Morningstar Bundle

Who Competes with Morningstar in the Financial Data Arena?

Morningstar, Inc. has become a cornerstone for investors seeking reliable financial insights since its inception in 1984. From its humble beginnings providing mutual fund data, the company has expanded to offer comprehensive investment research and analysis globally. Its mission to bring transparency to the financial world has made it a trusted source for both individual and institutional investors.

To truly understand Morningstar's impact, a deep dive into its Morningstar SWOT Analysis and the broader landscape is essential. This analysis will explore the company's market positioning, identify its key rivals, and dissect its competitive advantages within the financial data providers industry. We'll also examine how Morningstar's market share and industry position stack up against its competitors, providing a thorough Morningstar competitor analysis report.

Where Does Morningstar’ Stand in the Current Market?

Morningstar maintains a strong market position within the investment research and data industry. The company is known for its comprehensive offerings and established brand reputation. It is a leader in independent investment research, particularly for mutual funds and ETFs. The company's primary product lines include investment data and analytics, research reports, investment management solutions, and software tools.

The company's global presence spans North America, Europe, Asia, and Australia. Morningstar has diversified its offerings beyond mutual fund data to encompass equities, fixed income, and alternative investments. This diversification, along with its digital transformation efforts, has helped the company maintain its relevance and expand its customer segments. For those interested in understanding the company's broader strategic direction, you can read about the Growth Strategy of Morningstar.

Morningstar's financial health is evident in its revenue figures. The company reported total revenue of $1.3 billion for the full year 2023, reflecting a 6.5% increase compared to 2022. The DBRS Morningstar segment reported a 10.4% increase in revenue for the fourth quarter of 2023, highlighting growth in its credit ratings business.

Morningstar holds a significant market position, especially in providing data and research for retail and institutional investors. While specific market share data fluctuates, the company is consistently recognized as a leader in its sector. The company's established brand and comprehensive offerings contribute to its strong market presence.

Morningstar offers a wide range of products and services. These include investment data and analytics, research reports, investment management solutions, and software tools. The company caters to financial advisors, asset managers, and individual investors, providing them with essential tools for investment decisions.

Morningstar operates globally, with a presence in North America, Europe, Asia, and Australia. This global reach allows the company to serve a diverse client base and adapt to varying market conditions. The international presence is a key factor in its competitive landscape.

Morningstar's financial performance reflects its strong market position. The company's revenue for 2023 was $1.3 billion, demonstrating solid growth. The DBRS Morningstar segment also showed strong revenue growth, indicating success in its credit ratings business.

Morningstar's competitive advantages include its comprehensive data, established brand, and global presence. However, the company faces challenges from increasing competition in fintech and specialized data providers. The company's ability to innovate and adapt to market changes will be crucial for maintaining its competitive edge.

- Strong brand reputation and customer loyalty.

- Comprehensive product offerings that cater to various investor needs.

- Global presence, allowing access to diverse markets.

- Ongoing competition from fintech and specialized data providers.

