Sun Hung Kai Bundle

How Does Sun Hung Kai Company Stack Up Against Its Rivals?

The alternative investment world is a battlefield, and understanding the players is crucial for anyone looking to thrive. Sun Hung Kai Company, a long-standing name in the financial sector, has carved out a significant niche. But who are its main competitors, and how does Sun Hung Kai SWOT Analysis shape its strategy?

This analysis of the competitive landscape will dissect Sun Hung Kai Company's market position, examining its strengths and weaknesses within the real estate market and beyond. We'll explore how SHK company analysis reveals its strategic moves, its impact on the Hong Kong property market, and how it aims to maintain or grow its market share against its key rivals. Understanding these dynamics is essential for grasping the company’s financial performance and future outlook.

Where Does Sun Hung Kai’ Stand in the Current Market?

Sun Hung Kai & Co. Limited (SHK & Co.) holds a distinctive market position within the alternative investment industry, particularly in Asia. Its core operations revolve around a diverse portfolio of investments and financial services. The company's value proposition centers on providing a wide array of financial solutions, including direct investments and wealth management, catering to both institutional and high-net-worth clients.

SHK & Co. distinguishes itself through its strategic focus on key sectors like financial services, healthcare, and real estate. This approach allows the company to capitalize on growth opportunities and maintain a robust presence in these dynamic markets. Furthermore, its long-standing relationships and deep understanding of local dynamics, especially in Hong Kong, contribute to its competitive edge.

The company has evolved from its traditional brokerage roots to become a more sophisticated alternative investment manager, reflecting a deliberate diversification of offerings. This strategic shift is aimed at capturing growth opportunities in higher-margin alternative assets. SHK & Co.'s financial health and scale are robust, as evidenced by its net asset value attributable to shareholders reported at HK$46.4 billion as of December 31, 2023.

While specific market share figures for niche alternative investment firms can be fluid, SHK & Co. is recognized as a leading alternative investment firm in Asia. The company's strong presence in Hong Kong, leveraging its long-standing relationships and deep understanding of local dynamics, supports its market position.

SHK & Co.'s primary offerings include direct investments in public and private markets, with a strategic emphasis on financial services, healthcare, and real estate. Additionally, it provides comprehensive financial services such as brokerage, wealth management, and investment banking.

The company primarily concentrates its operations in Hong Kong and other parts of Asia, serving a wide array of institutional and high-net-worth individual clients. This geographic focus allows SHK & Co. to leverage its regional expertise and market knowledge effectively.

SHK & Co.'s financial health is robust, with a net asset value attributable to shareholders reported at HK$46.4 billion as of December 31, 2023. This substantial asset base reflects a strong capital position that supports its investment activities and ongoing expansion.

Over time, SHK & Co. has strategically shifted its positioning, moving beyond its traditional brokerage roots to become a more sophisticated alternative investment manager. This evolution reflects a deliberate diversification of offerings, aiming to capture growth opportunities in higher-margin alternative assets.

- Focus on alternative investments and wealth management.

- Emphasis on financial services, healthcare, and real estate.

- Strong presence in the Hong Kong market.

- Leveraging long-standing relationships and local market knowledge.

