PCC SE Bundle

Who Buys From PCC SE? Unveiling the Customer Landscape

Navigating the complex world of chemicals and commodities requires a deep understanding of the end-users. For PCC SE company, knowing its customer demographics and target market is not just beneficial—it's essential for survival and growth. From its roots in commodity trading to its current diversified portfolio, PCC SE's evolution reflects a strategic adaptation to changing market demands. This analysis delves into the specifics of who PCC SE's customers are and how the company caters to their needs.

Understanding the customer profile of PCC SE, including their geographic location and income levels, is crucial for effective market segmentation. This exploration will examine the demographic data for PCC SE customers, providing insights into their buying behavior and the benefits of understanding their needs. Furthermore, we'll analyze how PCC SE defines its target market and the marketing strategies employed, supported by insights from a comprehensive PCC SE SWOT Analysis.

Who Are PCC SE’s Main Customers?

Understanding the customer demographics and target market is crucial for the success of any company. For PCC SE company, this involves a deep dive into its primary customer segments. This analysis helps in tailoring products, services, and marketing strategies to meet the specific needs of its diverse clientele. The company's focus on B2B operations across multiple industrial sectors shapes its approach to market segmentation.

PCC SE primarily serves businesses (B2B) across various industrial sectors. Its customer base is diversified across industries such as electronics, construction, automotive, plastics, cosmetics, and textiles. These industries rely on specialized chemicals and silicon products, which are core offerings of the company. The company's strategic focus and investments reflect a commitment to meeting the evolving needs of these key sectors.

The company's primary customer segments include businesses in electronics, construction, automotive, plastics, cosmetics, and textiles. These sectors require specialized chemicals and silicon products. Furthermore, the company's logistics and transportation services, particularly its intermodal transport division, also serve as a significant customer segment, contributing substantially to its overall income. Investor relations and financial stakeholders are also considered a crucial customer segment, emphasizing transparent reporting.

PCC SE's products are essential for industries like electronics, construction, and automotive. These sectors rely on the specialized chemicals and silicon products offered by the company. The company's strategic focus on these key industries drives its market segmentation and customer engagement strategies.

The intermodal transport division is a significant customer segment for PCC SE. This division is a market leader in Poland, holding a 19.6% share of freight revenue in 2024. It contributes approximately 20% of the total income, highlighting its importance to the company's financial performance.

PCC SE considers investors and financial stakeholders as a crucial customer segment. The company emphasizes transparent reporting and strong investor relations. This approach is essential for maintaining investor confidence and supporting the company's growth initiatives.

PCC SE allocated €50 million in 2024 to expand its specialty chemicals division into Southeast Asia. This investment is projected to increase sales by 15% within two years. The company's strategic investments drive its growth and market expansion efforts.

PCC SE's market segmentation strategy focuses on identifying and serving specific industry needs. The company's customer profile includes businesses in electronics, construction, and logistics. Understanding the needs of these customers is critical for providing tailored solutions. For more insights, see the Revenue Streams & Business Model of PCC SE.

- The global silicon market was valued at approximately $10 billion in 2024.

- The construction chemicals market is projected to reach $88.6 billion by 2025.

- The textile chemicals market is expected to hit $28.5 billion by 2025.

- The global renewable energy market is projected to reach $2.15 trillion by 2025.

