Neomobile Bundle

What Happened to Neomobile?

Once a prominent player in the mobile commerce arena, Neomobile's story offers a compelling case study in strategic adaptation and market dynamics. Founded in 2007, the company rapidly expanded, leading the direct-to-consumer (D2C) market in Italy and establishing a significant presence globally. This analysis delves into the Neomobile SWOT Analysis to dissect its growth strategy and assess its future prospects, providing valuable lessons for today's businesses.

Examining Neomobile's journey, from its early success to its eventual cessation of operations in 2020, provides critical insights into the challenges and opportunities within the mobile payment solutions and digital content distribution sectors. This exploration will analyze the Neomobile growth strategy, its engagement with telecommunications industry trends, and the factors that influenced its trajectory, offering a comprehensive Neomobile company analysis.

How Is Neomobile Expanding Its Reach?

The expansion initiatives of the company were primarily focused on broadening its service offerings and increasing its market share. This involved a dual approach of geographical expansion and strategic acquisitions. The goal was to establish a strong presence in key markets and diversify revenue streams within the rapidly evolving mobile commerce sector.

The company aggressively pursued international expansion. By 2009, it had established offices in 15 countries, including major markets across Europe, Latin America, and Asia. This widespread presence was crucial for accessing new customer bases and adapting to local market demands.

A significant part of the company's strategy involved inorganic growth through mergers and acquisitions. These moves were designed to enhance its capabilities and market reach. These acquisitions and divestitures allowed the company to adapt to market changes and focus on core business areas.

The company's geographical expansion was a key element of its growth strategy. By 2009, the company had established a presence in 15 countries. Key markets included Barcelona, Madrid, Lisbon, Paris, London, Istanbul, Casablanca, Mumbai, Dhaka, Shanghai, Tokyo, São Paulo, Mexico City, and Miami. This broad footprint allowed the company to tap into diverse markets and customer bases.

Strategic acquisitions played a crucial role in the company's growth. In 2008, the acquisition of Arena Mobile expanded its geographic and business footprint, especially in the B2B sector. The acquisition of Zero9 in 2010 strengthened its position in Brazil and diversified its digital content portfolio. These moves were aimed at enhancing service offerings and market share.

The divestiture of Onebip SpA in 2016 allowed the company to concentrate on its core digital entertainment business. This strategic move enabled increased investments in new products, particularly in programmatic advertising. The focus was on accelerating entry into new markets, including the Middle East and Asia. This sharpened the company's strategic direction.

The company's expansion initiatives were designed to adapt to the changing telecommunications industry trends. By entering new markets and acquiring strategic assets, the company aimed to stay competitive. This involved a combination of organic growth and strategic acquisitions. The company's ability to adapt to evolving consumer behavior was key.

The company's expansion was driven by a combination of geographical reach and strategic acquisitions. These initiatives were aimed at broadening its service offerings and market share. The company's approach reflects a commitment to growth and adaptation in the digital market.

- International Expansion: Significant presence across Europe, Latin America, and Asia.

- Strategic Acquisitions: Arena Mobile and Zero9 to expand services and market reach.

- Divestiture: Focus on core digital entertainment and programmatic advertising.

- Market Entry: Accelerating entry into new markets in the Middle East and Asia.

