Mills Bundle

How Does Mills S.A. Stack Up in Brazil's Booming Construction Sector?

Brazil's construction and infrastructure sectors are experiencing a surge, with significant growth in housing sales and new unit releases. Mills S.A., a veteran of the Brazilian market since 1952, stands at the forefront, providing essential equipment rental services. But in this dynamic environment, how does Mills SWOT Analysis position itself among its rivals?

This analysis delves into the Mills company competitive landscape, examining its market position within the Mills company industry. We'll uncover the Mills company competitors, providing a detailed competitive analysis Mills company perspective. Understanding the Mills company overview is crucial to grasping its strengths and challenges in the evolving market, including its key differentiators and Mills company competitive advantages.

Where Does Mills’ Stand in the Current Market?

Mills S.A. is a key player in the Brazilian construction equipment rental industry. The company is recognized as the largest rental partner in Brazil, offering a wide range of equipment and services. This includes access platforms, shoring systems, and other specialized equipment, along with engineering services and technical support.

The company's extensive network of 60 units across various Brazilian regions and a diverse customer base contribute to its resilience against market fluctuations. Mills operates in 'Heavy Rental' and 'Formwork and Shoring' units, with the Formwork and Shoring unit showing strong growth. This strategic positioning and operational strength are vital in understanding the competitive landscape of Mills company.

Mills is the market leader in Latin America. It has a fleet of over 10,000 pieces of equipment, serving more than 1,400 Brazilian cities. This extensive reach and service capability are critical to its market position. The company's ability to provide comprehensive solutions is a key strength.

Mills reported a total net revenue of R$353.2 million in the first quarter of 2024. The adjusted EBITDA reached R$170.1 million in Q1 2024, up 4.4% year-on-year. Net income for Q1 2024 was R$67.7 million, with a 19.2% net margin, demonstrating strong financial health.

Mills is believed to hold approximately 30% of Brazil's total Mobile Elevating Work Platform (MEWP) fleet size. This positions Mills as the top MEWP rental company in the country. This significant market share highlights its dominance in a key product area.

The Brazilian construction equipment rental market is estimated at USD 2.40 billion in 2025 and is expected to reach USD 3.28 billion by 2030, growing at a CAGR of 6.5%. The broader Latin America market is projected to grow at a CAGR of 4.7% from 2024 to 2030. Brazil is expected to register the highest CAGR in the region, indicating significant growth potential for Mills.

Mills' strong market position is supported by its extensive geographic presence, diverse service offerings, and solid financial performance. The company's focus on specialized equipment and engineering services differentiates it from competitors. Understanding these advantages is crucial for a comprehensive competitive analysis Mills company.

- Leading market share in Brazil's construction equipment rental industry.

- Extensive fleet of over 10,000 pieces of equipment.

- Strong financial results, including revenue and EBITDA growth in Q1 2024.

- Focus on specialized equipment and engineering services.

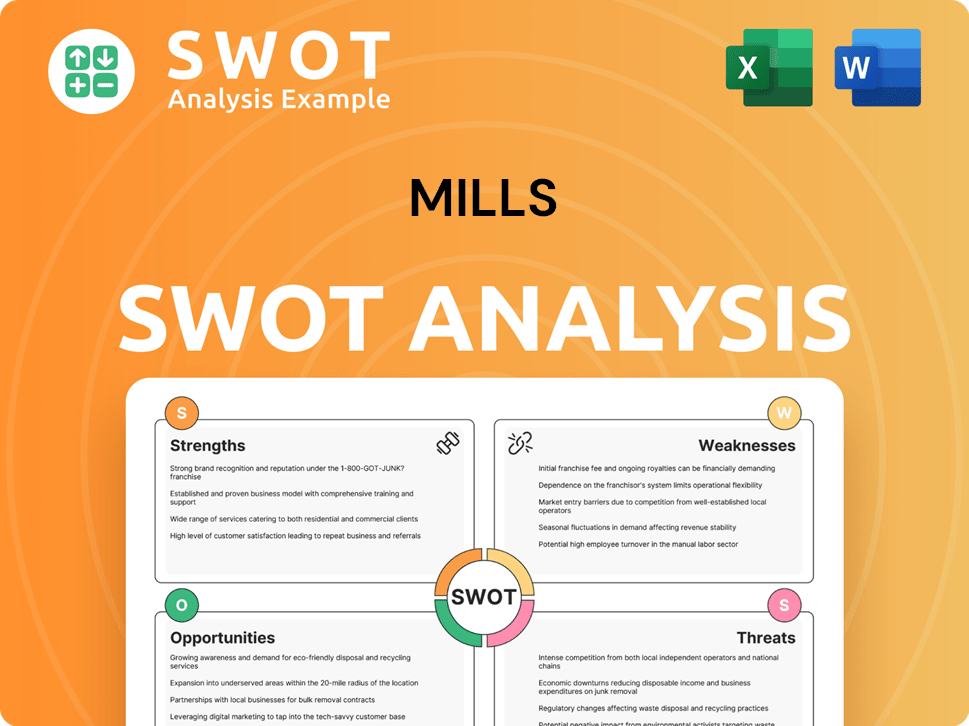

Mills SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Mills?

