Priority Bundle

Decoding Priority Company: How Does It Revolutionize Payments?

In the ever-evolving landscape of financial technology, understanding the mechanics of key players is paramount. Priority Technology Holdings, Inc. stands out as a significant force, offering a comprehensive suite of payment solutions. But how exactly does Priority SWOT Analysis work, and what makes it a crucial partner for businesses today?

This exploration into How Priority Company works will delve into its core operations, examining how it creates value and generates revenue. We'll uncover the Priority Company services and features that empower businesses to streamline financial transactions, from small enterprises to large corporations. Discover the Priority Company benefits and understand its strategic market positioning within the dynamic payment processing sector.

What Are the Key Operations Driving Priority’s Success?

Priority Technology Holdings, often referred to as Priority Company, operates by offering a comprehensive suite of payment solutions. These solutions are designed to streamline and improve how businesses handle payments. The core of their business revolves around providing integrated payment processing and proprietary software.

The company's value proposition lies in simplifying payment experiences for businesses of all sizes. This is achieved through a unified platform that consolidates various payment functionalities. This approach reduces complexity and associated costs, offering businesses a more efficient and secure way to manage their financial transactions.

Priority Company serves a diverse range of customers, from retail and e-commerce businesses to healthcare providers and educational institutions. Their services are designed to meet the specific needs of different sectors, ensuring that businesses can accept various payment methods seamlessly and manage their financial operations effectively.

Priority Company's integrated payment processing allows businesses to accept a wide array of payment methods. This includes credit and debit cards, as well as emerging payment technologies. The platform ensures secure and efficient transaction processing, enhancing the overall customer experience.

The company provides proprietary software that offers tools for managing transactions, recurring billing, and customer data. These tools help businesses streamline their financial operations. This software is a key feature of the Priority Company platform.

Priority Company specializes in commercial payment systems, catering to the complex needs of larger enterprises. These systems are designed to handle intricate payment workflows. This is a crucial aspect of how Priority Company works for enterprise solutions.

Priority Company serves a wide range of customer segments, including retail, e-commerce, healthcare, and educational institutions. This diverse customer base highlights the versatility of Priority Company services. The company's platform is designed to meet the needs of various industries.

The operational processes behind Priority Company's offerings involve advanced technology development to ensure secure and efficient payment processing. This includes robust data security protocols and compliance with industry standards. Their supply chain focuses on technology infrastructure and partnerships with financial institutions and payment networks. Priority leverages direct sales, independent sales organizations (ISOs), and strategic partnerships to reach its diverse customer base. This comprehensive approach translates into significant customer benefits, such as improved operational efficiency, enhanced security, and streamlined financial reporting, differentiating Priority from competitors.

Priority Company offers several key benefits to its customers, enhancing their operational efficiency and financial management. These benefits are a direct result of their integrated platform and comprehensive services.

- Improved Operational Efficiency: Streamlined payment processes reduce manual tasks and errors.

- Enhanced Security: Robust security measures protect sensitive financial data.

- Streamlined Financial Reporting: Consolidated reporting simplifies financial management.

- Cost Reduction: The unified platform helps in reducing costs.