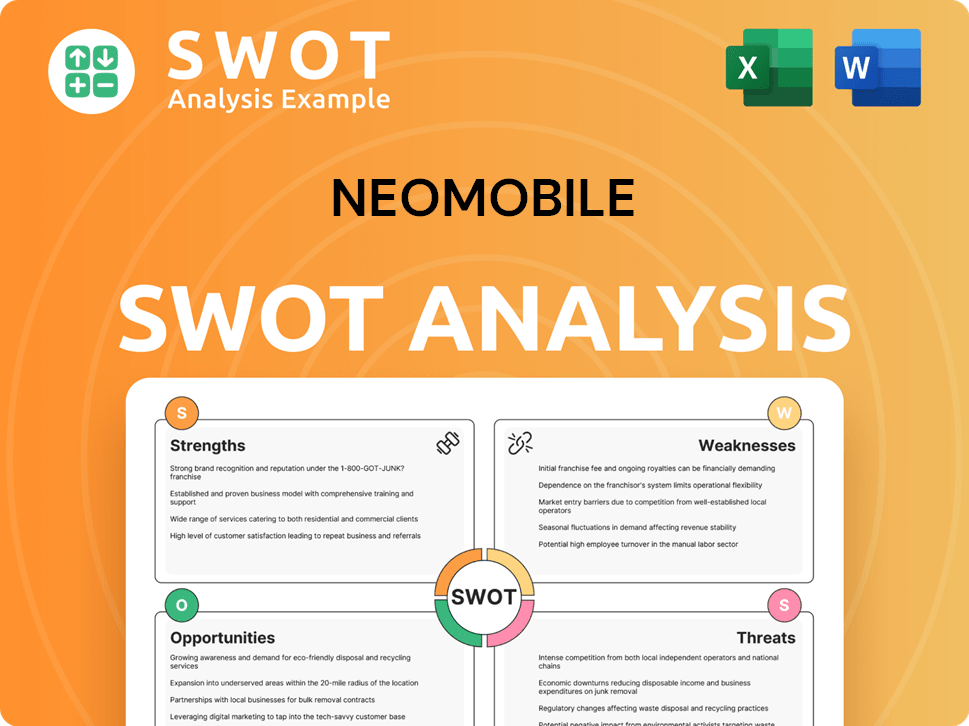

Neomobile SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Neomobile Invest in Innovation?

The innovation and technology strategy of the company, focused on mobile commerce and digital entertainment, was crucial for its success. This strategy involved developing solutions for mobile payments, content distribution, and user acquisition, demonstrating a commitment to staying ahead in a rapidly evolving market. The company's ability to adapt and invest in new technologies was key to its competitive advantage.

The company's moves, such as the sale of Onebip in 2016 and the spin-off of DigitalGO in 2017, highlight a strategic emphasis on technology and digital transformation. These actions suggest a forward-thinking approach to the evolving needs of the mobile market and a focus on providing comprehensive solutions for its clients. This forward-thinking approach was essential in the dynamic telecommunications industry.

The company's operations, connecting merchants with mobile users globally, relied on robust technological platforms. This reliance underscores the importance of seamless transactions and content delivery in its business model. The company's ability to adapt to advancements in mobile technologies, including smartphones and mobile payments, was critical to maintaining its market position. The broader telecommunications industry trends, such as the rise of smartphones and mobile payments, significantly influenced the company's technological considerations.

The company invested in mobile payment solutions to facilitate transactions for its users. These solutions were essential for enabling seamless and secure payments for digital content and services. This focus on mobile payment solutions was a key element of the company's growth strategy.

The company focused on digital content distribution to provide a wide range of entertainment options. This involved developing platforms for delivering content to mobile users. This strategy was crucial for attracting and retaining customers in the competitive digital market.

The company employed various strategies for user acquisition to expand its customer base. These strategies included marketing campaigns and partnerships to reach a wider audience. Effective user acquisition was vital for driving revenue and market share.

Continuous investment in platform development was essential for supporting its services. This included upgrading existing platforms and developing new features to meet evolving market demands. This commitment to platform development ensured the company's ability to deliver high-quality services.

Efficient content delivery systems were crucial for providing a seamless user experience. This involved optimizing content delivery networks and ensuring fast and reliable access to content. The company's focus on content delivery was critical for customer satisfaction.

The company explored programmatic advertising to enhance its revenue streams. This involved using automated systems to manage and optimize advertising campaigns. This strategy allowed the company to target users more effectively and increase advertising revenue.

The company's technological considerations were shaped by the rapid advancements in the mobile sector. The rise of smartphones, mobile payments, and the Internet of Things (IoT) significantly influenced its strategies. These trends created both opportunities and challenges for the company.

- Smartphone Adoption: The increasing use of smartphones drove demand for mobile content and services.

- Mobile Payments: The growth of mobile payments created new avenues for transactions and revenue.

- Internet of Things (IoT): The expansion of IoT offered opportunities for new services and content delivery.

