Rathbone Brothers Bundle

How Well Do You Know Rathbone Brothers Company?

Journey back in time with us to uncover the fascinating Rathbone Brothers SWOT Analysis and its remarkable story. From its humble beginnings as a merchant bank in 1742, Rathbones has evolved into a titan of wealth management. Discover the key milestones and strategic decisions that have shaped this enduring investment company.

This exploration into Rathbones history will reveal how the company navigated centuries of financial services, demonstrating resilience and innovation. Learn about the Rathbone Brothers founders and the early years that laid the foundation for its current success. Explore the acquisitions, investment strategies, and financial performance that have solidified its reputation as a leader in wealth management.

What is the Rathbone Brothers Founding Story?

The story of Rathbone Brothers Company, now known as Rathbones, begins in 1742. It started with Rathbone & Co. in Liverpool. This marks the beginning of a long history in the financial world.

William Rathbone II founded the firm. He built upon his family's existing business interests. The Rathbone family was well-known in Liverpool's commercial scene. They saw an opportunity to offer financial services alongside their trading activities. This move was key to their early success.

The initial business model was merchant banking. This included trade finance and bill discounting. It also involved early forms of wealth management. This was for wealthy individuals and families involved in commerce. Liverpool's booming port and global trade helped the firm grow. This provided a strong base for their financial services.

Rathbones' early years focused on merchant banking, crucial for trade and wealth management.

- The company's name came from the Rathbone family, a respected name in business.

- Initial funding came from the family's wealth and ventures.

- The main challenge was managing risks in international trade and building a strong reputation.

- Rathbones' history is a testament to adapting to changes in the financial world.

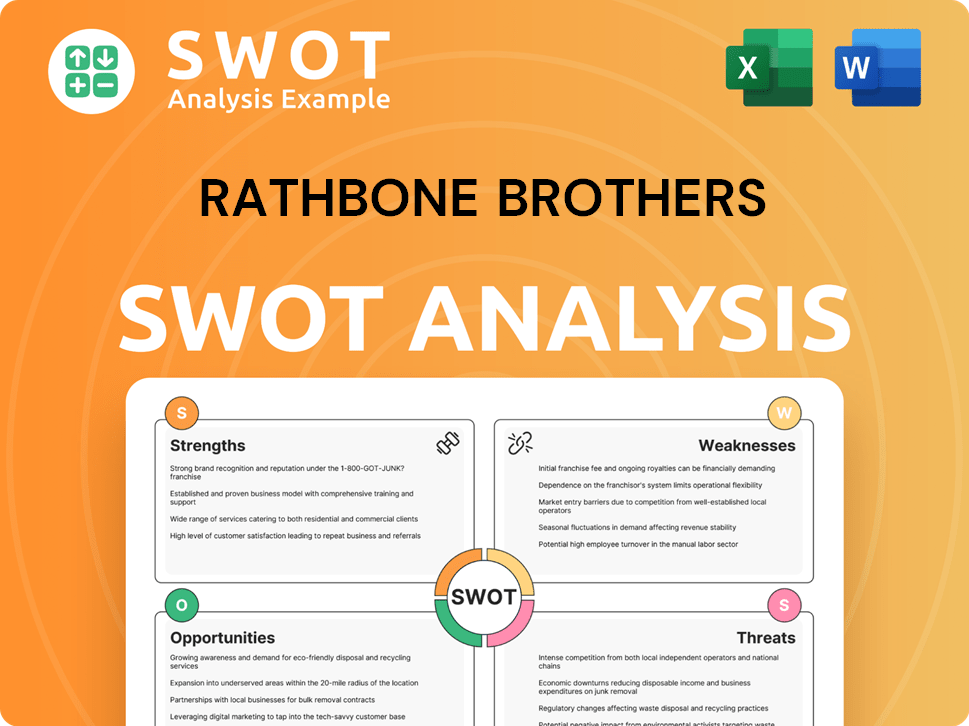

Rathbone Brothers SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Rathbone Brothers?

The early growth and expansion of the Rathbone Brothers Company marked a significant transition for the firm. From its merchant banking origins, Rathbones evolved into a dedicated investment management company. This strategic shift allowed the company to specialize in managing portfolios, building a reputation for financial stewardship. The company expanded its client base by leveraging existing relationships and referrals.

After selling its merchant banking interests in the mid-1800s, Rathbones focused on investment management. This specialization allowed the firm to cater to private clients. The company's service offerings expanded as financial markets developed, including more sophisticated investment strategies. This focus was key to its growth within the financial services sector.

The company expanded its client base through relationships with wealthy families and referrals. This approach helped establish a strong reputation. The ability to build and maintain trust was crucial for attracting and retaining clients. This strategy contributed to the firm's early success in the wealth management arena.

Rathbones began to expand its physical presence beyond Liverpool. Establishing offices in new locations allowed the firm to serve a wider clientele. This expansion was a key step in growing its assets under management. The firm's ability to adapt and grow geographically supported its long-term development.