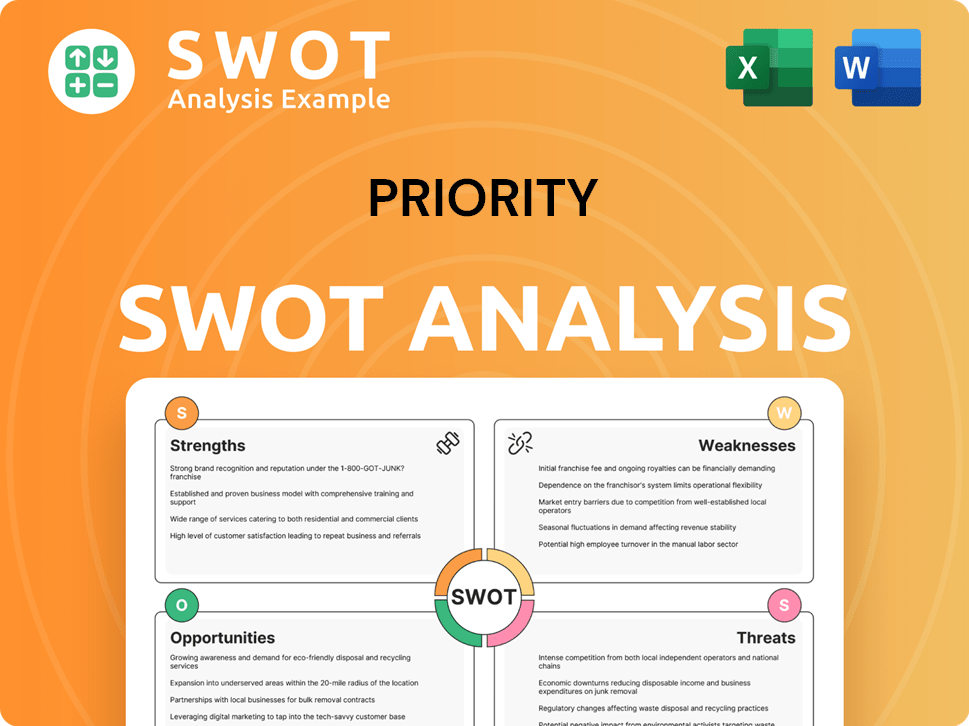

Priority SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Priority Make Money?

Understanding the revenue streams and monetization strategies of Priority Technology Holdings is crucial for grasping its business model. The company primarily generates revenue through its payment processing and software solutions, offering a multifaceted approach to financial services.

Priority's financial success is rooted in its ability to monetize its services effectively. This involves a blend of transaction-based fees, subscription models, and strategic partnerships, all aimed at maximizing revenue and fostering long-term customer relationships. The company's approach reflects a dynamic adaptation to the evolving demands of the payment industry.

Priority Technology Holdings leverages several key revenue streams to sustain and grow its business. A significant portion of its revenue comes from transaction fees, which are charged for processing credit, debit, and ACH payments for merchants. These fees are directly tied to the volume of transactions processed, making them a fundamental component of the company's financial performance. In recent financial reports, transaction-based revenues have shown consistent growth, reflecting the increasing volume of digital payments.

In addition to transaction fees, Priority also generates revenue from recurring software subscription fees. These fees are associated with its proprietary platforms and value-added services, such as risk management, data analytics, and compliance tools. This subscription model provides a stable and predictable revenue stream, contributing to the company's financial stability. Furthermore, Priority engages in strategic partnerships, which may generate revenue through licensing agreements or revenue-sharing models. The company's ability to diversify its revenue sources is a key factor in its overall financial health.

- Transaction Fees: Generated from processing credit, debit, and ACH payments.

- Subscription Fees: Recurring revenue from software platforms and value-added services.

- Strategic Partnerships: Revenue from licensing agreements or revenue-sharing models.

- Tiered Pricing: Offering favorable rates to larger merchants.

Priority's monetization strategies are designed to optimize revenue generation and enhance customer value. The company often employs tiered pricing models, where larger merchants or those with higher transaction volumes may benefit from more favorable rates. This approach encourages greater usage of their services and fosters long-term relationships. Moreover, Priority utilizes cross-selling strategies, offering additional services like business management tools or loyalty programs to existing clients, thereby increasing the average revenue per user. To learn more about Priority's target market, read this article: Target Market of Priority.

