PCC SE Bundle

Can PCC SE Maintain Its Growth Trajectory?

PCC SE, a diversified investment holding company, has transformed from a commodity trading firm to a global industrial group. Founded in 1993, the company's strategic evolution showcases its commitment to expansion across chemicals, energy, and logistics. With a presence in 17 countries and a focus on a future-aligned investment portfolio, PCC SE's journey offers a compelling case study in strategic growth.

This in-depth PCC SE SWOT Analysis will dissect the company's current market position, exploring its PCC SE growth strategy and PCC SE future prospects. We'll examine its PCC SE company analysis, including its diversified portfolio and recent achievements like PCC Intermodal S.A.'s leadership in intermodal transportation. Understanding PCC SE's business model and financial performance is key to assessing its long-term investment potential and its impact on the economy, considering its PCC SE's expansion plans and sustainability initiatives.

How Is PCC SE Expanding Its Reach?

PCC SE's expansion initiatives are central to its PCC SE growth strategy, focusing on geographical expansion, product diversification, and strategic investments. These efforts aim to strengthen the company's PCC SE market position and capitalize on emerging opportunities in the chemical industry. The company's approach is characterized by a blend of organic growth and strategic partnerships, designed to enhance its long-term value and market presence.

The company's strategic investments are geared towards tapping into new markets and stimulating growth, reflecting a proactive approach to adapt to evolving market dynamics. These initiatives are supported by a commitment to innovation and sustainable practices, which are key components of the PCC SE business model. Through these expansion strategies, PCC SE aims to improve its PCC SE financial performance and maintain a competitive edge in the global chemical market.

PCC SE's expansion strategy includes significant investments in new production facilities and strategic partnerships to drive future growth. One of the most notable projects is the construction of a chlor-alkali plant in DeLisle, Mississippi, USA. This project, with an anticipated investment of $540 million, is scheduled to commence construction in early 2026 and begin operations in 2028. This initiative is expected to have an annual nominal capacity of up to 340,000 metric tons. The project is supported by a long-term offtake agreement with Chemours, signed in December 2024, which mitigates market and sales risks.

The DeLisle, Mississippi plant represents a significant investment. The project is expected to be operational by 2028, with a substantial production capacity. This expansion highlights PCC SE's commitment to the North American market and its strategy to diversify its production capabilities.

PCC SE's joint venture with PETRONAS Chemicals Group Berhad (PCG) in Malaysia is another key initiative. This plant, which began operations, expands PCC Group's core business in global growth markets. The project underscores PCC SE's focus on strategic partnerships for growth.

PCC SE is also planning additional alkoxylate production in the USA. A land lease agreement in Bay City, Texas, was signed in September 2023. This expansion further strengthens PCC SE's presence in the North American market. This expansion is a part of the company's long-term strategy.

PCC SE continues to strengthen its position in Eastern Europe. PCC Rokita SA is a major chlorine manufacturer and polyol producer. PCC Exol SA is one of Europe's most advanced surfactant manufacturers. These efforts demonstrate PCC SE's commitment to optimizing its investment portfolio.

These initiatives demonstrate PCC SE's commitment to continuous optimization through strategic acquisitions and investment projects. The company's focus on expanding its production capabilities and entering new markets aligns with its long-term growth objectives. These expansion efforts are crucial for enhancing the company's PCC SE future prospects. For more insights into the competitive landscape, consider reading about the Competitors Landscape of PCC SE.

PCC SE's expansion strategy includes significant investments in new production facilities and strategic partnerships to drive future growth. These initiatives are designed to boost production capacity and enhance market presence. The company is focusing on both geographic expansion and product diversification.

- Construction of a chlor-alkali plant in DeLisle, Mississippi, USA, with an investment of $540 million.

- Expansion of alkoxylate production through a joint venture in Malaysia.

- Additional alkoxylate production planned in Bay City, Texas, USA.

- Strengthening of market position in Eastern Europe through PCC Rokita SA and PCC Exol SA.

