PCC SE Bundle

How Did PCC SE Transform from a Trading Startup to a Global Powerhouse?

Embark on a fascinating journey through the PCC SE SWOT Analysis to uncover the remarkable story of PCC SE, a company that began with a bold vision. From its humble beginnings in 1993, this diversified investment holding company has evolved into a significant player in the chemicals, energy, and logistics sectors. Discover the key milestones and strategic decisions that shaped the PCC SE history.

This PCC SE overview will explore the PCC SE background, detailing its evolution from a trading company to a vertically integrated industrial group. We'll examine the PCC SE timeline, highlighting its geographical expansion and the key figures who drove its success, offering insights into the company's past and present.

What is the PCC SE Founding Story?

The PCC SE history begins in October 1993, marking the inception of Petro Carbo Chem Rohstoffhandelsgesellschaft mbH (PCC GmbH) in Duisburg, Germany. This foundational step was taken by Waldemar Preussner, the sole shareholder and current Chairman of the Supervisory Board. From its inception, PCC SE has charted a course of strategic growth and diversification.

The initial vision for PCC GmbH was rooted in recognizing opportunities in the opening markets of Eastern Europe. The company's focus was on the international trading of petroleum, carbon, and natural gas-based raw materials. This strategic focus set the stage for the company's future expansion and development.

Ulrike Warnecke, now a member of the Supervisory Board, was involved from the start, with Dr. Alfred Pelzer joining in 1995, currently serving on the Executive Board. A key element in PCC SE's early success was its innovative approach to financing. The company's growth was fueled by direct bond issuance, a practice adopted in 1998, independent of banks, allowing for sustained expansion and investment.

PCC SE's early years were marked by strategic decisions and innovative financing. The company focused on international trading of raw materials.

- Founded in October 1993 in Duisburg, Germany.

- Initial focus on trading petroleum, carbon, and chemical raw materials.

- Employed direct bond issuance for financing from 1998.

- Strategic acquisitions and modernization of state-owned companies in Eastern Europe.

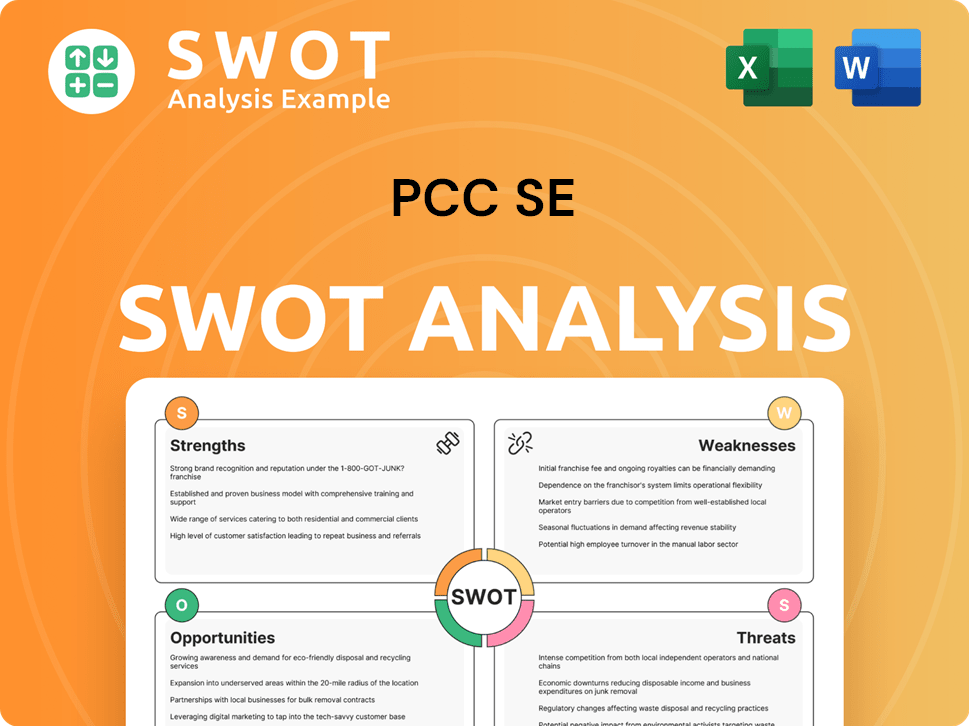

PCC SE SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of PCC SE?

The early growth and expansion of PCC SE, a company with a rich PCC SE history, were characterized by strategic acquisitions and diversification beyond its initial trading activities. This expansion was particularly notable in Central and Eastern Europe. The transformation from PCC AG to PCC SE in February 2007 was a key organizational shift that supported its growing portfolio.

