Rathbone Brothers Bundle

How Does Rathbone Brothers Thrive in the Wealth Management Arena?

Rathbones, a titan in the UK's financial landscape, significantly boosted its market presence in 2024 by successfully integrating Investec Wealth & Investment (IW&I). This strategic move catapulted Rathbones' Funds Under Management and Administration (FUMA) to an impressive £109.2 billion by the close of 2024, showcasing its robust growth. The integration also yielded a remarkable 79.1% surge in underlying profit before tax, demonstrating the immediate financial benefits.

This article offers an in-depth exploration of Rathbone company, examining its core operations, diverse revenue streams, and strategic milestones. We'll dissect how Rathbone Brothers SWOT Analysis helps shape its competitive edge in the wealth management sector. Whether you're curious about Rathbones investment strategy explained or seeking insights into Rathbone Brothers client reviews, this analysis provides a comprehensive overview of this leading financial services provider, including its Rathbone Brothers financial performance and future outlook.

What Are the Key Operations Driving Rathbone Brothers’s Success?

Rathbone Brothers, often referred to as Rathbones, creates and delivers value primarily through its personalized investment management and wealth management services. The company's core operations revolve around providing a comprehensive suite of financial solutions tailored to meet the diverse needs of its clients. These services are designed to cater to a broad client base, including private clients, charities, trustees, and professional partners.

The operational framework of Rathbones is centered on a client-centric approach and robust investment capabilities. Investment managers at Rathbones provide direct contact and personalized service, building portfolios customized to individual client requirements and risk profiles. This approach is supported by a dependable operating platform, which contributes to high client satisfaction and long-term success.

The recent combination with Investec Wealth & Investment (IW&I) has significantly enhanced Rathbones' operational capabilities and value proposition. This integration has led to a larger platform, attracting record gross inflows of £12.1 billion in 2024, and is expected to further improve efficiency and innovation. The integration process, which includes migrating IW&I clients onto one platform, is a key priority for 2025, aiming to deliver a better client experience through enhanced technology and deeper investment insights from an enlarged research team.

Rathbones offers discretionary investment management services, crafting portfolios aligned with individual client needs and risk tolerances. They provide access to a wide range of investments across various asset classes. The focus is on achieving consistent returns while managing risk, ensuring long-term financial success for clients.

Beyond investment management, Rathbones provides comprehensive wealth management solutions, including tax planning, trust and company management, and pension advice. These services are designed to address the broader financial needs of clients. This holistic approach ensures clients receive integrated financial planning.

Rathbones offers banking services as a licensed deposit taker, including currency and payment services, fixed interest term deposits, and loans to existing clients. These services enhance the overall value proposition. This provides clients with a more complete financial solution.

A key element of Rathbones' value proposition is its client-centric approach, which emphasizes personalized service and direct contact with investment managers. This approach ensures that clients receive tailored financial solutions. The company's focus on building long-term relationships is evident in its high client satisfaction rates.

Rathbones' operational stability is supported by a dependable operating platform, which contributes to high client satisfaction. The company aims for consistent returns while minimizing excessive risk and volatility. This approach is designed to deliver long-term financial success for clients.

- Personalized Investment Management: Tailored portfolios based on individual client needs.

- Comprehensive Wealth Management: Integrated services including tax planning and pension advice.

- Robust Investment Capabilities: Access to a wide range of investments across various asset classes.

- Client-Centric Service: Direct contact with investment managers and a focus on building long-term relationships.

Rathbone Brothers SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Rathbone Brothers Make Money?

The primary revenue streams for Rathbone Brothers are investment management and asset management fees. These fees are directly tied to the Funds Under Management and Administration (FUMA). In 2024, the company saw a significant increase in operating income, demonstrating the importance of these revenue sources within the financial services sector.

Net interest income also contributes substantially to the company's revenue. This income is derived from various financial activities, including client money deposits. Commission income, stemming from transaction volumes, is another area of revenue generation for Rathbones.

Rathbones focuses on recurring fee income as a key monetization strategy. This approach is supported by higher average FUMA and revenue synergies from strategic integrations. The company also benefits from advisory services and other income streams, contributing to its overall financial performance.

