Rathbone Brothers Bundle

Who Really Controls Rathbone Brothers Plc?

In the ever-shifting landscape of finance, understanding the ownership of established firms is crucial. Knowing who owns a company like Rathbone Brothers Plc can reveal its strategic direction and accountability. Founded in 1742, this UK-based investment management firm has a rich history.

As of early 2025, Rathbone Brothers Plc stands as a significant player in UK wealth management, managing considerable assets. This exploration into Rathbone Brothers SWOT Analysis will dissect its ownership structure, from its founding to the influence of major shareholders. We'll uncover the evolution of Rathbone Brothers ownership, providing a comprehensive view of who owns Rathbones and guides this enduring financial institution, including details on Rathbone Brothers shareholders.

Who Founded Rathbone Brothers?

The story of Rathbone Brothers Plc begins in 1742, with its roots firmly planted in Liverpool as a merchant house. The firm's inception was spearheaded by William Rathbone I, marking the start of a legacy that would span centuries. While precise details of the initial equity distribution among the founders are not readily available in public records, the Rathbone family's influence was undeniably central to the company's early ownership and development.

The initial ownership structure of Rathbone Brothers was likely concentrated within the Rathbone family, reflecting the business practices of the era. This setup evolved from a partnership model, common for businesses of that time. The family's active involvement in leadership and growth highlights their significant, if not exclusive, initial ownership stake. Early financial backing primarily came from family capital and potentially loans from other wealthy merchants or banking houses.

The evolution of Rathbone Brothers ownership is a fascinating journey through time. The lack of readily available documentation from the 18th century makes it challenging to pinpoint exact shareholding percentages for William Rathbone I and his immediate successors. However, the enduring influence of the Rathbone family strongly suggests a substantial initial ownership stake. The early financial arrangements were quite different from today's formal structures, such as angel investors or venture capital.

The Rathbone family played a pivotal role in the company's early development and ownership.

Early financial support came from family capital and wealthy merchants.

The initial structure was likely concentrated within the Rathbone family.

Agreements such as vesting schedules were not typical for these early merchant firms.

Ownership disputes were resolved through private family or commercial agreements.

The founding team's vision was linked to the family's reputation and direct control.

Understanding the early ownership of Rathbone Brothers provides a critical foundation for analyzing its long-term success. The focus on prudent financial management and client service, core values of the founding team, was intrinsically linked to the family's reputation and direct control over the business operations. For a deeper dive into the company's strategic direction, consider exploring the Growth Strategy of Rathbone Brothers. Today, as a publicly listed company, the ownership structure of Rathbone Brothers has evolved significantly from its early days, with shares held by institutional investors and the public. While specific details of the early shareholdings remain limited, the enduring legacy of the Rathbone family is evident in the company's continued focus on wealth management and financial services.

Rathbone Brothers SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Rathbone Brothers’s Ownership Changed Over Time?

The evolution of Rathbone Brothers Plc's ownership has been significantly shaped by its transition to a public company. The initial public offering (IPO) marked a pivotal moment, shifting the ownership structure from the founding family to a broader base of shareholders. This move, which occurred on the London Stock Exchange, introduced a diverse range of investors, including institutional entities and individual shareholders, thereby altering the dynamics of the company's governance and strategic direction. This shift towards public ownership was a key step in the company's history, influencing its growth and market presence.

Since its IPO, the ownership of Rathbone Brothers has continued to evolve. The company's shareholder base now includes a variety of institutional investors and fund managers. The acquisition of Investec Wealth & Investment UK, completed in September 2023, further reshaped the ownership landscape. This merger, which involved a share-based consideration, brought new shareholders into the fold. This strategic move not only expanded the company's scale but also potentially altered its shareholder composition, impacting capital allocation and strategic priorities. The combined entity's increased Assets Under Management and Administration (AUMA) to £107.5 billion as of December 31, 2023, is a testament to the impact of this acquisition.