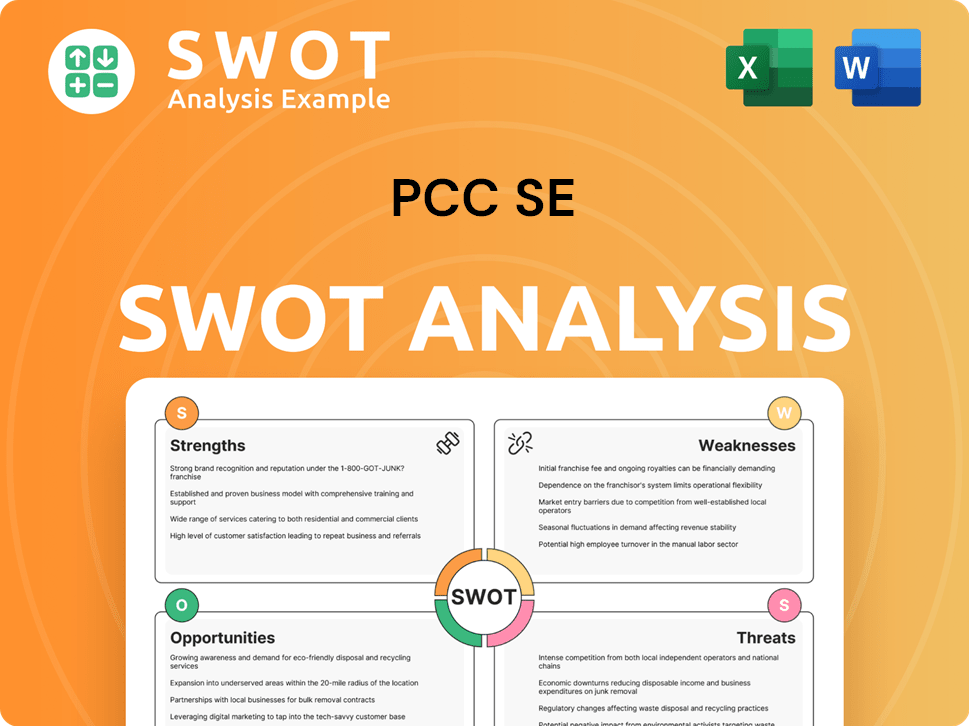

PCC SE SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do PCC SE’s Customers Want?

Understanding the needs and preferences of its customers is crucial for the success of the [Company Name]. The company's customer base, across industries like electronics, construction, and automotive, is driven by specific requirements for specialized solutions and technical expertise. This focus helps [Company Name] tailor its offerings to meet the evolving demands of its target market.

Customers of [Company Name] prioritize solutions that offer unique material properties and strong technical support. The company's ability to provide expert advice on chemical products and logistics services is key to customer satisfaction. In 2024, companies that provided robust technical support saw a 15% increase in customer retention, underscoring the importance of this aspect.

The company's approach to customer relationships is characterized by long-term partnerships and contracts, which accounted for approximately 60% of its revenue in 2024. This model provides stability and ensures a consistent revenue stream. The company's dedication to innovation and market adaptation, particularly in specialty chemicals, allows it to enhance its offerings to meet evolving industry needs.

Customers require specialized solutions and materials with unique properties. Technical expertise and support are essential for optimizing operations and ensuring product performance. Reliability in supply chain and product quality is a priority for customers.

B2B relationships are often based on long-term contracts, providing stability. Decision-making factors include product quality, technical specifications, and efficient supply chain management. The company focuses on providing high-purity materials and timely delivery.

Customer feedback and market trends significantly influence product development. The demand for sustainable products is driving investment in green production methods. Marketing and customer experiences are tailored through client-focused strategies.

Digital platforms are crucial for B2B interactions, with over 70% of engagements starting online in 2024. These platforms offer easy access to product details and streamlined order tracking. The company leverages digital tools to enhance customer experience.

Investment in green silicon production using renewable energy is a key initiative. This aligns with the growing customer demand for sustainable products. Sustainability efforts strengthen the company's market position.

Dedicated sales and account management teams build strong customer relationships. Customized solutions are offered to meet specific client needs. The company focuses on client-centric strategies.

The [Company Name] focuses on providing specialized solutions and technical expertise to meet the needs of its target market. This includes offering high-purity materials and efficient supply chain management. Understanding the customer demographics and preferences is crucial for the company's success.

- Prioritize tailored solutions and technical support.

- Focus on long-term partnerships and contract stability.

- Adapt to market trends, particularly sustainability.

- Utilize digital platforms for customer engagement.

- Build strong customer relationships through dedicated teams.