A significant milestone in the PCC SE company’s journey was the acquisition of shares in Polish freight transport companies. This led to the consolidation of these activities into the PCC Logistics (Poland) group. By 2009, this group had become the largest private rail freight operator in Poland. Between 2002 and 2010, PCC progressively acquired shares in a major Polish chemicals producer, which later became PCC Rokita SA. The full acquisition was completed in 2010, marking a pivotal entry into chemical production.

Further expansion in the chemicals sector included the establishment of PCC Chemax, Inc. in Piedmont, South Carolina, USA, a surfactants manufacturer. PCC also ventured into renewable energy, establishing the joint venture PCC DEG Renewables GmbH in 2005. This venture led to the operation of six small hydroelectric power plants in Southeast Europe. This diversification highlights the PCC SE company's commitment to growth and sustainability.

The company's growth was supported by major capital raises through direct bond issuance, a financing instrument PCC SE has utilized since 1998. In 2012, PCC SE placed minority stakes of PCC Exol SA on the Warsaw Stock Exchange, followed by PCC Rokita SA's initial public offering in 2014. Dr. Peter Wenzel became Chairman of the Executive Board of PCC SE on August 31, 2021, focusing on corporate and project development and sustainability.

In the fourth quarter of 2024, PCC SE achieved a significant increase in earnings, with quarterly revenue rising by 5.4% to €237.8 million and EBITDA by 27.2% to €42.0 million compared to the previous year's quarter. Despite economic challenges, the PCC Group reported consolidated sales of €960.0 million for 2024, with an investment volume of €126.5 million. This performance underscores the PCC SE overview's resilience and strategic focus.

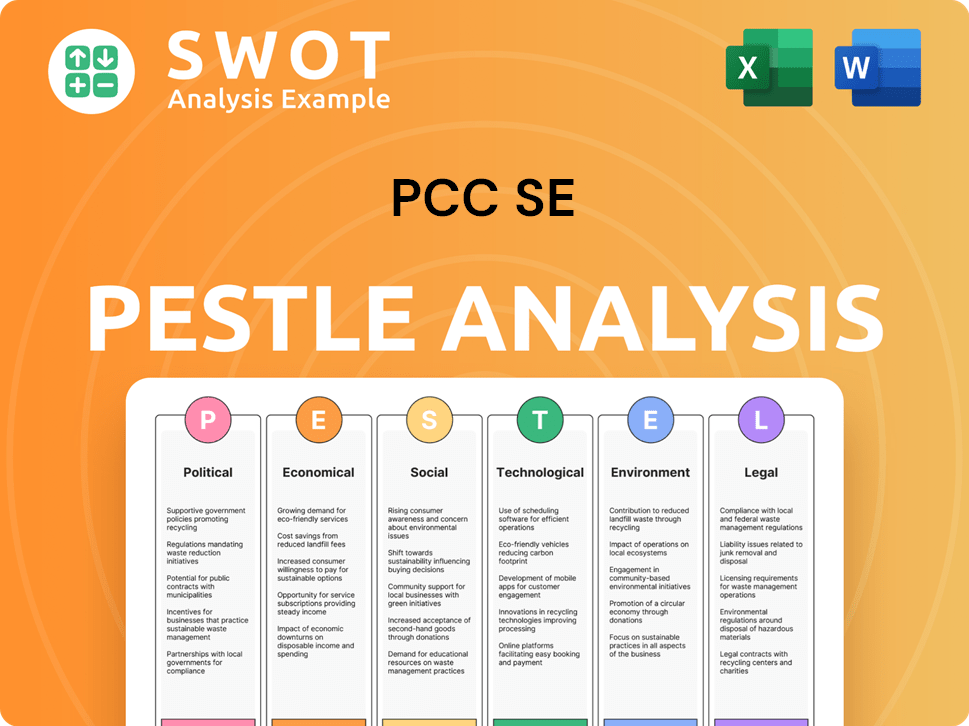

PCC SE PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in PCC SE history?

The PCC SE company's history reflects a journey marked by strategic milestones, significant innovations, and the ability to navigate complex challenges. This PCC SE overview highlights key events in its evolution, showcasing its growth and adaptation within the industry.

| Year | Milestone |

|---|---|

| 2015 | Established a joint venture with IRPC Polyol Company Ltd. in Thailand. |

| 2018 | Commissioned a silicon metal production plant in Iceland, investing approximately US$300 million (about €265 million). |

| 2018 | Increased stake in the joint venture with IRPC Polyol Company Ltd. to 50%. |

| 2024 | PCC Exol SA received the EcoVadis gold level for corporate social responsibility. |

| 2024 | PCC SE and PETRONAS Chemicals Group Berhad (PCG) established a joint venture in Malaysia for alkoxylates production. |

| 2028 (expected) | PCC GulfChem Corporation is expected to begin manufacturing operations in Mississippi, USA, with a corporate investment of at least $540 million. |

PCC SE has consistently embraced innovation, particularly in sustainable production methods. A notable example is the use of 100% renewable geothermal energy at its silicon metal plant in Iceland. This commitment to green energy and environmentally friendly practices demonstrates the company's forward-thinking approach. Furthermore, the company has been upgrading its chlorine production to environmentally friendly membrane technology.

