Neomobile Bundle

What Happened to Neomobile's Sales and Marketing?

Neomobile S.p.A., a pioneer in mobile commerce, once envisioned a global network connecting merchants with mobile users. This company, founded in 2004, navigated the dynamic landscape of digital entertainment and direct carrier billing. Understanding their Neomobile SWOT Analysis can provide valuable insights into their strategic decisions.

This exploration into Neomobile's sales and marketing strategies offers a crucial look at how a company adapted to the evolving mobile ecosystem. By examining their Neomobile sales strategy and Neomobile marketing strategy, we can understand the challenges and opportunities in the digital space. The analysis will also touch upon their Neomobile business plan, providing a comprehensive view of their approach to the market.

How Does Neomobile Reach Its Customers?

The core of the company's sales strategy revolved around its business-to-business (B2B) model. As an enabler of mobile commerce, it didn't directly engage with consumers. Instead, its primary focus was on forging relationships with merchants, content providers, and mobile network operators (MNOs). This approach was essential for integrating its direct carrier billing solutions and content distribution platforms.

The company's sales channels were primarily driven by direct sales teams. These teams were responsible for establishing strategic partnerships and negotiating agreements. Their efforts were crucial for integrating the company's services into the infrastructure of mobile operators and content providers. The success of these channels was directly linked to the adoption of direct carrier billing and the overall growth of the mobile content market.

The evolution of these channels likely mirrored the growth of the mobile internet and the increasing demand for digital content. Initially, the focus would have been on securing agreements with mobile operators to integrate direct carrier billing as a viable payment option for their subscribers. As the digital content market expanded, the company would have then targeted content providers (e.g., gaming companies, music streaming services) to offer them a platform for monetizing their offerings through mobile payments. Key partnerships with telecommunication companies were crucial, as these collaborations provided the necessary infrastructure and user base for the company’s services to function and scale.

Direct sales teams formed the backbone of the company's sales strategy. These teams were tasked with building and maintaining relationships with key partners. Their primary goal was to secure agreements for integrating direct carrier billing and content distribution platforms.

Strategic partnerships were vital for the company's success. Collaborations with mobile network operators (MNOs) provided the necessary infrastructure and user base. These partnerships were crucial for enabling direct carrier billing, a key revenue stream.

The company focused on integrating its services with content providers, such as gaming companies and music streaming services. This allowed these providers to monetize their offerings through mobile payments. This approach was essential for expanding its reach and revenue streams.

Collaborations with Mobile Network Operators (MNOs) were fundamental. These partnerships provided the infrastructure and access to a large user base. The integration of direct carrier billing with MNOs was a cornerstone of the company's business model.

The company's sales strategy was heavily reliant on B2B relationships, primarily focusing on direct sales teams and strategic partnerships. These channels were crucial for integrating direct carrier billing and content distribution platforms. The company's approach to Target Market of Neomobile was centered on these key partnerships.

- Direct Sales Teams: Focused on building relationships and securing agreements with MNOs and content providers.

- Strategic Partnerships: Collaborations with MNOs provided infrastructure and user access, enabling direct carrier billing.

- Content Provider Integration: Allowing content providers to monetize offerings through mobile payments.

- Market Focus: The company's primary focus was on enabling mobile commerce rather than direct-to-consumer sales.

