Sun Hung Kai Bundle

Unveiling the Inner Workings of Sun Hung Kai Company: A Deep Dive

Sun Hung Kai & Co. (SHK & Co.) is a major player in Asia's financial world, evolving into a leading alternative investment firm. Its strategic focus includes financial services, healthcare, and real estate, showcasing a diversified investment approach. As of early 2025, the company continues to demonstrate influence through a strong portfolio and active participation in high-growth industries.

Understanding the Sun Hung Kai SWOT Analysis can provide a more in-depth look at its competitive advantages and potential risks. This analysis will explore the core operational mechanics of Sun Hung Kai Company, dissecting its value creation processes and revenue streams. This will provide a clear picture of how the firm maintains profitability and expands its influence within the dynamic global financial environment, including its real estate holdings and property development projects in Hong Kong.

What Are the Key Operations Driving Sun Hung Kai’s Success?

Sun Hung Kai & Co. (SHK) creates and delivers value through alternative investment strategies and comprehensive financial services. Their core operations center around managing capital across diverse asset classes, catering to institutional investors, high-net-worth individuals, and corporate entities. SHK's investment arm focuses on public and private markets, with a strategic emphasis on sectors like financial services, healthcare, and real estate.

Operationally, SHK leverages its market insights and network to identify and execute investment opportunities, involving rigorous due diligence and risk assessment. The financial services division supports brokerage activities, offering access to trading platforms and market insights. Wealth management services provide personalized investment advice, while the investment banking arm facilitates corporate finance activities.

The integrated approach of SHK, combining direct investment with a strong financial services platform, is a key differentiator. This synergy allows for effective capital deployment and generates recurring revenue. SHK's network of financial intermediaries contributes to efficient deal execution, offering a one-stop solution for investment and financial service needs. For more insights into their strategic approach, explore the Growth Strategy of Sun Hung Kai.

SHK focuses on both public and private markets. Their investment strategies include direct investments, fund investments, and co-investments. SHK's investment portfolio is diversified across various sectors, including financial services, technology, and real estate. This diversification helps to mitigate risk and enhance returns.

SHK offers a range of financial services, including brokerage, wealth management, and investment banking. Brokerage services provide clients with access to various trading platforms and market insights. Wealth management services offer personalized investment advice and portfolio management. Investment banking facilitates corporate finance activities.

SHK offers a one-stop solution for both investment and financial service needs. Their integrated approach provides clients with access to a wide range of services. SHK's focus on long-term value creation and commitment to client service sets them apart. SHK aims to deliver superior returns and build lasting relationships.

SHK has a strong presence in Hong Kong and a growing international footprint. They compete with other financial institutions and investment firms. SHK's focus on innovation and client-centric solutions helps them maintain a competitive edge. Their commitment to sustainable growth is a key factor in their market position.

SHK's integrated approach and diversified investment strategies provide a competitive edge. The company's focus on client-centric solutions and long-term value creation sets it apart. SHK's commitment to innovation and sustainable growth is a key factor in its success.

- Integrated Financial Services Platform: Combines investment and financial services.

- Diversified Investment Portfolio: Spreads across various asset classes and sectors.

- Client-Centric Approach: Focuses on long-term value creation and building relationships.

- Strong Market Presence: Established in Hong Kong with international expansion.

Sun Hung Kai SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Sun Hung Kai Make Money?

The company, also known as SHK, generates revenue through a mix of investment gains and financial services. As an alternative investment firm and financial services provider, its income streams are diversified. The financial performance is significantly influenced by its investment activities and the performance of its portfolio.

Investment gains from its portfolio are a key revenue source, with fluctuations tied to market performance and asset realization. The company strategically allocates capital in sectors like financial services, healthcare, and real estate. Brokerage commissions, management fees from wealth management, and advisory fees from investment banking also contribute to revenue.

The financial services segment provides a more stable, recurring income stream compared to investment gains. Brokerage and wealth management consistently contribute to profitability through transaction fees and assets under management (AUM) based charges. SHK's strategy focuses on expanding alternative investment platforms and enhancing financial services to capture new market opportunities.

