Morningstar Bundle

Who Are Morningstar's Key Players?

Understanding the Morningstar SWOT Analysis is crucial, but who exactly relies on Morningstar's insights? Unveiling the Morningstar company analysis reveals a dynamic shift from its initial focus. This exploration delves into the evolving customer demographics and the strategic expansion of its Morningstar target market.

The journey of understanding the Morningstar investors and their needs is ongoing. From individual investors to financial institutions, the investment research audience has grown. This analysis will explore Morningstar customer age range, Morningstar user income levels, and Morningstar customer location data, offering insights into Morningstar's ideal customer profile and Morningstar's market share and demographics.

Who Are Morningstar’s Main Customers?

Understanding the Brief History of Morningstar helps to identify its customer base. The company effectively serves a dual market, catering to both individual investors (B2C) and businesses (B2B). This strategic approach allows it to provide a wide range of financial products and services. The Morningstar target market is diverse, reflecting the breadth of its offerings and its influence within the financial industry.

The B2C segment includes individual investors, from beginners to experienced individuals. These users seek investment research, fund ratings, and portfolio analysis tools to manage their personal investments. The B2B segment, however, represents a significant portion of revenue and growth. This includes financial advisors, asset managers, wealth managers, and institutional investors.

The B2B segment offers financial data users with tools such as the Morningstar Advisor Workstation for financial advisors. Asset managers and institutional investors use Morningstar's data for competitive analysis, product development, and risk management. The company's focus on B2B offerings has increased due to the growing complexity of the financial services industry and the need for data-driven solutions.

This segment includes a broad spectrum of individual investors. They utilize Morningstar's resources for personal investment management. This group generally possesses financial literacy or a desire to improve it, alongside disposable income for investments.

Financial advisors use Morningstar's software, like Advisor Workstation, for portfolio management. They benefit from tools for portfolio construction, client reporting, and rebalancing. This segment represents a key professional user base within the B2B market.

Asset managers utilize Morningstar's data for competitive analysis and product development. They rely on Morningstar's research to inform their investment strategies. This group often includes professionals with specialized financial expertise.

Institutional investors leverage Morningstar's data for due diligence and risk management. They use the comprehensive data sets for strategic asset allocation. This segment typically requires advanced financial analysis tools.

The Morningstar investors and users span different demographics, from individual retail investors to financial professionals. The B2B segment is characterized by professionals with higher education and financial expertise. The company's focus on B2B offerings has grown significantly, reflecting the increasing demand for data-driven solutions.

- Financial Literacy: A fundamental understanding of financial concepts is common among users.

- Professional Roles: The B2B segment consists of financial advisors, asset managers, and institutional investors.

- Data-Driven Decision-Making: Users rely on Morningstar's data and analytical tools for investment decisions.

- Technological Proficiency: Users are comfortable with financial software and online platforms.