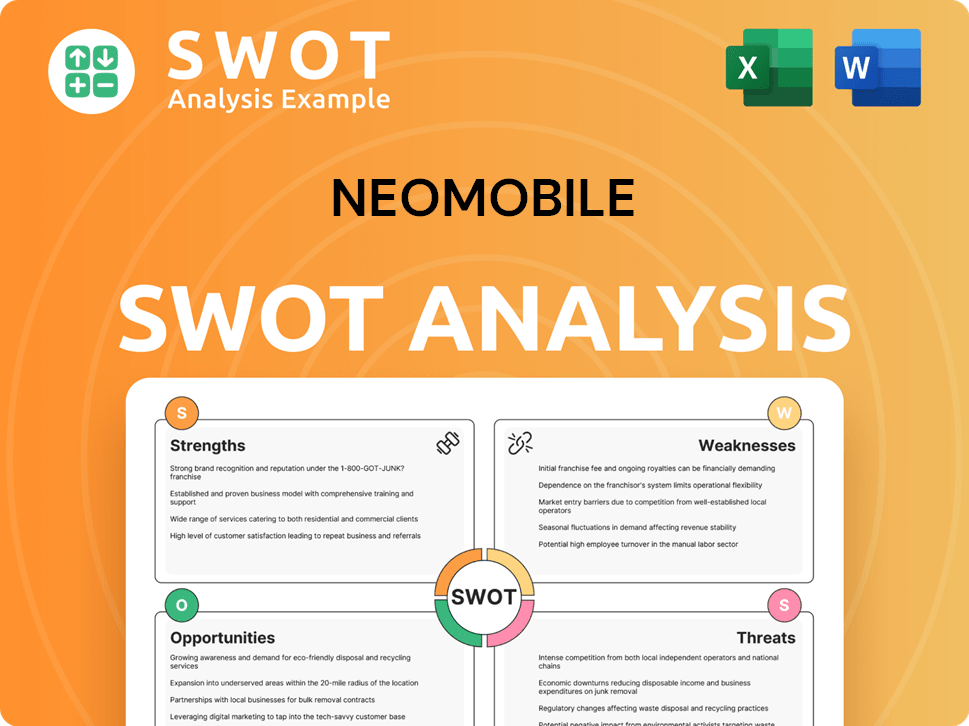

Neomobile SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Neomobile Use?

The marketing tactics employed by the company, focused primarily on a B2B approach, were designed to attract and retain merchants and mobile network operators. Given the nature of its services, the company's approach would have evolved with technological advancements in mobile commerce and digital advertising. The core aim was to demonstrate the security, efficiency, and revenue-generating potential of its platforms.

Given the company's operational status, specific details on its digital marketing campaigns are limited. However, it is plausible that they utilized content marketing to establish thought leadership in mobile payments and digital content distribution. This would have involved various strategies to reach the target audience effectively.

A robust Growth Strategy of Neomobile likely included a multi-channel approach to reach its target audience. This would have involved a combination of digital and traditional marketing methods to maximize reach and impact.

Content marketing was likely a key component of the company's strategy. This would have involved creating valuable content to attract and engage the target audience.

SEO was crucial to ensure visibility for businesses searching for mobile payment solutions. This involved optimizing website content to rank higher in search engine results.

Paid advertising on platforms like LinkedIn and industry-specific online publications would have targeted decision-makers within potential client organizations. This helped in reaching a specific audience.

Email marketing was used for lead nurturing and communicating updates or new service offerings to existing partners. This helped in maintaining communication with clients.

Participation in industry events, conferences, and trade shows served as a significant traditional marketing channel. This provided opportunities for networking and lead generation.

Data-driven marketing was essential for understanding the needs of business clients and tailoring solutions accordingly. CRM systems were likely employed to manage client relationships.

The company's Neomobile sales strategy and Neomobile marketing strategy likely involved a mix of digital and traditional methods. The focus was on reaching and engaging the target audience effectively.

- Content Marketing: Creating and distributing valuable content, such as whitepapers and case studies, to establish thought leadership and attract potential clients.

- SEO: Optimizing website content to improve search engine rankings and increase visibility for businesses seeking mobile payment solutions. The global SEO market was valued at $80.3 billion in 2023 and is projected to reach $145.8 billion by 2029.

- Paid Advertising: Utilizing platforms like LinkedIn and industry-specific publications to target decision-makers within potential client organizations. The digital advertising market is expected to reach $873 billion in 2024.

- Email Marketing: Nurturing leads and communicating updates to existing partners through targeted email campaigns. Email marketing ROI averages $36 for every $1 spent.

- Industry Events: Participating in conferences and trade shows to network, showcase solutions, and generate leads. The global events industry generated approximately $2.8 trillion in 2023.

- Data-Driven Marketing: Employing CRM systems and data analysis to understand client needs and tailor solutions. The CRM market is projected to reach $128.9 billion by 2028.

