Samsung SDI Co Bundle

How did Samsung SDI transform from a picture tube maker to a battery powerhouse?

Explore the fascinating Samsung SDI Co SWOT Analysis to understand how this global leader in energy solutions and electronic materials emerged. From its inception in 1970 in South Korea, Samsung SDI has continuously adapted, embracing technological advancements and market demands. Discover the pivotal moments and strategic decisions that shaped this evolution.

This deep dive into the brief history of Samsung SDI uncovers the company's remarkable journey, highlighting its evolution from producing electronic materials to becoming a leading provider of Samsung batteries and energy solutions. Learn about its early products, significant milestones, and the challenges it overcame to establish its current global presence. Understanding Samsung SDI's history provides valuable insights into its current business, role in electric vehicles, and future plans within the dynamic landscape of Samsung electronics.

What is the Samsung SDI Co Founding Story?

The story of Samsung SDI Co. begins on January 20, 1970. It started as a joint venture between the Samsung Group and NEC Corporation, initially named Samsung-NEC Co. Ltd. The company's establishment in Suwon, South Korea, marked a strategic move to manufacture cathode ray tubes (CRTs) for televisions.

This early focus addressed the growing need for localized production of electronic components in South Korea. The goal was to support the expanding domestic electronics industry and reduce dependence on imported parts. The company's initial business model revolved around producing and supplying essential display components.

The founding of Samsung-NEC Co. Ltd. was a calculated step by the Samsung Group into core electronic components manufacturing. The initial funding came from both Samsung and NEC. A key aspect of its early history was its commitment to localizing electronics materials, especially picture tubes, which set the stage for its future in advanced materials and components. The company later changed its name to Samsung SDI Co., Ltd., reflecting its expanded focus beyond displays to 'Samsung Display Interface' or 'Samsung Digital Interface,' indicating its broader ambitions in digital and display technologies. To learn more about the ownership structure and key stakeholders, you can refer to Owners & Shareholders of Samsung SDI Co.

Samsung SDI's founding was a strategic move to enter the electronic components market.

- 1970: Established as Samsung-NEC Co. Ltd.

- Initial Focus: Manufacturing CRTs for televisions.

- Strategic Goal: Support the domestic electronics industry.

- Later Evolution: Expanded focus to digital and display technologies.

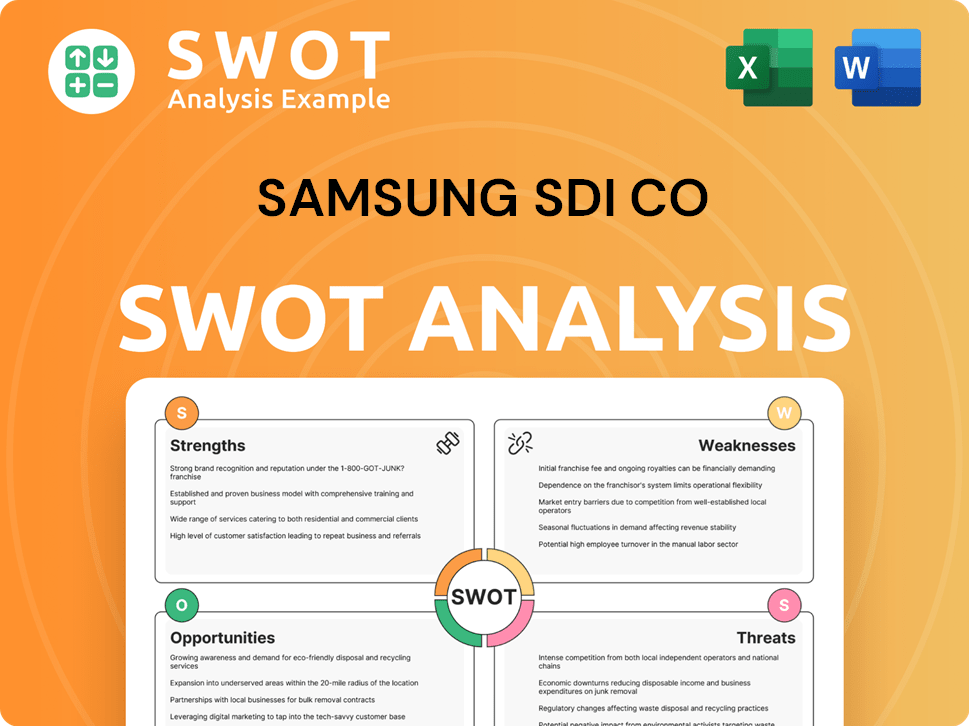

Samsung SDI Co SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Samsung SDI Co?