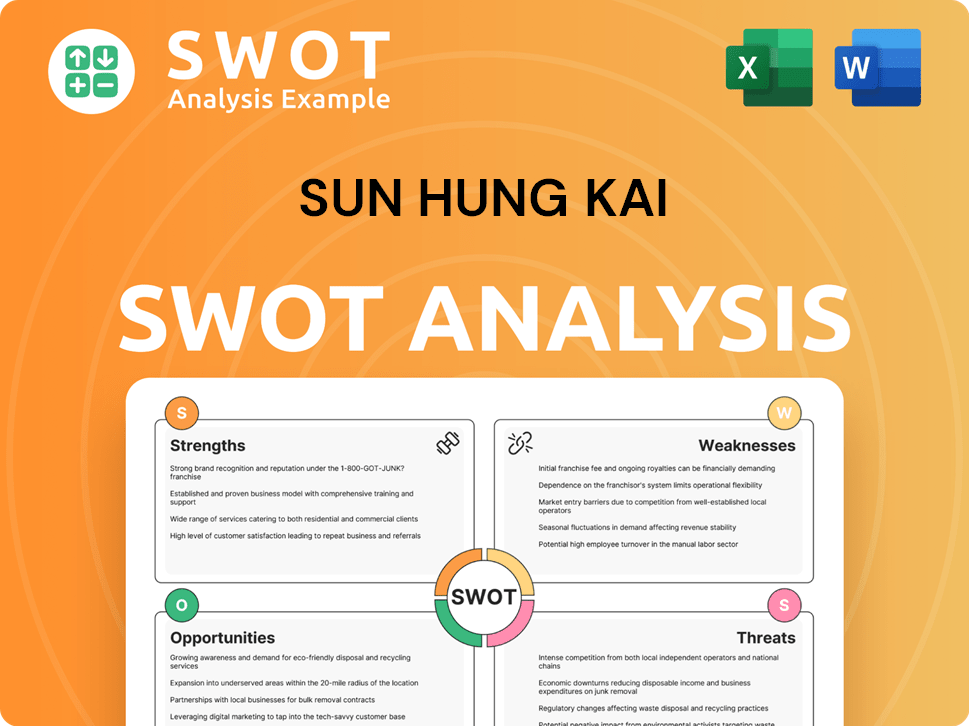

Sun Hung Kai SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Sun Hung Kai?

The competitive landscape for Sun Hung Kai & Co. Limited (SHK & Co.) is multifaceted, encompassing various financial sectors. SHK & Co. faces competition from global and regional players in alternative investments, financial services, brokerage, wealth management, and investment banking. Understanding the key competitors and their strategies is crucial for analyzing SHK & Co.'s market position and formulating effective business strategies.

SHK & Co.'s ability to maintain a competitive edge depends on its capacity to adapt to evolving market dynamics, technological advancements, and the strategies of its rivals. The company's financial performance and market share are directly influenced by its ability to differentiate itself and effectively compete in these diverse segments. For a deeper understanding, you can refer to a Brief History of Sun Hung Kai.

The competitive analysis of SHK & Co. requires a detailed examination of its key competitors across different business segments. This analysis considers the scale, scope, and strategic approaches of these competitors, providing insights into the challenges and opportunities SHK & Co. faces.

In the alternative investment space, SHK & Co. competes with major global asset managers and private equity firms. Firms like Blackstone, KKR, and Carlyle Group operate on a much larger scale, competing for similar investment opportunities.

Regionally, firms such as PAG and Gaw Capital Partners are significant competitors, especially in real estate and private equity investments across Asia. These firms leverage local expertise and networks.

Within financial services, SHK & Co. competes with traditional banks like HSBC and Standard Chartered. Independent brokerage houses and wealth management firms also pose competition.

Private banks offer highly personalized services and a broad range of structured products, challenging SHK & Co. in wealth management. Fintech platforms and online brokers increase competitive pressure in brokerage.

Emerging players and boutique investment firms disrupt the landscape by specializing in niche sectors or adopting innovative technological solutions. This prompts SHK & Co. to adapt its strategies.

The rise of fintech platforms and online brokers emphasizes lower fees and digital accessibility. This creates new competitive pressures in the brokerage sector.

Several factors determine the competitive dynamics of SHK & Co. These include the scale of operations, geographical reach, product offerings, technological innovation, and the ability to attract and retain clients. The firm's financial performance is directly influenced by its ability to navigate these competitive pressures.

- Market Share: The market share of SHK & Co. and its competitors in various sectors.

- Financial Performance: Revenue, profitability, and growth rates of SHK & Co. compared to its rivals.

- Product Innovation: The ability to offer innovative financial products and services.

- Customer Service: The quality of customer service and client relationships.

