Samsung SDI Co Bundle

How Does Samsung SDI Power the Future?

In an era defined by technological leaps and sustainability goals, Samsung SDI Company emerges as a critical player. From powering electric vehicles to enabling advanced electronics, Samsung SDI's innovative energy solutions are reshaping industries. But how does this global powerhouse operate, and what drives its success in a competitive landscape?

This deep dive into Samsung SDI Co SWOT Analysis will uncover the intricacies of Samsung SDI operations, exploring its cutting-edge battery technology and its impact on the global market. We'll examine how Samsung SDI manufactures batteries, its role in electric vehicles, and its contributions to sustainable energy, providing a comprehensive understanding of its business model. Whether you're an investor, a customer, or an industry observer, understanding Samsung SDI's journey is vital.

What Are the Key Operations Driving Samsung SDI Co’s Success?

The core operations of the Samsung SDI Company revolve around the development and manufacturing of advanced battery cells and electronic materials. Samsung SDI creates value by producing lithium-ion batteries for electric vehicles (EVs), energy storage systems (ESS) for grid-scale applications and residential use, and small-sized batteries for IT devices. The company also manufactures electronic materials, including display materials for OLED and LCD panels, and semiconductor materials, serving a diverse customer base.

Samsung SDI's operational processes are characterized by advanced manufacturing capabilities, rigorous quality control, and extensive research and development. This includes sophisticated sourcing of raw materials, automated production lines, and a global logistics network. The company's supply chain is carefully managed, often involving strategic partnerships to ensure a stable and high-quality input flow. The company's focus on technological innovation, particularly in battery energy density, safety, and charging speed, provides superior performance and reliability for its customers.

Samsung SDI's core capabilities in material science and cell design provide a significant competitive advantage, enabling it to offer products that meet the stringent demands of high-performance applications in the automotive and energy sectors. The company's commitment to innovation and quality has positioned it as a key player in the global battery market. For more insights into the company's origins, consider reading a Brief History of Samsung SDI Co.

Samsung SDI produces a variety of products, including lithium-ion batteries for EVs, ESS for grid-scale applications, and small-sized batteries for IT devices. The company also manufactures electronic materials such as display materials and semiconductor materials. These products cater to diverse sectors, including automotive, energy, and consumer electronics.

Samsung SDI's operations involve advanced manufacturing, rigorous quality control, and extensive R&D. This includes sourcing raw materials, automated production lines, and a global logistics network. The company emphasizes technological innovation, particularly in battery energy density, safety, and charging speed.

Samsung SDI serves a diverse range of customers, including global automotive manufacturers, renewable energy developers, and leading consumer electronics brands. The company's products are essential components in EVs, energy storage systems, and various IT devices. Samsung SDI has expanded its customer base to meet the growing demand for sustainable energy solutions.

Samsung SDI offers superior performance and reliability through its focus on technological innovation. The company's core capabilities in material science and cell design provide a competitive advantage. Samsung SDI delivers value by providing high-quality batteries and materials that meet the stringent demands of various industries.

Samsung SDI is a key player in the global battery market, with a strong focus on technological innovation and quality. The company's strategic partnerships and advanced manufacturing capabilities enable it to meet the growing demand for sustainable energy solutions. In recent financial reports, Samsung SDI has shown significant growth in its EV battery business, with increased production capacity to meet rising demand. The company is investing heavily in R&D to improve battery performance and expand its product offerings.

- Samsung SDI has increased its production capacity for EV batteries to meet growing demand.

- The company is investing heavily in R&D to improve battery performance.

- Samsung SDI is expanding its product offerings to include new energy storage solutions.

- The company is focused on strengthening its partnerships with key material suppliers.

Samsung SDI Co SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Samsung SDI Co Make Money?

The primary revenue streams for the Samsung SDI Company come from selling its battery products and electronic materials. The company's battery segment, which includes EV batteries, ESS (Energy Storage Systems), and batteries for IT devices, is a major source of income. For the first quarter of 2024, Samsung SDI reported revenue of KRW 5.13 trillion (approximately $3.75 billion USD), with the energy solutions division being a key driver.

The monetization strategy of Samsung SDI mainly involves direct product sales to original equipment manufacturers (OEMs) and system integrators. This approach is crucial for the Samsung SDI operations, ensuring a steady flow of revenue from its diverse product range. The company's focus on these sales channels helps maintain its market position and supports its growth plans.

