Morningstar Bundle

What's Next for Investment Research Giant, Morningstar?

Morningstar, a titan in the investment research world, is charting a course for continued expansion. From its humble beginnings in 1984, Morningstar has evolved into a global powerhouse, providing critical data and analysis to investors worldwide. With a strong Q1 2025 performance, the company's Morningstar SWOT Analysis is more crucial than ever.

This in-depth analysis delves into Morningstar's growth strategy, examining its recent successes and future prospects within the dynamic financial landscape. We'll explore Morningstar's market share analysis, uncovering the key drivers behind its impressive revenue growth and sustainable growth strategies. Furthermore, we'll investigate Morningstar's digital transformation initiatives and international market opportunities, providing a comprehensive look at this leading investment research firm's journey.

How Is Morningstar Expanding Its Reach?

The company is actively pursuing expansion initiatives to broaden its market presence and diversify revenue streams. A significant focus is on bolstering its private credit and structured finance offerings. These efforts are designed to deliver efficiency, transparency, and enhanced decision-making to institutional investors and asset managers.

Geographic expansion, particularly in the Asia-Pacific region, is another strategic pillar. The company aims for market share gains in fund research in emerging markets like Indonesia and Vietnam. This involves increasing staffing in the region.

Morningstar also continues to enhance its core product offerings. These initiatives aim to improve user experience and expand its product portfolio, supporting its overall growth strategy.

The acquisitions of Lumonic Inc. on March 3, 2025, and Dealview Technologies Limited (DealX) on March 1, 2025, are key moves. Lumonic specializes in private credit portfolio monitoring, while DealX provides data for CMBS and CLOs. These acquisitions are designed to deliver efficiency, transparency, and enhanced decision-making.

The company targets 2-3% market share gains in fund research in emerging markets. A Singapore-based research hub and localized Mandarin-language insights support this. Increasing staffing in the region by 25% is part of this strategy.

In 2024, the company introduced the Morningstar Direct Advisory Suite, PitchBook Credit, and the Consensus Thematic index family. PitchBook, a Morningstar company, continues to expand its data coverage, including leveraged loan and high-yield bond news and analysis, and BDC portfolio holdings.

The private credit market had grown to over $15.5 trillion in assets by June 2024. The company's focus on this area highlights its strategy to capitalize on expanding markets and provide critical data and insights.

The company's Morningstar growth strategy involves strategic acquisitions and geographic expansion. These moves are designed to enhance its product offerings and increase its market share. The company's Morningstar future prospects look promising as it continues to adapt to market needs, as detailed in this 0.

- Acquisitions: Lumonic Inc. and DealX to strengthen private credit offerings.

- Geographic Expansion: Focus on Asia-Pacific, aiming for 2-3% market share gains in emerging markets.

- Product Development: Introduction of new tools and expansion of data coverage through PitchBook.

- Market Focus: Targeting the growing private credit market, which reached over $15.5 trillion by June 2024.

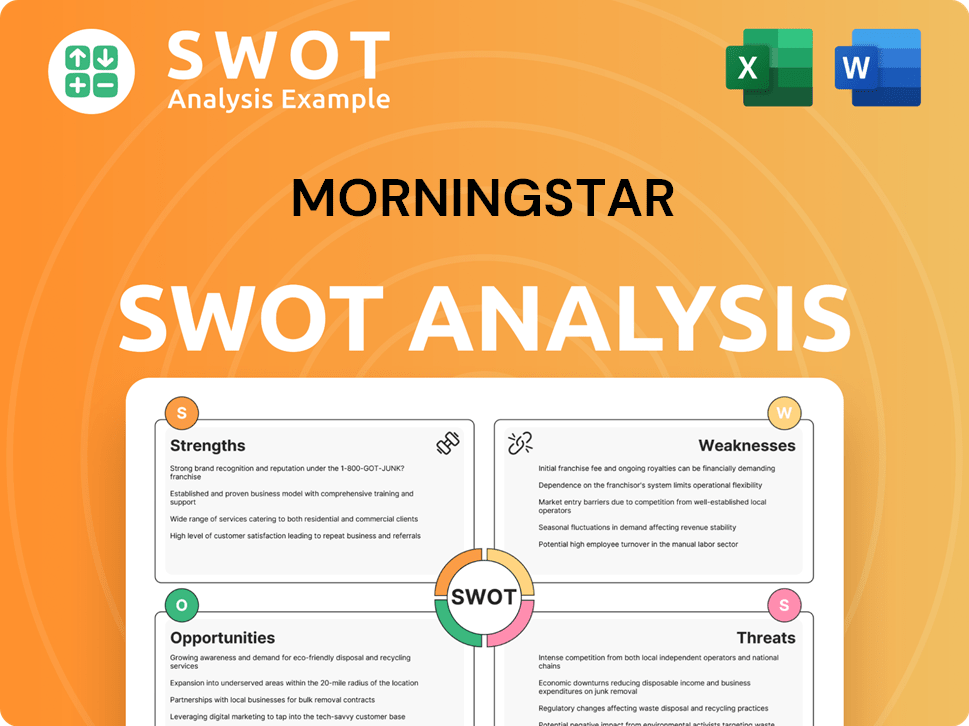

Morningstar SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Morningstar Invest in Innovation?