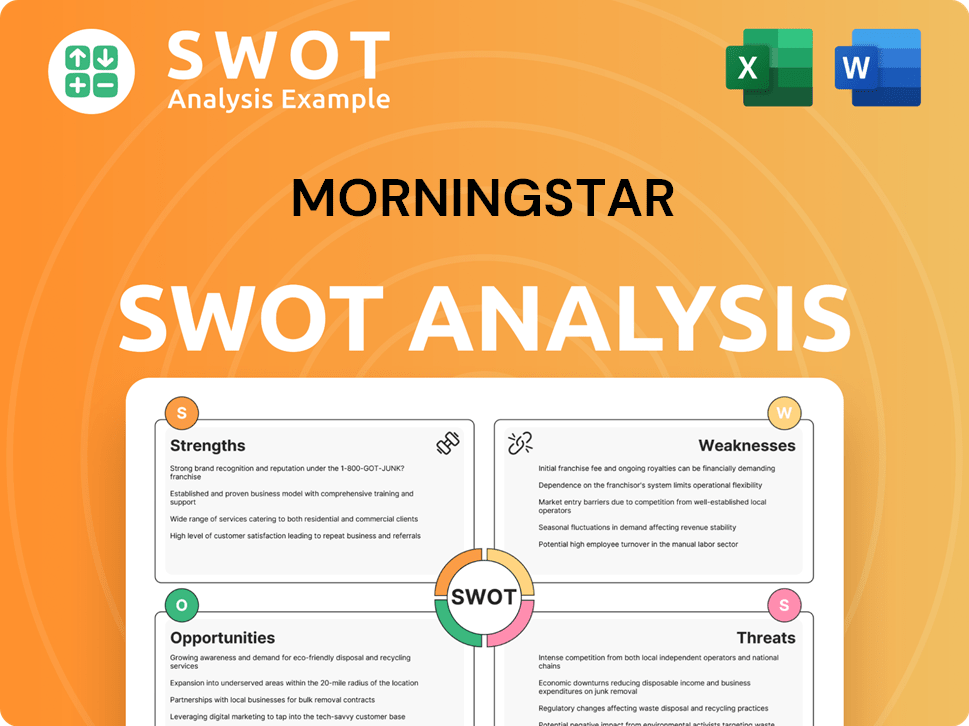

Morningstar SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Morningstar?

The Morningstar competitive landscape is shaped by a diverse set of rivals, spanning from established financial data providers to agile fintech startups. These competitors challenge its market position by offering alternative data, analytics, and investment solutions. Understanding these competitors is crucial for Morningstar market analysis and strategic planning.

Morningstar's main rivals include industry giants like Bloomberg, Refinitiv (now part of LSEG), and S&P Global, alongside specialized research firms and fintech disruptors. Each competitor brings unique strengths and strategies to the market, influencing Morningstar's market share and overall performance. A comprehensive Morningstar competitor analysis report must consider these factors to understand the competitive environment fully.

Morningstar's competitive advantages lie in its comprehensive investment research and data, but it faces stiff competition from various players. For example, Bloomberg’s revenue in 2023 was approximately $13.3 billion, highlighting its strong position in the financial data space. Understanding the strategies of these competitors is vital for Morningstar's growth opportunities and maintaining its industry position.

Bloomberg is a direct competitor, offering comprehensive financial data, news, and analytics. It primarily targets institutional clients with real-time market information and trading functionalities. Bloomberg's market dominance is evident in its extensive terminal usage and high revenue figures.

Refinitiv, now part of LSEG, competes directly in providing financial data, analytics, and trading solutions. It has a strong presence in fixed income and foreign exchange markets. The acquisition by LSEG has consolidated its market power, creating a more formidable rival.

S&P Global, known for its credit ratings and market intelligence, also provides financial data and analytics. Its S&P Capital IQ platform offers extensive company and market data. S&P Global's diversified services make it a significant competitor in the financial data market.

MSCI offers robust analytical tools and data sets, often targeting portfolio managers and quantitative analysts. It provides specialized data and analytics for investment professionals. MSCI's focus on specific segments allows it to compete effectively.

FactSet provides analytical tools and data sets, similar to MSCI, targeting portfolio managers and quantitative analysts. It offers comprehensive financial data and analytics solutions. FactSet's offerings compete directly with Morningstar's analytical tools.

These firms offer investment management and advisory software, integrating portfolio management, reporting, and financial planning tools. They compete with Morningstar's advisor-focused solutions. Their platforms provide comprehensive tools for financial advisors.

The Morningstar competitive landscape is dynamic, with ongoing shifts in market share and strategic moves by key players. The acquisition of Refinitiv by LSEG, for instance, has reshaped the competitive environment, creating a more formidable rival. The rise of fintech companies also poses a continuous challenge, demanding that Morningstar innovate and adapt to maintain its market position. For a deeper dive into the company’s history, you can read a Brief History of Morningstar.

- Mergers and Acquisitions: Consolidation among major players like LSEG and Refinitiv reshapes the competitive landscape.

- Fintech Disruption: Emerging fintech companies introduce AI-driven insights and low-cost investment platforms.