- Technological Adoption: The use of technology to enhance services and reduce costs.

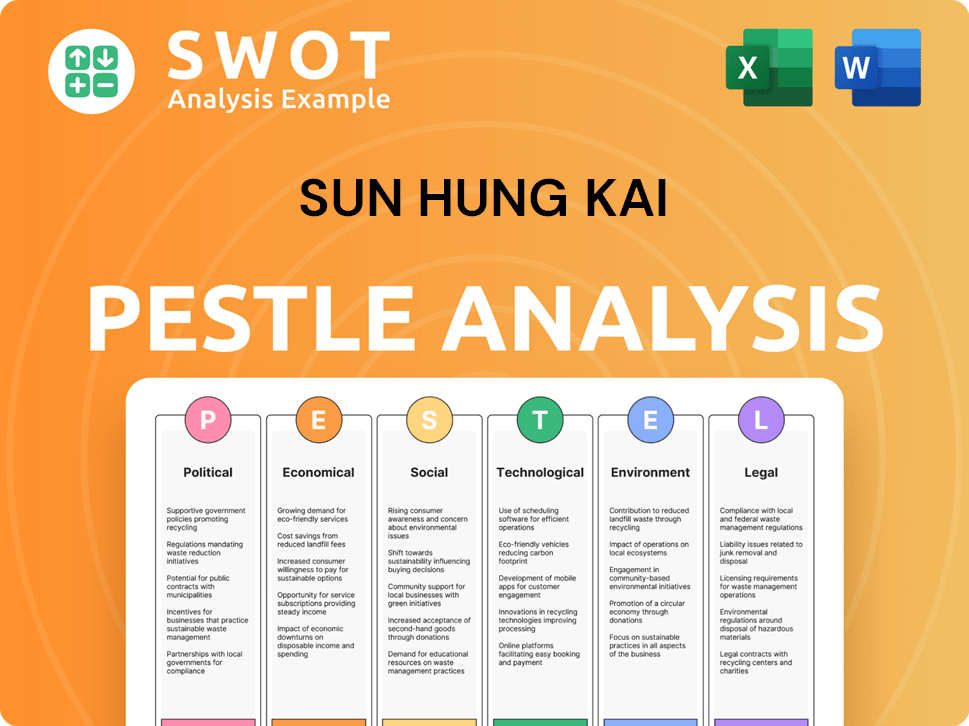

Sun Hung Kai PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Sun Hung Kai a Competitive Edge Over Its Rivals?

The competitive landscape for Sun Hung Kai & Co. Limited (SHK & Co.) is shaped by its long-standing presence and strategic diversification within the Asian financial markets. SHK & Co. has cultivated a strong market position through decades of experience and a broad investment approach. Understanding its competitive advantages is crucial for assessing its ability to maintain and grow its market share.

SHK & Co. has navigated various economic cycles, building a robust financial foundation. Its ability to adapt and evolve, from its brokerage roots to a sophisticated alternative investment platform, highlights its resilience. This adaptability is key in a dynamic market, allowing it to capitalize on emerging opportunities.

The company's strategic moves and competitive edge are vital for stakeholders. For more information, you can read about the Owners & Shareholders of Sun Hung Kai.

With over five decades in operation, SHK & Co. possesses deep market knowledge and a strong network, particularly in the Asian financial landscape. This extensive experience provides proprietary deal flow and insights, creating a significant barrier to entry for competitors. This long-standing presence has allowed the company to build a strong reputation and client loyalty.

SHK & Co.'s diversified investment approach, spanning public and private markets with a focus on financial services, healthcare, and real estate, is a key strength. This diversification helps mitigate risks and capitalize on opportunities across different economic cycles and sectors. This strategy provides resilience compared to more specialized firms.

The company's robust financial health, reflected in its net asset value of HK$46.4 billion as of December 31, 2023, provides a significant advantage. This strong capital base enables substantial investments and allows the company to weather market volatility. This financial stability supports its ability to pursue strategic initiatives and maintain its competitive edge.

