategies are crucial for optimizing revenue generation and adapting to market dynamics.

The company also focuses on profitable product segments, as evidenced by its healthy Value of New Business (VNB) margin. Another significant monetization strategy involves leveraging its bancassurance partnerships, such as the one with Axis Bank, to access a large customer base and distribute its products effectively.

The MFS company, through its life insurance business, utilizes several key strategies to generate revenue and maximize profitability. These strategies are crucial for its financial success and market competitiveness. These strategies include a focus on profitable product segments and strategic partnerships.

- Premium Collection: The core revenue source is the collection of premiums from various insurance policies, including individual and group life insurance, and pension plans. This includes both new business premiums and renewal premiums.

- Value of New Business (VNB) Margin: The company focuses on profitable product segments. For the nine months ending December 31, 2024, the VNB margin stood at 29.6%, indicating the profitability of its new business acquisitions.

- Bancassurance Partnerships: Leveraging partnerships, such as the one with Axis Bank, to access a large customer base and distribute products efficiently. Axis Bank contributed ₹1,353 crore in APE to Max Life in fiscal year 2024.

- Investment Income: Investment income from policyholders' funds also forms a crucial revenue component, with premiums strategically invested to generate returns. This is a fundamental aspect of how life insurance companies generate profit.

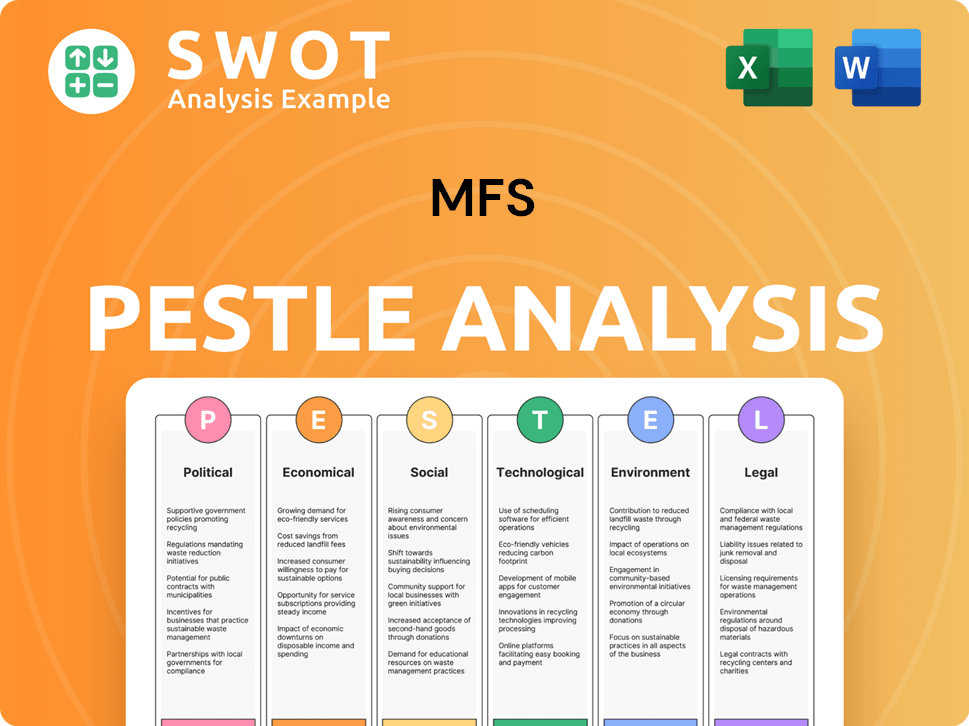

MFS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped MFS’s Business Model?

The journey of Max Financial Services Limited (MFS company) has been marked by significant milestones and strategic shifts that have shaped its operations and financial performance. A key development has been the deepening of the partnership with Axis Bank. Axis Bank's increased stake in Max Life Insurance, reaching 19.02% as of April 2024, is a crucial strategic alliance, significantly boosting Max Life's distribution capabilities through bancassurance channels.

The company has consistently focused on product innovation and digital transformation to maintain its competitive edge. New product launches catering to evolving customer needs in savings, protection, and retirement solutions have been a continuous strategic priority. Operationally, Max Life has faced challenges common to the insurance sector, such as adapting to regulatory changes and navigating market fluctuations. However, its robust risk management frameworks and agile operational responses have enabled it to sustain growth. For instance, despite a slight dip in the Value of New Business (VNB) margin for the nine months ending December 31, 2024, from 32.1% to 29.6%, the company's overall VNB still grew by 12% to ₹2,075 crore, demonstrating resilience.

Max Life’s competitive advantages stem from several factors, including strong brand recognition as a leading private life insurer in India, an extensive and diversified distribution network, and a focus on customer-centricity and service quality. The company also benefits from its scale, which allows for economies of scale in operations and investment management. To adapt to new trends and competitive threats, Max Life continues to invest in technology, enhance its digital platforms, and explore new avenues for growth, such as expanding its presence in underserved markets and innovating its product offerings to address emerging financial needs. For more insights into the target market, consider reading about the Target Market of MFS.

The MFS business model relies heavily on strategic partnerships and technological advancements to enhance its operations. These moves are designed to improve customer service and expand market reach, which are crucial for sustaining a competitive edge. The company's focus on digital transformation and product innovation are key strategies for growth.

- Strategic Partnerships: The alliance with Axis Bank is a prime example, boosting distribution capabilities.

- Product Innovation: Continuous launches of new products to meet evolving customer needs.

- Digital Transformation: Investments in technology to improve customer experience and operational efficiency.

