Priority Bundle

How Does Priority Company Dominate the Fintech Market?

Priority Technology Holdings has rapidly transformed the fintech landscape, but how did they achieve such impressive growth? This analysis dives deep into the Priority SWOT Analysis, examining the core sales and marketing strategies that fuel their success. Discover the innovative tactics and strategic decisions driving their impressive financial performance and future projections.

From its inception in 2005, Priority Company has prioritized a merchant-centric approach, leading to a robust sales strategy and effective marketing campaigns. The company's diversified business segments and strategic acquisitions, such as the recent Rollfi deal, highlight a commitment to sustainable company growth. This exploration will uncover the specific methods Priority uses to acquire customers, optimize its sales funnel, and maintain a competitive edge within the dynamic fintech industry, providing valuable insights for businesses seeking to enhance their own sales and marketing strategies.

How Does Priority Reach Its Customers?

The sales and marketing strategy of Priority Company centers on a diverse sales channel approach to reach its wide customer base. This strategy incorporates both online and offline methods, ensuring comprehensive market coverage. The company's focus on integrated payments and embedded finance is evident in its channel evolution, positioning it to capitalize on the growing demand for these solutions.

Priority Company's sales channels are tailored to specific market segments, including Small and Medium-Sized Businesses (SMBs), Business-to-Business (B2B) clients, and Enterprise customers. This multifaceted approach allows the company to effectively address the unique needs of each segment. The company supports its partners and resellers with its cloud-based solution, MX Connect, which serves as a customer relationship management (CRM) and business operating system, facilitating merchant engagement and offering value-added features.

This omnichannel strategy, combining direct sales, a robust reseller network, and strategic partnerships, has significantly contributed to Priority's growth and market share. As of Q1 2025, the company reported over 1.3 million customer accounts, up from 1.2 million at the end of 2024, and an annual transaction volume exceeding $135 billion.

For SMBs, Priority Company primarily utilizes Independent Sales Organizations (ISOs), financial institutions (FIs), and Independent Software Vendors (ISVs) and Value-Added Resellers (VARs) to drive sales. These channels provide direct access to SMBs, offering tailored solutions and support. This approach ensures that the company can effectively reach and serve a large number of SMBs.

In the B2B segment, Priority Company expands its reach through direct sales initiatives, ISVs and business partnerships, major card networks like Mastercard and Visa, and collaborations with large U.S. banking institutions. This multi-channel strategy enables the company to engage with a diverse range of B2B clients. The company also employs a direct vendor sales model to provide turnkey merchant development, product sales, and supplier enablement programs.

The Enterprise segment leverages integrations with software partners and business platform customers, enabling them to embed Priority's payment and treasury solutions directly into their core operating systems. This approach allows for seamless integration and enhanced value for enterprise clients. This strategy allows for seamless integration and enhanced value for enterprise clients.

MX Connect, a cloud-based solution, acts as a CRM and business operating system, supporting partners and resellers. It facilitates merchant engagement and offers value-added features. This platform is crucial for partner enablement and customer relationship management, contributing to overall sales and marketing effectiveness.

The sales strategy of Priority Company is built on a foundation of multiple channels, ensuring broad market coverage and customer reach. The company is well-positioned to capitalize on the increasing demand for integrated payment solutions and new technology adoption in the SMB market. This approach allows for efficient customer acquisition and supports overall company growth.

- Strategic Partnerships: Collaborations with ISOs, FIs, ISVs, and VARs.

- Direct Sales: Initiatives targeting B2B and enterprise clients.

- Technology Integration: Embedding payment solutions into core operating systems.

- Focus on Embedded Finance: Leveraging integrated payment solutions.

The company's sales and marketing efforts are further enhanced by its understanding of its target market. For more insights into the specific customer segments, explore the Target Market of Priority.

