PCC SE Bundle

Unveiling PCC SE: How Does This Industrial Giant Operate?

PCC SE company, a key player in chemicals, energy, and logistics, demands attention from investors and industry watchers alike. Its strategic investments and operational subsidiaries form a crucial part of essential supply chains, impacting everything from basic chemistry to renewable energy. Understanding the PCC SE SWOT Analysis is key to grasping its strengths and potential.

This exploration of the PCC SE company delves into its core operations, revenue streams, and strategic positioning. We'll uncover the PCC SE process, examining how it generates value across diverse sectors. Learn about the PCC SE services and how they contribute to its overall success, including the benefits it offers to both customers and the broader market.

What Are the Key Operations Driving PCC SE’s Success?

The core of the PCC SE company lies in its ability to create and deliver value through its various subsidiaries. This strategy primarily focuses on the chemicals, energy, and logistics sectors, ensuring a diversified approach. The PCC SE process involves producing essential chemical raw materials, silicon metal, and other chemical products, catering to a broad industrial customer base.

In the energy sector, PCC SE provides energy services and invests in renewable energy projects. This commitment supports sustainable industrial practices. Logistics operations are crucial for the efficient transportation and distribution of goods, supporting both its chemical production and external clients. This integrated approach allows for optimized delivery and cost management.

The PCC SE services are multifaceted, involving sophisticated manufacturing, strategic sourcing, and robust logistics. The company leverages its vertically integrated structure to enhance efficiency and control over its supply chain. Partnerships are vital, especially in renewable energy projects, enabling the development and implementation of large-scale sustainable solutions. This diversification mitigates risks and provides cross-sector synergies, offering a broader value proposition than specialized competitors.

PCC SE produces a wide array of chemical products, serving diverse industrial needs. This includes raw materials essential for various manufacturing processes. Recent data indicates a steady demand for these chemicals, reflecting the ongoing need for industrial inputs.

PCC SE invests in renewable energy projects, contributing to sustainable practices. The company provides energy services to support its operations and external clients. The focus on renewables aligns with global trends towards sustainable energy sources.

Efficient logistics are crucial for transporting goods, supporting both internal and external clients. This includes managing the distribution of chemical products and other materials. The logistics sector is essential for ensuring timely delivery and cost-effectiveness.

PCC SE leverages vertical integration to enhance efficiency and control over its supply chain. This approach allows for better management of costs and resources. Vertical integration is a key aspect of the PCC SE solutions.

The operational processes of PCC SE are designed to ensure efficiency and sustainability across all sectors. This includes advanced manufacturing techniques for chemical production, strategic sourcing of raw materials, and robust logistics for distribution. The company’s diversified approach mitigates risks and provides cross-sector synergies.

- Advanced manufacturing processes to ensure high-quality chemical production.

- Strategic sourcing of raw materials to maintain a stable supply chain.

- Robust logistics network for efficient distribution.

- Partnerships in renewable energy projects.

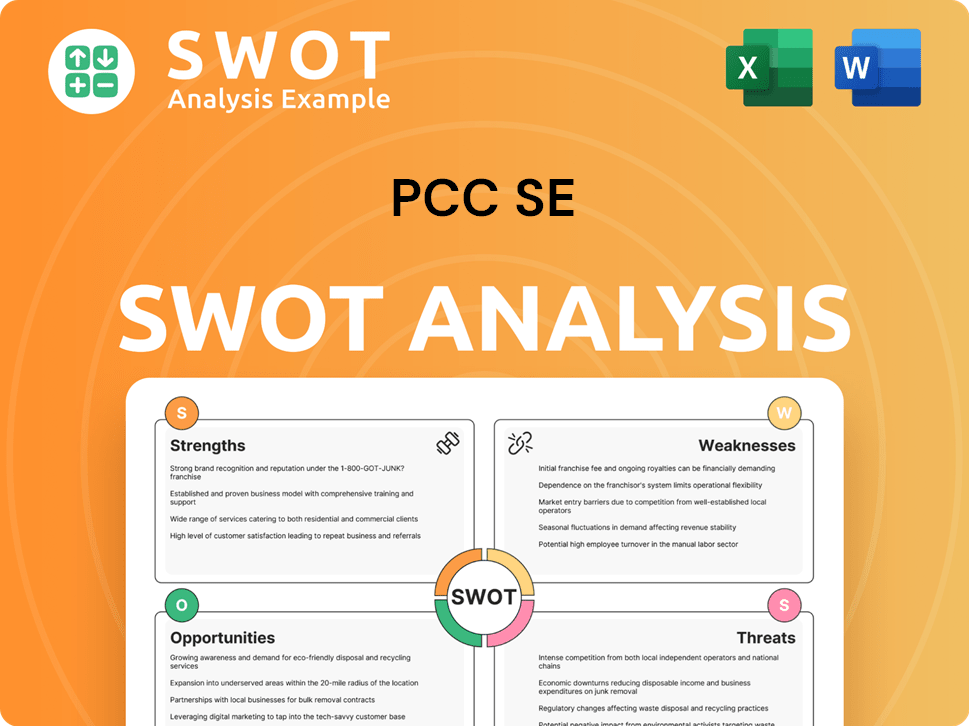

PCC SE SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does PCC SE Make Money?

