Morningstar Bundle

How Does the Morningstar Company Shape Your Investments?

Morningstar, a titan in the investment world, offers independent Morningstar SWOT Analysis and data-driven insights that are crucial for informed financial decisions. Its influence is undeniable, empowering investors of all levels with the tools needed for success. With a global footprint and a commitment to innovation, Morningstar continues to evolve, making it a key player in the ever-changing market landscape.

The Morningstar company's recent financial performance, including a 7.2% revenue increase in Q1 2025, highlights its robust Morningstar business model. This article will dissect the core operations of Morningstar, exploring its value proposition, revenue streams, and strategic initiatives. Understanding how Morningstar works is vital for anyone seeking to leverage its investment research and financial analysis capabilities to make sound investment choices and navigate the complexities of the market.

What Are the Key Operations Driving Morningstar’s Success?

The core of the Morningstar company revolves around delivering independent investment research and data. This empowers a wide range of clients to make informed financial decisions. Their services include investment data, research reports, investment management, and software tools, catering to individual investors, financial advisors, and institutional investors.

Morningstar's operational processes are rooted in extensive data collection, technology development, and rigorous analytical methodologies. Their commitment to independence ensures that their research is unbiased. The company's data and research services are crucial for those seeking clarity in fund selection and investment decision-making.

Morningstar's business model is built on providing value through comprehensive data, independent research, and integrated technology solutions. Key operational segments include PitchBook, which focuses on private capital markets, and Morningstar Credit, which concentrates on debt securities. These segments utilize proprietary data and analytical tools to streamline workflows and increase transparency.

Morningstar offers a wealth of investment data and research reports. They cover stocks, funds, and markets globally. Their offerings include stock ratings, fund ratings, and analyst reports to guide investment decisions.

Morningstar provides software and tools for financial analysis and portfolio management. These tools help investors analyze their portfolios, screen investments, and monitor market trends. Morningstar Direct is a key platform.

Morningstar also offers investment management services. They provide managed portfolios and investment advisory services to help clients achieve their financial goals. They focus on delivering long-term investment performance.

Morningstar provides data and analytics for private capital markets through PitchBook. This helps investors and advisors make informed decisions in this sector. PitchBook offers comprehensive data and insights.

Morningstar's operational segments include PitchBook and Morningstar Credit, which provide specialized data and insights. These segments use proprietary data and analytical tools to increase transparency in historically opaque markets. Strategic partnerships also play a key role.

- PitchBook provides data and insights on private capital markets.

- Morningstar Credit focuses on debt securities and structured finance.

- Partnerships enhance distribution networks and integrate data and analytics.

- These segments use proprietary data and analytical tools.

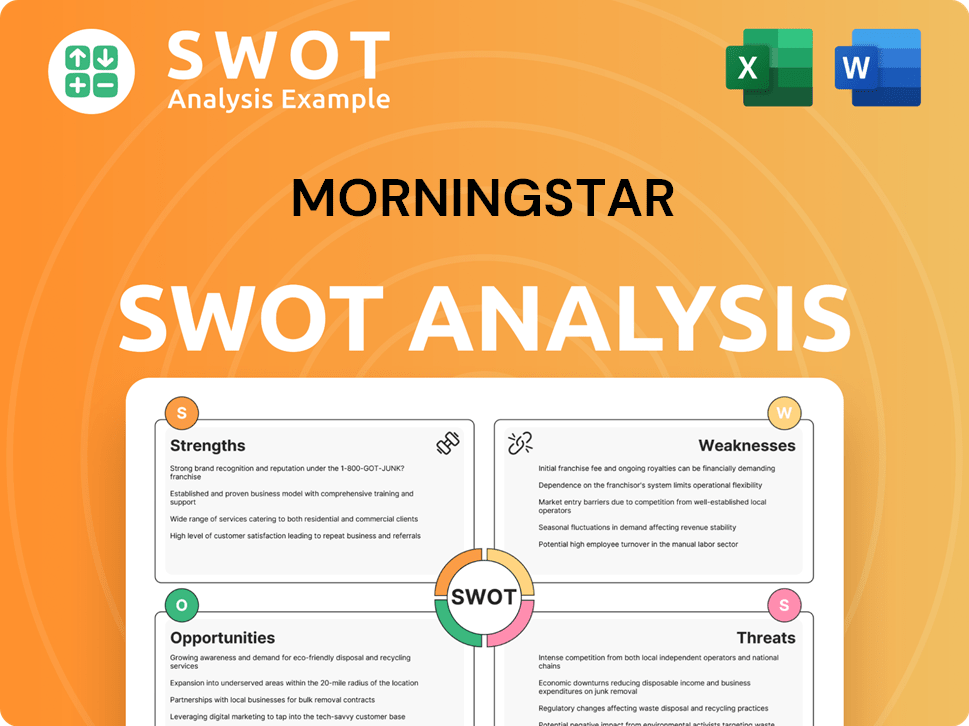

Morningstar SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Morningstar Make Money?

