PCC SE Bundle

Who Really Controls PCC SE?

Unraveling the ownership of a company is like charting its destiny. Understanding who owns PCC SE, a major player in chemicals, energy, and logistics, is crucial for grasping its strategic direction and future potential. From its founding in Germany to its global presence today, PCC SE's ownership story offers valuable insights.

This exploration of PCC SE SWOT Analysis delves into the company's ownership structure, a critical factor influencing its long-term strategy and market performance. We'll examine the evolution of PCC SE ownership, from its founders to its current shareholders, providing a clear picture of who controls this diversified investment holding company. Discover the key players shaping PCC SE's trajectory and gain a deeper understanding of this fascinating company profile, including its major shareholders and the dynamics of its ownership.

Who Founded PCC SE?

The genesis of PCC SE's ownership structure dates back to October 1993. That's when Waldemar Preussner established Petro Carbo Chem Rohstoffhandelsgesellschaft mbH in Duisburg, Germany. This marked the beginning of what would evolve into the current PCC SE. The company initially focused on trading raw materials derived from petroleum, carbon, and natural gas.

Preussner, now the Chairman of the Supervisory Board, has been a central figure from the outset. While early partners joined the venture, Preussner's role has remained pivotal. The evolution from a commodity trading firm to a European-focused SE reflects a strategic vision.

The transformation of the company into PCC AG in 1998 and subsequently into PCC SE in February 2007, were significant steps. These changes formalized the company's structure and underscored its European identity. The company's approach to financing, including the issuance of corporate bonds, demonstrates a deliberate strategy to maintain control.

The initial ownership of PCC SE was primarily vested in Waldemar Preussner. He established the company and has maintained a significant stake.

Ulrike Warnecke and Dr. Alfred Pelzer were among the early contributors. They later took on significant roles within the company.

The transition to PCC AG and later PCC SE formalized the company's structure. This also reflected its growth and European focus.

PCC SE's issuance of corporate bonds independently of banks is a key part of its financing strategy. This approach helps maintain control.

The company's ownership structure supports long-term investment goals. It ensures strategic control.

The initial focus on commodity trading laid the groundwork for future diversification. This approach has been a key part of the company's history.

Understanding the Revenue Streams & Business Model of PCC SE can provide further insights into how the company operates. Currently, PCC SE's ownership is primarily held by Waldemar Preussner, highlighting a privately-held structure. Details on specific shareholding percentages of early partners are not publicly available, but Preussner's foundational role is clear. The company's history and the evolution of its ownership structure reflect a strategic approach to maintaining control and supporting long-term goals. Further information on PCC SE shareholders can be found in the company's financial reports and public filings, although the company is not publicly traded, so information is limited.

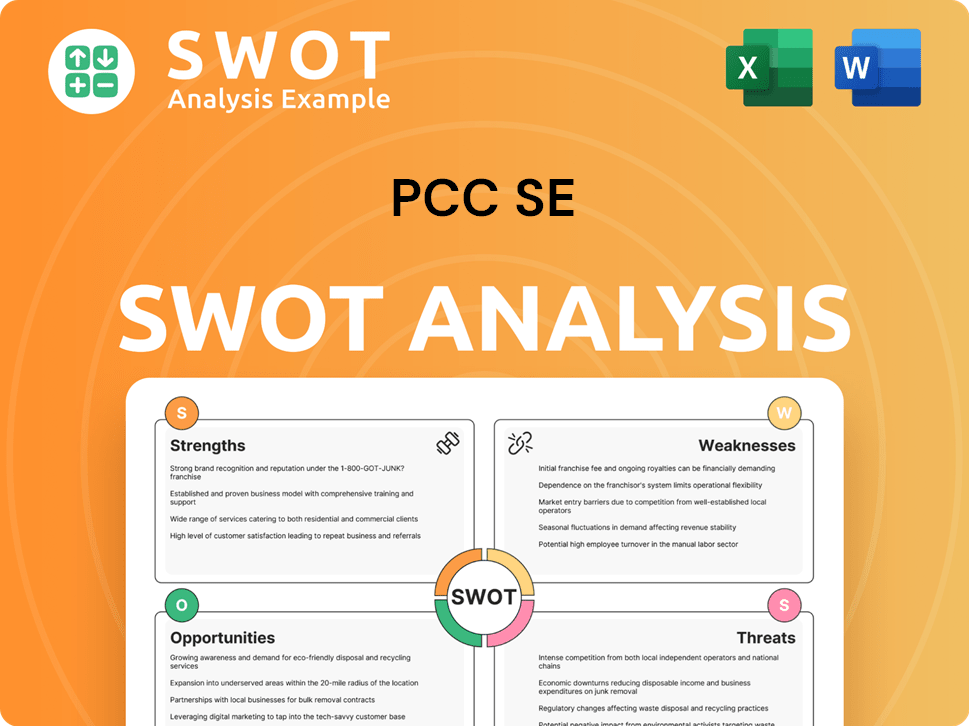

PCC SE SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has PCC SE’s Ownership Changed Over Time?