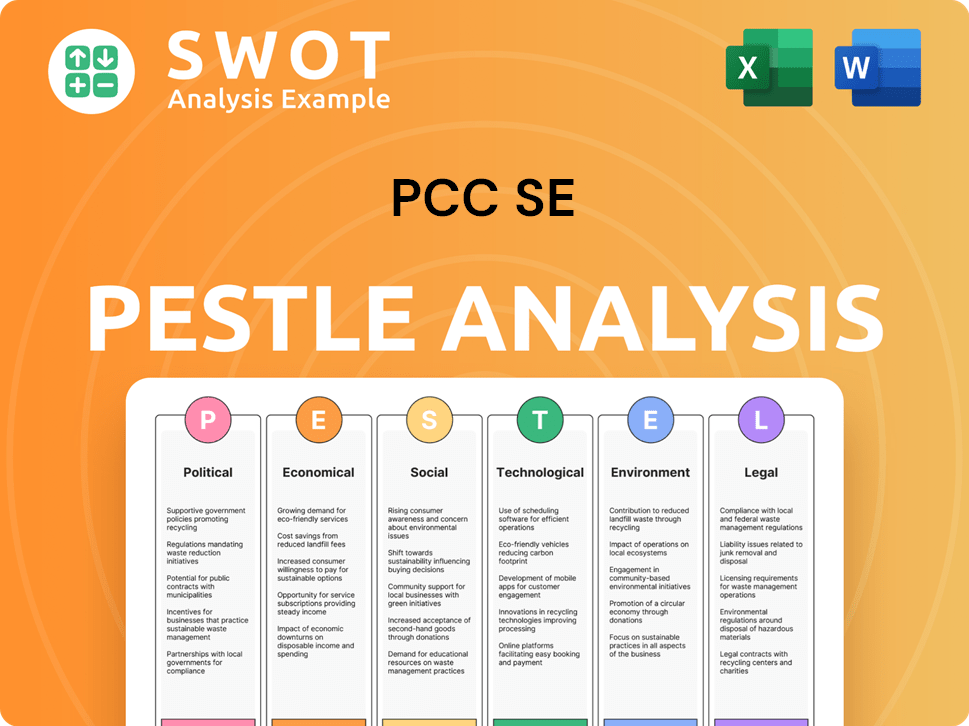

PCC SE PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does PCC SE operate?

The geographical market presence of the PCC SE company is a critical aspect of its business strategy, focusing on a global footprint with strongholds in Europe and Asia, alongside expanding operations in the United States. This strategic approach allows the company to diversify its revenue streams and mitigate risks associated with over-reliance on any single market. Understanding the geographical distribution of its customer base is essential for effective market segmentation and tailoring products and services to meet regional demands.

PCC SE's primary markets include Central, Eastern, and Southeastern Europe, where it has historically grown through acquisitions and modernization, especially in Poland. The company's presence in these regions is solidified by key subsidiaries like PCC Rokita SA, a major chlorine and polyols producer, and PCC Exol SA, a leading surfactant manufacturer. Furthermore, PCC Intermodal S.A. has become a market leader in intermodal transportation in Poland as of 2024.

The company's expansion into Asia is marked by strategic investments, with a €50 million allocation in 2024 for its specialty chemicals division in Southeast Asia, which is projected to increase sales by 15% within two years. This includes a joint venture for oxyalkylates production in Malaysia. Simultaneously, PCC SE is actively planning further expansion in the USA, including a potential chlor-alkali plant in Mississippi, with construction scheduled to commence in early 2026, capitalizing on favorable energy and raw material costs.

PCC SE's roots are firmly planted in Europe, particularly Central, Eastern, and Southeastern Europe. Strategic acquisitions and modernization efforts, especially in Poland, have established a strong market position. Key subsidiaries like PCC Rokita SA and PCC Exol SA contribute significantly to the company's European revenue.

The company is strategically expanding into Asia, with a focus on Southeast Asia. A €50 million investment in the specialty chemicals division is expected to boost sales by 15% within two years. This expansion includes a joint venture in Malaysia, highlighting the company's commitment to the Asian market.

PCC SE is also focusing on North America, driven by favorable energy and raw material costs. Plans include a chlor-alkali plant in Mississippi, with construction starting in early 2026. This expansion is part of a broader strategy to diversify its geographical footprint and capture new market opportunities.

Expansion into Asia and the US has contributed to revenue growth. In 2024, these regions accounted for a 5% and 7% increase in revenue, respectively. This diversification strategy helps mitigate risks and ensures a balanced global presence.

