Mills Bundle

How Did Mills Company Rise to Become a Brazilian Industry Leader?

For over seven decades, Mills Company has been a cornerstone of Brazil's equipment rental sector. From its early days, the company has played a crucial role in the nation's development. This Mills SWOT Analysis will delve into the company's journey, examining its evolution and significant milestones.

This brief history of Mills Company explores its founding in 1952 and its transformation into a leading provider of lifting platforms and construction solutions. The company's strategic expansion and technological investments have been key factors in its success. Understanding the Mills Company timeline and its impact on the industry provides valuable insights for investors and business strategists alike, offering a comprehensive look at its business model and legacy.

What is the Mills Founding Story?

The Brief history Mills Company begins in 1952. This marked the start of its pioneering role in Brazil's construction and infrastructure sectors. The company's origins were driven by the chance to support Brazil's growing development by providing essential equipment.

The exact details of the founders and their backgrounds are not readily available. However, the company's establishment was centered on meeting the needs of a developing nation. The initial business model focused on renting equipment for construction, infrastructure, and mining. This core offering remains a defining aspect of its operations.

Early on, the company recognized the critical need for reliable and specialized equipment in the Brazilian market. This need was coupled with engineering services and technical support. Initially, the focus likely involved providing structures for major projects. This laid the groundwork for expansion into diverse equipment rental solutions. Mills' long-standing presence, spanning over seven decades, shows its foundational resilience. It also shows its ability to adapt to changing market demands. This is a testament to its initial strategic choices and operational execution.

The company's early focus was on equipment rental for construction, infrastructure, and mining.

- Founded in 1952.

- Focused on supporting Brazil's development.

- Provided essential equipment and services.

- Adapted to changing market demands over time.

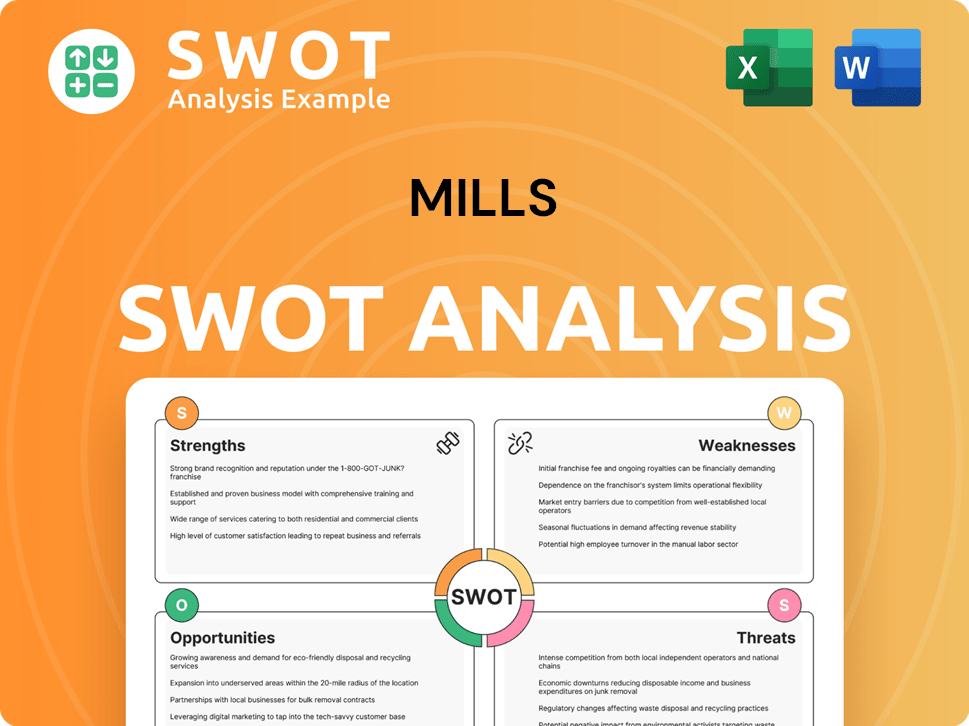

Mills SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Mills?

The early growth of Mills Company, a significant player in the construction equipment rental market, was marked by strategic expansions. A key move in its initial phase was the establishment of a business unit focused on renting and selling lifting platforms, introducing innovative solutions to the domestic market. This diversification allowed Mills to broaden its offerings beyond traditional shoring and formwork systems. The company's history is a story of calculated growth and market adaptation.