The company's revenue model is based on selling its products directly to other businesses. This includes long-term supply agreements in the EV sector, sales related to energy storage solutions, and supplying batteries for IT devices to global consumer electronics companies. The electronic materials business also contributes by providing materials to display and semiconductor manufacturers.

Revenue is generated through long-term supply agreements with major automotive companies.

Sales are driven by projects for grid stabilization, industrial applications, and residential energy storage.

Relies on sales to global consumer electronics companies.

Supplies high-value-added materials to display and semiconductor manufacturers.

The company is focused on expanding its revenue streams through advancements in solid-state battery technology and increased applications for its energy storage solutions. This strategy aims to diversify and strengthen its revenue mix.

- Samsung batteries are a significant part of the revenue.

- The energy solutions division consistently accounts for a substantial portion of the total revenue.

- The company is exploring new opportunities to diversify its revenue sources.

- The focus is on long-term supply agreements and direct sales to OEMs.

For more insights into the competitive environment, you can explore the Competitors Landscape of Samsung SDI Co.

Samsung SDI Co PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Samsung SDI Co’s Business Model?

Samsung SDI has marked significant milestones, shaping its Samsung SDI operations and financial trajectory. A key strategic move has been its aggressive expansion into the electric vehicle (EV) battery market. This has involved securing partnerships with major global automakers and investing heavily in large-scale production facilities across different regions. For instance, the company is constructing a new battery plant in Indiana, United States, in collaboration with Stellantis, with operations expected to commence in the first quarter of 2025.

Another notable development is its collaboration with Hyundai Motor Company for EV battery supply, which strengthens its position in the automotive sector. These strategic initiatives underscore Samsung SDI Company's commitment to innovation and its proactive approach to meeting the growing demands of the EV market. The company's focus on technological advancements and strategic partnerships has been crucial in navigating the competitive landscape and driving its growth.

Operational challenges have included managing global supply chain disruptions and intense competition within the battery market. Samsung SDI has responded by diversifying its raw material sourcing and investing in advanced manufacturing processes to enhance efficiency and reduce costs. The company's competitive advantages include strong brand recognition, technological leadership in battery cell chemistry and design, and significant economies of scale in manufacturing. Continuous investment in research and development (R&D), particularly in next-generation battery technologies like all-solid-state batteries, provides a crucial competitive edge.

Samsung SDI has achieved significant milestones, including its expansion in the EV battery market and strategic partnerships with major automakers. The company is constructing a new battery plant in Indiana, United States, with Stellantis, expected to begin operations in the first quarter of 2025. Collaboration with Hyundai Motor Company for EV battery supply further reinforces its position in the automotive sector.

Samsung SDI's strategic moves include aggressive expansion in the EV battery market, securing partnerships, and investing in large-scale production facilities. The company is focusing on technological advancements and strategic collaborations to navigate the competitive landscape. These moves aim to meet the growing demands of the EV market and drive growth.

Samsung SDI's competitive advantages include strong brand recognition, technological leadership, and economies of scale. The company continuously invests in R&D, particularly in next-generation battery technologies. Samsung SDI adapts to new trends by innovating its product portfolio and collaborating with industry leaders to maintain market relevance.

In 2023, Samsung SDI reported strong financial results, driven by increased demand for EV batteries and energy storage systems (ESS). Revenue increased by double digits, with significant growth in the battery division. The company's profitability improved due to higher sales volume and operational efficiencies. For more detailed insights, consider reading Growth Strategy of Samsung SDI Co.

Samsung SDI continually adapts to new trends, such as the increasing demand for higher energy density and faster charging capabilities, by innovating its product portfolio and collaborating with industry leaders to maintain its market relevance and sustain its business model. The company's focus on sustainable energy solutions and its commitment to technological advancements are key to its long-term success.

- Strategic partnerships with major automakers.

- Continuous investment in R&D for advanced battery technologies.

- Diversification of raw material sourcing to mitigate supply chain risks.

- Strong brand recognition and technological leadership in the battery market.

Samsung SDI Co Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Samsung SDI Co Positioning Itself for Continued Success?

