Sun Hung Kai Bundle

How Did Sun Hung Kai Company Emerge as a Financial Powerhouse?

Sun Hung Kai & Co. Limited, or SHK & Co., has impressively rebounded, reporting substantial profits in 2024 after a strategic transformation. This success story highlights its evolution into a diversified alternatives investment platform, setting the stage for further expansion in 2025. But how did this firm, now a major player in alternative investments, actually begin?

Established in Hong Kong in 1969, Sun Hung Kai SWOT Analysis began its journey independent of the well-known property development firm, despite sharing a name. Initially focused on brokerage and related services, the company has since undergone a significant transformation. This brief history will explore the early years of Sun Hung Kai, its growth in Hong Kong, and its strategic pivots, revealing how it became a key player. The company's evolution showcases its resilience and adaptability within the dynamic financial landscape.

What is the Sun Hung Kai Founding Story?

The story of Sun Hung Kai & Co. (SHK) began in 1969 in Hong Kong. The company was founded by Fung King Hey, Kwok Tak Seng, and Lee Shau Kee. Fung King Hey, a prominent share trader, played a pivotal role in establishing the brokerage firm that would become a significant player in the city's financial landscape.

The founders saw an opportunity in providing financial services within a rapidly developing market. The initial focus was on brokerage services, which helped to meet the growing financial needs of Hong Kong's economy. This strategic move set the foundation for SHK's future growth and influence.

The company's listing on the Hong Kong Stock Exchange in 1983 marked a key milestone in its evolution. It is important to note that while sharing a name with the property developer, Sun Hung Kai Properties, they are distinct entities. Today, SHK is under the leadership of Group Executive Chairman Lee Seng Huang.

Sun Hung Kai & Co. was founded in 1969 by Fung King Hey, Kwok Tak Seng, and Lee Shau Kee.

- Fung King Hey's background as a share trader was crucial to the firm's early success.

- The company's initial focus was on brokerage services, catering to the financial needs of a growing market.

- The 1983 listing on the Hong Kong Stock Exchange was a significant step in its development.

- Currently led by Lee Seng Huang, the company continues to evolve.

The early years of Sun Hung Kai were marked by strategic decisions that positioned it for growth. The founding team's vision, combined with the burgeoning economic environment of Hong Kong, created a fertile ground for the company's expansion. The company's ability to adapt and capitalize on market opportunities has been a key factor in its longevity and success. For more information, you can check out the Competitors Landscape of Sun Hung Kai.