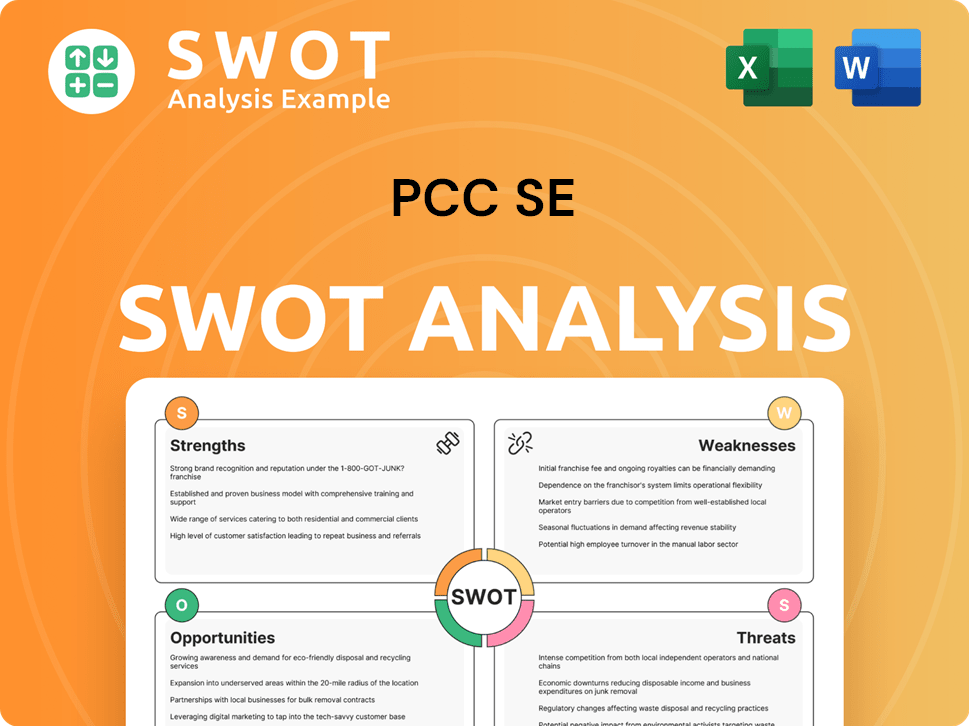

PCC SE SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does PCC SE Invest in Innovation?

The Revenue Streams & Business Model of PCC SE highlights the company's strategic focus on innovation and technology as key drivers for sustained growth. This approach is evident in its significant investments in research and development (R&D) and the adoption of cutting-edge solutions across its operations. The company's commitment to developing products with a broader application potential is a central theme in its growth strategy, as emphasized in its 2024 Annual Report.

A significant aspect of PCC SE's strategy involves leveraging technological advancements to enhance product performance and expand market reach. This includes projects aimed at improving the efficiency and capabilities of existing products, as well as developing new products to meet evolving market demands. The company's dedication to innovation is further demonstrated through its proactive approach to environmental responsibility and climate protection.

PCC SE's innovation strategy is closely tied to its sustainability initiatives, reflecting a commitment to environmentally conscious operations. This dual focus on technological advancement and environmental stewardship is a core element of its long-term vision, ensuring that its growth is both sustainable and responsible.

PCC SE consistently invests in research and development to drive innovation. These investments are crucial for the company's PCC SE growth strategy and future prospects.

PCC Thorion GmbH, a subsidiary, is working on a project to enhance lithium-ion battery performance. This project has received support from the German federal government, highlighting its importance in the energy transition.

PCC BakkiSilicon hf. became the first silicon producer to receive ISCC certification for its carbon footprint in January 2025. This demonstrates the company's commitment to sustainable practices.

PCC SE invests in renewable energy projects, such as hydropower plants, as part of its energy sector activities. This supports its sustainability goals and reduces its environmental impact.

The company actively adopts cutting-edge technologies to reduce energy and resource consumption. This includes implementing state-of-the-art technologies in its investment projects.

PCC SE is committed to environmental responsibility and climate protection. This is demonstrated through investments in sustainable technologies and practices.