Key leadership transitions, both within the Rathbone family and with professional managers, guided the firm. These leaders navigated economic changes and market fluctuations. By the 20th century, Rathbones was firmly established as a dedicated investment company. The firm adapted to evolving regulatory landscapes, increasing its assets under management. For more details on the Rathbones history, consider reading about Owners & Shareholders of Rathbone Brothers.

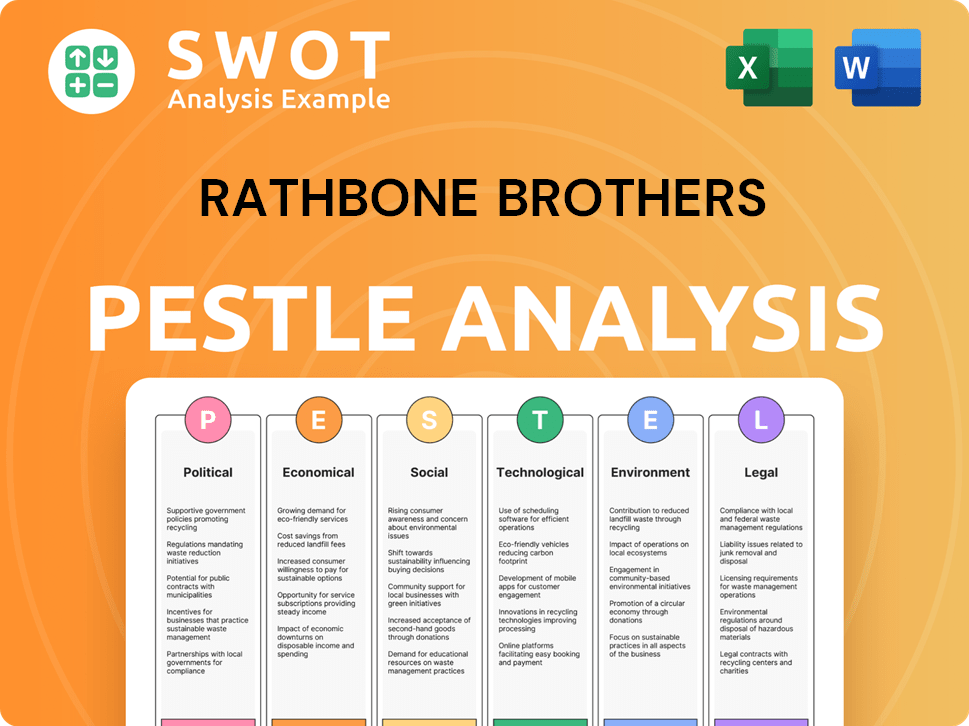

Rathbone Brothers PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Rathbone Brothers history?

The history of the Rathbone Brothers Company is marked by several key milestones that have shaped its growth and influence in the wealth management and financial services sectors. A significant moment was its listing on the London Stock Exchange in 1996, which provided capital for expansion and enhanced its public profile. This event was crucial for the investment company's evolution.

| Year | Milestone |

|---|---|

| 1742 | Founded in Liverpool, marking the beginning of its long-standing presence in the financial world. |

| 1980s | Expansion of services and client base, solidifying its position in the private client market. |

| 1996 | Listed on the London Stock Exchange, a pivotal moment for capital raising and increased visibility. |

| 2018 | Acquisition of Speirs & Jeffrey, boosting assets under management and expanding its footprint in Scotland. |

| 2024 | Continued growth in funds under management and administration, demonstrating market resilience and sustained performance. |

Throughout its history, Rathbones has consistently embraced innovation to meet evolving client needs. The integration of digital tools for client reporting and portfolio management represents a modern innovation, enhancing transparency and accessibility for investors. This focus on technological advancement has been a key element in maintaining its competitive edge in the financial services industry.

Implementation of digital platforms for client reporting and portfolio management, enhancing transparency and client experience.

Acquisitions of firms like Speirs & Jeffrey to expand its market presence and client base.

Development of tailored wealth management solutions to meet the diverse needs of its clients, reflecting its commitment to personalized service.

Adaptation of investment strategies to incorporate new asset classes and market opportunities, ensuring clients benefit from diversified portfolios.

Strengthening of risk management protocols to navigate market volatility and economic uncertainties, protecting client investments.

Investment in compliance and reporting systems to meet evolving regulatory requirements, such as MiFID II, ensuring operational efficiency.

Despite its successes, Rathbones has faced challenges, including market downturns and regulatory changes. The 2008 financial crisis and the economic uncertainties of the COVID-19 pandemic tested its resilience. The firm has responded by strengthening its risk management frameworks. Regulatory changes, such as MiFID II, also presented operational challenges. To learn more about the Rathbones's target market, read this article: Target Market of Rathbone Brothers.

Navigating through periods of economic instability, such as the 2008 financial crisis and the COVID-19 pandemic, which impacted investment performance.

Adapting to new regulations, such as MiFID II, which required significant investment in compliance and reporting systems.

