Neomobile Bundle

How Did Neomobile Navigate the Mobile Commerce Battlefield?

The mobile payments industry has always been a dynamic arena, with digital content providers and mobile technology trends constantly reshaping the competitive landscape. Neomobile S.p.A., a pioneer in mobile commerce, once stood as a formidable force, specializing in digital entertainment and direct carrier billing. Understanding Neomobile's journey offers crucial insights into the strategies that define success and failure in this rapidly evolving market.

This exploration of the Neomobile SWOT Analysis will dissect the company's market position, identifying its key competitors and competitive advantages within the mobile payments industry. We'll examine Neomobile's business model overview, its growth strategy, and its response to industry challenges, providing a comprehensive Neomobile market analysis. Uncover how Neomobile's geographical presence and key partnerships shaped its trajectory in the mobile commerce sector, and analyze the company's financial performance.

Where Does Neomobile’ Stand in the Current Market?

During its operational years, Neomobile established a strong market position within the mobile commerce and digital entertainment sectors. The company was a leading direct-to-consumer (D2C) player in Italy and held a significant presence in Spain, Turkey, and Brazil. Neomobile's core operations focused on mobile payments, content distribution, and user acquisition, connecting merchants with mobile users globally.

Neomobile's business model included a strong B2B segment, offering content and technology solutions to network operators and media companies. The company's geographic footprint was extensive, with offices in 15 countries across the Mediterranean region, Asia, and Latin America. This global presence allowed Neomobile to tap into diverse markets and leverage local expertise to drive growth. To understand the company's journey, one can refer to the Brief History of Neomobile.

The company's value proposition revolved around providing seamless mobile payment solutions and engaging digital content to users, while also offering robust technology platforms for businesses. Neomobile's strategic positioning, combined with its strong partnerships with major mobile operators like Vodafone, Telefonica, and Telecom Italia, enabled it to generate substantial revenue and achieve significant market share in the mobile payments industry.

Neomobile was a leading player in mobile commerce and digital entertainment. It was recognized as the leading D2C player in Italy and held a significant presence in Spain, Turkey, and Brazil. The company focused on mobile payments, content distribution, and user acquisition.

Neomobile's offerings included mobile payments, content distribution, and user acquisition services. It provided technology solutions to network operators and media companies. The company's acquisition of Onebip expanded its payment capabilities.

In 2008, Neomobile generated over €80 million in gross revenue. By 2014, revenue reached €120 million with an EBITDA of €16 million. These figures highlight the company's strong financial health and growth trajectory.

Neomobile had offices in 15 countries across the Mediterranean region, Asia, and Latin America. This broad geographic footprint allowed the company to serve a global customer base and adapt to local market dynamics.

The direct carrier billing (DCB) market continues to grow rapidly. The global market size was valued at $52.67 billion in 2024. It is projected to reach $60.45 billion in 2025, with a compound annual growth rate (CAGR) of 14.8%.

- The DCB market is expected to reach $103.6 billion by 2029, with a CAGR of 14.4%.

- North America was the largest region in the DCB market in 2024.

- Asia-Pacific is expected to be the fastest-growing region during the forecast period.

- The mobile commerce market is also experiencing growth, with sales projected to reach $2.07 trillion in 2024.