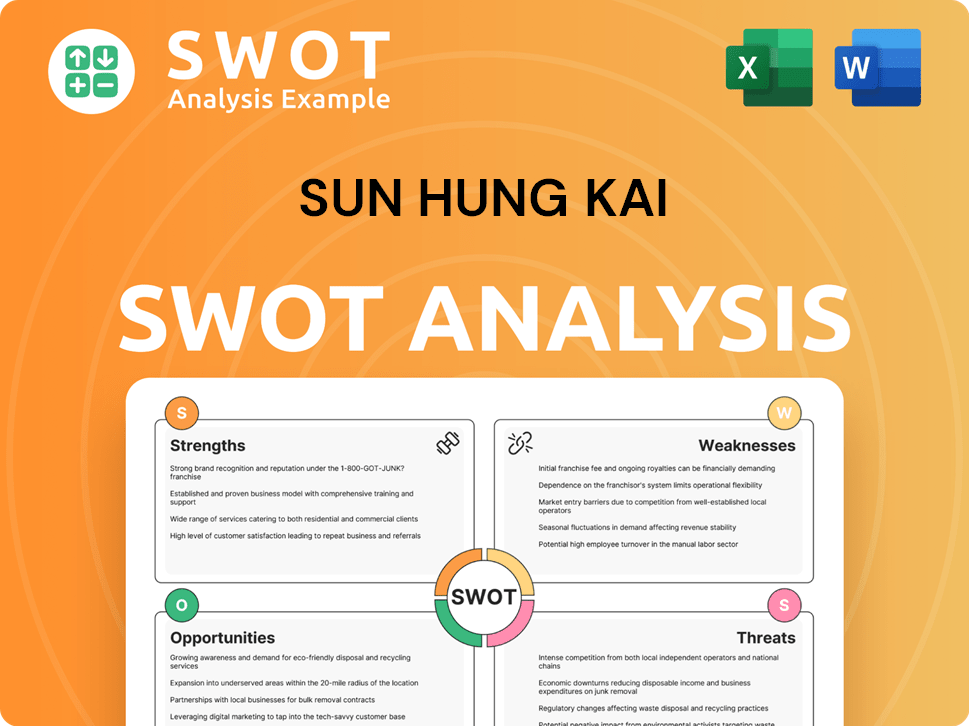

Sun Hung Kai SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Sun Hung Kai?

The early years of the Sun Hung Kai Company saw its establishment as a key player in Hong Kong's financial services sector. A significant move in its expansion involved acquiring UAF Holdings Limited in 2006, which marked its entry into consumer finance. UAF then began operations in Mainland China in 2007. These initial steps set the stage for further strategic developments and growth.

A major strategic shift occurred in 2015 when the company sold a majority stake (70%) of its Sun Hung Kai Financial business to Everbright Securities. The remaining 30% was divested in 2020. This move was a key step in the Group's transition into a comprehensive finance and investment institution. Simultaneously, in 2015, the company established its mortgage loans business through Sun Hung Kai Credit and built its Investment Management business, which became a major profit contributor.

Entering 2020, the Group expanded its Investment Management business into a Funds Management platform, officially launching this segment in 2021. This expansion included committing and launching four partnerships in the first half of 2021: East Point Asset Management, E15VC, ActusRayPartners, and Multiple Capital Investment Partners (MCIP). The Funds Management division represents a new phase for Sun Hung Kai & Co., combining institutional rigor with boutique agility.

As of December 31, 2024, the Funds Management business achieved strong growth, with total assets under management (AUM) reaching a record US$2.0 billion. External investor capital increased to nearly 80% of the AUM across its Fund Partnerships, Family Office Solutions, and Sun Hung Kai Capital Partners (SHKCP) Funds, leading to a 55.6% year-on-year increase in fee income for the division.

The strategic moves, including the sale of Sun Hung Kai Financial, were pivotal in transforming the company. The establishment and growth of the Investment Management and Funds Management businesses highlight the company's adaptation to market changes and its focus on expanding its financial services offerings. These shifts have positioned the company for continued growth.

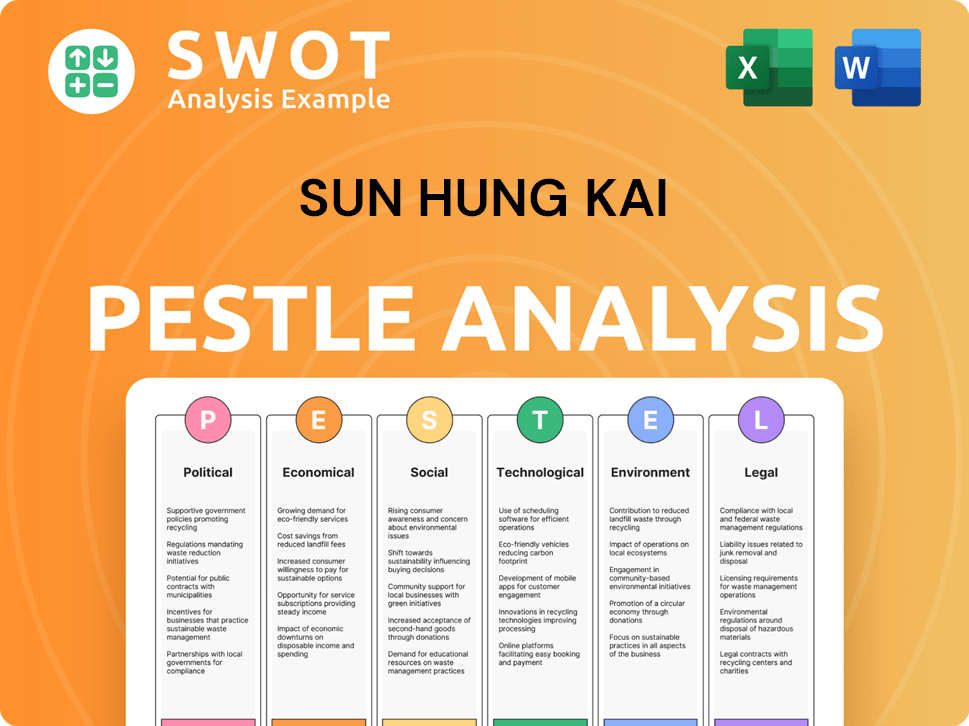

Sun Hung Kai PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Sun Hung Kai history?

