Mills Bundle

How Does Mills Company Thrive in Latin America?

Mills Company, a leading Brazilian firm, is reshaping Latin America's construction and infrastructure landscape through its equipment rental services. With a robust 24.3% revenue increase in 2023, reaching R$ 1,228.6 million, Mills demonstrates remarkable growth and market dominance. This success, coupled with a 20.9% rise in net income, highlights the company's operational efficiency and strategic prowess in a dynamic market.

To fully grasp Mills Company operations, we'll explore its core functions, from its Mills SWOT Analysis to its strategic advantages. This analysis will uncover how Mills Company functions, examining its business model and the Mills SWOT Analysis to understand its market position. Understanding the manufacturing process, production methods, and supply chain management is crucial for evaluating its long-term potential and impact on the economy.

What Are the Key Operations Driving Mills’s Success?

The core of how the Owners & Shareholders of Mills company functions lies in its ability to provide equipment rental services, along with engineering services and technical support. This integrated approach allows the company to meet the needs of various clients, from large construction firms to smaller contractors. The company focuses on offering a comprehensive solution that includes equipment provision and expert technical assistance.

Mills Company operations are designed to ensure the availability, efficiency, and reliability of its equipment. This is achieved through rigorous maintenance, strategic fleet management, and a robust distribution network. This operational effectiveness translates into benefits for clients, such as reduced capital expenditure, increased project efficiency, and improved safety.

Mills' business model explained centers on renting specialized equipment like access platforms and shoring systems. Their supply chain management is optimized to ensure high-quality equipment is available to meet client demands promptly. This is achieved through a network of branches and service points to provide timely delivery, technical assistance, and maintenance.

Mills offers a wide range of equipment for rent, including access platforms, shoring systems, and other specialized machinery. This allows clients to avoid the high costs of purchasing and maintaining equipment. This approach is particularly beneficial for projects with specific equipment needs.

In addition to equipment rental, Mills provides engineering services and technical support. This comprehensive approach helps clients optimize equipment utilization, adhere to safety protocols, and improve project efficiency. This value-added service differentiates Mills from competitors.

Mills focuses on acquiring high-quality equipment from leading manufacturers and maintaining a well-distributed inventory. This ensures that clients can access the equipment they need when they need it. Their supply chain management is crucial for meeting client demands promptly.

Mills employs strategic fleet management to ensure the availability and reliability of its equipment. This includes rigorous maintenance programs and efficient logistics. This helps minimize downtime for clients and ensures optimal performance.

Mills' customer service approach offers several advantages to its clients. These include reduced capital expenditure, enhanced project efficiency, and improved safety. These benefits contribute to the company's value proposition and customer satisfaction.

- Reduced Capital Expenditure: Clients can rent equipment rather than purchasing it, reducing upfront costs.

- Enhanced Project Efficiency: Reliable machinery and expert support contribute to smoother project execution.

- Improved Safety: Proper equipment handling and technical assistance help ensure safe operations.

- Access to Specialized Equipment: Mills provides access to specialized machinery that might not be feasible for clients to own.