- Specialized Research: Firms like MSCI and FactSet target specific segments with specialized data and tools.

- Advisor-Focused Solutions: Platforms like Envestnet and Orion offer integrated portfolio management and financial planning tools.

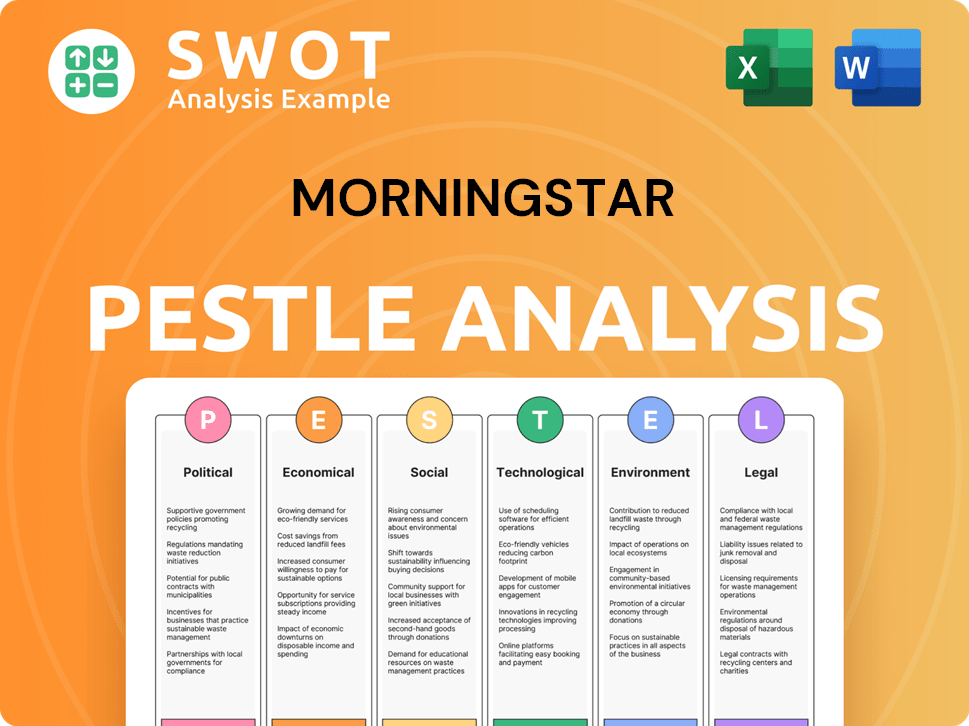

Morningstar PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Morningstar a Competitive Edge Over Its Rivals?

The competitive advantages of Morningstar stem from its commitment to independent, objective investment research and its extensive data capabilities. Its brand equity, built over decades, fosters strong customer loyalty among investors and financial professionals who rely on its research. The company's proprietary methodologies, such as the Morningstar Rating for funds, are widely recognized, acting as a significant differentiator in the Morningstar competitive landscape.

Economies of scale play a crucial role, especially in data collection and processing. Morningstar's vast database, encompassing millions of investment vehicles globally, creates a significant barrier to entry for new competitors. This extensive data infrastructure supports various product lines, from research reports to software tools. Furthermore, the company's global distribution network and established relationships provide a strong platform for disseminating its products and services, influencing the Morningstar market analysis.

Ongoing investment in technology, including AI and machine learning, enhances its data analytics capabilities, allowing for innovative tool development. These advantages have expanded from its initial focus on mutual funds to broader asset class coverage, demonstrating adaptability and commitment to maintaining its competitive edge. Understanding these factors is key to a Morningstar competitor analysis report.

Morningstar's brand is synonymous with unbiased and independent investment research. This reputation has cultivated trust among individual investors and financial professionals. This trust is a significant factor when comparing Morningstar's strengths and weaknesses against its competitors.

The Morningstar Rating for funds (the 'star rating') is a widely recognized tool in the industry. Its proprietary methodologies provide a consistent framework for evaluating investments. These tools help establish Morningstar's industry position.

Morningstar's vast database, covering millions of investments, creates a significant barrier to entry. This extensive data supports various product lines, from research reports to software. This comprehensive data is crucial for Morningstar's market share.