| Shareholder | Percentage of Shares (as of April 30, 2024) | Percentage of Shares (as of December 31, 2023) |

|---|---|---|

| BlackRock, Inc. | 7.28% | N/A |

| The Vanguard Group, Inc. | 3.86% | N/A |

| Redwheel | N/A | 5.02% |

| Liontrust Investment Partners LLP | N/A | 3.01% |

As of early 2025, the major stakeholders in Rathbone Brothers Plc include significant institutional investors. These entities hold substantial portions of the company's shares, reflecting their confidence in the firm's long-term strategy and financial performance. For instance, BlackRock, Inc. reported a holding of 7.28% as of April 30, 2024, while The Vanguard Group, Inc. reported 3.86% as of the same date. Other notable institutional holders include Redwheel, with 5.02% as of December 31, 2023, and Liontrust Investment Partners LLP, with 3.01% as of December 31, 2023. These figures, derived from regulatory filings and company reports, underscore the influence these institutional investors have on the company's strategy and governance. To learn more about the company's growth strategy, consider reading Growth Strategy of Rathbone Brothers.

The ownership of Rathbone Brothers has evolved significantly since its IPO, with major shifts driven by strategic acquisitions and the entry of institutional investors.

- The IPO marked a transition to a public company, broadening the shareholder base.

- Institutional investors such as BlackRock and The Vanguard Group hold significant shares.

- The acquisition of Investec Wealth & Investment UK in September 2023 reshaped the shareholder composition.

- These changes impact company strategy and governance.

Rathbone Brothers PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Rathbone Brothers’s Board?

The Board of Directors of Rathbone Brothers Plc is central to its corporate governance, steering the company's strategic direction and acting on behalf of shareholders. As of early 2025, the board is composed of executive directors, non-executive directors, and independent non-executive directors. Key figures include Clive Bannister as Chair, Paul Stockton as Chief Executive Officer, and Jennifer Mathias as Group Finance Director. The board's structure ensures a mix of expertise in investment management, finance, and corporate governance, providing oversight and independent perspectives.

The board's decisions directly affect shareholder value, particularly regarding capital allocation, acquisitions, and executive compensation. The focus on strengthening the governance framework has increased, especially after significant corporate actions like the merger with Investec Wealth & Investment UK. The board's decisions are subject to scrutiny from institutional investors, emphasizing the importance of effective oversight and clear communication with a broader shareholder base. Understanding the composition and responsibilities of the board is crucial for anyone seeking to understand Rathbone Brothers ownership and its future direction.

| Board Member | Role | Key Responsibility |

|---|---|---|

| Clive Bannister | Chair | Overseeing the board's effectiveness and strategic direction. |

| Paul Stockton | Chief Executive Officer | Leading the company's operations and strategic execution. |

| Jennifer Mathias | Group Finance Director | Managing the company's financial strategy and reporting. |

Rathbone Brothers operates under a one-share-one-vote structure, common in the UK, ensuring equal voting rights for ordinary shares. This structure is a key aspect of understanding Who owns Rathbones. There are no publicly reported dual-class shares or special voting rights that grant outsized control to specific entities. The company's commitment to this structure reflects its focus on shareholder equality and transparent governance. For more insights, you can explore the Marketing Strategy of Rathbone Brothers.

The Board of Directors at Rathbone Brothers is structured to ensure effective oversight and strategic direction. The board includes a mix of executive and non-executive directors with expertise in finance and investment. The company operates under a one-share-one-vote system, ensuring equal voting rights for all shareholders.

- The board's decisions directly impact shareholder value.

- Independent non-executive directors provide objective viewpoints.

- The governance framework has been strengthened, especially post-merger.

- Understanding the board's composition is key to understanding Rathbone Brothers shareholders.

Rathbone Brothers Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Rathbone Brothers’s Ownership Landscape?

Over the past few years, Rathbone Brothers' ownership has seen significant shifts. The most impactful change was the acquisition of Investec Wealth & Investment UK, completed in September 2023. This major move resulted in Investec Group becoming a substantial shareholder, holding approximately 41.25% of the combined entity's share capital. This significantly altered the shareholder base, making Investec Group a key strategic investor.