The company's innovation and technology strategy is central to its Morningstar growth strategy. It focuses on digital transformation and the integration of cutting-edge technologies to enhance its platforms and tools. This approach supports the company's Morningstar future prospects by improving its market position and service offerings.

Morningstar company analysis reveals a strong commitment to research and development, with significant investments in areas like artificial intelligence (AI) and data analytics. This strategy is essential for maintaining a competitive edge in the financial data provider and investment research firm sectors.

PitchBook, a key component of the company, has expanded its data coverage and introduced new capabilities to streamline market analysis and due diligence workflows. This includes enhanced search and filtering features in its Research Center, improving the efficiency and effectiveness of its services. The company's focus on innovation is evident in its strategic acquisitions and development of advanced tools.

A significant aspect of the company's innovation strategy is its focus on artificial intelligence (AI). The acquisition of Lumonic, completed in March 2025, brings AI-driven portfolio analytics to PitchBook, empowering private credit investment professionals. This strategic move enhances the company's capabilities in providing sophisticated financial analysis.

- The integration of AI-driven portfolio analytics improves the efficiency of market analysis.

- Digital transformation includes exploring innovation in Bitcoin applications, integrating analytics expertise with a commitment to digital asset growth.

- The company's leadership in innovation is also demonstrated by its efforts to bring greater transparency to private markets, such as the introduction of the Morningstar Medalist Rating for Semiliquid Funds in early 2025.

- The company's commitment to innovation is a key driver of its Morningstar's revenue growth drivers.

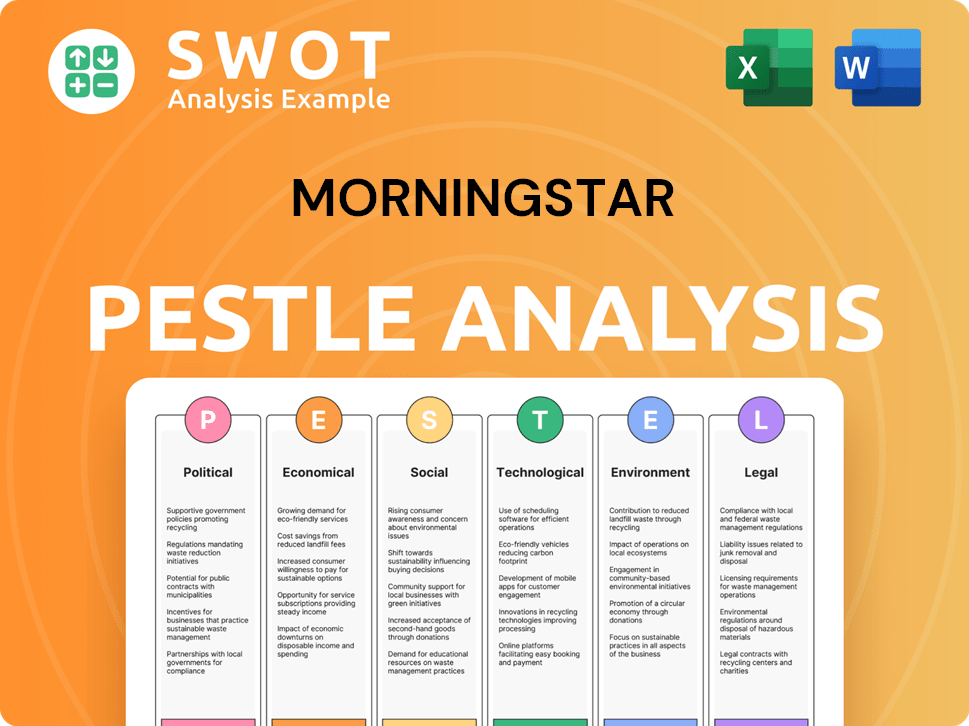

Morningstar PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Morningstar’s Growth Forecast?

The financial outlook for the future of the company appears robust, with strong performance indicators in early 2025. The company's strategic focus on expanding its credit and finance offerings, combined with its acquisitions, positions it well for future growth, even amidst market volatility. This positive trajectory is supported by significant revenue increases and margin expansions across key business segments.

