Rathbone Brothers Bundle

How is Rathbone Brothers Company Redefining Wealth Management Sales and Marketing?

In the ever-evolving landscape of financial services, understanding the sales strategy and marketing strategy of industry leaders is crucial. Rathbone Brothers Company, a prominent UK investment management firm, offers a compelling case study, especially after its strategic combination with Investec Wealth & Investment (IW&I) UK in 2023. This union has reshaped its approach, making it a key player in the wealth management sector.

This analysis delves into Rathbone Brothers' evolving sales approach and marketing campaigns, exploring how it acquires clients and positions itself in a competitive market. We'll examine its digital marketing strategy, content marketing efforts, and sales performance, providing insights into its growth strategy and Rathbone Brothers SWOT Analysis. Understanding these elements offers valuable lessons for anyone interested in investment management and business strategy.

How Does Rathbone Brothers Reach Its Customers?

The sales strategy of Rathbone Brothers Company centers on a direct, relationship-driven model, complemented by strategic partnerships and an expanding physical presence. Their approach emphasizes 'advice-led conversations' to secure high-quality revenue. This focus is crucial for their investment management and financial services offerings.

Rathbones' marketing strategy involves leveraging acquisitions to broaden its reach. The integration of Investec Wealth & Investment (UK) and Saunderson House are key examples of this inorganic growth strategy. These moves have significantly expanded their client base and assets under management.

Digital transformation plays a supporting role, enhancing client engagement and operational efficiency. Rathbones is investing in technology, such as the InvestCloud Client Lifecycle Management (CLM) platform, to improve its customer relationship management and overall service delivery.

The core of Rathbones' sales approach involves direct sales teams. These teams engage with clients seeking personalized investment strategies and wealth management solutions. This ensures a tailored approach to client needs.

Acquisitions, such as Investec Wealth & Investment (UK) and Saunderson House, are pivotal in their business strategy. These moves add substantial assets and expand their client base. The integration of these acquisitions is ongoing.

Rathbones is investing in digital tools to enhance client engagement and operational efficiency. The implementation of the InvestCloud CLM platform is a key step in this direction. Further enhancements are planned for 2025.

Rathbones complements its direct sales with strategic partnerships. An expanding physical presence supports client interactions. This multi-channel approach enhances service delivery.

Rathbones' sales strategy emphasizes direct client engagement and strategic acquisitions to expand its reach. The integration of Investec Wealth & Investment (UK) added £43.0 billion to its FUMA by the end of 2024. This shows the impact of their growth strategy. Further details can be found in a Brief History of Rathbone Brothers.

- Direct Sales: Focused on personalized investment strategies.

- Acquisitions: Expanding client base and assets under management.

- Digital Transformation: Enhancing client engagement and operational efficiency.

- Strategic Partnerships: Complementing direct sales efforts.

