Samsung SDI Co Bundle

How Does Samsung SDI Stack Up in the Global Battery Race?

In the dynamic world of energy solutions, Samsung SDI has carved a significant niche, but who are its main adversaries? This deep dive explores the Samsung SDI Co SWOT Analysis, revealing the company's position within the fiercely competitive landscape of the lithium-ion battery market and energy storage systems. We'll dissect its strategic moves, technological advancements, and market share to understand its current standing.

This comprehensive analysis will not only identify Samsung SDI's key competitors but also evaluate its competitive advantages, such as its cutting-edge battery technology. We'll examine the company's financial performance compared to its rivals, its strategic partnerships, and its global market presence, particularly in the EV battery market and ESS market. Furthermore, we'll discuss Samsung SDI's challenges, future growth prospects, and sustainability initiatives to provide a complete picture of its competitive positioning.

Where Does Samsung SDI Co’ Stand in the Current Market?

Samsung SDI is a leading company in the materials and energy solutions sector, known for its focus on innovation and sustainability. The company plays a critical role in the Growth Strategy of Samsung SDI Co, particularly in the lithium-ion battery market and energy storage systems (ESS).

The company's main business areas include batteries for electric vehicles (EVs), energy storage systems (ESS), and electronic materials. Samsung SDI's competitive advantages lie in its advanced battery technology and global market presence. They have a strong focus on research and development to stay ahead in the rapidly evolving battery market.

Samsung SDI's market position is significantly influenced by its performance in the EV battery market and the growing ESS market. The company faces both challenges and opportunities as it navigates the competitive landscape.

In 2024, Samsung SDI's market share in the global EV battery market was 3.9%, with a production capacity of 34 GWh. This represents a decrease of 1.2 percentage points from the previous year. The company ranked as the seventh-largest EV battery manufacturer globally in 2024. In Q1 2025, Samsung SDI's ranking slipped further to seventh place, with a market share of 3.3%, reflecting a 17.2% year-over-year decline.

The combined market share of the three major South Korean battery firms—LG Energy Solution, SK On, and Samsung SDI—in global EV battery usage was 18.4% from January to December 2024. This was a 4.7% decline from the previous year. The decline is attributed to the fast growth of LFP batteries, primarily from Chinese manufacturers.

In 2024, Samsung SDI held a 4% market share in the broader power and ESS battery shipments, ranking seventh. Despite the challenges in the EV battery market, Samsung SDI's ESS battery business achieved record-high revenue in Q4 2024. This growth was driven by increased sales to data centers in North America, boosted by the rise of AI.

Samsung SDI reported annual revenue of KRW 16.59 trillion (approximately $11.55 billion) in 2024, with an operating profit of KRW 363.3 billion ($253 million). This represents a 22.6% decline in revenue and a 76.5% drop in operating profit compared to 2023. The company experienced its first quarterly operating loss since Q1 2017 in Q4 2024.

Samsung SDI's competitive positioning is influenced by its global operations and strategic partnerships. The company's battery products are used in EVs from BMW, Rivian, and Audi. The global energy storage systems market was estimated at USD 668.7 billion in 2024 and is projected to reach USD 5.12 trillion by 2034, with a CAGR of 21.7% from 2025 to 2034, highlighting the growth potential in this sector.

- Global Presence: Operations in key markets to reach a wide range of customers.

- Strategic Partnerships: Collaborations with major automotive manufacturers.

- Market Trends: Adapting to the rapid expansion of LFP batteries and the growing demand for ESS.

- Financial Performance: Addressing the challenges of decreased revenue and operating profit.

