PCC SE Bundle

How Does PCC SE Navigate Its Competitive Arena?

PCC SE, a diversified investment holding company, operates in dynamic sectors, including chemicals, energy, and logistics. Understanding the PCC SE SWOT Analysis is crucial for investors and strategists alike. This analysis will dissect the company's market position and competitive advantages.

In today's volatile market, a deep dive into the PCC SE competitive landscape is essential. We'll explore PCC SE competitors and their impact on PCC SE's financial performance. This report offers a comprehensive PCC SE market analysis, uncovering PCC SE industry trends and the company's strategic responses, empowering you to make informed decisions. We will also examine PCC SE business strategy in a competitive environment.

Where Does PCC SE’ Stand in the Current Market?

PCC SE maintains a significant market position across its diverse sectors. This position is driven by strategic investments and the development of its portfolio companies. The company's core operations encompass chemical raw materials, specialty chemicals, silicon and silicon derivatives, and container logistics. A detailed Marketing Strategy of PCC SE can shed further light on its operational approach.

The company's value proposition lies in its diversified product offerings and geographical presence, primarily in Europe, the US, and parts of Asia. This diversification helps mitigate risks and capitalize on growth opportunities in various markets. The company's focus on innovation and sustainable practices, such as the climate-friendly silicon metal production in Iceland, further enhances its market position.

In the fiscal year 2024, the PCC Group reported consolidated sales of €960.0 million, with consolidated earnings before interest, taxes, depreciation, and amortization (EBITDA) reaching €88.0 million. The investment volume for 2024 was €126.5 million. In the first quarter of 2025, PCC SE achieved sales growth of 3.9% to €251.2 million, primarily due to volume growth in its Surfactants, Chlorine, Polyols, and Logistics segments.

The PCC SE competitive landscape is shaped by its diverse business segments. Its main competitors vary depending on the specific market, including the Surfactants, Chlorine, Polyols, and Logistics segments. The company's ability to adapt to market dynamics and maintain a strong financial performance is crucial.

PCC SE's market analysis reveals a strong focus on Europe, with a growing presence in the US and Asia. The intermodal transport business in Poland, part of the Logistics segment, achieved market leadership in 2024, accounting for 19.6% of freight turnover. This highlights the company's strategic positioning and market penetration.

PCC SE faces industry trends and challenges related to raw material costs, competition, and geographical expansion. The Surfactants & Derivatives segment increased selling prices despite competition. The Silicon & Derivatives segment's climate-friendly silicon metal production plant in Iceland leverages renewable energy sources to address sustainability concerns.

The financial performance of PCC SE in 2024 showed a slight operating profit of €1.8 million and a pre-tax loss of -€29.1 million. Despite this, individual segments like Surfactants & Derivatives and Logistics showed pleasing performance, with this positive trend continuing into early 2025. The growth in sales to €251.2 million in Q1 2025 indicates a positive trajectory.

Analyzing PCC SE's key competitors requires a segment-specific approach. Competitors vary across the chemical raw materials, specialty chemicals, silicon, and logistics sectors. Understanding the competitive landscape involves assessing market share, pricing strategies, and product offerings.

- The Surfactants & Derivatives segment faces competition from established players.

- The Logistics segment competes with other intermodal transport providers.

- The Silicon & Derivatives segment competes with other silicon metal producers.

- PCC SE's ability to outperform competitors depends on its strategic investments and operational efficiency.