The silicon metal production plant in Iceland, powered by renewable geothermal energy, is a prime example of PCC SE company's commitment to sustainable practices.

PCC Rokita SA commissioned a new production plant for specialty polyols (Rokopol iPol®) used in cold-foam materials.

Upgrading chlorine production to environmentally friendly membrane technology, scheduled for completion in 2015, significantly reduced CO2 emissions.

PCC Exol SA received the EcoVadis gold level for corporate social responsibility, placing it among the top 5% of rated organizations globally in 2024.

Despite its successes, PCC SE has faced challenges, including economic weakness in Germany and the EU, and aggressive export policies from non-European countries. The Silicon & Derivatives segment experienced losses in 2023 and Q4 2024, though the full-year loss was significantly reduced. The company is actively managing its investment portfolio to optimize returns.

Persistent economic weakness in Germany and the EU has impacted the company's performance, particularly in 2023.

Competitive pressure from low-cost imports, especially from China, has affected pricing in several segments.

Geopolitical uncertainties, such as the Russia-Ukraine war and the Middle East conflict, have posed risks to transportation and supply chains.

The Silicon & Derivatives segment experienced significant losses in 2023 and continued to operate at a loss in Q4 2024.

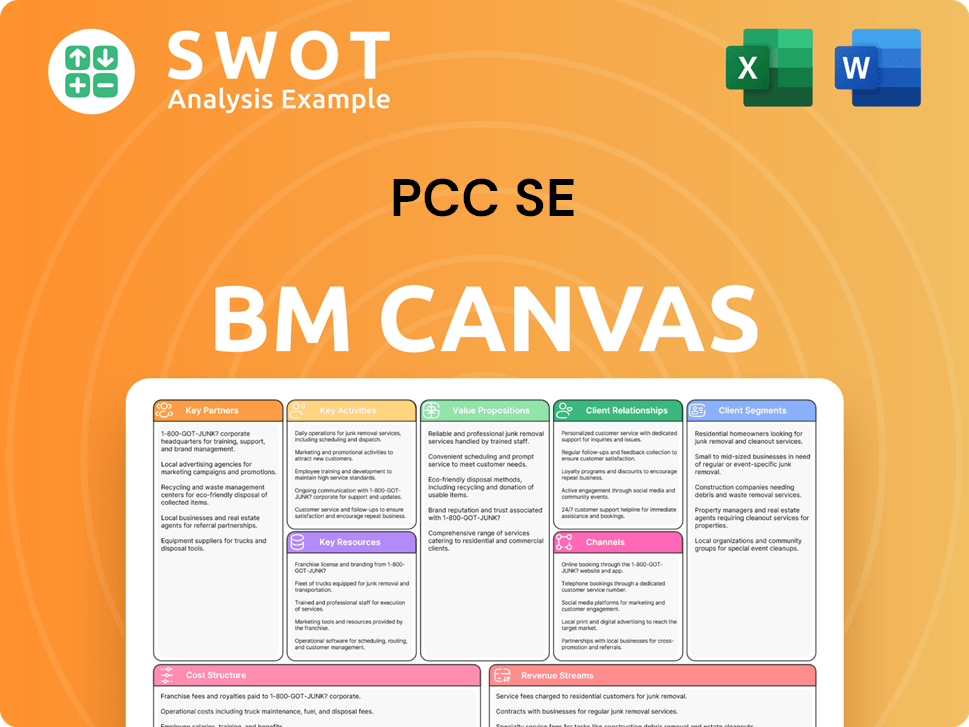

PCC SE Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for PCC SE?

The Revenue Streams & Business Model of PCC SE is a journey marked by strategic expansions and adaptations. It began in 1993 when Waldemar Preussner established Petro Carbo Chem Rohstoffhandelsgesellschaft mbH (PCC GmbH) in Duisburg, Germany. Over the years, PCC SE has grown significantly, evolving through acquisitions, joint ventures, and strategic shifts in its business model. The company's history showcases its ability to identify opportunities and adapt to changing market conditions, making it a key player in the chemical industry.

