MFS Bundle

Who are MFS Company's Ideal Customers?

In the competitive financial services landscape, understanding customer demographics and the target market is crucial. For Max Financial Services Limited (MFS), this understanding is the foundation of its strategy. This exploration dives into MFS's customer base, examining who they are and what drives their financial decisions.

The MFS SWOT Analysis highlights the importance of market segmentation and a deep understanding of the customer profile. Knowing the demographic data, including MFS customer age range, income levels, and geographic location, allows MFS to tailor its offerings. Analyzing MFS customer behavior and spending habits helps the company meet their needs and preferences effectively, ensuring continued growth in the financial services sector. This approach is key to identifying the ideal MFS target market and implementing best practices for market segmentation.

Who Are MFS’s Main Customers?

The primary customer segments for Max Financial Services (MFS), through its subsidiary Max Life Insurance, are broadly divided into individual consumers (B2C) and group entities (B2B) within the Indian market. This segmentation is crucial for understanding the company's approach to Owners & Shareholders of MFS and its strategic focus on financial solutions, including long-term savings, protection, and retirement products.

For the B2C segment, the target market predominantly consists of urban and semi-urban individuals. These individuals typically fall within the age range of 25-55 years, representing a significant portion of India's growing middle class. They are often salaried professionals or self-employed individuals with stable incomes, demonstrating increasing financial literacy and a growing need for financial security and wealth creation. This demographic is a key focus for the company, as they have the disposable income necessary for investing in insurance products.

The B2B segment of MFS focuses on corporate entities, offering group insurance solutions to their employees. This segment is driven by companies looking to provide employee benefits, with the specific characteristics of these groups varying based on the size and industry of the corporate client. The company has adapted its product portfolio to align with evolving market trends and product innovation, with a greater emphasis on digitally savvy younger demographics and protection-oriented plans.

The core customer demographics include individuals aged 25-55 years, primarily from urban and semi-urban areas in India. These individuals are typically salaried professionals or self-employed with stable incomes. The focus is on those in the mid to high-income brackets seeking financial planning solutions.

The target market is segmented into B2C and B2B. The B2C segment targets individual consumers seeking long-term savings, protection, and retirement solutions. The B2B segment focuses on corporate entities that offer group insurance solutions to their employees. This market segmentation strategy allows MFS to tailor its products and services effectively.

The primary geographic focus is on urban and semi-urban areas across India, reflecting the concentration of the target demographic. This includes major metropolitan cities and Tier 2 cities where financial literacy and disposable incomes are on the rise. The company's distribution network and marketing efforts are strategically aligned with these locations.

The target market includes individuals in the mid to high-income brackets. While specific income levels vary, the focus is on those who can afford comprehensive financial planning and insurance products. This ensures that the products offered align with the financial capacity of the target customer base.

Understanding the customer profile is crucial for MFS to tailor its products and marketing strategies. The company focuses on individuals with increasing financial literacy and a need for financial security.