The evolution of

PCC SE ownership

showcases a strategic approach to growth and capital management. From its inception, the company has been primarily under private ownership, with Waldemar Preussner as the sole shareholder of the parent company,PCC SE

. This structure has provided a stable foundation for long-term strategic decisions. ThePCC SE company profile

reveals a focus on private ownership, contrasting with the public listing of some subsidiaries on the Warsaw Stock Exchange, such asPCC Rokita SA

andPCC Exol SA

.Key events have significantly shaped the ownership landscape. The initial public offerings (IPOs) of subsidiaries like

PCC Rokita SA

andPCC Exol SA

allowed for capital generation and increased market visibility. However, the parent company,PCC SE

, has maintained its private status, ensuring consistent strategic direction. Divestitures, such as the sale of PCC Logistics to Deutsche Bahn AG in 2009, and strategic investments, likePCC Rokita SA

's increased stake in IRPC Polyol Company Ltd., demonstrate active portfolio management. ThePCC SE shareholders

benefit from these strategic moves, which are aimed at enhancing corporate value and expanding the group's global presence.| Event | Impact | Date |

|---|---|---|

| IPO of PCC Rokita SA | Capital generation and increased visibility | 2014 |

| IPO of PCC Exol SA | Capital generation and increased visibility | 2012 |

| Divestiture of PCC Logistics | Strategic realignment | 2009 |

| PCC Rokita SA's investment in IRPC Polyol Company Ltd. | Expansion in Asia | April 2018 |

The

PCC SE ownership structure explained

reveals a clear distinction between the parent company's private ownership and the public listings of some subsidiaries. This approach allows for strategic flexibility while maintaining control. In 2024,PCC SE

reported consolidated sales of €960.0 million and investments of €126.5 million, highlighting the company's continued growth and strategic investments. For those seeking detailed information, accessing thePCC SE company history and ownership

details can be found in their annual reports. ThePCC SE investors

can find more details about the company's performance and strategic decisions in the latest financial reports.The ownership of

PCC SE

is primarily held by Waldemar Preussner, ensuring strategic consistency.- Subsidiaries like

PCC Rokita SA

andPCC Exol SA

are publicly listed, allowing for capital raising. - Strategic decisions, such as divestitures and acquisitions, shape the company's portfolio.

- Financial reports provide insights into the company's performance and investment strategies.

- The company has a strong focus on expansion, as seen by the increased stake in IRPC Polyol Company Ltd.

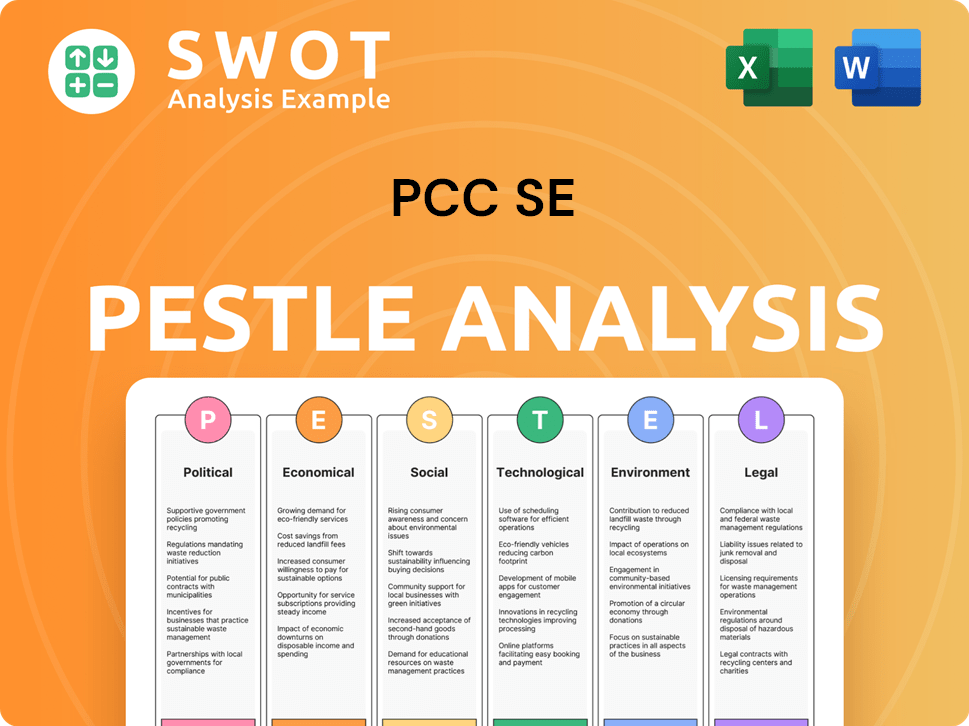

PCC SE PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on PCC SE’s Board?