The early growth of Samsung SDI was marked by its dominance in the global display market, initially known for picture tube manufacturing. This expansion included a pivotal diversification into rechargeable energy solutions, with the development of high-capacity batteries. This period also saw significant innovation in display technology, setting the stage for its future as a leader in electronic materials and advanced battery technologies.

Throughout the 1990s, Samsung SDI led the global display market with its picture tube manufacturing. This early success provided a strong foundation for future growth. The company's focus on innovation helped it maintain a competitive edge during this time, establishing its presence in the electronics industry.

By 1998, Samsung SDI developed the world's highest-capacity cylindrical Li-ion battery. This marked a crucial shift towards rechargeable energy solutions. This innovation was a key step in diversifying the company's product offerings beyond displays, setting the stage for its future in Samsung batteries.

The early 2000s saw Samsung SDI transforming into a 'digital frontier'. By 2008, the company developed large-sized polymer batteries for laptop computers. This strategic move highlighted its commitment to expanding into new product categories, solidifying its role in Samsung electronics.

In 2013, Samsung SDI acquired Novaled, a German OLED materials supplier, expanding its electronic materials portfolio. The company's commitment to sustainability was recognized through its consistent listing in the Dow Jones Sustainability Index for ten consecutive years by 2013. For more details on the company's business model and revenue streams, see Revenue Streams & Business Model of Samsung SDI Co.

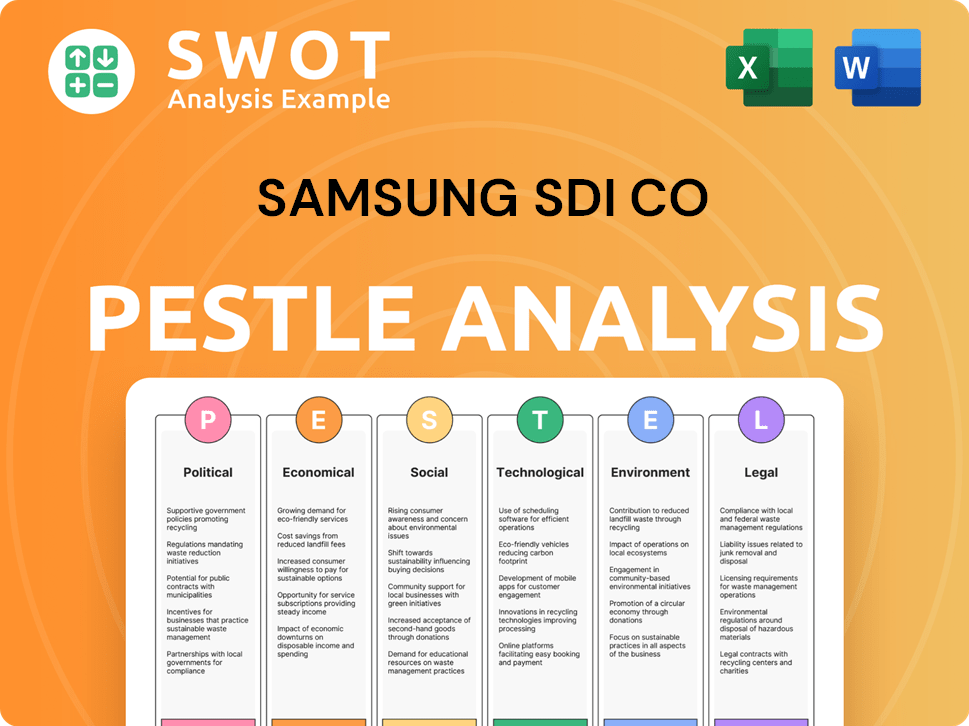

Samsung SDI Co PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Samsung SDI Co history?