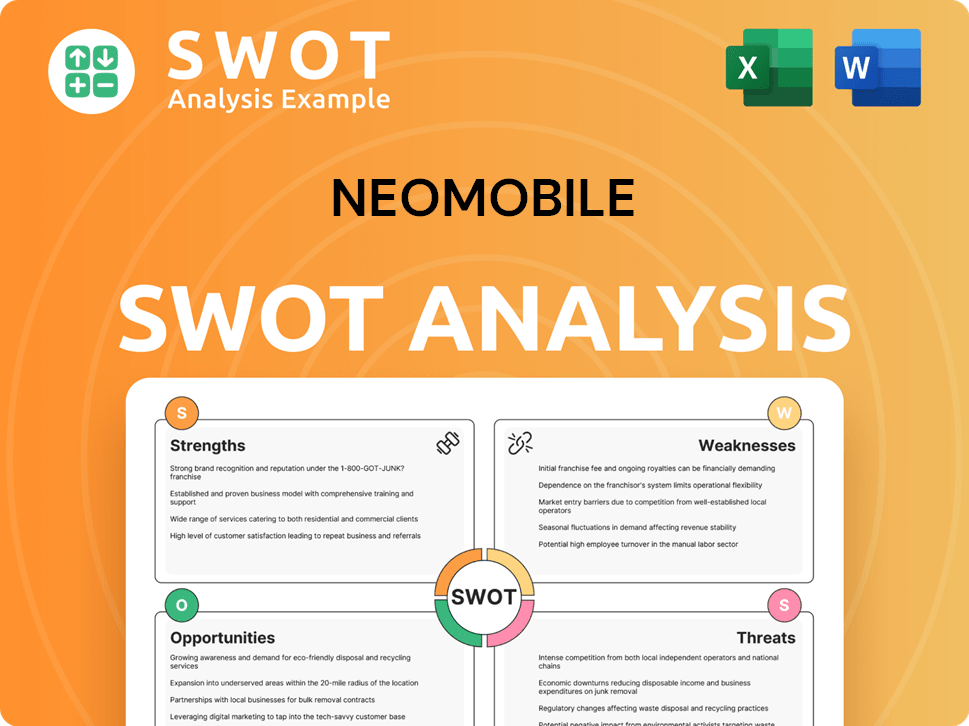

Neomobile SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Neomobile?

Analyzing the Neomobile competitive landscape requires understanding its position within the mobile commerce sector, particularly in digital entertainment and direct carrier billing. Although Neomobile ceased operations in 2020, its historical context offers valuable insights into its market dynamics and competitive pressures.

The company faced a complex environment, dealing with both direct and indirect Neomobile competitors. The mobile payments industry was, and still is, characterized by rapid technological advancements and evolving consumer behavior. Understanding these elements is crucial for any market analysis.

According to Owler, the primary competitors of Neomobile S.p.A. included Amirsoft, Orckestra, and BigCommerce. Payby.me was also a notable competitor, specializing in payment solutions for games, social networks, and digital goods sellers. The company's business model was centered around direct carrier billing, which provided convenient payment options for digital content.

Direct competitors offered similar services, such as direct carrier billing and digital content distribution. These companies directly challenged Neomobile's market share.

Indirect competitors included companies providing alternative payment solutions or digital content platforms. These companies competed for the same consumer spending.

The mobile payments industry is dynamic, with constant changes in technology, consumer preferences, and regulatory environments. These factors significantly impact the competitive landscape.

Technological advancements, such as the rise of smartphones and mobile internet, have fueled the growth of the mobile payments sector. These changes have driven innovation in the industry.

Consumer behavior is a key factor, with increasing demand for convenient and secure payment methods. This has led to greater adoption of mobile payment solutions.

The regulatory environment plays a vital role, with regulations impacting how companies operate and compete. Compliance is essential for all market participants.

The broader mobile monetization and direct carrier billing market, where Neomobile operated, includes many players. As of April 2025, the market has 82 active competitors, with 15 funded and 17 that have exited. Top competitors include Integral Ad Science, Singular, and Flurry. These companies offer various solutions for mobile monetization and advertising, challenging players through innovation in technology and pricing strategies. The direct carrier billing market continues to see growth driven by increasing smartphone penetration and demand for convenient billing solutions. For example, Vodafone Group partnered with a fintech startup in August 2024 to improve its DCB solutions in Europe, and Google expanded DCB options on the Google Play Store in Asia in September 2024, showing ongoing competitive dynamics. You can learn more about the Growth Strategy of Neomobile.

The mobile payments industry faces several trends and challenges. These include the rise of new technologies, changing consumer preferences, and regulatory changes.

- Mobile Technology Trends: The continuous evolution of mobile technology, including 5G and the Internet of Things (IoT), is creating new opportunities and challenges for mobile payments.

- Digital Content Providers: Digital content providers, such as streaming services and gaming platforms, are increasingly relying on mobile payment solutions to reach a wider audience.

