Neomobile Bundle

What Happened to Neomobile?

Ever heard of Neomobile, a pioneer in the early days of mobile commerce? Founded in 2007, this Italian company rapidly expanded to become a global force in digital entertainment and mobile payments. Explore the Neomobile SWOT Analysis to understand their strategic positioning.

This brief history of Neomobile explores its journey from a startup to a major player in mobile services. From its founding in Rome, Italy, Neomobile's expansion strategy focused on the burgeoning telecommunications and digital content markets. Understanding the Neomobile company evolution provides valuable insights into the challenges and opportunities within the mobile industry.

What is the Neomobile Founding Story?

The story of Neomobile begins in February 2007 in Rome, Italy. Founded by Gianluca D'Agostino and Claudio Rossi, the company quickly positioned itself in the rapidly evolving mobile market. Their vision was to capitalize on the growing demand for mobile services and digital content, establishing Neomobile as a key player in the telecommunications sector.

The founders saw an opportunity to facilitate mobile payments, content distribution, and user acquisition. This strategic focus helped Neomobile carve a niche in the market. The company's early business model was centered on enabling mobile monetization for digital media companies. This approach allowed them to connect merchants with mobile users globally, providing digital entertainment and direct carrier billing solutions.

This article explores the Growth Strategy of Neomobile, detailing its founding story and evolution.

Neomobile was established in February 2007 in Rome, Italy. Gianluca D'Agostino and Claudio Rossi were the founders, identifying opportunities in mobile payments and content distribution.

- Gianluca D'Agostino, an Electronics Engineer, brought extensive experience in telecommunications and tech.

- Claudio Rossi, a digital entrepreneur, was also a key figure in the company's early development.

- The initial business model focused on mobile monetization for digital media companies.

- Early funding included investments from MPS and Bluegem Capital Partners, totaling $13.5 million.

Gianluca D'Agostino, with a background spanning three decades in telecommunications and tech, brought significant expertise to the company. His experience included roles as a manager, entrepreneur, and investor. Prior to Neomobile, he was a key consultant in the mobile telco industry. Claudio Rossi, also a digital entrepreneur, advisor, and angel investor, played a crucial role in the company's early development.

Neomobile's core offering involved providing digital entertainment and direct carrier billing solutions. This enabled the company to connect merchants with mobile users worldwide. Early funding rounds saw investments from MPS and Bluegem Capital Partners. In 2008, MPS Venture 2 became a shareholder, and in 2009, they increased their investment. BlueGem L.P., a UK-based private equity fund, became a key shareholder in September 2009, replacing Teleunit S.p.A.

BlueGem, with a capital commitment of €205 million, aimed to support Neomobile's ambitious growth plan in the emerging mobile marketing industry. These investments were crucial in fueling Neomobile's expansion and establishing its presence in the mobile services market. The company's focus on mobile payments and digital content positioned it well for growth.

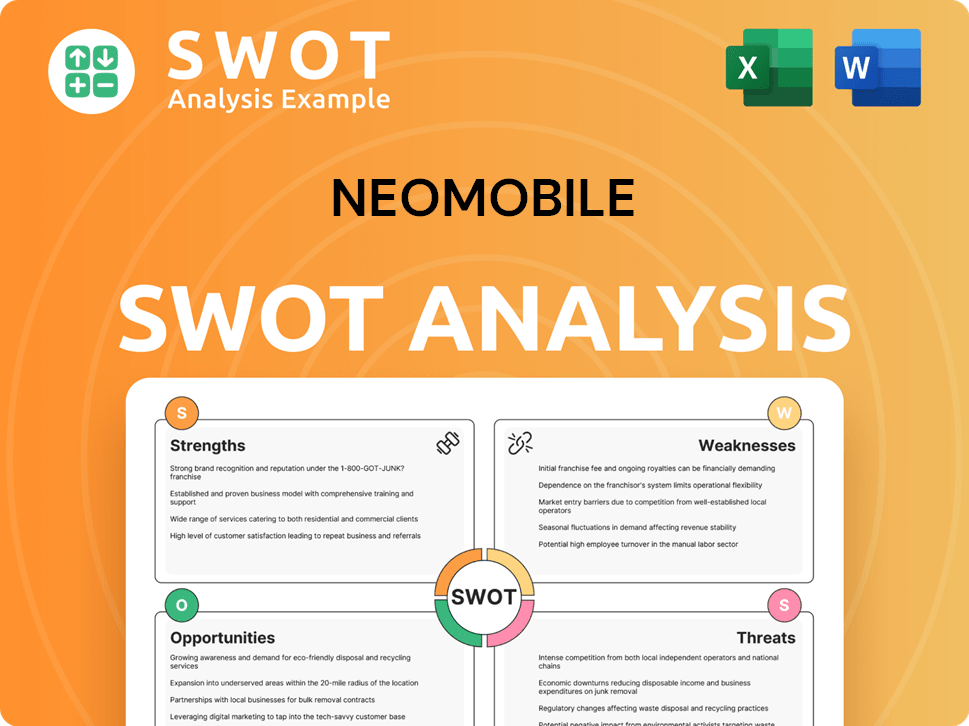

Neomobile SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Neomobile?