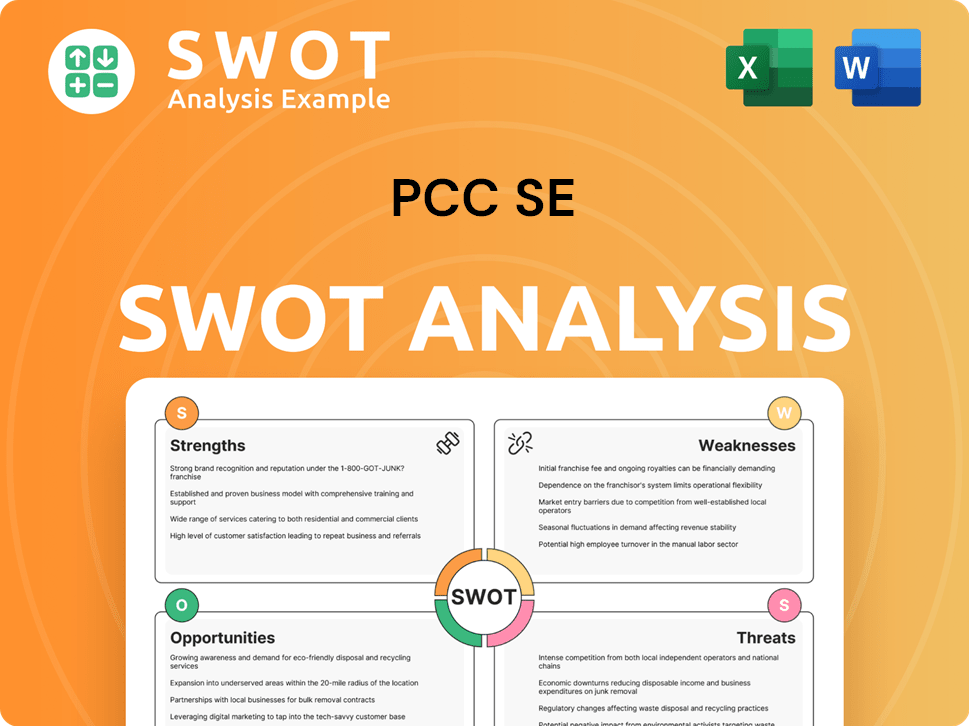

PCC SE SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging PCC SE?

Understanding the PCC SE competitive landscape requires a look at its diverse operations across chemicals, energy, and logistics. The company faces competition from a range of direct and indirect rivals. This analysis is crucial for a comprehensive PCC SE market analysis, guiding strategic decisions and assessing PCC SE financial performance.

The PCC SE industry is characterized by intense competition, necessitating a detailed examination of PCC SE competitors. This includes both global and regional players, reflecting the company's wide-ranging activities. A deep dive into these competitive dynamics is essential for formulating effective PCC SE business strategy.

The PCC SE competitive landscape is significantly shaped by its involvement in various sectors. In the chemical sector, subsidiaries like PCC Rokita SA and PCC Exol SA compete with major global and regional chemical companies. For instance, in the calcium carbonate market, key players such as Imerys, Omya AG, Carmeuse, Lhoist, CALCIT doo, and Nordkalk Corporation are significant competitors. The surfactant market sees competition from Chinese and Indian manufacturers, impacting PCC SE market share by competitor.

In the chemical sector, the company's subsidiaries face competition from global and regional players. This includes manufacturers of chlorine, polyols, and surfactants. The competitive environment is dynamic, influenced by market trends and technological advancements.

In the energy sector, particularly in silicon metal production, the company competes with other global silicon producers. Competition is influenced by energy costs and geographical advantages. The sector is capital-intensive, affecting PCC SE competitive advantages.

In the logistics sector, the company's intermodal operations in Poland compete with other providers. The global chemical logistics market, valued at approximately $294.16 billion in 2024 and projected to reach $305.83 billion in 2025, includes numerous players. This sector is crucial for understanding PCC SE industry trends impacting competition.

Emerging players and strategic alliances are reshaping the market. Regulatory bodies are also influencing the competitive landscape. The overall economic landscape, including aggressive export policies from non-European countries, creates competitive pressure.

The company faces challenges from competitors in various sectors. This includes pricing strategies and product comparisons with rivals. Understanding these pressures is key to formulating effective PCC SE growth strategies in a competitive market.

The company needs to consider various factors to outperform competitors. This includes customer acquisition strategies and addressing competitive threats and opportunities. A detailed PCC SE key competitors analysis is essential for strategic planning.

The energy sector, particularly in silicon metal production, sees competition from global silicon producers. The logistics sector, where the company holds market leadership in Poland, faces competition from other intermodal transportation providers. The global chemical logistics market, valued at approximately $294.16 billion in 2024, is projected to reach $305.83 billion in 2025. Emerging players and strategic alliances also influence the competitive landscape. For more insights, consider reading about the Growth Strategy of PCC SE.

Several factors influence the competitive dynamics within the company's operating sectors. These include market share, pricing strategies, and product differentiation. Analyzing these elements provides insights into PCC SE competitor pricing strategies and PCC SE product comparison with rivals.