PCC SE's innovation and technology strategy is multifaceted, encompassing R&D, sustainable practices, and strategic investments. These initiatives are designed to enhance the PCC SE market position and drive PCC SE future prospects.

- R&D Investments: Continuous investment in R&D to develop innovative products and solutions.

- Lithium-Ion Battery Project: Aims to improve the performance of lithium-ion batteries, supported by government funding.

- ISCC Certification: PCC BakkiSilicon hf. achieving ISCC certification for its carbon footprint, showcasing environmental leadership.

- Renewable Energy Projects: Investments in hydropower and other renewable sources to reduce carbon emissions.

- Technology Adoption: Implementing state-of-the-art technologies to optimize resource use and lower environmental impact.

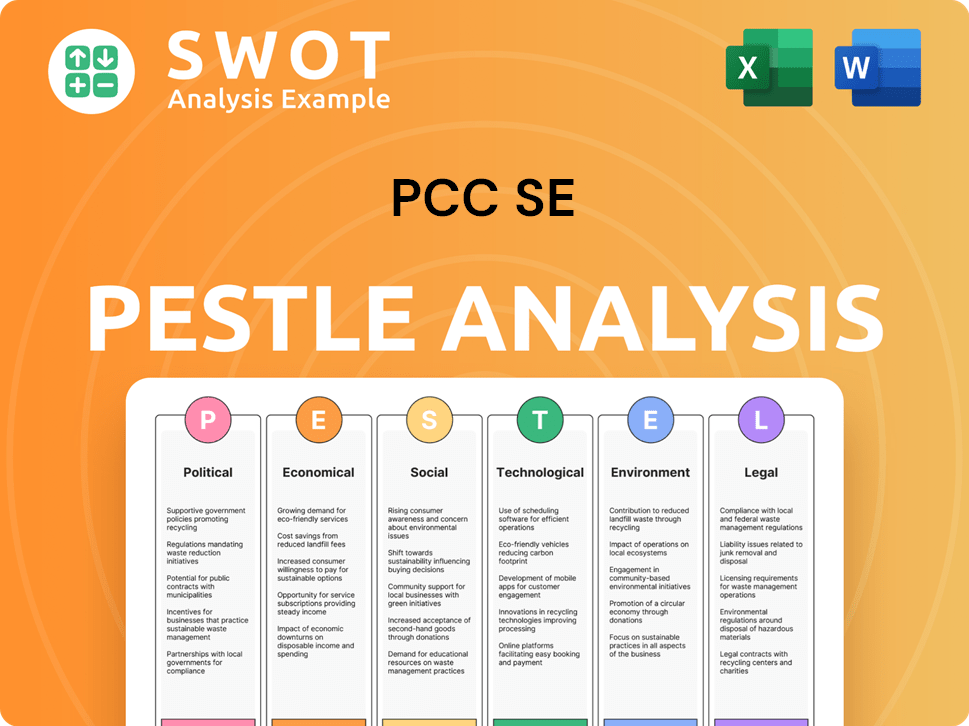

PCC SE PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is PCC SE’s Growth Forecast?

The financial outlook for PCC SE, as indicated by the latest reports, presents a nuanced picture. While the company demonstrates growth in sales, particularly in key segments, profitability faces headwinds. This situation is influenced by a combination of factors including increased operational costs and external economic pressures.

Analyzing the financial performance, it's evident that PCC SE is navigating a dynamic market environment. The company's strategic initiatives and investment decisions are crucial for shaping its future trajectory. Understanding these financial dynamics is essential for assessing the long-term viability and potential of PCC SE within the chemical industry.

In Q1 2025, PCC SE achieved a sales growth of 3.9%, reaching €251.2 million. This growth was primarily driven by volume increases in key segments. However, EBITDA decreased by 12.5% year-on-year to €13.4 million, and EBIT reached €-7.9 million. These figures highlight the challenges in maintaining profitability despite sales growth.

For the full year 2024, PCC SE reported consolidated sales of €960.0 million and a consolidated EBITDA of €88.0 million. The company invested €126.5 million during this period. The annual report for 2024 was published on May 15, 2025, providing a detailed overview of the company's financial health and strategic direction.