The fees generated from investment and asset management are a major source of revenue for Rathbones. These fees are directly proportional to the Funds Under Management and Administration (FUMA).

Net interest income is another crucial revenue stream. It is primarily derived from the legacy Rathbones Group and includes interest from client money deposits.

Commission income, driven by transaction volumes, also contributes to Rathbones' revenue. Higher transaction volumes directly lead to increased commission income.

Rathbones focuses on recurring fee income, which is supported by higher average FUMA. This strategy ensures a stable revenue stream.

Fees from advisory services and other income sources also contribute to the overall revenue. This segment experienced growth, especially due to acquisitions.

Rathbones anticipates growth in advice revenues, driven by increased advisor capacity. Net interest income is also expected to benefit from revenue synergies.

In 2024, operating income increased by 56.9% to £895.9 million, significantly boosted by the IW&I combination. FUMA reached £109.2 billion by the end of 2024, directly impacting investment management and asset management fees. Net interest income contributed £63.9 million in 2024, up from £51.7 million in 2023. Commission income improved due to higher transaction volumes.

- The company focuses on recurring fee income to ensure a stable revenue stream.

- Revenue synergies from the migration of Saunderson House FUMA into Rathbones' solutions.

- Fees from advisory services and other income grew by 10.3% in the first three months of 2016.

- For 2025, Rathbones anticipates growth in advice revenues due to increased advisor capacity.

- Net interest income is expected to benefit from revenue synergies in the second half of 2025 after the IW&I client migration.

Rathbone Brothers PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Rathbone Brothers’s Business Model?

Rathbone Brothers, a prominent player in the financial services sector, has a rich history marked by significant milestones and strategic shifts. The company's journey includes key acquisitions and a focus on adapting to market changes. Its competitive edge is rooted in a long-standing reputation, personalized service, and a commitment to technological advancements.

A pivotal moment for the company was its merger with Comprehensive Financial Services Ltd in 1988, leading to its listing on the London Stock Exchange. More recently, the acquisition of Investec's wealth and investment businesses in the UK and Channel Islands in April 2023 for £839 million, marked a considerable expansion of its operational scale. This strategic move has been central to its recent developments.

The integration of Investec Wealth & Investment (IW&I) has been a primary focus in 2024, with the client consent process nearing completion. The expectation is to migrate almost all of the 55,000 IW&I clients by the end of H1 2025. This integration has already delivered cost and revenue synergies ahead of target, with a run-rate synergy realization of £30.1 million by the end of 2024, surpassing the initial £15 million target.

The merger with Comprehensive Financial Services Ltd in 1988 and the subsequent listing on the London Stock Exchange were significant milestones. The acquisition of Investec's wealth and investment businesses in April 2023 was another critical strategic move.

Rathbones focused on integrating IW&I, with a target to migrate 55,000 clients by the end of H1 2025. They are also improving digital capabilities by launching the InvestCloud Client Lifecycle Management (CLM) system in June 2024.

Rathbones' brand strength, established since 1742, and its personalized service model are major advantages. The ability to attract record gross inflows in 2024, demonstrates its strong market position. The company continues to adapt to new trends by enhancing its services and investing in technology.

The company has navigated industry changes and geopolitical instability. They are also focused on improving their digital capabilities to enhance efficiency and client service.

Rathbones' competitive advantages include a strong brand reputation and a personalized service model. The company offers direct contact with investment managers and unrestricted investment choices. Its ability to attract significant gross inflows in 2024 further highlights its market strength. You can learn more about how the company stands against its rivals in the Competitors Landscape of Rathbone Brothers.

- Established brand since 1742.

- Personalized, relationship-led service.

- Direct contact with investment managers.

- Unrestricted choice of investments.

Rathbone Brothers Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Rathbone Brothers Positioning Itself for Continued Success?

Rathbones holds a prominent position in the UK's wealth and investment management sector. The company's substantial Funds Under Management and Administration (FUMA) of £109.2 billion as of December 31, 2024, highlights its significant influence and scale. This is supported by a strong focus on personalized service, which reinforces customer loyalty.

The company faces various risks and challenges, including fluctuating market conditions that can affect FUMA and overall performance. Managing interest rate risk and adapting to technological advancements are also crucial. The company is actively addressing these challenges by implementing strategic programs and ensuring compliance with regulatory changes, such as the Basel 3.1 regime.

