Morningstar Bundle

How Did Morningstar Revolutionize Investment Analysis?

Founded in 1984 by Joe Mansueto, the Morningstar SWOT Analysis company quickly became a game-changer in the investment world. Its iconic star ratings, introduced in 1985, provided investors with a clear, independent assessment of mutual fund performance, transforming how they evaluated investment options. From a one-bedroom apartment in Chicago, Morningstar's mission was to empower individual investors with transparent information.

The Morningstar company's early focus on rigorous fund analysis filled a critical gap in the market, where only total return data was the norm. This foresight by the Morningstar founder laid the foundation for its enduring influence. Today, Morningstar's global presence and financial success, with a reported revenue of $2.3 billion in 2024, demonstrate its remarkable journey from a startup to a global leader in investment insights, impacting the Morningstar stock value.

What is the Morningstar Founding Story?

The story of the [Company Name] begins on May 16, 1984, with its founder, Joe Mansueto. Inspired by the need for better information for investors, Mansueto, armed with an MBA from the University of Chicago, launched the company to fill this gap. His background as a stock analyst at Harris Associates further solidified his vision to bring in-depth analysis to the mutual fund industry.

The company's humble beginnings were in Mansueto's Chicago apartment. He started with a personal investment of US$80,000. The core business model involved publishing detailed data and analysis in a mutual fund sourcebook. This subscription-based model was key to its initial success, allowing the company to operate without significant outside funding.

The name 'Morningstar' was inspired by Thoreau's 'Walden,' reflecting Mansueto's vision of a guiding light for investors. The subscription model provided 'float,' enabling early operations without external capital. This approach was crucial in overcoming early challenges. To learn more about the company's core values, you can read more about the Mission, Vision & Core Values of Morningstar.

Here are some key points about the founding of Morningstar:

- Founded on May 16, 1984, by Joe Mansueto.

- Initial investment: US$80,000 from Mansueto's personal savings.

- First product: 'Mutual Fund Sourcebook,' published in December 1984.

- Business model: Subscription-based for early capital generation.

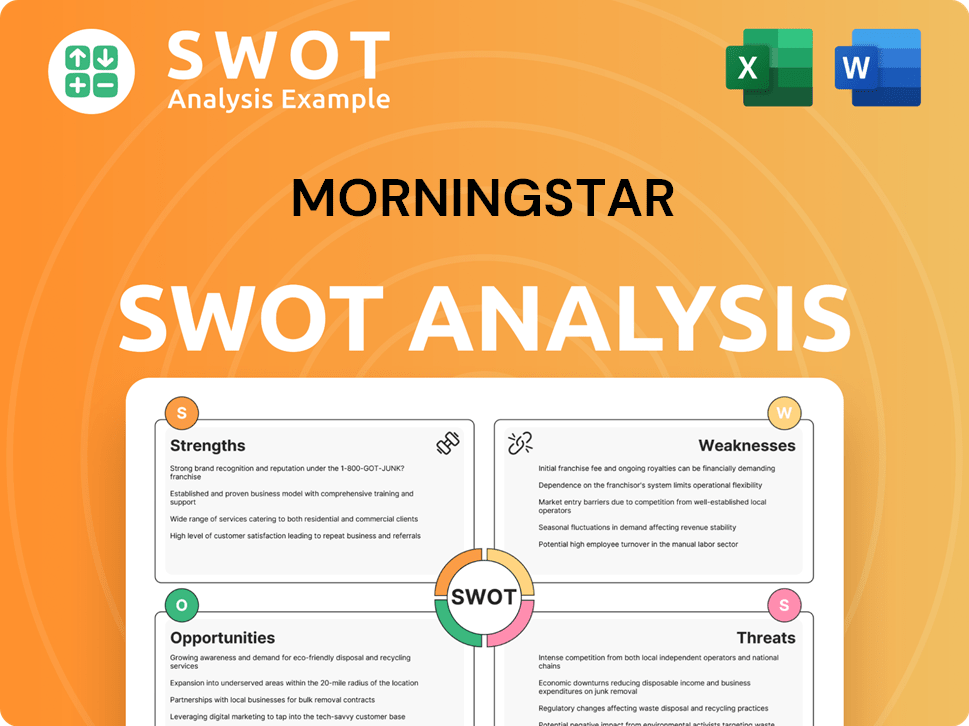

Morningstar SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Morningstar?

The early years of the Morningstar company were marked by significant product launches and strategic expansion. This period saw the company establish itself as a key player in the investment research field. Key moves included the introduction of influential rating systems and the expansion into digital platforms and international markets. The company's growth strategy focused on providing accessible investment data and tools.