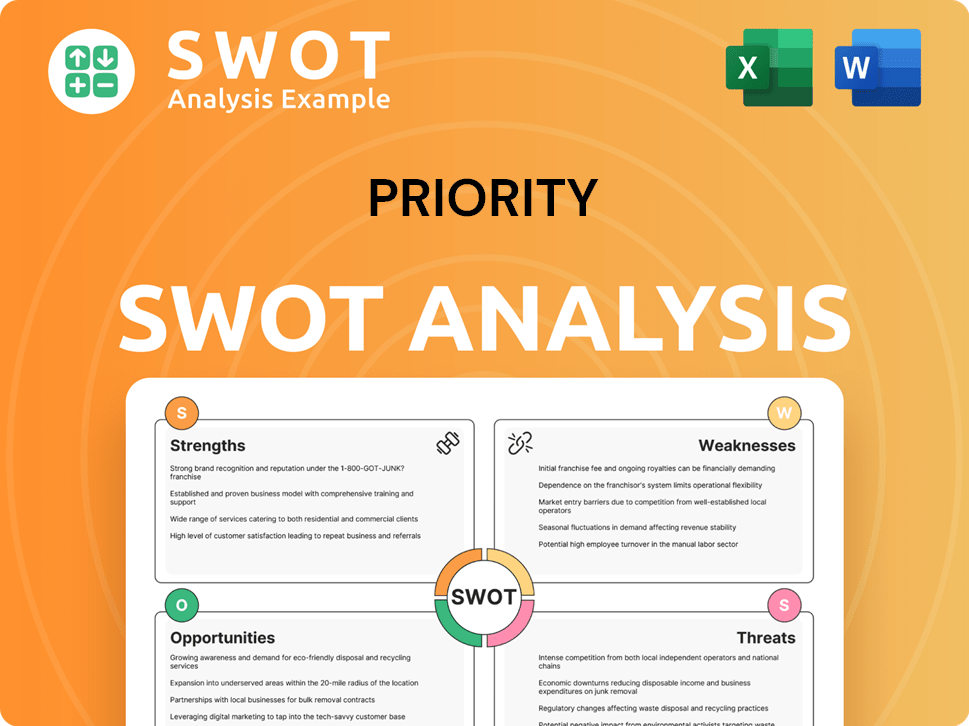

Priority SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Priority Use?

The marketing tactics employed by the company are designed to boost brand awareness, generate leads, and drive sales for its payment technology solutions. The company emphasizes its proprietary technology platforms, such as the MX product line and the commercial payments exchange (CPX) product line, as core marketing messages. These platforms highlight the company's ability to provide integrated payment processing and business management capabilities to various clients.

The marketing strategy integrates both digital and traditional methods. Digital marketing includes content creation, SEO, paid advertising, email marketing, and social media engagement. Traditional methods may involve participation in industry events and investor conferences to communicate its strategic vision and financial performance.

The company's approach to data-driven marketing is evident through its internal platforms like MX Connect, which serves as a customer relationship management (CRM) and business operating system for resellers. This suggests a focus on understanding customer needs and personalizing offerings.

Content marketing educates businesses on optimizing payment processes and managing cash flow. This strategy focuses on streamlining financial operations through its 'Priority Commerce Engine'.

SEO is crucial to ensure visibility for businesses seeking payment processing, accounts payable automation, and embedded finance solutions.

Paid advertising on platforms where business decision-makers seek fintech solutions is a logical tactic. This helps in reaching a targeted audience.

Email marketing is utilized for lead nurturing and communicating product updates or new service offerings. The acquisition of Rollfi to bolster payroll and benefits is an example.

Social media platforms, particularly professional networking sites, are used to engage with potential clients and partners in the SMB, B2B, and Enterprise segments.

Participation in investor conferences serves as a marketing channel to communicate its strategic vision and financial performance to a broader audience.

The company's approach to data-driven marketing is evident through its internal platforms like MX Connect, which serves as a customer relationship management (CRM) and business operating system for resellers. This focus on understanding customer needs and personalizing offerings has contributed to the company's growth. The company's consistent growth in customer accounts and transaction volume, with over 1.3 million customer accounts and $135 billion in annual transaction volume as of Q1 2025, indicates effective marketing and sales alignment.