The Morningstar business model thrives on a diversified revenue strategy, primarily through license-based, asset-based, and transaction-based services. This approach allows the

The

A significant portion of

License-based revenue, primarily from subscription services, increased by 7.1% in 2024, or 7.6% organically. This growth was driven by strong demand for products like PitchBook and Morningstar Data and Analytics. PitchBook saw its revenue increase by 10.9% in Q1 2025, while Morningstar Direct licenses also increased by 0.6% in Q1 2025.

- Subscription services are a key revenue stream for

, providing access to investment research and financial analysis tools. - PitchBook's strong performance contributed significantly to the overall revenue growth.

- Morningstar Direct licenses also saw an increase, indicating continued demand for their data and analytics products.

Asset-based revenue, mainly from Morningstar Wealth and Morningstar Retirement segments, increased by 19.2% in 2024. This revenue stream is based on fees charged for assets under management or advisement (AUMA). As of March 31, 2025, Morningstar's investment advisory subsidiaries managed approximately $341 billion in AUMA. Morningstar Wealth's revenue increased by 3.9% in Q1 2025.

- Asset-based revenue depends on the volume of assets managed by Morningstar's advisory services.

- The growth in AUMA reflects the increasing trust and reliance on Morningstar's advisory services.

- Morningstar Wealth's revenue growth indicates the segment's strong performance and client base expansion.

Transaction-based revenue saw a substantial increase of 31.2% in 2024, primarily driven by Morningstar Credit. This segment includes one-time revenue and recurring revenue from surveillance and research. Morningstar Credit's revenue rose by 21.1% in Q1 2025.

- Transaction-based revenue is significantly influenced by the performance of Morningstar Credit.

- The growth in this segment highlights the demand for credit ratings and research services.

- Both one-time and recurring revenues contribute to the overall financial performance.

Morningstar Sustainalytics and Morningstar Indexes also contribute to consolidated revenue. In 2024, revenue from Morningstar Sustainalytics was $117.3 million, and Morningstar Indexes contributed $84.7 million. The company is actively expanding its offerings in private credit and structured finance through acquisitions like Lumonic and DealX in March 2025.

- Morningstar Sustainalytics and Morningstar Indexes add to the company's diverse revenue streams.

- Acquisitions like Lumonic and DealX are expected to boost analytical capabilities.

- These acquisitions are strategic moves to expand into growing market segments.

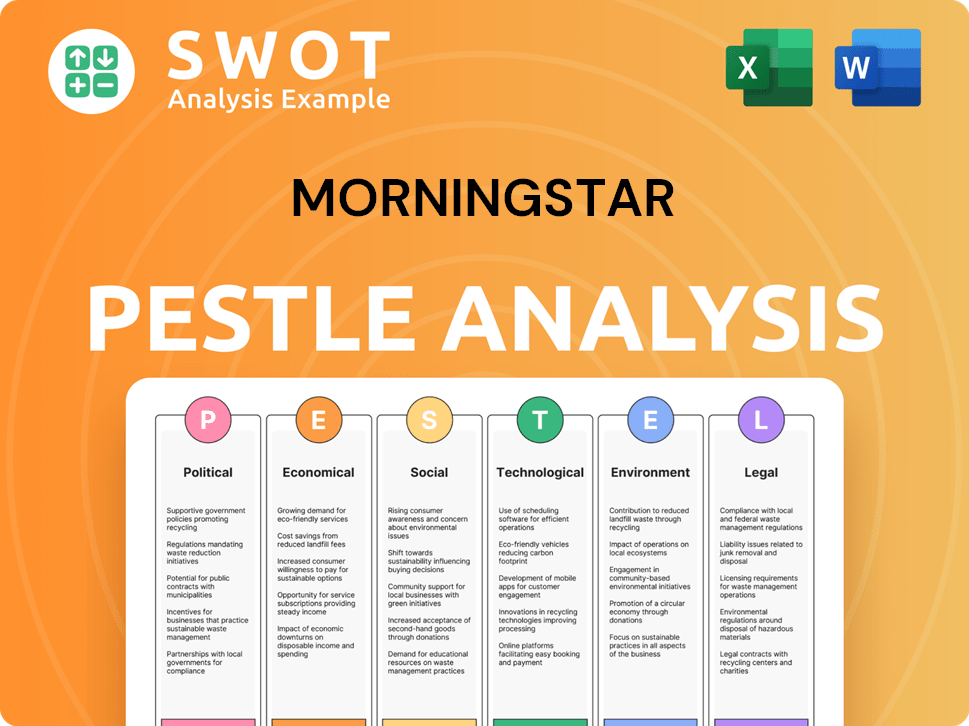

Morningstar PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Morningstar’s Business Model?