- Age: 25-55 years

- Income: Mid to high-income brackets

- Occupation: Salaried professionals, IT, and service industry

- Location: Urban and semi-urban areas in India

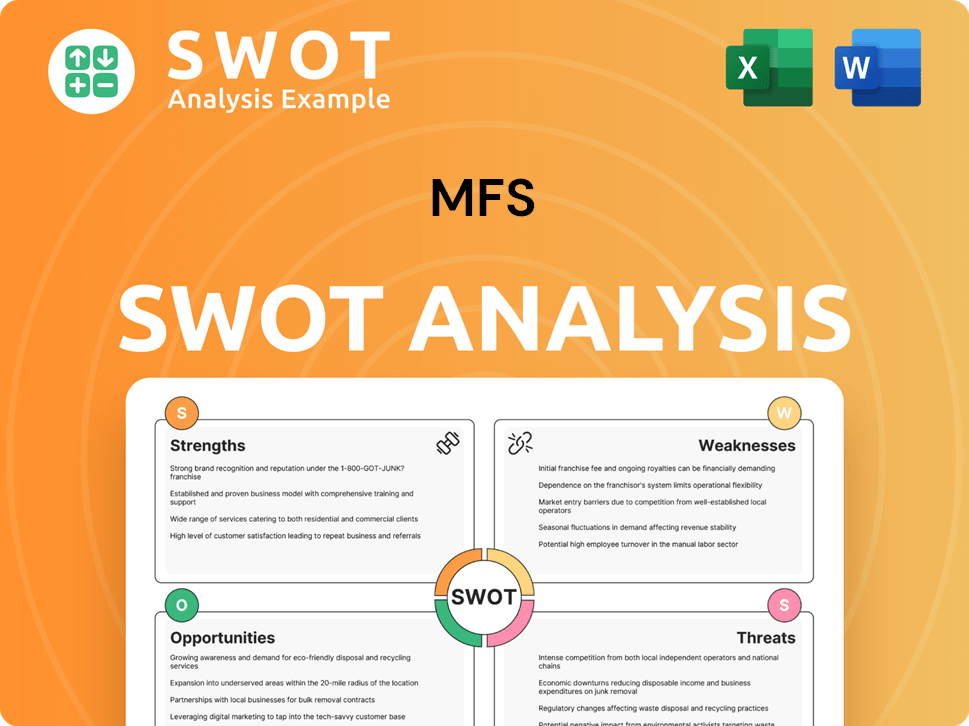

MFS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do MFS’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any financial services company, including the MFS company. This involves a deep dive into what drives customer decisions, their expectations, and how they interact with the products and services offered. By analyzing the customer demographics and target market, the company can tailor its offerings to meet specific needs and preferences, ultimately enhancing customer satisfaction and loyalty.

The primary drivers for customers of the MFS company are financial security, wealth creation, and protection against unforeseen events. Customers often seek a combination of savings, investment, and insurance benefits, indicating a desire for comprehensive financial solutions. This long-term perspective is often influenced by life stages like marriage, parenthood, or retirement planning.

Decision-making is heavily influenced by trust, policy flexibility, ease of access to information, and competitive premiums. Product usage patterns reveal a preference for plans that offer a balance of guaranteed returns and market-linked growth, along with robust protection features. Loyalty is fostered through consistent customer service, transparent communication, and the ability to meet promised benefits.

Customers of the MFS company are driven by a desire for peace of mind, a sense of responsibility towards dependents, and the aspiration for a secure financial future. They seek tax benefits, reliable savings avenues, and a hedge against inflation and medical emergencies. The company addresses pain points such as product complexity, the need for personalized advice, and efficient claims processing. Market trends, like the growing demand for health and wellness benefits, influence product development.

- Customer Demographics: The customer base is diverse, including individuals from various age groups, income levels, and educational backgrounds. The geographic location of users spans across urban and semi-urban areas, reflecting the company's broad reach.

- Target Market: The ideal target market includes individuals and families seeking financial security, wealth accumulation, and protection. Market segmentation allows the company to tailor its offerings to specific customer segments, such as young professionals, families with children, and retirees.

- Customer Behavior Analysis: Understanding customer spending habits, preferences, and needs is essential. This involves analyzing their financial goals, risk tolerance, and preferred communication channels. The company uses this data to build a detailed customer profile.

- Product Development: The company has tailored its marketing and product features by introducing plans with specific riders for critical illnesses or accidental disability, and by simplifying policy terms to enhance customer understanding.

