Mills Bundle

Can Mills Company Continue Its Ascent in the Equipment Rental Market?

Mills Company, a Brazilian leader in equipment rental services, has built a strong foundation since its inception in 1952. Offering everything from access platforms to shoring systems, Mills has become a key player in the construction, infrastructure, and mining sectors. This article dives into the Mills SWOT Analysis to explore its strategic roadmap for future success.

Understanding the Mills SWOT Analysis is crucial for grasping the company's growth strategy and future prospects. Through strategic expansion and continuous innovation, Mills aims to capitalize on market trends and solidify its position. This company analysis will examine the key drivers behind Mills' potential, offering insights into its business strategy and long-term vision for the next 5 years, including how they plan to address future challenges.

How Is Mills Expanding Its Reach?

The Competitors Landscape of Mills reveals that the company is actively pursuing several expansion initiatives to strengthen its market position and diversify its revenue streams. These strategic moves are designed to capitalize on growth opportunities within the construction, infrastructure, mining, and agricultural sectors. The company's focus is on both geographical expansion and broadening its service offerings.

Mills is strategically expanding within Brazil, targeting regions with high growth potential in construction and infrastructure projects. This involves increasing its presence in key urban centers and expanding operations in areas driven by mining and agricultural investments. This targeted approach is designed to align with Brazil's economic development and infrastructure needs.

Furthermore, Mills is exploring opportunities to expand its product and service offerings beyond its traditional equipment rental business. This includes potential ventures into new specialized equipment categories or complementary service lines. The company also emphasizes optimizing its existing branch network to improve efficiency and customer reach.

Focus on key urban centers and regions with high growth potential in construction, infrastructure, mining, and agriculture within Brazil. The aim is to increase market share and capitalize on regional economic growth. This expansion strategy is a core part of the company's growth strategy.

Exploring opportunities to broaden product and service offerings beyond traditional equipment rental. This includes considering new specialized equipment categories and complementary service lines. Diversification aims to cater to evolving client needs and expand revenue streams.

Emphasis on optimizing the existing branch network to improve efficiency and customer reach. This includes streamlining operations and enhancing service delivery. Efficient operations are critical for supporting expansion and maintaining profitability.

Consistent investment in its fleet and service capabilities. This continuous investment indicates a proactive approach to expansion and a commitment to meeting future market demands. This investment is a key element of the company's business strategy.

Mills' expansion strategy is multifaceted, focusing on geographical growth, diversification of services, and operational efficiency. These initiatives are designed to address market trends and capitalize on opportunities within the construction, infrastructure, mining, and agricultural sectors. The company aims to strengthen its market leadership through these strategic moves.

- Geographical expansion within Brazil, targeting high-growth regions.

- Diversification of product and service offerings to meet evolving client needs.

- Optimization of the existing branch network to improve efficiency and customer reach.

- Continuous investment in fleet and service capabilities to support expansion.