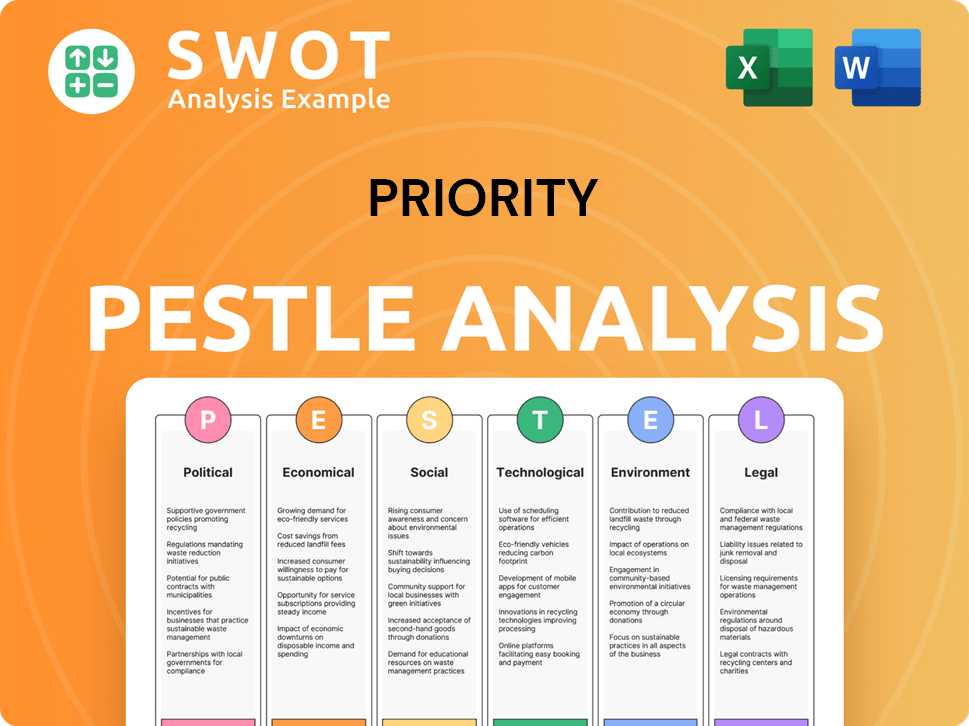

Priority PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Priority’s Business Model?

Understanding the operational dynamics of Priority Technology Holdings involves examining its key milestones, strategic moves, and competitive advantages. The company has established itself as a significant player in the payment processing industry. Its journey is marked by strategic decisions aimed at expanding its market presence and technological capabilities, which have been crucial to its growth.

A core aspect of Priority's strategy has been its investment in proprietary technology. This approach allows the company to offer highly integrated and customizable payment solutions tailored to various business needs. This focus on technology has enabled Priority to serve a wide range of clients, from small merchants to large enterprises, enhancing its value proposition in a competitive market.

The company's approach to the market has been shaped by its ability to adapt and innovate, particularly in response to industry trends and regulatory changes. By focusing on its competitive strengths, Priority has aimed to maintain a strong position in the market. This includes leveraging its brand reputation, technological leadership, and efficient operational infrastructure to provide secure and efficient payment processing services.

Priority Technology Holdings has achieved significant milestones, including technological advancements and strategic acquisitions. These achievements have enhanced its market position and service offerings. The company's expansion reflects its commitment to growth and innovation in the payment solutions sector.

Strategic moves include continuous investment in proprietary technology and targeted acquisitions. These actions have broadened its service capabilities and market reach. Priority's focus on innovation and strategic expansion is key to its ongoing development.

Priority's competitive advantages include a strong brand reputation and technology leadership. The company benefits from economies of scale and ecosystem effects, creating a sticky customer base. These factors contribute to its ability to offer competitive pricing and comprehensive services.

The company adapts to market trends by innovating offerings and forming partnerships. This includes embracing contactless payments and embedded finance. Priority's proactive approach helps maintain its competitive edge in the evolving payment landscape.

Priority Company operates by providing integrated payment solutions, focusing on technology and customer service. The platform supports various payment methods and integrates with other business tools. Priority offers a comprehensive suite of services designed to meet diverse business needs, from small businesses to enterprise-level operations.

- Payment Processing: Handles transactions securely and efficiently.

- Technology Integration: Offers seamless integration with existing business systems.

- Customer Support: Provides dedicated support to ensure customer satisfaction.

- Customizable Solutions: Tailors services to meet specific business requirements.