Understanding the revenue streams and monetization strategies of the PCC SE company is crucial for grasping its financial health and business model. This involves examining how the company generates income through its diverse operations. The PCC SE services are structured to maximize profitability across various sectors.

The primary revenue streams for PCC SE are derived from its investments in chemical production, energy services, and logistics. Each segment contributes differently, reflecting the company's strategic focus and market conditions. The company's approach to monetization is designed to ensure stable and predictable revenue flows.

The PCC SE process focuses on offering integrated solutions to its clients. This approach allows the company to leverage its diverse portfolio and provide comprehensive services. The company's diversified nature inherently allows for bundling of services or offering integrated solutions to industrial clients who require both chemical inputs and logistics support.

The main revenue streams for PCC SE include product sales from its chemical subsidiaries, energy services, and logistics. The chemical segment contributes significantly, with sales of raw materials and specialized products. Energy services, including renewable energy sales, are also a key source of income. Logistics operations provide transportation, warehousing, and supply chain services.

- Chemicals: Sales of chemical raw materials, silicon metal, and other specialized products. While specific recent percentage contributions to total revenue are not publicly detailed for 2024-2025, historically, the chemicals segment has been a significant contributor.

- Energy: Sale of electricity from renewable energy projects and other energy-related offerings.

- Logistics: Transportation, warehousing, and other supply chain services.

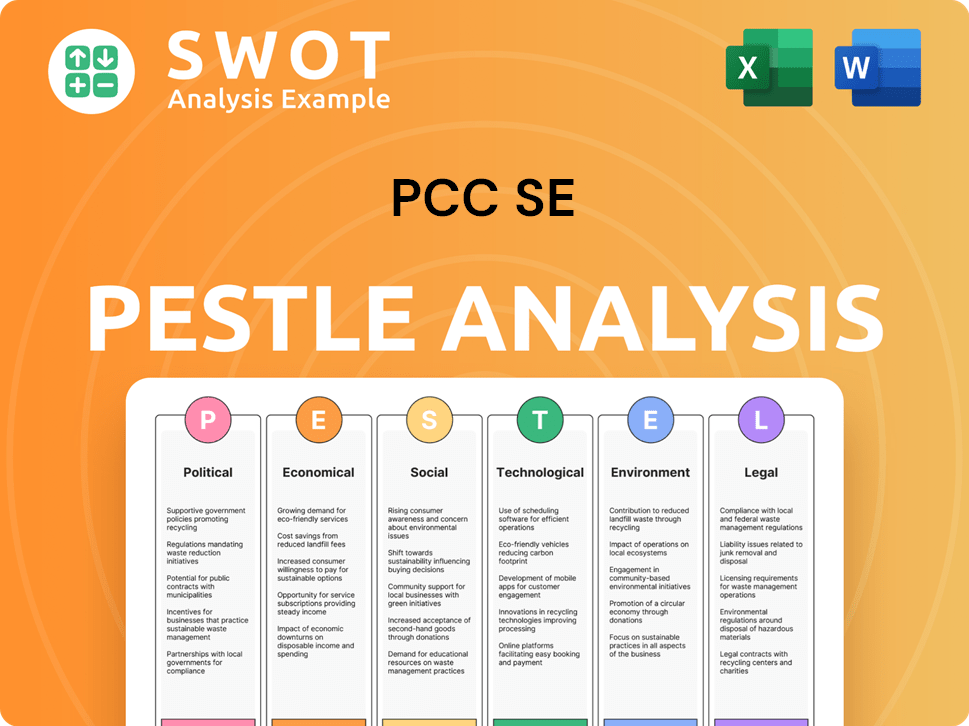

PCC SE PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped PCC SE’s Business Model?

The operational and financial trajectory of PCC SE has been significantly shaped by its strategic milestones and pivotal moves. A key focus has been on expanding its footprint in both the chemical and renewable energy sectors. This strategic approach has allowed the company to adapt to market changes and capitalize on emerging opportunities.