In 2021, PCC SE shifted from a monistic to a dualistic governance structure. This change established an Executive Board and a Supervisory Board to separate the roles of management and oversight more distinctly. This is a key aspect of understanding the PCC SE company profile.

The Supervisory Board is currently chaired by Waldemar Preussner, the sole shareholder of PCC SE. Dr. Hans-Josef Ritzert serves as the Vice Chairman, and Reinhard Quint is also a member. The Executive Board is composed of Dr. Peter Wenzel as Chairman, Dr. Alfred Pelzer, and Ulrike Warnecke. Dr. Wenzel focuses on business development and sustainability, Ulrike Warnecke on finance and human resources, and Dr. Pelzer retains his previous responsibilities.

| Board Role | Name | Responsibilities |

|---|---|---|

| Chairman of the Supervisory Board | Waldemar Preussner | Oversight and Strategic Direction |

| Vice Chairman of the Supervisory Board | Dr. Hans-Josef Ritzert | Oversight |

| Member of the Supervisory Board | Reinhard Quint | Oversight |

| Chairman of the Executive Board | Dr. Peter Wenzel | Business Development, R&D, Sustainability |

| Member of the Executive Board | Dr. Alfred Pelzer | Operational Management |

| Member of the Executive Board | Ulrike Warnecke | Finance, HR, Public Relations |

As the sole shareholder, Waldemar Preussner has significant voting power, directly influencing PCC SE's strategic decisions. This concentrated ownership structure means that Preussner has complete control over the company. Details about the governance and financial performance can be found in the PCC SE Annual Report 2024.

Understanding PCC SE ownership is crucial for investors and stakeholders. Waldemar Preussner's position as the sole shareholder gives him substantial control over the company's direction. Knowing who owns PCC SE helps in evaluating the company's strategic decisions.

- The dualistic structure separates operational management from oversight.

- The Executive Board manages daily operations.

- The Supervisory Board, chaired by the sole shareholder, provides oversight.

- This structure concentrates decision-making power.

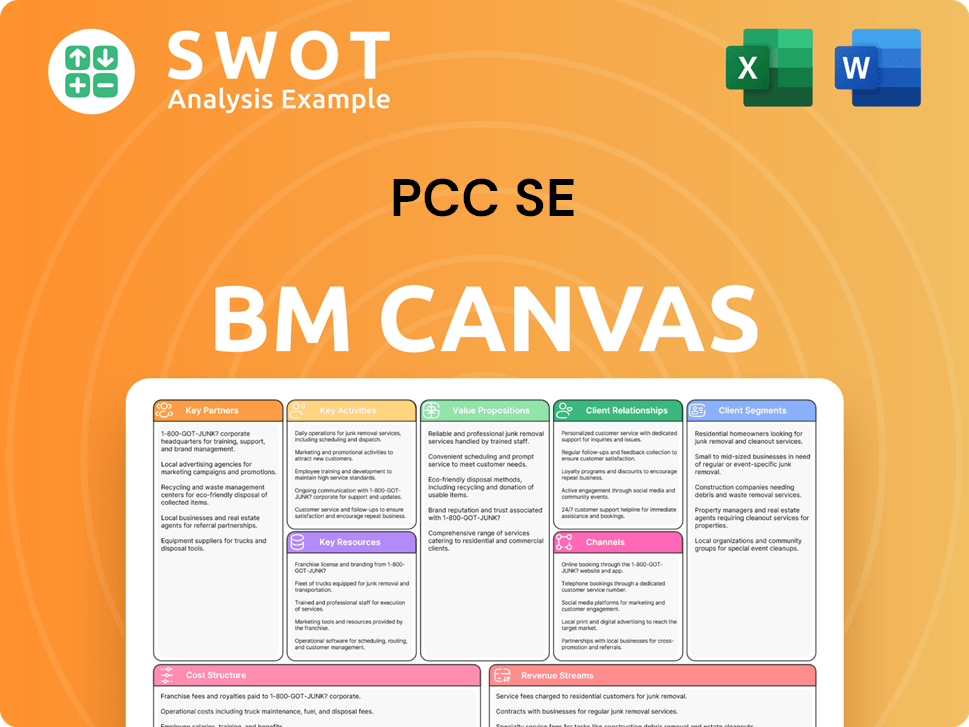

PCC SE Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped PCC SE’s Ownership Landscape?