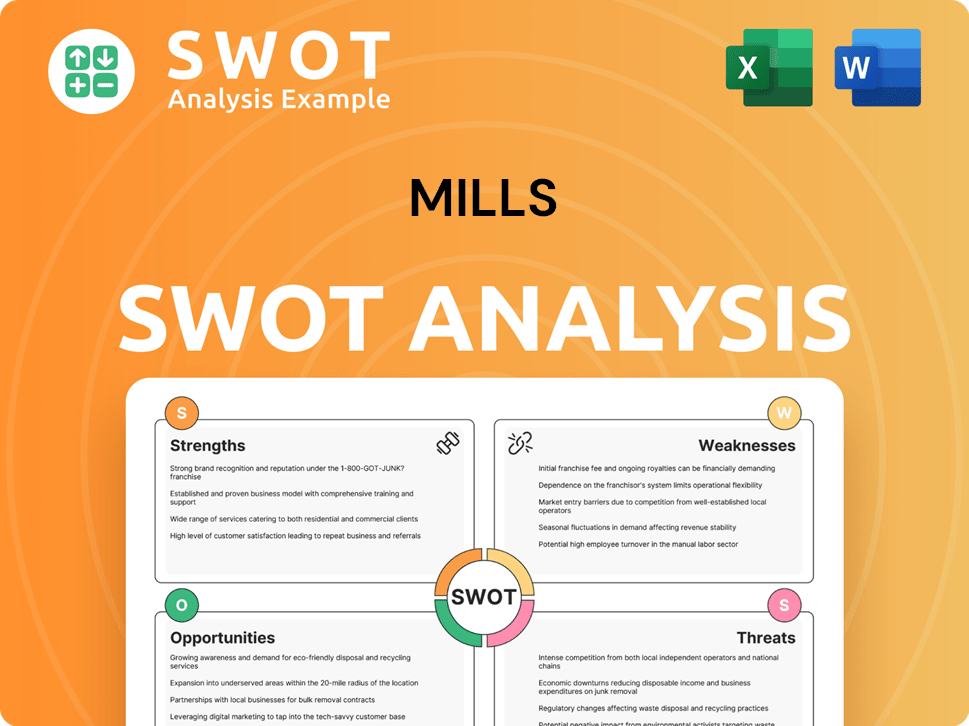

Mills SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Mills Make Money?

The core of Mills Company operations revolves around its multifaceted revenue streams and monetization strategies. These strategies are primarily centered on equipment rental services, complemented by engineering and technical support. This approach allows the company to capture a significant portion of the construction, infrastructure, and mining sectors' demand for outsourced equipment.

The primary driver of revenue for Mills is the rental of its diverse equipment fleet. This includes access platforms, shoring systems, and other specialized equipment. This segment consistently contributes the largest portion of the company's income. Mills also generates revenue through engineering services and technical support, which provide clients with specialized knowledge and project planning assistance.

In 2023, the rental of aerial work platforms (AWP) significantly contributed to Mills' revenue. The AWP segment recorded a gross revenue of R$ 1,029.0 million, reflecting a 28.5% increase compared to 2022. Additionally, the shoring and scaffolding segment generated a gross revenue of R$ 263.2 million in 2023. Mills employs innovative monetization strategies such as bundled services, combining equipment rental with engineering consultation or extended technical support packages.

Mills utilizes various strategies to maximize revenue and customer value. These include bundled services and tiered pricing models. The company's focus on expanding its service offerings beyond equipment rental has been crucial in maintaining its competitive edge and fostering sustained growth.

- Equipment Rental: The primary revenue stream, including access platforms, shoring systems, and other specialized equipment.

- Engineering Services: Providing specialized knowledge, project planning, and technical support.

- Bundled Services: Combining equipment rental with engineering consultation or extended technical support.

- Tiered Pricing: Pricing models based on rental duration, equipment type, and service level.

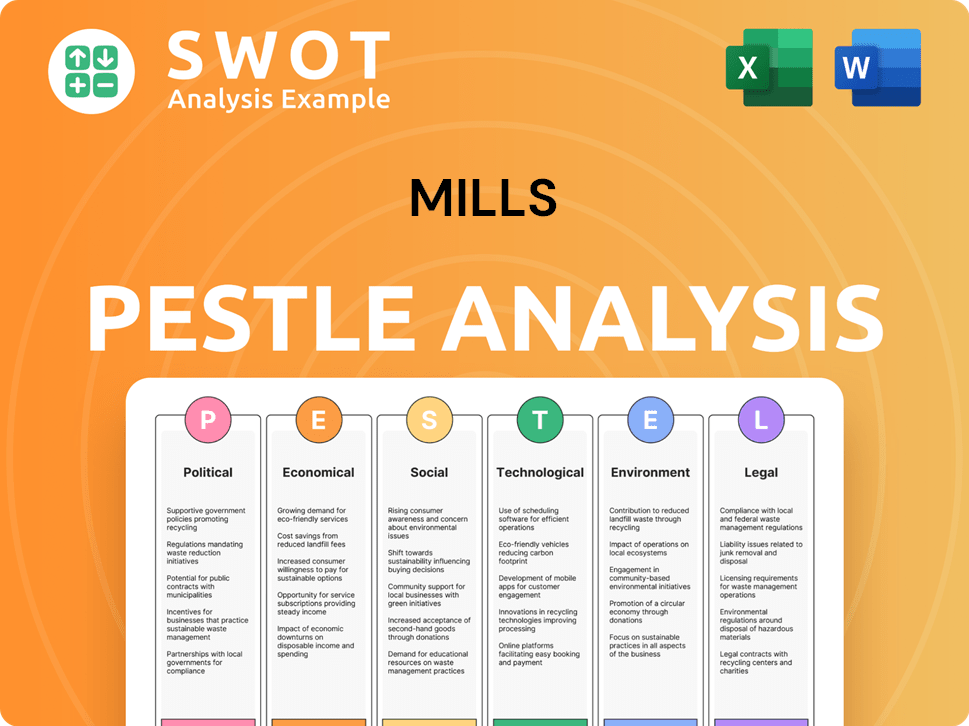

Mills PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Mills’s Business Model?

