Priority Bundle

Can Priority Technology Holdings Conquer the Payments Arena?

The payments industry is undergoing a seismic shift, fueled by technological innovation and changing consumer habits. Understanding the Priority SWOT Analysis is crucial to navigate this dynamic environment. With mobile payments projected to explode, the competitive landscape demands a deep dive into players like Priority Technology Holdings (PRTH).

This article provides a comprehensive Priority SWOT Analysis, offering a detailed examination of the competitive landscape surrounding Priority Technology Holdings. We'll explore the company's market position, conduct thorough competitor analysis, and assess its strategic advantages within the industry overview. This Priority company analysis will equip you with the insights needed to understand Priority's strengths, weaknesses, and overall potential in this rapidly evolving sector, addressing questions like "What are the key competitors of Priority Company?" and "How does Priority Company differentiate itself from competitors?"

Where Does Priority’ Stand in the Current Market?

Priority Technology Holdings, Inc. (referred to as Priority) holds a significant market position within the payment technology industry. The company has a strong presence in the small to medium-sized business (SMB) market, B2B payables, and enterprise payments segments. Understanding the market position of Priority is crucial for a comprehensive Priority company analysis.

Priority's core operations revolve around providing comprehensive payment processing and business management solutions, particularly through its MX Merchant platform for SMBs. Additionally, it offers the Commercial Payments Exchange (CPX) for B2B payables, which provides accounts payable automation. The company's value proposition lies in its ability to offer integrated payment solutions, new technology adoption, and value-added services, especially targeting the SMB market.

As of Q1 2025, Priority reported over 1.3 million customer accounts, an increase from 1.2 million at the end of 2024, and an annual transaction volume surpassing $135 billion, demonstrating a strong and expanding market presence. This solidifies its place within the competitive landscape.

Priority's primary product lines include the MX Merchant platform for SMBs, offering payment processing and business management solutions. The company also provides the Commercial Payments Exchange (CPX) for B2B payables, providing accounts payable automation. Furthermore, Priority offers embedded finance and Banking-as-a-Service (BaaS) solutions for enterprise clients.

Priority has a diversified merchant base across the United States. The company strategically positions itself to capitalize on integrated payment solutions and new technology adoption. This includes a move towards offering more sophisticated technology and services that were historically exclusive to larger merchants, focusing primarily on the SMB market.

For the full year 2024, Priority's revenue reached $879.7 million, a 16% increase from the previous year, with a 5-year revenue CAGR of 15%. In Q1 2025, net revenue increased by 9% year-over-year to $224.6 million, with adjusted gross profit rising 14% to $87.3 million and adjusted EBITDA improving by 11% to $51.3 million.

The company projects 10-14% top-line revenue growth for 2025, targeting between $965 million and $1 billion, and adjusted EBITDA between $220 million and $230 million. Priority's B2B and enterprise segments are particularly strong, contributing over 62% of total adjusted gross profit in Q1 2025, with B2B revenue increasing by over 12% and enterprise revenue by over 22% year-over-year.

Priority's strategic focus on integrated payment solutions and value-added services, especially within the SMB market, positions it well for future growth. The company's financial performance, including robust revenue growth and improved profitability, indicates a strong market position. Understanding the competitive landscape also involves a competitor analysis to assess Priority Company's market share compared to rivals.

- Priority's B2B and enterprise segments contribute significantly to its adjusted gross profit.

- The company's net leverage improved to 4.2x at the end of Q1 2025.

- Priority's focus on technology adoption and value-added services differentiates it from competitors.

- For further insights into how Priority generates revenue, explore Revenue Streams & Business Model of Priority.

