Morningstar Bundle

Who Really Calls the Shots at Morningstar?

Ever wondered who shapes the destiny of a financial powerhouse like Morningstar? Understanding the Morningstar SWOT Analysis helps to appreciate its strengths and weaknesses. Unraveling the Morningstar ownership structure is key to grasping its strategic direction and future prospects. From its humble beginnings to its current global footprint, the story of who owns Morningstar is a compelling narrative of influence and control.

The Morningstar company, a titan in investment research, has a complex ownership tapestry that influences its every move. Knowing the Morningstar shareholders, including its founder and institutional investors, is vital for anyone looking to understand its corporate governance. This deep dive into Morningstar Inc's ownership reveals the forces that drive its innovation and shape its market position, impacting everything from the decisions of Morningstar executives to its overall valuation.

Who Founded Morningstar?

The financial information and investment research firm, Morningstar, Inc., was established in 1984. Joe Mansueto is the founder of the company. His initial vision and capital were crucial in setting up and fostering the early expansion of the company.

As the sole founder, Mansueto held the primary ownership stake. This arrangement reflected his entrepreneurial drive and guided the company's initial direction. The company's growth was heavily influenced by its independent research model.

There is no publicly available information regarding early angel investors or significant stakes held by friends and family during the company's initial phase. Early agreements likely centered around Mansueto's control and the reinvestment of profits to support expansion.

Joe Mansueto, the founder, played a central role in the company's establishment and early growth. His vision and financial backing were key to the company's initial success.

Mansueto held the predominant ownership stake. This structure allowed for focused development of core offerings like independent investment research.

The company's growth was primarily fueled by its independent research model. This model set it apart in the financial information sector.

No specific details about early angel investors or significant stakes by friends and family are publicly available. The focus was on reinvesting profits.

Early agreements would have likely focused on Mansueto's control and the reinvestment of profits to fund expansion rather than complex external shareholder agreements.

No significant initial ownership disputes or buyouts have been publicly documented from Morningstar's nascent period, indicating a relatively stable founder-led beginning.

The initial ownership structure of the Morningstar company, with Joe Mansueto as the founder, enabled a focused approach to developing its core offerings. The company's early success was built on its independent research model, which set it apart in the financial industry. You can learn more about the company's strategies by reading about the Marketing Strategy of Morningstar.

The early Morningstar ownership was primarily held by founder Joe Mansueto. This structure allowed for focused growth and development.

- Joe Mansueto founded Morningstar Inc. in 1984.

- The early ownership structure was largely centered around Mansueto.

- The company's independent research model was a key driver of early growth.

- No significant early ownership disputes or buyouts were publicly documented.

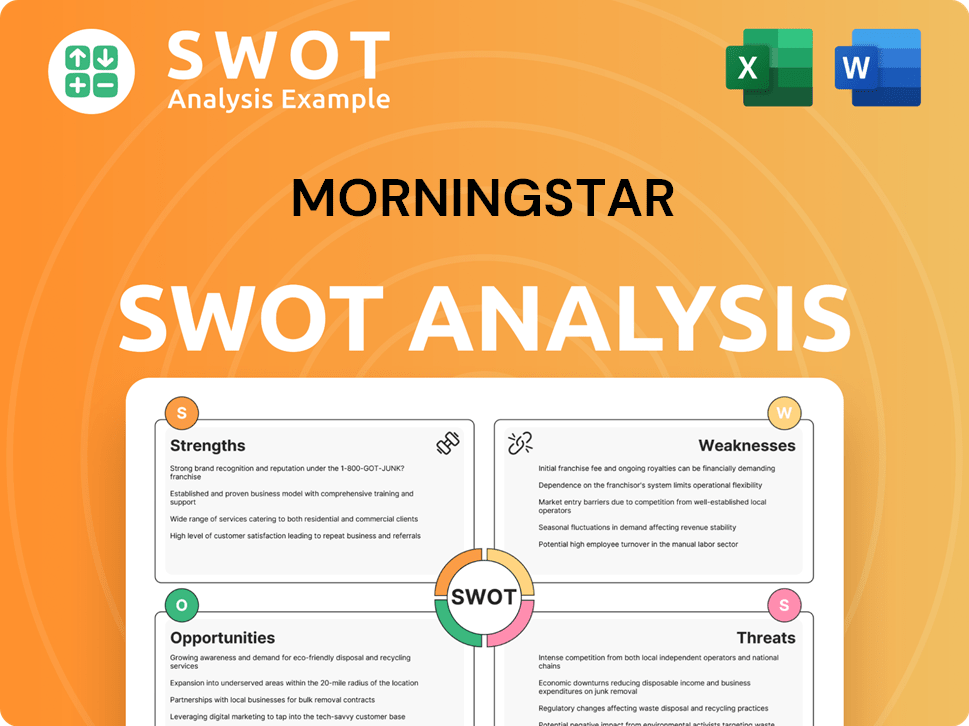

Morningstar SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Morningstar’s Ownership Changed Over Time?