- Market Consolidation: Mergers and acquisitions are common in the mobile payments industry, leading to market consolidation and increased competition.

- Security Concerns: Security is a major concern, with companies investing heavily in fraud detection and prevention measures.

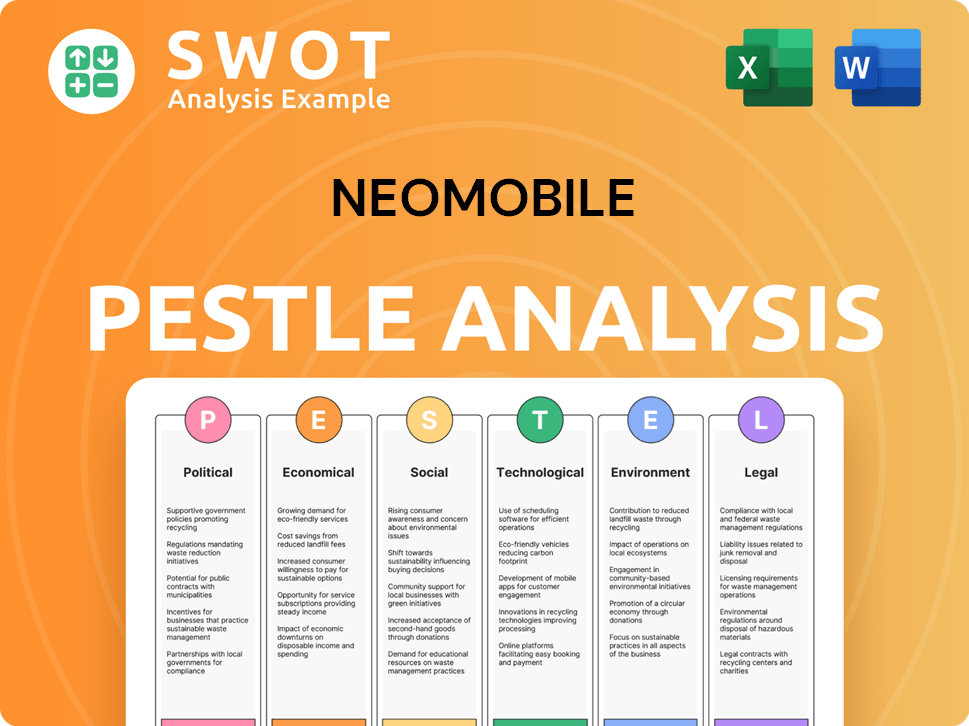

Neomobile PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Neomobile a Competitive Edge Over Its Rivals?

The competitive landscape for companies like Neomobile is dynamic, shaped by constant innovation and shifting market demands. Analyzing the competitive advantages of such firms provides valuable insights into their strategies and market positioning. Understanding these elements helps assess their ability to succeed in the mobile commerce and digital entertainment sectors. This analysis is crucial for anyone studying the mobile payments industry and digital content providers.

Neomobile leveraged several key strengths to differentiate itself in the market. These included a strong presence in key regions, extensive partnerships with mobile operators, and expertise in mobile marketing and technology. These factors contributed to its ability to compete effectively and generate substantial revenue. A detailed look at these advantages is essential for understanding the company's strategic approach and market impact.

Neomobile's success was also influenced by its ability to adapt to mobile technology trends and its focus on mobile monetization. The company's ability to design, develop, market, and distribute digital content and interactive services was a significant advantage. This specialized approach allowed Neomobile to carve out a niche in the competitive mobile market. For more information on the company's structure, see Owners & Shareholders of Neomobile.

Neomobile held a leading position in Italy and was a major player in Spain, Turkey, and Brazil. This strong regional presence gave the company valuable market insights and operational experience. This geographical advantage was crucial for understanding local market dynamics and consumer preferences.

The company's partnerships with leading mobile operators globally were a significant advantage. These partnerships facilitated content distribution and direct carrier billing, enabling Neomobile to reach a broad mobile user base. Collaborations with operators like Vodafone and Telefonica were key to its success.