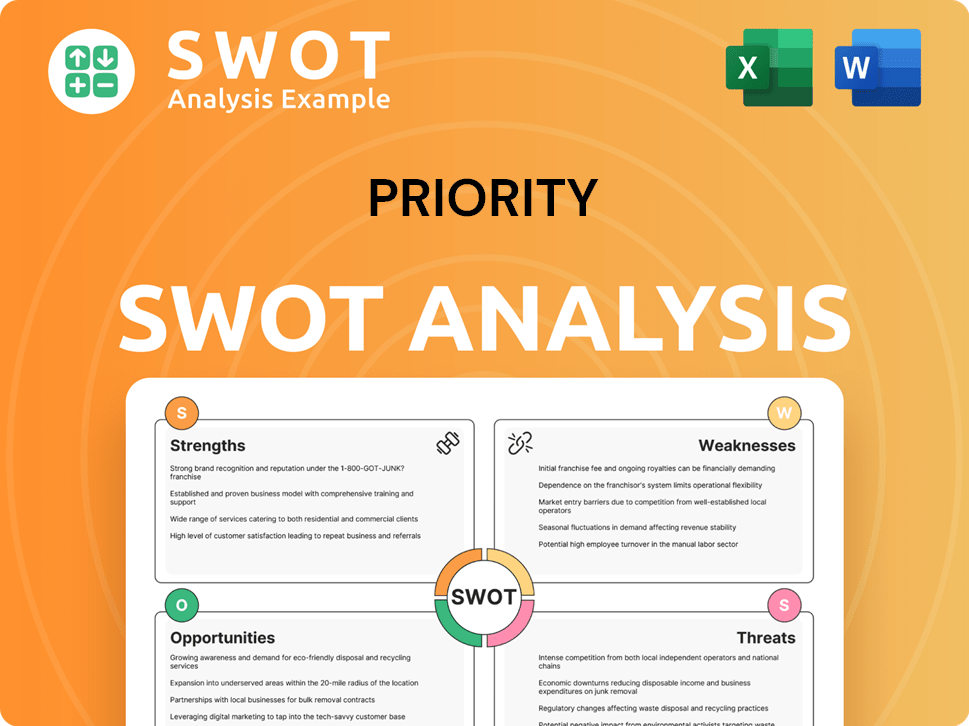

Priority SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Priority?

The competitive landscape for payment processing is intense, with many players vying for market share. This environment presents both challenges and opportunities for companies like the one under analysis. Understanding the competitive dynamics is crucial for strategic decision-making and maintaining a strong market position.

The industry is constantly evolving due to technological advancements and shifting consumer preferences. New entrants and established players are continuously innovating, making it essential to conduct regular competitor analysis. This analysis helps identify strengths, weaknesses, and potential areas for differentiation.

A comprehensive Marketing Strategy of Priority is vital to navigate this competitive environment effectively. This includes understanding the strengths and weaknesses of competitors, and developing strategies to capitalize on market opportunities.

Direct competitors include major financial institutions and their affiliates. These entities often have significant resources, enabling them to offer competitive pricing and incentives. This can impact the market position of smaller players.

Major financial institutions like Bank of America Merchant Services and Chase Merchant Services are key competitors. Elavon, Inc. is another significant player in this space. These banks leverage their existing customer base and financial strength.

Well-established payment processing companies and Independent Sales Organizations (ISOs) also compete for SMB merchants. These entities often focus on specific niches or offer specialized services. They can pose a significant competitive threat.

New and emerging fintech players are disrupting traditional models. These companies often offer better user experiences and lower prices. The rapid innovation in this sector creates a dynamic competitive environment.

The proliferation of alternative electronic payment services and payment-enabled software solutions intensifies competition. These services often cater to specific market segments or offer unique features. This increases the complexity of the competitive landscape.

Mergers and alliances in the financial services, payments, and technology industries can strengthen existing services or create new competitive offerings. These strategic moves can significantly impact market dynamics. They can also lead to increased market concentration.

The competitive landscape is shaped by various factors, including pricing, technology, and customer service. Companies must continuously adapt to maintain their market position. Understanding these dynamics is crucial for strategic assessment.

- Pricing: Competitive pricing is essential to attract and retain merchants.

- Technology: Innovative technologies and payment solutions are key differentiators.

- Customer Service: Excellent customer service builds loyalty and trust.

- Market Share: Analyzing market share helps understand competitive positioning. In 2024, the market share of the top payment processors varied, with some holding over 10% of the market.

