Mills Bundle

Who are Mills Company's Key Customers?

Understanding the Mills SWOT Analysis is crucial for grasping its position in the Brazilian market. For Mills Company, a leader in equipment rental, pinpointing its customer demographics and target market is not just beneficial; it's essential for survival and growth. This analysis delves into the core of Mills' business, examining its evolution and strategic shifts.

Mills Company's journey, marked by acquisitions and market expansion, demands a thorough audience analysis. This exploration will reveal the specific needs, preferences, and behaviors of the Mills Company customer base, helping to understand its market segmentation. By defining the consumer profile, we can better understand the company's strategic positioning and future opportunities, including its customer age range, income levels, and geographic location, ultimately providing insights into its market share analysis and customer lifetime value.

Who Are Mills’s Main Customers?

Understanding the Marketing Strategy of Mills requires a deep dive into its customer demographics and target market. Unlike businesses that focus on individual consumers (B2C), Mills operates primarily in the business-to-business (B2B) sector. This means its customer base consists of other companies, not individual end-users.

The primary customer segments for Mills are concentrated in the construction, infrastructure, and mining industries. These sectors utilize Mills' equipment for various projects, including hydroelectric plants, highways, and bridges. The company's equipment is also used in facade restoration, agribusiness, ports, and industrial assembly. Historically, construction and infrastructure accounted for around 35% of Mills' total revenue, but the company is expanding into other sectors like general industry and services.

Mills' approach to customer segmentation focuses on firmographic data, such as company size and industry. The decision-making process for these B2B customers is primarily driven by factors like saving time, reducing costs, and boosting revenue. This strategic focus allows Mills to tailor its offerings to meet the specific needs of its clients in different sectors.

Mills' target market includes large construction firms, mining operations, and industrial clients. These businesses require equipment for work at height or heavy machinery. The company's diversified customer base helps mitigate risks associated with economic fluctuations.

Mills has expanded its reach through strategic acquisitions. The acquisition of Triengel Locações e Serviços in July 2022 significantly boosted its heavy equipment rental fleet. Furthermore, the acquisition of JM Empilhadeiras in June 2024 expanded its portfolio and created new cross-selling opportunities.

Mills' customer segmentation differs from B2C models. Instead of focusing on individual demographics, Mills uses firmographic data like company size and industry. This allows Mills to tailor its services to the specific needs of each business client.

Mills' strategic shifts, including acquisitions and sector diversification, are driven by market research. These actions aim to consolidate opportunities in the fragmented rental market, particularly in aerial platforms and earthmoving equipment. This approach allows Mills to adapt to changing market conditions.

Mills' ideal customer profile includes companies in construction, infrastructure, and mining. These businesses are looking to improve operational efficiency and reduce costs. Mills focuses on providing solutions that meet these specific business needs.

- Large-scale construction firms needing heavy machinery rentals.

- Mining operations requiring specialized equipment.

- Industrial clients looking for work-at-height solutions.

- Companies seeking to improve project timelines and reduce expenses.

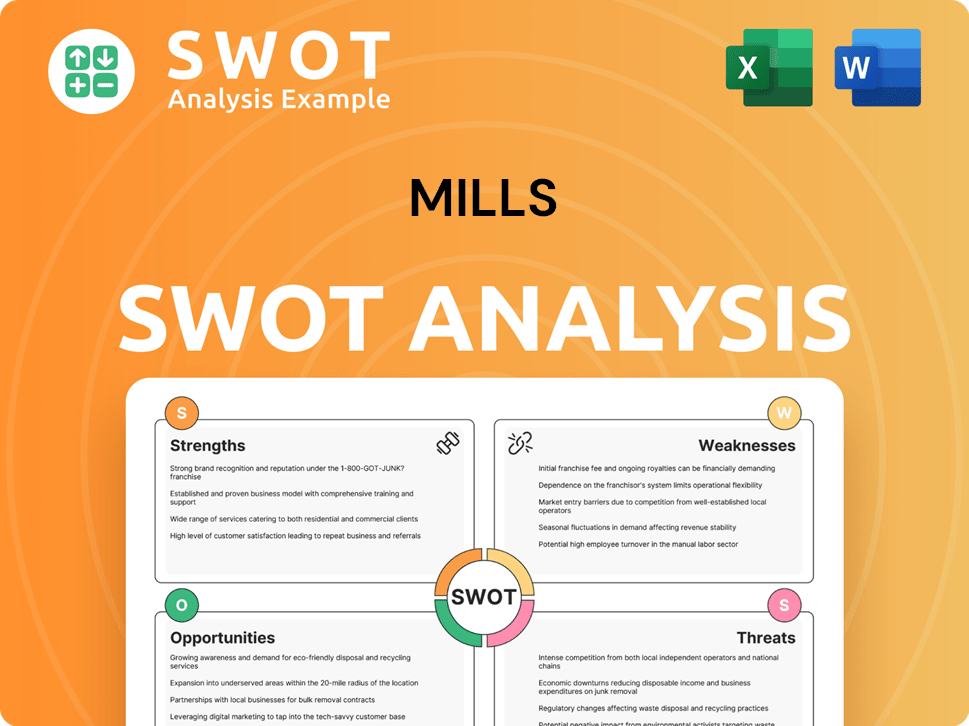

Mills SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Mills’s Customers Want?