The operational and financial performance of the company has been significantly shaped by key milestones and strategic moves. A core element of its strategy involves the continuous expansion and modernization of its equipment fleet. This approach ensures that it offers the latest and most efficient machinery to its clients, which is crucial for maintaining a competitive edge in the market.

One of the strategic moves has been integrating engineering services and technical support alongside equipment rental. This transformation has allowed the company to evolve into a comprehensive solutions provider rather than just a rental company. This strategy has enabled them to capture a larger share of project budgets and cultivate stronger client relationships.

The company has navigated various operational challenges, including supply chain disruptions for new equipment and economic fluctuations impacting the construction sector. Responding to these challenges, the company has optimized its inventory management, diversified its supplier base, and maintained strong financial discipline to weather market downturns. Understanding the target market of the company is crucial for grasping its strategic direction.

The company has consistently invested in its aerial work platform (AWP) segment, recognizing the growing demand for safe and efficient access solutions in construction. This focus has led to substantial growth in its AWP gross revenue, reaching R$ 1,029.0 million in 2023, a 28.5% increase from 2022. This growth reflects the company's ability to adapt to market demands.

The integration of engineering services and technical support alongside equipment rental has been a key strategic move. This has allowed the company to capture a larger share of project budgets and build stronger client relationships. This shift has transformed the company from a simple rental provider into a comprehensive solutions provider.

The company's competitive advantages are multifaceted, including brand strength, technological leadership, and economies of scale. These factors contribute to its strong market position. The company's comprehensive ecosystem of equipment rental, engineering services, and technical support creates a sticky customer base.

- Brand strength and a long-standing reputation for reliability and quality service in the Brazilian market.

- Technological leadership, particularly in maintaining a modern and well-serviced fleet.

- Economies of scale, derived from its extensive network and large fleet, enable more competitive pricing and efficient logistics.

- Comprehensive ecosystem of equipment rental, engineering services, and technical support creates a sticky customer base.

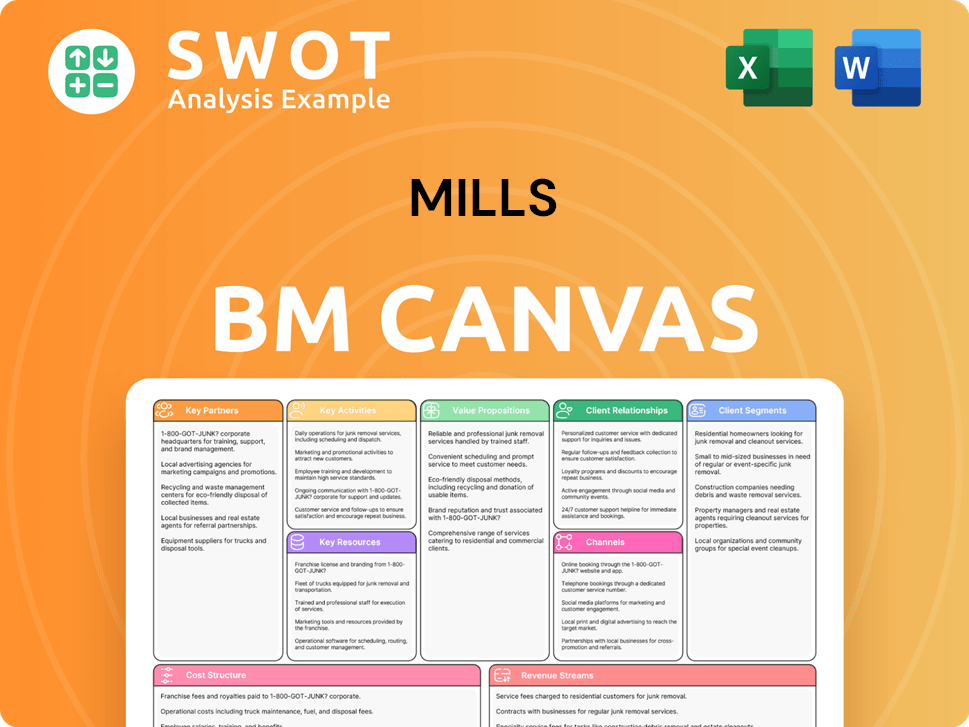

Mills Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Mills Positioning Itself for Continued Success?