In 1985, Morningstar launched the Morningstar Rating™ for mutual funds, a five-star system that quickly became an industry standard. This rating system helped investors evaluate fund performance effectively. The introduction of Principia software in 1991, a CD-ROM-based tool for financial advisors, marked a move into software solutions.

A new logo, designed by Paul Rand in 1991, featured a prominent 'O' symbolizing a rising sun, enhancing the company's brand identity. In 1992, the introduction of the nine-square Morningstar Style Box™ further aided investors in understanding fund investment styles. The launch of Morningstar.com® in 1997 expanded the company's reach to individual investors.

International expansion began with establishing a presence in Australia and New Zealand. This was followed by operations in Canada in 1999. By 2000, Morningstar had expanded further, opening offices in Europe, Asia, and Korea. This global expansion was a key part of the Morningstar company timeline.

A significant investment of US$91 million from SoftBank in July 1999, in exchange for a 20% stake, boosted Morningstar's growth. The company also made strategic acquisitions, such as Ibbotson Associates, Inc. in 2006, and the mutual fund data business of S&P Global in 2007. These moves helped diversify offerings and solidify its position in the market. To learn more about Morningstar's strategic moves, consider reading about the Growth Strategy of Morningstar.

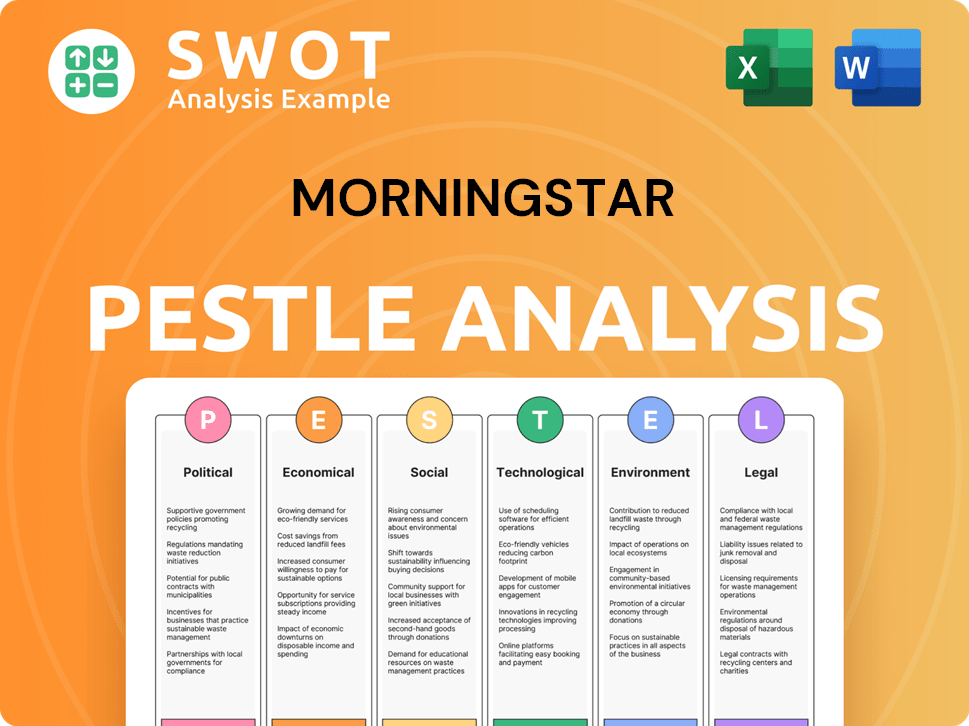

Morningstar PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Morningstar history?

The Morningstar history is marked by significant milestones that have shaped the investment research landscape. From its inception, the Morningstar company has introduced groundbreaking tools and services that have become industry standards, continually evolving to meet the changing needs of investors and financial professionals. These developments have solidified its position as a leading provider of independent investment research.

| Year | Milestone |

|---|---|

| 1985 | Introduction of the Morningstar Rating™ for mutual funds, providing a star-based system for assessing fund performance. |

| 1992 | Creation of the Morningstar Style Box™, offering a visual representation of a fund's investment style. |

| 1997 | Launch of Morningstar.com, revolutionizing access to investment information for individual investors. |

| 2001 | Debut of Morningstar Direct™ and Morningstar® Advisor Workstation™, providing comprehensive tools for financial professionals. |

| 2009 | Commencement of publishing corporate credit ratings. |

| 2011 | Introduction of the Morningstar Analyst Rating™ for funds. |

| 2016 | Acquisition of PitchBook Data for $180 million, expanding data offerings. |

| 2022 | Launch of the Morningstar PitchBook Global Unicorn Indexes, providing daily insights into late-stage venture capital-backed companies. |

The Morningstar company has consistently embraced technological advancements to enhance its offerings. In November 2022, the launch of the Morningstar PitchBook Global Unicorn Indexes showcased its commitment to bringing transparency to new markets.