- Market Share: Understanding the market share of key competitors is crucial for assessing the company's position.

- Pricing Strategies: Analyzing competitor pricing strategies helps in formulating effective pricing models.

- Product Differentiation: Differentiating products and services is essential for gaining a competitive edge.

- Customer Acquisition: Effective customer acquisition strategies are vital in a competitive environment.

- Competitive Threats: Identifying and addressing competitive threats is necessary for sustainable growth.

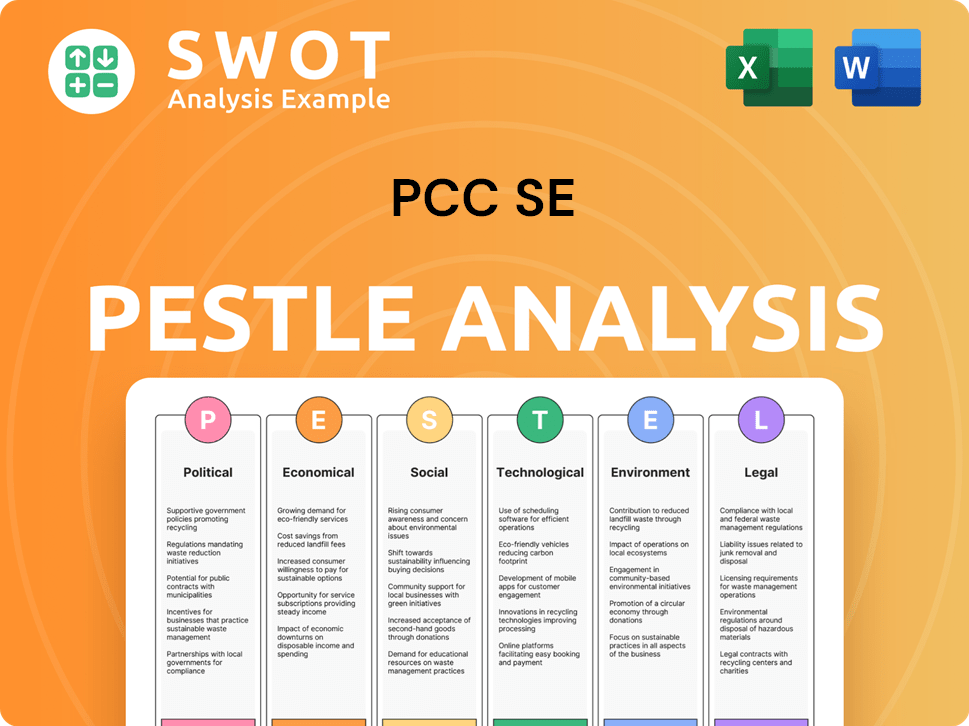

PCC SE PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives PCC SE a Competitive Edge Over Its Rivals?

The competitive advantages of PCC SE, an investment holding company, are rooted in its diversified portfolio, strategic focus on niche markets, and commitment to sustainable practices and innovation. This structure allows for active portfolio management, enabling acquisitions and development across chemicals, energy, and logistics. This diversification provides resilience against market fluctuations, a key factor in the PCC SE competitive landscape.

A key strength lies in identifying and operating within 'less competitive sub-markets and market niches.' This strategy enhances profitability through increased efficiency and continuous portfolio optimization. For example, PCC Rokita SA is a significant chlorine manufacturer and leading polyols producer in Eastern Europe, showcasing a strong regional and product-specific market position. PCC Exol SA is recognized as a modern surfactant producer in Europe. This approach is central to understanding the PCC SE business strategy.

Furthermore, the company emphasizes sustainability and environmental protection, increasingly becoming a competitive differentiator. Its subsidiary, PCC BakkiSilicon hf., operates one of the world's most advanced and climate-friendly silicon metal production facilities in Iceland, utilizing renewable energy sources. This commitment to 'Green Chemistry, Silicon and Logistics' aims to halve greenhouse gas emissions from chemical production by 2030 compared to 2020 (Scope 1 and 2) and achieve net climate-neutrality by 2050. These initiatives enhance brand equity and appeal to environmentally conscious customers and partners, impacting the PCC SE industry.