PCC SE continues to utilize corporate bonds as a main financing instrument. In April 2025, a 3.00% bond issued in 2021 with a repayment volume of €7.8 million was redeemed, and a 4.00% bond issued in 2019 with a repayment volume of €29.1 million was redeemed in February 2025. New bonds were issued in March and May 2025 with interest rates of 5.50% and 4.00% respectively.

The company's financial activities support its strategy to strengthen its capital base and fund future growth. Investments are primarily focused on core businesses in Europe, Asia, and North America. These investments are critical for the Mission, Vision & Core Values of PCC SE and its long-term growth strategy.

The financial performance of PCC SE reflects a strategic focus on sustainable growth and operational efficiency. The company's ability to manage its capital structure and investment strategy will be key to navigating market challenges and capitalizing on future opportunities. This includes a focus on innovation and development to maintain a competitive edge.

- Sales growth in key segments drives overall revenue.

- EBITDA and EBIT margins are impacted by higher costs.

- Strategic use of bonds supports capital base and investments.

- Investments are focused on core businesses across key regions.

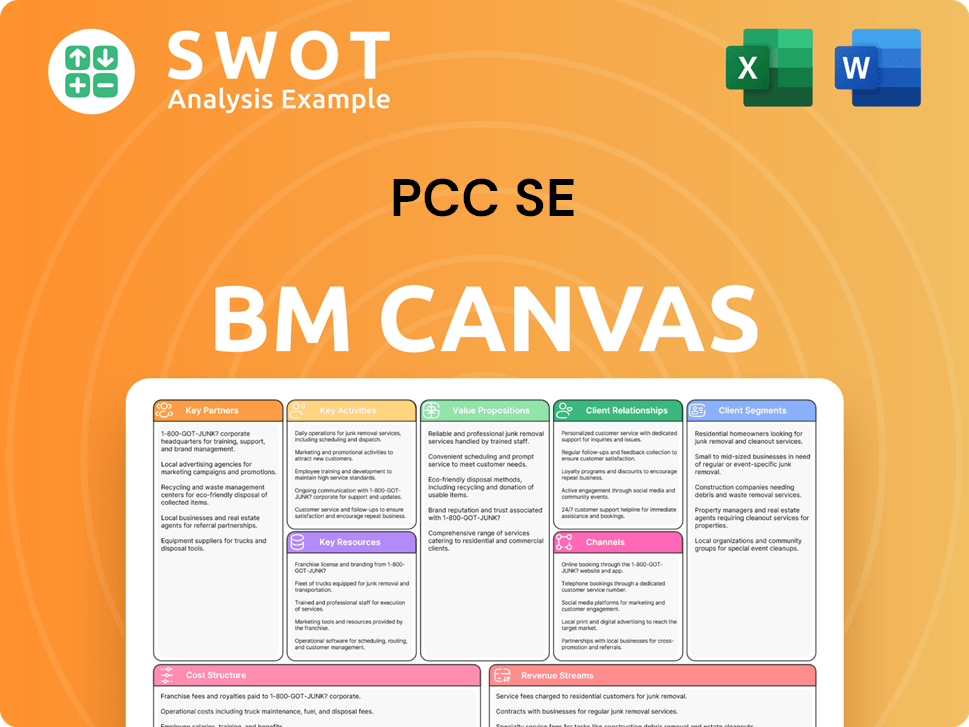

PCC SE Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow PCC SE’s Growth?

The strategic and operational landscape for PCC SE is fraught with potential risks that could impede its PCC SE growth strategy and affect its PCC SE future prospects. These challenges include intense competition and supply chain vulnerabilities, which can significantly impact its financial performance. Understanding these risks is crucial for a comprehensive PCC SE company analysis.

One of the primary obstacles is the fierce market competition, especially from low-cost imports. This pressure has led to price reductions in certain segments, notably affecting the Silicon & Derivatives segment. The company's ability to navigate these competitive pressures and maintain profitability is a key factor in its long-term success.