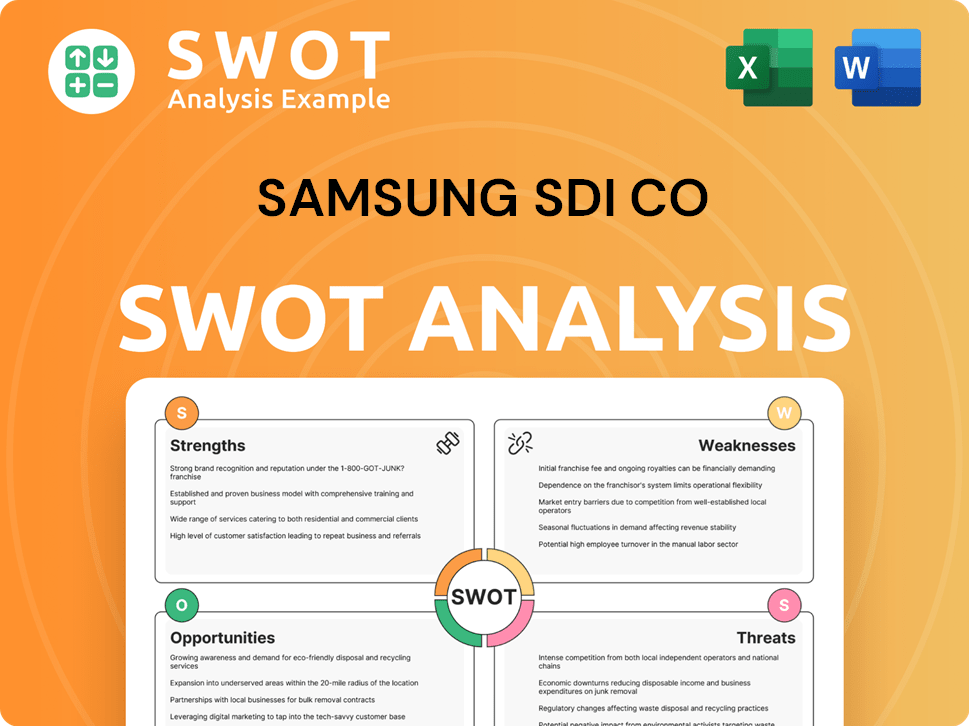

Samsung SDI Co SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Samsung SDI Co?

The Samsung SDI competitive landscape is shaped by intense competition in the battery and electronic materials sectors. Understanding the key players and their strategies is crucial for evaluating the company's position and future prospects. This analysis highlights the major competitors and their impact on the SDI battery market.

The Samsung SDI analysis reveals a dynamic market where innovation and cost-effectiveness are paramount. The rise of electric vehicles and the growing demand for energy storage systems have intensified the competition, making it essential to monitor the strategies and performance of key rivals. This competitive environment influences Samsung SDI's strategic decisions and market share.

The battery industry is dominated by several major players, each with distinct strengths and strategies. These competitors include established companies and emerging forces, all vying for market share in the rapidly expanding EV and ESS markets.

A significant player in the battery market, Panasonic offers a wide range of battery solutions. Their focus on research and development is a key factor in maintaining their competitive edge. Panasonic's continuous innovation in battery technology supports its market position.

LG Energy Solution is a prominent competitor, specializing in advanced materials and energy solutions. With a diverse product portfolio and a strong global presence, LGES is a major player in the lithium-ion battery market. In Q1 2025, LG Energy Solution held a 10.7% market share.

BYD is a major player in the battery market, particularly known for its focus on LFP batteries. BYD's competitive pricing and technology advancements have made it a strong contender. In Q1 2025, BYD held a 17.3% market share.

SK On is a key competitor, expanding its presence in the global battery market. SK On is focused on growing its manufacturing capacity and securing partnerships. In Q1 2025, SK On held a 4.7% market share.

Chinese companies have significantly intensified competition, especially with their focus on LFP (lithium iron phosphate) batteries, which are often more cost-effective. CATL and BYD are dominant forces. Other notable Chinese competitors include CALB, Gotion High-tech, EVE, and Sunwoda.

The competitive landscape is further influenced by the energy storage systems (ESS) market and emerging technologies. In the ESS market, key competitors include BYD, General Electric, LG Energy Solution, and Siemens. Emerging players in alternative battery technologies, such as solid-state batteries, include QuantumScape Corporation, Toyota Motor Corporation, and Solid Power, Inc. For more insights into Samsung SDI's strategic approach, consider reading the Marketing Strategy of Samsung SDI Co.

Several factors drive competition in the battery market, including technological innovation, cost-effectiveness, and manufacturing capacity. These factors influence Samsung SDI's strategic positioning and market performance.

- Technological Innovation: Continuous advancements in battery technology, such as energy density, charging speed, and safety, are crucial.

- Cost Competitiveness: The ability to produce batteries at a competitive cost is essential for market share.