Rathbones is a leading provider of wealth and investment management services in the UK. Its strong market position is underscored by its extensive FUMA. They are known for their focus on personalized service and long-standing reputation, which helps maintain their market position.

Key risks include challenging market conditions, impacting FUMA and performance. The company must also manage interest rate risk. Technological disruption and new market entrants pose threats, requiring strategic adaptation. Regulatory changes, like Basel 3.1, also need attention.

Rathbones is focused on completing the IW&I client migration and integrating its businesses onto one platform in 2025. They aim to improve services and boost organic growth, expecting advice revenue increases in 2025. The company maintains a strong capital base to support strategic investments.

Rathbones had a surplus of £207.2 million at December 31, 2024. The company's progressive dividend policy saw a 6.9% increase in the total dividend for 2024 to 93.0p per share. They are focused on a growth agenda in 2025 to drive improved net flows and deliver value to shareholders.

Rathbones' strategic priorities include completing the integration of IW&I clients and enhancing their service offerings. The company aims to boost organic growth and increase advice revenues in 2025 due to increased advisor capacity. This strategic focus is designed to drive improved net flows and deliver sustainable value to shareholders.

- Completion of IW&I client migration in 2025.

- Enhancement of services to clients.

- Expectations for growth in advice revenues.

- Focus on improved net flows.

For those interested in the ownership structure and key stakeholders, further details can be found in the article about Owners & Shareholders of Rathbone Brothers.

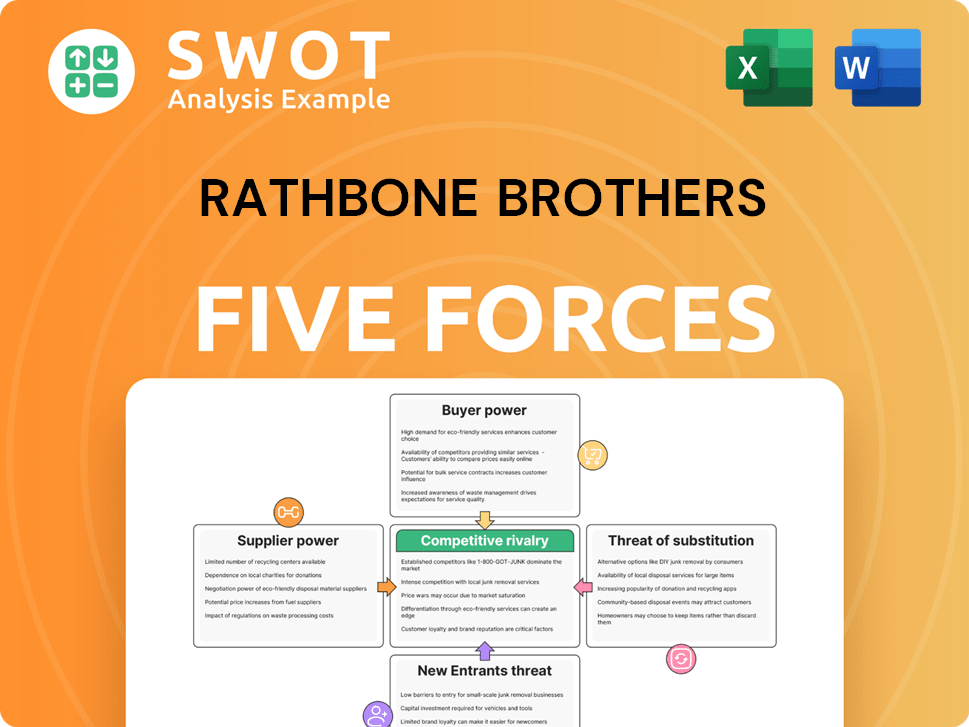

Rathbone Brothers Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Rathbone Brothers Company?

- What is Competitive Landscape of Rathbone Brothers Company?

- What is Growth Strategy and Future Prospects of Rathbone Brothers Company?

- What is Sales and Marketing Strategy of Rathbone Brothers Company?

- What is Brief History of Rathbone Brothers Company?

- Who Owns Rathbone Brothers Company?

- What is Customer Demographics and Target Market of Rathbone Brothers Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.