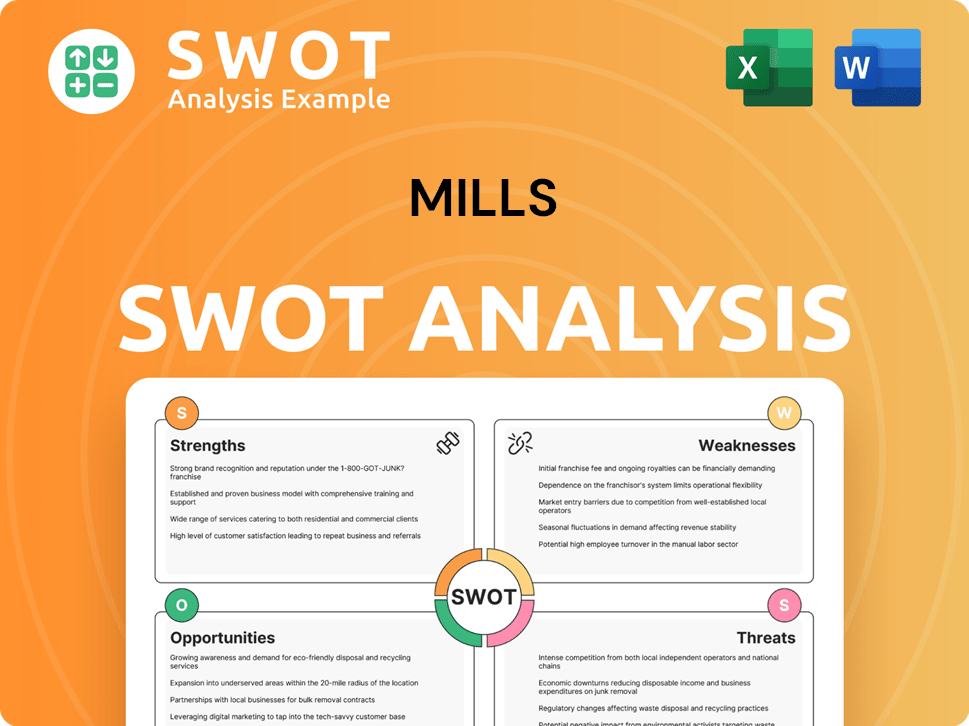

Mills SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Mills Invest in Innovation?

The Mills Company actively employs innovation and technology as key pillars of its growth strategy, aiming to secure a strong competitive position. This approach is designed to enhance operational efficiency, improve customer satisfaction, and adapt to evolving market trends.

By strategically investing in research and development, the company continually upgrades its equipment fleet. This focus includes acquiring and developing equipment that is more efficient, safer, and environmentally friendly, which directly contributes to the company’s future prospects.

Digital transformation initiatives are also a core part of this strategy, with the integration of digital platforms to streamline customer interactions and improve logistics. This enhances data analytics capabilities, enabling better decision-making processes across the organization.

The company allocates a significant portion of its budget to research and development (R&D) to foster innovation. This commitment helps the company stay ahead of the curve in terms of technology and equipment advancements.

A key area of investment is the continuous upgrade of the equipment fleet. This includes the adoption of advanced machinery that enhances operational efficiency and reduces environmental impact. The company aims to improve overall performance and sustainability.

Exploring automation in equipment operation and maintenance is another key focus. Automation helps optimize operational efficiency and reduce costs. This strategic move supports the company's business strategy.

The company embraces digital transformation to streamline processes and improve customer interactions. This digital integration enhances data analytics capabilities for informed decision-making. This strategic shift supports Mills Company's long-term goals.

Sustainability is a core value, with the company adopting newer, less impactful equipment. This commitment to responsible resource management helps minimize environmental impact. These initiatives are critical for long-term success.

Advanced data analytics is used to improve decision-making across all departments. This data-driven approach helps optimize operations and enhance customer satisfaction. This is a key element of the company’s growth strategy.

The integration of technology and innovation provides multiple benefits for the Mills Company. These advancements contribute to increased operational efficiency, improved customer satisfaction, and a stronger market position.

- Enhanced Operational Efficiency: Automation and advanced equipment reduce operational costs and improve productivity.

- Improved Customer Satisfaction: Digital platforms and streamlined processes enhance customer interactions and service delivery.

- Competitive Differentiation: Technological advancements help the company stand out in the market.

- Sustainability: Commitment to environmentally friendly equipment and practices.

