Mills Bundle

Who Really Controls Mills Company?

Understanding Mills SWOT Analysis and its ownership is crucial for any investor or strategist. Mills, a key player in Brazil's equipment rental market, has a fascinating history and a complex ownership structure. This analysis delves into the details of who owns Mills Company, exploring the key players and their influence.

As a public company listed on B3, Mills Company's ownership is a dynamic landscape shaped by institutional investors, public shareholders, and potentially, a controlling entity. This exploration of Mills Company's ownership will provide insights into the company's strategic direction, potential risks, and opportunities. We'll examine the major shareholders, the influence of the board of directors, and how ownership changes have shaped Mills' trajectory over time, offering a comprehensive view of who owns Mills Company.

Who Founded Mills?

The Nacht family founded the company, and their involvement spans over six decades. While the precise initial equity distribution isn't publicly available, the family's sustained presence signifies their enduring influence. The company's long-term presence in the market indicates a solid foundation and early backing that facilitated its growth in the Brazilian market.

Francisca Kjellerup Nacht, a descendant of Mr. Jose Nacht, one of the founders, currently serves as Co-Chairman of the Board of Directors. This continued family presence underscores the significance of the founding vision, which likely centered on equipment rental and services. This specialization remains a core aspect of the company's operations today.

Early financial backers or angel investors aren't specifically detailed in public records. However, the company's longevity in the market suggests a stable base and early support that allowed it to establish itself in Brazil. The company's history reflects a commitment to its core business, as highlighted in Revenue Streams & Business Model of Mills.

Understanding the ownership structure of the company is key to assessing its strategic direction and financial health. The company's ownership has likely evolved over time, reflecting market dynamics and strategic decisions.

- The Nacht family's continued involvement, with Francisca Kjellerup Nacht as Co-Chairman, points to family influence in the company's governance and strategic decisions.

- The absence of detailed information on early backers suggests that the initial funding may have come from private sources.

- The company's long-term presence in the market also suggests a stable foundation and early support that enabled its growth within the Brazilian market.

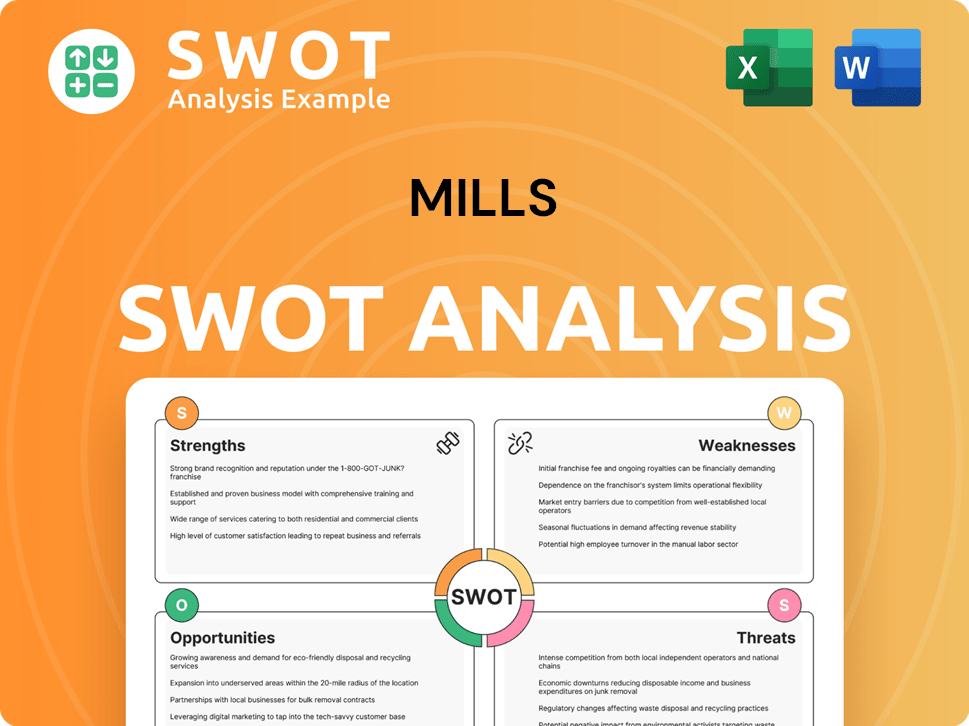

Mills SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Mills’s Ownership Changed Over Time?