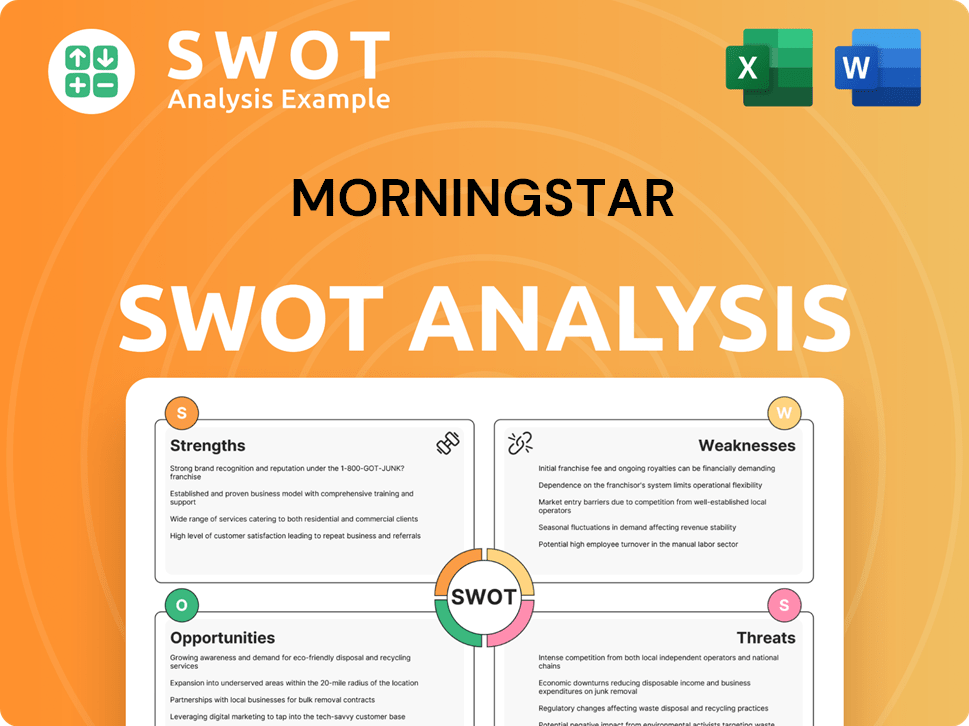

Morningstar SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Morningstar’s Customers Want?

Understanding the customer needs and preferences is crucial for any company, and for the [Company Name], this means focusing on the diverse needs of its investment research audience. The company's success hinges on providing independent, reliable, and comprehensive investment information. This approach helps in making informed financial decisions for a wide range of users.

The primary goal of [Company Name] is to empower both individual investors and financial professionals. The company achieves this by offering tools and insights that address their specific needs, ranging from fund performance analysis to advanced data analytics. This customer-centric approach ensures that the company remains relevant and valuable in a competitive market.

The [Company Name] serves a broad spectrum of customers, each with unique requirements. For individual investors, the focus is on user-friendly interfaces, clear insights, and tools to build diversified portfolios. Financial professionals, on the other hand, require robust data feeds, advanced analytical capabilities, and seamless integration with existing workflows. The company caters to these needs through its various platforms and services.

Individual investors often seek to understand fund performance, assess investment risks, and build diversified portfolios. They prioritize user-friendly interfaces and clear, actionable insights. Their purchasing decisions are influenced by a desire for transparency and unbiased research.

Financial professionals and institutions require robust data feeds, advanced analytical capabilities, and integration with existing workflows. Their decision-making criteria include data accuracy, breadth of coverage, and customization options. Efficiency and compliance are also key considerations.

The company addresses these needs through its star ratings, analyst reports, and portfolio X-Ray tools for individual investors. For professionals, platforms like Morningstar Direct offer extensive data and analytical models. These resources help users make informed decisions, regardless of their experience level.

Common pain points include information overload, difficulty comparing investment products, and the need for efficient client communication. The company addresses these challenges by providing streamlined data, comparison tools, and reporting functionalities to simplify the investment process.

Customer feedback and market trends, such as the increasing demand for ESG data and personalized advice, have directly influenced product development. The integration of ESG metrics into research and tools reflects the company's responsiveness to evolving investor preferences.

The company tailors its offerings by providing different tiers of service and product features. This ranges from basic free access for individual investors to highly customized enterprise solutions for institutional clients. This approach ensures that each customer segment receives the appropriate level of support and functionality.

The [Company Name]'s customer base is diverse, with needs varying based on their role and expertise. Understanding these differences is key to providing effective and valuable services. The company's success depends on its ability to meet these varied demands.

- Individual Investors: They need easy-to-understand information, tools for portfolio diversification, and insights into fund performance. They value transparency and unbiased research.

- Financial Professionals: They require robust data, advanced analytics, and seamless integration with existing systems. Data accuracy, customization, and scalability are crucial.