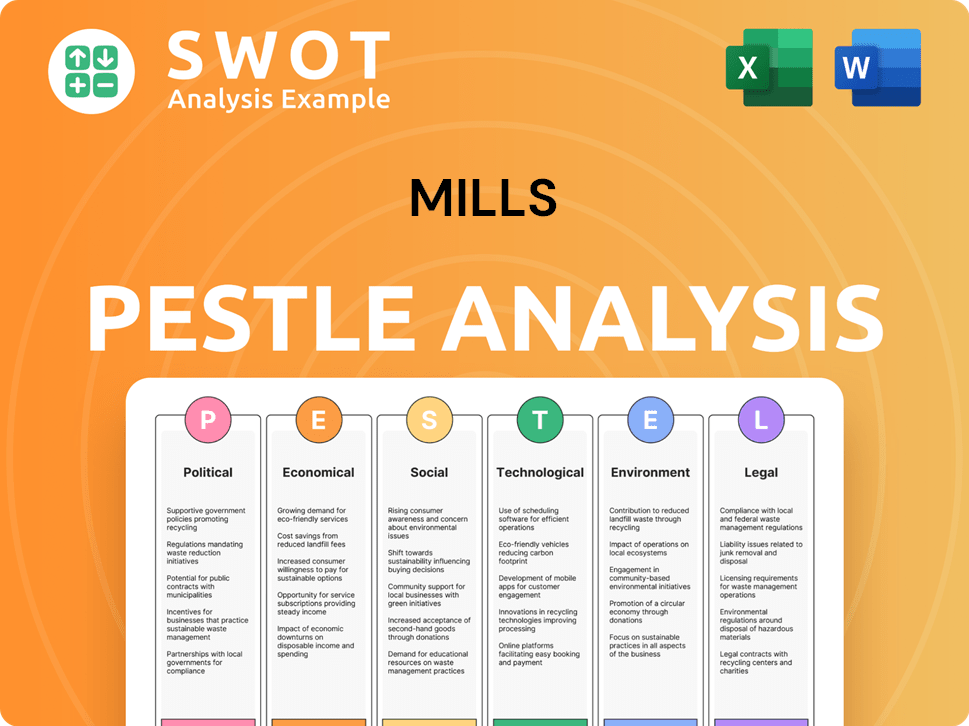

Mills PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Mills’s Growth Forecast?

The financial performance of the company is a key indicator of its robust growth strategy and future prospects. In 2023, the company demonstrated significant financial achievements, which set a solid foundation for its expansion plans. The consistent financial growth, coupled with strategic investments, positions the company favorably for future market opportunities.

The company's financial health is further highlighted by its strong profitability metrics, including a high EBITDA margin. This efficiency in operations, combined with strategic investments, reflects a sustainable business model. The company's ability to maintain and improve these metrics is crucial for its long-term growth and competitive advantage. For a deeper understanding of the company's approach, consider exploring the Marketing Strategy of Mills.

The company's focus on fleet investment, with a net CAPEX of R$ 362.4 million in 2023, demonstrates a commitment to enhancing its operational capabilities and supporting its growth strategy. This investment is expected to drive future revenue and EBITDA growth, especially considering the positive market trends in the infrastructure sector. The company's strategic investments are crucial for its expansion plans and maintaining its competitive edge.

In 2023, the company reported net revenue of R$ 1,228.3 million, marking a substantial increase. This growth reflects the effectiveness of its growth strategy and its ability to capitalize on market trends. The company's financial performance in 2023 sets a strong base for future growth.

The company achieved a record EBITDA of R$ 732.1 million in 2023, representing a significant year-over-year growth. The EBITDA margin of 59.6% underscores the company's operational efficiency and strong profitability. This high margin is a key indicator of the company's financial health.

For the first quarter of 2024, the company continued its positive trajectory. Net revenue reached R$ 344.2 million, up 17.6% from the same period in 2023. This growth demonstrates the company's sustained momentum and effective business strategy.

The adjusted EBITDA for Q1 2024 reached R$ 205.1 million, a 20.3% increase year-over-year. The adjusted EBITDA margin remained strong at 59.6%, reflecting the company's consistent profitability. These figures highlight the company's operational efficiency.

The company’s growth is driven by several key factors, including strategic investments and favorable market conditions. The company's ability to adapt to market trends and capitalize on opportunities is crucial for its future prospects. The company's focus on infrastructure investments in Brazil is a key driver of its growth.