Mills' early strategy involved expanding into various segments within the construction equipment rental market. This included the rental and sale of lifting platforms, which brought innovative and safe solutions to the domestic market. This diversification was a key factor in its early growth, setting the stage for further expansion. The Competitors Landscape of Mills shows how this strategy helped them stand out.

In the first quarter of 2011, Mills' equipment rental division saw a substantial increase in revenues. This was a 96.5% increase compared to the same period in 2010. The opening of ten new rental depots in 2010 contributed significantly to this revenue growth, highlighting the company's rapid expansion and market penetration.

Mills continued to grow through both organic expansion and strategic acquisitions. In June 2024, Mills acquired JM Empilhadeiras, a forklift truck rental company, for approximately R$280 million. This acquisition was a significant move, increasing Mills' pipeline and expanding its portfolio, particularly in the heavy business segment.

The third quarter of 2024 saw Mills achieving a historic record in net rental revenue. This record reached R$419.5 million, a 20.6% increase compared to the same period the previous year. This growth was driven by the expansion in its heavy business and the revenue from JM Empilhadeiras.

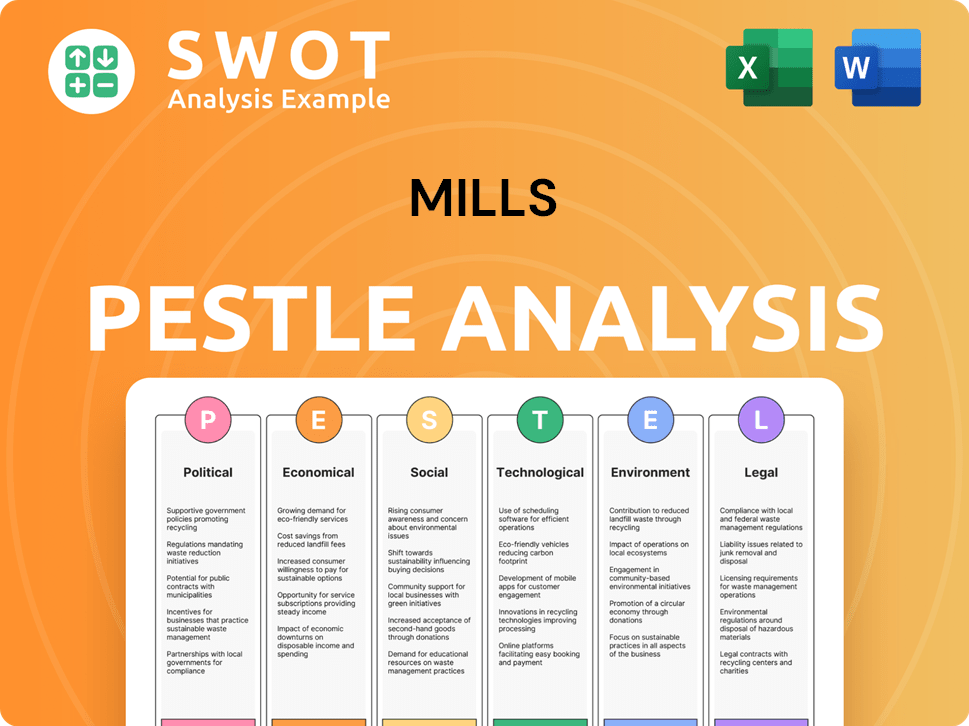

Mills PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Mills history?

Throughout its history, the story of the Mills Company history has been marked by significant milestones, solidifying its position in the Brazilian equipment rental industry. The company has consistently adapted to market changes, achieving notable successes and earning industry recognition.

| Year | Milestone |

|---|---|

| Early Days | The company was established, marking the beginning of its journey in the equipment rental sector. |

| Mid-2010s | The company underwent a restructuring process due to the economic crisis in Brazil. |

| 2024 | Mills received the IAPA Awards as 'Best Rental Company of the Year' in March, demonstrating industry leadership. |

| 2024 | Acquisition of JM Empilhadeiras, enhancing heavy equipment offerings. |

| Q1 2024 | Consolidated gross revenue reached R$386.4 million, an 8.5% year-on-year increase. |

A key innovation for Mills was the expansion of its portfolio to include the rental and sale of lifting platforms. This strategic move addressed a growing market need for safe and efficient work-at-height solutions, positioning Mills as a pioneer in the lifting platforms leasing market in Brazil.