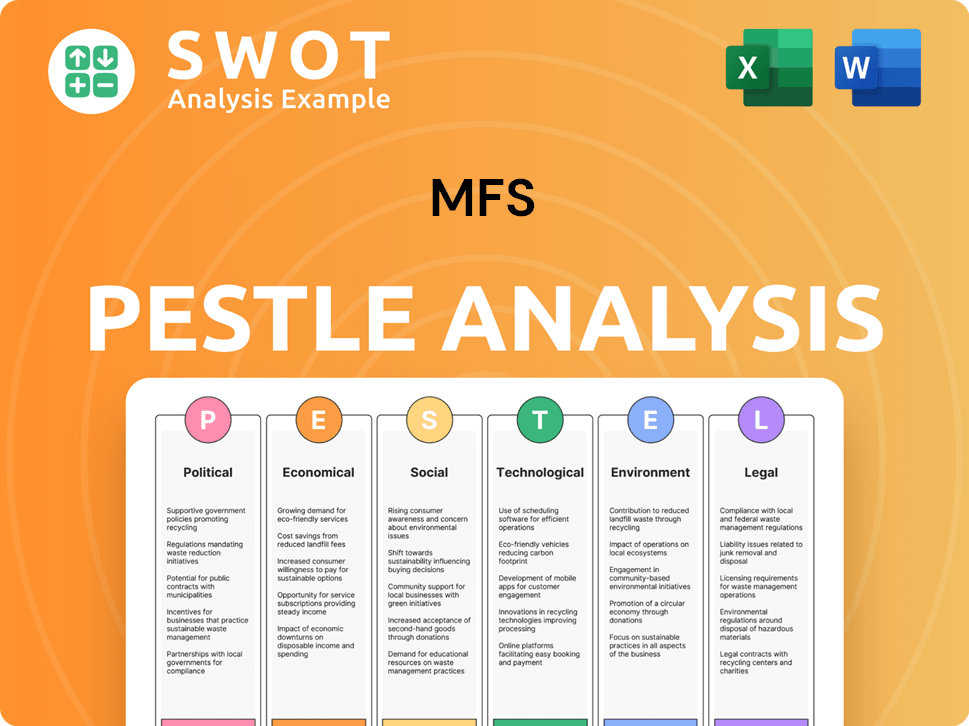

MFS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does MFS operate?

The geographical market presence of Max Financial Services (MFS), primarily through Max Life Insurance, is predominantly focused on India. The company strategically targets regions with higher disposable incomes and greater financial literacy. This approach allows MFS to effectively reach potential customers for life insurance products.

MFS concentrates its efforts in major metropolitan areas and Tier 1 and Tier 2 cities across India. Key markets include Mumbai, Delhi NCR, Bangalore, Chennai, Kolkata, and Hyderabad. These urban centers are crucial due to their robust economic activity and the prevalence of financial planning awareness.

The company adapts its offerings and marketing strategies to resonate with regional nuances. This includes tailoring communications in local languages and adapting product features to specific regional needs. MFS also leverages digital channels to expand its reach across diverse regions, capitalizing on emerging market opportunities.

MFS employs market segmentation to understand and cater to the diverse needs across different regions. This approach helps in tailoring products and services to specific customer preferences. For instance, customers in southern India might prefer savings-oriented plans, while those in northern India might prioritize protection-focused products.

While MFS has a strong presence in urban markets, it is also expanding into Tier 2 and Tier 3 cities. This expansion is driven by increasing economic prosperity and insurance awareness in these areas. The company is using digital channels to broaden its reach and tap into these emerging markets.

MFS leverages digital platforms to reach a wider audience across India. Digital channels are crucial for expanding market penetration and offering convenient access to insurance products. These channels also facilitate personalized customer experiences.

MFS forms partnerships with regional distributors to enhance its market presence. The company tailors its marketing and communication strategies to resonate with regional preferences. This includes using local languages and adapting product features to meet specific regional needs.

The company's focus on geographical market presence is a key aspect of its strategy to reach its target market. This approach allows MFS to tailor its products and services to meet the diverse needs of customers across India.

MFS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does MFS Win & Keep Customers?

The acquisition and retention strategies of Max Financial Services (MFS), primarily through Max Life Insurance, involve a blend of digital and traditional methods. The company focuses on attracting customers through digital campaigns, social media, and partnerships, while also leveraging its agency force. Retention efforts include personalized service and digital enhancements to improve customer experience. Understanding the customer demographics and the target market is crucial for effective strategy.

MFS employs a multi-channel approach to reach its target market. This includes digital marketing, print media, and a strong agency network. The company also utilizes strategic partnerships, such as bancassurance, to expand its reach. This diverse approach helps in acquiring a wide range of customers and building brand awareness across different segments.

For customer retention, MFS focuses on providing excellent after-sales service, including efficient claims processing and responsive customer support. The company also invests in digital platforms to enhance customer convenience. These efforts aim to build long-term relationships and increase customer loyalty, which is vital in the competitive financial services sector.

MFS utilizes extensive digital campaigns across social media, search engine marketing, and content marketing. These campaigns target prospective customers with tailored financial planning advice and product information. Digital marketing is a key component in reaching a broader audience and building brand awareness. In 2024, digital ad spending in India is projected to reach $12.6 billion, highlighting the importance of digital channels.

The company relies heavily on its robust agency force for direct sales and personalized customer engagement. Agents and financial advisors help customers understand their financial needs and recommend suitable insurance solutions. The agency model remains a critical channel for customer acquisition and relationship building. The insurance industry in India depends significantly on the agency channel for customer acquisition.

Strategic partnerships with banks (bancassurance) and other financial institutions are significant acquisition channels. These partnerships provide access to a large existing customer base. Bancassurance helps in reaching a wider customer base and leveraging the trust that customers have in their banks. In 2023, bancassurance contributed significantly to the distribution of insurance products in India.