- Infrastructure Investments: The company is benefiting from significant infrastructure investments in Brazil.

- Operational Efficiency: The company maintains high EBITDA margins, reflecting efficient operations.

- Strategic Investments: The company's consistent investment in its fleet supports future growth.

- Market Trends: The company is well-positioned to capitalize on positive market trends.

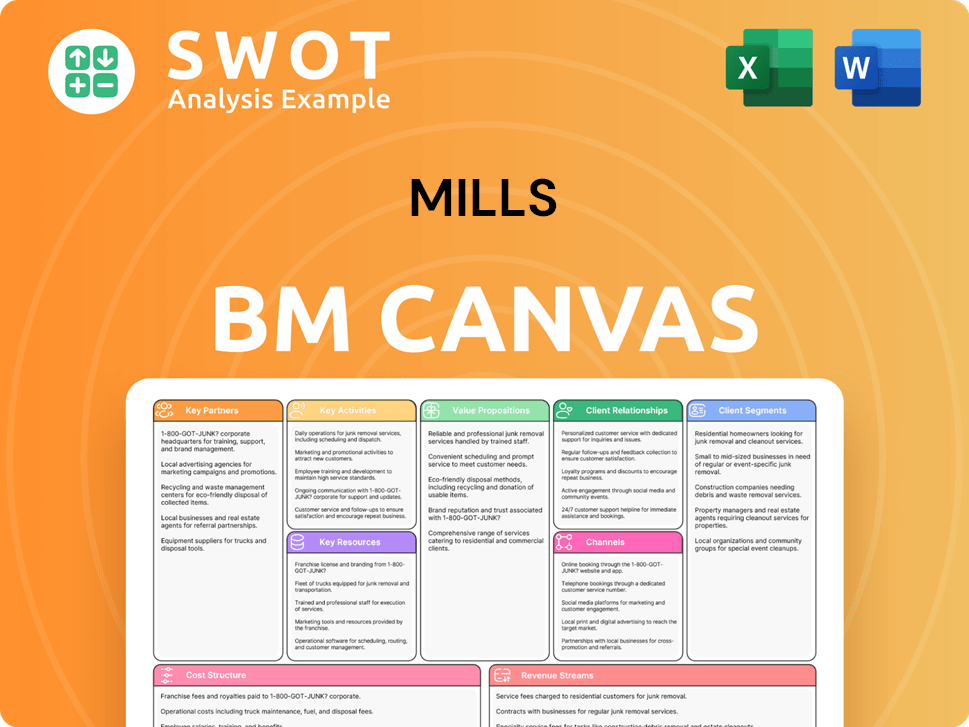

Mills Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Mills’s Growth?

The path forward for Mills Company is not without its challenges. The company's success hinges on navigating several potential risks and obstacles. Understanding these hurdles is crucial for assessing the future prospects of Mills Company and its growth strategy.

Market dynamics and economic conditions in Brazil present significant challenges. External factors, such as competition and supply chain disruptions, could also impact operations. A proactive approach to risk management is essential for sustained growth.

Mills faces potential risks related to market competition, economic fluctuations, regulatory changes, and supply chain vulnerabilities. These factors can influence the company's growth strategy and overall performance. The company's ability to mitigate these risks is critical for achieving its future prospects.

The equipment rental sector is highly competitive, with both local and international players vying for market share. Intense competition can pressure pricing and margins, impacting profitability. Strategic differentiation and operational efficiency are key to maintaining a competitive edge in this environment. Mills must continuously analyze its Revenue Streams & Business Model of Mills to stay ahead.

Economic instability in Brazil, including changes in interest rates, inflation, and government spending, directly affects demand. Economic downturns can lead to reduced infrastructure projects and decreased demand for rental equipment. Mills needs to be prepared for economic volatility, as seen in the Brazilian economy, which grew by only 2.9% in 2023, according to the Central Bank of Brazil.