The evolution of the Mills Company's ownership structure is marked by a significant shift in April 2010. This occurred when Mills Locação, Serviços e Logística S.A. went public. It listed its shares on B3's Novo Mercado under the ticker 'MILS3'. This move broadened the shareholder base beyond the founding family.

The transition to public ownership was a pivotal moment, transforming the company's ownership dynamics. This change opened the door for a more diverse group of investors to participate in the company's growth. The listing on Novo Mercado also signaled a commitment to high corporate governance standards.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | April 2010 | Transitioned from private to public ownership, broadening the shareholder base. |

| Ongoing Operations | 2024-2025 | Continued business activity and growth, reflected in financial performance. |

| Market Valuation | June 9, 2025 | Market capitalization of R$2.40 billion, reflecting the company's current value. |

As of recent information, major stakeholders in Mills include the Nacht family, the founders. Other significant stakeholders include Sullair Argentina and Southern Cross. In the first quarter of 2024, Mills reported a net rental revenue of R$353.2 million. The company's market capitalization as of June 9, 2025, stood at R$2.40 billion. The company's share capital consists exclusively of common shares with voting rights, and it adheres to 100% tag-along rights.

Mills Company's ownership structure has evolved significantly since its IPO in 2010.

- The Nacht family, Sullair Argentina, and Southern Cross are key stakeholders.

- The company's market capitalization was R$2.40 billion as of June 9, 2025.

- Mills reported a net rental revenue of R$353.2 million in Q1 2024.

- The company's shares have 100% tag-along rights.

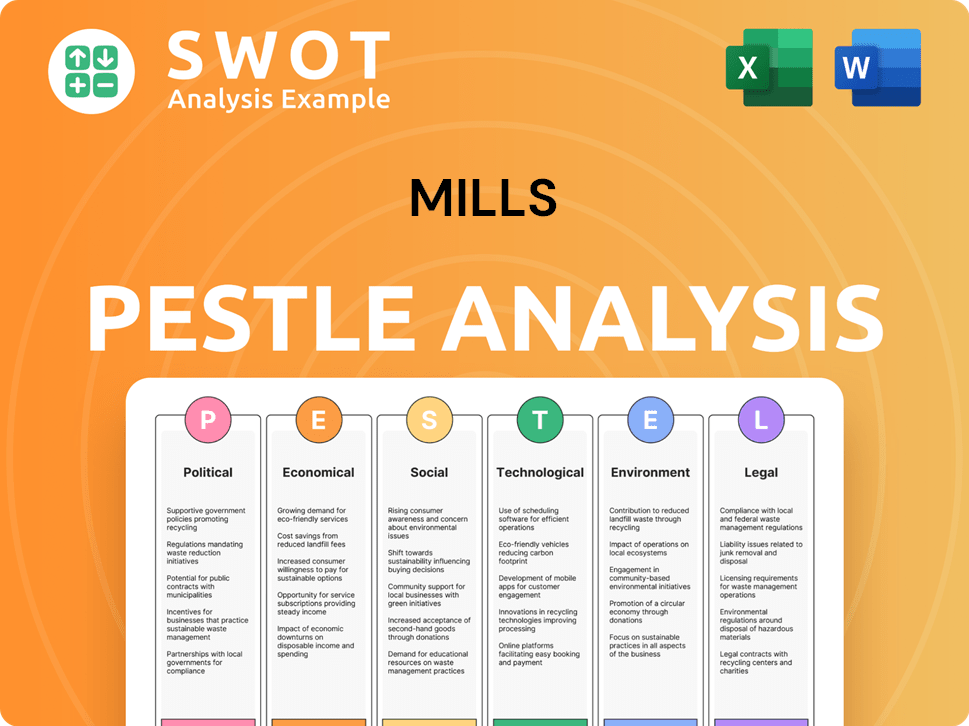

Mills PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Mills’s Board?

The management of the Mills Company is overseen by a Board of Directors, which is responsible for setting the company's strategic direction. Their main goals include maximizing value, protecting assets, and fostering continuous growth. The Board operates under the company's bylaws and the Novo Mercado Listing Rules, which dictate the structure and operation of the Board.