The evolution of Morningstar's ownership has been marked by key events, most notably its Initial Public Offering (IPO) on May 3, 2005. This transition to a publicly traded company fundamentally changed its ownership structure, introducing a wide array of public shareholders. The IPO enabled Morningstar to secure capital for expansion and enhanced its visibility within the financial markets. Since then, the ownership has diversified, involving institutional investors, mutual funds, index funds, and individual insiders, alongside the continued significant stake held by its founder.

The initial market capitalization at the time of the IPO is not immediately available. However, the shift to public ownership was a pivotal moment, allowing for greater access to capital and increased market presence. The company's ownership structure continues to evolve, reflecting changes in market dynamics and investor confidence.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | May 3, 2005 | Transitioned from private to public ownership, introducing a broad base of public shareholders and enabling capital raising. |

| Ongoing Market Activity | 2005-2025 | Continuous shifts in ownership due to trading by institutional investors, mutual funds, and individual shareholders. |

| Founder's Continued Stake | 2005-2025 | Joe Mansueto maintains a significant ownership percentage, influencing company direction. |

As of late 2024 and early 2025, Joe Mansueto remains a central figure in Morningstar ownership. Through various entities, including personal holdings and trusts, Mansueto holds a substantial portion of the Morningstar company's shares. For example, as of March 31, 2024, Mansueto held approximately 32.5% of Morningstar's total outstanding shares, underscoring his significant influence. Major institutional stakeholders also play a crucial role in the Morningstar ownership structure. Large asset management firms and investment funds hold considerable positions, with The Vanguard Group, Inc., and BlackRock, Inc., being among the top institutional holders. These institutional holdings are dynamic, fluctuating with market conditions and investment strategies, and are regularly updated in SEC filings.

The ownership of Morningstar has evolved significantly since its IPO in 2005, with a mix of institutional and individual investors. Joe Mansueto, the founder, continues to hold a significant stake, maintaining his influence over the company. Understanding the Morningstar shareholders and their holdings is crucial for anyone interested in the company's direction.

- Joe Mansueto remains a significant shareholder.

- Institutional investors like Vanguard and BlackRock hold substantial positions.

- Ownership structure is dynamic and subject to change.

- The IPO in 2005 was a pivotal moment.

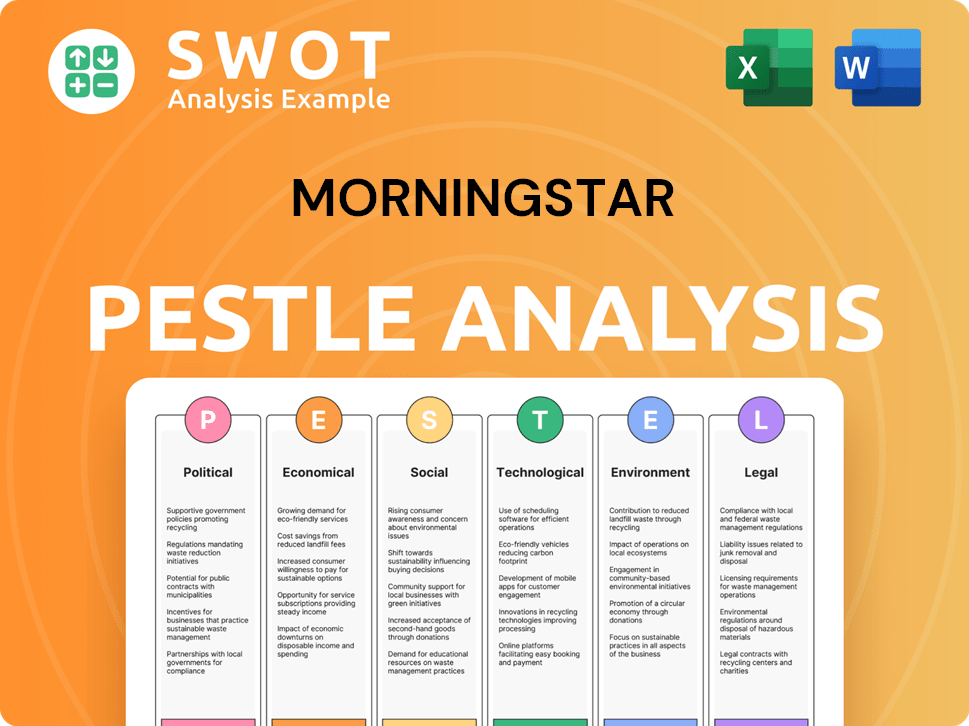

Morningstar PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Morningstar’s Board?