The company adapts its offerings and marketing strategies to address the differences in customer demographics, preferences, and buying power across these regions. For instance, Growth Strategy of PCC SE showcases how the company leverages its understanding of market segmentation to tailor its approach. While Europe remains a primary market, the expansion into Asia and the US has been significant, with these regions contributing to revenue growth. The diverse customer base across various sectors further helps to mitigate risks associated with reliance on any single client or region. This strategic diversification is crucial for the long-term sustainability and growth of the PCC SE company.

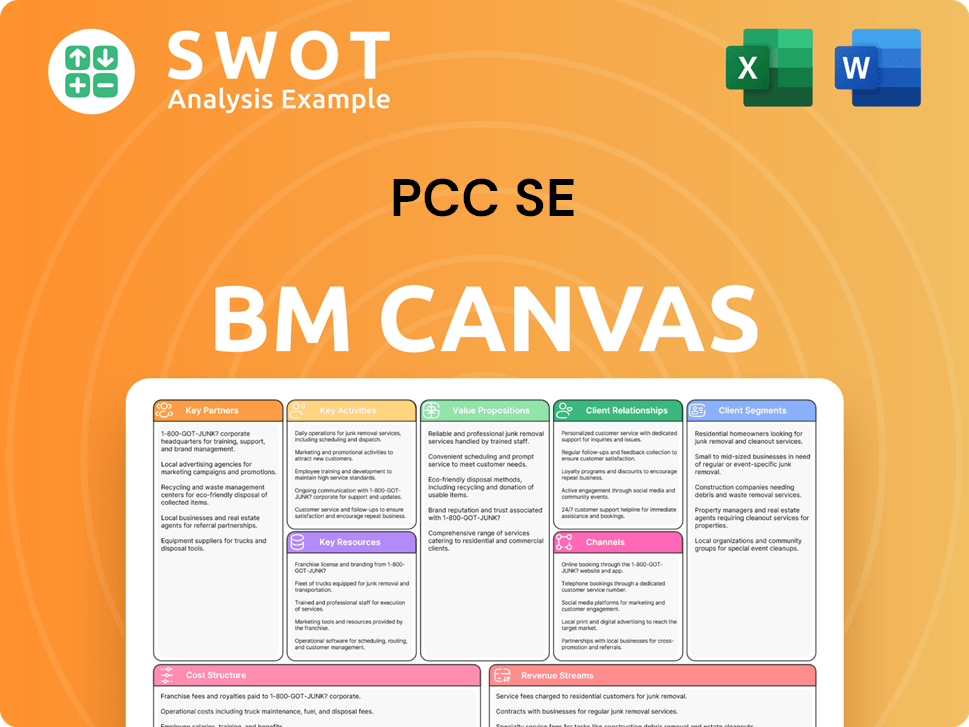

PCC SE Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does PCC SE Win & Keep Customers?

The strategies employed by the company to acquire and retain customers are multifaceted, focusing on direct sales, distribution networks, and digital engagement. This approach is crucial for the company, especially in the complex chemical and logistics services sector. Understanding the customer demographics and target market is vital for tailoring these strategies effectively. The company's success in customer acquisition and retention is reflected in its financial performance and market position.

Direct sales are a core component, accounting for a significant portion of revenue. Subsidiary distribution networks extend the company's reach globally, ensuring product availability. Digital marketing and online portals play a crucial role in B2B interactions, streamlining processes and enhancing customer relationships. These combined efforts demonstrate a comprehensive approach to customer management.

The company places a strong emphasis on building and maintaining strong customer relationships. This includes providing personalized service through dedicated teams, expert technical support, and long-term partnerships. By focusing on these areas, the company aims to ensure customer satisfaction and foster lasting business relationships. This approach is crucial for the company's long-term success and sustainability.

Direct sales are a cornerstone of the company's customer acquisition strategy. In 2024, direct sales accounted for approximately 65% of the total sales revenue. This approach allows for tailored service and immediate feedback from customers. Understanding the needs of PCC SE customers is essential for effective direct sales.

Subsidiary distribution networks are vital for global market penetration. The company's revenue reached approximately EUR 1.2 billion in 2024, thanks to these networks. This ensures product availability across diverse markets. The target market for the company's products benefits from this wide reach.