SHK & Co. benefits from a reputable brand name and a proven track record of successful investments. This contributes to strong client loyalty and attracts high-quality talent. The company's established brand enhances its ability to secure deals and maintain a strong market position, particularly in the competitive Hong Kong property market and broader financial services sector.

SHK & Co.'s competitive advantages are rooted in its experience, diversification, and financial strength, allowing it to navigate the complexities of the financial markets. These advantages are essential for sustaining its market position and achieving long-term growth. The company's ability to adapt and innovate is crucial in the face of increasing competition.

- Extensive Market Experience: Over 50 years of operation.

- Diversified Investments: Across financial services, healthcare, and real estate.

- Strong Financial Position: Net asset value of HK$46.4 billion as of December 31, 2023.

- Reputable Brand: Strong client loyalty and talent attraction.

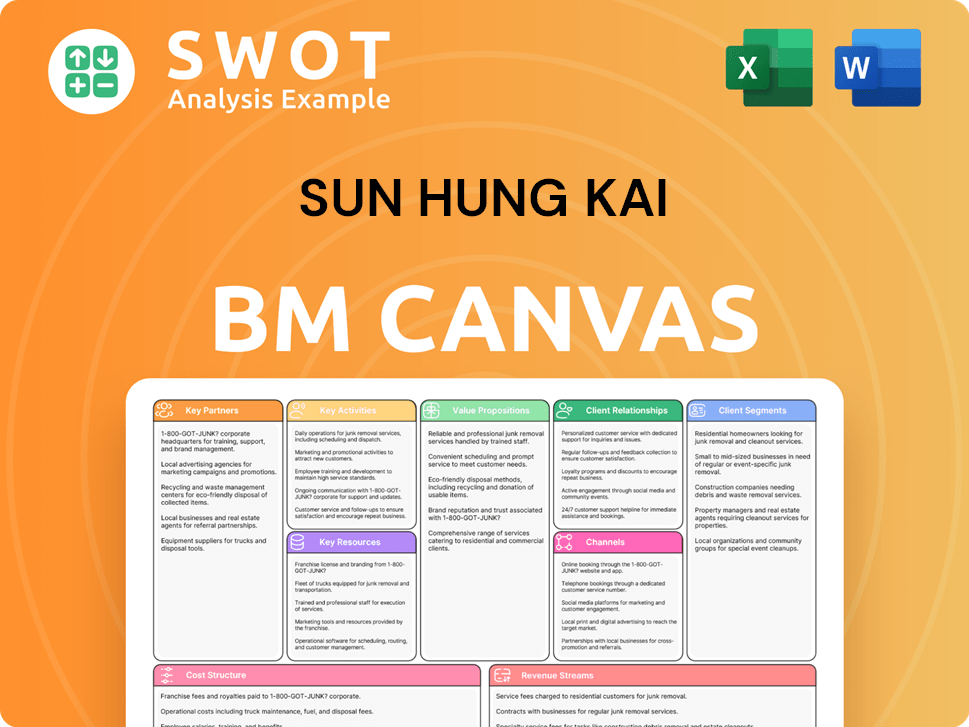

Sun Hung Kai Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Sun Hung Kai’s Competitive Landscape?

Understanding the Sun Hung Kai Company's (SHK) competitive landscape requires an analysis of industry trends, potential challenges, and future opportunities. The alternative investment industry is experiencing significant shifts, including increased institutional interest in alternative assets and the growing importance of ESG factors. These trends present both opportunities and hurdles for SHK.

SHK's strategic position in the market is influenced by its established presence in public and private markets, particularly within the real estate market and healthcare sectors. However, the company faces increasing competition from traditional asset managers and specialized funds. The company's ability to adapt to economic fluctuations and technological advancements will be crucial for maintaining its competitive edge. For a deeper dive into the company's strategic direction, consider reading about the Growth Strategy of Sun Hung Kai.