The Morningstar company has achieved significant milestones that have shaped its operations and financial performance. A key strategic move in early 2025 was the acquisition of Lumonic and DealX. This was aimed at strengthening its private credit and structured finance offerings, along with expanding PitchBook's capabilities in portfolio monitoring. These acquisitions highlight Morningstar's commitment to delivering efficiency and transparency in these growing markets.

In February 2025, Morningstar formed a strategic alliance with SS&C's Black Diamond Wealth Platform. This integration of its investment data and research with Black Diamond's portfolio accounting and client communication tools is significant. This partnership is particularly relevant as Morningstar Office is set to shut down in early 2026, with Black Diamond becoming a default option for transitioning advisors. The company continues to adapt by focusing on anticipating investor needs, particularly as public and private markets converge, and by investing in strategic initiatives to expand its offerings.

Operational challenges faced by Morningstar include navigating market volatility and economic uncertainty, as highlighted in its Q1 2025 earnings report. The company also faces challenges related to regulatory changes, particularly in sustainable investing, where Europe is reviewing key measures that could impact data and comparability for investors. Despite these, Morningstar has demonstrated resilience, with key segments like PitchBook and Morningstar Credit driving revenue growth.

Early in 2025, Morningstar acquired Lumonic and DealX. These acquisitions were strategic moves to enhance its private credit and structured finance offerings. They also aimed to broaden PitchBook's capabilities in portfolio monitoring, reflecting Morningstar's focus on expanding its services.

In February 2025, Morningstar partnered with SS&C's Black Diamond Wealth Platform. This alliance integrates Morningstar's investment data and research with Black Diamond's portfolio accounting tools. This partnership is particularly relevant as Morningstar Office is set to shut down in early 2026.

Morningstar's competitive advantages stem from its independent research and data, a long-standing heritage as a trusted provider, and its global reach. Its comprehensive data coverage, including private capital markets and debt securities, and its analyst-driven insights differentiate it from competitors. The company leverages technology, including AI, to drive innovation in its products and services, aiming to enhance intangible assets and generate new products.

- Independent Research and Data: Morningstar provides unbiased investment research and data.

- Global Reach: Morningstar operates globally, offering services to a wide range of investors.

- Technological Innovation: The company uses AI to improve its products and services.

- Analyst-Driven Insights: Morningstar provides in-depth financial analysis and insights.

- Focus on Behavioral Insights: Morningstar helps investors avoid common pitfalls.

The company continues to adapt by focusing on anticipating investor needs, particularly as public and private markets converge, and by investing in strategic initiatives to expand its offerings. For a broader understanding of Morningstar's position in the market, you can explore the Competitors Landscape of Morningstar. This will help you understand how the company stacks up against its rivals.

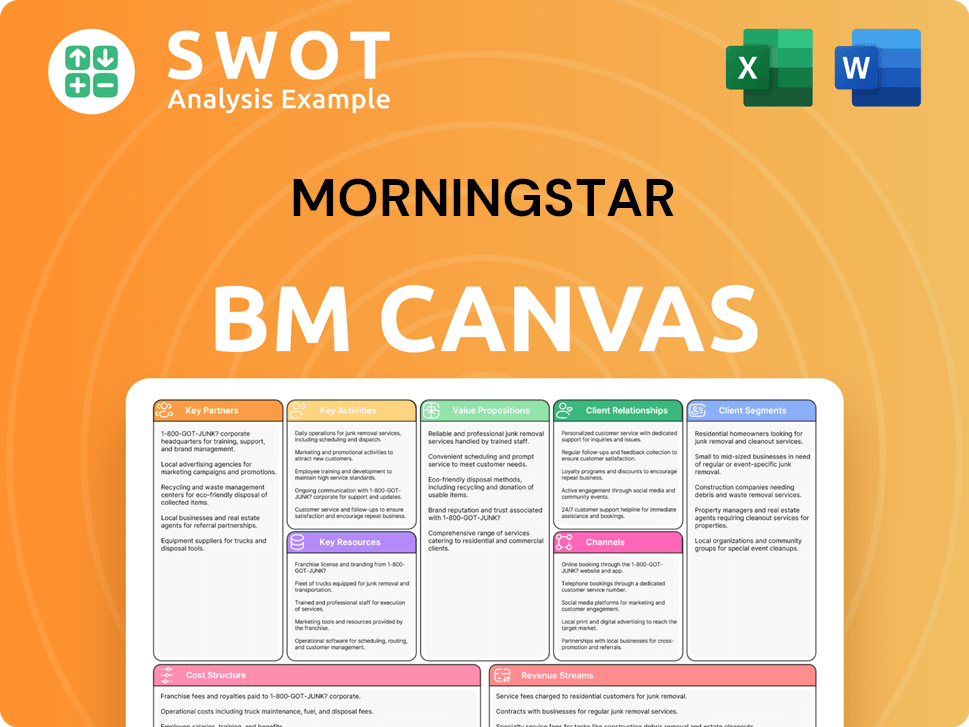

Morningstar Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Morningstar Positioning Itself for Continued Success?