In the first quarter of 2025, the company reported a revenue increase of 7.2%, reaching $581.9 million. Organic revenue grew by 9.1%, and the operating income saw a substantial increase of 23.2% to $114.1 million. These figures demonstrate the company's ability to drive growth and improve operational efficiency.

The company's commitment to shareholder value is evident through its stock repurchase program. In the first quarter of 2025, the company allocated $109.6 million towards stock repurchases, reflecting confidence in its financial health and future prospects. A deeper look at the Marketing Strategy of Morningstar can provide additional insights into their growth initiatives.

The company's total revenue for 2024 was $2.3 billion, an 11.6% increase from 2023. Organic revenue growth was 11.8%. This strong performance indicates robust demand for its services and effective market penetration.

Net income surged by 162.2% to $369.9 million, leading to a diluted earnings per share (EPS) of $8.58 for the full year 2024. The net profit margin for Q1 2025 was 16.64%, significantly higher than the 2024 average of 13.11%.

PitchBook's revenue increased by 10.9% reported and 11.1% organic in Q1 2025, with adjusted operating income increasing by 30.8%. Morningstar Credit's revenue increased by 21.1% reported and 23.2% organic. Morningstar Retirement showed strong revenue growth of 15.8% to $32.9 million.

Operating income increased by 23.2% to $114.1 million in Q1 2025. The operating margin expanded to 19.6%, with the adjusted operating margin reaching 23.3%. This expansion reflects operational efficiency.

The company's management anticipates continued growth, driven by acquisitions and strategic focus. Analysts are projecting an EPS of $0 for the next earnings report on July 23, 2025.

- The company's strong financial performance in early 2025 sets a positive tone.

- Key segments like PitchBook and Morningstar Credit are driving significant revenue growth.

- The company is actively repurchasing stock, demonstrating confidence in its financial health.

- Strategic acquisitions and a focus on credit and finance offerings support future growth.

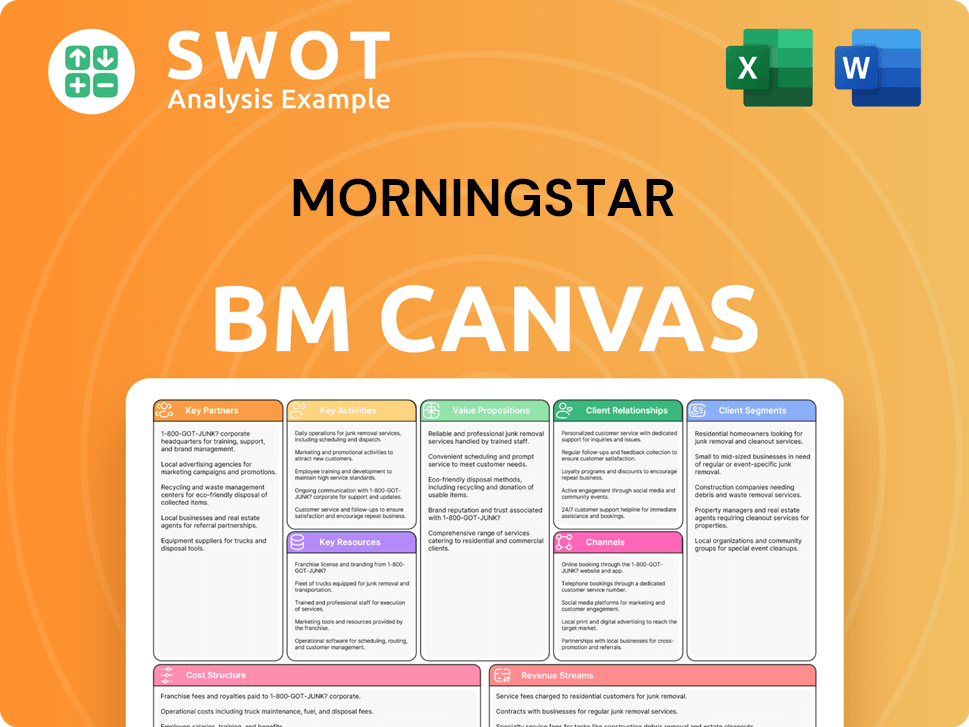

Morningstar Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Morningstar’s Growth?

The growth trajectory of the financial data provider, faces a complex landscape of risks and obstacles. These challenges span market dynamics, regulatory changes, technological disruptions, and internal operational issues. Understanding these potential pitfalls is crucial for evaluating the company's long-term viability and its ability to execute its growth strategies effectively.

Market competition within the financial information and investment research industry poses a constant threat. Regulatory changes, particularly in areas like sustainable finance, require significant adaptation. Additionally, the rapid advancements in technology, especially in AI, necessitate continuous innovation and strategic investments to stay ahead.

