Neomobile Bundle

How Did Neomobile Conquer the Mobile World?

Ever wondered how a company could thrive in the early days of mobile commerce? Neomobile, a pioneer in the mobile services sector, once connected millions with digital entertainment and payment solutions. From its Italian roots, the Neomobile SWOT Analysis reveals the strategies that fueled its rise to prominence across Europe and beyond. This deep dive explores the inner workings of Neomobile, a key player in the telecommunications industry.

By examining Neomobile's history, we can understand the evolution of digital payments and the mobile industry. Its business model offers valuable lessons for today's entrepreneurs and investors. Learn how Neomobile company leveraged partnerships and technology to capture a significant share of the global market, providing insights into the challenges and opportunities within the mobile content and digital entertainment landscapes.

What Are the Key Operations Driving Neomobile’s Success?

The core operations of the Neomobile company centered on mobile commerce, specializing in digital entertainment and direct carrier billing. The company's value proposition lay in connecting merchants with mobile users worldwide, offering solutions for mobile payments, content distribution, and user acquisition. This approach allowed Neomobile to facilitate transactions and content delivery directly to consumers, leveraging the convenience of mobile devices.

Its primary offerings included HTML5 games, video streaming, mobile web apps, consumer cloud services, and social networking services, all delivered directly to consumers (D2C) and paid for via carrier billing. This model streamlined the payment process, making it easy for users to access and pay for digital content through their mobile carrier accounts. This direct-to-consumer strategy, combined with carrier billing, provided a seamless experience, especially in regions with lower credit card penetration.

Operationally, Neomobile functioned as a digital media expert, focusing on mobile internet traffic. They managed media buying, content creation, and brand optimization to drive business results. Through the integration of various media inventories and continuous data analysis, Neomobile designed and managed mobile portals that marketed both their own products and those of their partners. This sophisticated operational process involved technology development for content delivery and payment, strategic partnerships with mobile network operators, and robust marketing and sales channels.

Direct carrier billing was a key component of how Neomobile worked, simplifying payments by allowing users to charge purchases to their phone bills. This method was particularly effective in markets with limited credit card usage, broadening the accessibility of digital content. Carrier billing also provided a secure and convenient payment option, enhancing the user experience.

The company's ability to partner with leading mobile operators globally, such as Vodafone, Telefonica, and others, enabled a wide distribution network. These partnerships were crucial for expanding its reach and offering its services to a vast audience. These collaborations were essential for Neomobile to successfully operate and provide its services worldwide.

The company offered a diverse range of digital content and services, including games, video streaming, and mobile web apps. This variety catered to different consumer preferences, driving user engagement and revenue. The D2C model allowed Neomobile to directly control the distribution and monetization of its content.

Effective marketing and user acquisition strategies were vital for Neomobile. They managed media buying, content creation, and brand optimization to attract users. This involved continuous data analysis to refine marketing efforts and maximize the reach of their services. For more information on the target market, you can check out Target Market of Neomobile.

The operational success of Neomobile hinged on several key factors, including strategic partnerships, efficient payment processing, and a robust content delivery network. These elements worked together to provide a seamless user experience and facilitate the distribution of digital content globally. The company's focus on direct carrier billing and D2C distribution was a significant differentiator.

- Direct-to-Consumer (D2C) Approach: Enabled direct content delivery and monetization.

- Direct Carrier Billing: Simplified payments, increasing accessibility.

- Global Partnerships: Extended reach and distribution capabilities.

- Content Variety: Offered a wide range of digital products.