- Manufacturing Capacity: Expanding production capacity to meet growing demand is a key competitive advantage.

- Strategic Partnerships: Collaborations with automotive manufacturers and other industry players are vital.

- Global Market Presence: Establishing a strong presence in key markets worldwide is important for growth.

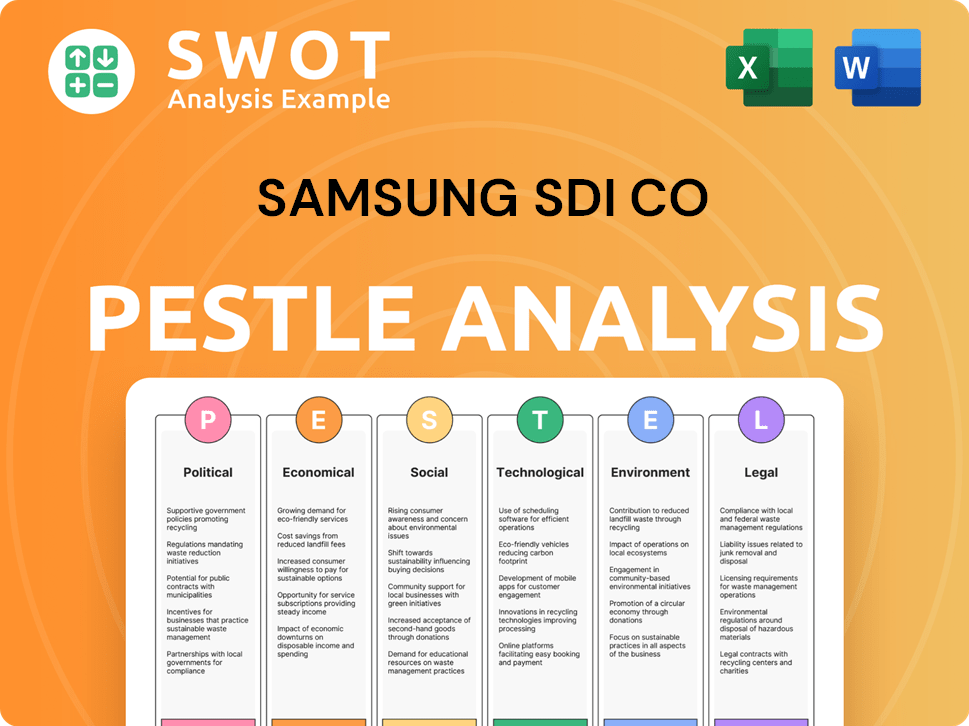

Samsung SDI Co PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Samsung SDI Co a Competitive Edge Over Its Rivals?

The competitive landscape for Samsung SDI is shaped by its technological prowess, diverse product portfolio, and global presence. The company, a key player in the SDI battery market, continually invests in research and development (R&D) to stay ahead of technological advancements. Its strategic moves, including partnerships and a focus on sustainability, are designed to maintain a competitive edge in a rapidly evolving industry. For a deeper understanding of their strategic approach, consider exploring the Growth Strategy of Samsung SDI Co.

Samsung SDI faces both opportunities and challenges in the energy solution sector. The company's ability to innovate and adapt to market demands is crucial for its success. The company's ability to innovate and adapt to market demands is crucial for its success. Samsung SDI's competitive advantages are continuously tested by the aggressive market penetration of Chinese companies, particularly in the cost-effective LFP battery segment.

Samsung SDI's competitive position is further strengthened by its focus on sustainability and its commitment to developing next-generation battery technologies. This includes all-solid-state batteries, which are expected to offer significant improvements over conventional lithium-ion batteries. With prototypes already demonstrating impressive energy density, Samsung SDI is aiming for mass production by 2027, positioning itself as a leader in advanced battery solutions.

Samsung SDI invests heavily in R&D to develop cutting-edge battery technologies. This focus has led to innovations like the 50-ampere high-power cylindrical battery cell and the LFP+ platform, enhancing energy density. Prototypes of all-solid-state batteries have shown an 85% increase in energy density.

The company's product range includes batteries for electric vehicles, energy storage systems (ESS), and IT devices. This diversification allows Samsung SDI to serve various customer segments and adapt to market changes. Recent innovations have earned awards at InterBattery 2025 and CES 2025.