The alternative investment industry is seeing a rise in institutional allocations to alternative assets. ESG factors are becoming increasingly important in investment decisions. Technological advancements, such as AI and blockchain, are rapidly changing the financial landscape.

Economic slowdowns could impact asset valuations and investment returns. Regulatory changes in Asia require continuous adaptation. Technological disruption necessitates investment in new technologies to stay competitive.

Growing demand for alternative investments provides expansion opportunities. Expanding into emerging Asian markets with low alternative investment penetration. Developing specialized funds to meet specific investor demands, such as impact investing.

SHK has an established presence in public and private markets. Expertise in real estate and healthcare sectors. Strategic deployment of capital and adaptability to evolving trends.

SHK's future outlook depends on its ability to navigate economic uncertainties and regulatory changes. The company must invest in technological advancements to remain competitive. SHK's ability to capitalize on emerging market opportunities is crucial.

- Market Share: Analyze SHK's market share in key sectors like real estate and healthcare within the Hong Kong property market.

- Financial Performance: Evaluate the company's financial performance, including revenue growth, profitability, and return on investment.

- Investment Portfolio: Examine the composition and performance of SHK's investment portfolio, including real estate projects and other ventures.

- Competitive Positioning: Assess how SHK compares to other real estate developers in Hong Kong and its competitive advantages.

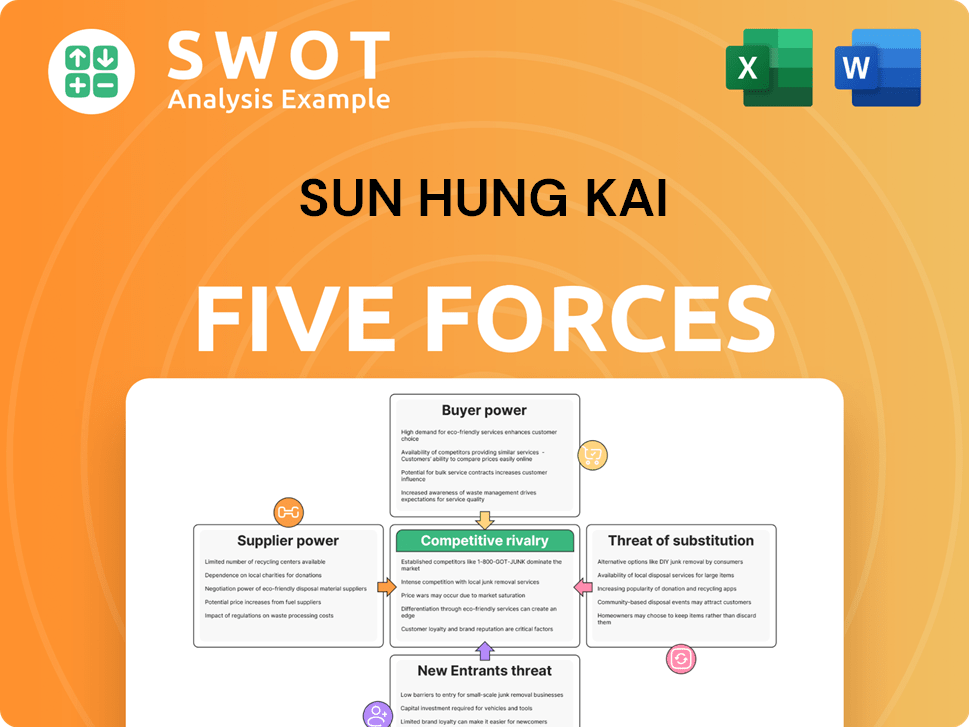

Sun Hung Kai Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sun Hung Kai Company?

- What is Growth Strategy and Future Prospects of Sun Hung Kai Company?

- How Does Sun Hung Kai Company Work?

- What is Sales and Marketing Strategy of Sun Hung Kai Company?

- What is Brief History of Sun Hung Kai Company?

- Who Owns Sun Hung Kai Company?

- What is Customer Demographics and Target Market of Sun Hung Kai Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.