PCC SE's diversified portfolio across chemicals, energy, and logistics provides resilience. Strategic focus on niche markets and sub-markets enhances profitability and efficiency. This approach is crucial for understanding PCC SE key competitors analysis.

Commitment to sustainability and environmental protection is a key differentiator. PCC BakkiSilicon hf. in Iceland uses renewable energy. Initiatives aim to halve greenhouse gas emissions by 2030 and achieve climate-neutrality by 2050.

PCC SE has a long-term investor orientation with expertise since 1993. It has deep knowledge of international growth markets, particularly Eastern Europe and Asia. This is a factor in PCC SE competitive advantages.

Focus on increasing synergies between divisions and new business areas. Extending the value chain and continuously developing new business and product fields. This approach is part of PCC SE market analysis.

PCC SE's competitive edge is enhanced by its diversified structure, strategic niche focus, and commitment to sustainability. The company's long-term perspective and expertise in international markets, especially Eastern Europe and Asia, further solidify its position. Understanding these elements is key to analyzing the PCC SE competitors and their strategies.

- Active portfolio management through acquisitions and development.

- Focus on less competitive sub-markets for higher profitability.

- Emphasis on sustainability to attract environmentally conscious customers.

- Leveraging synergies and value chain extension for growth.

The company's approach to acquisitions and market positioning has been successful, as highlighted in the analysis of Owners & Shareholders of PCC SE. This approach to acquisitions and market positioning has been successful, with the company consistently seeking opportunities for growth and efficiency improvements within its portfolio. The company's financial performance reflects these strategic advantages, with a focus on sustainable practices and long-term value creation. For a comprehensive view, the company's financial data and strategic initiatives provide insights into its PCC SE financial performance and future outlook in the competitive landscape.

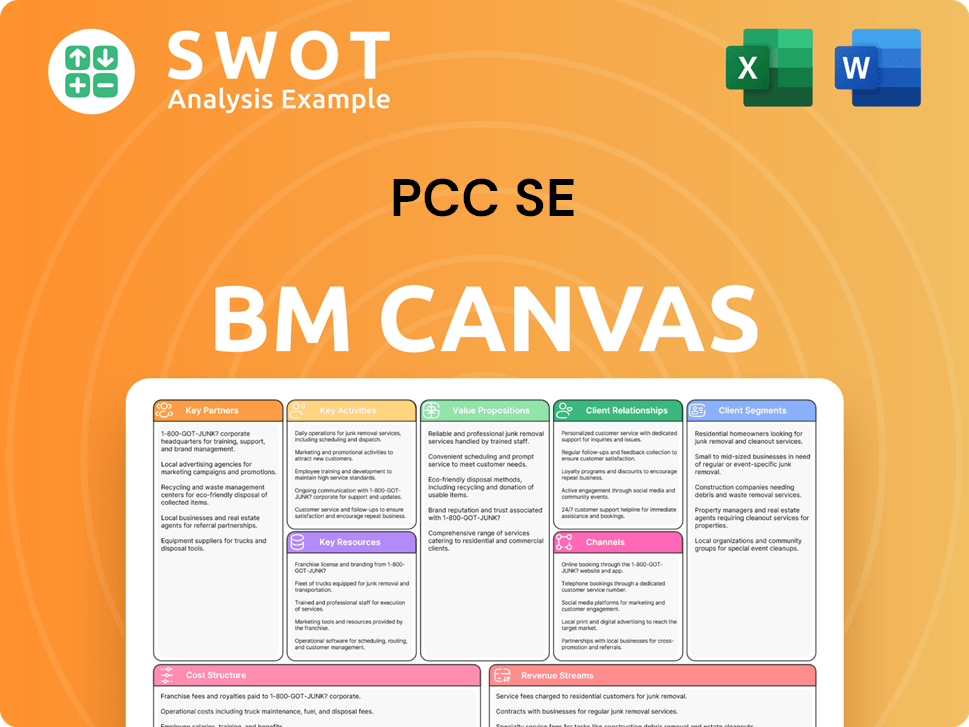

PCC SE Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping PCC SE’s Competitive Landscape?

Understanding the PCC SE competitive landscape involves analyzing the industry trends, future challenges, and opportunities that shape its strategic direction. The company's financial performance and business strategy are significantly influenced by these factors. A thorough PCC SE market analysis is crucial for investors and stakeholders to assess the company's position and potential.