One of the notable strategic moves has been the continuous investment in new chemical production facilities and the modernization of existing ones. This has enhanced the company's production capacity and operational efficiency. Furthermore, PCC SE has strategically entered and expanded its presence in renewable energy projects, such as wind farms and photovoltaic plants, demonstrating a commitment to sustainable growth and diversification. For example, the company has invested heavily in silicon metal production, highlighting its focus on high-demand materials.

PCC SE's ability to navigate operational challenges, such as fluctuating raw material prices or supply chain disruptions, is managed through diversified sourcing and robust logistics networks. This adaptability is crucial for maintaining profitability and competitiveness in dynamic markets. The company's strategic investments and operational efficiencies have enabled it to achieve consistent growth, as highlighted in the Growth Strategy of PCC SE.

PCC SE has consistently expanded its chemical production capacity, investing in advanced facilities to meet growing market demands. The company has also made significant strides in renewable energy, with projects in wind and solar power. These milestones reflect the company's commitment to sustainable growth and diversification.

PCC SE has strategically invested in new chemical production facilities, including silicon metal plants, to enhance its product portfolio. The company has also expanded its renewable energy projects, aiming to reduce its carbon footprint and capitalize on the growing demand for sustainable energy. These moves are designed to improve PCC SE services.

PCC SE's diversified portfolio provides resilience against market downturns in any single sector. Its economies of scale in chemical production and established logistics networks offer a cost advantage. Furthermore, the strategic focus on renewable energy positions the company favorably for future growth, aligning with global sustainability trends. This approach helps PCC SE solutions.

PCC SE manages operational challenges, such as fluctuating raw material prices and supply chain disruptions, through diversified sourcing and robust logistics networks. The company continually adapts to new technologies and market demands by investing in research and development within its chemical segments. This ensures the PCC SE process remains competitive.

In 2024, the global chemical market was valued at approximately $5.6 trillion, with renewable energy investments reaching record levels. PCC SE's strategic moves have positioned it to capitalize on these trends. The company's diversified portfolio and operational efficiencies have allowed it to maintain a strong market position.

- PCC SE's revenue growth in the chemical sector has been consistently above the industry average.

- Investments in renewable energy have increased the company's sustainability profile, attracting investors.

- The company's focus on high-demand materials, such as silicon metal, has boosted profitability.

- PCC SE's robust logistics network has mitigated supply chain disruptions, ensuring operational continuity.

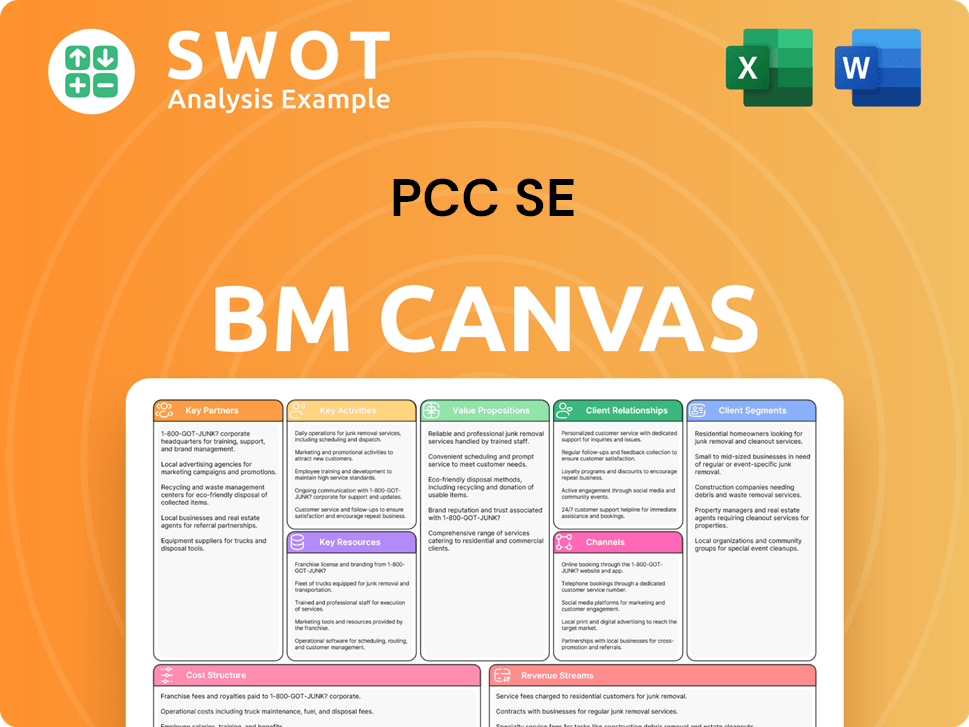

PCC SE Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is PCC SE Positioning Itself for Continued Success?