This acquisition aligns with a broader trend of consolidation within the wealth management sector. This trend is driven by factors such as increasing regulatory costs and the need for greater scale. Such mergers often lead to a rise in institutional ownership, changing the composition of the shareholder base. While there haven't been significant share buybacks or secondary offerings beyond the Investec transaction, the focus has been on integrating the acquired business and achieving synergies.

Looking ahead, the focus is on organic growth and potential future acquisitions. The integration of Investec Wealth & Investment UK is expected to strengthen the company's market position. The long-term trend points towards a more diversified institutional ownership structure, with an emphasis on ESG factors influencing investment decisions and shareholder engagement. The headquarters of Rathbone Brothers is located in London, United Kingdom. You can find more information in the annual reports and financial statements.

The acquisition of Investec Wealth & Investment UK in September 2023 was a pivotal event. This transaction led to Investec Group holding a significant stake. The deal reflects consolidation trends within the wealth management industry.

Investec Group now holds a major share, around 41.25%. This has diluted the stakes of pre-existing shareholders. The ownership is becoming more institutionally focused.

The company is focused on organic growth and potential acquisitions. Integration of Investec is expected to enhance market position. ESG factors will likely play a greater role in investment decisions.

Institutional investors are expected to have a greater influence. ESG considerations are becoming increasingly important. This shift may influence company strategy.

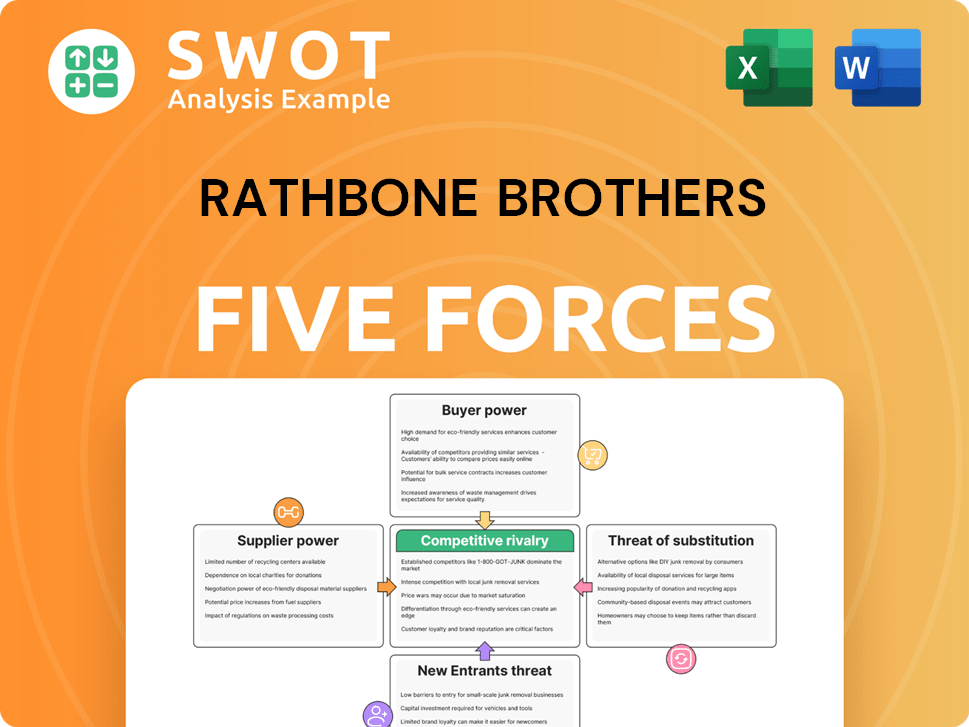

Rathbone Brothers Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Rathbone Brothers Company?

- What is Competitive Landscape of Rathbone Brothers Company?

- What is Growth Strategy and Future Prospects of Rathbone Brothers Company?

- How Does Rathbone Brothers Company Work?

- What is Sales and Marketing Strategy of Rathbone Brothers Company?

- What is Brief History of Rathbone Brothers Company?

- What is Customer Demographics and Target Market of Rathbone Brothers Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.