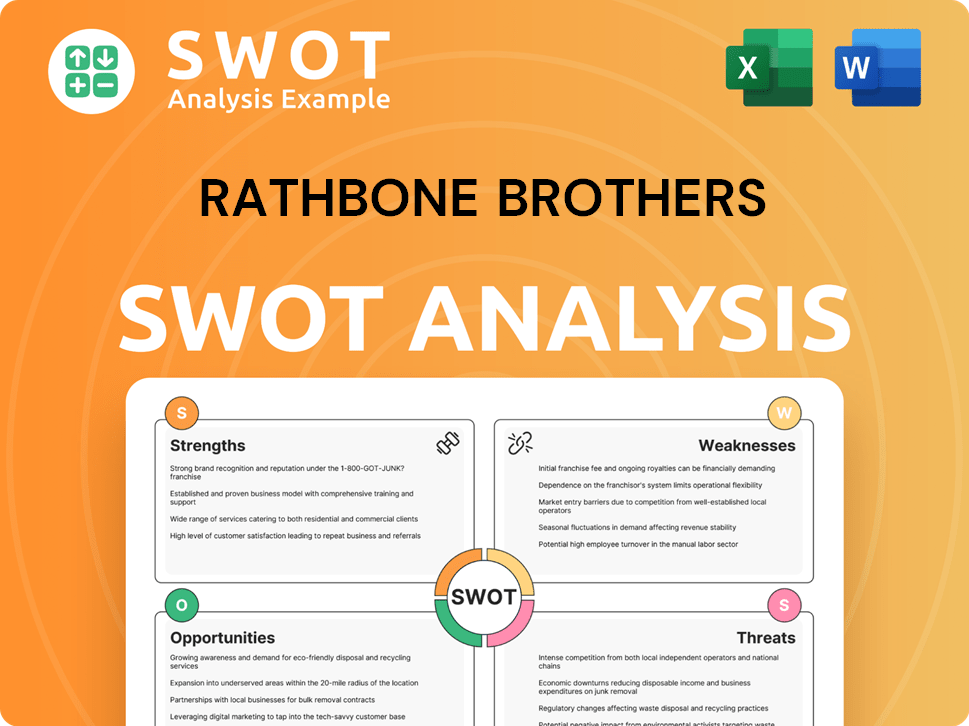

Rathbone Brothers SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Rathbone Brothers Use?

The marketing tactics employed by Rathbone Brothers Company, a key element of their overall business strategy, involve a blend of digital and traditional approaches. Their focus is on strengthening marketing and distribution capabilities to foster organic growth and facilitate advice-led conversations with clients. This strategy is underpinned by a commitment to digital transformation and data-driven decision-making.

A core aspect of their marketing strategy involves leveraging technology to enhance client experience and operational efficiency. This includes the development and deployment of a client lifecycle management (CLM) system, which was expected to go live by mid-2024. The firm also implements common financial planning, intermediated distribution, and marketing software across the combined group.

While specific details on elements like content marketing, SEO, and paid advertising are not extensively available in public reports, the emphasis on refreshed marketing and distribution capabilities suggests ongoing development in these areas. Traditional media and events likely play a role, especially in reaching high-net-worth individuals. The firm's proactive communication strategy, such as addressing potential tax changes, is also noteworthy.

Rathbones is actively investing in its digital program, including the CLM system, to enhance client experience and operational efficiency. This system is designed to improve client engagement, portfolio management, risk assessment, and compliance.

The CLM system is a key initiative, expected to be live by mid-2024, aiming to revolutionize the end-to-end client experience. It supports client engagement, portfolio management, and compliance.

The CLM system supports data-driven marketing, customer segmentation, and personalization. This investment aims to improve digital client reporting and enhance client satisfaction and retention.

Traditional media and events likely play a role in reaching high-net-worth individuals and professional partners. The firm's engagement around potential taxation changes also indicates a proactive communication strategy.

The evolution of their marketing mix is influenced by integration activities, such as the client consent process for the IW&I combination, which requires significant client engagement.

Deployment of common financial planning, intermediated distribution, and marketing software systems across the combined group is another key tactic.

The sales strategy is closely aligned with the marketing efforts, focusing on delivering advice-led conversations and enhancing client relationships. The firm likely uses a multi-channel approach to reach its target market, which includes high-net-worth individuals and professional partners. The integration of new technologies, such as the CLM system, supports improved customer relationship management and personalized client experiences, which are crucial for client retention and satisfaction. This approach is essential for the growth strategy in the competitive financial services industry.