- 5G Technology: The rollout of 5G technology would have improved content delivery speeds and user experiences.

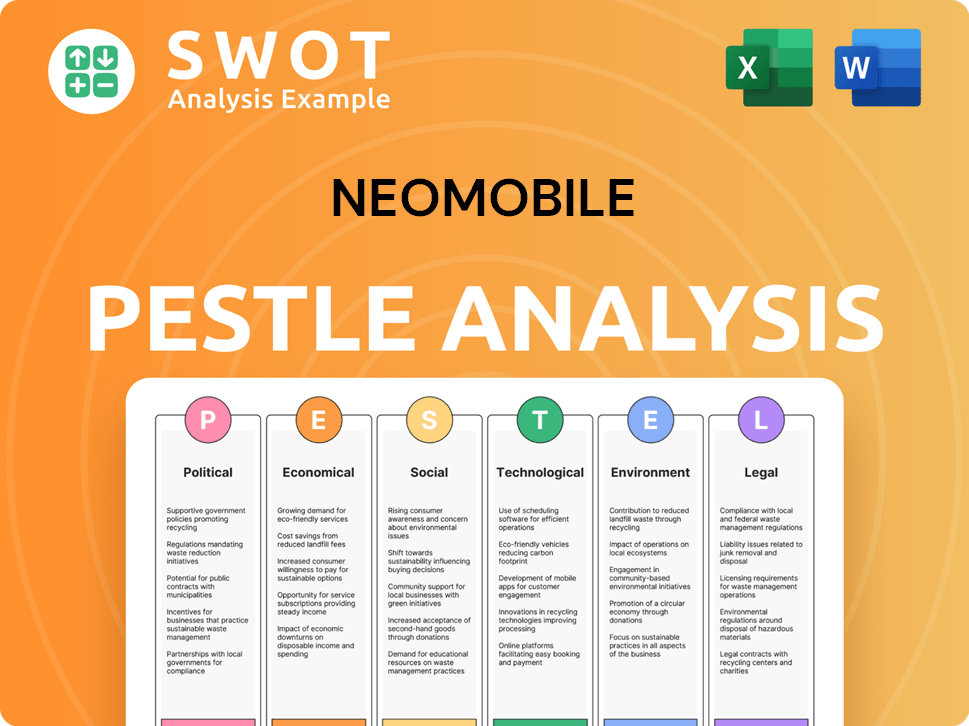

Neomobile PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Neomobile’s Growth Forecast?

The financial outlook for Neomobile S.p.A. is non-existent as the company ceased operations in 2020. Therefore, any discussion on future financial prospects or growth strategy is not applicable to the original entity. The company's historical financial performance provides context, but it does not reflect current market conditions or future projections.

Historically, Neomobile was a significant player in the Italian digital market. During its operational years, the company generated approximately €1 billion in revenue. In 2014, under the leadership of its co-founder and CEO Gianluca D'Agostino, Neomobile achieved revenues up to €120 million and an EBITDA of €16 million. This historical data offers insights into its past success but does not provide a basis for current or future financial analysis.

Neomobile raised a total of $13.5 million in funding across two rounds, with its last funding round being a Series B in September 2009. The investors included BlueGem Capital Partners and MPS Venture. While DigitalGO, a company born from the experience of the Neomobile Group, reported €44 million in revenues in 2017, it is a separate entity. For a comprehensive understanding of the Competitors Landscape of Neomobile, it is essential to differentiate between the original company and any related entities.

Neomobile generated around €1 billion in revenue over its operational years. In 2014, the company's revenue reached up to €120 million. These figures highlight the company's past financial success in the digital content and mobile payment solutions sectors.

In 2014, Neomobile reported an EBITDA of €16 million. This metric is crucial for understanding the company's profitability. The EBITDA demonstrates its operational efficiency before considering interest, taxes, depreciation, and amortization.

Neomobile secured a total of $13.5 million in funding across two rounds. The last funding round was a Series B in September 2009. This funding supported its growth and expansion in the mobile payment solutions market.