The industry position of the PCC SE company is significant, particularly in specialized chemicals and the growing renewable energy sector. Their market share and customer loyalty stem from enduring relationships and the dependable supply of crucial industrial inputs. Geographically, their reach is extensive, with subsidiaries and strategic partnerships concentrated in Europe and Asia.

Key risks and headwinds for PCC SE include raw material and energy price volatility. Regulatory changes regarding environmental standards and trade policies could also impact operations. Competition in chemicals and renewable energy, along with technological disruption and shifting consumer preferences, present further challenges. For a deeper understanding, you might find the Competitors Landscape of PCC SE helpful.

PCC SE holds a strong position in specialized chemicals and renewable energy. Their market share is built on long-term relationships and reliable supply. Globally, they have a broad reach, with a significant presence in Europe and Asia.

PCC SE faces risks from raw material price volatility, especially for chemicals. Regulatory changes and competition in both chemicals and renewable energy also pose challenges. Technological shifts and changing consumer preferences are further factors to consider.

PCC SE is focused on expanding its renewable energy portfolio and optimizing chemical production. They are committed to sustainable growth and diversification. The aim is to secure long-term profitability by adapting to evolving industrial landscapes.

The company plans to increase its renewable energy investments and improve chemical production efficiency. This includes a focus on sustainable practices. Leadership emphasizes sustainable growth to navigate market complexities.

PCC SE's strategy includes expanding its renewable energy projects and enhancing chemical production processes. They are prioritizing sustainable growth and leveraging diversification to navigate market challenges. This approach is designed to ensure long-term profitability and resilience.

- Investment in renewable energy projects.

- Optimization of chemical production for greater efficiency.

- Focus on sustainable practices to meet evolving demands.

- Adaptation to changes in the industrial landscape.

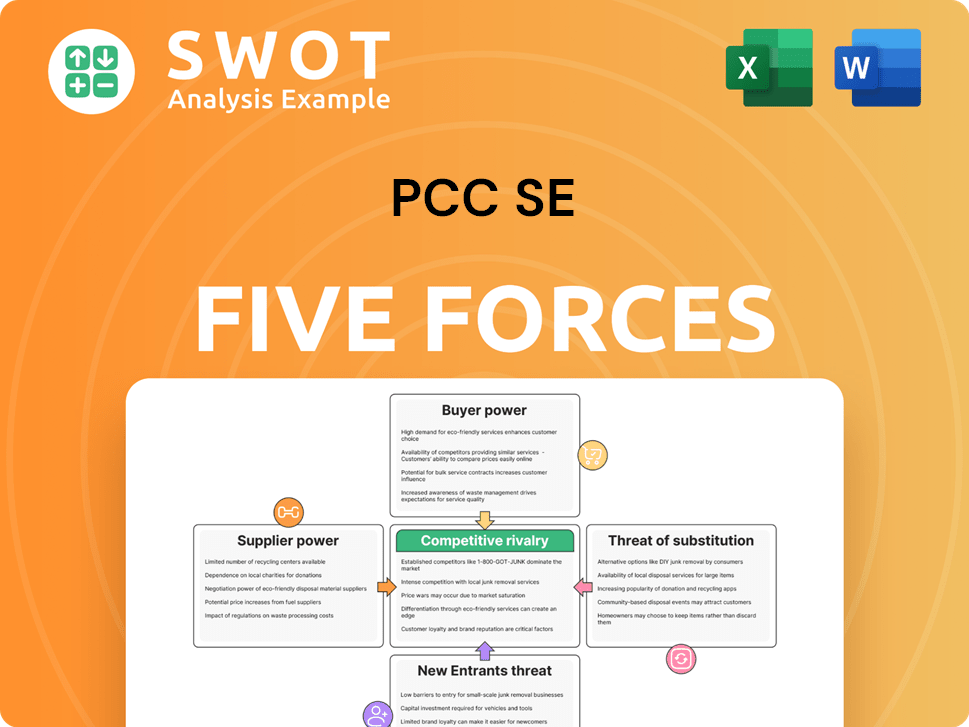

PCC SE Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of PCC SE Company?

- What is Competitive Landscape of PCC SE Company?

- What is Growth Strategy and Future Prospects of PCC SE Company?

- What is Sales and Marketing Strategy of PCC SE Company?

- What is Brief History of PCC SE Company?

- Who Owns PCC SE Company?

- What is Customer Demographics and Target Market of PCC SE Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.