- Key Features: The company offers star ratings, analyst reports, and portfolio tools for individual investors. For professionals, platforms like Morningstar Direct provide extensive data and analytical capabilities.

- Addressing Pain Points: The company helps with information overload, product comparison, and client communication through streamlined data and reporting tools.

- Market Trends: The company integrates ESG data and provides personalized advice based on customer feedback and market demands.

- Service Tiers: The company offers different service tiers, from free access for individuals to customized enterprise solutions for institutional clients. This ensures that all segments receive tailored support.

For a deeper dive into the competitive landscape, consider reading about the Competitors Landscape of Morningstar.

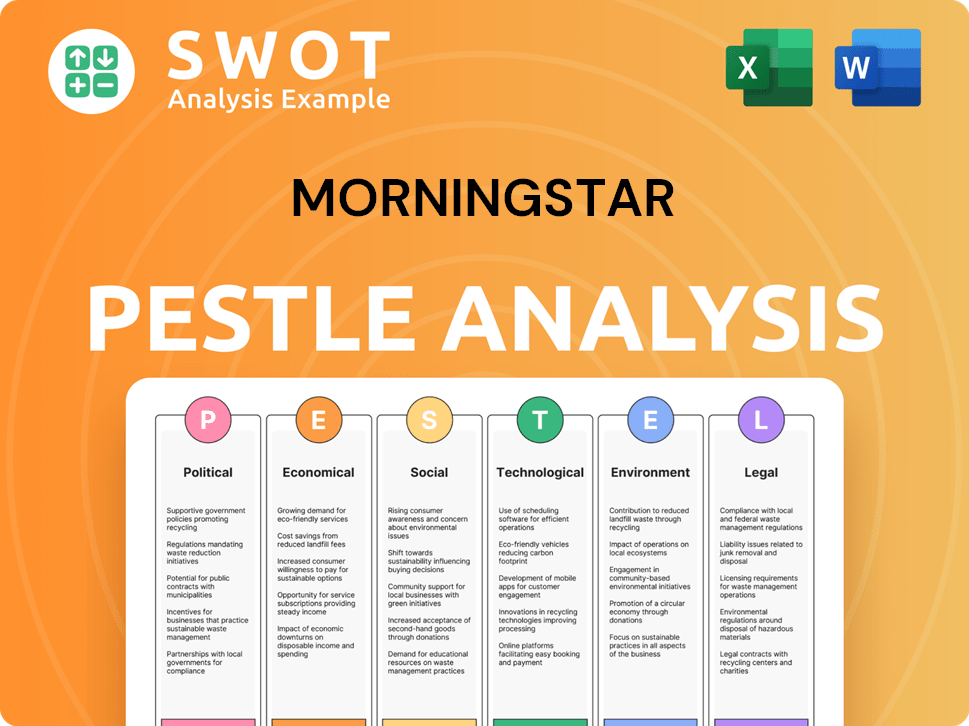

Morningstar PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Morningstar operate?

The geographical market presence of the company is extensive, spanning across North America, Europe, Asia, and Australia. Its reach includes major financial hubs such as the United States, the United Kingdom, and key regions in Asia, including China, India, and Japan. The company's operations also extend to Australia and Canada, reflecting a broad global footprint.

Significant differences exist in customer demographics, preferences, and buying power across these regions. For example, the demand for sustainable investing may be higher in Europe, while Asian markets could show a greater need for local market insights. The company tailors its offerings to meet these regional needs, providing region-specific data, research, and regulatory compliance features.

The company's strategy involves localizing its services, offering data coverage for thousands of local funds and securities in various countries. It also adapts its research reports to include local market nuances. Marketing and partnerships are customized to align with regional cultural and business practices. Recent expansions have focused on emerging markets, recognizing their growth potential. This approach supports the global demand for independent investment research and data.

The United States is a major market, holding a significant market share. Europe, particularly the United Kingdom and continental Europe, forms another key area. Asia, with countries like China, India, and Japan, represents a rapidly growing market for the company.