Samsung SDI operates globally, reaching a broad customer base and adapting to local market conditions. Its reputation for quality and reliability fosters long-lasting customer relationships. The company's global presence is crucial for its competitive positioning.

Samsung SDI leverages semiconductor expertise and a vertically integrated supply chain. They are exploring new applications, such as integrating ESS with EV charging infrastructure. Strategic partnerships and a focus on sustainability further enhance its competitive edge.

Samsung SDI's competitive advantages include technological innovation, a diverse product portfolio, a global presence, and strategic partnerships. The company's focus on R&D and its vertically integrated supply chain provide a strong competitive edge. The company's focus on R&D and its vertically integrated supply chain provide a strong competitive edge.

- Advanced Battery Technology: Developing all-solid-state batteries with higher energy density.

- Diverse Product Range: Catering to EV, ESS, and IT device markets.

- Global Operations: Serving customers worldwide and adapting to local needs.

- Strategic Partnerships: Collaborating to expand market reach and capabilities.

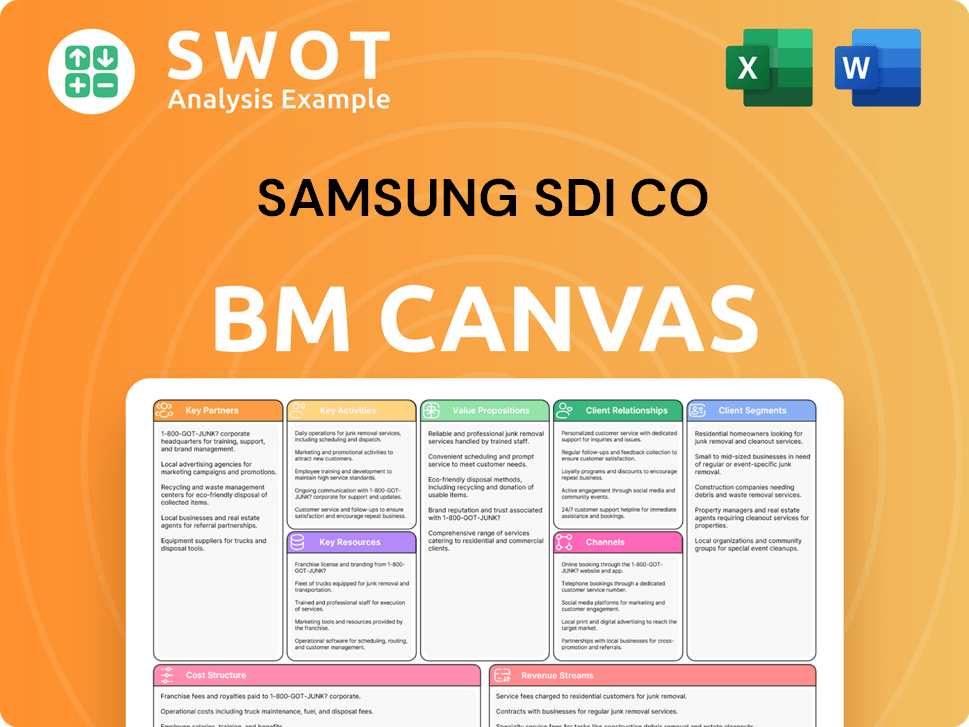

Samsung SDI Co Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Samsung SDI Co’s Competitive Landscape?

The competitive landscape for Samsung SDI is shaped by the dynamic shifts in the energy sector, particularly the growth of electric vehicles (EVs) and energy storage systems (ESS). The company faces both significant opportunities and challenges in this evolving market. Understanding its position, the associated risks, and future outlook is crucial for assessing its long-term viability.

The company's strategic focus on technological innovation, cost competitiveness, and strategic partnerships is central to its response. Recent market data and projections provide a clearer picture of the challenges and opportunities within the industry, influencing the company’s strategic decisions and future growth prospects. For a deeper dive into the company's origins, consider reading the Brief History of Samsung SDI Co.

The global EV battery market is projected to reach USD 91.93 billion in 2024 and USD 251.33 billion in 2035, with a CAGR of 9.6% from 2024-2035. The ESS market is expected to grow significantly. The increasing demand for efficient energy storage systems is driven by the transition to renewable energy.