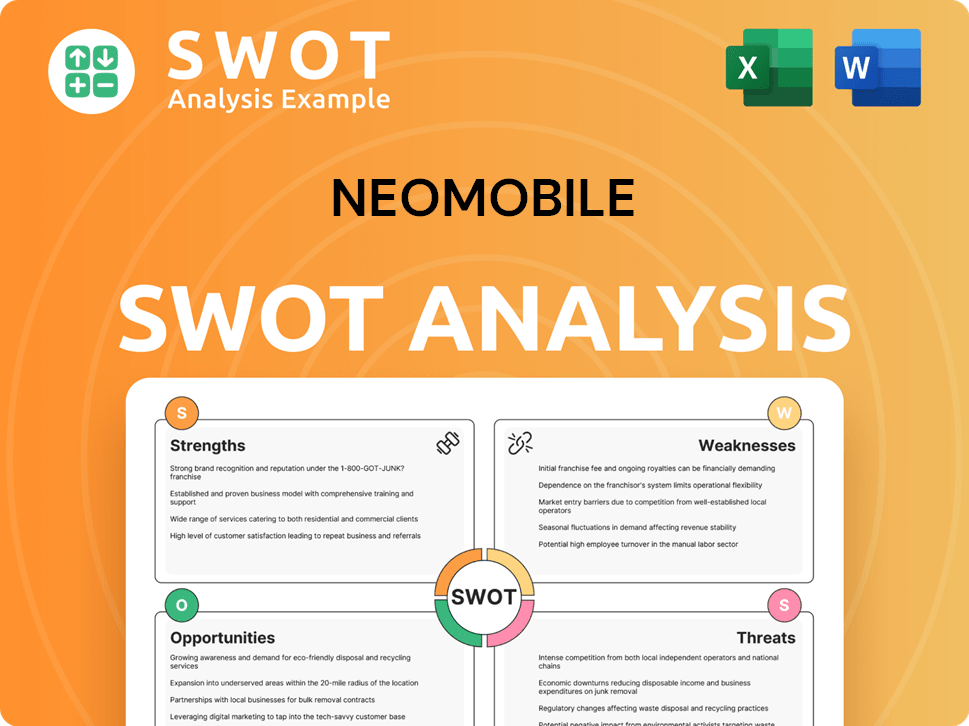

Neomobile SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Neomobile Make Money?

Understanding the revenue streams and monetization strategies of the Neomobile company provides insight into its operational dynamics. The company, which focused on mobile services, primarily generated revenue through mobile commerce, particularly in digital entertainment, and by utilizing direct carrier billing.

The business model of Neomobile was centered around direct-to-consumer (D2C) products, with payments facilitated through carrier billing, which were advertised on mobile platforms. While the company ceased operations in 2020, historical data indicates its capacity to generate substantial revenue.

The monetization strategies of Neomobile heavily relied on direct carrier billing, which allowed users to charge in-app purchases directly to their phone bills or prepaid balances. This method was especially effective for digital content like HTML5 games, video streaming, and mobile web apps. The company's approach included a mobile premium ad network, NeoPowerAd, to generate revenue for publishers and enhance campaign performance for advertisers.

Direct carrier billing was a key component of Neomobile’s monetization strategy. This method allowed users to easily purchase digital content.

Neomobile operated NeoPowerAd, a mobile premium ad network that generated revenue for publishers and enhanced campaign performance for advertisers.

The company focused on performance marketing, managing media buying, content creation, and brand optimization to drive business results.

In 2008, Neomobile generated over €80 million in gross revenue. By 2014, the company's revenue reached up to €120 million.

The global direct carrier billing market was valued at $52.67 billion in 2024 and is projected to reach $60.45 billion in 2025.

The global direct carrier billing market is estimated to reach $103.6 billion by 2029, with a CAGR of 14.4%.

The company's approach to revenue generation involved both direct consumer payments and advertising revenue. The company's historical performance, combined with the growth of the direct carrier billing market, highlights its strategic focus on digital payments and telecommunications. For more details, explore the Brief History of Neomobile.

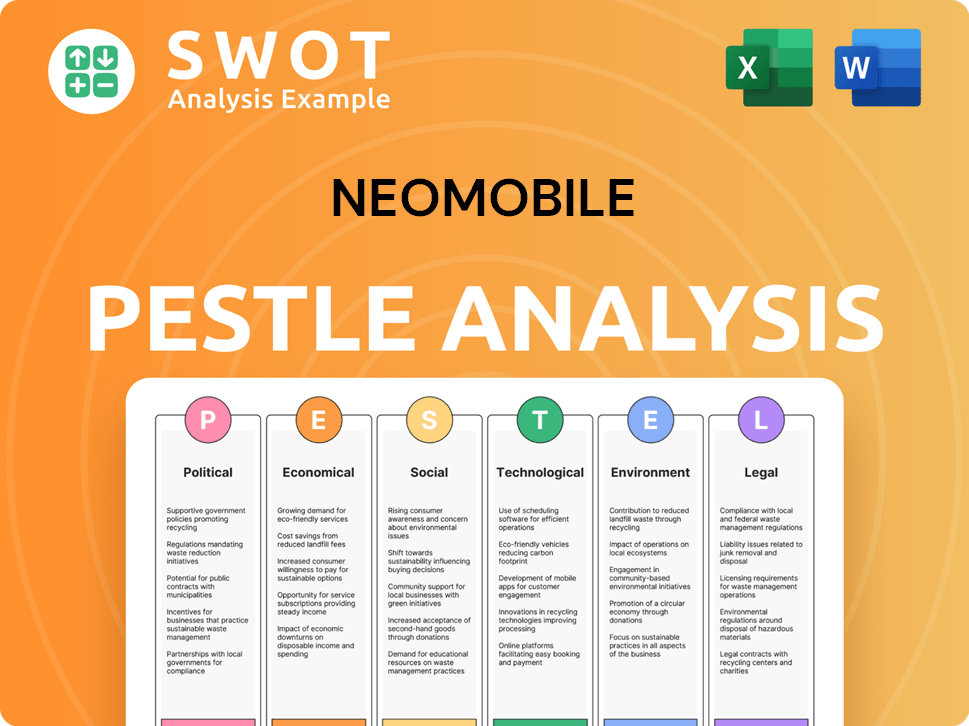

Neomobile PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Neomobile’s Business Model?