The Morningstar Rating™ for mutual funds, introduced in 1985, was a groundbreaking innovation. It provided investors with a clear, star-based system to assess fund performance.

The Morningstar Style Box™, created in 1992, offered a visual representation of a fund's investment style. This tool helped investors understand a fund's investment approach at a glance.

The launch of Morningstar.com in 1997 revolutionized access to investment information. It made investment data and research more readily available to individual investors, democratizing access to financial analysis.

In 2001, Morningstar Direct™ and Morningstar® Advisor Workstation™ debuted. These provided comprehensive tools for financial professionals, enhancing their ability to serve clients.

Morningstar began publishing corporate credit ratings in 2009, expanding its analytical offerings. This allowed investors to assess the creditworthiness of companies.

The Morningstar Analyst Rating™ for funds, introduced in 2011, provided forward-looking assessments. This helped investors evaluate the prospects of funds based on expert analysis.

The Morningstar company has faced challenges inherent in a dynamic industry. The company has navigated market downturns and competitive pressures by consistently evolving its product offerings and expanding its global footprint.

Morningstar has successfully navigated market downturns, adapting its strategies to maintain its position. This has involved adjusting product offerings and operational efficiencies.

The company has faced competitive pressures by continuously evolving its product offerings. This includes expanding into new markets and enhancing existing services.

Strategic acquisitions, such as PitchBook Data in 2016, demonstrate how Morningstar has responded to market needs. This has diversified its data offerings to cover private capital markets.

In 2000, Joe Mansueto aimed to put Morningstar on a faster track to profitability by reducing expenses. This strategic move highlighted the company's focus on financial health.

Morningstar has expanded its global footprint to adapt to market changes. This has involved entering new regions and tailoring its services to local markets.

Through these experiences, Morningstar has reinforced its commitment to independent research. This has helped it maintain its position as a leading provider of investment insights.

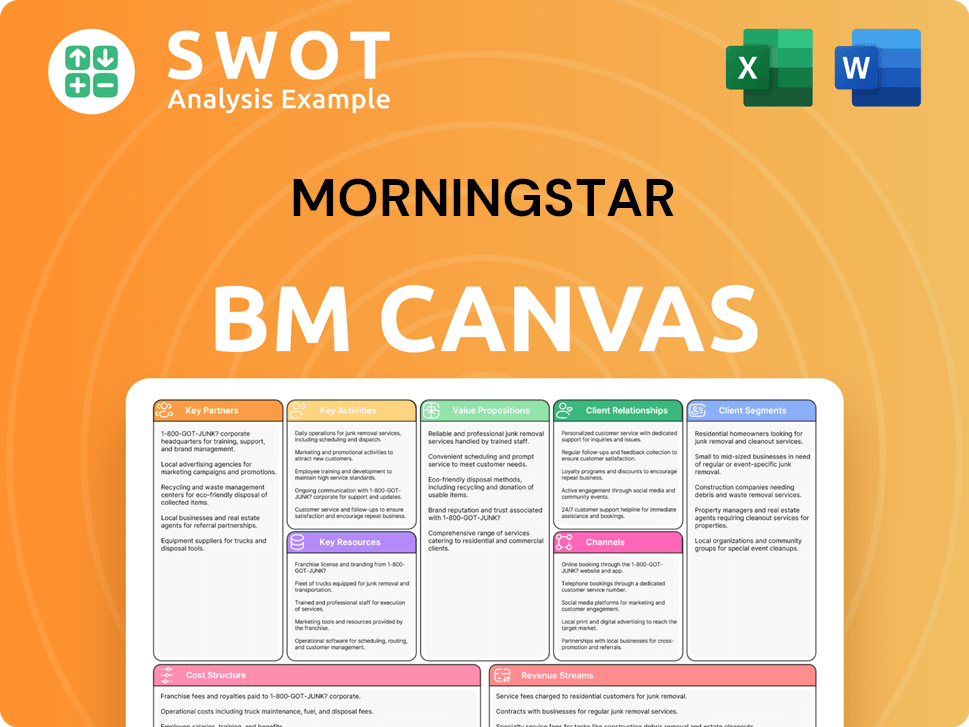

Morningstar Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Morningstar?