The EV market is experiencing a slowdown, expected to last until the first half of 2026. Intense market competition from Chinese manufacturers who offer cost-effective LFP batteries poses a threat. In 2024, Samsung SDI's global EV battery market share declined to 3.9%.

Samsung SDI is focusing on strengthening its technological competitiveness with investments in next-generation products like all-solid-state batteries. The company is expanding into new markets and forming strategic partnerships. The company is also developing an improved LFP+ battery for commercial vehicles.

Samsung SDI plans to continue investments for future technologies and production capabilities. Market researchers forecast the global battery market to grow 20% on average each year from 2025 to 2030. The company aims to capitalize on growth opportunities in emerging markets and through product innovations.

Samsung SDI is actively pursuing several key strategies to navigate the competitive landscape and capitalize on future growth opportunities. These initiatives focus on technological innovation, market expansion, and strategic partnerships to bolster its position in the battery market.

- Technological Advancements: Investing in next-generation battery technologies, such as all-solid-state batteries, with a target for mass production by 2027.

- Market Expansion: Expanding battery plant capacity in Hungary and building lines for all-solid-state batteries in Korea.

- Strategic Partnerships: Forming joint ventures, such as the one with Stellantis (StarPlus Energy) in the U.S., to enhance production capabilities and market reach.

- Product Innovation: Developing improved LFP+ batteries with enhanced energy density for commercial vehicles and moduleless cell-to-pack (CTP) designs for cost-effective battery packs.

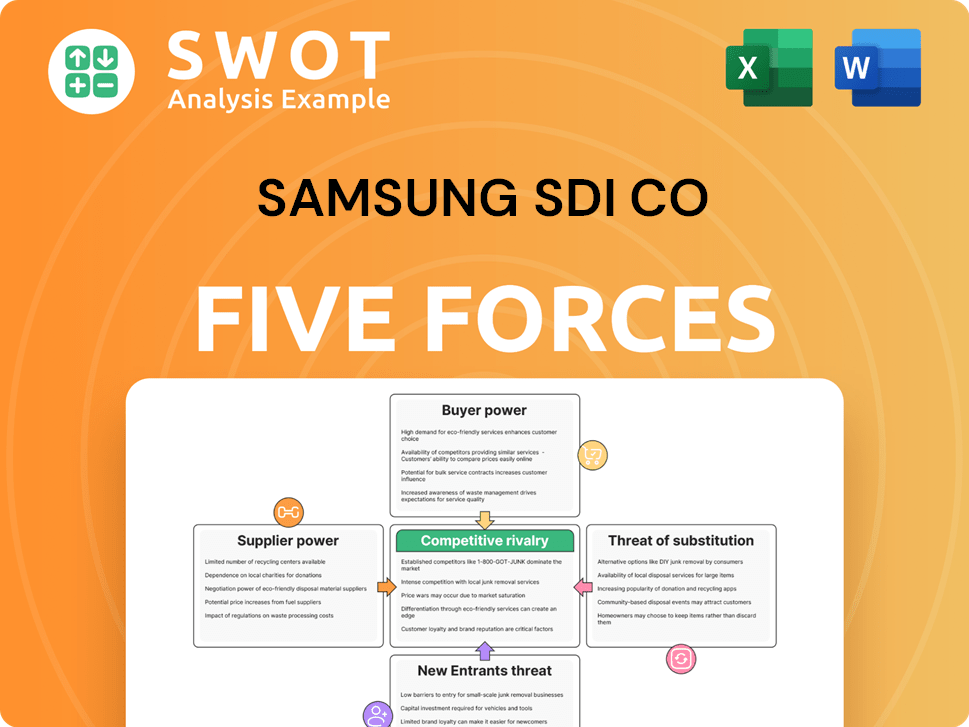

Samsung SDI Co Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Samsung SDI Co Company?

- What is Growth Strategy and Future Prospects of Samsung SDI Co Company?

- How Does Samsung SDI Co Company Work?

- What is Sales and Marketing Strategy of Samsung SDI Co Company?

- What is Brief History of Samsung SDI Co Company?

- Who Owns Samsung SDI Co Company?

- What is Customer Demographics and Target Market of Samsung SDI Co Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.