The Samsung SDI Company holds a significant position in the global battery market, particularly in the electric vehicle (EV) and energy storage system (ESS) sectors. It competes with major players like CATL and LG Energy Solution. Its strong ties with leading automakers and electronics companies highlight its customer loyalty and international reach. You can learn more about the Marketing Strategy of Samsung SDI Co.

However, Samsung SDI operations face several risks, including intense competition and the volatility of raw material prices. Regulatory changes and technological disruptions also pose challenges. The company is focused on expanding its global production capacity and developing next-generation batteries to maintain its market position.

Samsung SDI is a leading player in the global battery market. Its main focus is on the EV and ESS segments. The company consistently ranks among the top battery manufacturers worldwide.

Samsung batteries face intense competition, impacting pricing and profit margins. The prices of raw materials like lithium, cobalt, and nickel are volatile. Regulatory changes and technological shifts also pose risks.

Samsung energy solutions plans to expand its global production. It aims to accelerate the development of next-generation batteries, such as solid-state batteries. The company wants to strengthen its presence in the ESS market.

Samsung SDI products focuses on technological leadership. It aims to diversify its customer base. The company plans strategic investments in high-growth areas. It is committed to advanced battery platforms and global expansion.

Samsung SDI is expanding its production capacity to meet growing demand, particularly in the EV market. The company is investing heavily in R&D to advance battery technology. It is focusing on solid-state batteries to gain a competitive edge.

- Samsung SDI's key partnerships with major automakers.

- The company's commitment to sustainable energy solutions.

- Samsung SDI's strategic investments in cathode materials.

- Its focus on expanding its global footprint.

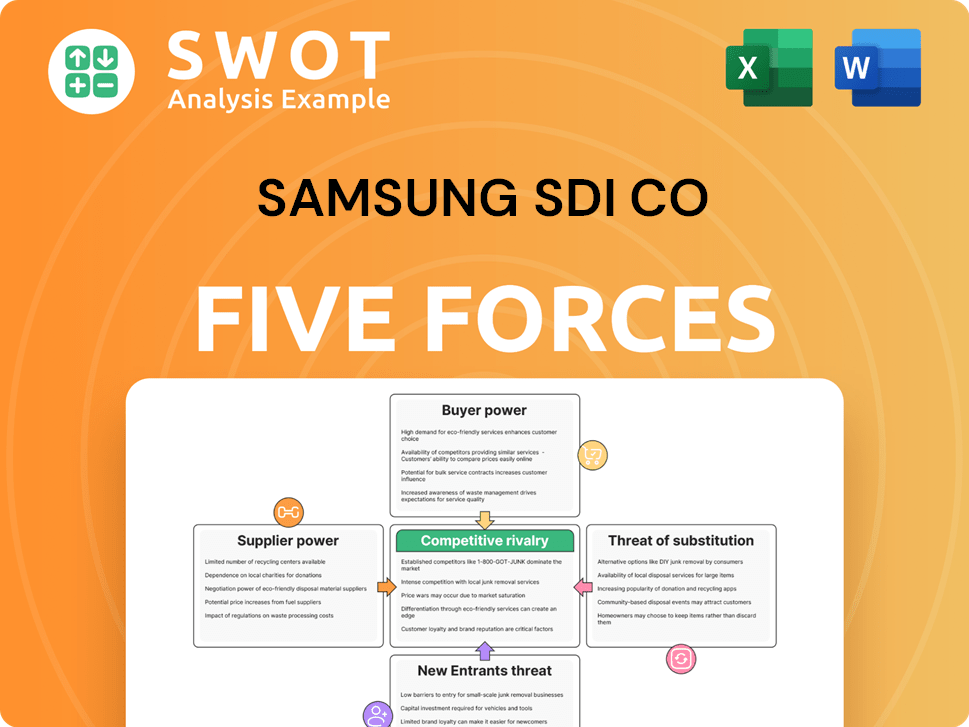

Samsung SDI Co Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Samsung SDI Co Company?

- What is Competitive Landscape of Samsung SDI Co Company?

- What is Growth Strategy and Future Prospects of Samsung SDI Co Company?

- What is Sales and Marketing Strategy of Samsung SDI Co Company?

- What is Brief History of Samsung SDI Co Company?

- Who Owns Samsung SDI Co Company?

- What is Customer Demographics and Target Market of Samsung SDI Co Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.