Neomobile had a team of around 200 professionals focused on mobile marketing and technology. This expertise enabled the company to design, develop, market, and distribute digital content and interactive services. This specialized approach was critical for staying ahead in the mobile market.

The company focused on mobile monetization for digital media companies, content producers, and publishers. This specialized approach to the market allowed Neomobile to effectively monetize digital products, services, and traffic. This focus was a key differentiator in the competitive landscape.

Neomobile's competitive advantages included its established market presence, extensive operator partnerships, and expertise in mobile marketing. The acquisition of Arena Mobile in 2008 expanded its footprint, strengthening its market position. These factors allowed the company to generate significant revenue, reaching €120 million in 2014.

- Established Market Presence: Leading D2C player in Italy and top contender in key markets.

- Strategic Partnerships: Collaborations with major mobile operators for content distribution.

- Mobile Monetization Platform: Specialized platform for monetizing digital products and services.

- Technological Expertise: Strong capabilities in mobile payments through Onebip.

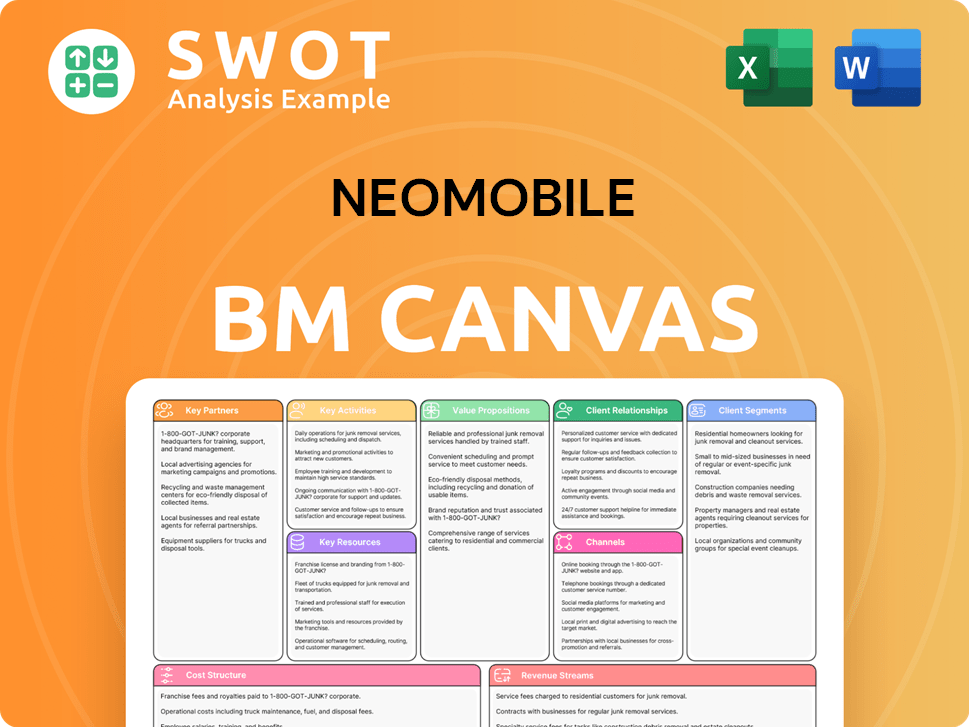

Neomobile Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Neomobile’s Competitive Landscape?

The mobile commerce and digital entertainment sectors, where Neomobile once operated, are currently shaped by rapid growth and technological advancements. A detailed Neomobile market analysis reveals the sector's dynamic nature, with opportunities and challenges driven by evolving consumer behaviors and technological shifts. Understanding the Neomobile competitive landscape is crucial for any analysis of the company's past and future prospects.

The industry faces risks such as market saturation and regulatory changes, particularly concerning data privacy and advertising. Despite these challenges, the sector offers substantial opportunities for companies that can adapt and innovate. The Neomobile competitors must navigate these trends to maintain a competitive edge.

The mobile payments industry is experiencing significant expansion, with global mobile commerce sales projected to reach $2.07 trillion in 2024. The increasing number of smartphone users, expected to reach almost 5 billion in 2024, fuels this growth. Direct carrier billing (DCB) is also growing, with a market size valued at over $45 billion in 2024.