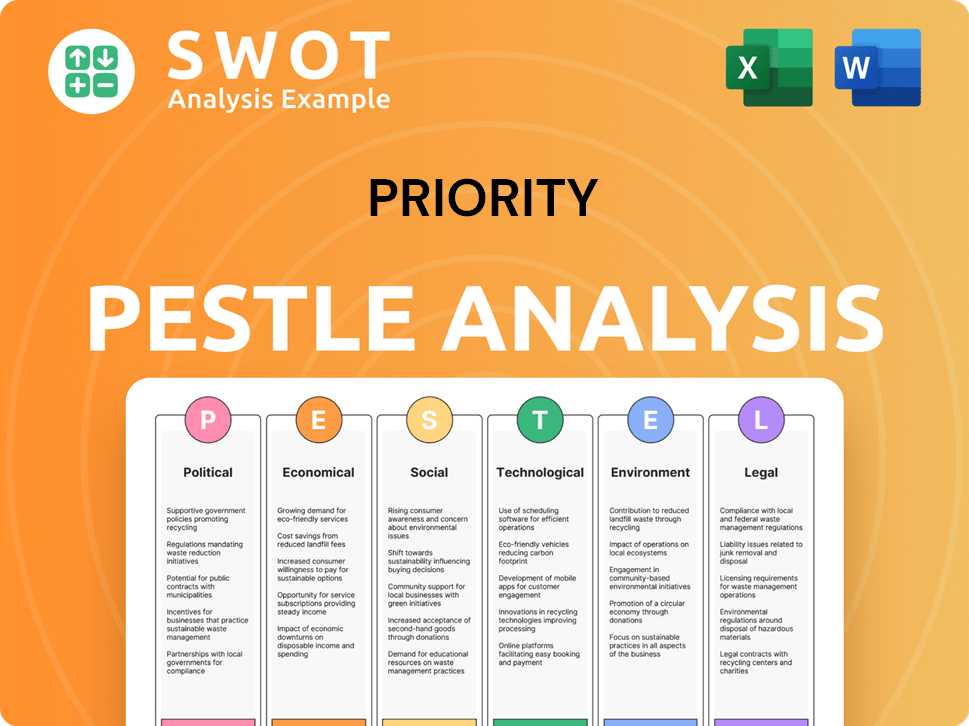

Priority PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Priority a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of a company involves a thorough examination of its strengths, weaknesses, opportunities, and threats. For Priority Technology Holdings, Inc., a deep dive into its competitive advantages reveals key differentiators that position it strategically within the payments industry. This analysis is crucial for investors, analysts, and business strategists seeking to understand the company's market position and potential for growth.

Priority Technology Holdings, Inc. distinguishes itself through a combination of proprietary technology, a diversified platform, and a strategic distribution model. These elements work together to create a robust competitive edge, allowing the company to navigate the complexities of the payments sector effectively. This article provides an in-depth look at these advantages, supported by relevant data and insights.

The company's 'Vortex. Cloud and Vortex. OS' infrastructure forms the backbone of its operations, offering a cost-efficient and agile system for payment processing and business operations. This technology is a key differentiator, supporting a scalable business model with operating leverage. Furthermore, Priority leverages proprietary product platforms, including MX and CPX, to serve diverse market segments. The MX Merchant platform focuses on the consumer payments market, while CPX addresses the commercial payments sector, enhancing its market reach and service offerings.

Priority's 'Vortex. Cloud and Vortex. OS' infrastructure provides a cost-efficient and agile payment processing system. This technology enables rapid integration of acquired businesses and optimization of revenue and cost synergies. It supports a scalable business model, contributing to operational efficiency and growth.

The MX product suite caters to the consumer payments market, offering a comprehensive range of payment products and services. The CPX platform, enhanced by the 2023 acquisition of Plastiq, automates accounts payable processes for corporations. These platforms allow Priority to serve a wide range of customer needs.

Priority's distribution model relies on a network of ISOs, financial institutions, and ISVs. The MX Connect platform enhances reseller efficiency in marketing solutions and maintaining customer relationships. This model supports strong customer retention and consistent merchant onboarding.

The experienced management team, comprised of industry veterans, plays a crucial role in developing and enhancing proprietary platforms. Their expertise is instrumental in identifying market opportunities and driving the company's strategic direction. This team's leadership contributes significantly to Priority's competitive edge.