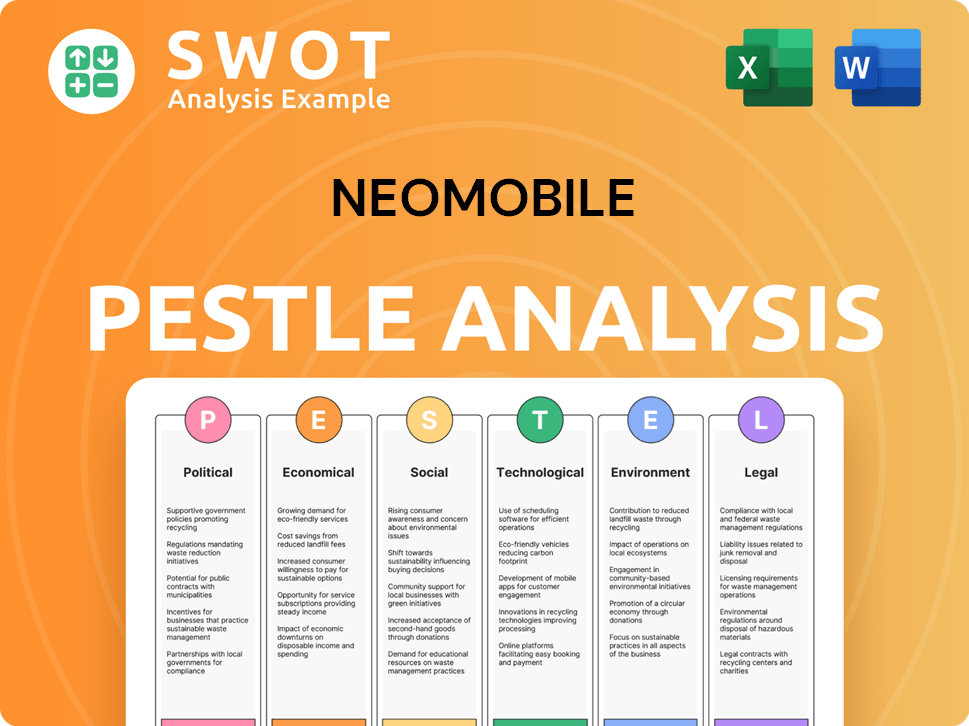

Neomobile PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Neomobile Positioned in the Market?

The company strategically positioned itself as a key facilitator within the mobile commerce ecosystem. Its primary goal was to act as a bridge, connecting digital content providers with mobile users. This was achieved through seamless payment solutions, particularly focusing on direct carrier billing.

The brand's identity likely emphasized reliability, innovation, and a global reach, especially within the direct carrier billing and digital entertainment sectors. The core message was centered around simplifying mobile monetization for businesses and enhancing access to digital content for consumers, which is a crucial aspect of any effective Neomobile sales strategy.

The company aimed to appeal to its target audience, primarily businesses, by promising increased revenue streams, expanded market reach, and streamlined payment processing. To understand the broader picture, you can explore the Growth Strategy of Neomobile.

The primary target audience consisted of businesses looking to monetize their digital content or services on mobile platforms. This included app developers, mobile game creators, and digital content providers.

The company's value proposition centered on simplifying payment processes, expanding market reach, and increasing revenue for businesses. It offered a straightforward way to bill users directly through their mobile carrier.

The company faced competition from other payment processors, mobile wallet providers, and traditional credit card companies. Differentiating through carrier billing was key.

While specific brand perception data is not readily available, the company likely focused on building trust through secure and efficient platforms, crucial for its Neomobile marketing strategy.

In a rapidly evolving industry, the company needed to respond to shifts in consumer sentiment and competitive threats. Key considerations included:

- Transparency in mobile billing to address consumer concerns.

- Adapting to alternative payment methods like mobile wallets.

- Maintaining a strong focus on security and efficiency.

- Continuous innovation in payment solutions.

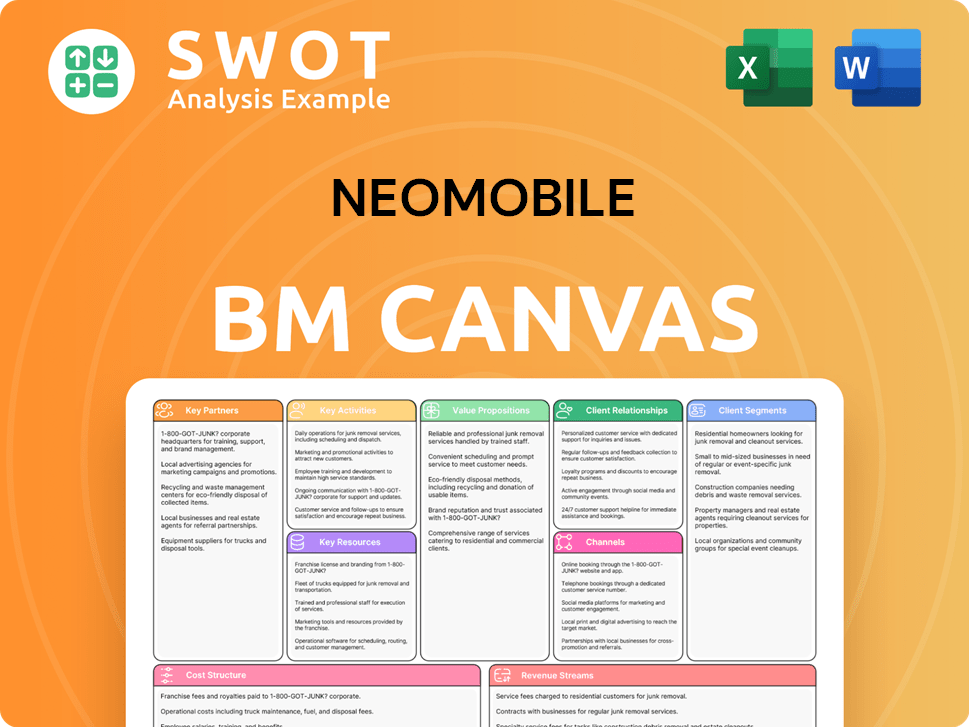

Neomobile Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Neomobile’s Most Notable Campaigns?