- The company's sales and marketing efforts are designed to increase company growth.

- A strong sales strategy is implemented to target various segments.

- The marketing strategy includes digital and traditional tactics.

- For more details, consider reading the analysis of Owners & Shareholders of Priority.

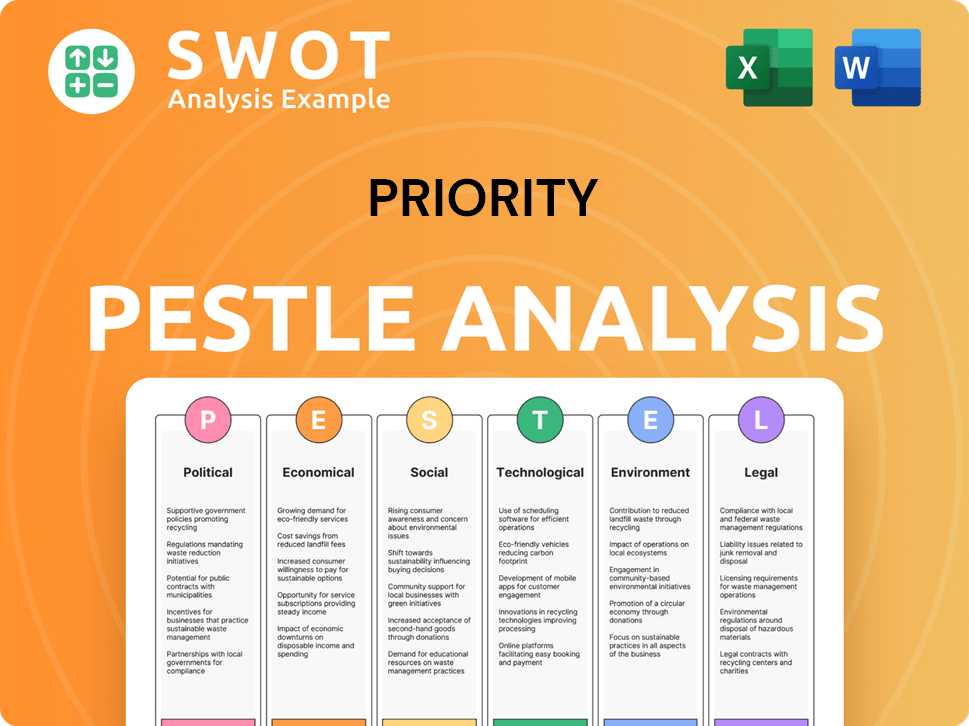

Priority PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Priority Positioned in the Market?

The company positions itself as a fintech provider, focusing on payments and banking solutions through its 'Priority Commerce Engine' (PCE). This core message emphasizes revenue generation and operational success for businesses. The goal is to offer a unified commerce platform integrating payables, merchant services, and banking solutions, providing a flexible financial toolset.

This positioning aims to establish the company as a comprehensive solution provider. The objective is to accelerate cash flow, optimize working capital, and reduce costs for clients. The value proposition centers on efficiency, innovation, and comprehensive solutions to attract its target audience.

The company differentiates itself through its proprietary software platforms. These platforms, such as the MX product line for consumer payments and the Commercial Payments Exchange (CPX) for commercial payments, provide technology-enabled payment acceptance and business management capabilities. Continuous product enhancement, with an annual R&D investment of $7.2 million in 2024, reinforces its innovation-driven brand.

The company offers a unified commerce platform. This platform integrates payables, merchant services, and banking solutions. This approach provides a flexible financial toolset for its clients.

The company invests heavily in R&D. With $7.2 million invested in 2024, it demonstrates a commitment to continuous product enhancement. This focus supports its innovation-driven brand positioning.

The company appeals to its target audience through efficiency, innovation, and comprehensive solutions. Its value proposition focuses on providing effective financial tools. This approach aims to attract businesses looking for streamlined operations.