Priority's competitive advantages are multifaceted, stemming from its technological infrastructure, product offerings, and distribution strategy. These strengths enable the company to secure a strong market position and drive sustainable growth. Understanding these advantages is crucial when conducting a Priority company analysis and assessing its market position.

- Proprietary Technology: The 'Vortex' infrastructure provides a scalable and efficient platform for payment processing.

- Diversified Product Suites: The MX and CPX platforms cater to both consumer and commercial payment markets.

- Reseller-Centric Distribution: A strong network of ISOs and ISVs supports customer acquisition and retention.

- Strategic Acquisitions: The Plastiq acquisition in 2023 enhanced CPX capabilities.

- Experienced Management: Industry veterans drive innovation and strategic growth.

The company's focus on innovation and strategic acquisitions, such as the 2023 acquisition of Plastiq, further strengthens its market position. The reseller-centric distribution model, supported by the MX Connect platform, facilitates efficient marketing and customer relationship management. Furthermore, the experienced management team, comprised of industry veterans, plays a crucial role in developing and enhancing these proprietary platforms and identifying market opportunities. These elements collectively contribute to Priority's strong competitive edge. For more insights into the company's broader strategy, consider reading about the Growth Strategy of Priority.

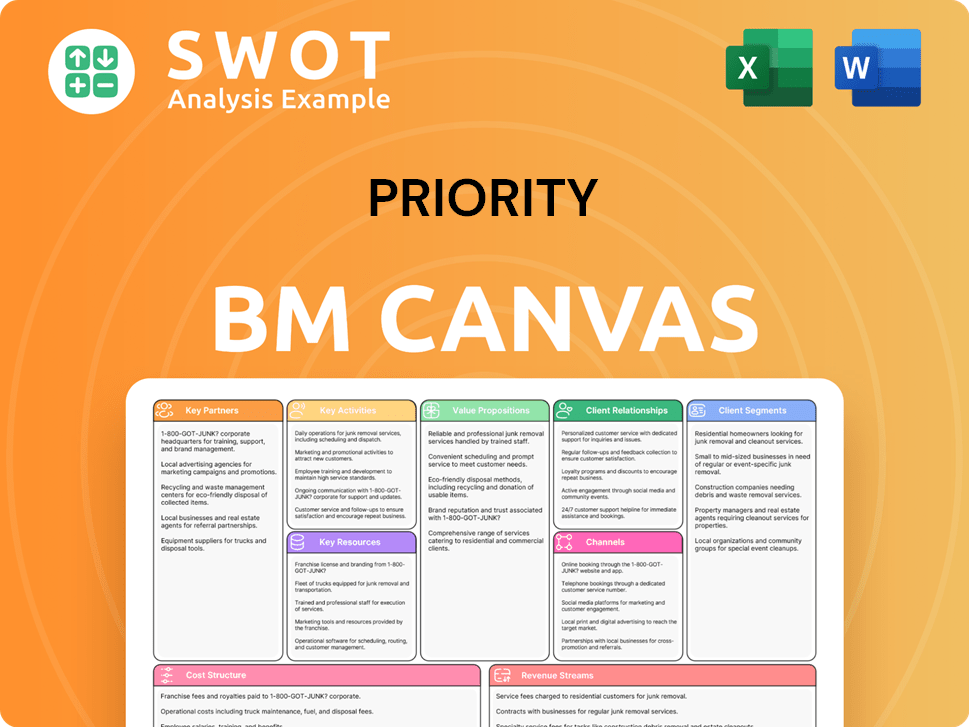

Priority Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Priority’s Competitive Landscape?

The payment technology industry is dynamic, with the competitive landscape constantly shifting. Target Market of Priority offers an in-depth look at the company's positioning within this environment. The sector is marked by rapid technological advancements, evolving consumer preferences, and intense competition, necessitating continuous strategic adaptation for companies like Priority Technology Holdings.

Several factors shape the future outlook for Priority Technology Holdings. The company faces potential risks from larger competitors and regulatory changes. However, the company is also well-positioned to capitalize on industry trends, such as the growth of digital payments, presenting significant opportunities for expansion and innovation.