Conversion rates on mobile devices remain lower than on desktops, requiring optimization of the mobile purchasing journey. The proliferation of streaming services leads to market saturation, making it harder to increase revenue per subscription. Regulatory changes and mobile fraud also pose significant challenges for digital content providers.

Companies can enhance mobile app experiences and leverage AI for personalized content and marketing. Strategic partnerships with telecom operators and digital service providers are crucial. Expansion into emerging markets with high mobile adoption and lower traditional banking penetration presents further opportunities for growth.

Advancements in AI and immersive experiences (AR/VR/XR) are transforming content creation, distribution, and monetization. Generative AI is being used for scriptwriting and marketing optimization. AR/VR/XR technologies aim to enhance customer engagement, creating new product innovations.

To thrive, companies should focus on mobile-first strategies and innovative monetization models. Adaptation is key to overcoming challenges and seizing opportunities in the evolving mobile technology trends landscape. Understanding Neomobile's strengths and weaknesses within this context is essential for strategic planning.

- Prioritize mobile app optimization for enhanced user experience and higher conversion rates.

- Explore AI-driven personalization to improve content recommendations and marketing effectiveness.

- Forge strategic partnerships with telecom operators and digital service providers.

- Expand into emerging markets with high mobile adoption rates and DCB potential.

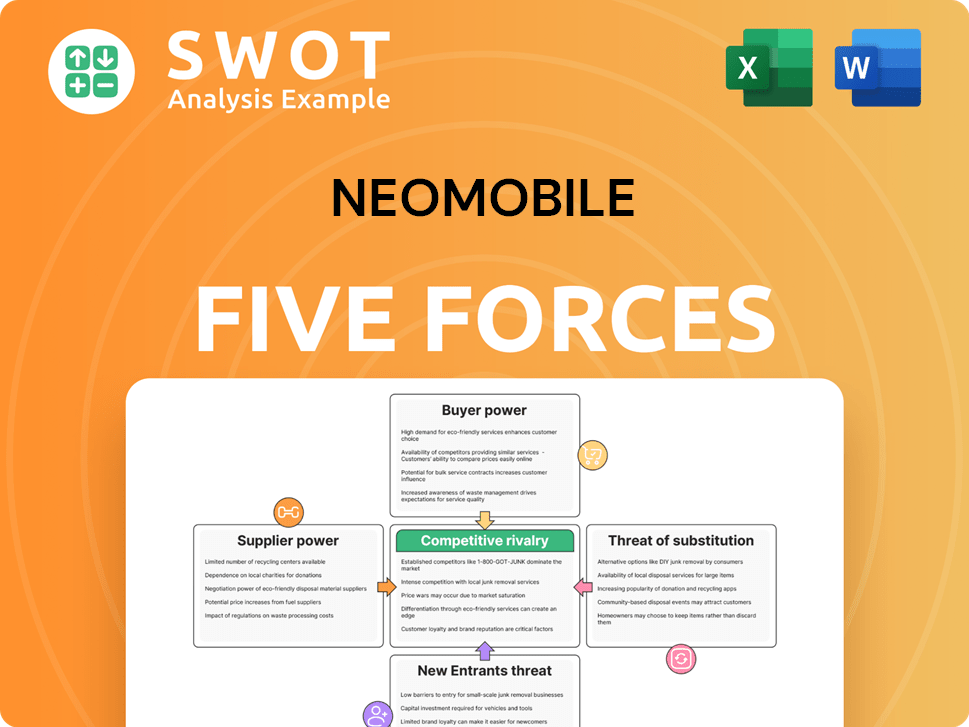

Neomobile Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Neomobile Company?

- What is Growth Strategy and Future Prospects of Neomobile Company?

- How Does Neomobile Company Work?

- What is Sales and Marketing Strategy of Neomobile Company?

- What is Brief History of Neomobile Company?

- Who Owns Neomobile Company?

- What is Customer Demographics and Target Market of Neomobile Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.