Founded in 2007, the Neomobile company quickly became a notable player in the mobile commerce and digital entertainment sectors. The company's journey involved strategic acquisitions and partnerships that allowed it to expand its reach and services. By leveraging direct carrier billing, the company aimed to simplify digital payments, particularly in regions with low credit card penetration.

The company's strategic moves and focus on mobile services helped it to establish a strong market position. By 2014, the company's revenue had reached €120 million. The company ceased operations in 2020, but its impact on the mobile industry remains a point of interest.

The company's approach to mobile monetization and its expertise in digital media and mobile internet traffic were key to its success. The company's performance marketing strategies, including media buying and content creation, further solidified its market position.

In 2008, the company generated over €80 million in gross revenue. The acquisition of Arena Mobile in 2008 expanded its geographic and business footprint. By 2014, the company's revenue reached €120 million.

The acquisition of Arena Mobile was a key strategic move, expanding its reach. The company focused on direct carrier billing to simplify payments. It also leveraged digital media and mobile internet traffic for marketing.

Its expertise in direct carrier billing provided a simplified payment method. This was particularly beneficial in regions with low credit card penetration. The company's performance marketing approach further solidified its market position.

The digital media and entertainment market was valued at US$ 363,308.3 million in 2024. The mobile commerce market is projected to reach $2.07 trillion in 2024. The direct carrier billing market has a CAGR of 14.8% from 2024 to 2025.

The company's business model centered around mobile services, digital payments, and telecommunications. It used direct carrier billing to facilitate transactions. The company also designed and managed mobile portals to market its products.

- Direct Carrier Billing: Simplified payment for digital content.

- Digital Media: Designed and managed mobile portals.

- Performance Marketing: Media buying, content creation, and brand optimization.

- Partnerships: Collaborated with mobile operators.

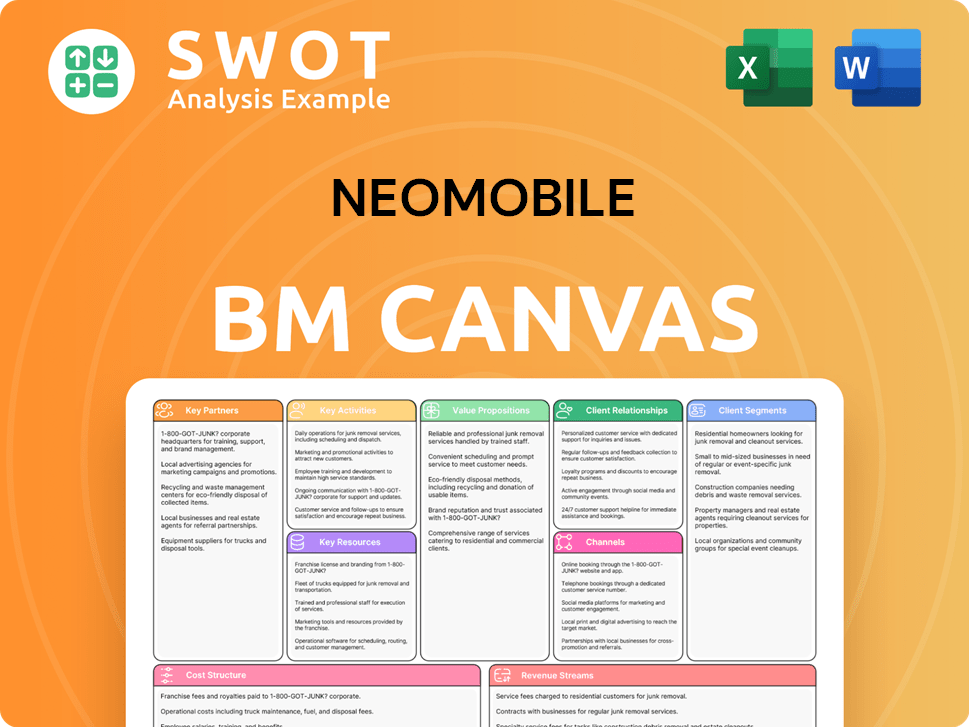

Neomobile Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Neomobile Positioning Itself for Continued Success?

