Priority Bundle

How did Priority Company transform from a startup to a payment processing powerhouse?

Priority Technology Holdings, Inc. isn't just another name in the financial services sector; it's a story of innovation and strategic growth. Founded in 2005 in Alpharetta, Georgia, the company set out to revolutionize payment processes for businesses. This Priority SWOT Analysis reveals how its early vision shaped its current market dominance.

Understanding the Priority Company history is crucial for grasping its current market position. From its humble beginnings, the company has evolved, adapting to the dynamic payment technology landscape. Exploring its corporate history provides valuable insights into its strategic decisions and achievements, making it a compelling case study for any investor or business strategist looking to understand the evolution of a successful enterprise.

What is the Priority Founding Story?

The story of Priority Company begins in 2005. The company's establishment was driven by the need to streamline payment processes for businesses.

Headquartered in Alpharetta, Georgia, the company quickly focused on providing integrated payment solutions. This focus aimed to help businesses manage their finances more efficiently.

The founding of Priority Company in 2005 marked the beginning of its journey. The company's initial focus was on providing payment solutions. This was a response to the growing need for efficient financial management.

- The company aimed to offer integrated payment processing.

- It also developed proprietary software.

- Commercial payment systems were another key component of its offerings.

- The mid-2000s saw increasing digitization.

The company's early years were shaped by the increasing digitization of financial transactions. The demand for efficient business operations also played a key role. The primary goal was to enable businesses to optimize their payment processes. This was achieved through a combination of integrated payment processing, proprietary software, and commercial payment systems. The company's mission has evolved, but its core focus on improving financial workflows remains consistent. For more insights into the company's growth, you can explore the Growth Strategy of Priority.

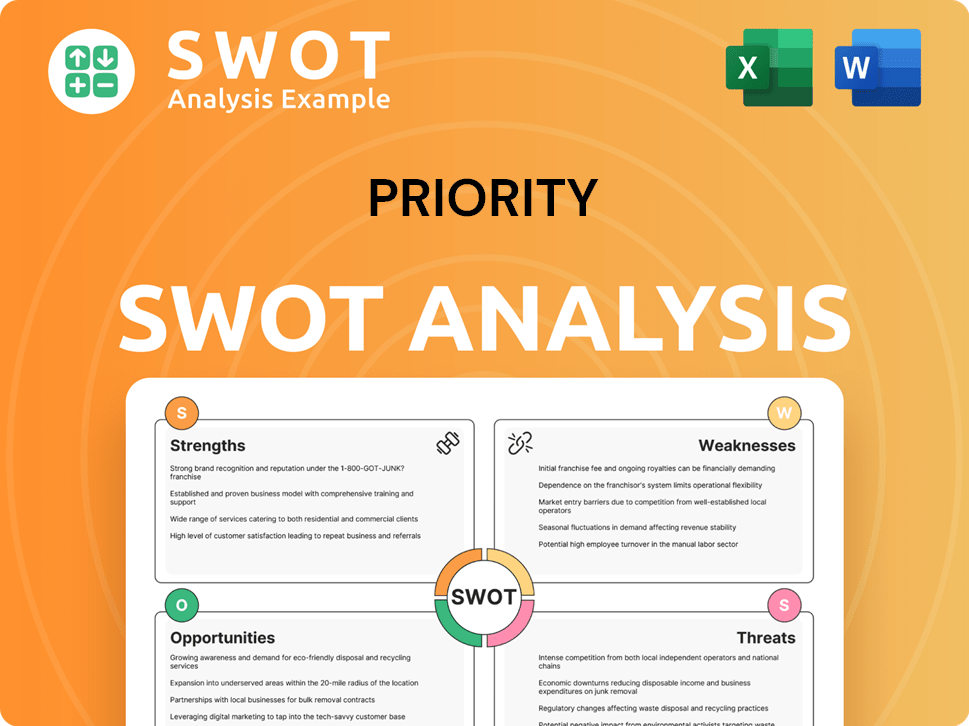

Priority SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Priority?

The early growth of the company, a key part of its Priority Company history, focused on building its proprietary software platform. This platform, known as the MX product line, included tools designed to offer flexible business applications. The company has expanded its reach through organic growth and strategic acquisitions, significantly impacting its financial performance.

The company's early development centered on the MX product line. This line included tools such as MX Connect, MX Merchant, MX Insights, MX Storefront, MX Retail, MX Invoice, and MX B2B. These products were designed to provide customizable business applications for resellers and merchant clients, marking a significant phase in the company's Priority Company evolution.

The company expanded its market reach by serving SMBs, enterprises, and distribution partners. This included independent sales organizations (ISOs), financial institutions, and independent software vendors (ISVs). Strategic acquisitions, such as Plastiq in August 2023, played a crucial role in boosting its B2B segment revenue.

For the full year 2024, the company reported revenue of $879.7 million, a 16.4% increase from 2023. Adjusted gross profit for 2024 reached $328.1 million, up 19.2% from the previous year, with a gross profit margin of 37.3%. Adjusted EBITDA increased by 21.3% to $204.3 million in 2024, demonstrating strong financial health.