Facing competition from other wealth management firms and financial services providers, requiring continuous innovation and client focus.

Dealing with economic downturns that can affect investment returns and client confidence, requiring robust risk management strategies.

Meeting evolving client expectations and demands for digital services and personalized advice, requiring continuous adaptation.

Managing risks associated with geopolitical events and uncertainties that can impact global markets and investment strategies.

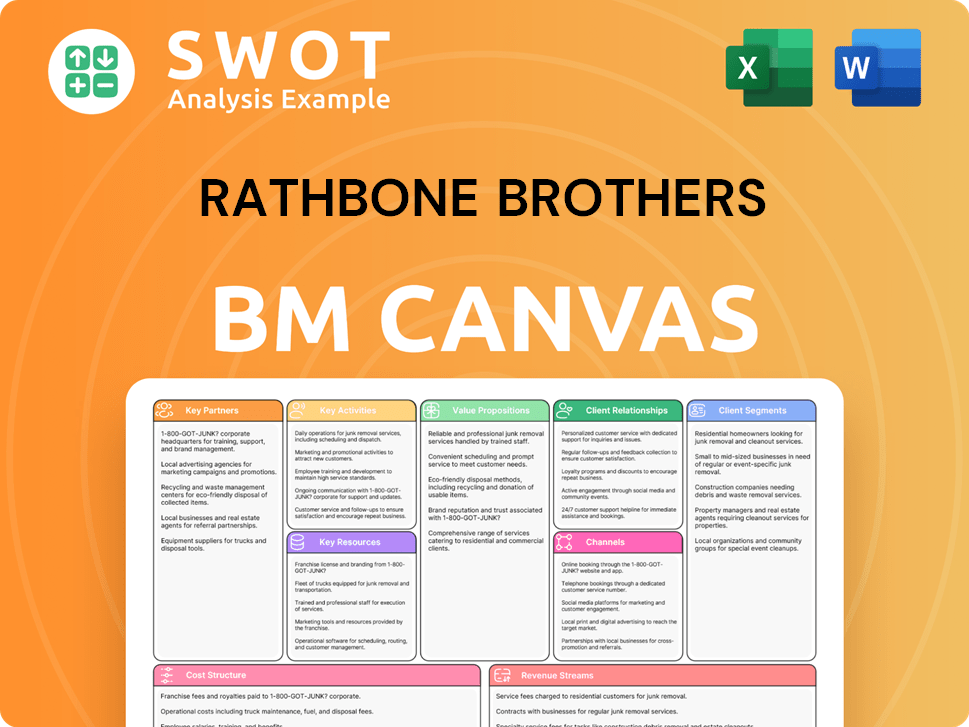

Rathbone Brothers Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Rathbone Brothers?

This article delves into the Rathbones history, tracing its evolution from its founding to its current status as a prominent player in the wealth management sector. The Rathbone Brothers Company has a rich history, marked by significant milestones that have shaped its identity and strategic direction.

| Year | Key Event |

|---|---|

| 1742 | Founding of Rathbone & Co. in Liverpool, marking the beginning of the firm's long history. |

| Mid-1800s | Transition from merchant banking to specialized investment management, signaling a strategic shift. |

| 1996 | Listing on the London Stock Exchange, providing access to public markets and enhancing its profile. |

| 2018 | Acquisition of Speirs & Jeffrey, significantly expanding assets under management and market reach. |

| 2023 | Funds under management and administration reached £111.8 billion, demonstrating substantial growth. |

| 2024 | Reports strong financial performance, with continued growth in funds under management, reflecting ongoing success. |

Rathbones is focused on long-term strategic initiatives aimed at sustainable growth and enhanced client experience. The company continues to invest in technology to improve its digital platforms and operational efficiency. This reflects a broader industry trend towards digitalization in wealth management.

The firm is exploring opportunities for further market expansion, both organically and through potential acquisitions, to consolidate its position in the UK and potentially international markets. This includes a focus on personalized service and bespoke investment solutions, aligning with growing demand. Analysts predict continued growth in the wealth management sector.

Rathbones is committed to responsible investing and sustainability, integrating ESG (Environmental, Social, and Governance) factors into their investment processes. This is a key industry trend for 2024 and beyond. The company's leadership emphasizes its commitment to responsible investing.

The future trajectory of Rathbones remains firmly rooted in its founding vision of safeguarding and growing client wealth, adapting to modern challenges while upholding its enduring principles. The firm is well-positioned to capitalize on the growth in financial services. The company's focus will be on adapting to the evolving needs of its clients.

Rathbone Brothers Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Rathbone Brothers Company?

- What is Growth Strategy and Future Prospects of Rathbone Brothers Company?

- How Does Rathbone Brothers Company Work?

- What is Sales and Marketing Strategy of Rathbone Brothers Company?

- What is Brief History of Rathbone Brothers Company?

- Who Owns Rathbone Brothers Company?

- What is Customer Demographics and Target Market of Rathbone Brothers Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.