Internally, factors such as integrating acquired companies and managing economic uncertainties also create challenges. These elements can impact the company's operational efficiency and financial performance.

The investment research firm operates in a highly competitive market. The financial data provider faces ongoing challenges from established players and emerging competitors. Maintaining its competitive edge is essential for sustained growth.

Changes in regulations, especially in sustainable finance, can significantly impact the company. The EU's review of directives like the Corporate Sustainability Reporting Directive and the EU Taxonomy, expected in 2025, could lead to substantial shifts.

Rapid technological advancements, including AI, pose ongoing risks. The company must continuously invest in innovation to stay relevant. Adaptation to these technological changes is critical for long-term success.

Geopolitical risks and economic uncertainties, such as the impact of US tariffs and central bank actions, are significant concerns. These factors can influence market volatility and investment strategies. The company closely monitors these risks.

Integrating acquired companies and managing internal operations presents challenges. These include assimilating employees, managing cultural differences, and optimizing resource allocation. These challenges can affect operational efficiency.

The loss of a large client can negatively impact revenue. Softness in research distribution, as seen in 2024, highlights the importance of client retention and diversification. This can affect the company's financial performance.

To mitigate these risks, the company employs several strategies. These include diversification of its offerings, strategic acquisitions to strengthen key areas, and a cautious approach in volatile market conditions. The financial data provider's ability to navigate these challenges will be crucial for its long-term success. Understanding the Target Market of Morningstar is also vital for strategic planning.

In Europe, between 30% and 50% of ESG funds may change names by mid-2025 due to new guidelines. In Australia, changes to superannuation regulations and merger control reforms are set for July 2025. These changes impact investment strategies.

The company actively invests in innovation. The rapid evolution of technologies like AI presents challenges. Increasing spending on AI by technology companies is a factor to consider. This requires continuous adaptation.

Morningstar DBRS revised its outlook for the global property and casualty (P&C) reinsurance sector from positive to stable in early 2025. This change reflects growing geopolitical risks and economic uncertainties. These factors require careful monitoring.

The company addresses risks through diversification and strategic acquisitions. The company adopts a cautious approach amidst market volatility. These strategies aim to mitigate potential negative impacts.

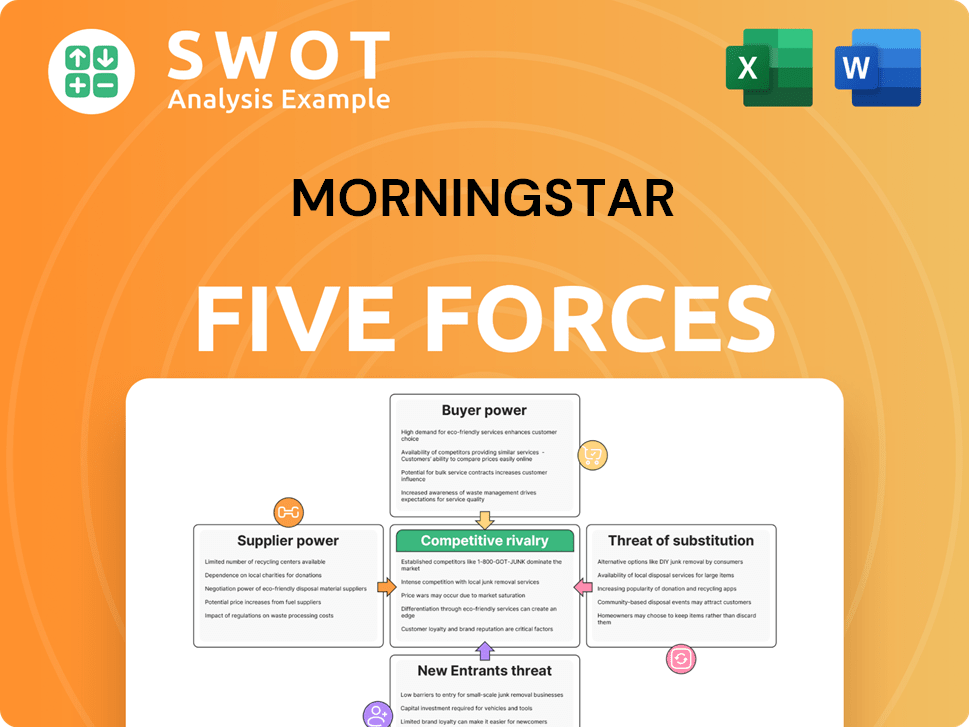

Morningstar Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Morningstar Company?

- What is Competitive Landscape of Morningstar Company?

- How Does Morningstar Company Work?

- What is Sales and Marketing Strategy of Morningstar Company?

- What is Brief History of Morningstar Company?

- Who Owns Morningstar Company?

- What is Customer Demographics and Target Market of Morningstar Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.