The early years of the Neomobile company saw rapid expansion, marked by significant revenue growth and strategic acquisitions. This period was crucial in establishing the company's presence in the mobile services sector. The company's focus on digital content and telecommunications helped it to quickly gain traction in the market.

During its early years, Neomobile experienced impressive growth. The company achieved a compound revenue growth exceeding 50% in the three years leading up to 2009. By 2008, gross revenue surpassed €80 million, demonstrating strong market reception and successful partnerships.

Neomobile quickly became a leading player in several key markets. It held the number one position in Italy as a direct-to-consumer (D2C) provider. The company also ranked among the top players in Spain, Turkey, and Brazil, solidifying its international presence in the mobile services industry.

Neomobile's expansion involved both geographical and business growth. The company established offices in 15 countries across the Mediterranean, Asia, and Latin America. A key strategic move was the acquisition of Arena Mobile, which significantly expanded its reach in the digital content market.

In 2009, with new shareholders, Neomobile announced an ambitious growth plan targeting the emerging mobile marketing industry. This included the launch of a dedicated business unit. The mobile marketing segment was projected to reach a market size of $20 billion by 2011, highlighting Neomobile's foresight.

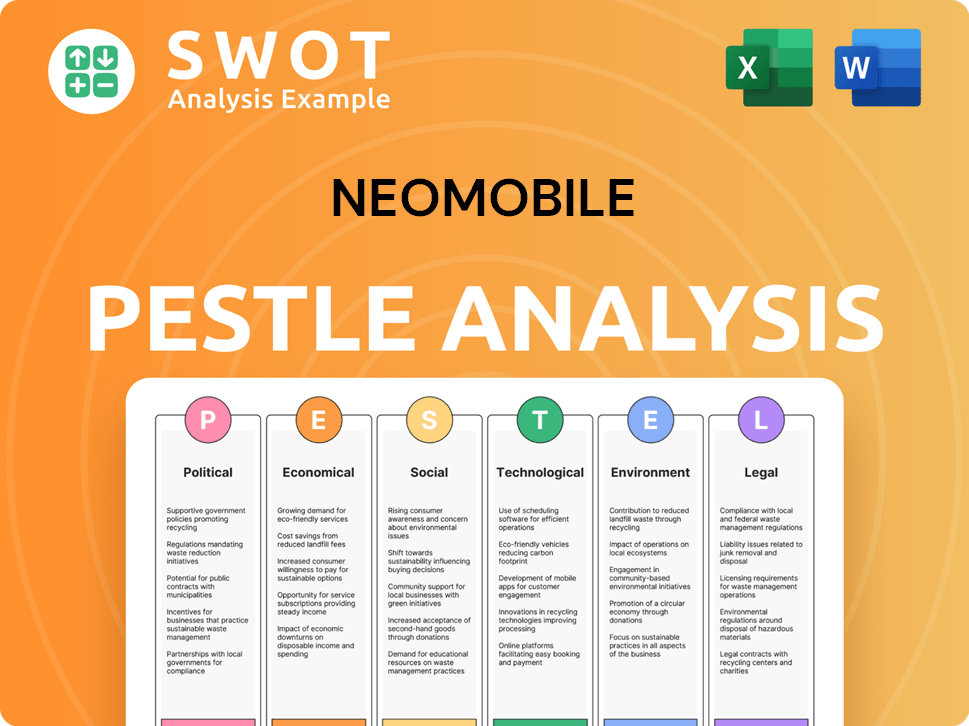

Neomobile PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Neomobile history?