Mills expanded its offerings to include the rental and sale of lifting platforms. This diversification catered to the growing demand for safe and efficient work-at-height solutions.

The company became a pioneer in the lifting platforms leasing market in Brazil. This strategic move helped solidify its market position and drive growth.

The acquisition of JM Empilhadeiras in 2024 enhanced its heavy equipment offerings. This move broadened its service portfolio and strengthened its market position.

Mills has faced challenges, including economic downturns and increased competition from imported machines. These challenges have led to price pressures and the need for strategic adjustments.

The economic crisis in Brazil in the mid-2010s led to a restructuring process. This period required strategic financial adjustments and operational changes.

The arrival of imported machines from China at competitive prices increased competition. This led to slight pressure on prices, requiring strategic responses.

Mills has actively worked to strengthen its market footprint and consolidate partnerships with manufacturers. This helped maintain its leadership during challenging times.

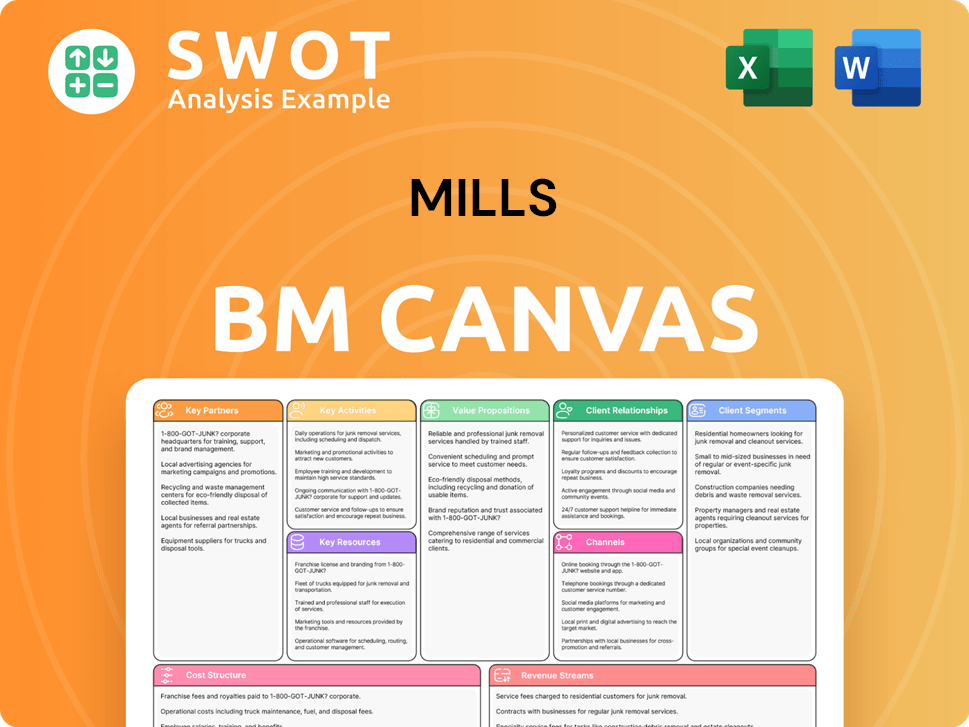

Mills Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Mills?

The Owners & Shareholders of Mills company has a rich history, marked by strategic expansions and adaptations within Brazil's construction and rental sectors. From its inception in 1952, the company has grown significantly, evolving its business model to meet market demands and economic challenges. The company's journey includes pioneering efforts in construction, expansions into equipment rental, and strategic realignments, reflecting its resilience and commitment to innovation.