Understanding the customer needs and preferences is crucial for a company like Mills, which operates primarily in the B2B sector, serving construction, infrastructure, and mining industries. The customer demographics of Mills Company are primarily businesses that require specialized equipment for various projects. These entities are driven by key needs such as efficiency, safety, and cost savings.

The target market for Mills Company is defined by the specific demands of these industries. Their purchasing decisions are significantly influenced by the need for the right equipment for specific tasks, minimizing machine downtime, and the availability of specialized operational services. This focus helps in defining the customer profile for Mills Company, ensuring that the company meets the requirements of its target audience.

The decision-making process for these businesses often involves a careful evaluation of the financial benefits of renting versus buying equipment. Considerations include expense and inventory control, equipment tracking, and avoiding maintenance costs. These factors shape the customer buying behavior analysis, which is essential for tailoring services and offerings to meet the needs of the market.

To address these needs, Mills offers a diverse fleet of over 10,000 pieces of equipment, including lifting platforms, heavy machinery, and shoring systems. This extensive inventory ensures a wide range of applications for its customers. The company also provides engineering services and technical support, which are critical for complex projects.

- Mills has prioritized the acquisition of 100% electric or hybrid aerial platforms since 2023, reflecting a growing demand for sustainable solutions.

- Contractual terms vary; formwork and shoring services typically have contracts from 9 to 24 months, while heavy machinery leases average 4-6 years.

- The company focuses on building long-term relationships with its customers, which is a key aspect of its business model.

- The company's market share analysis reveals its strong position in the equipment rental market, catering to the specific needs of its target audience.

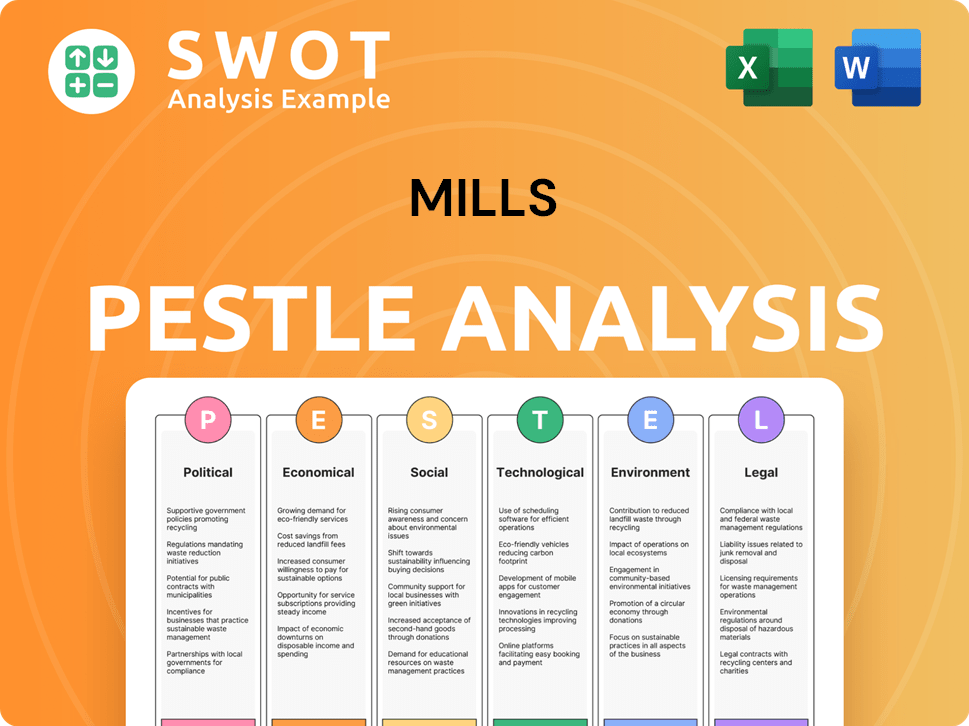

Mills PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Mills operate?

The geographical market presence of the company is primarily focused on Brazil. The company serves over 1,400 Brazilian cities through its 45 branches, supported by a workforce of more than 1,800 employees. This extensive network allows for a close relationship with clients across the country, with its headquarters located in Rio de Janeiro.