The Brazilian equipment rental industry sees Mills Company in a strong position, particularly in construction, infrastructure, and mining. Mills Company operations are extensive, with a leading presence in the aerial work platform (AWP) segment, which showed significant growth in 2023. Their wide geographical reach and integrated services, including engineering and technical support, strengthen their market share and customer loyalty, setting them apart from smaller competitors.

However, the company faces several risks. Economic downturns in Brazil, regulatory changes, and new competitors could affect demand. Technological advancements, like new construction methods, could also impact future demand. The Competitors Landscape of Mills shows the challenges the company faces.

Mills Company holds a leading position in the Brazilian equipment rental market, particularly in the construction, infrastructure, and mining sectors. Their extensive fleet and wide geographic reach contribute to a strong market share. The company differentiates itself through its integrated offerings, including engineering and technical support.

Key risks include economic downturns in Brazil, regulatory changes, and the emergence of new competitors. Technological disruptions, such as new construction methods, could also impact future demand. These factors could affect the company's financial performance and market position.

Mills Company's future outlook remains positive, supported by strategic initiatives. The company plans to expand and modernize its fleet, particularly in high-growth segments like AWPs. They are focused on enhancing service offerings and leveraging digital platforms for improved customer experience and operational efficiency.

Mills Company is focused on sustainable growth, operational excellence, and maximizing shareholder value. They aim to capitalize on infrastructure development in Brazil, expand market share in key segments, and reinforce their integrated solutions approach. This strategy aims to deepen client relationships and drive long-term success.

Mills Company is focusing on high-growth segments like AWPs to drive future growth. The company is committed to enhancing its service offerings and leveraging digital platforms to improve customer experience. These initiatives are part of a broader strategy to achieve operational excellence and maximize shareholder value.

- Expansion of AWP fleet.

- Enhancement of service offerings.

- Leveraging digital platforms.

- Focus on operational excellence.

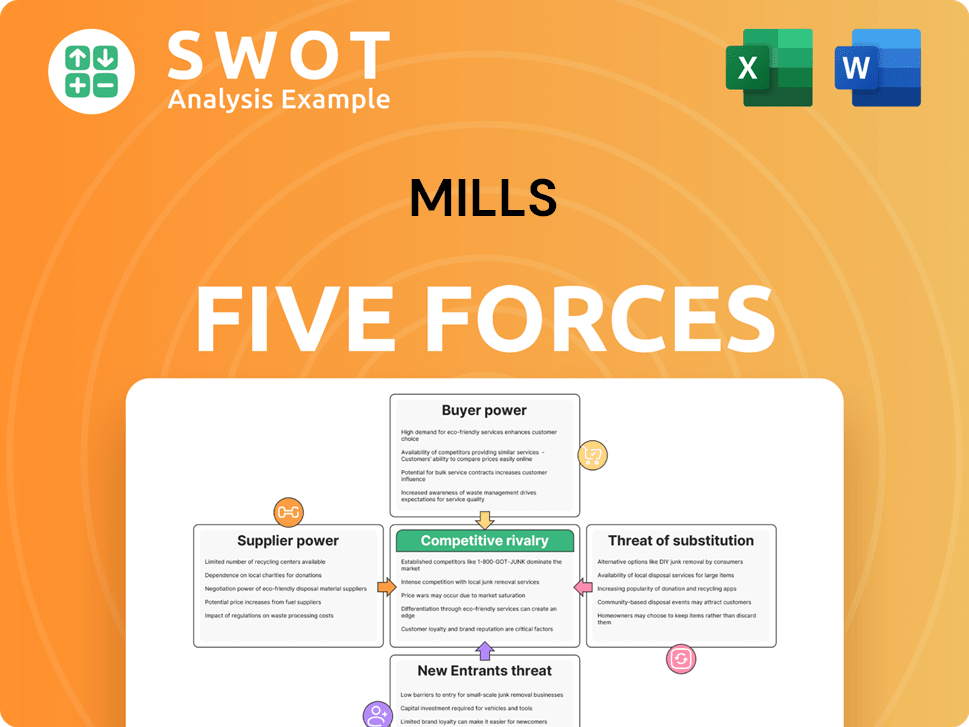

Mills Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mills Company?

- What is Competitive Landscape of Mills Company?

- What is Growth Strategy and Future Prospects of Mills Company?

- What is Sales and Marketing Strategy of Mills Company?

- What is Brief History of Mills Company?

- Who Owns Mills Company?

- What is Customer Demographics and Target Market of Mills Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.