The payment technology industry is experiencing substantial growth. Mobile payment transaction volume is expected to reach $4.7 trillion by 2025. The adoption of digital payments among small and medium-sized businesses (SMBs) has increased, reaching 67% in 2023. This creates a competitive landscape with numerous players vying for market share.

Priority Technology Holdings faces several challenges. Intense competition within the fintech sector and potential economic downturns pose risks. Increased operating expenses, such as a 16.4% rise in salaries and benefits in Q1 2025 compared to Q1 2024, also present a challenge. Regulatory changes in payment processing could significantly affect the company's business model.

Priority Technology Holdings has several opportunities to grow. The company's focus on integrated payment solutions aligns with the ongoing digital transformation in the industry. Expansion into new markets and strategic partnerships can boost performance. The growth in B2B digital payments offers significant avenues for the CPX platform.

Priority Technology Holdings aims for 10-14% top-line revenue growth in 2025, projecting total revenue between $965 million and $1 billion. The company expects free cash flow to exceed $80 million for the year, with a focus on debt reduction. Its strategy involves continued cloud migration for operational efficiency and leveraging opportunities in embedded finance.

Priority Technology Holdings differentiates itself through integrated payment solutions and strategic partnerships. The company's focus on B2B digital payments and its CPX platform provides a competitive edge. The company's diversified revenue sources and balanced asset portfolio position it well for different market conditions.

- Focus on Integrated Solutions: Offers comprehensive payment solutions.

- Strategic Partnerships: Expands market reach and capabilities.

- B2B Digital Payments: Capitalizes on the shift from checks.

- Cloud Migration: Improves operational efficiency and scalability.

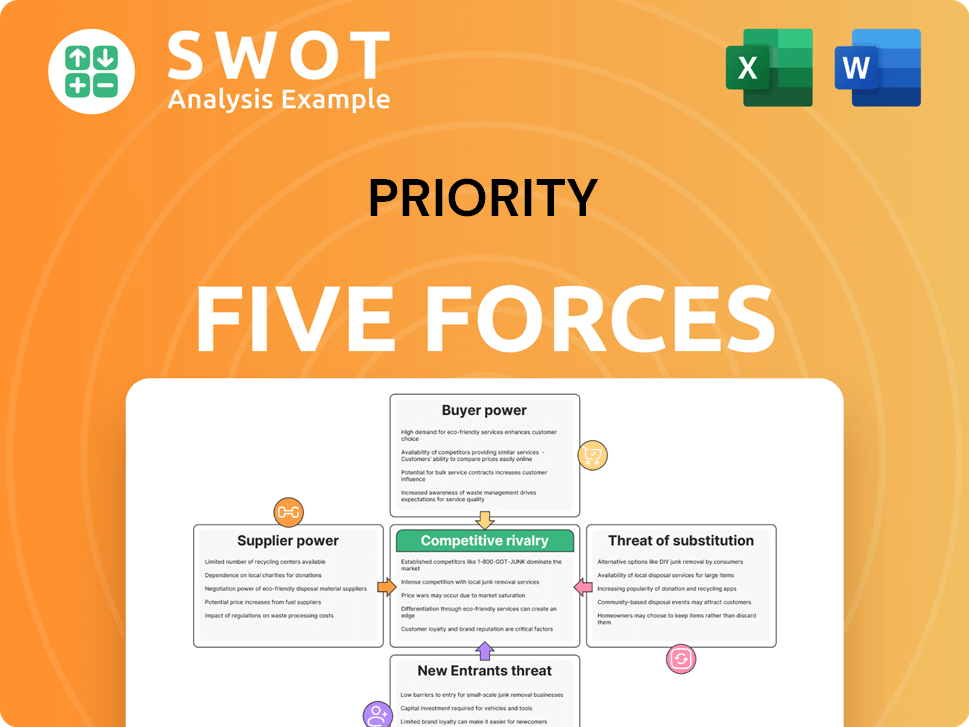

Priority Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Priority Company?

- What is Growth Strategy and Future Prospects of Priority Company?

- How Does Priority Company Work?

- What is Sales and Marketing Strategy of Priority Company?

- What is Brief History of Priority Company?

- Who Owns Priority Company?

- What is Customer Demographics and Target Market of Priority Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.