The Revenue Streams & Business Model of Mills operates within a dynamic Brazilian equipment rental market, facing competition from both global and local players. A comprehensive competitive analysis of the Mills company is crucial for understanding its market position and strategic challenges. The Mills company competitive landscape is shaped by the presence of established international firms and evolving dynamics within the industry.

Understanding the competitive landscape is essential for evaluating the Mills company's performance and future prospects. The industry is influenced by technological advancements, economic conditions, and the strategies of key competitors. Analyzing the Mills company's competitors provides insights into its strengths, weaknesses, and potential for growth.

Mills S.A. faces a competitive environment with various rivals in the Brazilian equipment rental market. The Brazil Construction Equipment Market includes global companies such as Caterpillar, Sany, New Holland, and AB Volvo. In the MEWP rental sector, Locar is a significant competitor, aiming to be among the second to fourth largest MEWP rental companies in Brazil after Mills. The competitive environment in the MEWP sector is intensifying, with an increase in the number of competitors in certain areas.

Caterpillar, Sany, New Holland, and AB Volvo are key global competitors in the broader Brazil Construction Equipment Market.

Locar is a significant player in the MEWP rental sector, investing in new equipment.

The market also includes local and regional rental companies that compete with Mills.

Chinese manufacturers are gaining dominance in the Brazilian market due to competitive pricing and credit offerings.

Mills has expanded its presence through acquisitions, such as Altoplat's aerial platform division in 2021.

Other competitors in the broader equipment rental and engineering services space may include companies like Wilo Group, Scm Group, KION Group, Tennant Company, and JLG Industries.

The competitive landscape of the Mills company involves several key factors influencing its market position and strategic decisions. These factors include the size and composition of the rental fleet, geographic coverage, pricing strategies, and the ability to offer specialized services. The industry also experiences mergers and alliances, as seen with Mills' own acquisitions, such as Altoplat's aerial platform division in 2021, to expand its presence and customer base.

- Market Share: The competitive landscape is influenced by market share, with Mills and Locar being significant players.

- Fleet Investment: Locar has doubled its fleet in the last two years, with investments in new equipment.

- Geographic Focus: Locar focuses its efforts in the central southeast and northeast areas of Brazil, with 10 depots.

- Pricing and Credit: Chinese manufacturers are gaining dominance due to competitive pricing and credit offerings.

- Mergers and Acquisitions: Mills' acquisitions, such as Altoplat, are part of its expansion strategy.

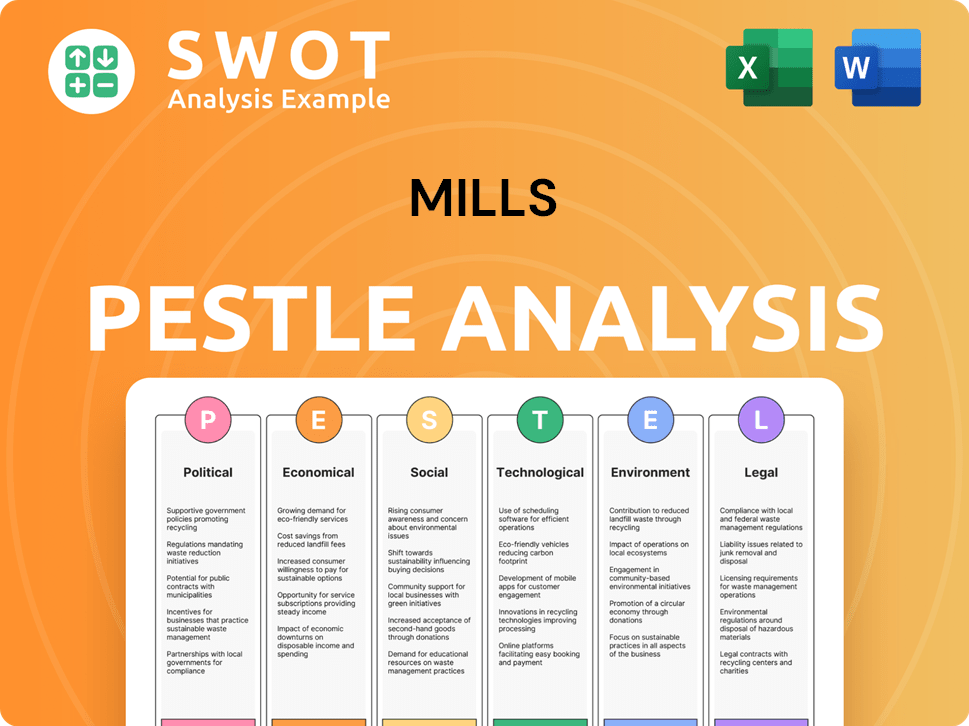

Mills PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Mills a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of the Mills company is crucial for assessing its position in the Brazilian equipment rental market. A deep dive into its competitive advantages reveals key strengths that set it apart. This analysis, incorporating the latest market data and strategic insights, provides a comprehensive view of Mills' standing.