In Q1 2025, the company reported revenue of $224.6 million, a 9.2% increase from Q1 2024. Adjusted gross profit rose 14.2% to $87.3 million. The B2B and Enterprise segments were key drivers, with B2B revenue up 12% and Enterprise revenue up 22%, showing a clear corporate history of growth.

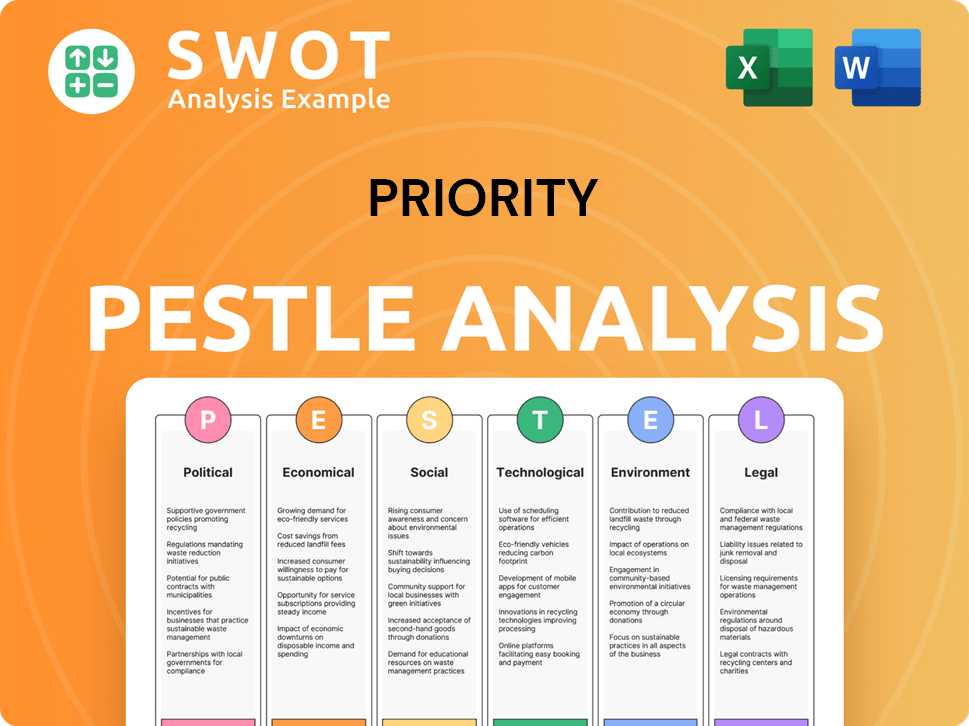

Priority PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Priority history?

The Marketing Strategy of Priority has seen significant evolution, marked by key milestones in its corporate history. These achievements reflect the company's growth and strategic focus within the payment technology sector.

| Year | Milestone |

|---|---|

| 2024 | Achieved record revenue of $879.7 million, a 16.4% increase from the previous year. |

| 2024 | Adjusted EBITDA reached $204.3 million, marking a 21.3% increase. |

| Q1 2025 | Revenue increased to $224.6 million, reflecting a 9.2% growth. |

| Q1 2025 | Adjusted EPS reached $0.22, a significant increase from $0.03 in Q1 2024. |

Innovations at Priority Company have centered on streamlining financial processes. A key development is the 'Priority Commerce Engine,' a unified platform designed to integrate various financial services. This platform aims to accelerate cash flow for businesses.

The 'Priority Commerce Engine' integrates payables, merchant services, and banking solutions. This integration streamlines financial operations for businesses.

Focus on embedded finance and BaaS solutions allows for modernizing legacy platforms. This approach enables enterprise customers to monetize payments effectively.

Ongoing cloud infrastructure migration is a key part of operational efficiency. This migration supports scalability and improved performance.

Challenges for Priority Company include navigating a competitive landscape and an uncertain macro-economic environment. While the company has shown strong financial results, it faces the need to continuously adapt to market dynamics.

The payment technology sector is highly competitive, requiring constant innovation. Staying ahead demands continuous platform development and strategic partnerships.

Market perception can be sensitive to revenue performance, as seen with the stock price dip despite profit growth. This highlights the need for consistent revenue growth.

The company acknowledges an 'uncertain macro-economic environment'. This requires strategic agility and risk management to navigate economic fluctuations.