The history of Sun Hung Kai & Co. (SHK) showcases significant milestones, particularly its transformation from a brokerage to a diversified alternative investment platform. This evolution has been marked by strategic shifts and expansions, solidifying its position in the financial market. The company's journey includes navigating economic cycles and adapting to market dynamics.

| Year | Milestone |

|---|---|

| 2024 | Return to profitability with a net profit of HK$377.7 million after strategic repositioning. |

| 2024 | Funds Management business doubled its total assets under management to US$2.0 billion. |

| 2024 | Net gearing ratio reduced by 740 basis points to 31.2%, reflecting enhanced capital efficiency. |

| August 1, 2024 | Strategic alliance with GAM Investments to enhance client coverage in Greater China. |

| April 1, 2025 | Appointment of Kelvin Cheung as CEO of Sun Hung Kai Capital Partners. |

Key innovations at Sun Hung Kai & Co. include the strategic repositioning of its business model, focusing on alternative investments. This shift involved expanding into credit, investment management, and funds management, driving profitability. The company's focus on alternative investments has been a key factor in its success.

The company's strategic shift towards alternative investments, including credit, investment management, and funds management, has been a key driver of its recent financial performance. This repositioning allowed the company to capitalize on new market opportunities.

The Funds Management business has seen substantial growth, with total assets under management doubling to US$2.0 billion in 2024. This expansion has diversified revenue streams and broadened the range of products and strategies offered.

The alliance with GAM Investments, effective from August 1, 2024, exemplifies the company's strategy of forming partnerships to drive growth. This collaboration enhances client coverage and leverages global distribution capabilities.

Reducing the net gearing ratio by 740 basis points to 31.2% in 2024 indicates a focus on enhancing capital efficiency. This demonstrates a commitment to prudent financial management.

Challenges for Sun Hung Kai & Co. involve navigating a dynamic environment marked by high interest rates, geopolitical tensions, and economic weakness in Greater China. Despite these headwinds, the company has demonstrated resilience through its diversified business model.

The company faces challenges from high interest rates, geopolitical tensions, and economic weakness in Greater China. These factors impact the overall financial environment.

Navigating a dynamic market environment requires careful management of investments and prudent underwriting of new loans. The company's approach has been cautious to mitigate risks.

Geopolitical tensions add complexity to the operating environment, requiring strategic adaptability. The company's diversified business model helps to weather these challenges.

Persistent high interest rates pose a challenge, influencing investment decisions and financial performance. The company's strategies aim to manage these impacts effectively.

Economic weakness in Greater China presents challenges, necessitating careful risk management. The company continues to monitor and adapt to these regional economic conditions.

Despite these challenges, the company's diversified businesses have shown resilience. This is a testament to the strategic approach and adaptability of Sun Hung Kai & Co.