The company offers region-specific data and research. It provides data coverage for thousands of local funds and securities. Research reports incorporate local market nuances to cater to regional preferences. The company's Marketing Strategy of Morningstar includes localized marketing and partnerships.

The company is expanding its presence in emerging markets. This expansion recognizes the growth potential in these regions. The focus is on meeting the global demand for independent investment research and data.

Sales and growth reflect a mature presence in developed markets. There are increasing revenue contributions from emerging economies. This growth is driven by the global demand for independent investment research and data.

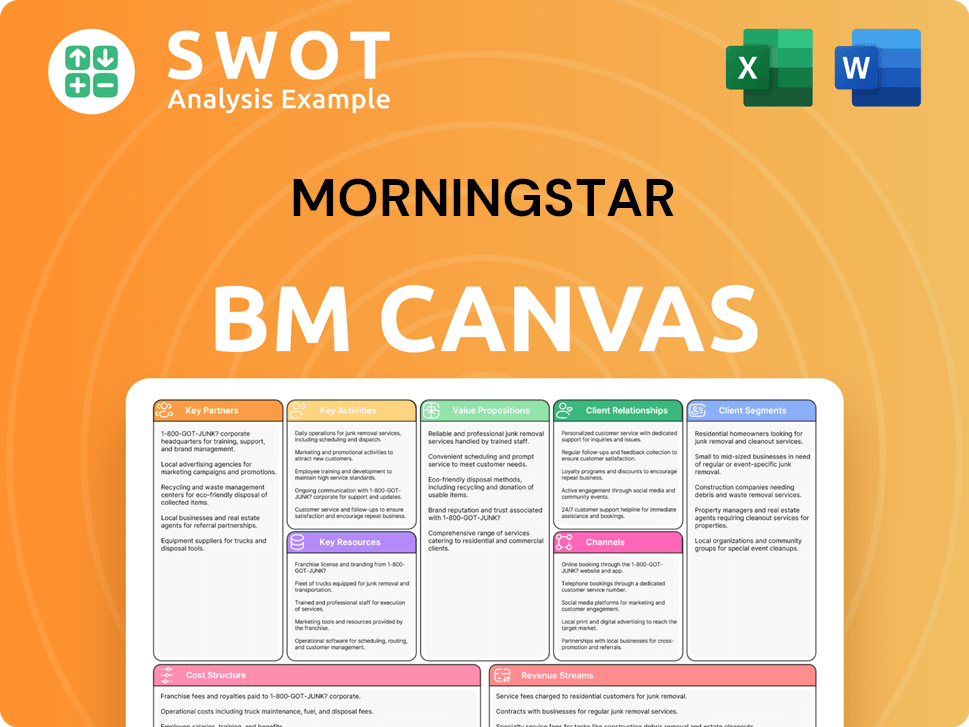

Morningstar Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Morningstar Win & Keep Customers?

The company employs a multi-pronged approach to acquire and retain customers, focusing on both digital and traditional methods. Their strategies are tailored to different customer segments, including individual investors and business-to-business (B2B) clients. This approach allows them to reach a broad audience, from retail investors seeking investment research to financial professionals requiring advanced analytical tools.

For individual investors, content marketing is a cornerstone of their acquisition strategy. They provide free articles, webinars, and educational resources to attract organic traffic and build brand awareness. Digital advertising, social media engagement, and search engine optimization (SEO) are also key for lead generation. B2B clients benefit from direct sales teams, industry conferences, and thought leadership content. Targeted digital campaigns and partnerships with financial industry associations further support their acquisition efforts.

Sales tactics include offering free trials of premium products and conducting product demonstrations. They also provide consultative sales approaches to meet the specific needs of financial professionals. Customer data and CRM systems are extensively used to segment their diverse customer base, enabling personalized marketing campaigns and tailored product recommendations. This enables them to understand the needs of the Morningstar target market more effectively.