During its operational years, the Neomobile company held a strong industry position as a mobile commerce company specializing in digital entertainment and direct carrier billing. It was a key player in several markets, partnering with leading mobile operators globally. However, the company ceased operations in 2020, highlighting the volatile nature of the mobile services and digital payments industries.

The Neomobile company faced challenges due to rapid technological advancements, evolving consumer preferences, and intense competition. The mobile commerce market is expected to reach $2.07 trillion in 2024, and the direct carrier billing market is growing from $52.67 billion in 2024 to an estimated $60.45 billion in 2025. The dynamic market conditions presented risks such as technological disruption, new competitors, and changing consumer behaviors.

Neomobile was a leading player in the mobile commerce sector, particularly in direct-to-consumer (D2C) digital entertainment. It held the number one position in Italy and was among the top players in Spain, Turkey, and Brazil. The company's success was built on partnerships with major mobile operators, ensuring a broad market reach.

Key risks included rapid technological changes, new competitors, and changing consumer habits. Regulatory changes in financial technology and mobile payments also posed a threat. The company's operational shortcomings or technical issues could also negatively impact customer trust and lead to loss of business partners.

The broader digital media and mobile commerce sectors are focusing on personalization, contactless payments, and expansion into IoT and smart devices. Enhancing user experience and financial inclusion through simplified payment methods remains a key driver for growth in the direct carrier billing market. For more information, see Competitors Landscape of Neomobile.

The mobile commerce market's growth is driven by increasing mobile device usage and demand for convenient payment methods. The online entertainment market is projected to reach USD 261.23 billion by 2032. The direct carrier billing market is experiencing rapid expansion, reflecting the ongoing demand for mobile payment solutions.

The Neomobile company faced challenges related to technological disruption and evolving consumer behavior. Despite its closure, the trends it operated within continue to shape the industry, with a focus on enhanced user experience and financial inclusion.

- Technological advancements in payment solutions.

- Changing consumer preferences regarding content consumption.

- Increased regulatory oversight in financial technology.

- The rise of new competitors and market entrants.

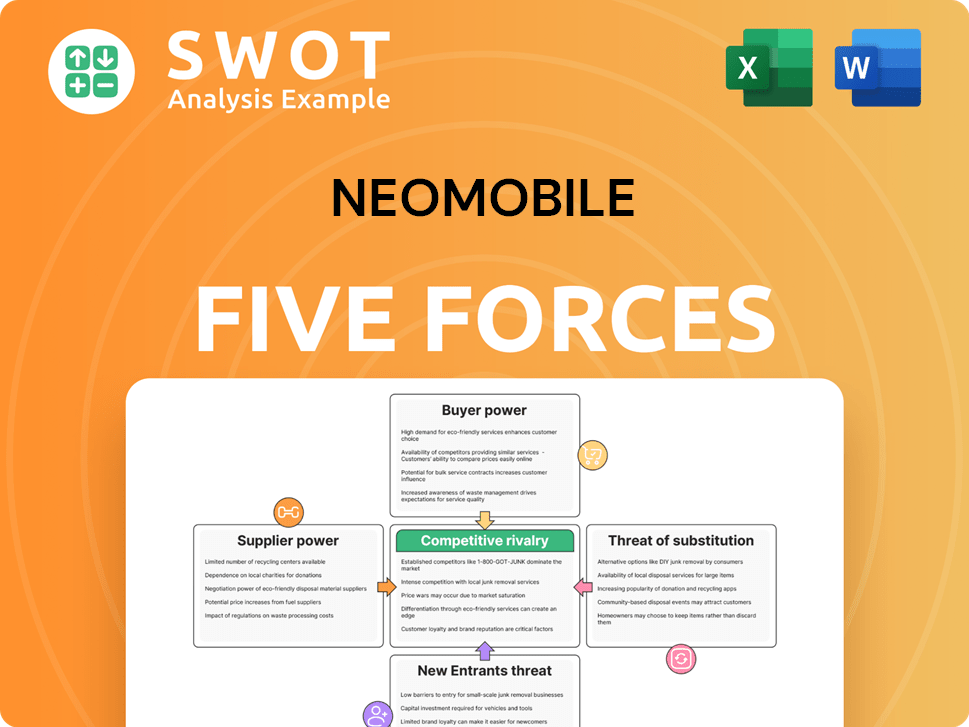

Neomobile Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Neomobile Company?

- What is Competitive Landscape of Neomobile Company?

- What is Growth Strategy and Future Prospects of Neomobile Company?

- What is Sales and Marketing Strategy of Neomobile Company?

- What is Brief History of Neomobile Company?

- Who Owns Neomobile Company?

- What is Customer Demographics and Target Market of Neomobile Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.