MFS utilizes advanced analytics to segment its customer base, enabling personalized product recommendations and customized marketing messages. Customer Relationship Management (CRM) systems are paramount in targeting campaigns effectively. Data-driven insights are crucial for understanding customer demographics and preferences. The effective use of CRM can significantly improve customer retention rates.

MFS segments its customer base to tailor product recommendations and marketing messages. This involves analyzing various factors, including age, income, and geographic location. Effective market segmentation allows for more targeted and efficient marketing campaigns. Understanding the MFS customer age range and MFS customer income levels is critical for effective segmentation.

Building a detailed customer profile helps MFS understand its target market better. This includes demographic data, financial goals, and risk tolerance. Creating a comprehensive customer profile enables MFS to offer relevant products and services. Analyzing MFS customer behavior is essential for refining the customer profile.

MFS is increasingly investing in digital-first strategies, including online self-service portals and digital claims processing. This enhances customer convenience and improves the overall customer experience. Digital transformation is crucial for reducing churn rates and increasing customer lifetime value. The shift towards digital channels has accelerated in recent years.

Understanding MFS customer needs and wants is essential for product development and service delivery. This involves gathering feedback and analyzing customer behavior. Addressing customer needs leads to higher satisfaction and loyalty. Analyzing MFS customer preferences helps in tailoring products to meet specific needs.

Efficient claims processing and responsive customer support are critical for customer retention. Providing excellent after-sales service builds trust and long-term relationships. High-quality service reduces the likelihood of customers switching to competitors. Improved customer service can significantly boost customer retention rates.

Referral programs incentivize existing customers to recommend Max Life's products. This leverages word-of-mouth marketing, which is highly effective. Referral programs help in acquiring new customers at a lower cost. Word-of-mouth referrals often lead to higher conversion rates.

To gain a deeper understanding of the competitive landscape, it's beneficial to analyze the strategies of competitors in the financial services sector. A detailed look at the Competitors Landscape of MFS reveals how MFS positions itself against its rivals and the tactics they employ for customer acquisition and retention.

- Analyzing competitors' marketing strategies.

- Comparing customer service offerings.

- Evaluating pricing and product features.

- Assessing digital presence and customer engagement.

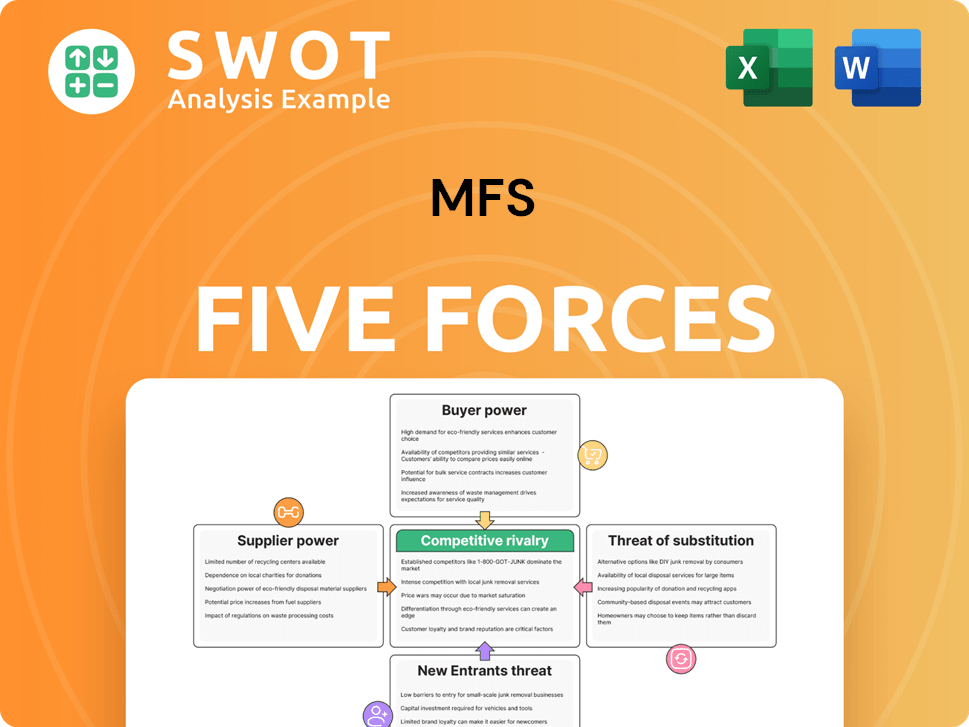

MFS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.