Content marketing, including free articles, webinars, and educational resources, attracts organic traffic. Digital advertising, social media engagement, and SEO are used for lead generation. These strategies aim to build brand awareness and attract potential customers interested in investment research.

Direct sales teams, industry conferences, and thought leadership content are key. Targeted digital campaigns and partnerships with financial industry associations are also utilized. These efforts focus on reaching financial professionals and providing them with valuable insights and tools.

Offering free trials and product demonstrations is a common practice. Consultative sales approaches are tailored to the specific needs of financial professionals. These tactics aim to showcase the value of their products and services.

Customer data and CRM systems are used for segmentation. Personalized marketing campaigns and tailored product recommendations are implemented. This data-driven approach helps in understanding and meeting the needs of the Morningstar investors.

Retention efforts emphasize the value of their proprietary data and analytical tools. They focus on continuous product development, excellent customer support, and fostering a community of users. Regular software updates, new data sets, and enhanced functionalities keep professional users engaged.

- Continuous product development and innovation.

- Excellent customer support and dedicated account managers.

- Regular software updates and new data sets.

- Focus on helping clients achieve better investment outcomes.

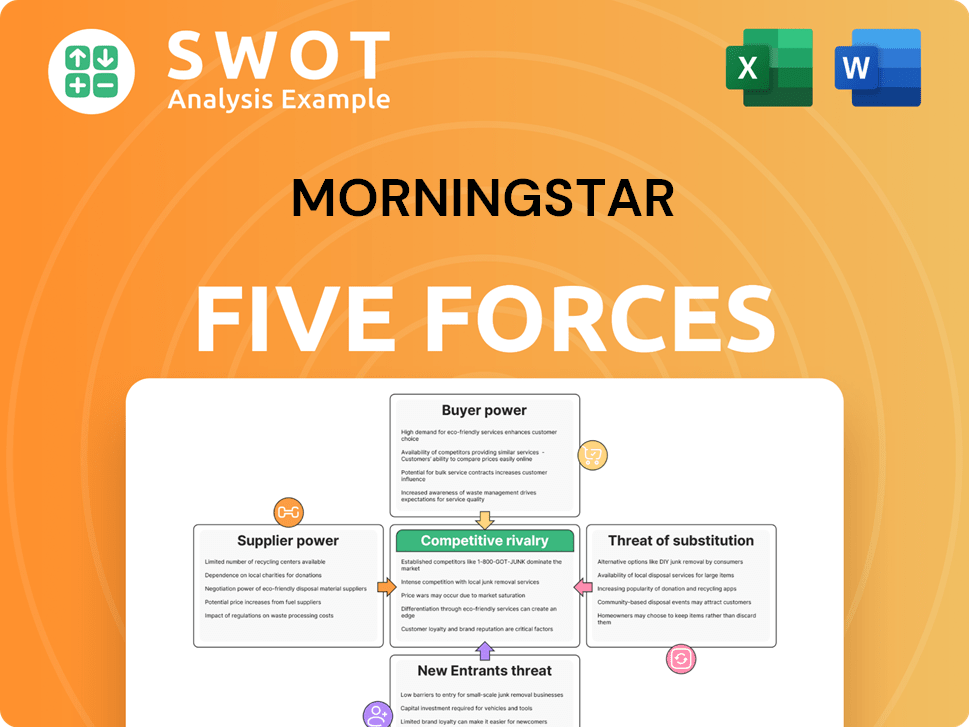

Morningstar Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Morningstar Company?

- What is Competitive Landscape of Morningstar Company?

- What is Growth Strategy and Future Prospects of Morningstar Company?

- How Does Morningstar Company Work?

- What is Sales and Marketing Strategy of Morningstar Company?

- What is Brief History of Morningstar Company?

- Who Owns Morningstar Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.