The PCC SE industry faces dynamic shifts, demanding adaptability and strategic foresight. This chapter explores the key elements that define the competitive environment for PCC SE, offering insights into its future prospects and challenges.

Technological advancements are driving innovation in chemicals, energy, and logistics. This necessitates continuous investment in modern, energy-efficient production technologies. Regulatory changes, especially concerning environmental protection and sustainability, are also increasingly important for the company.

Global economic shifts and geopolitical uncertainties pose significant challenges. The weak economy in Germany and the EU, PCC SE's main sales markets, combined with aggressive export policies from non-European countries, intensify competitive pressure. High energy prices in Europe also remain a major hurdle.

Emerging markets, particularly in Central, Eastern, and South Eastern Europe, and Asia, offer growth potential. Product innovations, such as new specialist products, are key to seizing these opportunities. Strategic partnerships can also reduce market risks and support future investments.

PCC SE's proactive investment portfolio management aims to sustainably increase enterprise value. The company's commitment to reducing greenhouse gas emissions by 2030 and achieving net climate-neutrality by 2050 positions it well. Focus on eco-friendly products is a key competitive advantage.

PCC SE's strategic initiatives include product innovation and geographic expansion. The company is focusing on developing new specialist products and expanding its presence in emerging markets. Strategic partnerships also play a key role in mitigating risks.

- Focus on sustainable and eco-friendly products to meet market demand.

- Expansion into emerging markets such as Central and Eastern Europe.

- Investment in modern and energy-efficient production technologies.

- Strategic partnerships to reduce market and sales risks.

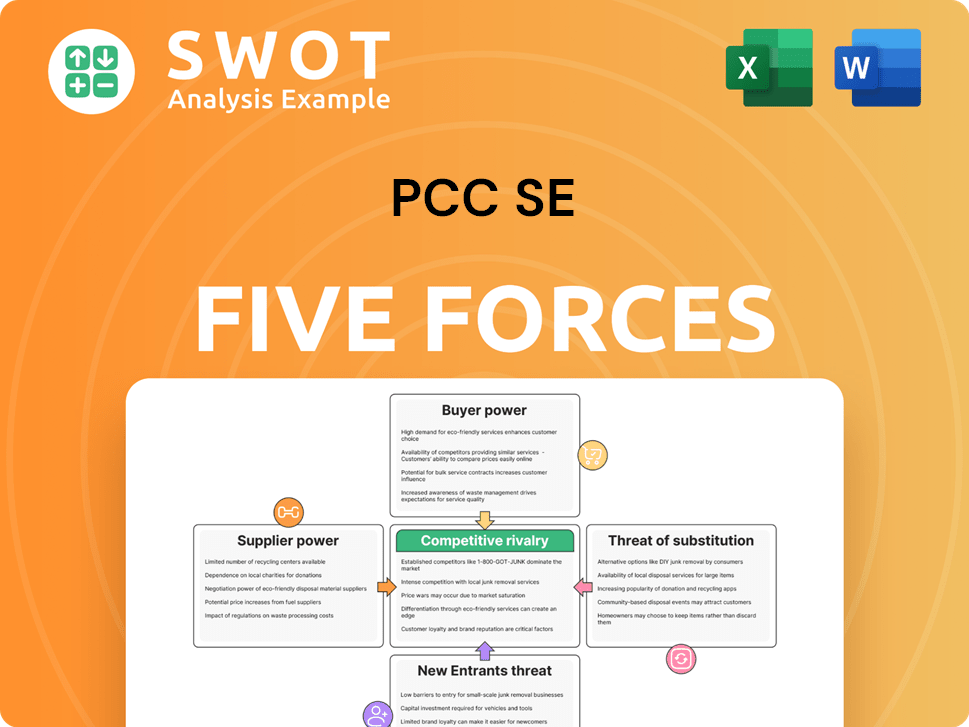

PCC SE Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of PCC SE Company?

- What is Growth Strategy and Future Prospects of PCC SE Company?

- How Does PCC SE Company Work?

- What is Sales and Marketing Strategy of PCC SE Company?

- What is Brief History of PCC SE Company?

- Who Owns PCC SE Company?

- What is Customer Demographics and Target Market of PCC SE Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.