Mills S.A. has established a strong market presence, leveraging its extensive capillarity and leadership position. Its operational efficiency and diversified client base further enhance its competitive edge. Analyzing these factors helps in understanding how Mills navigates the industry's challenges and capitalizes on opportunities.

The Target Market of Mills is significantly influenced by these competitive advantages, shaping its strategic approach and market performance. This chapter will explore these advantages in detail, providing a clear picture of Mills' competitive dynamics.

Mills boasts the largest fleet in Latin America, with over 10,000 pieces of equipment. It serves more than 1,400 Brazilian cities through 60 units. This widespread presence ensures unique territorial coverage, making it resilient to market fluctuations and positioning it as a leader in the equipment rental sector.

With over 70 years in the market, Mills is a pioneer in lifting platforms and complex construction solutions in Brazil. This long-standing experience has cultivated strong relationships and a reputation for trust, quality, and safety. This deep-rooted history provides a significant competitive advantage.

Mills' diversified client base across various economic sectors helps mitigate cyclicality risks. Optimized operations, including a solid balance sheet and broad access to capital, provide excellent credit ratings. This operational efficiency enhances profitability and supports its market position.

Mills offers specialized engineering services and technical support, providing creative solutions for major infrastructure and construction projects. This comprehensive service offering, including planning and design, adds significant value for clients. This differentiates Mills from competitors.

Mills' competitive advantages are rooted in its extensive reach, long-term expertise, and operational efficiency. These factors enable Mills to maintain a strong market position and offer comprehensive solutions.

- Largest fleet in Latin America, ensuring broad coverage.

- Over 70 years of experience, building trust and expertise.

- Diversified client base, reducing cyclical risks.

- Specialized services, providing added value to clients.

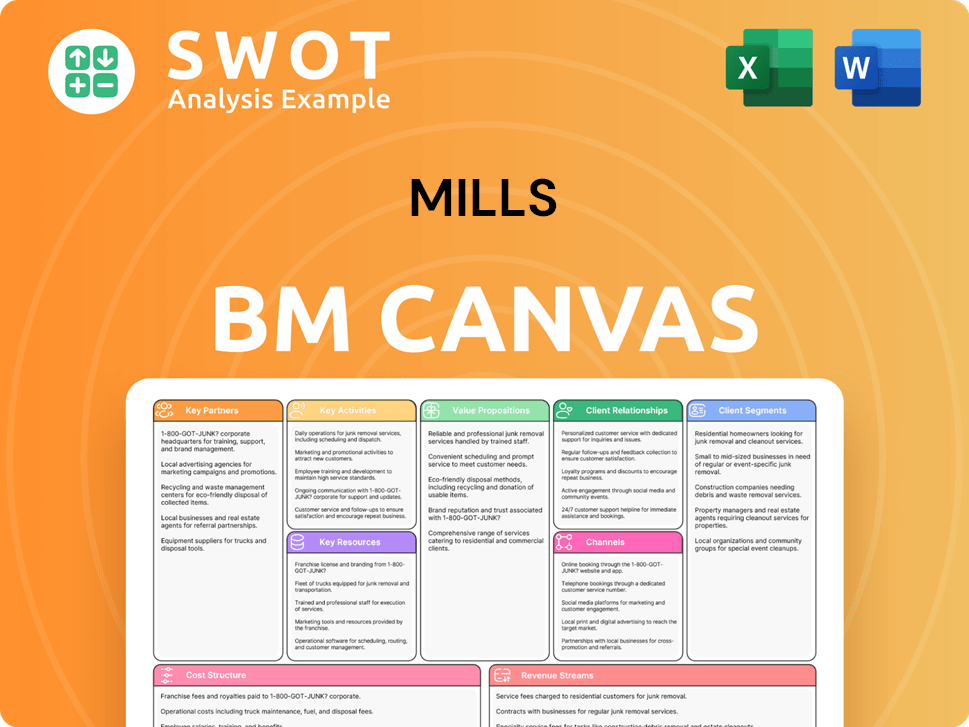

Mills Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Mills’s Competitive Landscape?