The Board of Directors must consist of a minimum of five and a maximum of eleven members. These members are elected for a two-year term and are eligible for re-election. Decisions made by the Board are determined by a majority vote of the members present at any meeting. As of the most recent information, the Board of Directors is composed of eight members. Understanding the Target Market of Mills is critical to understanding the company's strategic direction.

| Board Member | Role | Notes |

|---|---|---|

| Francisca Kjellerup Nacht | Co-Chairman | Granddaughter of one of the founders, Jose Nacht. |

| Roberto Pedote | Co-Chairman | Board member since April 2016, Co-Chairman since April 2018. |

| Independent Members | Various | At least two independent members are required, or 20%, whichever is greater. |

The company's corporate governance adheres to B3's Novo Mercado segment standards. This means that the share capital comprises exclusively common shares with voting rights. Additionally, all shareholders are guaranteed 100% tag-along rights in the event of a change of control. This structure is designed to ensure fair treatment for all shareholders and promote transparency and accountability in the company's decision-making processes. The Board is supported by two advisory committees: the Audit, Finance and Risk Committee, and the People, Management and Sustainability Committee.

The Board of Directors plays a crucial role in the strategic direction of the company.

- The Board consists of a minimum of five and a maximum of eleven members.

- Decisions are made by a majority vote of the present members.

- The company's governance aligns with the Novo Mercado segment.

- Shareholders have 100% tag-along rights.

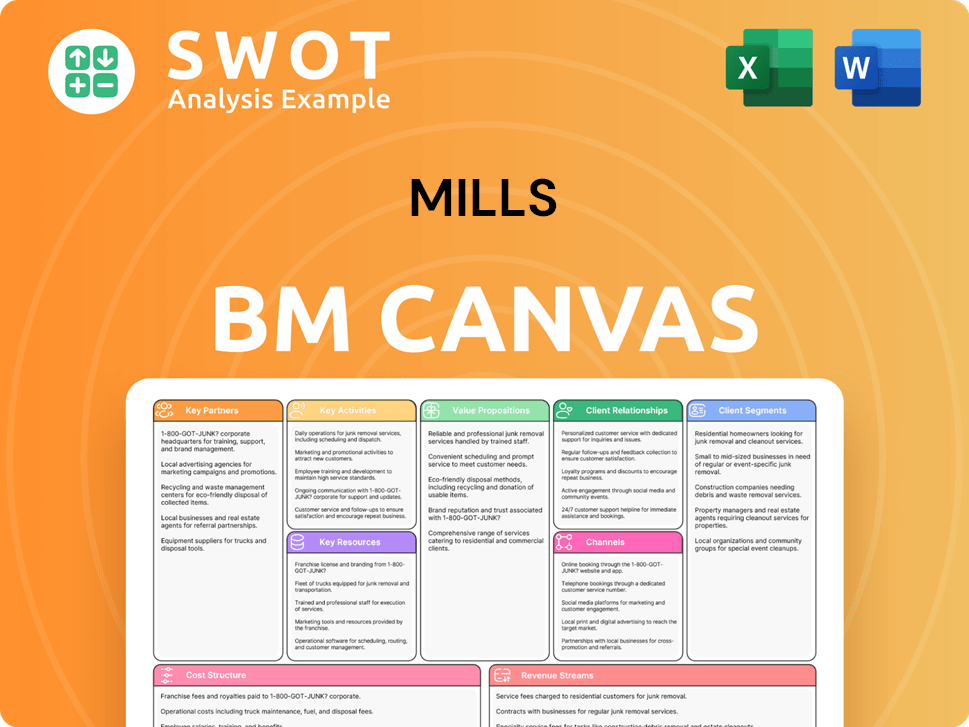

Mills Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Mills’s Ownership Landscape?

In the past few years, the focus of Mills has been on sustainable growth and expanding its market reach. The company's strategy includes expanding its service offerings and geographical presence. This is evident in its expansion plans, such as the opening of new branches in Light Rental and anticipated new operating centers in Heavy Rental during 2024. This expansion aligns with industry trends of capturing more market share through broader service offerings and geographical reach. In Q1 2024, Mills reported a total consolidated gross revenue of R$386.4 million, an 8.5% increase year-on-year. Additionally, the company's consolidated net rental revenue reached R$317.9 million, up 11.6% compared to Q1 2023. Net income for Q1 2024 was R$67.7 million, marking a 2.0% increase from Q1 2023.