The Neomobile company, a prominent player in the mobile services sector, achieved several key milestones throughout its operational history, significantly impacting the telecommunications and digital content industries. The Neomobile history is marked by strategic moves and expansions that shaped its trajectory in the mobile commerce arena. The company's evolution reflects its adaptability and ambition in a dynamic market.

| Year | Milestone |

|---|---|

| Early 2000s | Neomobile was founded, marking its entry into the mobile services market. |

| 2014 | The company reached a peak, becoming a leading mobile monetization platform and generating up to €120 million in revenue and €16 million in EBITDA. |

| 2016 | Neomobile sold Onebip, a mobile payment company, to DIMOCO, shifting its focus to digital entertainment and programmatic advertising. |

| 2020 | Neomobile ceased operations, ending its run in the mobile services industry. |

Neomobile was at the forefront of innovation in mobile commerce, particularly in direct carrier billing (DCB). A significant innovation was the development of Onebip, a mobile payment solution for apps, games, and social networks. This strategic move allowed Neomobile to focus on digital entertainment and programmatic advertising.

Creation and growth of Onebip, a mobile payment company, which was later sold. This innovation focused on DCB for apps, games, and social networks, expanding Neomobile's reach. This strategic move allowed Neomobile to focus more on its main business of digital entertainment and programmatic advertising.

Providing DCB solutions for content distribution and user acquisition. This enabled seamless transactions for mobile users. This also strengthened its partnership with DIMOCO, the acquirer of Onebip, to expand in Europe and Latin America.

Forming partnerships to enhance mobile services and expand market presence. These collaborations were key to Neomobile's growth. Neomobile expanded its leadership from Europe to overseas markets, including Brazil, Mexico, Colombia, and India.

Despite its successes, Neomobile faced challenges, including fluctuating revenues and increasing competition. The company's revenue declined significantly in the years leading up to its closure, reflecting market pressures.

Neomobile experienced significant revenue declines, with a 38% drop in 2016, 21% in 2017, 12% in 2018, and a substantial 60% in 2019. These fluctuations indicate market challenges or internal issues.

Competition from companies such as Amirsoft, Orckestra, and BigCommerce increased, affecting Neomobile's market position. The mobile services market became increasingly competitive, impacting Neomobile's ability to maintain its market share.

The sale of Onebip, while allowing a focus on digital entertainment, also marked a shift away from mobile payments. This strategic change altered the company's core business focus and long-term strategy. For more in-depth details, explore the Revenue Streams & Business Model of Neomobile.

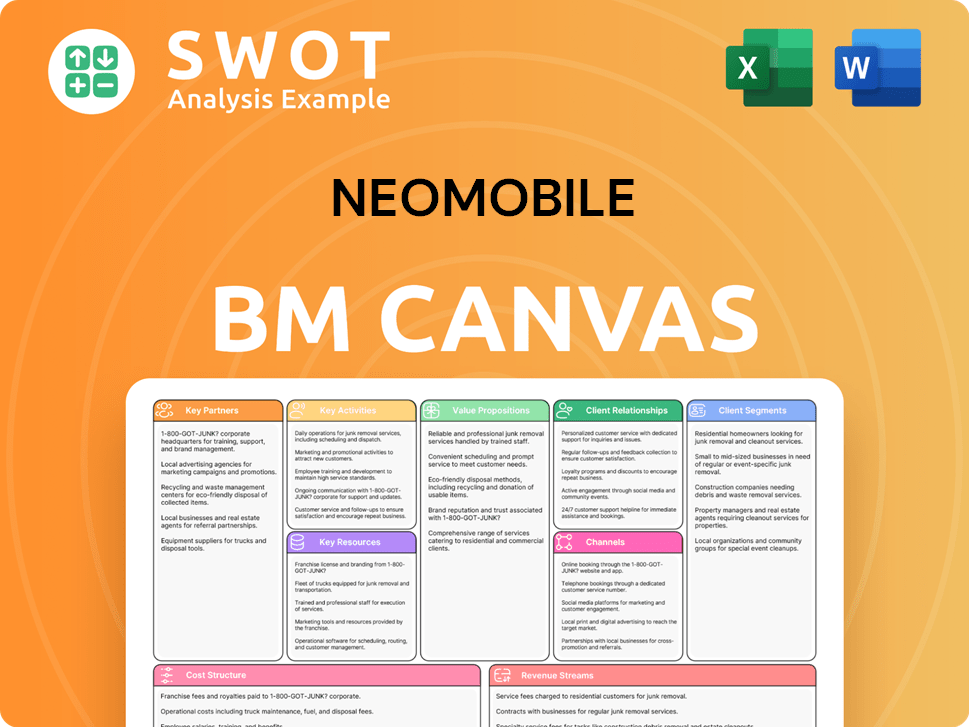

Neomobile Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Neomobile?