The company holds a strong position in the Brazilian equipment rental market, recognized as a pioneer and leader, particularly in lifting platforms and complex constructions. Its broad presence across various states, including 32 offices in 18 states, indicates significant national coverage. This widespread presence supports its ability to cater to a diverse customer base.

The company's strategy includes a diversified portfolio to address regional differences in customer demographics, preferences, and buying power. This approach helps the company to be resilient to market fluctuations across various regions and sectors.

The company has been expanding its operations through both organic and inorganic growth strategies. In 2024, the company initiated an expansion plan for its Light Rental unit, opening four new branches. It also plans to open new Heavy Rental operating centers.

The acquisition of JM Empilhadeiras in June 2024 expanded its portfolio and market reach, especially in the industrial fork truck rental sector. This acquisition broadened its service offerings and created new cross-selling opportunities.

The company's unique capillarity supports its ability to serve customers across diverse economic segments in various Brazilian regions. This extensive reach is a key factor in its market strategy. For more details on the company's strategic initiatives, consider reading this article on Growth Strategy of Mills.

- The company's customer base is spread across various sectors, including industry, commerce, infrastructure, civil construction, and agribusiness.

- The company's broad geographic presence and diversified portfolio contribute to its resilience against market fluctuations.

- Recent expansions and acquisitions, like the JM Empilhadeiras deal in June 2024, are aimed at strengthening its market position.

- The company's focus on both organic and inorganic growth is a key part of its strategy.

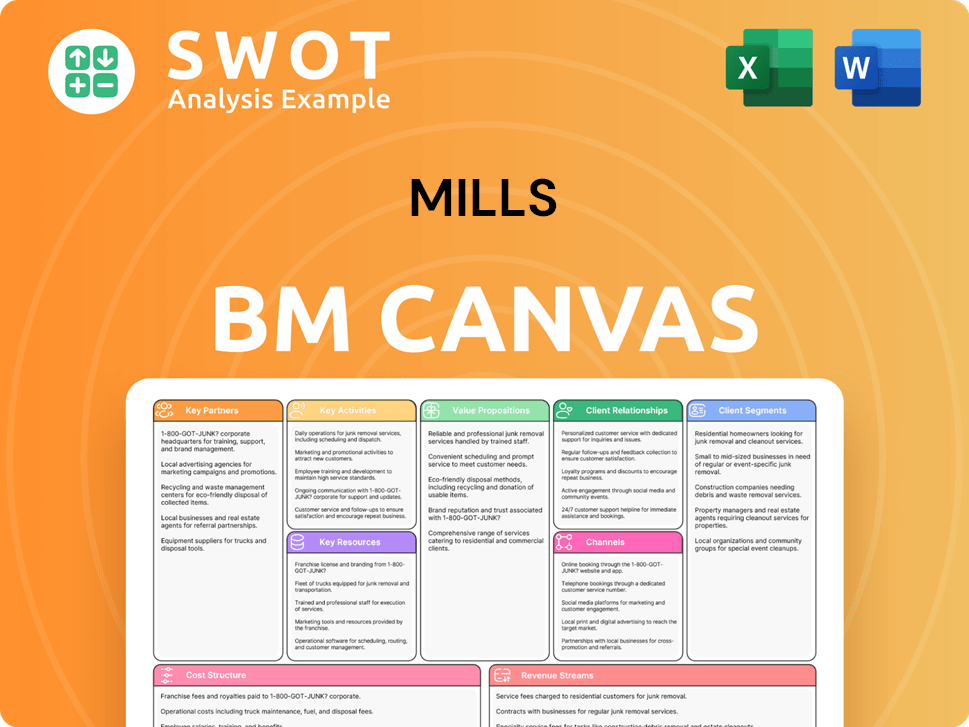

Mills Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Mills Win & Keep Customers?

The company, a leader in equipment leasing in Brazil, employs a comprehensive approach to customer acquisition and retention. Its strategy leverages its extensive market presence and over 70 years of experience. This is particularly relevant in the context of its target market, which includes construction, infrastructure, and mining companies.

To attract new customers, the company emphasizes its expertise and market leadership in Latin America, with a fleet exceeding 10,000 pieces of equipment. Marketing efforts likely involve direct sales, industry-specific trade shows, and digital platforms. Expanding into new product lines, such as heavy machinery, also draws in clients with broader equipment needs. Understanding the Competitors Landscape of Mills can also inform customer acquisition strategies.

For retention, the company focuses on delivering value and building long-term relationships. Key strategies include providing specialized support and ensuring equipment reliability to minimize downtime. The company's commitment to customer satisfaction is crucial, as is its focus on meeting customer needs. Equipment leasing benefits, like cost savings and risk management, are also emphasized.

The company highlights its over 70 years of experience and position as a market leader in Latin America to attract new customers. This emphasizes its deep understanding of the equipment leasing market and its ability to serve a diverse range of clients. The company's large fleet of over 10,000 pieces of equipment also demonstrates its capacity to meet customer needs.