A strong global distribution network and established relationships with financial advisors and institutions are key. This network allows for effective dissemination of products and services. Understanding this network is essential for Morningstar's competitive advantages.

Morningstar's competitive edge is reinforced by its commitment to innovation and adaptability. The company continually invests in technology, including AI and machine learning, to enhance its data analytics and develop innovative tools. These investments help Morningstar maintain its competitive edge against imitation and industry shifts. To understand more about the company's financial aspects, you can read about the Revenue Streams & Business Model of Morningstar.

- Data Coverage: The company's database includes data on over 600,000 investment offerings.

- Global Presence: Morningstar operates in 29 countries, serving a global client base.

- Revenue: In 2024, Morningstar's revenue was approximately $1.9 billion.

- Client Base: Morningstar serves over 1.7 million users globally.

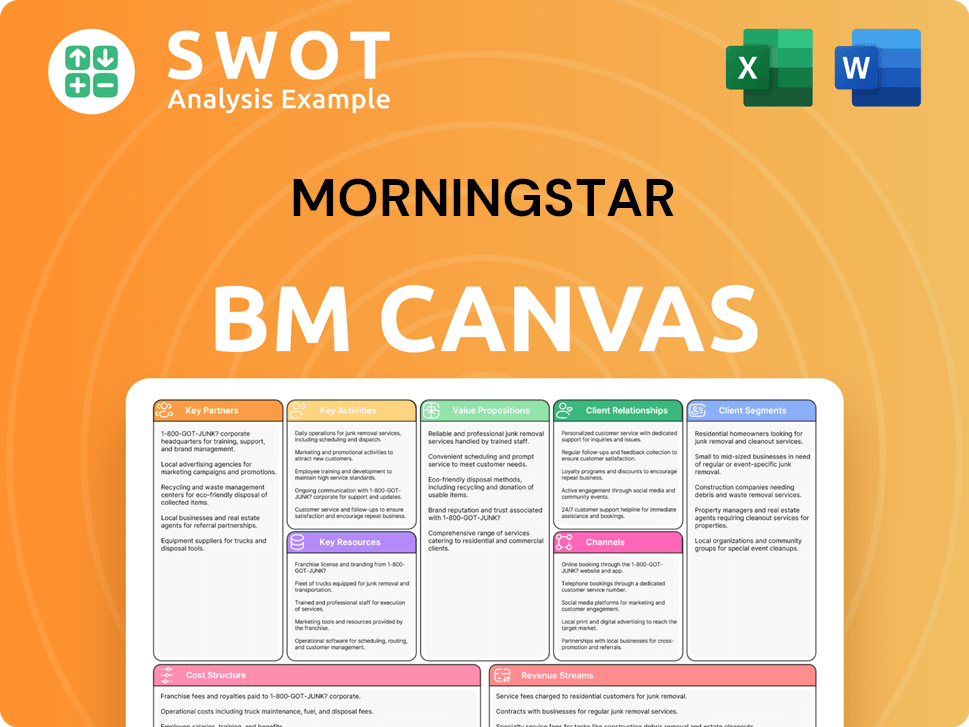

Morningstar Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Morningstar’s Competitive Landscape?

The investment research and data industry is experiencing rapid change, driven by technological advancements, regulatory shifts, and evolving consumer preferences. This dynamic environment presents both opportunities and challenges for companies like Morningstar. Understanding the Morningstar competitive landscape is crucial for investors and industry participants to assess its future prospects. A thorough Morningstar market analysis reveals the strategic positioning of the company within a complex ecosystem.

The industry's landscape is marked by increased competition from both established players and emerging fintech firms. Regulatory changes and the demand for sustainable investing are also reshaping the market. This analysis helps in identifying potential risks and growth avenues, ensuring informed decision-making in the ever-evolving financial data and investment research sector. Analyzing the Morningstar competitors is essential for grasping its position.