Mills has also made significant investments to support its growth. In Q1 2024, the company invested R$188.3 million in Capex, with 97% allocated to rental assets. This investment underscores Mills' commitment to providing quality solutions and equipment. The company's commitment to quality was recognized when it received the IAPA Awards 2024 as 'Best Rental Company of the Year' in March 2024. This recognition further solidifies its position in the market. To learn more about the company's strategic direction, you can read about the Growth Strategy of Mills.

The ownership structure of Mills reflects a blend of founding influence and institutional backing. While specific recent changes in major shareholder percentages are not readily available in the provided information for 2024-2025, the continued presence of the Nacht family and strategic investors like Sullair Argentina and Southern Cross suggests a balance between founding influence and institutional backing. Mills' listing on the Novo Mercado segment of B3 underscores its commitment to attracting and maintaining institutional investors through strong corporate governance. This structure is common in the industry as companies mature and seek capital for expansion.

Mills Company's ownership includes a mix of founding family influence and institutional investors. The Nacht family and strategic investors are key stakeholders. The company's listing on the Novo Mercado segment of B3 indicates a commitment to attracting institutional investors.

In Q1 2024, Mills reported a total consolidated gross revenue of R$386.4 million, an 8.5% increase year-on-year. Consolidated net rental revenue was R$317.9 million, up 11.6% from Q1 2023. Net income for Q1 2024 was R$67.7 million, a 2.0% increase from Q1 2023.

Mills invested R$188.3 million in Capex during Q1 2024, with 97% allocated to rental assets. This investment reinforces the company's commitment to providing quality solutions. The company also received the IAPA Awards 2024 as 'Best Rental Company of the Year'.

Mills is focusing on sustainable business growth by expanding its market reach. The company opened new branches in Light Rental and plans to open new Heavy Rental operating centers in 2024. This is in line with industry trends of increasing service offerings.

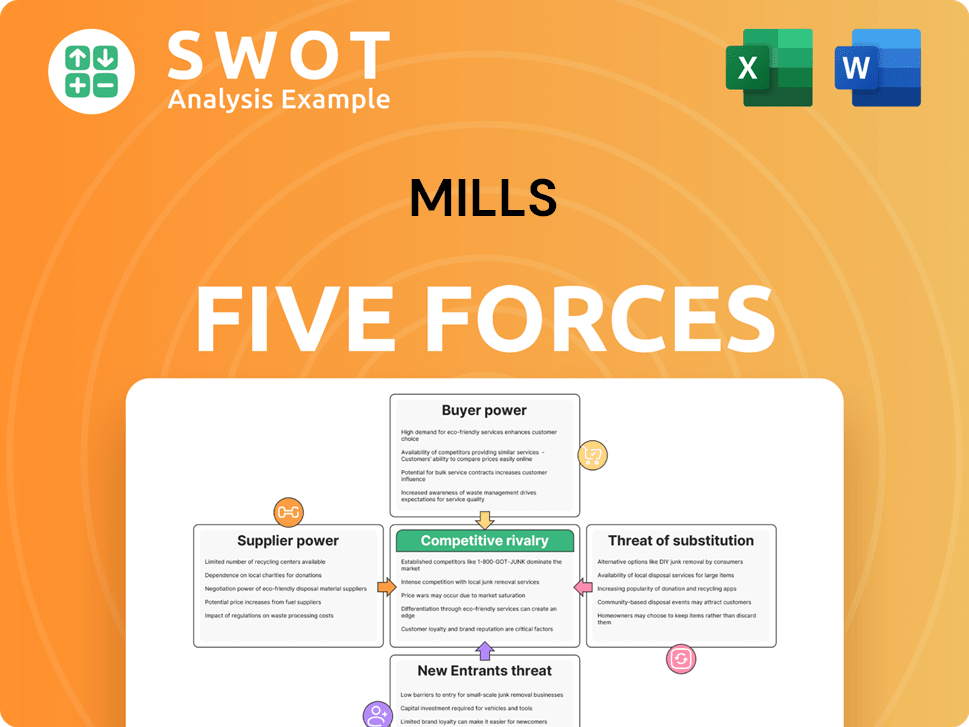

Mills Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mills Company?

- What is Competitive Landscape of Mills Company?

- What is Growth Strategy and Future Prospects of Mills Company?

- How Does Mills Company Work?

- What is Sales and Marketing Strategy of Mills Company?

- What is Brief History of Mills Company?

- What is Customer Demographics and Target Market of Mills Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.