DigitalGO, a company that emerged from the Neomobile Group's experience, reported €44 million in revenues in 2017. This information provides context about the evolution of the business, but it is not directly related to Neomobile S.p.A.'s financial performance.

Neomobile held a significant position in the digital content distribution and mobile payment solutions market. Its strategies included partnerships and collaborations to enhance its market share. Understanding these strategies is key to analyzing the company's competitive advantages.

Neomobile's past success was influenced by telecommunications industry trends. The company adapted to changing consumer behavior and invested in new technologies. The impact of 5G on the company's services, had it continued operations, would have been significant.

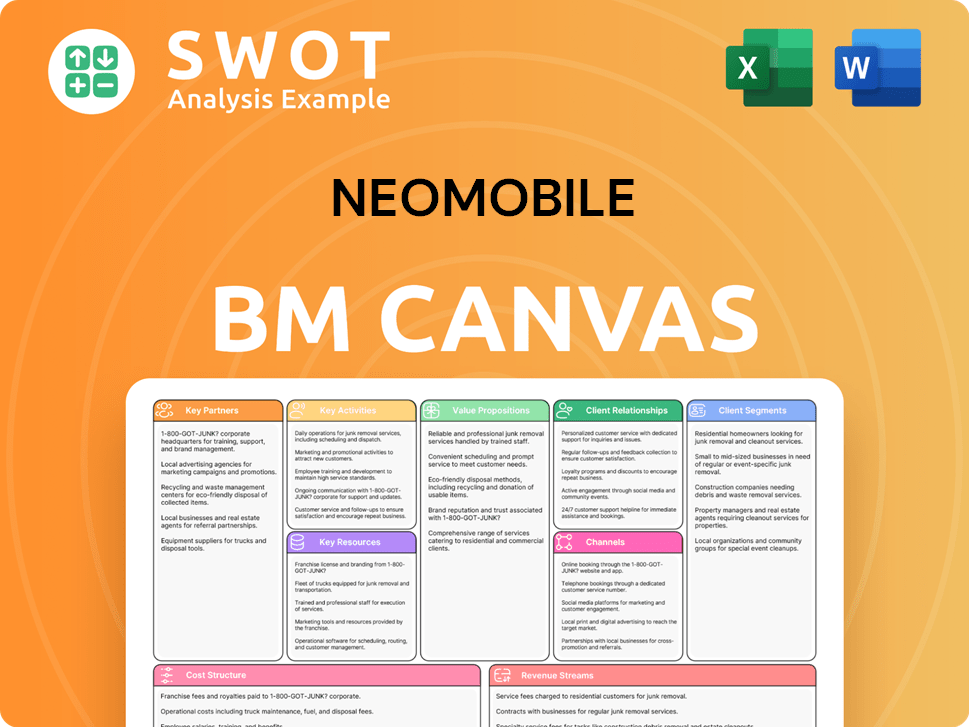

Neomobile Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Neomobile’s Growth?

The primary risk for Neomobile, which ceased operations in 2020, was its inability to sustain its business model in a rapidly changing market. The mobile commerce and digital entertainment industries are characterized by intense competition and rapid technological shifts. Understanding the challenges Neomobile faced offers insights into the broader dynamics of the telecommunications industry trends.

Market competition played a significant role, with numerous companies vying for market share in mobile payment solutions and digital content distribution. Regulatory changes, particularly those concerning mobile payments and data privacy, could have posed challenges. Internal resource constraints, such as attracting and retaining top talent, could also have impacted growth.

Neomobile's ability to adapt, as seen in its divestment of Onebip, suggests a management capable of strategic shifts. However, the ultimate cessation of operations indicates that these strategies were not sufficient to overcome all obstacles. The Marketing Strategy of Neomobile provides additional context.

The mobile market is highly competitive, with established players and new entrants constantly vying for market share. The rise of 5G and evolving consumer preferences add to the complexity. According to a 2024 report, the global mobile payments market is projected to reach $7.6 trillion by 2027, highlighting the intense competition.

Rapid technological advancements constantly disrupt the mobile industry. New platforms, devices, and user behaviors can quickly shift market dynamics. The integration of AI and machine learning is transforming content delivery and user engagement, creating new challenges and opportunities.