Digital marketing is crucial for B2B interactions. Over 70% of B2B interactions started online in 2024. Online portals and communication channels enhance customer relationships. This includes convenient access to product details and streamlined order tracking.

The company actively participates in industry events. The European Coatings Show saw a 15% increase in lead generation for similar firms in 2024. This boosts brand visibility and helps connect with potential clients. It's a key part of the company's customer acquisition strategy.

The company focuses on tailored client service. Dedicated sales and account teams build robust relationships across key sectors. This approach helps in understanding the customer profile. The company's customer demographics and marketing strategies are aligned with this focus.

Offering expert technical support is a key strategy. Companies providing strong technical support saw a 15% rise in customer retention in 2024. This boosts client satisfaction and operational efficiency. It directly addresses the needs of PCC SE customers.

Long-term partnerships and contracts are vital for retention. These secure around 60% of the 2024 revenue. This strategy ensures a stable revenue stream. It is a critical part of the company's market segmentation strategy.

The company prioritizes investor relations. Transparent communication through annual and quarterly reports engages a financially literate audience. The company's website and 'PCC ChemNews' effectively engage stakeholders. This highlights the benefits of understanding PCC SE target market.

The company utilizes its website and 'PCC ChemNews' for engagement. These platforms effectively communicate with stakeholders. This is part of the company's customer demographics and marketing strategies. It helps in how the company defines its target market.

Understanding the target market is essential for success. Analyzing the target market helps tailor strategies. For more details, consider reading about the Growth Strategy of PCC SE. This is a key aspect of the company's approach.

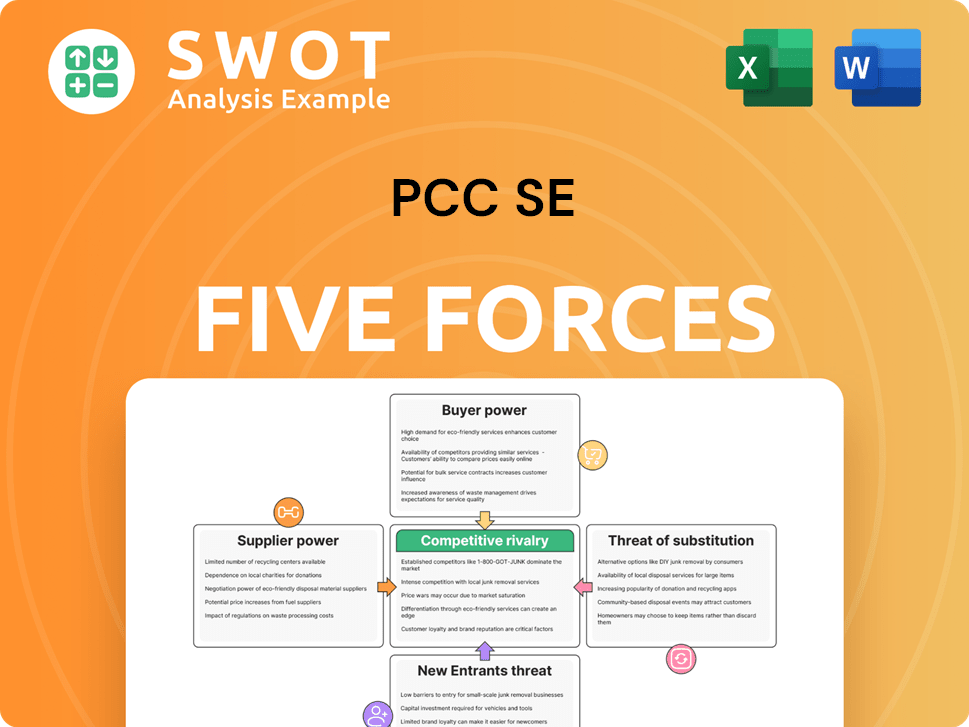

PCC SE Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of PCC SE Company?

- What is Competitive Landscape of PCC SE Company?

- What is Growth Strategy and Future Prospects of PCC SE Company?

- How Does PCC SE Company Work?

- What is Sales and Marketing Strategy of PCC SE Company?

- What is Brief History of PCC SE Company?

- Who Owns PCC SE Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.