Technological advancements, especially in artificial intelligence and machine learning, are transforming how investment insights are generated and delivered. Regulatory changes, such as increased transparency requirements, are also impacting the industry. Shifting consumer preferences towards digital solutions and sustainable investing represent significant growth opportunities.

Intensified competition from large financial data vendors and specialized niche players poses a threat. The increasing availability of free or low-cost investment data could pressure pricing models. Adapting to evolving regulatory landscapes and maintaining data accuracy are also significant challenges.

Expanding into emerging markets and developing innovative solutions for alternative investments present growth opportunities. Forging strategic partnerships to integrate data and research into broader financial ecosystems is also beneficial. There's also a growing demand for ESG (Environmental, Social, and Governance) data and analytics.

Morningstar will likely evolve towards a more integrated and technology-driven approach. It can leverage its strengths in independent research and extensive data to capture new market segments. Continuous innovation and strategic partnerships are crucial for long-term success. For more information, consider reading this Growth Strategy of Morningstar.

The financial data and investment research sector is dynamic, with Morningstar's industry position constantly evolving. Key trends include the integration of AI and machine learning to enhance data analysis and the growing importance of ESG investing. The company must adapt to these shifts to maintain its competitive edge.

- Technological Integration: Implementing AI and machine learning to improve data processing and analytics.

- ESG Expansion: Expanding ESG research and data offerings to meet increasing demand.

- Strategic Partnerships: Forming alliances to integrate data into broader financial ecosystems.

- Market Expansion: Targeting growth in emerging markets and alternative investment solutions.

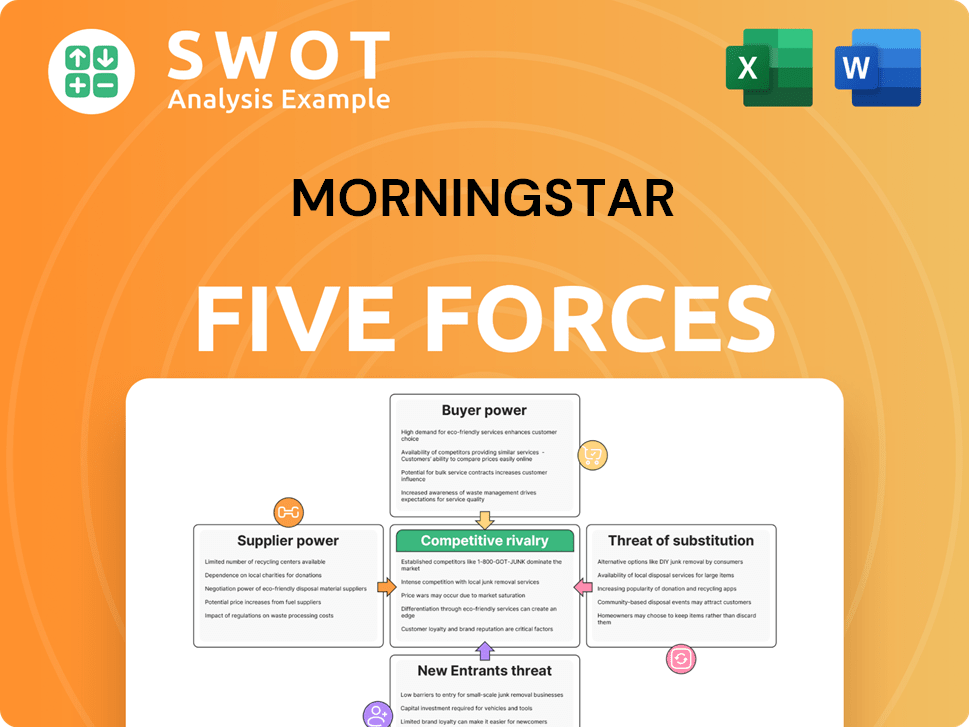

Morningstar Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Morningstar Company?

- What is Growth Strategy and Future Prospects of Morningstar Company?

- How Does Morningstar Company Work?

- What is Sales and Marketing Strategy of Morningstar Company?

- What is Brief History of Morningstar Company?

- Who Owns Morningstar Company?

- What is Customer Demographics and Target Market of Morningstar Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.