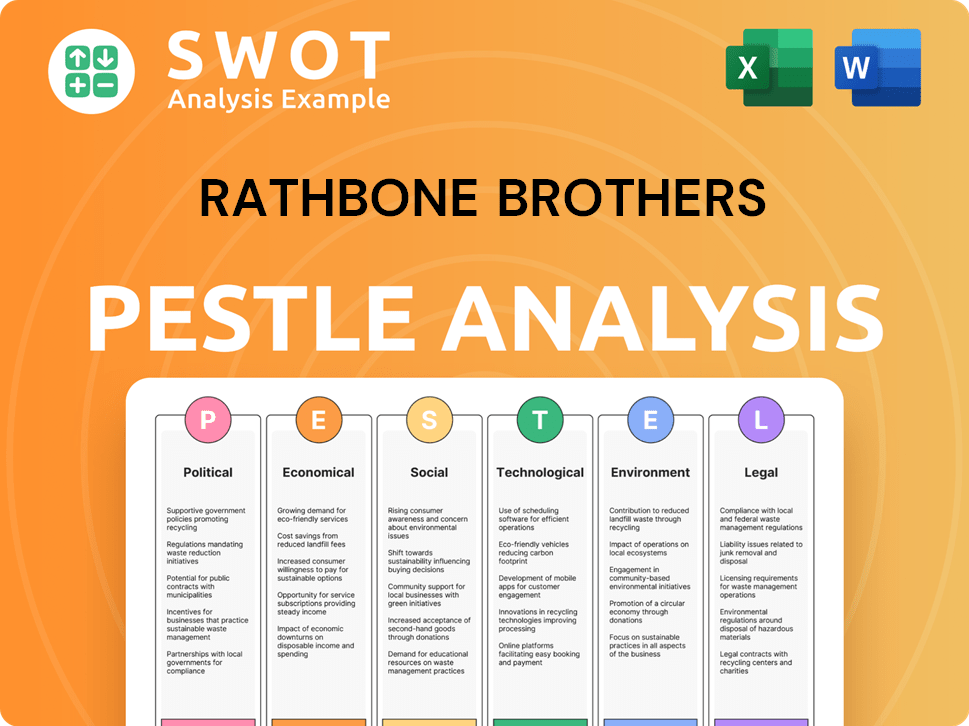

Rathbone Brothers PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Rathbone Brothers Positioned in the Market?

The brand positioning of the company centers on providing personalized investment management and wealth management services, primarily within the UK market. This is achieved through a relationship-led approach, emphasizing client-centric values. The company's identity is built on trust, prestige, and a commitment to managing and safeguarding wealth for various client types, including individuals, families, charities, and trustees.

The acquisition of Investec Wealth & Investment (UK) significantly reinforced this positioning, establishing one of the largest discretionary wealth managers in the UK under a unified brand. This combination aimed to merge two businesses with similar cultures and operating models, focusing on client-centric values and sustainable growth. The firm aims to offer direct, personal service, which they believe is becoming harder to find in the market, appealing to clients who value bespoke solutions.

The company's commitment to 'stewardship and responsible investment activities' is also highlighted, suggesting an appeal to clients with an interest in sustainable practices. The company's sustained financial performance, with underlying profit before tax increasing by 79.1% to £227.6 million in 2024, and FUMA reaching £109.2 billion, further underpins its market position and reputation. For a deeper dive into the company's target audience, consider reading about the Target Market of Rathbone Brothers.

The company's sales strategy emphasizes a relationship-led approach. This involves building trust and providing personalized service to clients. This approach helps in acquiring and retaining clients in the competitive financial services market.

The company's marketing strategy is centered on client-centric values. They focus on bespoke solutions to meet individual client needs. This approach is designed to attract clients who value personalized financial services.

The company's brand positioning highlights a commitment to sustainable and responsible investment. This appeals to clients interested in ethical and environmentally friendly investment practices. This approach is increasingly relevant in today's market.

The company's strong financial performance, with significant growth in underlying profit before tax, supports its market position. The increase in Funds Under Management (FUMA) to £109.2 billion in 2024, demonstrates the effectiveness of its sales and marketing strategies.