Regulatory changes and geopolitical factors also pose potential threats. The company's global operations require careful management of these external influences. Furthermore, the temporary suspension of operations at its subsidiary BakkiSilicon hf. in Iceland, announced in May 2025, highlights the need for proactive risk management and adaptation to changing market conditions.

PCC SE faces significant competition, especially from imports from China and Brazil, which impacts its PCC SE market position. This competition has led to price reductions, particularly in the Silicon & Derivatives segment. The company must continually innovate and optimize its PCC SE business model to maintain its competitive edge and ensure positive PCC SE financial performance.

Supply chain disruptions and vulnerabilities present another risk. The company's operations rely on a complex network of suppliers and logistics. Any disruptions in this network could affect production and profitability. Diversifying suppliers and improving supply chain resilience are critical for mitigating these risks and supporting PCC SE's expansion plans.

Regulatory changes and geopolitical factors can significantly impact PCC SE's operations. The company must stay informed about changing regulations in the regions where it operates. The company's strategic investments and diversification efforts aim to mitigate these risks. Adaptability is key for its long-term PCC SE's revenue growth drivers.

Operational challenges, such as the temporary suspension of operations at its subsidiary, BakkiSilicon hf., in Iceland, demonstrate the need for flexible management. The company's ability to adapt to changing market conditions and make strategic decisions is crucial. Focusing on less competitive sub-markets and increasing synergies between divisions are part of the strategy to reduce risks and sustain PCC SE's innovation and development.

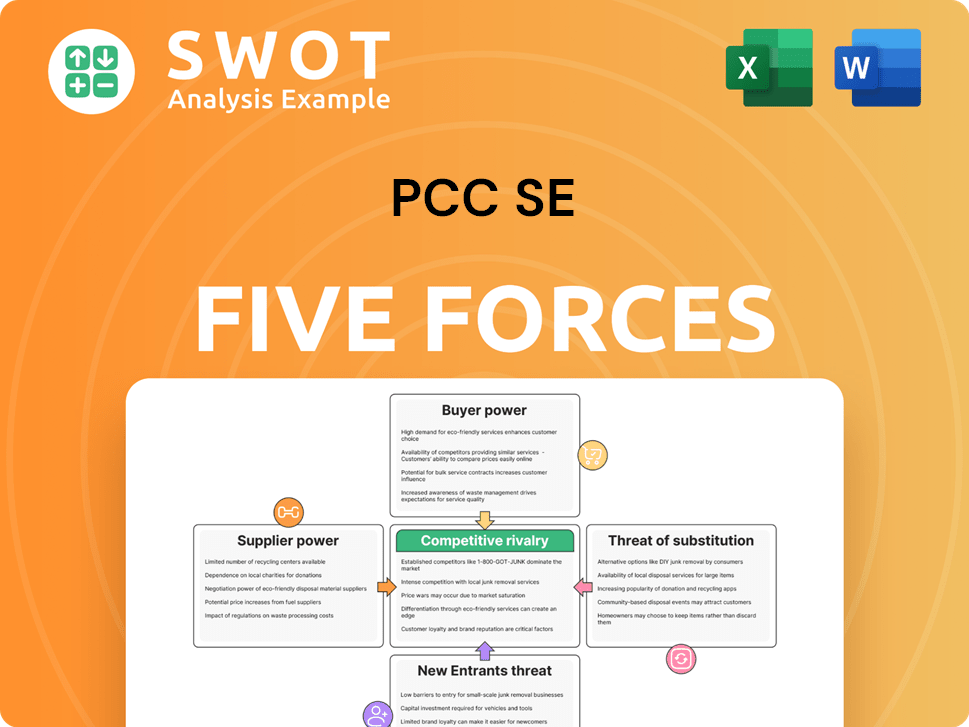

PCC SE Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of PCC SE Company?

- What is Competitive Landscape of PCC SE Company?

- How Does PCC SE Company Work?

- What is Sales and Marketing Strategy of PCC SE Company?

- What is Brief History of PCC SE Company?

- Who Owns PCC SE Company?

- What is Customer Demographics and Target Market of PCC SE Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.