| Year | Key Event |

|---|---|

| 1952 | The company is founded, beginning its journey in Brazil's construction sector. |

| 1997 | The company expands its offerings by establishing a business unit for the rental and sale of lifting platforms. |

| 2003 | The aerial platforms division is sold to Sullair Argentina, which renames the new company Solaris. |

| 2010 | The company conducts its Initial Public Offering (IPO). |

| 2011 | The equipment rental division reports a 96.5% increase in Q1 revenues, driven partly by opening ten new rental depots. |

| 2015 | The restructuring process at the company and Solaris begins due to the economic crisis in Brazil. |

| 2019 | Business merger between the company and Solaris. |

| March 2024 | The company receives the IAPA Awards 2024 as 'Best Rental Company of the Year'. |

| May 2024 | The company announces first-quarter 2024 results, with total net revenue of R$353.2 million, and approves Interest on Equity (IoE) of R$19.5 million. |

| June 2024 | The company acquires JM Empilhadeiras for approximately R$280 million. |

| Third Quarter 2024 | The company reports a historic record net revenue of R$419.5 million, up 20.6% from the same period last year. |

| First Quarter 2025 | The company expects to open new Heavy Rental operating centers. |

The company is focused on sustainable business growth, aiming to be the largest rental partner for its customers. Its business strategy emphasizes long-term value creation and operational efficiency. The company's strategic initiatives are designed to enhance its market position and deliver consistent results.

The company has a solid business perspective in its Heavy Rental unit. It maintains a strong contracted backlog in Formwork and Shoring. This supports the company's annual growth in 2024. The company's strategic focus on Heavy Rental is expected to drive significant revenue growth.

The company is actively pursuing its expansion plan in Light Rental. It opened four branches in the first quarter of 2024. The company anticipates further expansion in the Heavy Rental segment. This expansion strategy aims to increase market share and customer reach.

The company believes in significant cross-sell opportunities and a broad customer base to increase market share. It has already secured most of its planned investment for 2024. The company's commitment to quality solutions and services is a key driver of its success.

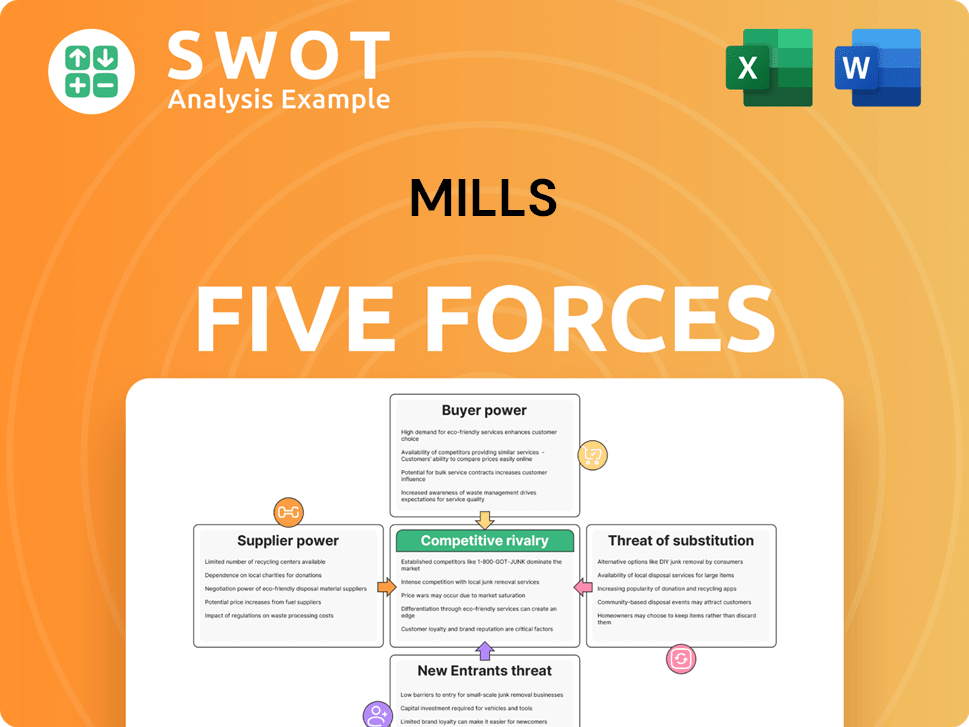

Mills Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Mills Company?

- What is Growth Strategy and Future Prospects of Mills Company?

- How Does Mills Company Work?

- What is Sales and Marketing Strategy of Mills Company?

- What is Brief History of Mills Company?

- Who Owns Mills Company?

- What is Customer Demographics and Target Market of Mills Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.