Focusing on value delivery is central to the company's retention strategy. This includes specialized support for each customer type and ensuring equipment reliability. The company emphasizes the cost savings and risk management benefits of equipment leasing, crucial for B2B clients, contributing to customer loyalty and long-term relationships.

Marketing efforts likely involve direct sales, industry-specific trade shows, and digital platforms. These channels are designed to reach construction, infrastructure, and mining companies. This targeted approach ensures that marketing messages are relevant and effective in acquiring new customers within the company's core target market.

The company’s expansion into new product lines, like heavy machinery, serves as an acquisition strategy. This allows the company to attract new clients with broader equipment needs. Diversifying its offerings enhances its ability to meet the evolving demands of its target market, driving growth.

The company implicitly uses customer data and segmentation to tailor its offerings to diverse sectors. While specific CRM systems aren't detailed, its ability to maintain strong credit risk management suggests robust internal data analysis. Understanding the customer demographics is critical for effective market segmentation.

The company reported net rental revenue growth in all business units for Q1 2024, reaching R$ 353.2 million. This indicates successful client engagement and retention efforts. This financial performance reflects the effectiveness of its customer acquisition and retention strategies.

The company's focus on long-term contracts, which increased by 12 percentage points compared to Q2 2023, reaching 44% of revenue, demonstrates effective retention. This focus on long-term contracts provides a stable revenue stream. This strategy helps secure consistent revenue and build stronger customer relationships.

Changes in strategy over time include a continued emphasis on diversification and strategic acquisitions. These efforts enhance customer loyalty and lifetime value by offering a more comprehensive suite of solutions. This approach allows the company to expand its offerings and provide greater value to its customers.

The company's pursuit of operational efficiency is crucial for customer satisfaction. This focus ensures the reliability of its equipment and minimizes downtime for customers. By optimizing its operations, the company can better meet its customers' needs and maintain a competitive edge.

The company's focus on meeting customer needs is a key retention strategy. Understanding and addressing the specific requirements of its diverse customer base is essential. This customer-centric approach fosters long-term relationships and drives repeat business.

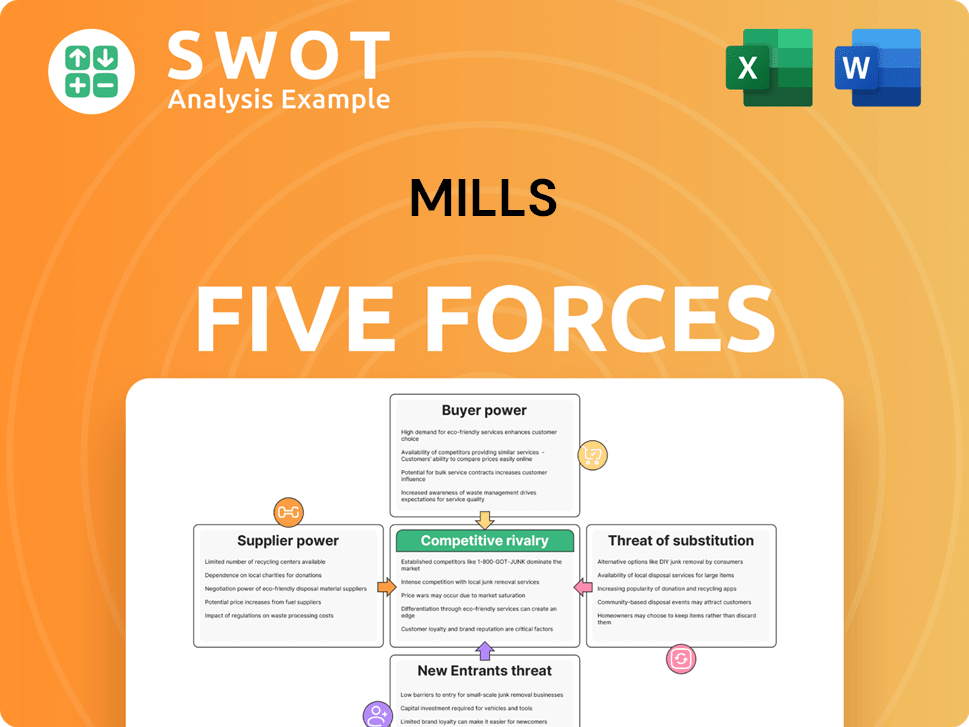

Mills Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Mills Company?

- What is Competitive Landscape of Mills Company?

- What is Growth Strategy and Future Prospects of Mills Company?

- How Does Mills Company Work?

- What is Sales and Marketing Strategy of Mills Company?

- What is Brief History of Mills Company?

- Who Owns Mills Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.