The company's strong financial performance, including a 9% year-over-year revenue growth in Q1 2025, suggests positive market reception. The reaffirmed 2025 revenue guidance of $965 million to $1 billion indicates strong brand trust.

Brand consistency is maintained across its segments—SMB Payments, B2B Payments, and Enterprise Payments—by focusing on the overarching theme of a unified commerce engine that simplifies complex financial operations. The company's strong financial performance and consistent growth, along with strategic acquisitions, such as Rollfi, demonstrate its ability to adapt to changes in consumer sentiment and competitive threats. For a broader understanding of the competitive environment, consider reviewing the Competitors Landscape of Priority.

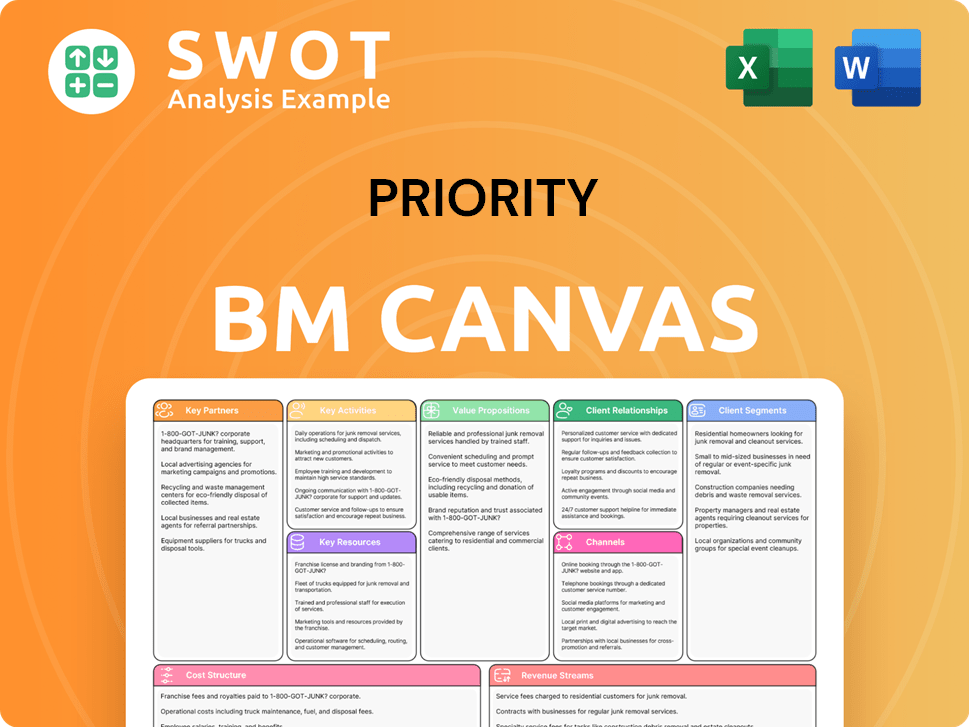

Priority Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Priority’s Most Notable Campaigns?

The sales and marketing strategy of the company is multifaceted, focusing on continuous expansion across its core segments: SMB Payments, B2B Payments, and Enterprise Payments. These efforts are not defined by individual, large-scale campaigns but rather by ongoing strategic initiatives. This approach has resulted in a geographically and industry-diversified merchant base in the United States.

A key aspect of their sales and marketing strategy is the consistent merchant boarding, with over 5,100 merchants added monthly. This constant influx of new merchants in the SMB segment demonstrates effective market penetration and sales force efficiency. Furthermore, the company's focus on securing new contracts in the B2B sector and expanding its enterprise partnerships highlights a sustained commitment to growth within high-potential markets.

The company's financial performance underscores the success of its sales and marketing efforts. For the full year 2024, revenue increased by 16.4%, reaching $879.7 million. Moreover, the projected revenue for 2025 is between $965 million and $1 billion, reflecting the continued effectiveness of their sales and marketing strategies. The company's approach to sales and marketing is clearly driving consistent growth.