The Neomobile company journey, though concluded in 2020, left a mark on the mobile services and digital content sectors. Founded in Rome, Italy, Neomobile quickly became a significant player in mobile entertainment and payment solutions. Its expansion and strategic moves, including acquisitions and market entries, shaped its trajectory within the telecommunications industry.

| Year | Key Event |

|---|---|

| 2007 | Neomobile S.p.A. was founded in Rome, Italy, by Gianluca D'Agostino and Claudio Rossi. |

| October 2008 | The company secured its first funding round, raising $13.5 million. |

| 2008 | Neomobile generated over €80 million in gross revenue. |

| September 2009 | BlueGem L.P. and MPS Venture 2 became the controlling shareholders, replacing Teleunit S.p.A. |

| 2009 | Neomobile acquired the Spanish group Arena Mobile. |

| 2009 | The company was ranked as a global leader in the mobile entertainment industry, operating in 15 countries. |

| 2014 | Neomobile achieved up to €120 million in revenue and €16 million in EBITDA. |

| May 2016 | Onebip, its mobile payment company, was sold to DIMOCO. |

| 2020 | Neomobile ceased its operations. |

Neomobile's focus on mobile monetization remains highly relevant. The app-driven economy continues to grow, with mobile advertising revenue worldwide expected to reach over $360 billion by 2027. This shows the continued importance of the company's original vision. The demand for mobile content and services is still strong, highlighting the potential for similar business models.

The digital entertainment industry is rapidly evolving. The global video streaming market is projected to reach $596.8 billion by 2030, demonstrating the increasing consumption of digital content. Neomobile's historical focus on digital content distribution aligns with these trends. This growth underscores the continued demand for mobile entertainment services.

The mobile payment sector has seen significant advancements. The global mobile payment market is expected to reach $16.6 trillion by 2028. Neomobile's early involvement in mobile payments via Onebip reflects this trend. The continued expansion of mobile payment technologies presents opportunities for businesses.

Neomobile's expansion into emerging markets like Brazil and Mexico highlighted the potential of these regions. The increasing smartphone penetration in these areas continues to drive demand for mobile services. These markets offer significant opportunities for businesses. They provide a large consumer base for digital content and mobile services.

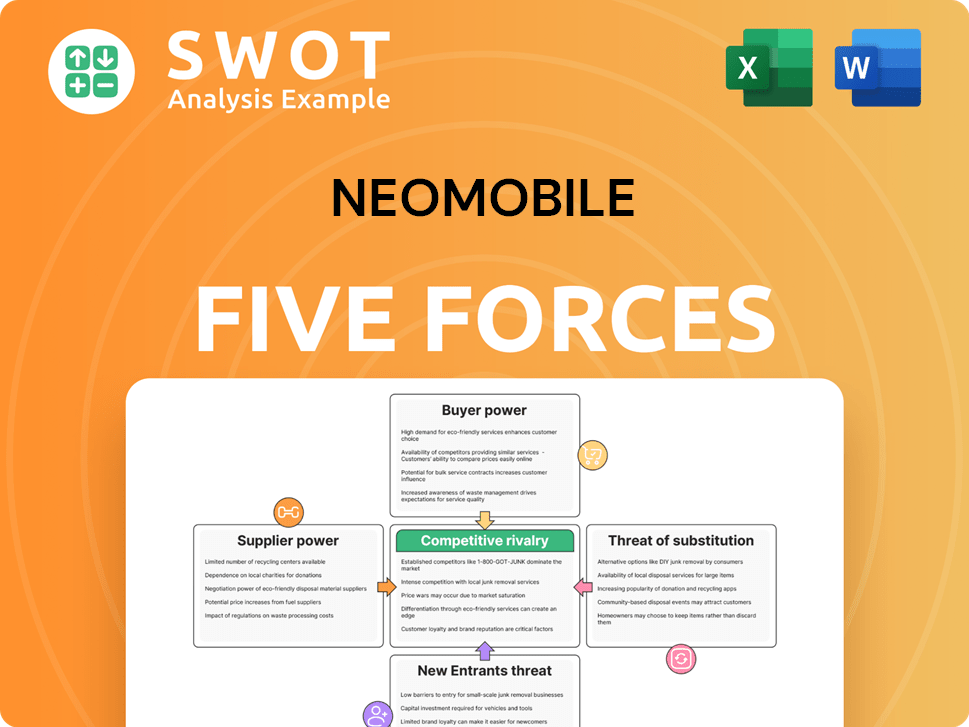

Neomobile Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Neomobile Company?

- What is Growth Strategy and Future Prospects of Neomobile Company?

- How Does Neomobile Company Work?

- What is Sales and Marketing Strategy of Neomobile Company?

- What is Brief History of Neomobile Company?

- Who Owns Neomobile Company?

- What is Customer Demographics and Target Market of Neomobile Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.