Over the past few years, PCC SE's company profile has shown a consistent strategic focus on sustainable investments and expanding its core businesses. In 2024, the company's investment volume reached €126.5 million, demonstrating its ongoing commitment to growth. This includes significant moves such as the planned chlor-alkali facility in Mississippi, USA, in partnership with The Chemours Company, which is expected to have an annual capacity of 340,000 metric tons. This expansion into the US market is a key trend, highlighting geographical diversification in PCC SE's ownership strategy.

Another significant trend is the company's increasing emphasis on sustainability. In 2024, PCC SE increased its investments in green initiatives by 15% compared to 2023. This commitment is reflected in certifications like the ISCC certification for carbon footprint received by PCC BakkiSilicon hf. in January 2025 and RSPO certifications obtained by PCC Exol SA and PCC Consumer Products Kosmet. These actions underscore PCC SE's dedication to environmentally conscious practices and sustainable raw material sourcing.

PCC SE's ownership structure is primarily private, with Waldemar Preussner as the owner. However, subsidiaries like PCC Rokita SA and PCC Exol SA are publicly traded on the Warsaw Stock Exchange. This hybrid model enables PCC SE to leverage public markets for certain segments while maintaining centralized control. The company's financial reporting, including the 2024 Annual Report, provides transparency regarding its performance and investment activities, giving insights into the PCC SE shareholders and PCC SE investors.

PCC SE is primarily privately owned by Waldemar Preussner, maintaining centralized control at the holding company level. Subsidiaries like PCC Rokita SA and PCC Exol SA are publicly traded on the Warsaw Stock Exchange.

In 2024, PCC SE invested €126.5 million. A new chlor-alkali facility in Mississippi, USA, is planned, with an annual capacity of 340,000 metric tons. Investments in green initiatives increased by 15% compared to 2023.

PCC BakkiSilicon hf. received ISCC certification for carbon footprint in January 2025. PCC Exol SA and PCC Consumer Products Kosmet obtained RSPO certificates, showing dedication to sustainable practices.

PCC SE is expanding its geographical footprint, particularly in Europe, Asia, and North America. The new facility in the USA marks a significant move toward diversification.

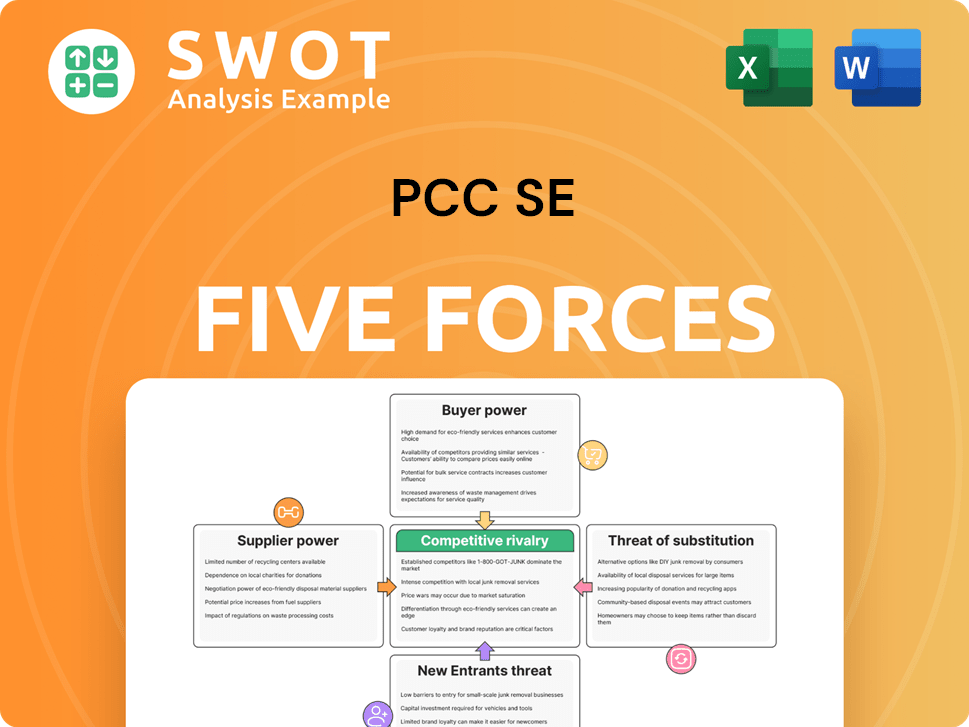

PCC SE Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of PCC SE Company?

- What is Competitive Landscape of PCC SE Company?

- What is Growth Strategy and Future Prospects of PCC SE Company?

- How Does PCC SE Company Work?

- What is Sales and Marketing Strategy of PCC SE Company?

- What is Brief History of PCC SE Company?

- What is Customer Demographics and Target Market of PCC SE Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.