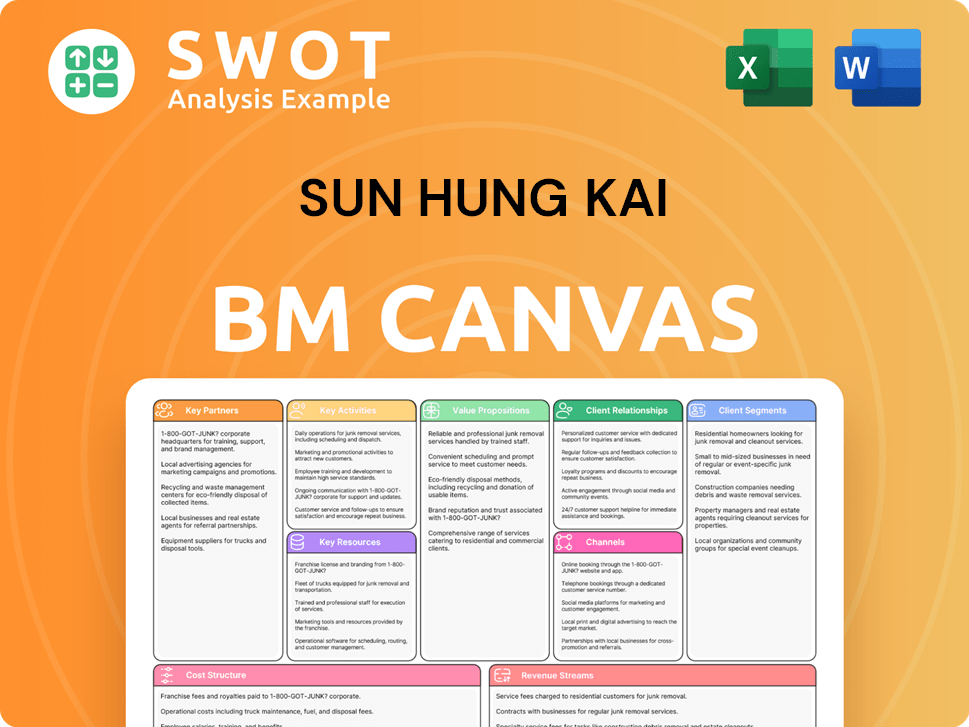

Sun Hung Kai Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Sun Hung Kai?

The Sun Hung Kai Company (SHK) has a rich history, marked by significant milestones. Founded in 1969 in Hong Kong by Fung King Hey, Kwok Tak Seng, and Lee Shau Kee, the company quickly became a key player in the region's financial landscape. Its journey includes strategic expansions, acquisitions, and a focus on alternative investments, shaping its evolution over the decades.

| Year | Key Event |

|---|---|

| 1969 | Sun Hung Kai & Co. is established in Hong Kong. |

| 1983 | The company is listed on the Hong Kong stock exchange. |

| 1996 | Allied Properties (HK) Limited acquires a majority stake in the company. |

| 2006 | Sun Hung Kai & Co. enters the consumer finance business by acquiring UAF Holdings Limited. |

| 2007 | UAF commences business in Mainland China. |

| 2015 | Sun Hung Kai & Co. sells 70% of its Sun Hung Kai Financial business and establishes its mortgage loans and Investment Management businesses. |

| 2020 | The remaining 30% of Sun Hung Kai Financial is sold, and the Investment Management business expands into a Funds Management platform. |

| 2021 | The Funds Management segment is officially launched, with new partnerships formed. |

| 2024 | Sun Hung Kai & Co. returns to profitability with a net profit of HK$377.7 million, and total assets under management in Funds Management reach US$2.0 billion. |

| August 1, 2024 | Strategic alliance with GAM Investments becomes effective. |

| April 1, 2025 | Kelvin Cheung is named CEO of Sun Hung Kai Capital Partners. |

Sun Hung Kai & Co. is focused on deepening its strategic partnerships. These collaborations are vital for expanding its investment models globally. The firm plans to monetize partnerships with ActusRayPartners, GAM, and Wentworth Capital.

The company will continue building client relationships through its Family Office Solutions platform in 2025. This platform is key for providing tailored financial services to high-net-worth and ultra-high-net-worth individuals.

With its transformation into an alternative investment platform nearly complete and profitability restored, Sun Hung Kai & Co. is poised for growth. This includes expanding its offerings for high-net-worth and institutional partners.

The firm's vision is to expand through highly selective collaborations that deliver mutual value. The company aims to generate long-term risk-adjusted returns for its shareholders, building on its founding vision of providing sophisticated financial services.

Sun Hung Kai Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Sun Hung Kai Company?

- What is Growth Strategy and Future Prospects of Sun Hung Kai Company?

- How Does Sun Hung Kai Company Work?

- What is Sales and Marketing Strategy of Sun Hung Kai Company?

- What is Brief History of Sun Hung Kai Company?

- Who Owns Sun Hung Kai Company?

- What is Customer Demographics and Target Market of Sun Hung Kai Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.