Changes in environmental standards and labor laws can increase operational costs and compliance requirements. Stricter regulations may necessitate investments in new equipment or operational adjustments. Staying compliant with evolving regulations is crucial for avoiding penalties and maintaining operational licenses. For example, environmental regulations related to emissions standards are becoming increasingly stringent.

Disruptions in equipment manufacturing or spare parts availability can impact fleet readiness and service delivery. Delays in receiving equipment or parts can lead to downtime and lost revenue. Mills needs to maintain strong relationships with suppliers and diversify its sourcing to mitigate supply chain risks. The global supply chain disruptions of the last few years have highlighted the importance of resilient supply chains.

Mills mitigates these risks through a diversified client base, strong supplier relationships, and continuous monitoring of economic and regulatory landscapes. The company employs robust risk management frameworks and scenario planning. These proactive measures help Mills anticipate and respond to potential disruptions effectively. The company's strong performance in the face of market dynamics demonstrates the effectiveness of its risk management strategies.

Mills' financial performance is a key indicator of its ability to manage risks. The company's revenue growth, profitability, and cash flow are closely monitored. Strong financial results demonstrate the company's resilience and ability to navigate challenges. Analyzing key financial metrics, such as revenue growth and profit margins, provides insights into the effectiveness of the company's risk management strategies. For example, a consistent increase in revenue, even during economic downturns, indicates strong risk mitigation.

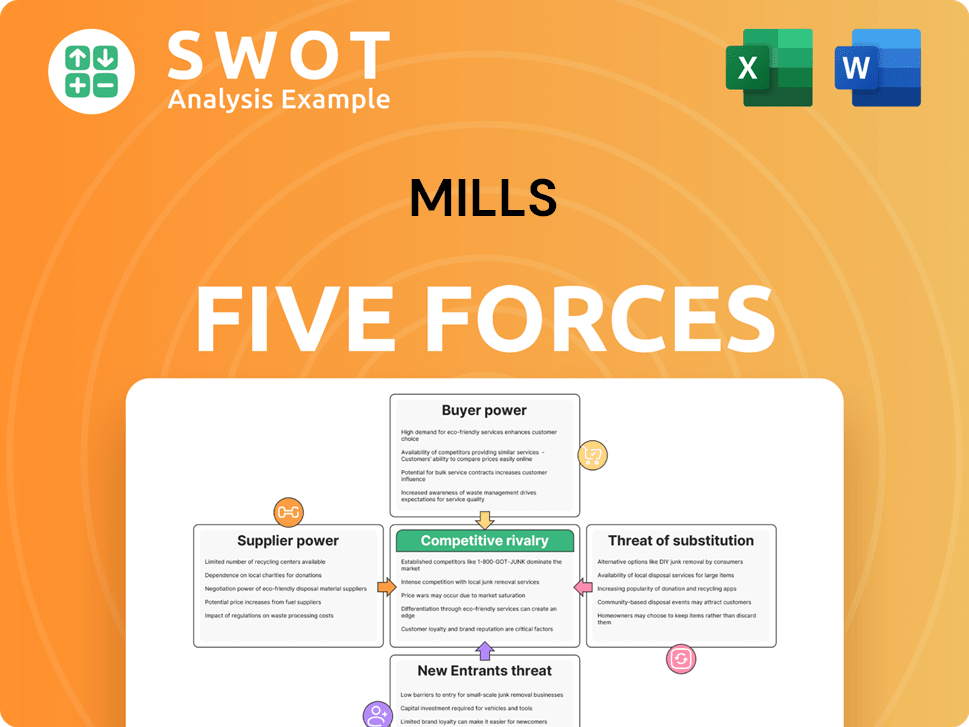

Mills Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mills Company?

- What is Competitive Landscape of Mills Company?

- How Does Mills Company Work?

- What is Sales and Marketing Strategy of Mills Company?

- What is Brief History of Mills Company?

- Who Owns Mills Company?

- What is Customer Demographics and Target Market of Mills Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.