Given the nature of the business-to-business (B2B) model and the cessation of operations in 2020, detailed public information on specific, large-scale sales and marketing campaigns is limited. However, the most significant 'campaigns' likely involved strategic initiatives aimed at onboarding new mobile network operators (MNOs) and expanding the merchant network. These initiatives were crucial for driving revenue and increasing the company's global footprint.

A 'campaign' could have focused on penetrating new geographical markets, such as Latin America or Southeast Asia, where mobile penetration was rapidly growing and direct carrier billing (DCB) had significant potential. The objectives would have been to secure new partnerships, increase transaction volumes, and expand the company's global reach. The creative concept would have revolved around demonstrating the technical robustness of the platform, its compliance with local regulations, and its ability to drive significant revenue for partners.

The primary channels used were direct sales engagements, participation in international telecom and mobile commerce trade shows, and targeted industry publications. Success was measured by the number of new operator agreements, transaction volume, and market share within the DCB segment. Any collaborations would have been with mobile operators or major content providers, boosting credibility and expanding reach within the mobile ecosystem. For more insights into the company's operations, consider reading Revenue Streams & Business Model of Neomobile.

These campaigns focused on entering new markets with high mobile penetration rates and growth potential. The goal was to secure partnerships with local mobile network operators and content providers. This was a key part of the overall Neomobile sales strategy.

These initiatives aimed at expanding the network of merchants who would use the platform for direct carrier billing. This involved sales efforts to onboard content providers, app developers, and digital service providers. A key aspect of the Neomobile marketing strategy.

Demonstrating the platform's technical capabilities, security, and compliance with local regulations was crucial. This was often done through trade show presentations, white papers, and direct sales pitches. This was key to Neomobile's business plan.

Building strategic alliances with mobile operators and content providers was critical for market penetration and credibility. These partnerships expanded the company's reach within the mobile ecosystem. This was a part of the digital strategy.

Success was measured by a combination of factors, reflecting the B2B focus of the business. These included:

- Number of new operator agreements signed.

- Volume of transactions processed through the platform.

- Increase in market share within the direct carrier billing segment.

- Revenue generated from partnerships.

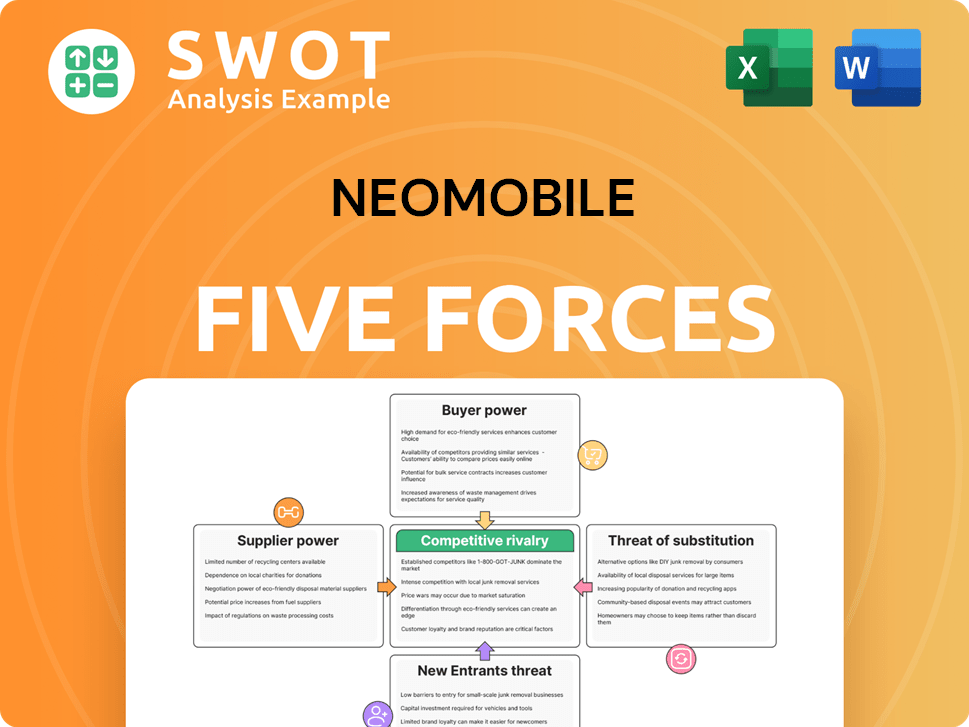

Neomobile Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Neomobile Company?

- What is Competitive Landscape of Neomobile Company?

- What is Growth Strategy and Future Prospects of Neomobile Company?

- How Does Neomobile Company Work?

- What is Brief History of Neomobile Company?

- Who Owns Neomobile Company?

- What is Customer Demographics and Target Market of Neomobile Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.