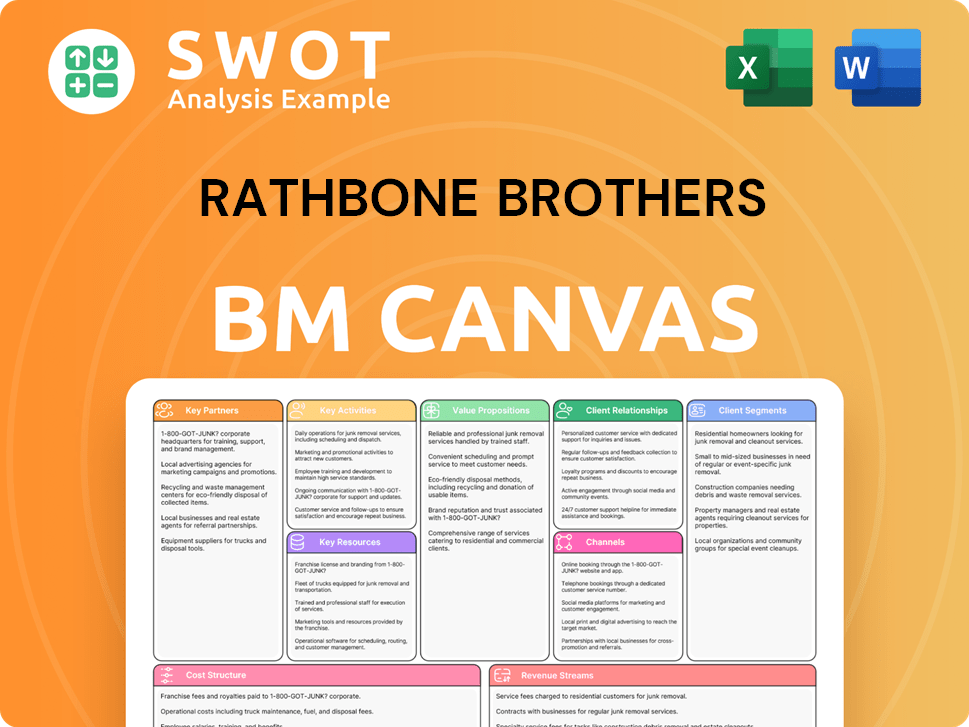

Rathbone Brothers Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Rathbone Brothers’s Most Notable Campaigns?

The most significant recent undertaking for Rathbone Brothers Company has been the strategic combination and integration of Investec Wealth & Investment (UK) (IW&I). This initiative, announced in April 2023 and completed in September 2023, fundamentally reshaped the company's scale and future growth trajectory. This was a key element of their overall Growth Strategy of Rathbone Brothers.

The primary goal of this 'campaign' was to establish the UK's leading discretionary wealth manager. This involved leveraging synergies, enhancing client services across investment management, financial planning, and banking, and building a robust multi-channel distribution network. The integration strategy focused on bringing together two well-regarded wealth management firms with similar operational models.

Another crucial 'campaign' involves the ongoing digital transformation. This includes the deployment of the InvestCloud Client Lifecycle Management (CLM) system, which aims to improve client experiences and operational efficiency. The migration of Saunderson House client assets into Rathbones investment solutions also represents a significant integration effort.

The integration of IW&I was a major focus. The client consent process was nearly complete as of February 2025, with Rathbones expecting to migrate almost all of the approximately 55,000 IW&I clients by the end of H1 2025. Only 0.3% of clients declined to migrate.

The IW&I integration has already produced significant financial benefits. Run-rate synergy realization reached £30.1 million by the end of 2024, surpassing the initial £15 million target. This contributed to a substantial increase in underlying profit before tax, which rose by 79.1% to £227.6 million in 2024.

The deployment of the InvestCloud CLM system is part of the company's digital transformation. This initiative aims to enhance the overall client experience and operational efficiency. The migration of Saunderson House client assets also contributed to gross inflows.

Rathbones' commitment to responsible investing is highlighted by awards such as those received at the Investment Week Sustainable Investment Awards 2024. This includes recognition for Rathbone Greenbank Multi-Asset Portfolios and Rathbone Greenbank Global Sustainable Bond Fund.

Rathbone Brothers Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Rathbone Brothers Company?

- What is Competitive Landscape of Rathbone Brothers Company?

- What is Growth Strategy and Future Prospects of Rathbone Brothers Company?

- How Does Rathbone Brothers Company Work?

- What is Brief History of Rathbone Brothers Company?

- Who Owns Rathbone Brothers Company?

- What is Customer Demographics and Target Market of Rathbone Brothers Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.