SHK employs a tiered pricing model for wealth management, with fees based on assets managed and service complexity. Investment banking fees are success-based or structured as retainers. The company uses cross-selling to offer additional services to investment clients, maximizing client value. For a deeper dive into the company's target market, consider reading Target Market of Sun Hung Kai.

- Investment Gains: Revenue from investments in public and private markets.

- Financial Services: Income from brokerage, wealth management, and investment banking.

- Tiered Pricing: Wealth management fees based on AUM and service complexity.

- Cross-Selling: Offering additional financial services to existing clients.

Sun Hung Kai PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Sun Hung Kai’s Business Model?

Sun Hung Kai & Co. (SHK) has established itself as a significant player in the alternative investment landscape, marked by strategic moves and a consistent focus on expanding its investment scope. The company's evolution has been characterized by key milestones that have shaped its operational and financial strategies. These milestones have been crucial in navigating market cycles and enhancing risk-adjusted returns.

A pivotal strategic move for Sun Hung Kai has been its consistent expansion into diverse alternative asset classes. This includes a notable shift from its traditional real estate focus to encompass private equity and credit investments. This diversification strategy has been instrumental in adapting to changing market conditions and optimizing financial performance. Recent reports highlight the company's ongoing investments in sectors like healthcare and technology, reflecting a forward-looking approach to capitalize on emerging growth opportunities.

The company's resilience is evident in its ability to adapt to various market and operational challenges, such as economic volatility and regulatory changes. SHK often demonstrates this through its agile investment approach and robust risk management frameworks. During market downturns, for example, Sun Hung Kai has strategically reallocated capital to defensive assets or distressed opportunities, showcasing its tactical flexibility. For further insights into the company's approach, consider exploring the Marketing Strategy of Sun Hung Kai.

Sun Hung Kai's journey includes several key milestones that have shaped its operational framework. These include strategic shifts in investment focus, expansion into new markets, and the continuous refinement of its risk management strategies. These milestones have been crucial in adapting to market dynamics and enhancing the company's investment strategies. The company's history is marked by a series of strategic decisions that have solidified its position in the financial sector.

The company's strategic moves are characterized by diversification and adaptability. This includes a shift from traditional real estate to alternative asset classes such as private equity and credit. SHK's ability to adapt to market changes is a key aspect of its strategy. Recent initiatives include investments in healthcare and technology, reflecting a forward-looking approach to capitalize on emerging growth sectors.

Sun Hung Kai's competitive advantages are multifaceted, including brand strength and a long-standing reputation in the Asian financial markets. Its extensive network and deep relationships within the financial and business communities in Hong Kong and mainland China offer unparalleled access to deal flow and market intelligence. Technological adoption is another area where SHK maintains a competitive edge, continuously investing in platforms that enhance its brokerage, wealth management, and investment analysis capabilities.

Looking ahead, Sun Hung Kai continues to adapt to new trends, such as the increasing demand for sustainable and impact investing. The company is actively exploring opportunities in these areas to maintain its market leadership. SHK's ability to innovate and adapt to market changes will be crucial for its continued success. This includes a focus on sustainable and impact investing.

Sun Hung Kai's competitive advantages are significant, stemming from its strong brand presence and extensive network in the Asian financial markets. The company's long-standing reputation fosters trust among investors and clients. SHK’s technological investments enhance operational efficiency and client service.

- Brand Strength: A strong brand and reputation in the Asian financial markets.

- Network: Extensive network and relationships in Hong Kong and mainland China.

- Technology: Continuous investment in platforms for brokerage and wealth management.

- Economies of Scale: Efficient capital deployment and better negotiation terms.

Sun Hung Kai Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Sun Hung Kai Positioning Itself for Continued Success?

Sun Hung Kai & Co. (SHK) holds a significant position in the alternative investment and financial services sector, especially in Asia. As a leading independent alternative investment firm in the region, SHK competes with both global asset managers and local financial institutions. Its established presence and loyal customer base, particularly in wealth management and brokerage, contribute to its strong market position. Sun Hung Kai's history underscores its commitment to the Asian market, with major operations in Hong Kong and mainland China, alongside growing interests in other regional markets.

Despite its strong industry standing, SHK faces various risks. Regulatory changes in financial services, competition from FinTech startups, and technological disruptions pose challenges. Shifts in consumer preferences towards passive investing could also impact revenue streams. The company must navigate these risks to maintain its competitive edge and ensure long-term growth.