- Risk Management: Robust frameworks to navigate market fluctuations and regulatory changes.

MFS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is MFS Positioning Itself for Continued Success?

Within the Indian financial landscape, Max Financial Services Limited (MFS) holds a significant position, particularly through its subsidiary, Max Life Insurance. As the largest non-bank private life insurer in India, MFS demonstrates a strong market presence, supported by solid financial performance and extensive reach. The MFS business model is fortified by a strategic partnership with Axis Bank, enhancing its ability to serve a broad customer base. For fiscal year 2024, the company reported a 13% year-on-year increase in individual adjusted new business premium (APE), reaching ₹6,961 crore, highlighting its competitive standing.

Despite its prominent position, MFS faces several risks. These include regulatory changes, intense competition from both established and new digital-first insurers, and the need for ongoing investment in technology. Furthermore, shifts in consumer preferences and macroeconomic factors can influence policyholder behavior and investment returns. Navigating these challenges requires continuous adaptation and strategic foresight to maintain and enhance its market position.

MFS, through Max Life Insurance, is a leading player in the Indian life insurance sector. It holds a significant market share and benefits from high customer loyalty. The company's robust growth in individual adjusted new business premium (APE) demonstrates its competitive advantage.

Key risks for MFS include regulatory changes, intense competition, and the need for continuous technological advancements. Macroeconomic factors and changing consumer preferences also pose challenges. The company must adapt to maintain its market position.

MFS is focused on enhancing digital capabilities, expanding its distribution network, and innovating its product offerings. The company's growth in Embedded Value (EV) indicates a positive long-term outlook. MFS aims to capitalize on the growth potential of the Indian insurance market.

The company is concentrating on improving customer onboarding and service through digital enhancements. Expanding its distribution footprint and innovating its product portfolio are also key strategies. These initiatives support MFS’s long-term growth.

Looking ahead, MFS is strategically positioned to leverage the substantial growth potential within the Indian insurance market. The company's focus is on sustaining and expanding revenue generation through various initiatives. These initiatives include enhancing digital capabilities to improve customer onboarding and service, expanding its distribution footprint, and continually innovating its product portfolio to meet the diverse needs of the Indian population, particularly in the areas of protection and retirement solutions. The increase in Embedded Value (EV) by 19% to ₹19,928 crore for the nine months ending December 31, 2024, indicates a healthy long-term outlook. To learn more about the ownership and shareholder structure of MFS, you can refer to Owners & Shareholders of MFS.

MFS is implementing several key strategies to drive future growth and maintain its competitive edge within the market. These strategies focus on expanding its reach and enhancing customer experience through digital and product innovation.

- Enhancing Digital Capabilities: Improving customer onboarding and service through digital platforms.

- Expanding Distribution Footprint: Increasing market reach through strategic partnerships and wider distribution networks.

- Product Innovation: Continuously innovating its product portfolio to meet the evolving needs of the Indian population.

- Focus on Protection and Retirement Solutions: Concentrating on products that cater to long-term financial security.

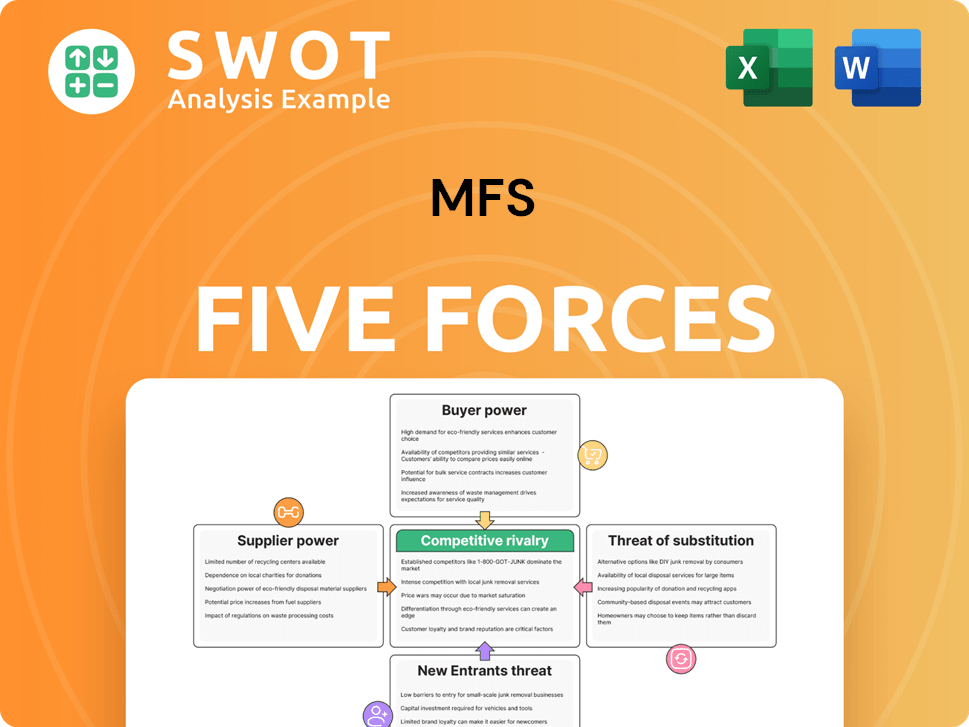

MFS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of MFS Company?

- What is Competitive Landscape of MFS Company?

- What is Growth Strategy and Future Prospects of MFS Company?

- What is Sales and Marketing Strategy of MFS Company?

- What is Brief History of MFS Company?

- Who Owns MFS Company?

- What is Customer Demographics and Target Market of MFS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.