The competitive landscape for Mills S.A. is significantly influenced by industry trends and the broader economic environment. Analyzing the Mills company competitive landscape reveals both opportunities and challenges. The company's market position is shaped by its ability to adapt to evolving demands and navigate competitive pressures within the construction equipment rental sector.

Understanding the Mills company industry dynamics is crucial for assessing its future outlook. The construction equipment rental market in Brazil is poised for growth, driven by factors like increased construction activity and the preference for rental services over direct ownership. However, the company faces risks such as macroeconomic uncertainties and increasing competition.

The construction equipment rental market is experiencing strong growth globally, with a projected value of USD $201.81 billion by 2034. This growth is fueled by the increasing demand for construction projects and cost optimization strategies. Brazil's construction machinery market is showing positive signs with a surge in housing activity and growth in the industrial and renewable energy sectors.

Mills company competitors face challenges such as uncertain macroeconomic conditions and increased competition, particularly from Chinese manufacturers. The industry also deals with issues related to climate change, port congestion, and rising input costs. These factors necessitate strategic adaptation and efficient resource management for sustained success.

The strong momentum in residential construction and growth in the industrial and renewable energy sectors in Brazil will continue to drive demand. Mills can capitalize on the increasing preference for equipment rental due to high purchasing costs and the need for cost-efficiency. The company's focus on sustainable business growth and fleet expansion positions it well to take advantage of these opportunities.

Mills' commitment to providing the best solutions, quality service, reliability, and safety, along with its unique capillarity, will be crucial in maintaining its competitive edge. The company's ability to adapt to technological advancements, such as the integration of telematics, will further enhance its market position. For more insights, you can explore a Brief History of Mills.

Mills' competitive strategy centers on providing comprehensive solutions and maintaining high service quality. The company's ability to adapt to technological advancements and expand its network is crucial for future success. The Brazilian market for construction equipment rental is expected to grow at a CAGR of 5% from 2024 to 2030, reaching USD $4,132.9 million by 2030.

- Focus on sustainable business growth and fleet expansion.

- Commitment to providing quality service, reliability, and safety.

- Leveraging unique market presence to increase penetration in existing segments.

- Adapting to the increasing demand for efficient and technologically advanced machinery.

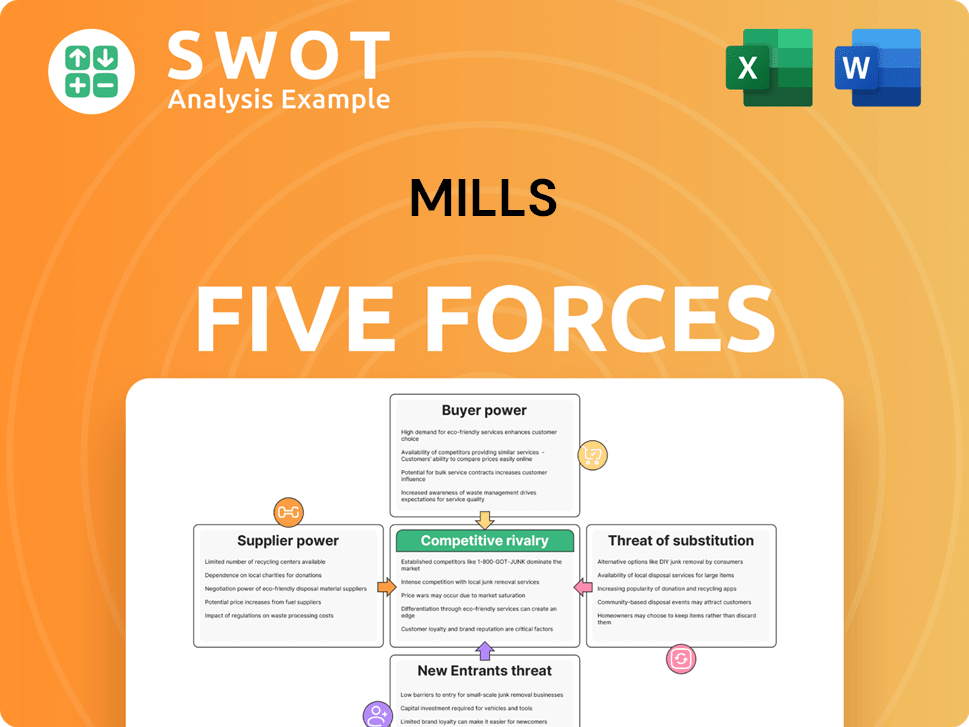

Mills Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mills Company?

- What is Growth Strategy and Future Prospects of Mills Company?

- How Does Mills Company Work?

- What is Sales and Marketing Strategy of Mills Company?

- What is Brief History of Mills Company?

- Who Owns Mills Company?

- What is Customer Demographics and Target Market of Mills Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.