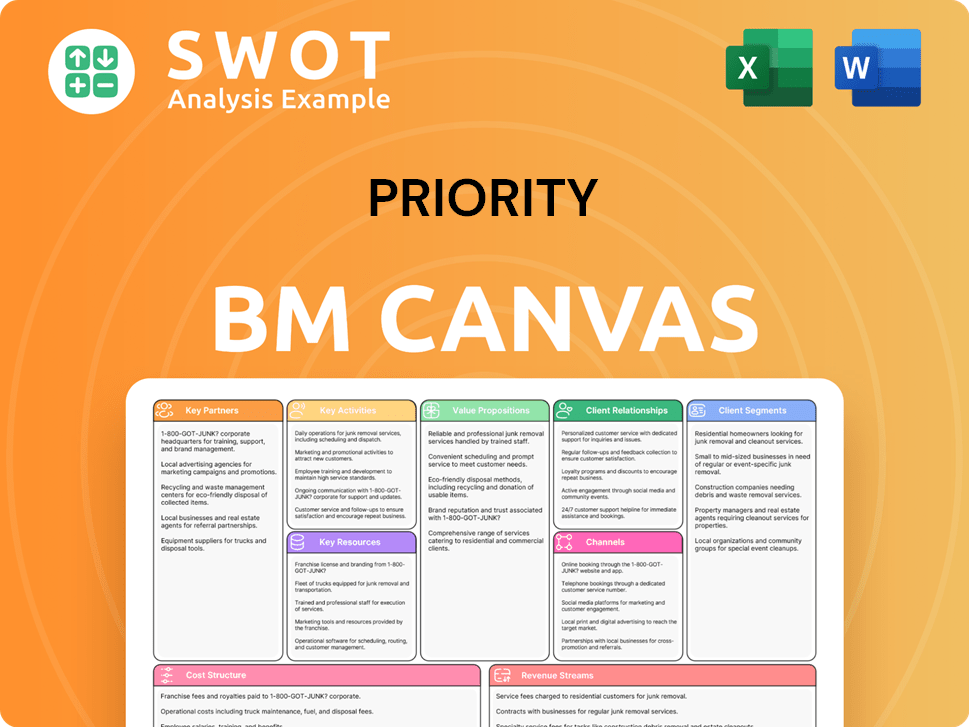

Priority Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Priority?

The Priority Company background reveals a journey marked by strategic growth and significant milestones. Founded in Alpharetta, Georgia, in 2005, the company has evolved considerably. Key events, including acquisitions and financial results, highlight its expansion and strategic focus on the B2B segment. The company's trajectory demonstrates a commitment to financial innovation and operational efficiency.

| Year | Key Event |

|---|---|

| 2005 | Priority Technology Holdings, Inc. was founded in Alpharetta, Georgia, marking the beginning of its journey. |

| August 2023 | The acquisition of Plastiq significantly boosted the B2B segment, enhancing revenue streams. |

| September 30, 2024 | Trailing 12-month revenue reached $899 million, reflecting strong financial performance. |

| Q4 2024 | Reported revenue of $227.1 million, a 13.9% increase year-over-year, demonstrating sustained growth. |

| Full Year 2024 | Achieved record revenue of $879.7 million, a 16.4% increase from 2023, with adjusted EBITDA reaching $204.3 million. |

| February 28, 2025 | Made a $10.0 million voluntary prepayment on its term loan, showcasing robust cash flow management. |

| March 6, 2025 | Released Fourth Quarter and Full Year 2024 financial results, providing insights into the company's performance. |

| May 1, 2025 | Minnesota Wild selected Priority to streamline ticket payments, expanding its market reach. |

| May 6, 2025 | Released First Quarter 2025 financial results, providing an update on the company's performance. |

| Q1 2025 | Reported revenue of $224.6 million, a 9.2% increase from Q1 2024, with adjusted EPS reaching $0.22. |

| May 15, 2025 | Scheduled to participate in upcoming investor conferences, indicating ongoing engagement with stakeholders. |

For 2025, Priority anticipates revenue between $965 million and $1 billion, reflecting a growth rate of 10% to 14%. Adjusted gross profit is projected to range from $360 million to $385 million, with an anticipated growth of 10% to 17%. Adjusted EBITDA is expected to be between $220 million and $230 million, representing an 8% to 13% increase.

The company is focused on the high-margin B2B and Enterprise segments, which account for over 62% of total adjusted gross profit. Ongoing cloud infrastructure migration aims to enhance operational efficiency. Free cash flow is expected to exceed $80 million, with a focus on debt reduction and strategic capital allocation.

Under the leadership of Chairman & CEO Tom Priore, the 'Priority Commerce Engine' accelerates cash flow and optimizes working capital. This approach positions the company well despite economic uncertainties. The company's mission remains consistent with its founding vision of streamlining financial operations and unlocking revenue opportunities.

Q1 2025 results showed a 9.2% revenue increase from Q1 2024, reaching $224.6 million. Adjusted EPS for Q1 2025 was $0.22, a substantial 633.3% increase compared to Q1 2024. These figures highlight the company's strong financial momentum and strategic execution.

Priority Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Priority Company?

- What is Growth Strategy and Future Prospects of Priority Company?

- How Does Priority Company Work?

- What is Sales and Marketing Strategy of Priority Company?

- What is Brief History of Priority Company?

- Who Owns Priority Company?

- What is Customer Demographics and Target Market of Priority Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.