The SMB segment benefits from a continuous sales and marketing 'campaign' centered around acquiring market share. Strong demand and volume growth in this segment suggest effective product adoption and sales force strategies. This approach has been crucial for driving the company's overall growth.

In the B2B segment, the company focuses on securing new contracts in the middle market and institutional space. This is a continuous sales and marketing 'campaign' aimed at expanding presence in a high-growth area. The 12% year-over-year revenue increase in Q1 2025 highlights the success of this focus.

The enterprise business has seen significant adoption, with 18 new partners joining the platform in early 2023. This indicates a successful 'campaign' around partner acquisition and platform integration. The company's strategy includes enhancing partner relationships.

The partnership with the Minnesota Wild, announced in May 2025, acts as a 'campaign' for brand visibility and new revenue streams. This collaboration enhances the team's ticketing operations with seamless payment processing, boosting the company's visibility in the sports and entertainment sector.

The company's overall financial performance reflects the success of its ongoing sales and marketing efforts. The consistent growth in adjusted gross profit and EBITDA, up 14% and 11% respectively in Q1 2025, further validates the effectiveness of its strategic market penetration and customer acquisition efforts. These results highlight the strength of the company’s sales strategy.

- Revenue growth in 2024 reached $879.7 million.

- The projected revenue for 2025 is between $965 million and $1 billion.

- The company continues to see strong demand and volume growth.

- Partnerships and acquisitions drive consistent growth.

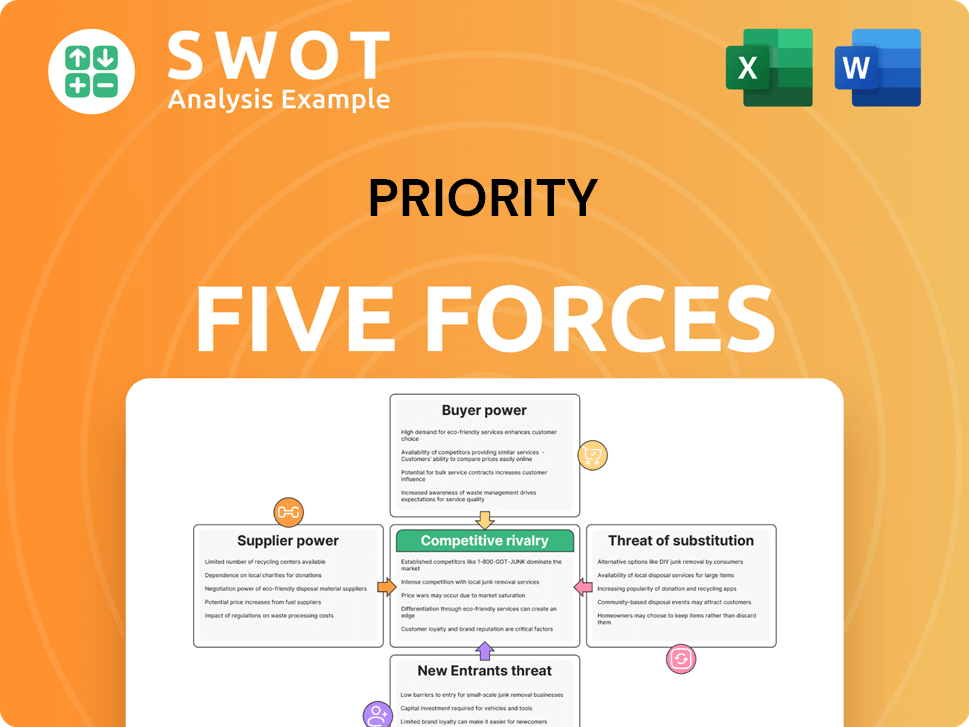

Priority Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Priority Company?

- What is Competitive Landscape of Priority Company?

- What is Growth Strategy and Future Prospects of Priority Company?

- How Does Priority Company Work?

- What is Brief History of Priority Company?

- Who Owns Priority Company?

- What is Customer Demographics and Target Market of Priority Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.