The current Board of Directors of Morningstar, Inc. reflects a blend of major shareholders, independent members, and company executives. As of early 2025, the board includes Joe Mansueto, who serves as Executive Chairman, reflecting his continued leadership and significant ownership. Other board members include the Chief Executive Officer, Kunal Kapoor, and a mix of independent directors who bring diverse expertise to the company's governance. Independent directors are crucial for providing objective oversight and ensuring the interests of all shareholders are considered. The structure aims to balance leadership continuity with independent oversight, ensuring the company's strategic direction and governance remain robust.

The board's composition is designed to balance experience and fresh perspectives, with independent directors contributing to robust corporate governance and accountability. The board's structure and the voting structure ensure that the vision for Morningstar continues to be a driving force.

| Board Member | Title | Key Role |

|---|---|---|

| Joe Mansueto | Executive Chairman | Leadership and substantial ownership representation |

| Kunal Kapoor | Chief Executive Officer | Executive leadership and strategic direction |

| Independent Directors | Various | Objective oversight and shareholder interest representation |

Morningstar operates with a one-share-one-vote structure for its common stock, meaning each share generally carries equal voting rights. However, Joe Mansueto's significant ownership stake provides him with outsized control. His substantial percentage of shares translates directly into a large block of voting power, allowing him to heavily influence major corporate decisions. While there are no widely publicized special voting rights or golden shares beyond his common stock holdings, Mansueto's concentrated ownership effectively gives him a controlling interest. This structure ensures that the company's leadership can effectively implement its strategic vision while still adhering to standard corporate governance practices.

The ownership structure of Morningstar, Inc. centers around a one-share-one-vote system, with a significant portion of voting power held by Joe Mansueto. This structure impacts the company's strategic decisions and governance.

- Joe Mansueto's role as Executive Chairman signifies his continued influence.

- The board includes a mix of company executives and independent directors.

- The voting structure gives Mansueto considerable influence over major corporate decisions.

- There have been no major recent proxy battles challenging Morningstar's governance.

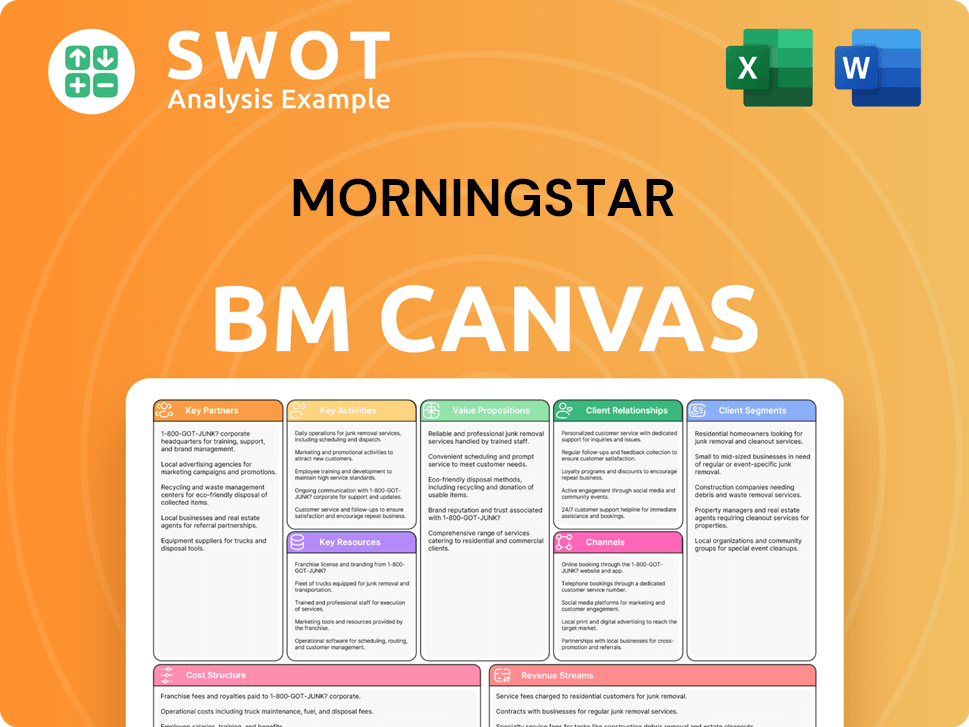

Morningstar Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Morningstar’s Ownership Landscape?

Over the last few years, the ownership structure of the Morningstar company, has shown continued trends rather than significant shifts. The company's ownership is characterized by steady institutional investment and the enduring influence of its founder. Strategic acquisitions, such as the 2020 acquisition of Sustainalytics, have expanded its offerings, potentially attracting new investors interested in sustainable investing. The transition of the CEO role to Kunal Kapoor in 2017, while Joe Mansueto remained as Executive Chairman, reflects a strategic succession plan.