SHK is a leading independent alternative investment firm in Asia, competing with global and local financial institutions. It benefits from a strong customer base, particularly in wealth management and brokerage. SHK's operations are primarily focused in Asia, with significant activities in Hong Kong and mainland China.

SHK faces risks from regulatory changes, competition from FinTech startups, and technological advancements. Changes in consumer preferences, such as a move towards passive investing, could also affect its revenue. These factors require strategic adaptation and investment to maintain market share.

SHK is expanding its alternative investment platforms, particularly in private equity and credit, and enhancing its digital capabilities. The company focuses on sustainable investing and exploring high-growth sectors. SHK aims to diversify, innovate, and form strategic partnerships for long-term growth.

SHK's strategic initiatives include expanding its alternative investment platforms and enhancing digital capabilities. The company is committed to sustainable investing and exploring opportunities in high-growth sectors like green technology. These efforts aim to ensure long-term growth and profitability by leveraging technology and expanding its geographical footprint.

To ensure long-term success, SHK focuses on expanding its alternative investment platforms, particularly in private equity and credit. The company is also enhancing its digital capabilities and exploring opportunities in sustainable investing. These strategies aim to capitalize on emerging market opportunities and maintain a competitive edge.

- Expansion of alternative investment platforms.

- Enhancement of digital capabilities across financial services.

- Focus on sustainable investing and high-growth sectors.

- Strategic geographical expansion and partnerships.

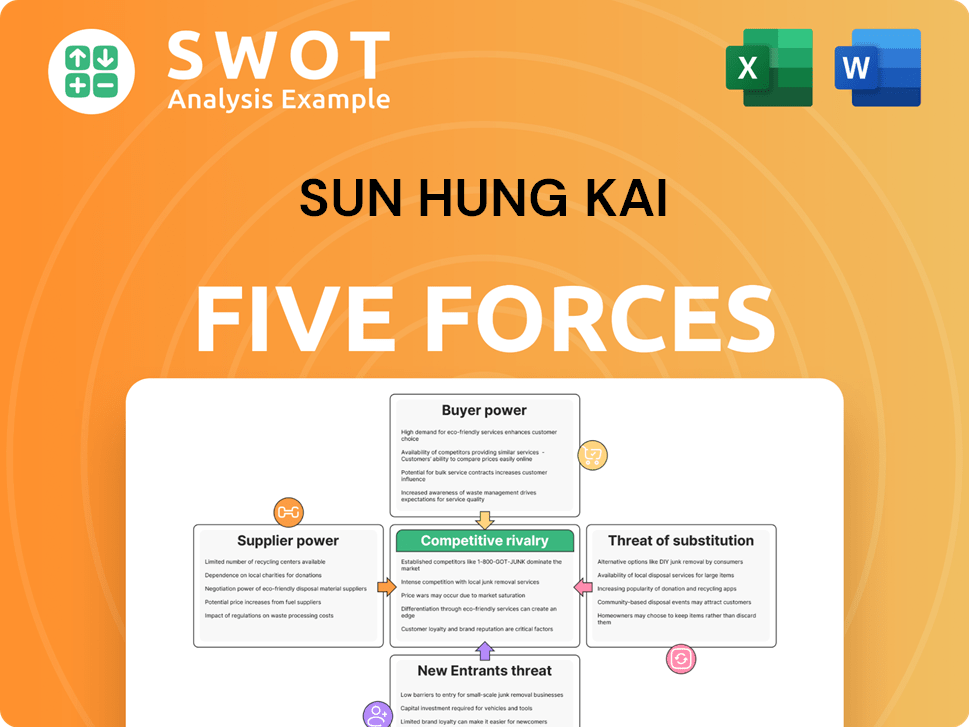

Sun Hung Kai Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sun Hung Kai Company?

- What is Competitive Landscape of Sun Hung Kai Company?

- What is Growth Strategy and Future Prospects of Sun Hung Kai Company?

- What is Sales and Marketing Strategy of Sun Hung Kai Company?

- What is Brief History of Sun Hung Kai Company?

- Who Owns Sun Hung Kai Company?

- What is Customer Demographics and Target Market of Sun Hung Kai Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.