The brief history of Samsung SDI is marked by significant milestones, including its early entry into the rechargeable battery market and strategic expansions. The company has consistently evolved, adapting to market demands and technological advancements. Its journey reflects a commitment to innovation and a drive to lead in the energy sector.

| Year | Milestone |

|---|---|

| 1998 | Development of high-capacity cylindrical Li-ion batteries, signaling entry into the rechargeable battery market. |

| 2012 | The company was renamed Samsung SDI Co., Ltd., reflecting a broader scope beyond display interfaces. |

| 2024 | Debuted the enhanced Samsung Battery Box (SBB) 1.5, targeting the energy storage systems (ESS) market. |

| 2025 | Unveiled the full 46-series battery lineup, with mass production beginning in Q1 2025, diversifying its product portfolio for electric vehicles. |

Samsung SDI has been at the forefront of technological advancements, particularly in battery technology. The company's innovations have significantly impacted the industry, driving improvements in energy density and efficiency.

Samsung SDI is a leader in solid-state battery (SSB) technology, with prototypes demonstrating an impressive 500 Wh/kg energy density. This represents an 85% increase over conventional lithium-ion batteries, promising safer and more efficient energy solutions.

The enhanced SBB 1.5, introduced in June 2024, boasts a total capacity of 5.26 MWh. It features improved safety features, targeting the growing energy storage systems (ESS) market.

In March 2025, Samsung SDI unveiled its full 46-series battery lineup. Mass production began in Q1 2025, showcasing the company's commitment to diversifying its product portfolio for electric vehicles.

Despite its advancements, Samsung SDI has faced various challenges, including market pressures and regulatory hurdles. The company's financial performance has been affected by these factors, prompting strategic adjustments and a focus on future growth.

In 2012, the company was fined by the European Union's antitrust regulator for fixing prices of TV cathode-ray tubes. This highlighted past regulatory challenges faced by the company.

The battery industry has experienced significant market pressures, with average pack prices dropping 20% in 2024 to US$115 per kWh. This has led to financial challenges for Samsung SDI.

Samsung SDI reported a net loss of KRW 222.0 billion in Q1 2025, a significant decline from a profit in Q1 2024. Revenue also saw a substantial drop of 38% in Q1 2025 compared to Q1 2024.

The EV battery segment has struggled due to factors like higher interest rates and reduced consumer subsidies, which curbed demand for electric vehicles. A decline in demand from major car OEMs in Europe and North America caused a 10.6% degrowth in Samsung SDI's battery usage from January to December 2024.

In response, Samsung SDI is implementing strategic pivots, including focusing on strengthening technological competitiveness, improving its business structure, and expanding partnerships. This includes joint ventures with General Motors and Stellantis for EV battery manufacturing in North America.

The company is also investing in eco-friendly technologies and processes to address sustainability concerns. This focus aligns with the broader industry trend towards sustainable practices.

For more insights into Samsung SDI's growth strategy, you can read the Growth Strategy of Samsung SDI Co.