The increasing influence of institutional investors and the rise of passive investing through index funds have also impacted Morningstar. Firms like Vanguard and BlackRock hold significant stakes. This trend generally leads to a greater focus on governance and long-term value creation. While founder dilution is a natural outcome of growth and public offerings, Mansueto's continued substantial stake demonstrates a commitment to maintaining a significant level of founder control. Public statements from Morningstar consistently highlight the company's stable leadership and strategic focus, with no public indications of planned privatization or immediate significant shifts in its core ownership structure.

| Ownership Category | Approximate Percentage | Notes |

|---|---|---|

| Institutional Investors | Varies, but significant (e.g., BlackRock, Vanguard) | Reflects broader market trends. |

| Founder (Joe Mansueto) | Significant, but exact percentage fluctuates | Maintains considerable influence. |

| Public Float | Remaining percentage | Subject to market dynamics. |

The ownership structure of Morningstar, as of the latest available data, reflects a stable composition with a significant institutional presence and continued influence from the founder. The company’s focus remains on long-term value creation and strategic expansion through acquisitions, rather than major shifts in its core ownership. This stability is a key factor in its continued operations.

Increased influence from institutional investors like BlackRock and Vanguard. This shift aligns with broader market trends towards passive investing and diversified funds. It generally leads to a greater focus on governance and long-term value creation for the company.

Joe Mansueto, the founder, maintains a substantial stake. This continued involvement distinguishes Morningstar from companies where founder influence diminishes rapidly post-IPO. The founder's commitment reflects a focus on maintaining a significant level of control.

Morningstar has made strategic acquisitions, such as Sustainalytics in 2020. These moves expand its offerings and attract new investor segments. This focus on expansion contributes to the company's overall growth and market position.

The transition of the CEO role to Kunal Kapoor in 2017, with Joe Mansueto remaining as Executive Chairman, has ensured stable leadership. This strategic succession plan maintains founder oversight while empowering new leadership. It reflects a commitment to stability.

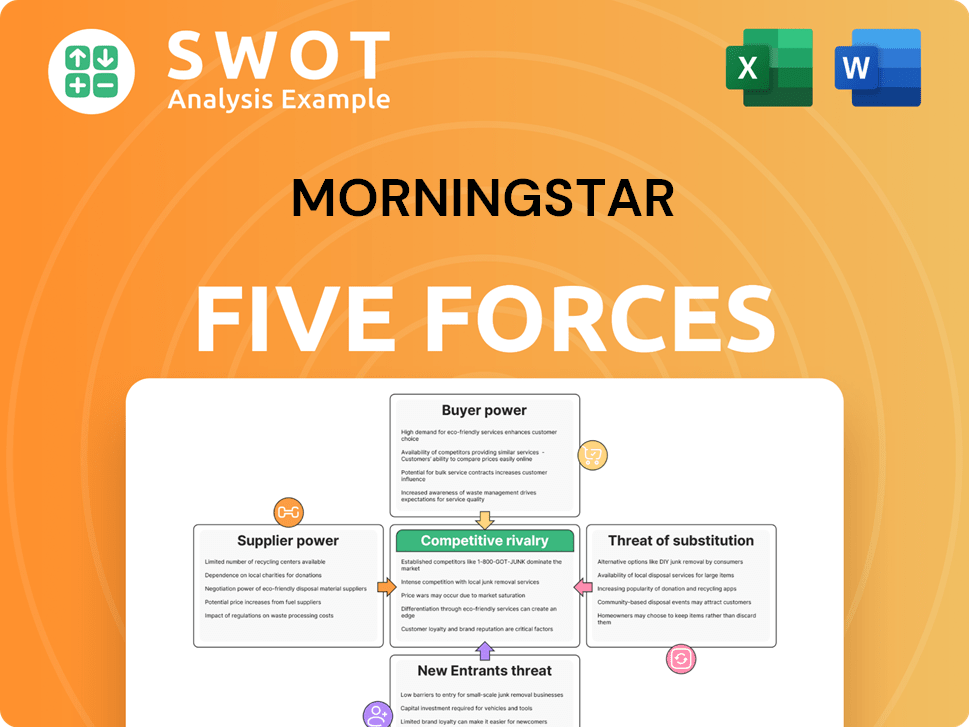

Morningstar Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Morningstar Company?

- What is Competitive Landscape of Morningstar Company?

- What is Growth Strategy and Future Prospects of Morningstar Company?

- How Does Morningstar Company Work?

- What is Sales and Marketing Strategy of Morningstar Company?

- What is Brief History of Morningstar Company?

- What is Customer Demographics and Target Market of Morningstar Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.