Changes in regulations, particularly those concerning mobile payments and data privacy, can pose significant challenges. Compliance with these regulations requires continuous adaptation and investment. The implementation of GDPR and similar data protection laws has significantly impacted the digital content distribution industry.

Increasingly sophisticated cyber threats pose a significant risk to mobile commerce. Data breaches and security vulnerabilities can damage consumer trust and lead to financial losses. The cost of cybercrime is expected to reach $10.5 trillion annually by 2025, emphasizing the importance of robust security measures.

Evolving consumer preferences for content consumption and mobile payment solutions can impact market dynamics. Understanding and adapting to these changes is crucial for success. The shift towards mobile-first content consumption requires companies to optimize their services for mobile devices.

The digital entertainment market is undergoing consolidation, with larger companies acquiring smaller ones to gain market share. This trend can create challenges for smaller players. The value of mergers and acquisitions in the tech sector reached $660 billion in the first half of 2024.

Attracting and retaining top talent in the competitive tech landscape is crucial. Competition for skilled professionals is intense. Companies must offer competitive compensation packages and foster a positive work environment. The average salary for tech professionals increased by 5% in 2024.

Reliance on specific mobile network operators or content providers can create vulnerabilities. Disruptions in these supply chains can impact service delivery. Diversifying partnerships and having contingency plans are essential. The global telecommunications market is projected to reach $2.1 trillion by 2025.

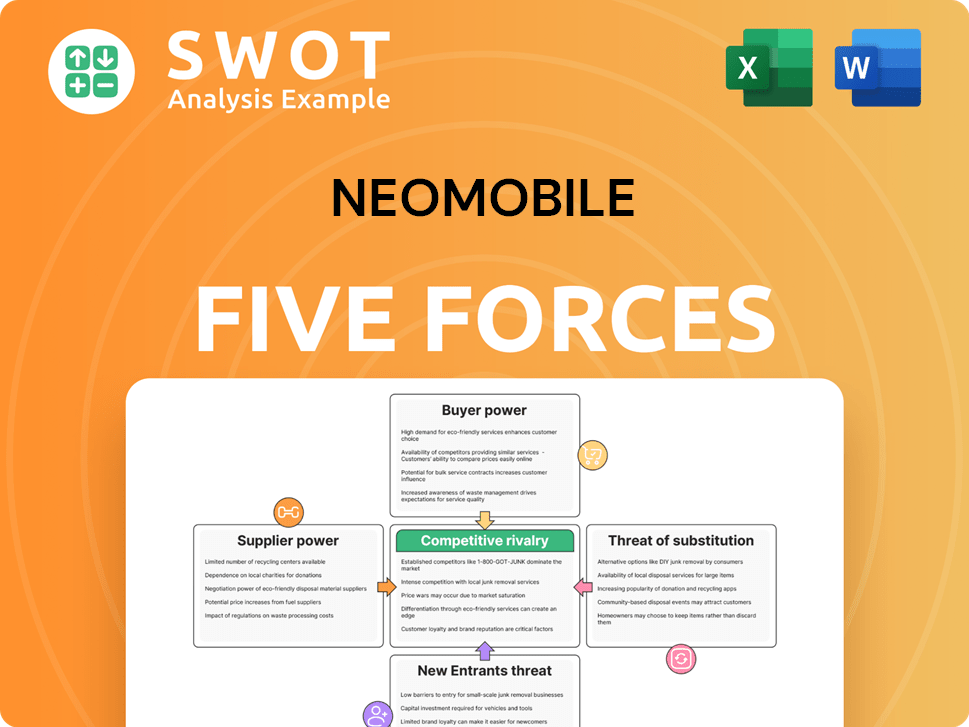

Neomobile Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Neomobile Company?

- What is Competitive Landscape of Neomobile Company?

- How Does Neomobile Company Work?

- What is Sales and Marketing Strategy of Neomobile Company?

- What is Brief History of Neomobile Company?

- Who Owns Neomobile Company?

- What is Customer Demographics and Target Market of Neomobile Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.