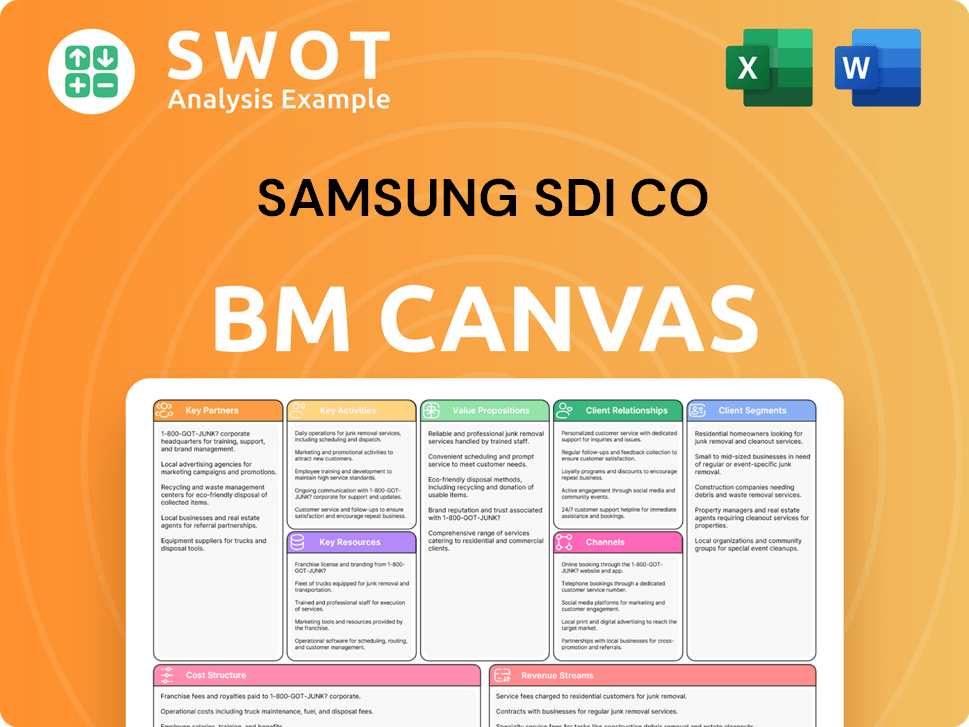

Samsung SDI Co Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Samsung SDI Co?

The Mission, Vision & Core Values of Samsung SDI Co is marked by significant milestones, from its inception to becoming a key player in the energy sector. This evolution showcases the company's adaptability and commitment to innovation in the rapidly changing landscape of electronics and energy solutions. The company's journey reflects its dedication to technological advancement and strategic partnerships.

| Year | Key Event |

|---|---|

| 1970 | Founded as Samsung-NEC Co. Ltd. in Suwon, South Korea, initially focused on picture tubes. |

| 1998 | Developed and launched the world's highest-capacity cylindrical Li-ion battery. |

| 2012 | Company name changed to Samsung SDI Co., Ltd., reflecting a broader focus. |

| 2013 | Acquired Novaled, a German OLED materials supplier, expanding its electronic materials portfolio. |

| 2015 | Acquired Magna Steyr's battery plant near Graz, Austria, boosting EV battery manufacturing capabilities. |

| 2017 | Completed construction of an EV battery plant in Hungary. |

| 2019 | Signed a long-term supply contract with BMW and a strategic partnership with Volvo Group for e-mobility. |

| 2020 | Celebrated its 50th anniversary. |

| 2021 | Launched its official battery brand, 'PRiMX'. |

| 2022 | Established Samsung SDI R&D America and Europe, and began construction of an all-solid-state battery pilot line. |

| 2023 | Announced a joint venture with General Motors and signed an EV battery supply deal with Hyundai Motor Company. |

| June 2024 | Debuted the enhanced Samsung Battery Box (SBB) 1.5 at InterBattery Europe. |

| Q1 2025 | Began mass production of larger 46-series cylindrical batteries. |

| March 2025 | Announced a rights offering to raise KRW 2 trillion (approximately $1.38 billion) for future investments. |

Samsung SDI is accelerating the commercialization of all-solid-state batteries, aiming for mass production by 2026. This technology is considered a 'game changer' for the EV market. The company's investment in this area highlights its commitment to leading-edge battery technology.

Starting in 2026, Samsung SDI plans to include Lithium Iron Phosphate (LFP) batteries for power ESS products. This 'two-track' strategy, alongside high-energy-density Nickel Cobalt Aluminum (NCA) batteries, aims to meet diverse market needs. The move reflects the company's adaptability.

The global EV battery market is projected to grow by about 21% in 2025, driven by demand in the U.S. and Europe. The ESS market is expected to grow by about 14%, particularly in North America due to AI industry growth. These figures highlight the opportunities for Samsung SDI.

Analyst forecasts suggest Samsung SDI's operating profit could surge 70% year-on-year in 2025 to KRW 2.8 trillion, partly due to the Advanced Manufacturing Production Credit (AMPC). The company's revenue is forecast to grow 10% per annum on average over the next three years. These estimates show strong growth potential.

Samsung SDI Co Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Samsung SDI Co Company?

- What is Growth Strategy and Future Prospects of Samsung SDI Co Company?

- How Does Samsung SDI Co Company Work?

- What is Sales and Marketing Strategy of Samsung SDI Co Company?

- What is Brief History of Samsung SDI Co Company?

- Who Owns Samsung SDI Co Company?

- What is Customer Demographics and Target Market of Samsung SDI Co Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.