The Morningstar company's history reflects a journey of innovation and expansion, marked by key milestones that have shaped its position in the investment research landscape. From its inception in 1984 to its current status, the company has consistently adapted to market changes and expanded its offerings to empower investors.

| Year | Key Event |

|---|---|

| 1984 | Joe Mansueto founded the company in Chicago. |

| 1985 | The Morningstar Rating™ for mutual funds was introduced. |

| 1991 | The CD-ROM-based Principia software was launched for advisors. |

| 1992 | The nine-square Morningstar Style Box™ was created. |

| 1997 | Morningstar.com® was launched, establishing an online presence. |

| 1999 | Received a $91 million investment from SoftBank and expanded internationally. |

| 2000 | Established Morningstar Europe, Morningstar Asia, and Morningstar Korea. |

| 2001 | Morningstar Direct™ and Morningstar® Advisor Workstation™ were launched. |

| 2005 | Completed its initial public offering (IPO) on NASDAQ. |

| 2006 | Acquired Ibbotson Associates, Inc. |

| 2009 | Began publishing corporate credit ratings. |

| 2011 | Morningstar Analyst Rating™ for funds was introduced. |

| 2016 | Acquired PitchBook Data, enhancing its private market data offerings. |

| 2020 | Sustainalytics, an ESG research firm, became part of the company. |

| 2022 | Launched Morningstar PitchBook Global Unicorn Indexes. |

| 2024 | Reported full-year revenue of $2.3 billion, with assets under management and advisement (AUMA) approximately $338 billion as of December 31, 2024. |

The company is focused on generating durable, long-term growth. This includes the convergence of public and private markets. The company is also leveraging AI to transform client workflows.

Recent product enhancements include PitchBook's integration of aftermarket equity research. Also, there's an improved research center experience and the January launch of the Direct Advisory Suite. This is a modernized software solution for financial advisors.

The company continues to expand its offerings to empower investor success. This includes a focus on sustainable investing. It also has the Morningstar Exponential Technologies Index, which identifies companies benefiting from disruptive technologies.

The company is adapting to evolving market needs, and maintaining its independent view in guiding investment decisions. The global ETF assets reached a record $13.8 trillion in 2024, with $1.5 trillion in net inflows, indicating a robust market for the company's data and research.

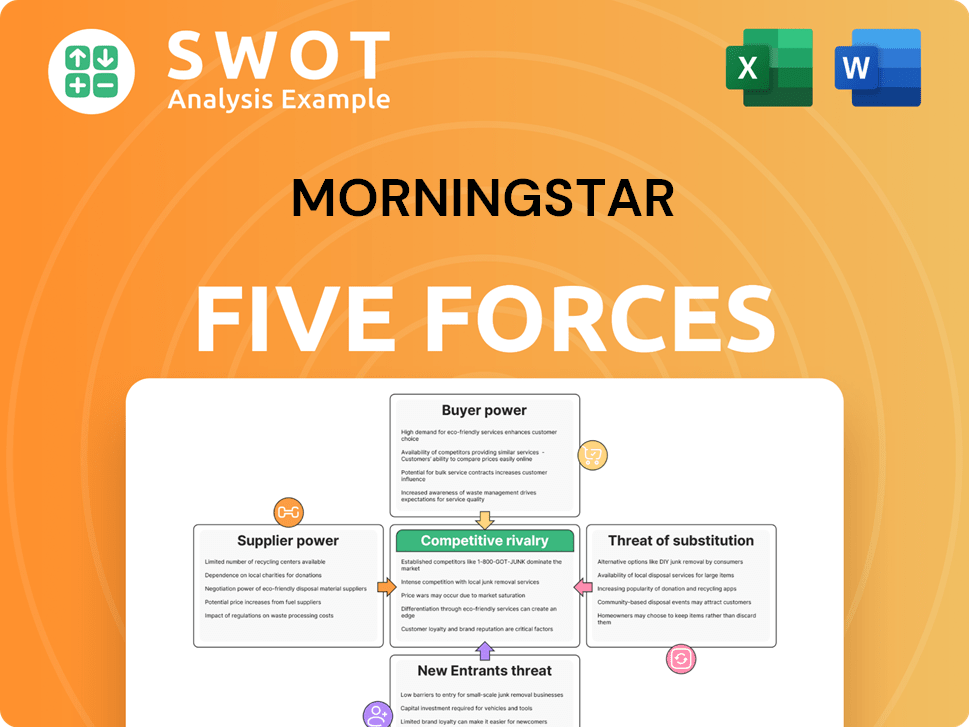

Morningstar Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Morningstar Company?

- What is Growth Strategy and Future Prospects of Morningstar Company?

- How Does Morningstar Company Work?

- What is Sales and Marketing Strategy of Morningstar Company?

- What is Brief History of Morningstar Company?

- Who Owns Morningstar Company?

- What is Customer Demographics and Target Market of Morningstar Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.