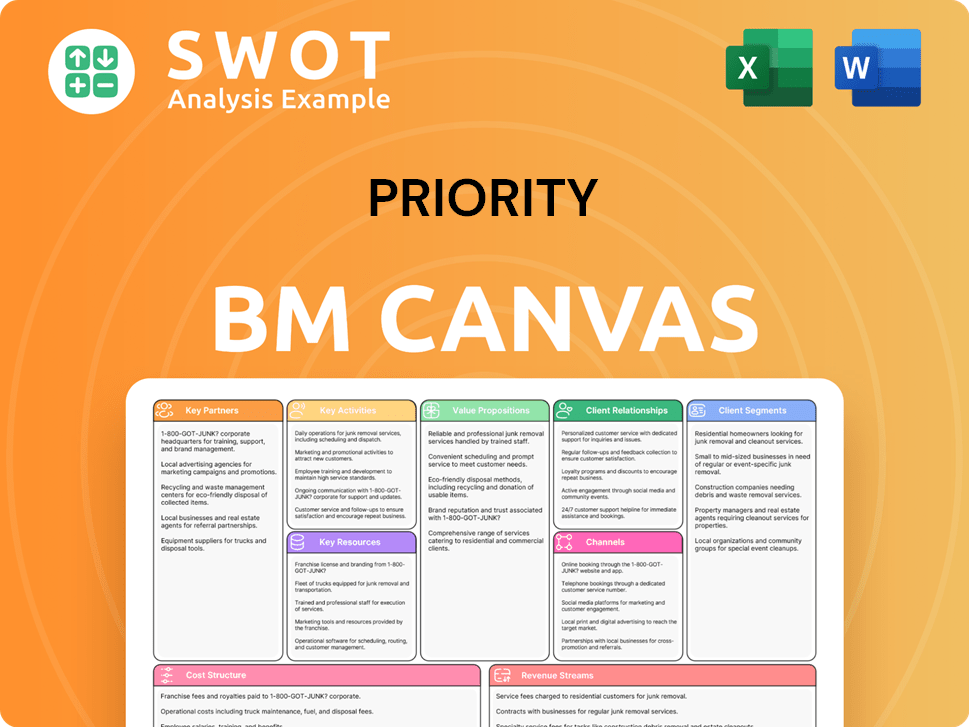

Priority Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Priority Positioning Itself for Continued Success?

The payment technology industry is highly competitive, yet it's also undergoing significant consolidation. Priority Company holds a solid position within this landscape, competing with both established payment processors and innovative fintech startups. Its market share is supported by a diverse client base and a wide range of Priority Company services, catering to various business sizes and sectors. Strong customer loyalty is a key advantage, driven by the essential nature of payment processing and the integration of its solutions into clients' core operations.

Priority Company is expanding its global reach, particularly through strategic partnerships and targeted market entries. However, the company faces several risks, including potential regulatory changes in the financial services sector, the emergence of new competitors with innovative payment technologies, and technological disruptions such as advancements in blockchain or alternative payment methods. These factors could necessitate significant investment in R&D to remain competitive. Changing consumer preferences, like a shift away from traditional card payments, could also influence revenue streams.

Priority Company benefits from a diverse client base and comprehensive service offerings. Its focus on both small and enterprise businesses is a key strength. The company's ability to adapt to changing market dynamics and leverage strategic partnerships supports its growth. The company's global reach is expanding, particularly through strategic partnerships and targeted market entries.

Potential regulatory changes in the financial services sector could impact compliance costs. The emergence of new competitors with innovative payment technologies poses a threat. Technological disruptions, such as advancements in blockchain, could necessitate significant investment in R&D. Changing consumer preferences, such as a shift away from traditional card payments, could also influence revenue streams.

Priority Company is actively addressing risks through strategic initiatives, including continued investment in technology and product innovation. The company is exploring new market segments and forming strategic alliances. The company's innovation roadmap emphasizes enhancing its proprietary platforms and expanding its commercial payment solutions.

Priority Company is focused on enhancing its proprietary platforms and expanding its commercial payment solutions. The company leverages data analytics to provide greater value to its merchants. Leadership is committed to organic growth complemented by strategic acquisitions. The company is investing in technology and product innovation.

Priority Company focuses on organic growth and strategic acquisitions to expand its revenue generation capabilities. The company’s innovation roadmap includes enhancing its proprietary platforms and expanding commercial payment solutions. Priority Company is actively exploring new market segments and forming strategic alliances to strengthen its position in the evolving payment landscape. Read more about the Growth Strategy of Priority.

- Continued investment in technology and product innovation.

- Strategic acquisitions to expand market reach and capabilities.

- Leveraging data analytics to provide greater value to merchants.

- Focus on expanding commercial payment solutions.

Priority Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Priority Company?

- What is Competitive Landscape of Priority Company?

- What is Growth Strategy and Future Prospects of Priority Company?

- What is Sales and Marketing Strategy of Priority Company?

- What is Brief History of Priority Company?

- Who Owns Priority Company?

- What is Customer Demographics and Target Market of Priority Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.