The Morningstar company holds a leading position in the independent investment research and data industry. It serves a global client base spanning across 32 countries. The company's influence is significant, supported by its extensive product line and diverse customer segments, ranging from individual investors to large institutions. Competitors include major financial data providers like Bloomberg and FactSet.

Key risks for the Morningstar business model include market volatility and economic uncertainty, as highlighted in its Q1 2025 earnings. Regulatory changes, particularly in sustainable investing and data disclosure, also pose a risk. The potential for new competitors and technological disruption, especially with the rise of AI, is an ongoing challenge. Operational risks related to managing complex data and technology infrastructure, as well as integrating acquired businesses, also contribute to the company's risk profile.

Morningstar's strong industry position is supported by its reputation for independent investment research and its mission to empower investor success. It competes with major players in the financial data industry. The company’s global presence and diverse offerings contribute to its market influence.

Market volatility and economic uncertainty are significant risks for Morningstar. Regulatory changes, particularly in areas like sustainable investing, also pose challenges. The rapid adoption of AI and the potential for new competitors represent ongoing threats. Operational risks related to data management and acquisitions also need consideration.

Morningstar is focused on the convergence of public and private markets, aiming to deliver insights across all asset classes. This includes expanding its private credit and structured finance offerings. The company is also leveraging AI to drive innovation and emphasizing operational excellence.

Morningstar is focused on building portfolio analytics and tools. It aims to create a common language of investing across public and private markets. The company plans to adapt to new trends and technology shifts to sustain growth.

Morningstar aims to sustain growth by continuing to build portfolio analytics and tools. The company is creating a common language of investing across public and private markets. Adapting to new trends and technology shifts will be crucial.

- Expanding private credit and structured finance offerings.

- Leveraging advances in artificial intelligence.

- Fostering operational excellence and scalability.

- Building portfolio analytics and tools.

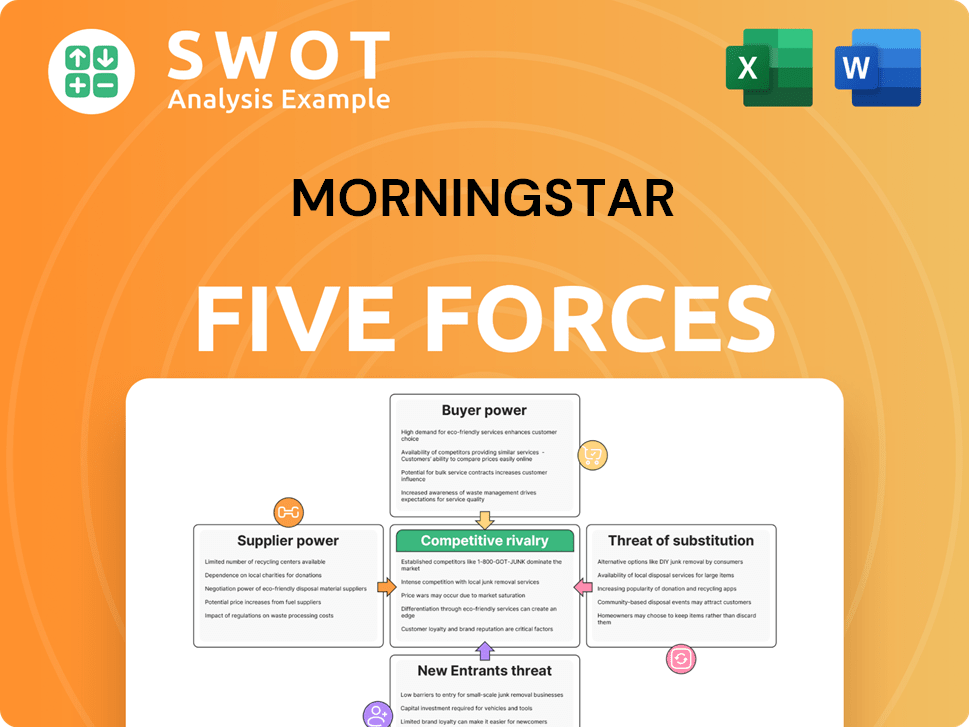

Morningstar Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Morningstar Company?

- What is Competitive Landscape of Morningstar Company?

- What is Growth Strategy and Future Prospects of Morningstar Company?

- What is Sales and Marketing Strategy of Morningstar Company?

- What is Brief History of Morningstar Company?

- Who Owns Morningstar Company?

- What is Customer Demographics and Target Market of Morningstar Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.