| Year | Key Event |

|---|---|

| 1993 | Waldemar Preussner founded Petro Carbo Chem Rohstoffhandelsgesellschaft mbH (PCC GmbH) in Duisburg, Germany. |

| 1998 | PCC AG was formed as a spin-off and began issuing bonds directly. |

| 2002-2010 | PCC successively acquired shares in a major Polish chemicals producer, which became PCC Rokita SA. |

| 2005 | PCC established the joint venture PCC DEG Renewables GmbH, entering the renewable energy sector. |

| 2007 | PCC AG converted into a Societas Europaea (SE). |

| 2009 | Acquisition of PCC Silicium S.A. in Poland, securing raw material for silicon metal production. |

| 2010 | Full acquisition of PCC Rokita SA was completed. |

| 2012 | PCC Exol SA was listed on the Warsaw Stock Exchange. |

| 2014 | PCC Rokita SA had its initial public offering on the Warsaw Stock Exchange. |

| 2015 | PCC Rokita SA established a joint venture with IRPC Polyol Company Ltd. in Thailand. |

| 2015-2018 | Construction and commissioning of the silicon metal plant in Iceland. |

| 2018 | PCC Rokita SA increased its stake in IRPC Polyol Company Ltd. to 50%. |

| 2021 | Dr. Peter Wenzel became Chairman of the Executive Board of PCC SE. |

| 2023 | PCC Chemicals Corporation signed a lease agreement for an alkoxylate production facility in Bay City, Texas, USA. |

| 2024 | PCC GulfChem Corporation began operations in Harrison County, Mississippi, for a chlor-alkali plant, expected to be operational in 2028. PCC Group achieved consolidated sales of €960.0 million and an EBITDA of €88.0 million. |

PCC SE is focusing on expansion in the USA and Asia. This includes further alkoxylates production in the USA and the construction of a chlor-alkali plant in Mississippi, set to be operational by 2028.

Sustainability and climate protection are becoming key strategic focuses. This will drive further investments in efficient and environmentally friendly production facilities.

PCC anticipates a sales increase of 5-10% in 2025, with significantly higher earnings at the EBITDA and EBT levels. Dividend payments in the double-digit million euro range are expected beyond 2025.

PCC SE aims to continuously increase enterprise value. This is achieved through proactive portfolio management, optimizing existing activities, and pursuing new acquisitions in less competitive sub-markets.

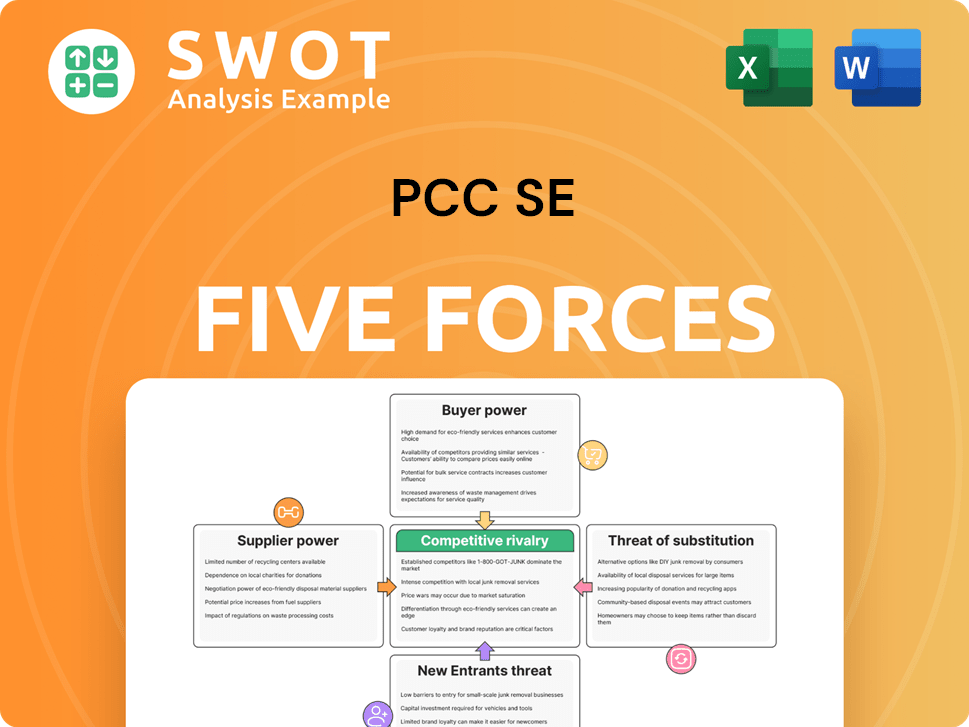

PCC SE Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of PCC SE Company?

- What is Growth Strategy and Future Prospects of PCC SE Company?

- How Does PCC SE Company Work?

- What is Sales and Marketing Strategy of PCC SE Company?

- What is Brief History of PCC SE Company?

- Who Owns PCC SE Company?

- What is Customer Demographics and Target Market of PCC SE Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.